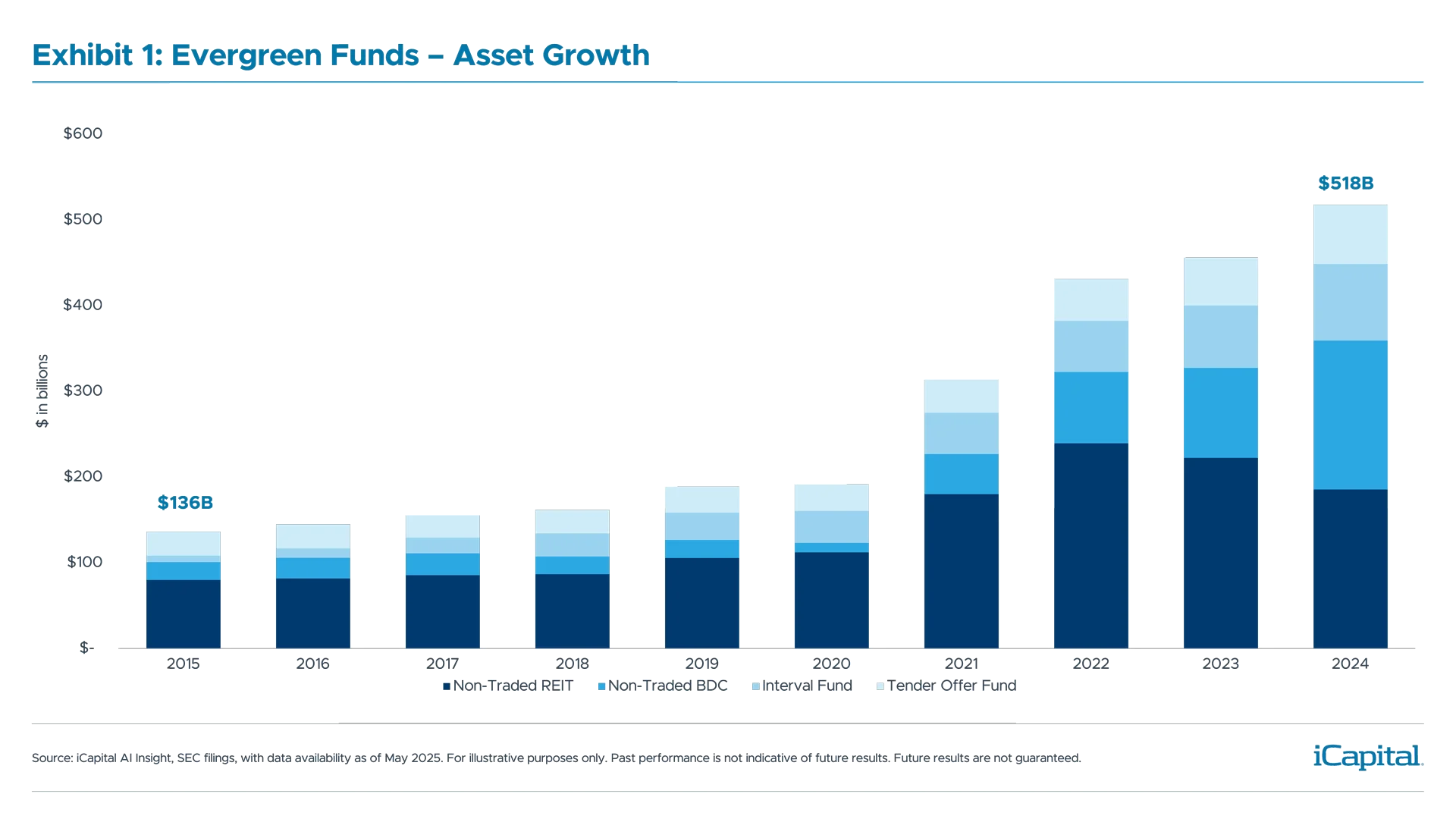

Evergreen or perpetual funds, often referred to as “semi-liquid” funds have in recent years become integral elements in the push to broaden access to alternative investments. These funds – including tender offer funds, non-traded REITs, non-traded BDCs, and interval funds, along with new evergreen structures like 34 Act Reporting Companies and others – now account for more than half a trillion dollars in assets. Additionally, investment managers are launching new funds on a regular basis. In 2024 alone, upwards of 50 new interval and tender offer funds were launched and as at the end of Q1 2025 another 14 funds became available with a further 27 funds in various stages of the Securities and Exchange Commission (SEC) registration process.1 This article, the second in “The Road to Mass Adoption” series offers some key areas for investment managers to consider to potentially increase client adoption.

Exhibit 1: Evergreen Funds – Asset Growth

Alternative investments have long been an asset class utilized extensively by endowments, family offices and other institutional-level investors, but many private wealth investors have struggled with high initial investment minimums, long lock-up periods, and complexities such as J-curves and capital calls, not to mention limited access due to high household income and wealth requirements. When alternative investment strategies are structured in an evergreen format, capital is deployed immediately, investors can invest as little as $2,500 with periodic liquidity, and there is simplified Form 1099 tax reporting as opposed to a Schedule K-1. Perhaps most importantly, the majority of evergreen funds are available to millions of U.S. mass affluent households who meet the accredited investor (AI) requirements whereas traditional private fund structures are restricted to the smaller number of qualified purchaser (QP) households with investable assets in excess of $5 million.2 Evergreen funds are also increasingly available elsewhere in the world, including Europe, Asia-Pacific, and Latin America, so the concept is quickly becoming a global trend.

Alternative investments have long been an asset class utilized extensively by endowments, family offices and other institutional-level investors, but many private wealth investors have struggled with high initial investment minimums, long lock-up periods, and complexities such as J-curves and capital calls, not to mention limited access due to high household income and wealth requirements. When alternative investment strategies are structured in an evergreen format, capital is deployed immediately, investors can invest as little as $2,500 with periodic liquidity, and there is simplified Form 1099 tax reporting as opposed to a Schedule K-1. Perhaps most importantly, the majority of evergreen funds are available to millions of U.S. mass affluent households who meet the accredited investor (AI) requirements whereas traditional private fund structures are restricted to the smaller number of qualified purchaser (QP) households with investable assets in excess of $5 million.2 Evergreen funds are also increasingly available elsewhere in the world, including Europe, Asia-Pacific, and Latin America, so the concept is quickly becoming a global trend.

Exhibit 2: U.S. Investor Wealth Tiers, 2023

Not so long ago an investment manager might have been able to launch and raise assets in an evergreen fund structure on the back of its reputation and private fund track record. Increasingly, however, this is no longer the case. Instead, with the rapid pace of change impacting how investment managers package their capabilities and target different private wealth channels, investment managers must be prepared to make a significant financial and time commitment. Helping wealth managers and their clients understand these products and how they can be effectively used to generate capital growth, provide income and diversify portfolios is an integral component of any successful effort.

Four key areas to help drive client adoption

Investment managers can help wealth managers and their clients gain confidence by reducing the confusion and anxiety that can potentially stall client adoption of evergreen funds. There is no one solution, but we believe adoption is best served when an investment manager has a complete understanding of the oftentimes varied fund approval and onboarding pre-requisites that each wealth management firm has. Investment managers should also ensure they understand the sales support and education expectations and needs of the firm with whom they are looking to partner. Easy access, the ready availability of fund information and on-going assistance to address any wealth manager questions or concerns are the key to success when a wealth manager is constructing a portfolio which incorporates alternative investments.

1. Path to the Wealth Manager’s Desk

Similar to other investment providers, sponsors of evergreen funds need to secure access to distribution. Whether it is a wirehouse, an Independent Broker Dealer (IBD), a Registered Investment Advisor (RIA), or a private bank, investment managers must ensure wealth managers across all their priority distribution channels can easily view, compare and purchase their funds. However, the path to distribution success varies, and many wealth management firms have increasingly stringent access requirements such as fund level assets under management. Alternative investments, including evergreen funds, face a high risk and suitability review bar. Some wealth management firms require third-party due diligence reports and some demand home office approval of all products before a fund can be purchased by a wealth manager. Others allow wealth managers to propose a new product to the home office for approval and thus developing and demonstrating wealth manager interest becomes paramount. Many wealth management firms use a preferred custodian, particularly within the IBD and RIA channels, and approval on one or more custodial platforms, each with their own requirements, is a gating item. Understanding and navigating these processes as well as successfully negotiating the necessary distribution agreements can be a time consuming and resource intensive process, one that is essential to building a robust sales pipeline.

2. Sales and Education

Given their generally lower investor net worth qualifications and other attractive features, evergreen funds often serve as an individual investor’s initial foray into alternative investments. As a result, this could be the first time wealth managers have to explain alternative investments to their clients. Wealth managers must have the ability to provide a clear narrative highlighting the benefits, risks and structural differences of these funds and to determine appropriate allocations in relation to traditional asset classes and vehicles. Investment managers who wish to gather significant assets should expect to provide meaningful sales and educational assistance, whether it is via an in-house capability or in partnership with a third-party provider. This includes resources to support the needs of the home office and other centers of influence along with individual wealth managers. Understanding drives engagement, so without the ability to scale these efforts, investment managers could see engagement and fundraising levels below expectations.

3. Portfolio Construction

Incorporating alternatives into client portfolios can become complicated as wealth managers try to best align investment strategies with client specific financial goals, risk tolerance, and investment horizons. Availability of data, standardization of that data across sources and the ability to quickly identify the impact of portfolio composition adjustments all create barriers to adoption. Investment managers may wish to consider how to integrate their evergreen funds into portfolio analytics and risk management tools such as iCapital Architect, which can effectively visualize the impact of adding funds to client portfolios. The more wealth managers can understand and communicate in a simple, easy to understand way the impact of an alternatives allocation, the more likely they are to allocate to those products across their client base. Further, the more an investment manager can articulate the positive impact of their products using clear and concise analytics, the more value they are adding to their wealth manager clients.

4. Ease-of-Use

Wealth managers value clear and positive interactions with clients about their investments. Obstacles that detract from the client experience can create friction and threaten the investment manager’s ability to build and maintain long-term relationships. Investment managers should carefully consider the various touchpoints that exist between wealth managers and a fund, and plan to create as positive an experience as possible across those touchpoints. The goal should be a seamless experience for wealth manager initiated actions, including subscriptions, additional investments, repurchases/tenders, account ownership transfers, and changes to client accounts.

It is important for investment managers to address and navigate these key areas when they begin planning an evergreen fund and through launch and beyond. In comparison to traditional private funds, evergreen funds have the potential to offer improved transparency and liquidity. However, investment managers must be careful to ensure wealth managers and their clients fully understand how evergreen funds differ. These differences can impact the client experience, especially in contrast to other investment vehicles with which they may be more familiar such as mutual funds and ETFs. If done correctly, this work should help successfully scale an investment manager’s business and grow the presence of their fund offering in the private wealth channel. In our next article, we will cover the operational considerations investment managers need to incorporate into their planning to function effectively at scale and how to do so by leveraging technology.

1. XA Investments’ Non-Listed Closed-End Funds First Quarter 2025 Market Update.

2. Review of the “Accredited Investor” Definition under the Dodd-Frank Act (sec.gov).

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.