One of the constants of being in or near the investment management industry is on-going change and innovation – mutual funds and ETFs, traditional private funds and evergreen funds, the list is seemingly endless. New products, asset types and structures are always being explored, and investment boundaries are continually pushed. At the same time fintech has improved ease of access and transparency, making previously cumbersome and time-consuming processes seamless and easy to use. First movers can be large institutions, perhaps an endowment or a public pension fund, or increasingly a sovereign wealth fund. Other times, it can be the wealth management channel, as product providers and wealth managers race to differentiate themselves and to meet the progressively more sophisticated investment needs and service level requirements of the high-net-worth or mass affluent investor. And let’s not forget the government’s role in its capacity as legislator and regulator. So, irrespective of the source, catalysts for change are numerous.

State of the Industry

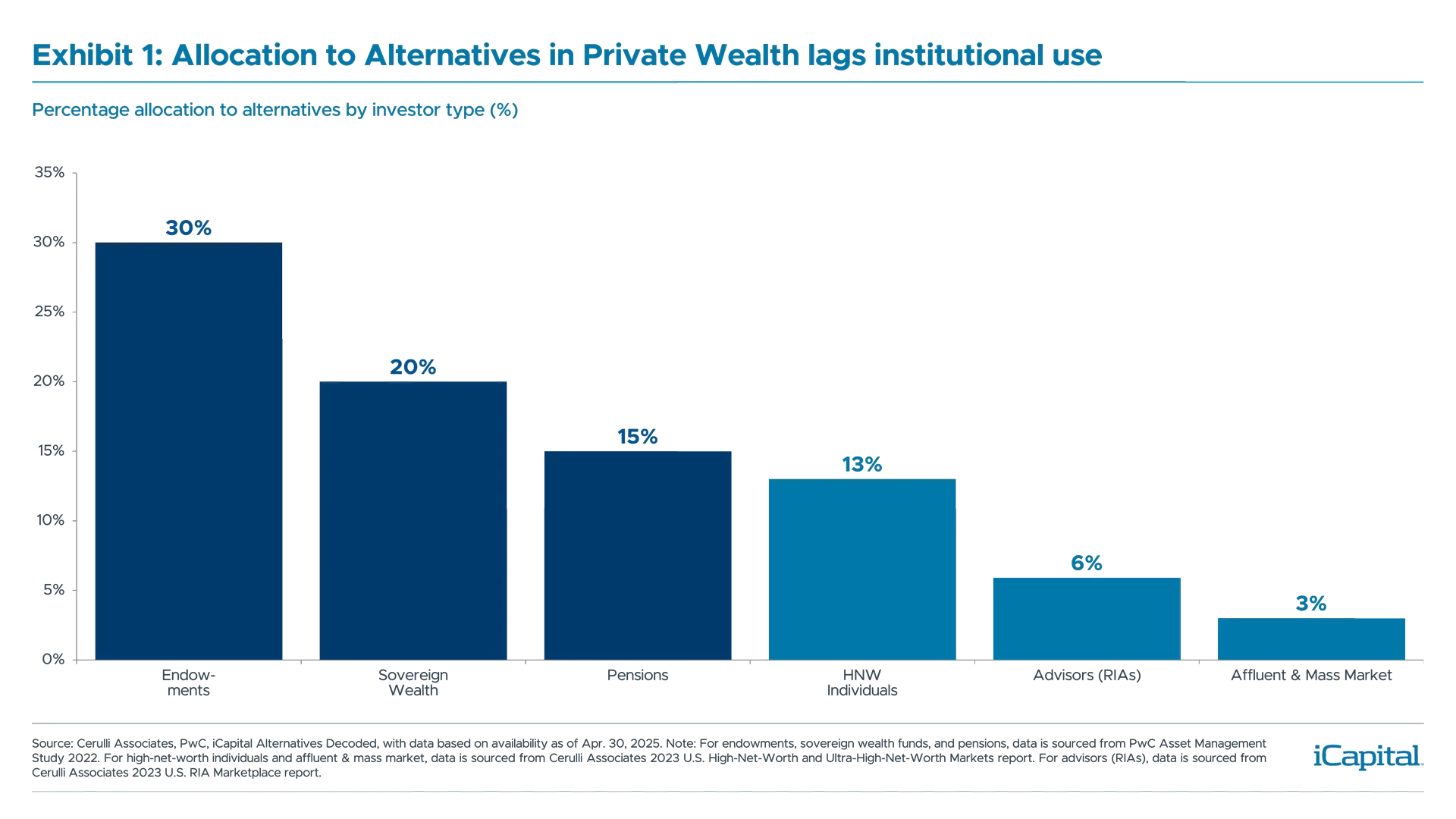

Over the last two decades one of the major sources and beneficiaries of a transformation impacting the investment management industry has been the utilization of alternative investments as a complement to traditional public equities and fixed income. No longer a niche asset class, alternative investments are increasingly viewed as a ‘must-have’ and institutions, wealth managers and individual investors have taken notice. Still, we believe the opportunity to increase the allocation to alternative investments is sizable given generally low portfolio allocation and wealth manager use. For example, as shown in Exhibits 1 and 2, amongst Registered Investment Advisors (RIA), just 36% of advisors allocate an average of 6% of client assets to alternative investments.

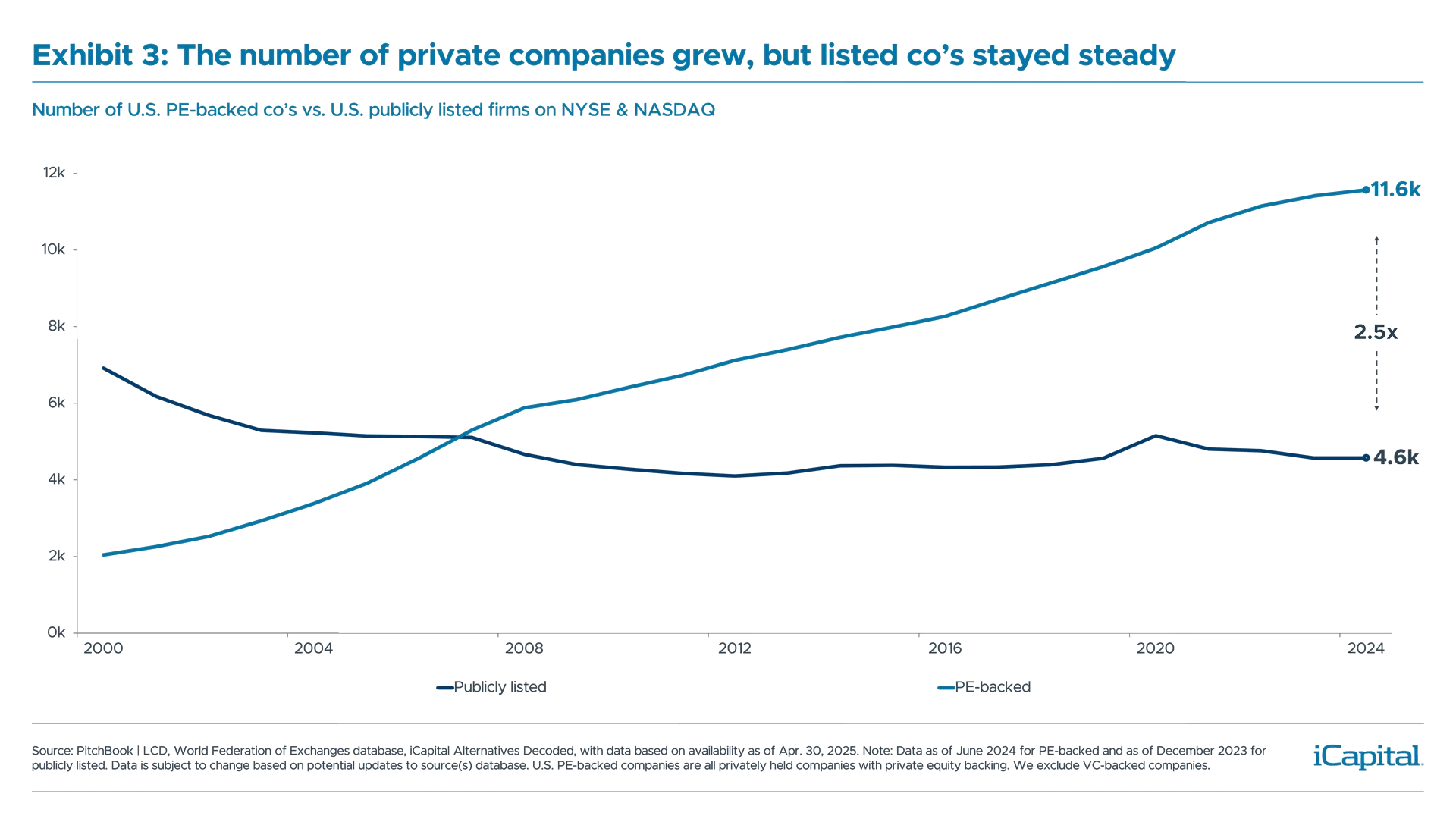

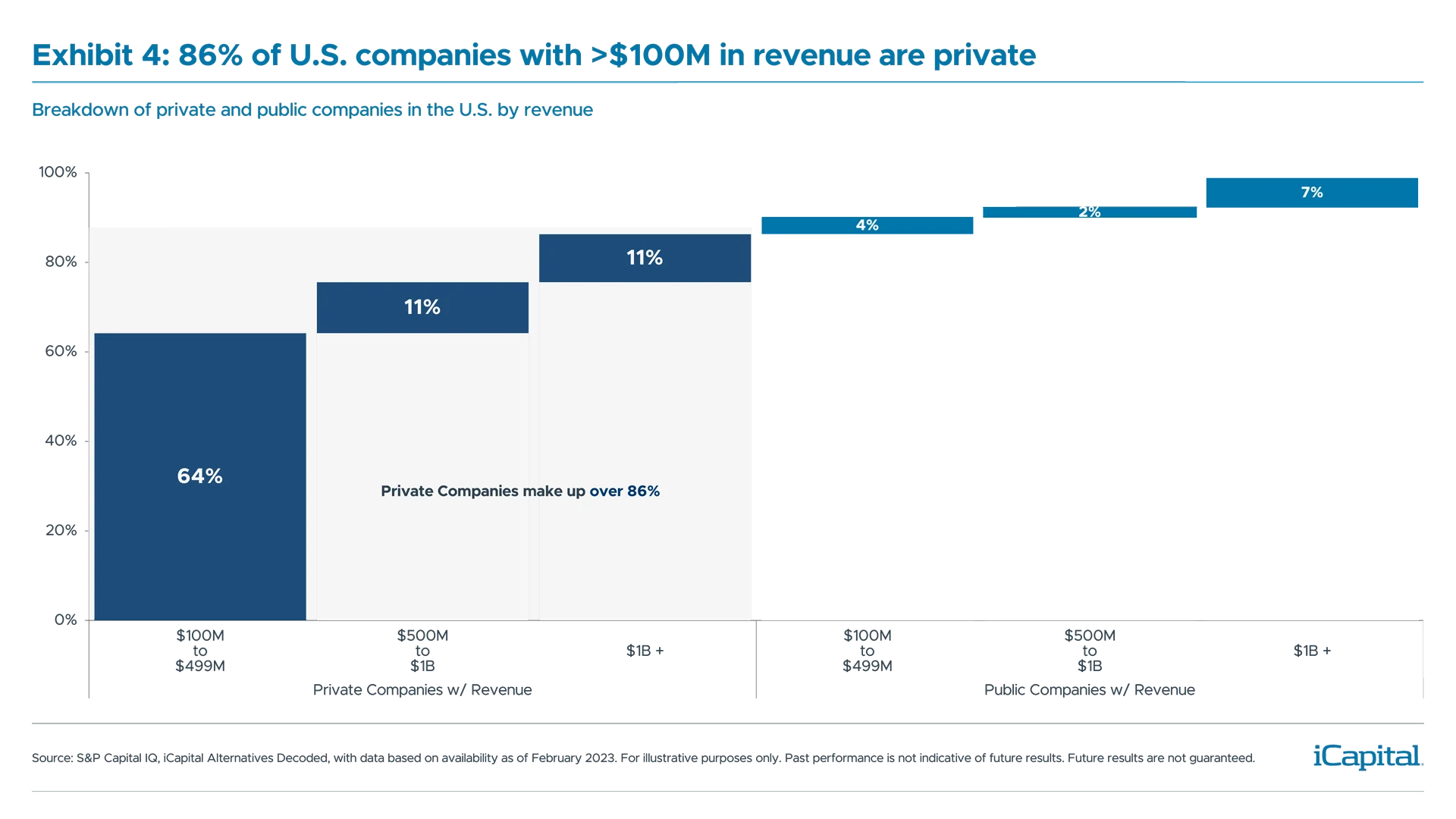

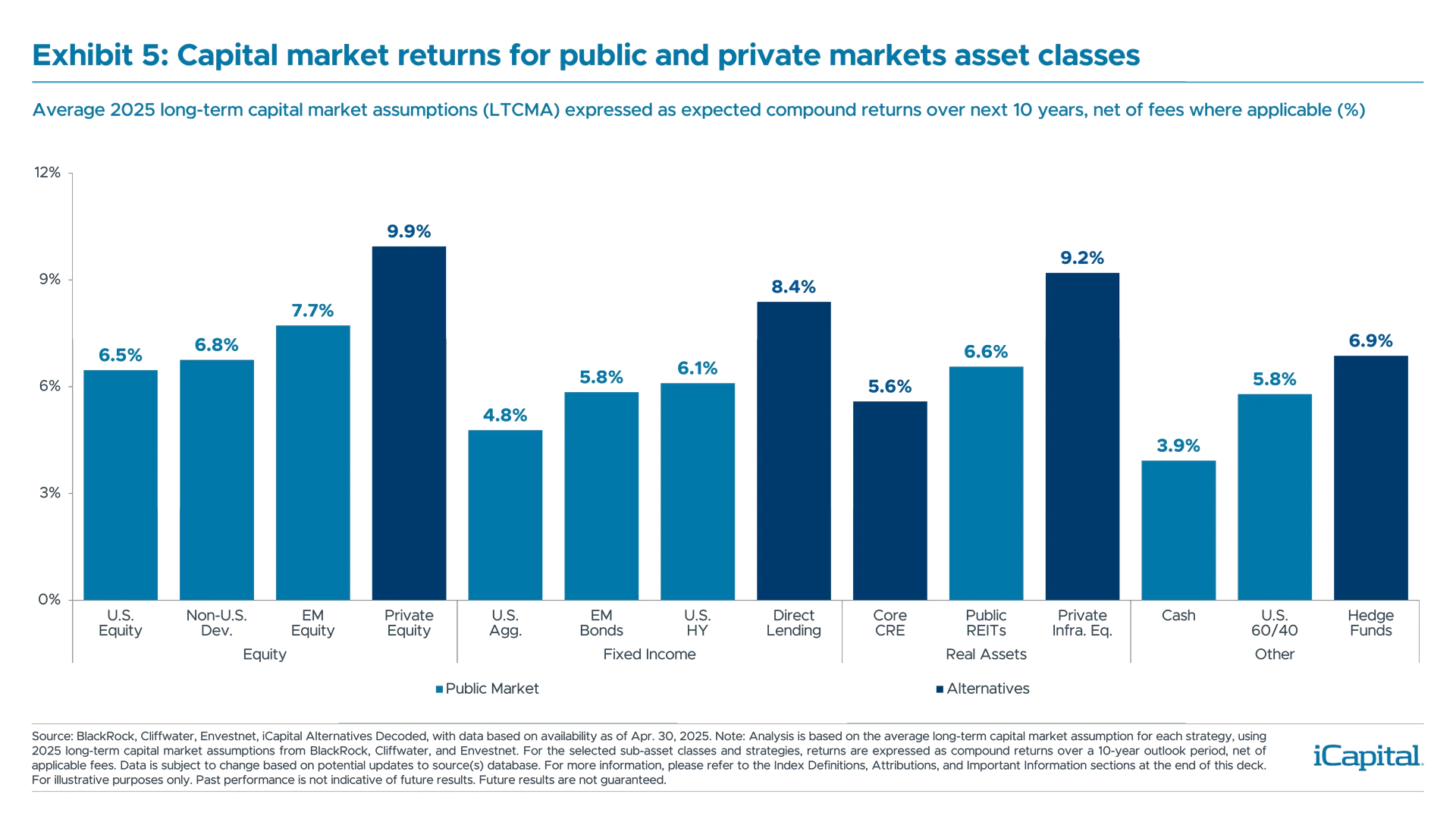

One might reasonably ask what’s driving this trend. Of course, although many large institutions are already heavily allocated, most continue to dedicate significant sums of money to various forms of alternative investments. Increasingly, however, it is wealth managers and investors who are now aware that compared to a traditional 60/40 portfolio, a 50/30/20 allocation to alternative investments can enhance a portfolio’s growth and income potential while at the same time improving its volatility profile. Investors are also more aware that in many cases the best companies, those with the potential to deliver exceptional returns, are choosing to remain private. Whether due to the ability to access ample private capital, freedom from public market pressure or simply to avoid a range of regulatory and compliance headaches, the number of public companies has dropped dramatically over the last several decades, albeit the trend appears to have stabilized.

In other instances, investors are simply questioning the ability of the traditional 60/40 portfolio to deliver above-average returns, especially if investors are concerned that we may be looking at a new world of anemic stock market returns. There is also increased public equity downside danger due to concentration in some indices, overheated valuations and the dominance of passive, all of which have created fears of downside risk. In this environment, the importance of having diversifying private market and hedge fund strategies grows, as does the ability to explore the role of properly vetted alternative investments in the asset allocation framework, especially in conjunction with risk management solutions.

Breaking Down Barriers

In recent years, the promise of alternative investments has been unleashed – barriers to entry have been broken, growth trends, technological and operational improvements, the appetite of investment managers to launch and support new products, not to mention demand from wealth managers, all continue to point to increased sales and AUM growth. We believe this will be especially pronounced in the private wealth channel as evergreen products such as interval and tender offer funds, non-traded REITs and non-traded BDCs become more numerous and their penetration of wirehouses, independent broker dealers (IBDs), private banks and RIAs steadily improves. Importantly, this is not just a U.S. phenomenon as evergreen funds launched under the European Long-Term Investment Fund (ELTIF) regulations are becoming more popular and interest in similar funds in Asia, Latin America and the Middle East grows.

Longer term, alternative investments may penetrate further into client portfolios, possibly via target date funds in 401(k) plans or closed-end funds that trade on an exchange. In the meantime, alternative investment allocations within the private wealth channel significantly lag institutions, and perhaps surprisingly the number of wealth managers who utilize alternatives, while growing, is still relatively low.

Wealth managers who wish to increase their use of alternatives will need to educate themselves, ensure they have access to the right tools, technology and partners, or run the risk of falling by the wayside.

Those who do not build a core competency in alternative investments, whether due to a lack of knowledge, competing priorities, inadequate technology or fear of operational burdens will be creating business risk. In fact, absent a core competency, they should not be surprised to see their clients utilize another wealth management relationship.

Although evergreen funds provide enhanced liquidity compared to traditional private funds, they are still long-term investment vehicles. Education is required to ensure that both wealth managers and clients understand the illiquid nature of the underlying investments and the cyclical nature of an allocation to private markets. Importantly, for long-term investors the illiquidity premium can be a source of significant alpha. One of the ways this alpha can be captured is when investors remain allocated throughout the ups and downs of a market cycle. Irrespective of whether it is a traditional private fund or evergreen fund, an allocation to alternative investments must be properly managed if the Illiquidity and behavioral benefits of private market and hedge fund allocations are to accrue to the satisfaction of wealth management clients. Key to this is a consistent and strategic approach in which both institutional allocators and private clients regularly invest and when necessary, re-balance.

Perhaps unsurprisingly, the number of evergreen funds in the market continues to grow, but what is required to succeed? Yes, evergreen funds offer a variety of important benefits, including immediate capital deployment and a more attractive liquidity framework, but it is not a build it, and they will come scenario.

Not so long ago an investment manager might have been able to launch and raise assets in an evergreen fund structure on the back of its reputation and private fund track record, but this is no longer the case. Instead, with the fast pace of change impacting how investment managers package their capabilities and target different private wealth channels, fund sponsors must be prepared to make significant financial and time commitments.

Of course, no matter the investment vehicle, mass adoption will be delayed if the industry fails to mitigate operational hurdles. Although progress has been made, this includes removing pain points related to client onboarding, whether it is the subscription process, the paperwork associated with Know Your Client (KYC) and Anti-Money Laundering (AML) requirements, or minimum investment amounts. Wealth managers are increasingly looking for a comprehensive and easy to implement all-in-one solution that allows them to focus on relationship management and building their businesses. Models and funds which package a variety of funds into one place as well as technological changes like tokenization and fractional ownership are likely to play a significant role in growing the total number of investors with an alternative investment allocation.

Finally, no discussion of mass adoption would be complete without an examination of private market investments beyond traditional private funds and evergreen funds. Importantly, the investment management industry has begun to make significant strides towards the inclusion of private market assets in an ETF wrapper. For example, in a dramatic shift and an ETF first, a recently launched ETF will be allowed to hold upwards of 35% in private credit even though illiquid holdings are normally limited to 15%. How the fund will work in practice given the liquidity mismatch, i.e., illiquid securities in a highly liquid ETF, remains to be seen. However, the ETF arbitrage mechanism is likely to function even if the bid/ask spread is wider than typical ETFs. We have our doubts about whether these products can fully capture the benefits of a private markets allocation, much like so-called liquid alt hedge funds often fall short, but they will find their place. In any event, the new fund opens the window for future products and a variety of public/private portfolios in a mutual fund or ETF wrapper.

Conclusion

Wealth management clients from the mass affluent to the very wealthy have an array of proven and increasingly easy to use means to access alternative investments to improve investment outcomes. While innovation is accelerating and choices are likely to multiply even further in the coming years, wealth managers should be comfortable embracing alternatives now, rather than waiting for further evolution. The benefits of an allocation to alternative investments are clear. Today, more than ever, alternative investments are no longer the exclusive domain of large institutions and ultra-high-net-worth investors. Investment managers and their partners in the wealth management industry are well on their way to mass adoption.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.