Last week, U.S. Federal Reserve (Fed) Chair Jerome Powell struck a more cautious tone on monetary policy during his semiannual Congressional testimony, in light of developments in Ukraine. A 50bp rise in interest rates in March was taken off the table, with 25bps all but assured.1 The markets cheered—at least for one day. Payrolls came in above consensus, with a solid 678,000 jobs added in February despite the recent market turmoil2, suggesting strength in the underlying economy. However, even together these developments are not yet enough to turn the tide of negativity.

In this week’s commentary, we discuss why we think it is not yet time for an all-clear signal in markets and share three things we are watching to identify a bottom.

Not yet time for an all clear

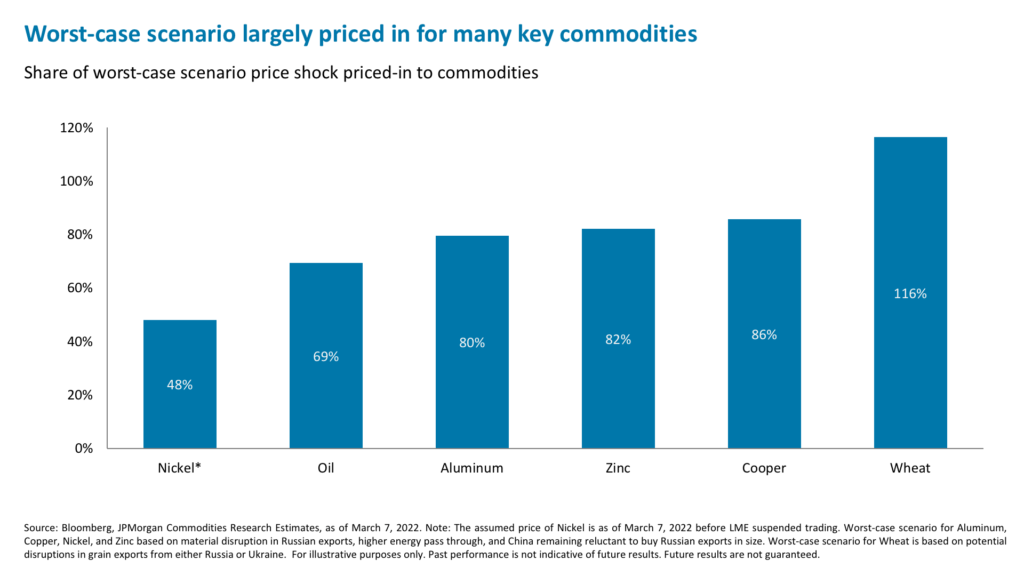

Yes, there are many reasons for optimism: Valuations have reset lower and retail and institutional investors (if not hedge funds) have been stepping in to buy the dip3; the U.S. is a pillar of strength amid the uncertainty, with limited exposure to the Russian economy; and markets have already priced in significant commodity disruption. The Fed is also becoming less hawkish in the face of uncertainty.

It seems like this could be the buy-the-dip moment, barring further significant escalation in Ukraine and a continued deterioration in global forecasts. However, neither of these scenarios can be ruled out.

First, we cannot rule out further escalation in Ukraine. It is clear that Vladimir Putin is not deterred by sanctions and is unlikely to shift direction. Backing down now does not seem like a viable option because he would be returning to an economy in shambles, with little support domestically, none internationally, and many companies unlikely to return to doing business in Russia for the foreseeable future. Absent a viable off-ramp, Mr. Putin might press on, push further into Ukraine, and escalate to get a “win”, which would involve land concessions, NATO neutrality pledges from Ukraine, and probably a change of government in Ukraine. Further sanctions escalation by the West seems likely with Russia likely to retaliate in kind.

All of the above massively raises the risk of further commodity price spikes. The good news is that a significant percentage of the worst-case scenario price upside has already been priced into many commodities and a tactical relief rally is possible if commodity price spikes abate.4 However, the second order impact from any persistently high commodity prices on economic activity is still a worry. Resurgent supply chain disruption (particularly in the auto and semiconductor sectors due to metals exposure) could also dampen demand.

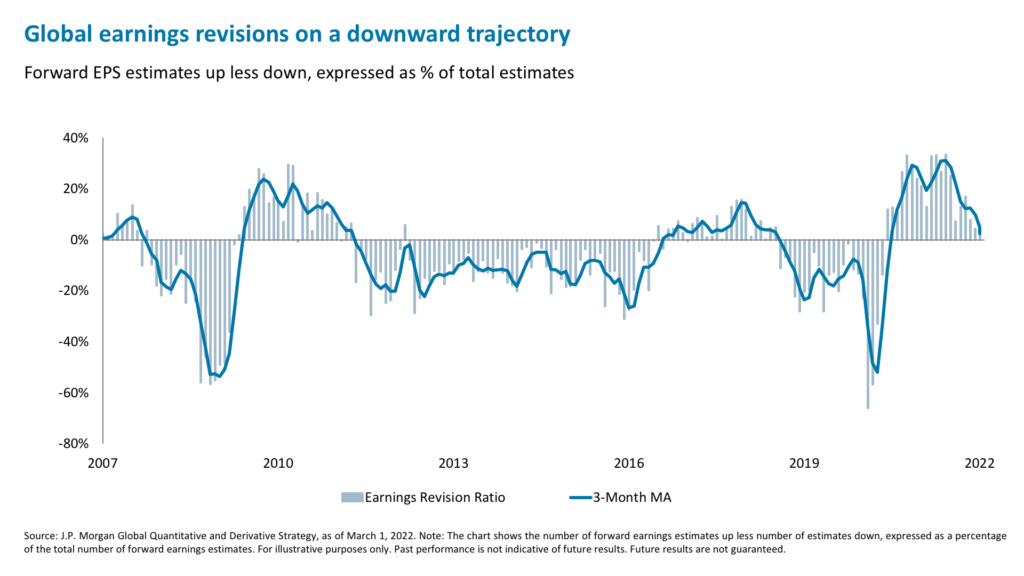

Second, even before the conflict in Ukraine took center stage, global economic data was already weakening. For example, the U.S. manufacturing Purchasing Managers’ Index has been on a downward trend since March 20215 and global consumer confidence and industrial production have similarly both declined since then6. At the same time, global earnings revisions have been trending downward and are currently flat-to-negative for the first time since September of 2020.7 We think this downward trend will continue, as historically a period of strong revisions has typically given way to a period of downgrades.8 Indeed, growth forecasts are being revised down and inflation is being revised up as commodity prices surge, on the assumption that elevated prices will start to hurt demand in both developed and emerging markets economies. As a rough guide, in the United States every $10 increase in oil correlates to approximately a 30bp rise in headline inflation, and a 10bp hit to GDP growth.9 U.S. inflation was recently revised up to 7.9% for February.10 And economists are guiding that the risks to their forecasts are skewed to the downside with higher inflation and lower growth.

Three things we are watching to find a bottom

Historically, during times when measures of global economic activity have peaked, U.S. equity markets have returned 4.6% over the following 12 months, though this is much more muted than the 15.5% they returned when the global economy is in an upswing.11 And the U.S. has typically outperformed other markets.

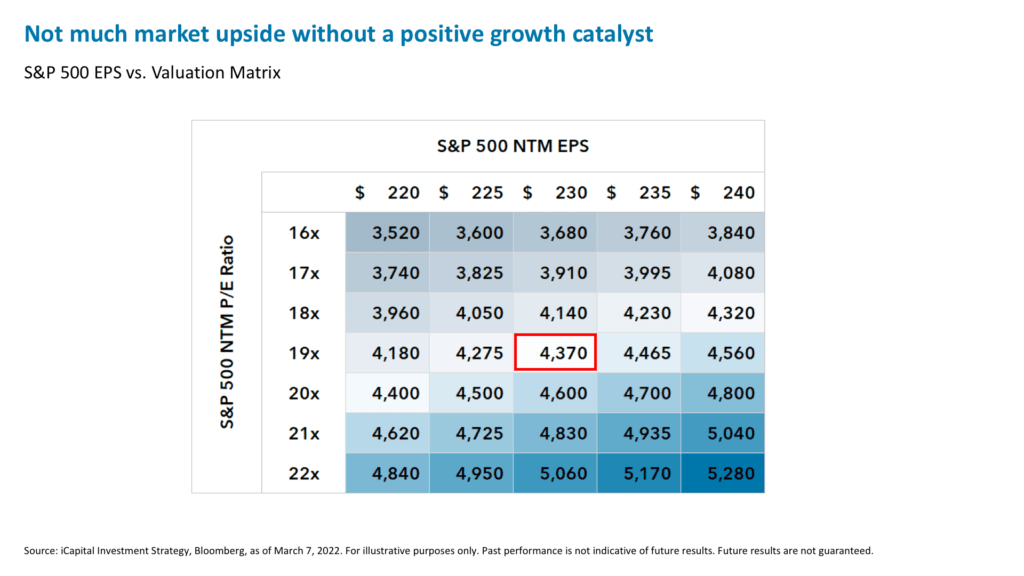

Current earnings multiples do not suggest much upside through year-end. If we assume current earnings per share (EPS) ($230 on a next-twelve-month [NTM] basis) and multiples (19x)12 persist, that would translate to a fair value of 4,370 for the S&P 500, which is only slightly above where we are today (4,171 as of market close on Tuesday)13. If we assume a 17x multiple, which was the average during the 2016-2019 Fed rate hiking cycle, and EPS of $230, that translates to 3,910 on the S&P 500, 10% below current levels. So if we assume further downside revisions and multiple compression the S&P would end up even lower. To reach 5,100 by the end of the year (which was both our and the consensus expectation to start the year)14, the index would need to rise 18% from here. This is possible but would require a significant material positive catalyst to improve the growth outlook.

Given all this uncertainty, there are three things we are watching to find a market bottom:

1) A positive growth catalyst. We need a material positive catalyst to improve the outlook from here—such as de-escalation in Ukraine, increased COVID reopening momentum, easing of supply bottlenecks, lower inflation, or perhaps an upside growth surprise from elsewhere (possibly China). For now, these are all very much “if” rather than “when”.

2) Capitulation in sentiment and positioning. While we have seen capitulation in sentiment—the American Association of Individual Investors’ Investor Sentiment Survey was 41% bearish as of March 215 —we have not seen an equivalent clearing in positioning. For example, hedge fund net leverage is down from record levels in 2021, but has not reached the lows of 2020.16 Commodity trading advisors (CTAs) reduced their beta to equities but, once again, are not at crisis-level lows. Finally, retail investors continue to buy dips17, and overall fund flows into global equities have been resilient year-to-date, although they did start to turn negative last week.18 History tells us that the more capitulation we see in these measures, the greater the potential for market upside in the following months.19 Given the fast pace of developments and continued reduction in hedge fund positions this week, we will monitor these positioning measures closely.

3) Higher priced-in recession probabilities. Despite plenty of talk about recession, consensus probability of a recession is just 15%20, not much higher than normal. However, it should be higher than that given current readings of traditional recession indicators: the 2-year/10-year yield spread is 23bps21, the high-yield bond spread is widening22, real wage growth is negative year-over-year23, and euro-denominated oil prices are well above levels seen in 2008 ahead of the Global Financial Crisis24. Further, input cost inflation for food producers is forecast to rise from 5% in 2021 to 14% in 2022 given the surge in wheat prices, which will likely be passed on to consumers.25 Historically, geopolitical shocks, commodity price spikes, and Fed tightening were among the three most common causes of recessions.26 Today we have all three. For now, consensus is ignoring these warning signs but risks are building. And whether a recession ultimately occurs or not (if commodities and the Fed reverse course), the rising probability of a recession does not yet appear to have been priced in.

Investors need to be selective

Relief rallies are possible in bear markets. However, given the above, we cannot be sure that we have hit bottom yet because we cannot rule out and have not yet priced in the worst-case scenario—escalation in Ukraine, greater and more prolonged global commodity price shocks, and recession—and have yet to see a full capitulation in positioning. Of course, the situation is extremely fluid and could change quickly, so we stay nimble in our conclusions.

1. Bloomberg, as of March 7, 2022.

2. Bloomberg, as of March 4, 2022.

3. Bank of America Data Analytics, March 7, 2022.

4. Bloomberg, JPMorgan Commodities Research Estimates, as of March 7, 2022.

5. Bloomberg, as of March 7, 2022.

6. Bank of America, February 2022

7. JPMorgan Global Quantitative and Derivative Strategy, as of March 1, 2022

8. Source Ibid

9. Goldman Sachs, Morgan Stanley, as of March 2022.

10. Ibid.

11. Bank of America Research, as of February 202

12. FactSet Earnings Insight, Bloomberg, as of March 1, 2022

13. Bloomberg, as of March 7, 2022.

14. Bloomberg, as of March 7, 2022.

15. Bloomberg, as of March 3, 2022.

16. Goldman Sachs, as of March 7, 2022.

17. JPMorgan Retail Radar, March 4, 2022

18. Goldman Sachs, as of March 7, 2022

19. Ibid.

20. Bloomberg, as of March 8, 2022

21. Bloomberg, as of March 7, 2022.

22. Ibid.

23. Ibid.

24. Ibid.

25. JPMorgan, March 7, 2022

26. JPMorgan Asset Management, as of December, 2020

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.