WELCOME TO OUR MONTHLY NEWSLETTER.

The source for navigating the world of alternative investments

There’s been no shortage of activity in the secondary market. 2025 transaction volumes are on pace to exceed 2024 record levels, validating the role that secondaries play in private capital markets.

As the market grows, we’re seeing two major changes. First, investors are increasingly tapping secondaries for regular portfolio management, not just as a last resort for liquidity. And assets other than private equity are starting to trade in the secondaries market with significant venture capital, private credit, and infrastructure volume on the way.

To learn more about the benefits secondaries can provide and the investment opportunities available at iCapital, please contact us by reaching out to our sales team ([email protected]) or iCapital Marketplace.

Dan Vene

Co-Founder and Managing Director,

Co-Head of iCapital Solutions

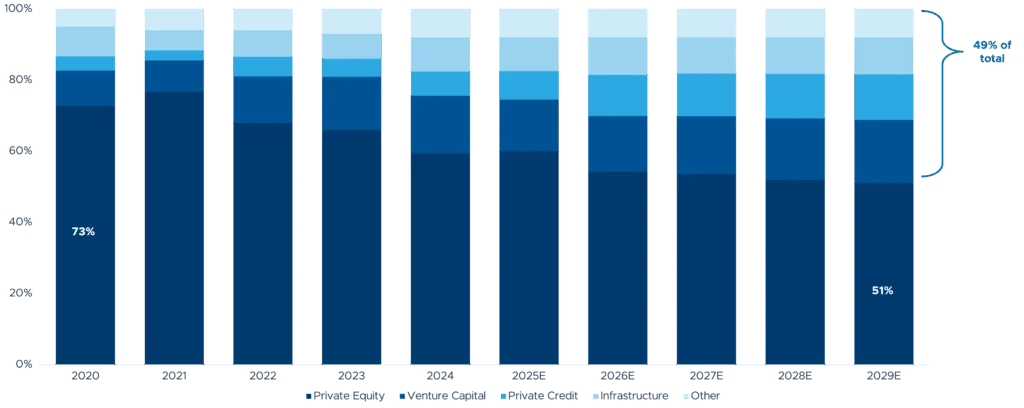

CHART OF THE MONTH

Private Market Secondaries Should See Expansion Beyond Private Equity

Share of secondaries volumes by asset class

Source: Private equity secondaries volumes are iCapital estimates. Venture capital secondaries volumes are iCapital estimates for 2015 to 2022 and 2027 to 2029, and PJT Partners data for 2023 to 2026. Private credit secondaries volumes are iCapital estimates for 2015 to 2019 and 2025 to 2029, and Evercore data for 2020 to 2024. Infrastructure secondaries volumes are Evercore data for 2016 to 2024 and iCapital estimates for 2015 and 2025 to 2029. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

NEW FROM iCAPITAL

Exploring Private Market Secondaries Across Different Asset Classes

The secondaries market is very different than it was just a few years ago—and in more ways than one. Often seen as a last resort for liquidity, fund managers and investors are increasingly tapping into the secondaries market as part of regular portfolio management.

Alternatives Decoded: Q3 2025

Navigating the World of Alternative Investments

After momentum picked up through the second quarter, a wait-and-see mode is hovering over markets. Growth remains relatively resilient, certain pockets of exits are improving, yet the focus remains on next steps for interest rates.

MARKET PULSE

Strategic Shifts: Fall Market Outlook

With school back in session for many students in the U.S. and the fourth quarter around the corner, we felt like this was a perfect time to level set and examine the macro, policy and market landscape. We outline the key themes heading into year-end and 2026 and how we would position ourselves in both public and private markets.

MONTHLY MARKET ROUNDUP

Mid-Year Credit Outlook: Navigating the Crosswinds

Apollo shows that resilient fundamentals and strong technicals kept credit markets steady through the first half of 2025—despite tariff noise, geopolitical tension, and fiscal policy shifts. With demand holding firm and supply remaining limited, credit spreads are expected to stay anchored into year-end.

The Rise of Private Markets

In The Rise of Private Markets, Jason Thomas, Head of Global Research & Investment Strategy at Carlyle, considers how the traditional “alternatives” label may no longer fully capture the role of private assets. Once viewed as a niche complement, private markets have become a more significant part of capital formation, with more than twice as many U.S. companies backed by private capital as listed publicly. As private credit increasingly serves as a financing source for these businesses, the opportunity set for investors could be shifting, suggesting that portfolio allocations may need to adjust over time.

The Truth About Secondaries: Separating Myth from Market Opportunity

Secondaries offer genuine discounts and compelling opportunities—but they’re often misunderstood. In this piece, Hamilton Lane breaks down prevailing misconceptions, unpacks the dynamics behind discounts, and highlights how secondaries can strategically strengthen client portfolios.

IN CASE YOU MISSED IT

How to Navigate a Growing Secondaries Market

The secondaries market is very different than it was just a few years ago—and in more ways than one. Often seen as a last resort for liquidity, fund managers and investors are increasingly tapping into the secondaries market as part of regular portfolio management.

m+ Contingent Income Fund Webinar

Don’t miss out: join our exclusive webinar for a deep dive into this innovative solution and learn how the m+ Contingent Income Fund can enhance portfolio potential.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2025 Institutional Capital Network, Inc. All Rights Reserved.