The source for navigating the world of alternative strategies

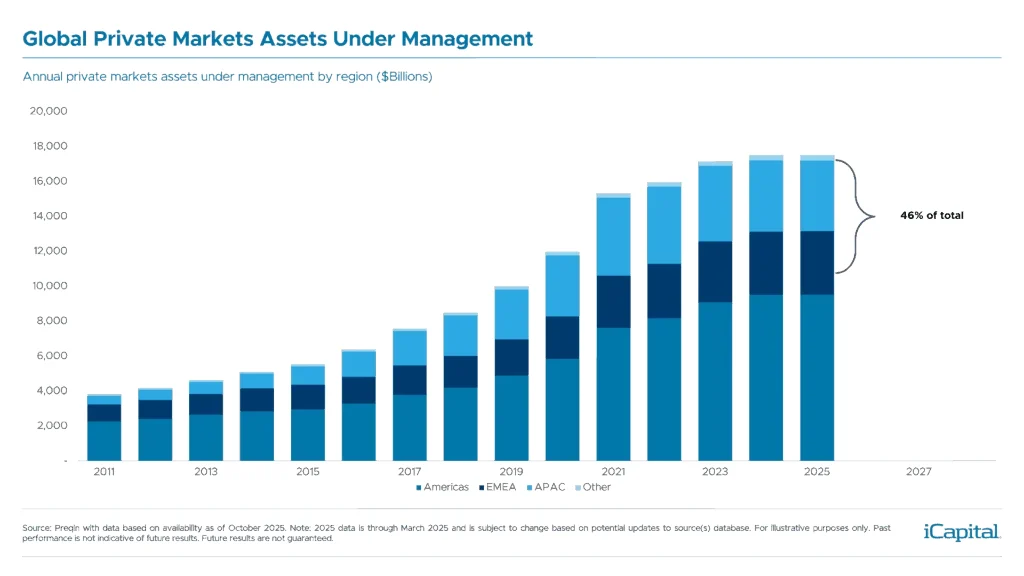

Going Private Across the Globe

It’s a big moment for private assets globally. If you think about the public markets, 2025 has been marked by a huge desire to capture gains in Europe and Asia given that the US stock market has run up so drastically over the last couple of years—and valuations elsewhere might be more favorable.

The iCapital universe is seeing a similar desire from clients in alternatives. In the Americas alone, more than 300 people joined us in Tulum, Mexico last week for iCapital CONNECT, with advisors across Latin America coming together to network, learn, and engage with others in the alternatives industry. In Canada, where I recently spent some time, the biggest banks have meaningful ambitions to increase client allocations to alternatives regionally—in the US and in Europe—given that current allocations are still quite small relative to adviser portfolios.

More of our team members are soon headed to the Middle East to Riyadh, Abu Dhabi and Dubai for iCapital Engage events. In the region, institutions have long been critical allocators—and wealth channels can continue to open up. While in Asia, my colleague Tim Lee tells me that he’s gearing up for iCapital Engage in Tokyo this December. He says there are two big themes his clients are keeping an eye on: Model portfolio construction, as banks look to effectively create an “easy button” for private market allocations, and how to differentiate between a growing number of evergreen funds.

To learn more about the private market education and investment opportunities available at iCapital, please contact our sales team at [email protected], and learn more on the iCapital Marketplace.

Sonali Basak

Managing Director,

Chief Investment Strategist

Asia Advisor Survey 2025

Navigating the Shift from “Why” to “How” in Alternatives

The 2025 iCapital Asia Advisor Survey reveals a decisive evolution in Asia’s wealth management landscape, as advisors in Singapore and Hong Kong increasingly embrace alternative investments—not just in principle, but in practice.

New from iCapital

Private Credit and its Link Back to the Rest of the Financial System

Recent credit events have raised questions about the growing interdependence between private credit and the broader financial system. The current risks appear limited due to moderate leverage and long-term underlying commitments in the form of capital lock-ups. Still, private credit has interdependencies with the banking system which makes evaluating overall systematic risk complex.

Market Pulse

Parsing Through the (Lack of) Signals

The one big takeaway from the latest Federal Open Market (FOMC) meeting: December isn’t a lock for the next interest rate cut. While the central bank lowered interest rates by another 25 basis points (bps – or one-hundredth of a percentage point), Fed Chair Powell’s message to the market is that another reduction at the next meeting is “far from a foregone conclusion.”1

1. Federal Reserve, as of Oct. 29, 2025.

MONTHLY MARKET ROUNDUP

Alternative Allocations: Revisiting investment goals—the role of private markets in year-end planning

Franklin Templeton Institute suggests that private markets may be uniquely suited for today’s market environment and can add value to traditional portfolios. Consider using the “5-Rs” (Revisit, Refresh, Rebalance, Reinvest, Recommit) as a guide to discuss and adjust client portfolios, emphasizing the long-term nature of private market investments and their ability to complement traditional allocations.

After the rate cut: Investing beyond U.S. markets

The Fed’s rate cut and strong corporate outlook have boosted market optimism, with leading indicators suggesting a potential economic rebound in 2026. International diversification presents opportunities, as attractive valuations and growth prospects in Europe and emerging markets make a compelling case for inclusion alongside U.S. assets in portfolios.

Thoughts from the Road: The Middle East

KKR’s “Thoughts from the Road: The Middle East” highlights the region’s strong structural transformation, driven by economic diversification away from oil, liberalizing capital markets, and a pro-business philosophy. The labor force across the Middle East is evolving positively, with improved workforce dynamics supporting the region’s broader economic modernization efforts. GCC markets now rank among the top five regions globally for IPO activity, signaling the region’s emergence as a significant global financial hub.

IN CASE YOU MISSED IT

iCapital® Launches a Series of Outcome-Based Model Portfolios Offering Investors in Latin America Simplified Exposure to Alternative Investments

As wealth managers seek greater portfolio diversification beyond public markets, iCapital’s model portfolios offer an innovative solution that complements traditional asset allocation frameworks. These portfolios simplify access to alternative investments through a single digital subscription workflow, allowing investments across all portfolio constituents.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2025 Institutional Capital Network, Inc. All Rights Reserved.