WELCOME TO OUR MONTHLY NEWSLETTER.

The source for navigating the world of alternative investments

Our most recent Global Advisor Survey provides a real-time view of how financial professionals are using alternatives and what’s shaping their decision making. The survey makes one thing clear: as alternative allocations increase, so does the need for technology that minimizes operational friction.

At iCapital, we remain deeply committed to supporting financial professionals with the technology and services they need to scale their businesses and better serve their clients.

To read more please see the full survey results or visit Thought Leadership on our website.

Dan Vene

Co-Founder and Managing Director,

Co-Head of iCapital Solutions

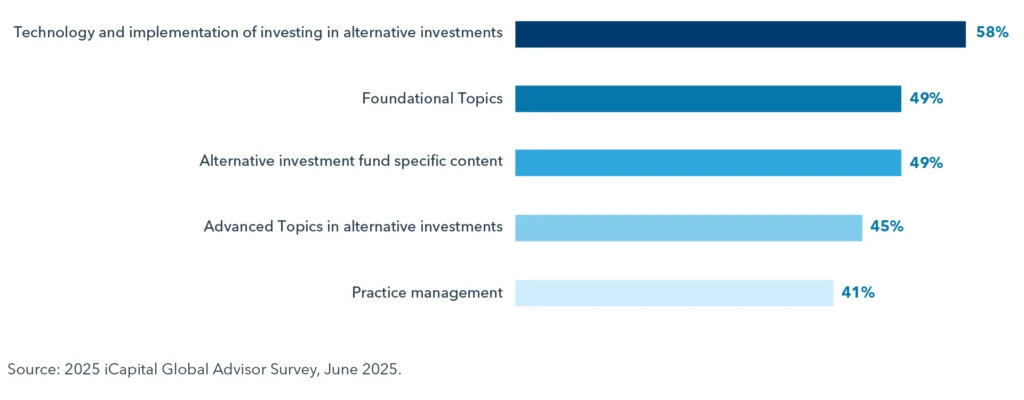

CHART OF THE MONTH

What topics on alternative investments would be of interest to you?

Advisors continue to prioritize education, with foundational and fund-specific content still in high demand. But technology and implementation are rising fast—signaling a shift toward learning that supports real-world execution and scale.

NEW FROM iCAPITAL

The 2025 Advisor’s Guide to Pivoting Portfolios During Volatile Markets

Diverging central bank policies. Rolling sector-level volatility. Sticky Inflation.

Clients are looking for real-time downside protection and steady income, but most models weren’t built for speed. It’s time for advisors to rethink and reallocate with intention.

MARKET PULSE

Mid-Year Outlook: Top of mind questions for investors in 2H ’25

M&As we start the second half of the year, investors are faces with many questions about how the outlook for the economy and markets will evolve from here. These include: What are the tail risks to markets? Is this the end of U.S. exceptionalism? When will the Fed cut?

MONTHLY MARKET ROUNDUP

Q&A: Greg Blank on Infrastructure Investing’s Trillion Dollar Opportunities

Infrastructure is no longer just bridges, tunnels and roads. It’s data centers, flexible electricity grids, modern seaports, cell towers, and more. Trillions of dollars are required, and Blackstone finds opportunity in these capital needs.

Real Estate Credit: Why Our Pipeline is at Record Highs Despite Volatility

KKR’s real estate lending pipeline has hit a high-water mark twice so far in 2025, most recently in April as the global investment firm moved quickly to provide alternatives to borrowers who found themselves unable to execute in the SASB and CMBS market due to tariff-related market volatility. From an investment standpoint, KKR’s real estate credit team thinks several aspects of today’s market environment make this vintage particularly attractive, but the team also sees private real estate credit as a long-term investment opportunity.

The Road Ahead – Investing in Volatile Markets with Confidence

Explore how alternative investments—across asset classes like private credit, real estate, infrastructure, and secondaries—can offer valuable diversification and resilience amid today’s market volatility. Designed for financial advisors, this resource provides timely perspectives on navigating uncertainty and helping clients stay focused on long-term goals, even in challenging environments.

Beyond 60/40 Series

Ep. 40 – KYC/AML Technology

iCapital’s Nick Goss, Senior Vice President of Alternative Solutions, joins Beyond 60/40 to speak about the integration of Parallel Markets’ KYC/AML technology into iCapital’s onboarding process after the recent acquisition. Nick talks about the KYC (Know Your Customer) and AML (Anti-Money Laundering) pain points & challenges firms face in customer identity verification and how iCapital streamlines these processes through software solutions.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2025 Institutional Capital Network, Inc. All Rights Reserved.