The Hassle Factor

While many RIAs acknowledge the benefits of adding alternatives to client portfolios, this is often overshadowed by the complexity of implementation and portfolio fit.

- Time-consuming process

80% of time spent on 10-20% of a client’s portfolio.

- Complex investment decisions

Fulfilling fiduciary responsibility through ongoing due diligence, monitoring and selecting the right investments.

- Operational challenges

Managing disparate systems, manual workflows, and custom reporting.

The Value-Creation Opportunity

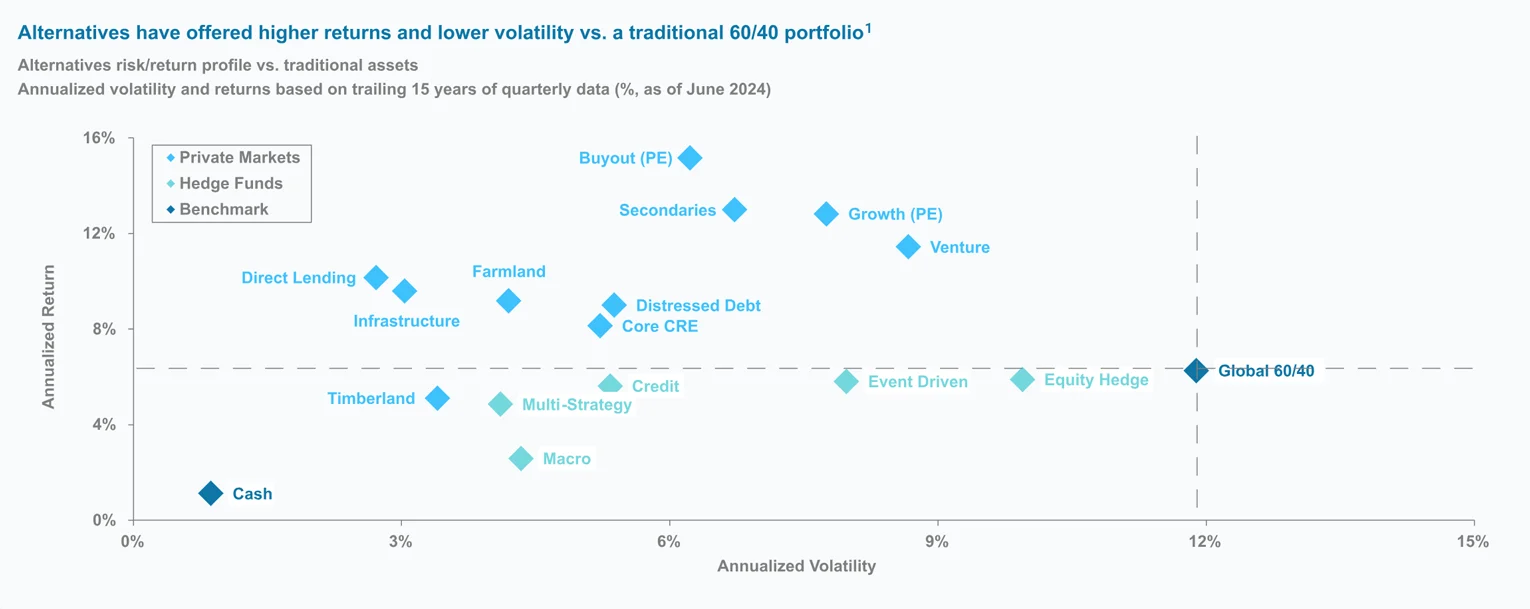

Alternatives can reduce portfolio volatility while maintaining — or even increasing — return potential. By introducing strategies that are less correlated to traditional stocks and bonds, they can help smooth performance through market cycles. In doing so, you can offer your clients new ways to capture growth without being overly reliant on a single asset mix.

To find out more about iCapital’s Alternatives Decoded interactive chartbook, which helps RIAs take a deeper dive into private market data, please visit: https://icapital.com/alternatives-decoded/

Breaking Down the Hassle Factor

Pre-Investment

From delivering materials to conducting eligibility checks and managing client communications, incorporating alternatives into a portfolios is layered and time consuming.

Key Pain points:

- Portfolio fit and risk-reward analysis.

- Delivering offering materials.

- Eligibility checks and compliance tracking.

- Managing communications with clients.

“Every part of the alternatives investing lifecycle can be a hassle. How do you confirm client eligibility? Ensure compliance oversight? Provide evidence to regulators? The iCapital platform is designed to track and document each step so advisors don’t have to.”

– Binoy Talati, Managing Director, Enterprise RIA

Investment Process:

Key Pain points:

- Lengthy, manual subscription process up to 100 pages.

- Occasionally digital, typical disconnected point solutions.

- Lacking critical partner connectivity with major custodians or reporting platforms.

“The subscription process is a well-known pain point for RIAs. Our platform simplifies it by turning a signed document into a transparent, step-by-step workflow — whether it needs to go to an admin or legal review.

It also automates the handoff to custodians. Without a platform, RIAs typically need to generate a Letter of Agreement (LOA), get it signed separately, create an order ticket, and manually upload both to the custodian — what we call the ‘swivel chair‘ process.

With our system, once the order is approved, it’s sent directly to the custodian via API — no separate documents, no manual order tickets.”

– Binoy Talati

Investment Lifecycle:

Key Pain points:

- Managing investments with long-dated time horizons.

- Wide range of reporting and client communication obligations including capital calls, K1s, 1099s.

- Balancing books with custodians.

“Post-investment reporting is critical. Our operating system has a range of tools and capabilities built in that work as one cohesive workflow. Once invested, it’s simple to generate client-end adviser and home office reporting. This covers capital calls, distribution notices, K1s and

statements, all done through our document center.

We also take the data associated with those investments and pipe it downstream into reporting platforms.”

– Binoy Talati

How iCapital Can Help

iCapital eliminates the hassle with cutting-edge technology, deep research expertise and a seamless operating system, allowing RIAs to focus on what matters most – delivering for your clients.

Key questions to address:

- How do you balance liquidity, fees and risk?

- What’s the right allocation to alternative investments?

- What products should be offered to your clients?

- How do the products fit into a portfolio?

- How do you manage continuous review and portfolio optimization?

Investment solutions: iCapital helps RIAs focus on what matters most — your clients, not administrative headaches.

- Model Portfolios – Growth, Balanced and Income models designed to assist with asset allocation.

- Due Diligence – In-house research team for research, due diligence, thought leadership or custom in-depth solutions as required.

- Architect Portfolio Analytics – Award-winning2 portfolio construction tool that can help design portfolios and illustrate the impact of alts.

Operational solutions: iCapital simplifies every stage

of the alternatives investing process, reducing friction and freeing up advisor capacity.

- Pre-Investment – Access to education, due diligence reports, offering materials and compliance tracking.

- Investment Process – Digital fund profiles, robust product search engine, integrated digital workflows for subscription documents.

- Investment Lifecycle – Saved client profiles, streamlined reporting, data reconciliation, document management, custodian and third party integrations.

For illustrative purposes only. Platform functionality subject to change.

Let iCapital eliminate the hassle so your team can focus on what truly matters: delivering value for clients and growing your practice. Contact Us

1. Bloomberg Index Services Limited, Cliffwater Direct Lending Index, FTSE Russell, Hedge Fund Research (HFR), MSCI, NCREIF, Preqin, iCapital Investment Strategy, with data based on availability as of Oct. 31, 2024. Note: Data as of June 2024 and is subject to change based on potential updates to source(s) database. Return and volatility is annualized and is based on quarterly data. Buyout proxied by Preqin Private Equity Buyout Index. Growth proxied by Preqin Growth Equity Index. Venture proxied by Preqin Venture Capital Index. Secondaries proxied by Preqin Secondaries Index. Direct Lending proxied by Cliffwater Direct Lending Index. Distressed proxied by Preqin Distressed Private Debt Index. Real Estate proxied by NCREIF NFI-ODCE Index. Infrastructure proxied by Preqin Infrastructure Index. Private Timber proxied by NCREIF Timberland Property Index. Private Farmland proxied by NCREIF Farmland Property Index. Macro HFs proxied by HFRI Macro Total Index. Multi Strat HFs proxied by HFRI RV: Multi-Strategy Index. Event Driven HFs proxied by HFRI Event-Driven Total Index. Equity Hedge HFs proxied by HFRI Equity Hedge Total Index. Global 60/40 proxied by 60% MSCI ACWI Net Total Return USD Index and 40% Bloomberg Global Aggregate Index. Cash proxied by the FTSE 3 Month US T Bill Index. Annualized risk and returns above are based on indices that are meant to estimate the asset class performance, hypothetically creating a return if one had access to all active funds. Not all the above indices are practically investable. See disclosure section for further index definitions, disclosures, and source attributions. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

2. Awards, rankings and/or recognition by una liated rating services and/or publications should not be construed by a client or prospective client as a guarantee that he or she will experience a certain level of results if Institutional Capital Network Inc. (“iCapital”) is engaged, nor should it be construed as a current or past endorsement of iCapital by any of its clients.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, situation, or specific financial situation, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.

Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

STRUCTURED INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.

Please note that there is no public secondary market for structured investments. Although the issuer may from time to time make a market in certain structured investments, the issuer does not have any obligation to do so and market making may be discontinued at any time. Accordingly, an investor must be prepared to hold such investments until maturity. Any or all payments are subject to the creditworthiness of the issuer. Before investing in any product, an investor should review the prospectus or other offering documents, which contain important information, including the product’s investment objectives or goals, its strategies for achieving those goals, the principal risks of investing in the product, the product’s fees and expenses, and its past performance.

ANNUITIES ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS.

The information is not intended as investment advice and is not a recommendation about managing or investing retirement savings. Actual annuity contracts may differ materially from the general overview provided. Prior to making any decision with respect to an annuity contract, purchasers must review, as applicable, the offering document, the disclosure document, and the buyer’s guide which contain detailed and additional information about the annuity. Any annuity contract is subject in its entirety is to the terms and conditions imposed by the carrier under the contract. Withdrawals or surrenders may be subject to surrender charges, and/or market value adjustments, which can reduce the owner’s contract value or the actual withdrawal amount received. Withdrawals and distributions of taxable amounts are subject to ordinary income tax and, if made prior to age 59½, may be subject to an additional 10% federal income tax penalty. Annuities are not FDIC-insured. All references to guarantees arising under an annuity contract are subject to the financial strength and claims-paying ability of the carrier. iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2025 Institutional Capital Network, Inc. All Rights Reserved.

Preqin Private Equity Buyout Index — A benchmark measuring the performance of global private growth equity funds, as tracked by Preqin.

Preqin Growth Equity Index — A benchmark measuring the performance of global private growth equity funds, as tracked by Preqin.

Preqin Venture Capital Index — A benchmark measuring the performance of global private venture capital funds, as tracked by Preqin.

Preqin Secondaries Index — A benchmark measuring the performance of global secondaries funds, as tracked by Preqin.

Cliffwater Direct Lending Index (CDLI) — An index reflecting the performance of U.S. middle market corporate loans, constructed from actual loan portfolios of business development companies (BDCs).

Preqin Distressed Private Debt Index — A benchmark measuring the performance of distressed private debt funds, as tracked by Preqin.

NCREIF Fund Index — Open End Diversified Core Equity (NFI-ODCE) — An index of open-end, diversified, core equity real estate funds investing in U.S. properties, reported by NCREIF.

Preqin Infrastructure Index — A benchmark measuring the performance of global infrastructure funds, as tracked by Preqin.

NCREIF Timberland Property Index — Measures investment performance of a pool of private timberland properties in the U.S., reported by NCREIF.

NCREIF Farmland Property Index — Measures investment performance of a pool of private farmland properties in the U.S., reported by NCREIF.

HFRI Macro (Total) Index — A composite index representing hedge funds with macro strategies, published by Hedge Fund Research (HFRI).

HFRI Relative Value (Multi-Strategy) Index — A composite index tracking hedge funds employing multiple relative value strategies, published by HFRI.

HFRI Event-Driven (Total) Index — A composite index representing hedge funds employing event-driven strategies, published by HFRI.

HFRI Equity Hedge (Total) Index — A composite index representing hedge funds employing equity hedge strategies, published by HFRI.

MSCI ACWI Net Total Return USD Index / Bloomberg Global Aggregate Index (60/40 Blend) — A blended benchmark with 60% allocated to the MSCI All Country World Index (ACWI) Net Total Return USD Index (global equities) and 40% allocated to the Bloomberg Global Aggregate Bond Index (global investment grade fixed income).

FTSE 3-Month U.S. Treasury Bill Index — An index representing the performance of U.S. dollar-denominated three-month Treasury bills, published by FTSE Russell.