Quarterly Technology Update

Unlock Smarter, Faster, and Easier Investing.

Discover how the latest innovations across iCapital are delivering real benefits to your business. In this issue, we highlight unlocking liquidity, streamlining global workflows, and empowering firms with greater control and insight across the alternative investment lifecycle.

Explore what’s new, and what’s next, below.

Unlocking Liquidity in Private Markets: New Strategic Investment into Tangible Markets

iCapital is integrating Tangible’s technology to give clients access to a seamless secondary market experience directly from our platform – enhancing transparency, price discovery, and execution across private equity, credit, real assets, and hedge funds. For details on the first auctions that will be launched, or how this capability can be made available for your client base, please reach out to your iCapital relationship manager.

For illustrative purposes only. Functionality subject to change.

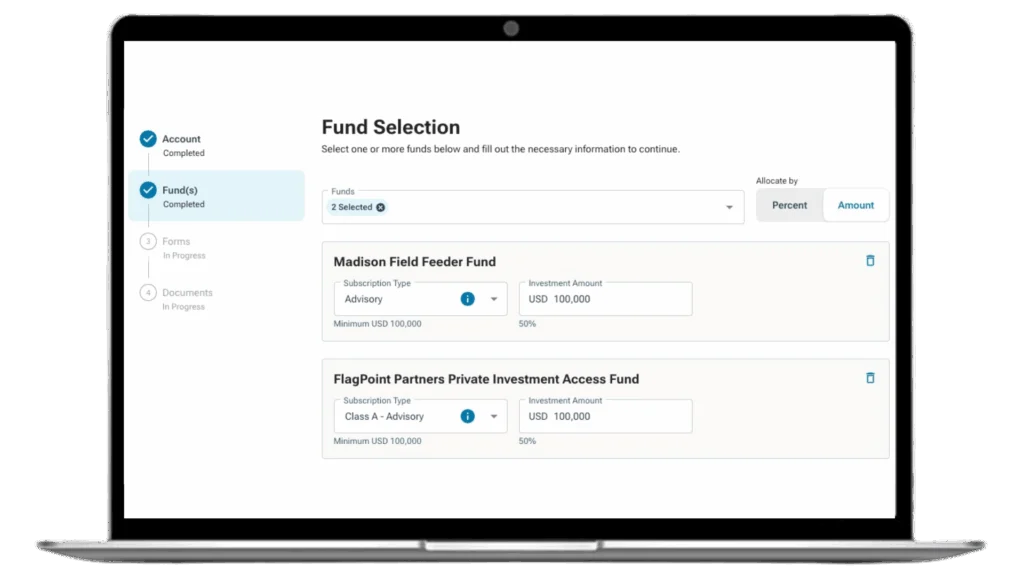

Streamline Investment Processes with Enhanced Multi-Investment Workflow for Global Marketplace

Building on last year’s successful launch of our market-leading Multi-Investment Workflow, it is now available for Global Marketplace. This workflow empowers users to transact at scale, reduce operational friction, and unlock broader access to global private market opportunities.

Clients can now seamlessly place multiple investments across strategies and geographies, in one simplified workflow, to efficiently allocate capital across a diversified portfolio. Access Multi-Investment Workflow through iCapital Global Marketplace.

For illustrative purposes only. Functionality subject to change

What’s Next From iCapital

We’re reimagining the investment experience – focused on providing greater control and transparency. In the coming quarters, you’ll see the rollout of the following enhancements, and more.

Advancing KYC/AML Automation with iCapital Identity Solutions

As part of our commitment to continuous innovation in investor onboarding, iCapital is enhancing Identity Solutions to further streamline KYC/AML compliance. iCapital provides a best-in-class technology solution and a professional compliance review team to simplify KYC/AML workflows and bring compliance, efficiency and scale to investor onboarding.

Future releases will build on the robust foundation of Identity Solutions while adding greater configurability, improved audit transparency, and expanded support from our expert compliance team. These enhancements are designed to help clients onboard investors faster, meet regulatory requirements with confidence, and deliver a first-class experience.

Simplifying Tax Operations with Updated iCapital Tax Portal

To improve the investor and advisor experience, iCapital is launching a new Tax Portal, designed to centralize and streamline access to tax documents across all holdings on the iCapital platform. With an intuitive interface, the portal will allow users to easily view, download, and manage tax-related materials in one place – bringing greater clarity and efficiency to a traditionally complex process.

Driving Intelligent Engagement with Increased Sales Insight

To empower firms to act on early indicators and accelerate conversion with precision, iCapital will launch top-of-funnel insights to help Asset and Wealth Managers identify investor intent and engagement. These data signals will support smarter outreach, faster conversion, and increased investment volumes during key fundraising windows.

Unified Investment Experience Across iCapital Instances

iCapital is introducing a powerful integration to simplify the investment journey, enhance transparency, and deliver a more connected experience. The Link Accounts feature will allow users with accounts on both Marketplace and Asset Manager white label instances to move effortlessly between sites using a single set of credentials.

With this feature, users can leverage existing profiles on other iCapital instances to streamline data entry during the investment process and access a unified Investment Dashboard and Document Center on Marketplace, consolidating reporting data across all linked platforms.

For more information, please reach out to your iCapital Relationship Manager, or contact us.

IMPORTANT INFORMATION

FOR FINANCIAL PROFESSIONALS

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2025 Institutional Capital Network, Inc. All Rights Reserved.