EXCLUSIVE RESEARCH PAPER1

Unlocking Growth in Alternative Investments

Alternative investments are no longer a niche strategy — they’re a core part of modern portfolios. But behind the scenes, operational complexity is slowing firms down. Disconnected systems, manual processes, and poor data practices are creating friction that limits scale. Explore how leading firms are addressing these challenges.

WEBINAR REPLAY

Dive into the Study with Experts

from Forrester

Catch an exclusive look at the survey findings with experts from guest Forrester Research and iCapital — and walk away with actionable strategies to streamline your operations and drive smarter growth.

Included in this study:

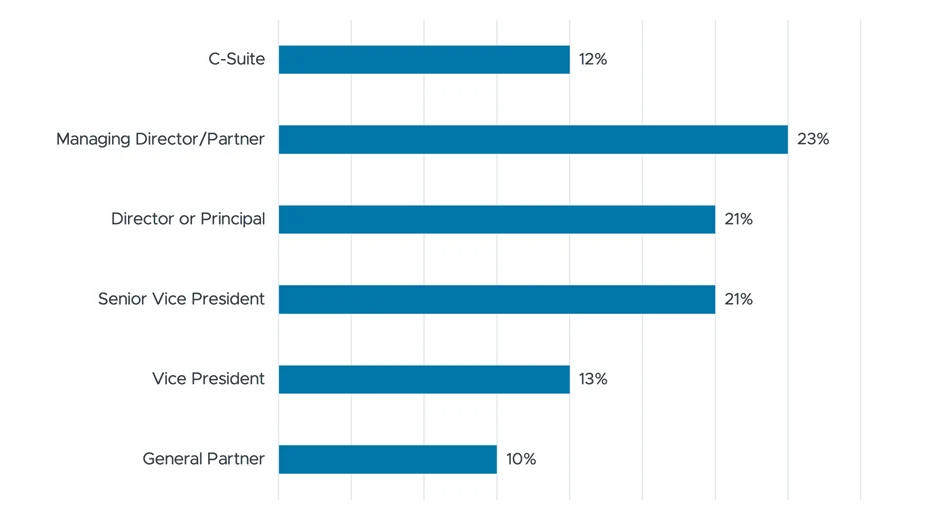

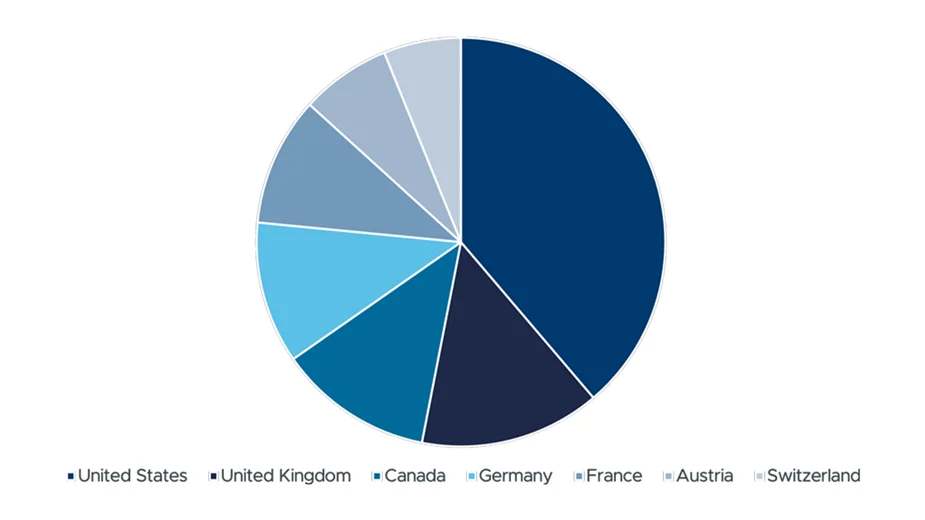

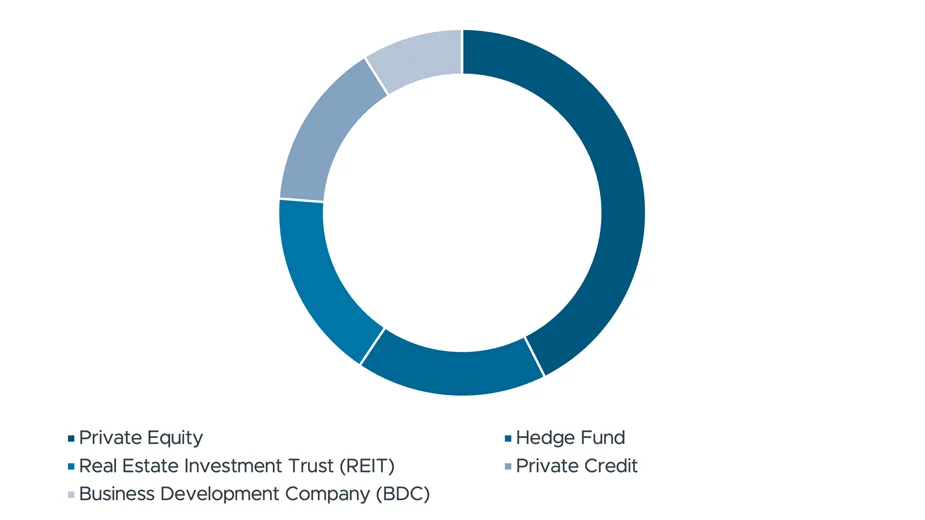

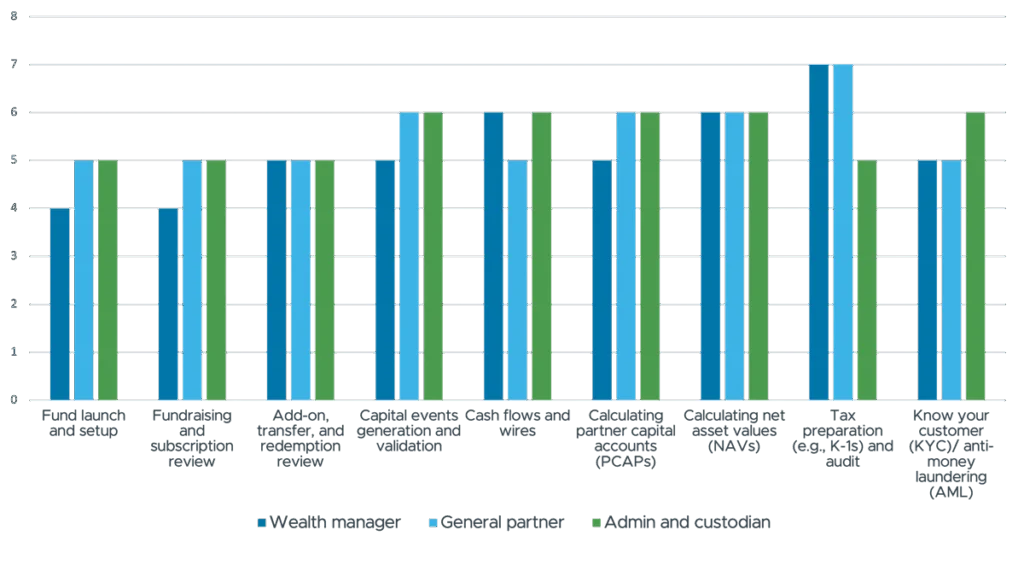

This study draws on insights from over 1,000 financial services decision-makers across North America and Europe, including wealth managers, general partners, and custodians, to uncover the true cost of operational complexity in alternative investments. It quantifies the hours and headcount required to manage fund lifecycle activities, revealing just how resource-intensive these processes are. From NAV calculations to tax prep, the findings highlight where firms are spending the most time, how responsibilities vary by firm type, and why automation is becoming essential to scale. Most importantly, the study describes the potential impact of technology to transform how data and workstreams flow across systems and parties to remove friction and enable scale.

1.

How firms are navigating fund lifecycle complexity and where they’re focusing resources to stay efficient and compliant.

2.

How leading organizations are reducing friction by integrating platforms, streamlining workflows, and improving real-time visibility.

3.

How firms are automating key lifecycle tasks to boost productivity, improve data accuracy, and free up teams for higher-value work.

Hours Spent Each Week On Fund And Investment Lifecycle Activity Across All Team Members

Operational Realities in Alternative Investments

Research demographics by

“I feel like I’m walking around with a yellow pad of paper checking if things got done.”

— Chief Information Officer, Community Bank, North America

Ready to see how your firm compares — and where the biggest opportunities lie?

Sign up to receive the full Forrester Consulting study thats explores the insights, strategies, and technologies shaping the future of alternative investments.

1. A FORRESTER CONSULTING THOUGHT LEADERSHIP PAPER COMMISSIONED BY iCAPITAL, JUNE 2025

IMPORTANT INFORMATION

iCapital and its affiliates provide various services through a number of affiliated entities – please refer to Certain iCapital Entities for a full list of entities. iCapital entities are collectively referred to as “iCapital”, and they all are affiliated with iCapital, Inc. and Institutional Capital Network, Inc. Among these affiliates, iCapital Markets LLC (“iCapital Markets”), an SEC-registered broker-dealer, member FINRA and SIPC, offers securities products and services. The registrations and memberships listed in Certain iCapital Entities in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services provided by iCapital. Additional information is available upon request.

This website is for informational purposes only. This website is the property of iCapital and may not be shared, reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This website and any information included on it are not intended, and may not be relied on in any manner, as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. Financial products, including investment funds and structured investments, are complex and may be speculative and are not suitable for all investors. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This website and the information contained on it is not intended to, and does not, address the financial objectives, situation or specific needs of any specific investor.

iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc.