Quarterly Technology Update

Unlock Smarter, Faster, and Easier Investing.

Discover how the latest innovations across the iCapital platform are delivering real benefits to your business. In this issue, we highlight powerful updates designed to help you work more efficiently, access more opportunities, and deliver better experiences to your clients.

Explore what’s new, and what’s next, below.

Investing Made Easier: A Streamlined Homepage for Our Integrated Platform.

iCapital’s newly redesigned homepage marks a major step forward in our vision to unify the investment experience. Built as the front door to the industry’s first fully integrated investment platform, Marketplace, the updated homepage delivers:

- A Modern, Intuitive Experience: Navigate with ease through refreshed layouts and simplified menus.

- Smarter Search & Discovery: Find what you need faster with improved search functionality.

- Personalized Insights: Stay informed with dynamic widgets that surface relevant investments, data, education, and critical alerts in real time.

For illustrative purposes only. Functionality subject to change.

This launch reflects iCapital’s broader commitment to building a connected platform experience that adapts to your needs and supports decision-making across asset types.

With a single login, clients can now access structured investments, alternatives, annuities, education, and analytics—streamlining the entire investment journey from discovery to reporting.

The new homepage experience is currently being rolled out to Alternatives clients on iCapital Marketplace and select custom solutions. Existing configurations are transitioning automatically. A broader rollout will continue throughout the year.

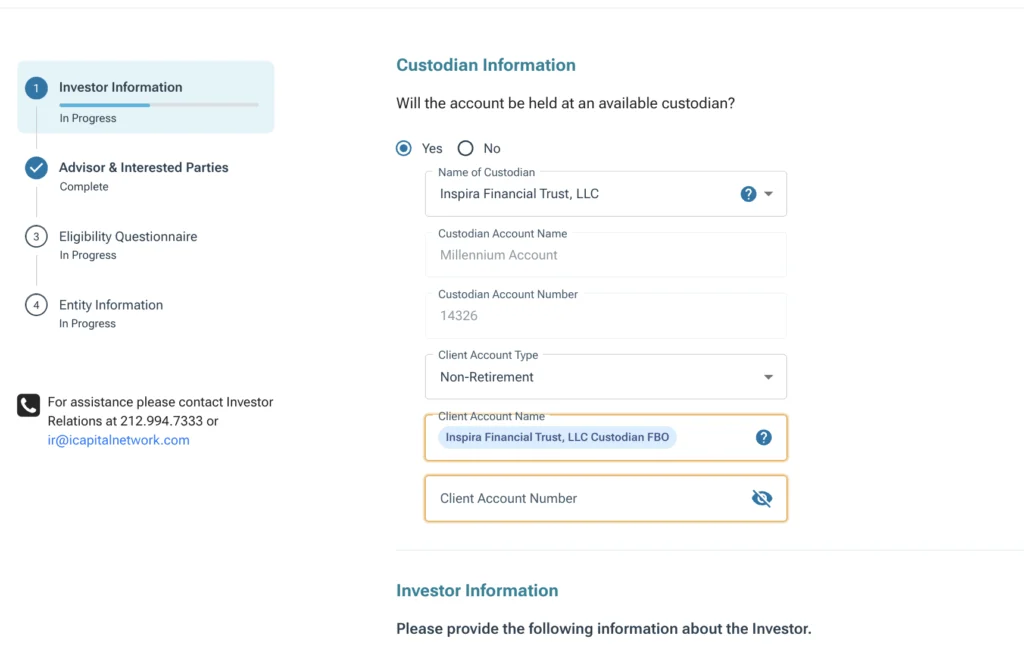

Upgrade Alternatives Access through New iCapital – TradePMR Integration

Advisors using TradePMR’s Fusion platform can now access iCapital Marketplace through single sign-on, streamlining the way advisors source and allocate to alternative investments. With the integration, users can submit investments to Inspira for custody, providing a fully digital, connected experience. The result is a faster, more efficient path to alternatives, with fewer friction points and expanded connectivity for TradePMR advisors.

For illustrative purposes only. Functionality subject to change

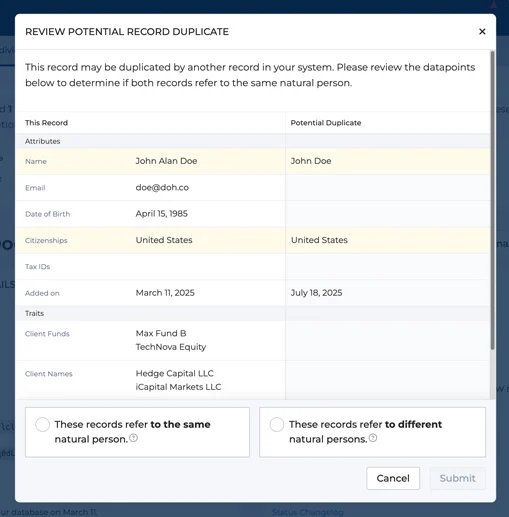

Boost KYC/AML Compliance Efficiency with Identity Solutions

iCapital’s Identity Solutions now offer enhanced capabilities to accelerate client onboarding and reduce manual effort. The platform proactively detects potential duplicate client records, regardless of how they were uploaded. These records are displayed side by side in a dedicated comparison view, making it easier to review and resolve duplicates with confidence and accuracy.

For illustrative purposes only. Functionality subject to change

Additionally, partners can now initiate public and private records searches directly from the client profile page – further streamlining workflows and improving operational efficiency.

For illustrative purposes only. Functionality subject to change

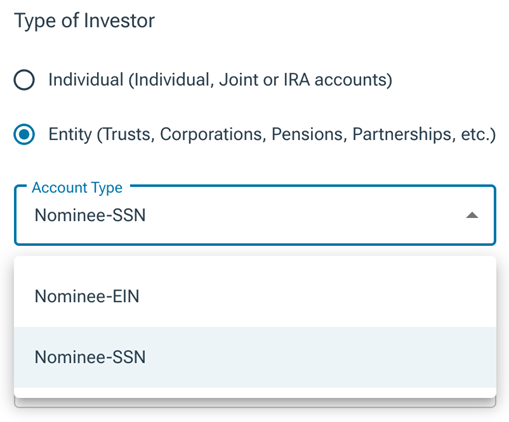

Simplify Execution, Enhance Privacy, and Optimize Global Investing with Nominee Functionality

With iCapital’s new Nominee functionality, global advisors can benefit from simplified execution while preserving investor-level data privacy, transparency and reporting. The iCapital global platform now allows clients to submit trades with aggregated and anonymized investor data under a single Nominee Investment.

For illustrative purposes only. Functionality subject to change

What’s Next From iCapital

We’re reimagining the investment experience—delivering smarter, more connected solutions that support advisors and investors at every stage of the lifecycle, from onboarding to ongoing management and liquidity events.

In the coming quarters, you’ll see the rollout of the following enhancements—and more.

Simplified Management Processes

From integrated investor onboarding to a dedicated tax management portal streamlining key platform workflows.

Deeper Insights Powering Client Conversations

Enhancements to Architect—including cash flow projections, refined client risk profiles, and upgraded analytical framework— and Investment Reporting —new exportable PDF —designed to support more personalized planning and communicate complex insights in a clear, client-friendly way.

Greater Flexibility Across Investment Scenarios

Expansion of multi-investment workflow capabilities to support a broader range of use cases and client needs.

A More Intuitive and Scalable Platform

On-platform support for redemption and transfer workflows and UI/UX updates for a more flexible and scalable user journey.

For more information on how we are reimagining alternative investing, please reach out to your iCapital Relationship Manager.

FOR FINANCIAL PROFESSIONALS

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2025 Institutional Capital Network, Inc. All Rights Reserved.