Key Takeaways:

- AI disruption is not uniform: AI is challenging traditional enterprise software’s economics (recurring revenue, moats, development costs), but its impact varies sharply across the software stack.

- Applications Software is bifurcating, but not “Dead”. Generative AI (GenAI) commoditizes niche, seat-based Software-as-a-Service (SaaS) models, but platforms with sticky ecosystems and deep integrations can adapt and defend their moats

- Infrastructure Software is the structural winner. With stronger moats, higher growth (+15.4% vs. +9.3% for Applications through 20271 ), and rising reliance from AI agents and data, Infrastructure benefits directly from AI rather than being disrupted by it.

- Overweight Infrastructure, highly selective in Applications. Overweight Infrastructure for durable growth and favorable valuations relative to historical norms; in Applications, be highly selective as dispersion between winners and losers widens.

Software has become a topic of debate in markets this year, driven by concerns that AI may disrupt current enterprise software companies pricing models, erode competitive moats, and lead to a “fast fashion” era of rapid commoditization. These concerns would fundamentally challenge software’s core strengths – recurring revenue, sticky adoption, and defensible moats – ultimately having meaningful implications for investors.

Yet, this “AI will kill software” narrative that some investors have subscribed to is overly simplistic and misses a critical point – not all enterprise software companies are created equal, nor are they equally vulnerable in the AI era. Software isn’t a monolithic industry, but rather a layered stack, and so AI’s impact varies sharply across these layers.

Some parts of the stack, like the Application layer, may see competitive moats and pricing challenged by AI, while other areas like the Infrastructure layer (not to be confused with Infrastructure like GPUs or Data Centers) are likely to gain importance as AI scales.

For investors, distinguishing between the layers is increasingly important. While select Application Software names may still offer some upside, especially those integrating AI deeply into their platforms, we see the clearest structural value in Infrastructure Software, where AI adoption reinforces the business rather than threatens it.

Framing the Modern Software Stack

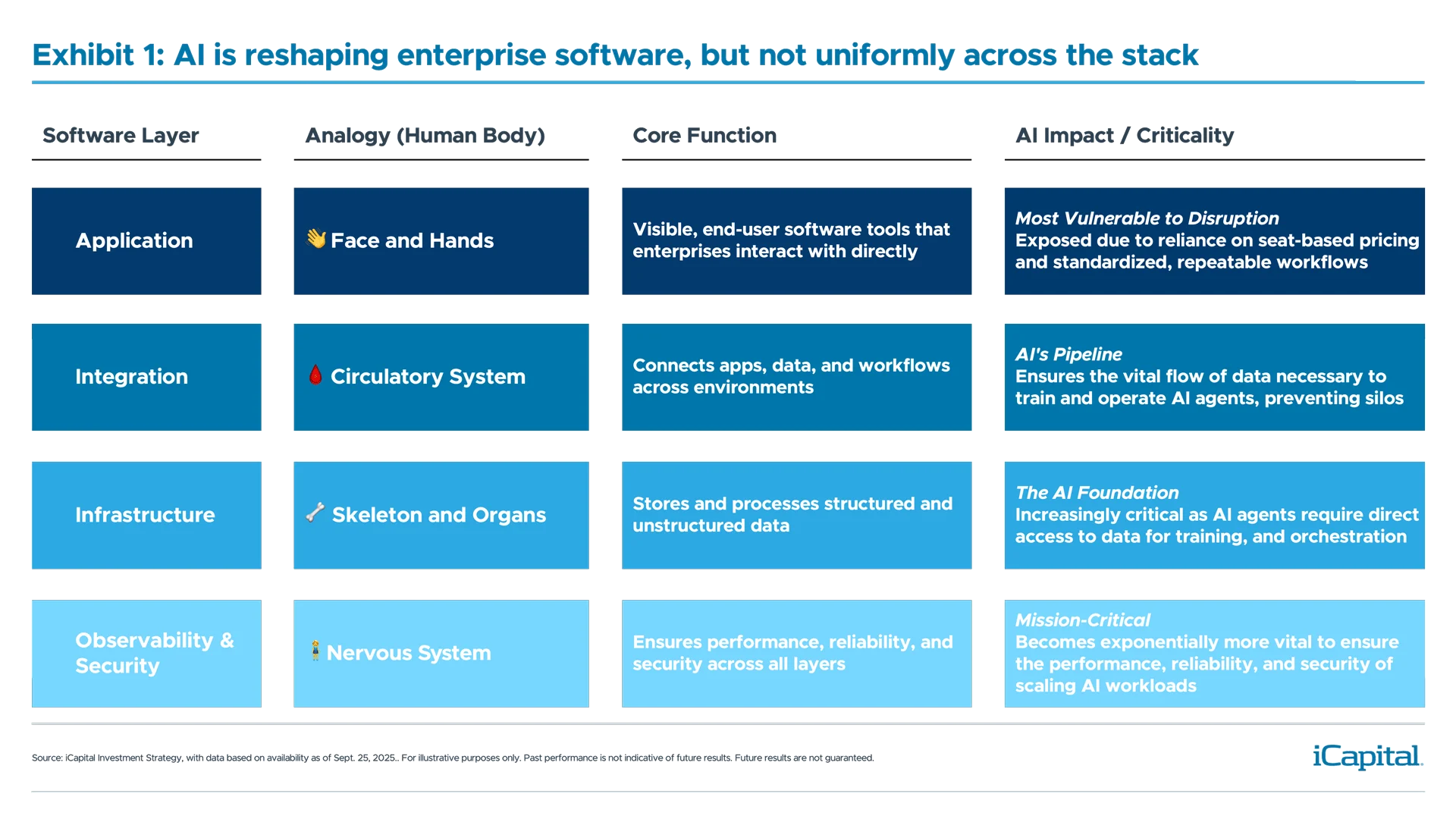

To understand how AI is impacting software, it helps to think of the enterprise stack as a living body (Exhibit 1):

- Application Layer → The Face and Hands. Often referred to as the SaaS layer, it’s the visible, end-user tools that enterprises interact with directly. Just like our face and hands are the most exposed, this layer is also the most vulnerable to AI-driven disruption due to its reliance on seat-based pricing and standardized workflows.

- Integration Layer → The Circulatory System. Veins and arteries moving information between organs – connecting applications, data, and workflows across cloud and on-prem environments. Without this circulatory flow, the system would be siloed and disconnected.

- Infrastructure Layer → The Skeleton and Organs. Data warehouses and data lakes – which respectively house pools of structured and unstructured data – that store, process, and manage enterprise data that all other layers depend on. Important here is that as AI agents scale, they increasingly rely on direct access to data making this layer critical for training, orchestration, and deployment in the AI era.

- Observability & Security Layer → The Nervous System. Monitoring, reliability, and security tools that operate across all layers, acting as the stack’s nervous system, ensuring the other layers are performing and healthy. Most important here is that as AI workloads scale, these tools become increasingly critical.

AI’s buildout is not disrupting all layers of the software stack equally. At its core, we believe the Application layer is more susceptible to AI disruption, while Infrastructure and Observability & Security layers (collectively “Infrastructure”) are proving to be more durable – and even thriving as AI adoption ramps.

AI’s buildout is not disrupting all layers of the software stack equally. At its core, we believe the Application layer is more susceptible to AI disruption, while Infrastructure and Observability & Security layers (collectively “Infrastructure”) are proving to be more durable – and even thriving as AI adoption ramps.

Application Software Faces Greater AI Disruption Risk

Application Software confronts multiple AI-driven challenges – commoditization, pricing pressure, reduced switching costs, and increasingly lower barriers to entry for AI-native startups.

GenAI and emerging AI agents can streamline workflows, replacing tasks that once required multiple users and licenses. This directly threatens traditional seat-based SaaS pricing models. And with AI-native startups gaining traction with value-based, pay-per-outcome pricing, incumbents may be forced to follow suit – a shift that is deflationary to current SaaS economics. As the cost of inference falls, defending legacy pricing structures will become increasingly difficult.

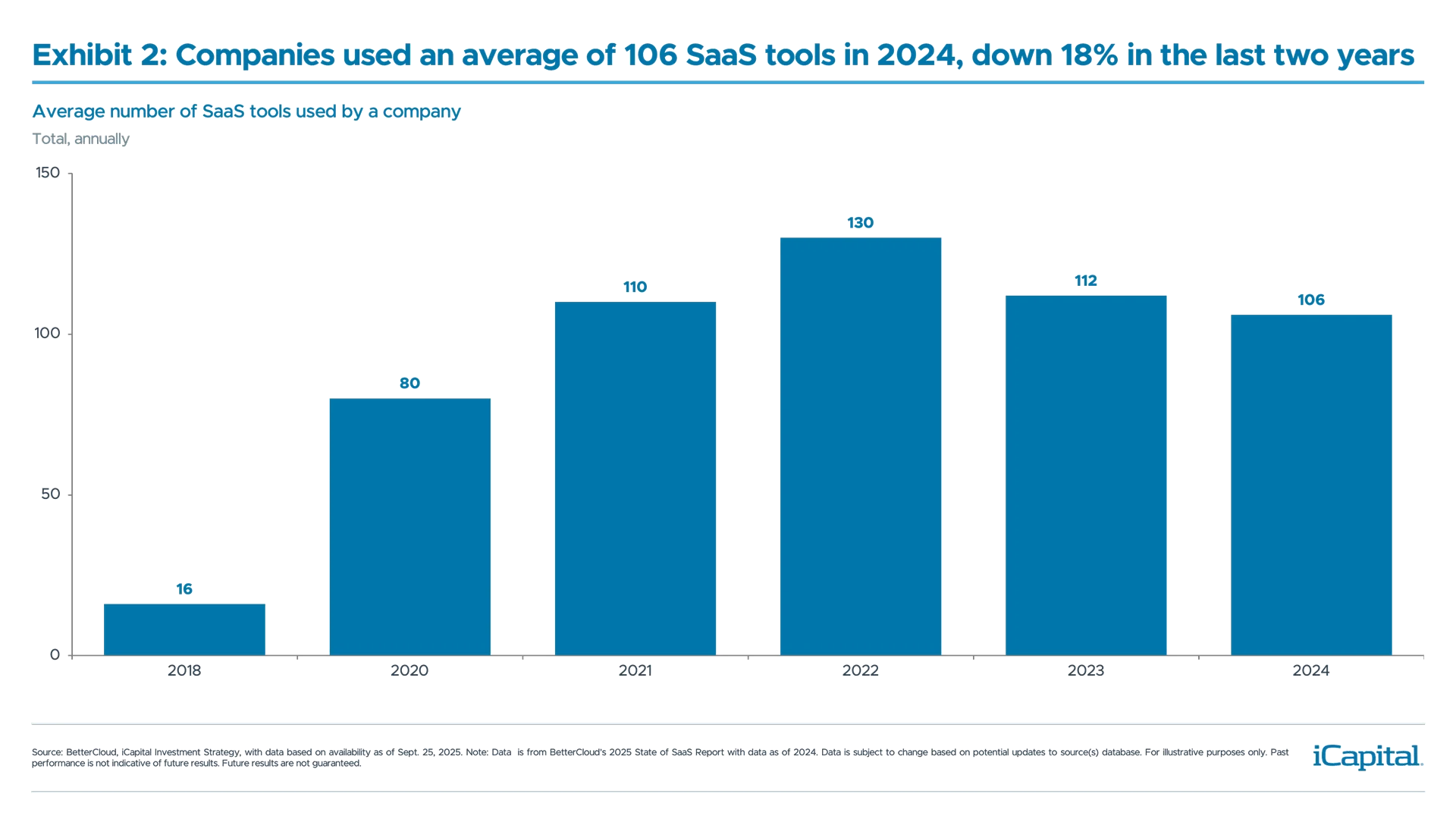

We believe the impact to the Application layer is greatest among niche SaaS players in fragmented and back-office areas like HR, marketing and customer support, where limited integration and straightforward workflows make them especially vulnerable. Indeed, we’re already seeing signs of this play out as enterprises are rationalizing their software stacks, using fewer applications for the second straight year – an 18% decline from the 2022 peak (Exhibit 2).2

Also, AI’s buildout will intensify the “build-or-buy” dilemma as companies may elect to insource AI capabilities rather than purchase off-the-shelf SaaS solutions. While this will likely be limited to well-resourced and large-to-mid sized enterprises, it adds pressure to SaaS vendors whose offerings are increasingly commoditized. By 2027 this dynamic could accelerate churn by three percentage points – and meaningfully more as AI matures.3

Also, AI’s buildout will intensify the “build-or-buy” dilemma as companies may elect to insource AI capabilities rather than purchase off-the-shelf SaaS solutions. While this will likely be limited to well-resourced and large-to-mid sized enterprises, it adds pressure to SaaS vendors whose offerings are increasingly commoditized. By 2027 this dynamic could accelerate churn by three percentage points – and meaningfully more as AI matures.3

But Disruption ≠ Disappearance

To be clear, we’re not calling for the death of Application Software – but the landscape is shifting. Just as the move from on-prem to cloud upended legacy leaders, today’s SaaS incumbents face a similar moment.

However, the entire layer isn’t obsolete. In fact, many leading SaaS players with deep workflows and broad ecosystems are actively integrating AI into their core, strengthening their value and reinforcing their moats. For these players, their sticky enterprise relationships and complex implementations offer a buffer against the commoditization squeezing smaller, niche vendors. Plus, some are even adapting on pricing – leaning into a hybrid pricing mix of seat-based and value-based to stay competitive.4

All this to say, the Application layer is becoming increasingly bifurcated. Over the next five years, we’d expect the dispersion between winners and losers to widen – with the leaderboard reflecting a mix of today’s SaaS incumbents that are able to successfully integrate AI, and new entrants building differentiated, AI-native platforms.

Infrastructure Software is Durable, Scalable, and Built for AI

Infrastructure is emerging a clear winners in the AI era. As workloads scale, its role in managing, processing, and securing vast datasets becomes mission-critical. We see four reasons why Infrastructure is structurally advantaged:

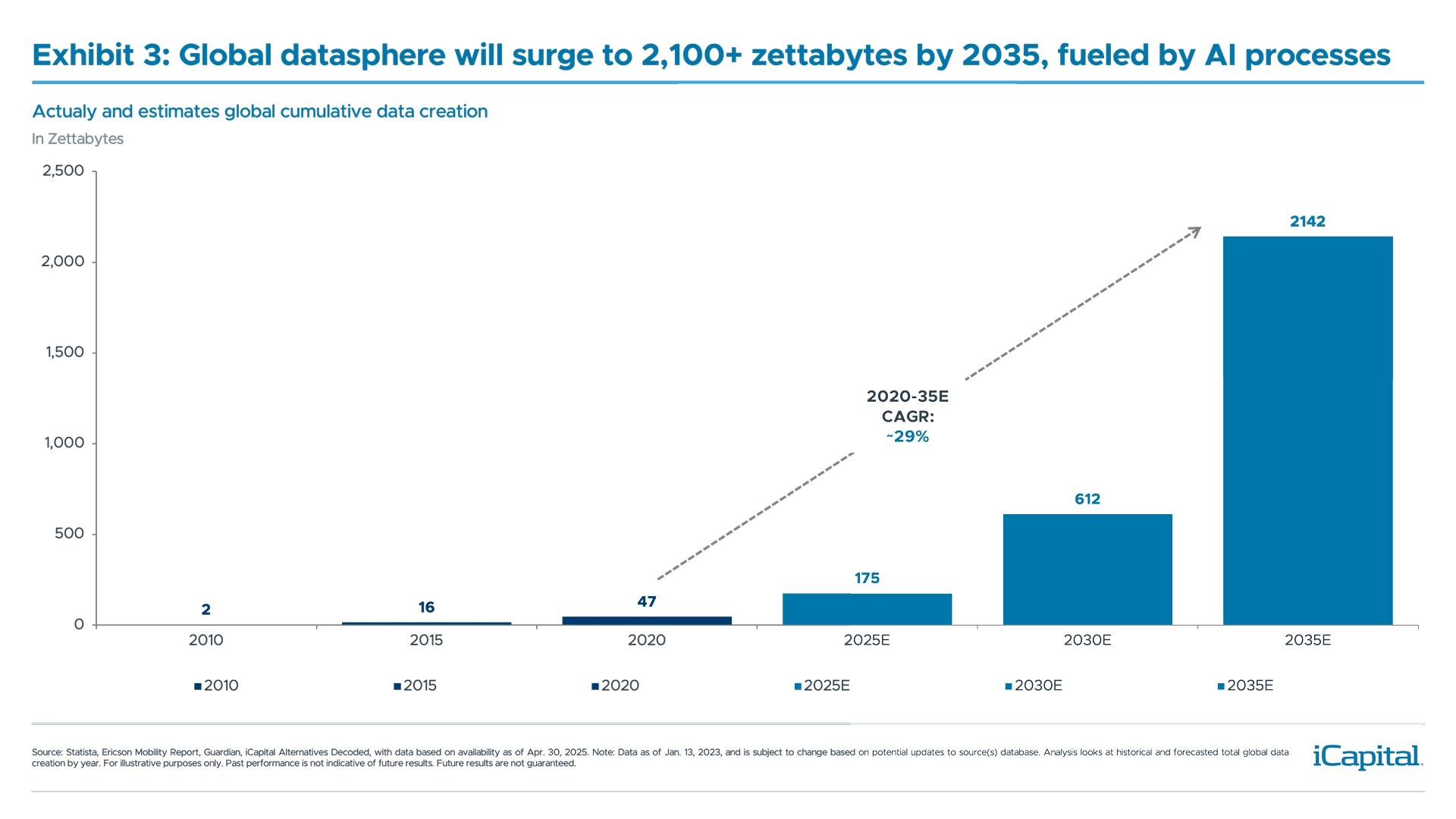

- Growth in global datasphere demands infrastructure scale. AI-driven training and inference generate immensely more data than traditional enterprise workloads. From 2 zettabytes in 2010, the global datasphere is projected to reach 2142 zettabytes by 2035 with much of it driven by AI processes (Exhibit 3).4 Infrastructure software ensures this data can be stored, managed, and retrieved efficiently – making it indispensable.

- Rise of AI agents amplifies focus on infrastructure. AI agents function as digital employees working autonomously across the tech stack. To be effective, they need direct, high-speed access to real-time data. Rather than operating at the application layer, where latency and integration constraints exist, agents naturally gravitate toward the infrastructure layer – living closer to data lakes and warehouses where they can rapidly access, process, and act on information. And agents operating here can provide differentiated value (think automation across departments) that’s harder to replicate at the application layer. Indeed, by 2030, agents could account for over 60% of the software market’s profit pool (from nearly zero today), shifting value toward the infrastructure layer.6 And the impact is already visible – Klarna eliminated 1,200 SaaS tools after deploying agents.7

- Observability & Security are force multipliers. The complexity of AI systems amplifies the need for robust monitoring and securing. These platforms face limited commoditization risk and become more valuable as AI adoption ramps. Enterprise spend on security and observability is expected to be nearly twice the rate of overall IT spend in 2026 (14.1% vs 7.9%).8 And AI security alone represents a $45+ billion opportunity by 2028, up from ~$16 billion in 2025 (30-40% CAGR).9

- Stronger economic moats. Unlike application software, Infrastructure software benefits from high switching costs (re-architecting data warehouses is expensive), network effects (more users = more data = better platform performance), and usage-based pricing aligns with AI scaling, unlike seat-based SaaS models.

That said, Infrastructure Software is not risk-free. New competitors can emerge and cyclical pressures exist. But the structural demand tailwinds, reinforced by AI’s reliance on robust data infrastructure, make it one of the most compelling areas for long-term investment.

That said, Infrastructure Software is not risk-free. New competitors can emerge and cyclical pressures exist. But the structural demand tailwinds, reinforced by AI’s reliance on robust data infrastructure, make it one of the most compelling areas for long-term investment.

For Investors, Be Selective in Applications, Bullish on Infrastructure

The risk/reward profile across software is shifting. We believe Application Software is more vulnerable to AI disruption and we’d be highly-selective, while Infrastructure software is emerging as the more resilient and structurally advantaged layer offering durable secular growth players.

Indeed, the market is starting to reflect this. Infrastructure software has outperformed Application software by +17 percentage points year-to-date (+11.5% vs. -5.5%).10 But under the surface, dispersion remains – the median Infrastructure software stock is down -8% YTD, only slightly better than the -9% decline for the median Application Software name, which we would move as an opportunity for investors.

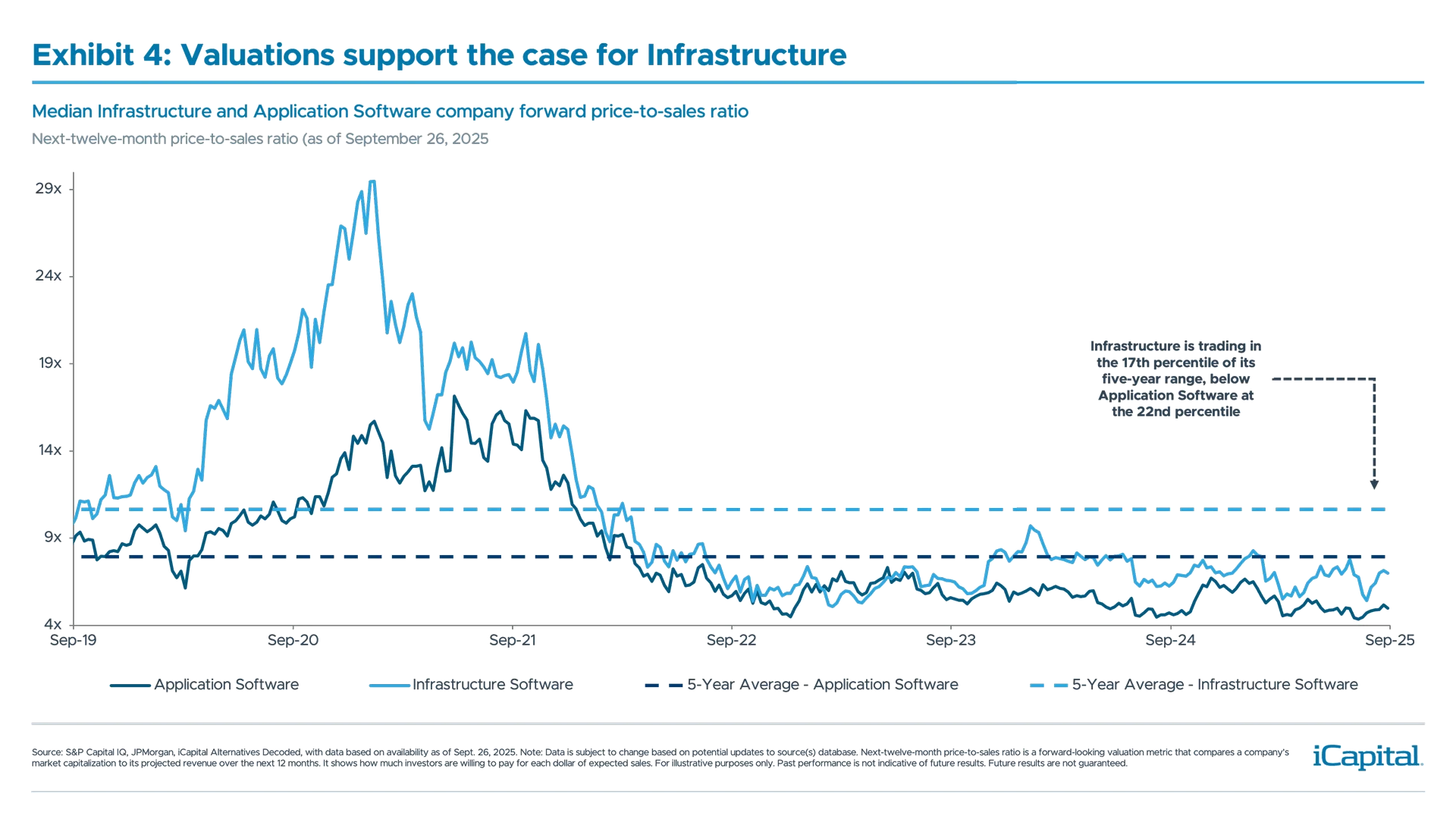

Valuations also support the case for Infrastructure. The median Infrastructure software company trades at 6.8x NTM Price/Sales, versus 5.0x for Application software (Exhibit 4).11 While Infrastructure typically command higher multiples, we believe it’s justified by its superior growth – +15.4% revenue CAGR through 2027 vs. just +9.3% for Applications.12 Importantly, Infrastructure is trading below its own historical average, sitting in the 17th percentile over a five-year lookback, compared to the 22th percentile for Application Software which to us suggests the premium reflects structural value rather than overvaluation.13

Within Applications, investors must be highly selective. With over 15,00014 SaaS companies in the U.S., the focus should be on identifying tomorrow’s winners – those with sticky products, high retention, and differentiated AI integration. Avoid niche players with limited integration or commoditized offerings.

Within Applications, investors must be highly selective. With over 15,00014 SaaS companies in the U.S., the focus should be on identifying tomorrow’s winners – those with sticky products, high retention, and differentiated AI integration. Avoid niche players with limited integration or commoditized offerings.

Infrastructure Software offers a more durable investment case. Many names are delivering >20% revenue growth, >70% gross margins, and scalable, usage-based platforms.15 Despite stronger fundamentals, they trade at a relative discount to historical norms.

We believe investors should overweight Infrastructure relative to Application, and under the surface prioritize companies with proven AI use cases and scalable platforms to capitalize on this durable, high-growth segment.

How to Play the Divergence

In public markets, the iShares Expanded Tech-Software Sector ETF (IGV) has historically been the main way to gain exposure to software. But its 73% allocation to Applications and only 12% to Infrastructure makes it suboptimal for capturing Infrastructure’s upside in our view.16 Instead, we’d look to a pure-play Infrastructure Software basket or the Global Cybersecurity ETF (HACK), which offers focused exposure to Security. Investors can also consider structured notes that provide access to these areas and that may offer some downside protection.

In private markets, venture capital offers another way to play the divergence. Venture has historically been heavily exposed to software given its low capital expenditure needs and high margins. Funds tend to be thematic, focusing on areas like SaaS, cybersecurity, and increasingly AI. Recently, many GPs have shifted attention to Infrastructure Software, with Q2 2025 posting the highest deal value for the space – excluding the two largest megadeals – since the 2021-22 peak, highlighting investor interest and market depth.17

What We’re Watching Next:

As the AI buildout continues, we’re closely monitoring several key developments that will shape how this dynamic evolves across the software stack:

- Upcoming Industry Events: OpenAI DevDay (Oct 6), Oracle CloudWorld (Oct 13-16), Salesforce Dreamforce (Oct 14-16), Nvidia AI GTC (Oct 27-29).

- Earnings Season: Expect divergence in commentary. Select Application names may cite pricing pressure and churn, while Infrastructure players highlight AI-driven demand.

- Software Lease Renewals: With many contracts up for renewal starting in 2026, we’re watching for further rationalization in Application spend and increased investment in Infrastructure and Security.

- Enterprise AI Adoption: The speed at which companies move from pilots to scaled deployments will shape near-term winners across the stack.

- AI Agent Proliferation: Continued agent growth will reinforce Infrastructure’s secular growth thesis, as agents demand direct data access.

Bottom Line:

AI is reshaping enterprise software, but not all software faces the same risks. The application layer may see moats eroded and pricing challenged, while the infrastructure layer looks more like the backbone of AI adoption. For investors, the distinction matters. Application Software is still relevant, but increasingly selective – a stock-picker’s market where only the strongest ecosystems and incumbents will hold up and potentially see a shift in the leaders in this space. Infrastructure Software, meanwhile, looks undervalued relative to its importance in scaling AI.

We recognize that the pace of change in the AI ecosystem is unprecedented and as such, our views will continue to evolve and adapt. We’re takers of feedback and welcome the various perspectives on this topic.

END NOTES

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 25, 2025.

- BetterCloud, 2025 State of SaaS Report, as of Apr. 30, 2025.

- McKinsey & Company, as of Jun. 5, 2024.

- Bloomberg, Goldman Sachs, Morgan Stanley, as of Sept. 25, 2025.

- Statista, Ericson Mobility Report, Guardian, as of Jan. 13, 2023. Note: 1 zettabyte is equal to 1 trillion gigabytes.

- Goldman Sachs, Gartner, as of Oct. 10, 2024.

- X, Klarna CEO Sebastian Siemiatkowski Gartner, as of Mar. 3, 2025.

- Gartner, as of Jul. 2025.

- Morgan Stanley, as of Sept. 22, 2025.

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 25, 2025.

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 25, 2025.

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 25, 2025.

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 25, 2025.

- Goldman Sachs, Statista, as of Aug. 17, 2025.

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 25, 2025.

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 25, 2025.

- PitchBook, Q2 2025 Infrastructure SaaS VC Trends, as of Sept. 26, 2025.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.