The 2025 iCapital Asia Advisor Survey highlights a pivotal shift among wealth managers in Asia’s financial hubs, particularly Singapore and Hong Kong, where interest in alternative investments is rising rapidly. Based on responses from 149 advisors overseeing at least $400 million in AUM, the findings reflect a region moving decisively beyond the “why” of alternatives to the “how”, with growing client demand outpacing the operational and technological readiness of many firms.

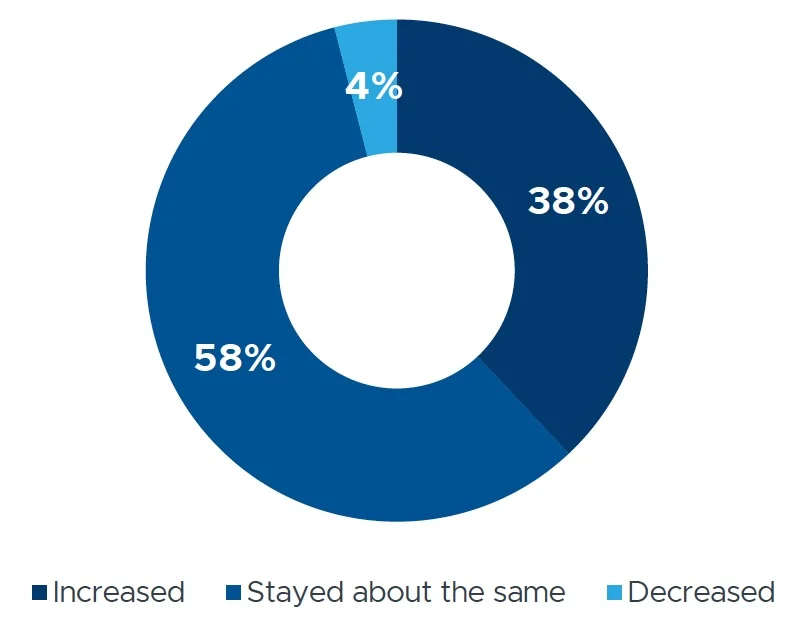

Client appetite for private market assets has grown substantially: 38% of advisors in Asia report increased interest, rising to 100% at firms managing more than $3 billion. Smaller firms and private banks are driving this allocation momentum, planning increases of 8% and 22%, respectively. It is clear that alternatives are no longer viewed solely as niche strategies but as central tools for diversification, income, and client engagement.

Client demand for alternatives is rising—and accelerating at the top

Compared to two years ago, has client interest in alternative investments…?

Client interest in alternatives is rising—38% of advisors have seen an increase, jumping to 100% among firms over $3B and 64% at private banks. The trend underscores growing demand in scaled, sophisticated segments and a need for advisor support and access.

“Client investment objectives are the most influential factors because long-term growth, income generation or capital preservation are the factors that influence investment choices.”

— Advisor Perspective

In contrast to global preferences favoring private equity, advisors in Asia show a strong tilt towards private credit, prioritizing yield and liquidity. Hedge funds and private equity remain important, but the regional focus is on income-oriented, risk-aware strategies. At the same time, interest in innovative exposures is growing, particularly artificial intelligence, fractional ownership, and sustainability themes such as the blue economy and clean energy.

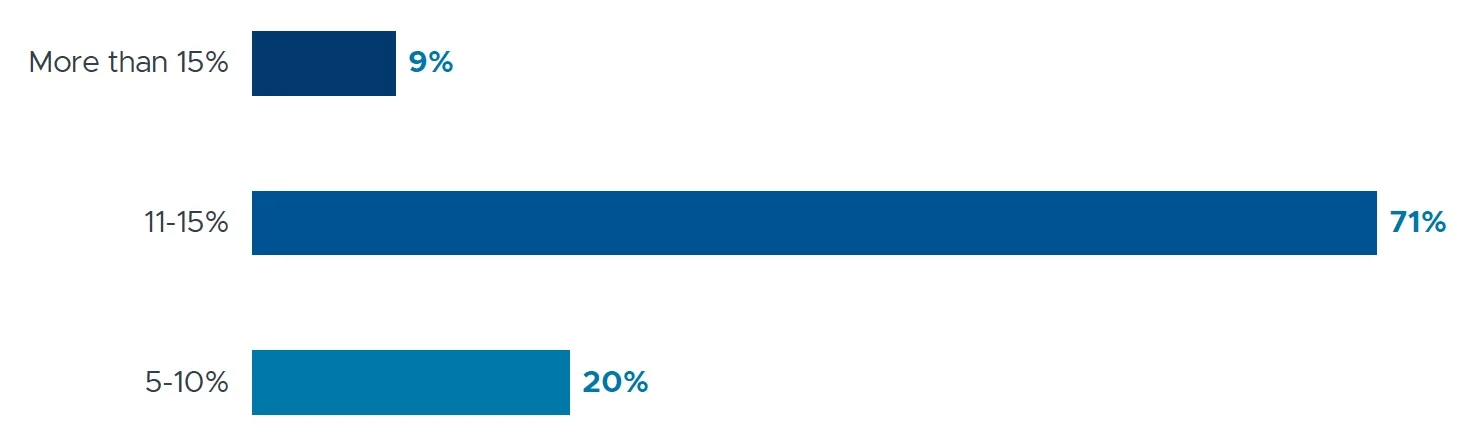

This year’s survey also found that evergreen strategies are gaining traction. Most advisors expect client allocations to rise to 11–15% within two years, with professional investment advisors and family offices often already exceeding that threshold. These vehicles offer long-term exposure and liquidity clients increasingly value.

Advisor interest in evergreen strategies continues to grow—especially among professional investment advisors and family offices

What do you anticipate will be your client′s average exposure to evergreen strategies in the next two years?

In line with global trends, most advisors in Asia expect client exposure to evergreen funds to rise—often to 11–15% or more. Allocations above 15% are most common among individual financial advisors and single-family offices, pointing to growing demand for access, liquidity, and long-term exposure.

Nevertheless, adoption is hindered by structural inefficiencies. Client reporting is the top barrier to broader implementation of the asset class, surpassing fees and complexity. This operational consideration reiterates the aforementioned shift from advisors asking “why” to “how”. Advisors cite friction in documentation, regulatory processes, and risk assessment. Many firms struggle to integrate private market assets into portfolios due to fragmented systems and limited access to high-quality products.

Unsurprisingly, education remains a critical dependency. While foundational knowledge around fund structures is still in demand, advisors are increasingly seeking practical, technology-focused content that supports implementation and compliance.

To keep pace with client expectations, the survey found that firms in Asia must modernize. Respondents called for better data integration, clearer reporting, and tools to streamline onboarding and risk analysis. It is clear that those who invest in scalable, tech-enabled infrastructure will be best positioned to lead in a market where alternatives are becoming not just more common but also core components of client portfolios.

This material has been provided to you for informational purposes only by iCapital, Inc. and/or one of its affiliates including Institutional Capital Network, Inc. (collectively, “iCapital”). This material is the property of iCapital and may not be shared without its written permission. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital. This is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation to employ a specific investment strategy, or as an offer to sell, a solicitation of an offer to purchase, or a recommendation of any interest in any fund or security. Security products and services are offered through iCapital Markets LLC (a registered broker/dealer, member FINRA and SIPC), Institutional CN (Europe) – Empresa de Investimento, S.A. (registered with CMVM), iCapital Hong Kong Limited (licensed by SFC) and iCapital SG Pte. Ltd (licensed by MAS), all affiliates of iCapital. Registrations and memberships in no way imply that FINRA, SIPC, CMVM, the SFC or MAS have endorsed any of the entities, products or services discussed herein. Financial products made available by iCapital Markets LLC, Institutional CN (Europe) – Empresa de Investimento, S.A., iCapital Hong Kong Limited and iCapital SG Pte. Ltd. may be complex and/or speculative and are not suitable for all investors. iCapital Advisors, LLC is an investment adviser registered with the Securities and Exchange Commission and acts as an adviser to certain privately offered investment funds.

iCapital Hong Kong Limited is licensed for Type 1 (Dealing in Securities) and Type 4 (Advising on Securities) regulated activities (SFC CE No: BTM925) under the Securities and Futures Ordinance, and is regulated by the Securities and Futures Commission. It is a private company registered in Hong Kong under Business Registration number 74237275 and its business address is Room 1003, 10th Floor, St. George’s Building, 2 Ice House Street, Central, Hong Kong.

iCapital SG Pte. Ltd. holds a CMS licence for dealing in capital markets products under the Securities and Futures Act, and is regulated by the Monetary Authority of Singapore. It is a private company registered in Singapore (UEN: 202237416C) and its business address is 88 Market Street, #40-01 CapitaSpring 048948, Singapore.

iCapital Hong Kong Limited and iCapital SG Pte. Limited are exempt from the requirement to hold an Australian financial services licence under the Corporations Act of Australia in respect of certain financial services they provide to “wholesale clients” for the purposes of the Corporations Act of Australia, and they do not hold such a licence. iCapital Hong Kong Limited is regulated by Securities and Futures Commission of Hong Kong under the laws of Hong Kong and iCapital SG Pte. Ltd. is regulated by the Monetary Authority of Singapore under the laws of Singapore. The laws of Hong Kong and Singapore differ from the laws of Australia. Any financial services provided to any person by iCapital Hong Kong Limited are provided pursuant to ASIC Instrument 24-0967 and any financial services provided to any person by iCapital SG Pte. Ltd. are provided pursuant to ASIC Class Instrument 23-0827.

“iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc.

© 2025 Institutional Capital Network, Inc. All Rights Reserved.