With August in the rear-view mirror, the S&P 500 exited the summer on a three-week losing streak, now down 9.5% from mid-August highs.1 This pullback made sense, as the 17.4% rally from mid-June lows led to technicals becoming stretched, while U.S. Federal Reserve (Fed) Chair Jerome Powell pushed back on the potential for rate cuts in 2023.2 The question is – where do we go from here?

We still see a potential further 3-5% downside on the S&P 500 in September, bringing us to 3,800, at which point we would see value in buying risk assets including equities and high-yield bonds. That said, given the current technical setup, we will still be carefully watching several upcoming events that could temper any short-term bounces and create a further risk-off move in equities.

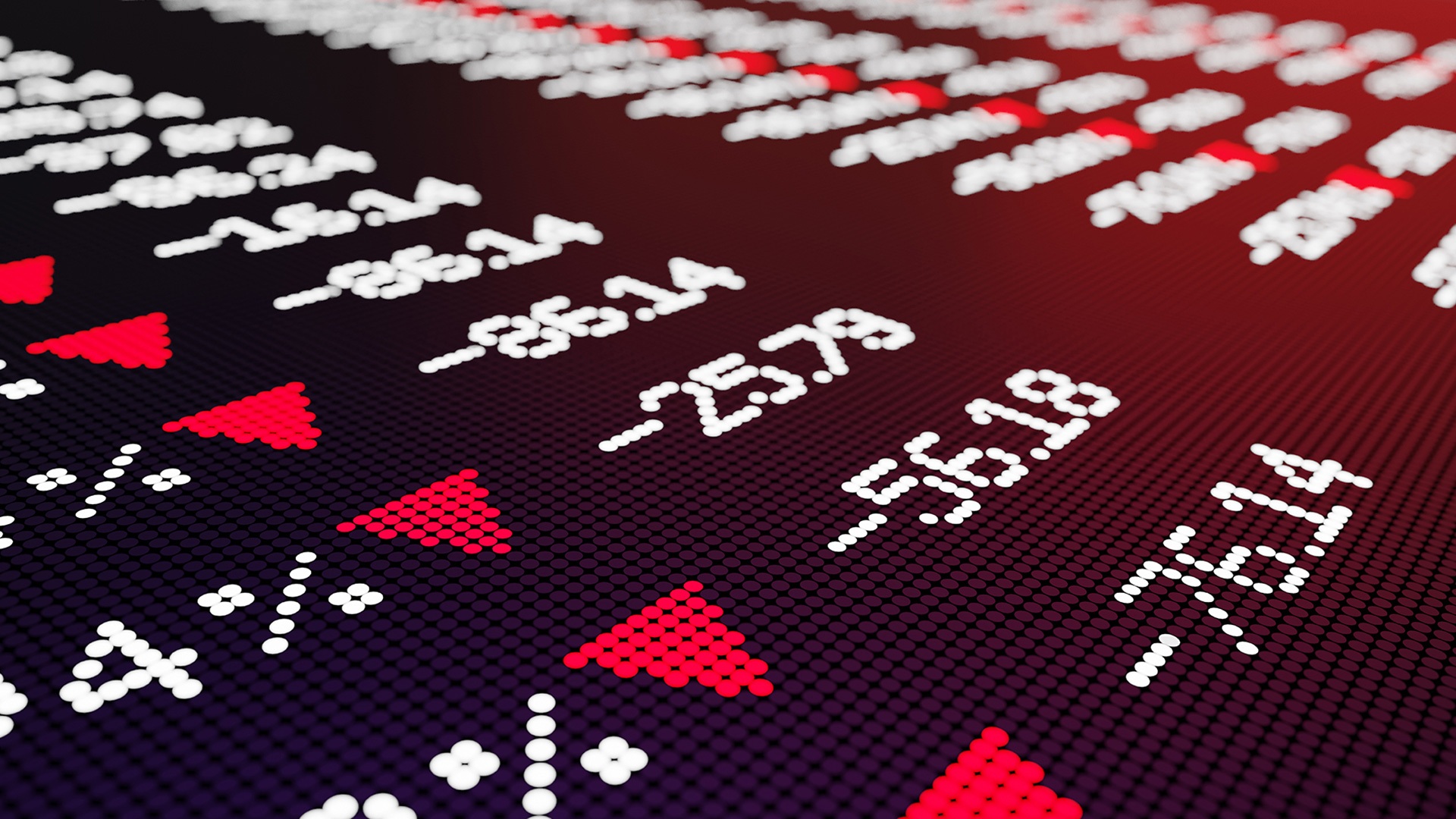

- August’s inflation print: We expect next week’s inflation print to continue to show signs that year-over-year headline inflation is moderating but month-over-month core inflation might not actually fall just yet. This could prompt markets to assume a 75-basis point rate hike is coming at the September Federal Open Market Committee (FOMC) meeting. Markets will also be more focused on services inflation. While goods inflation is starting to moderate, services inflation – which constitutes about 70% of core inflation and 80% of GDP – has proven to be more difficult to tame (See Exhibit 1).3 Continued pressure from the service side could add to market expectations of a more restrictive Fed.

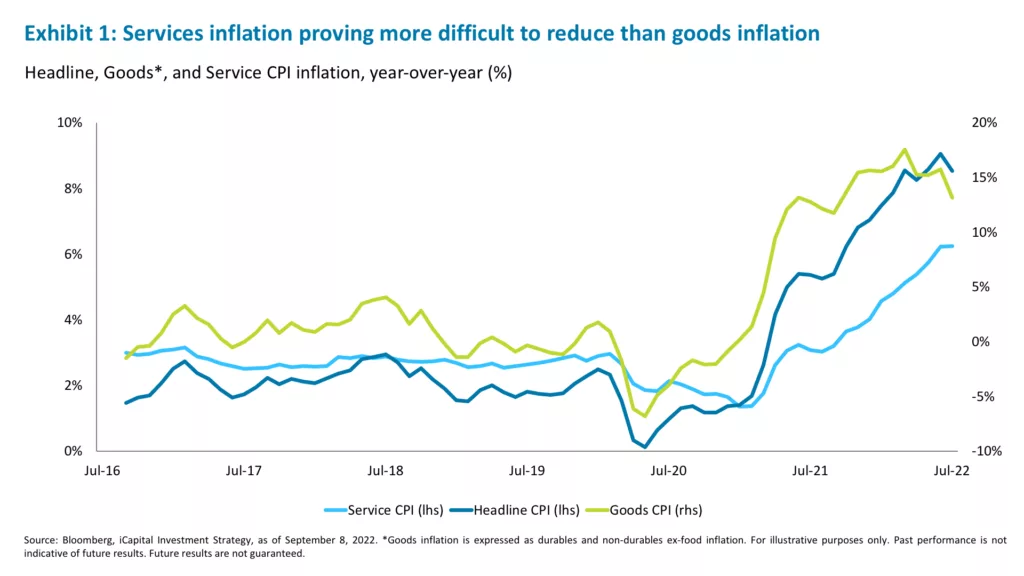

- The September FOMC meeting: The upcoming Fed meeting will loom large for the next couple of weeks, but after this Friday the Fed enters its blackout period, so there will be no more direct Fed communication until the September 21 press conference. That said, there will be lots of anticipation and second guessing as data points emerge and likely a broader unwillingness to take risks ahead of this event. This FOMC meeting will also carry greater weight as we will get a revised dot plot that will give us a better sense of the Fed’s expected terminal rate, which is currently projected at 3.8% in 2023 (See Exhibit 2).

- Natural gas and oil prices: Last Friday’s news that Russia would not be resuming gas flows on the Nord Stream 1 (NS1) pipeline following a three-day “maintenance” period caused an intraday decline of roughly 2.5% on the S&P 500 and suggests that markets are still highly sensitive to commodity-related news.4 Natural gas and oil prices will remain front and center as Europe and Russia appear locked in a vicious cycle of sanctions and retaliation. There is a not-insignificant risk of further spikes in the price of EU natural gas – which is already up 130% since the start of June (See Exhibit 3) – due to the NS1 shutdown. We think this could put upward pressure on oil prices due to the resulting gas-to-oil switching. Oil prices could also be pushed higher if Russia chooses to withhold supply if the EU proceeds with price caps.5 A renewed spike in commodity prices could adversely affect the economic outlook and market sentiment.

With the broader technical picture turning more negative, adverse outcomes from these events could pressure markets. There are three main technicals that we see exacerbating the downside in the event of a negative catalyst (which are largely the same as those that drove the summer rally, but may now act in reverse):

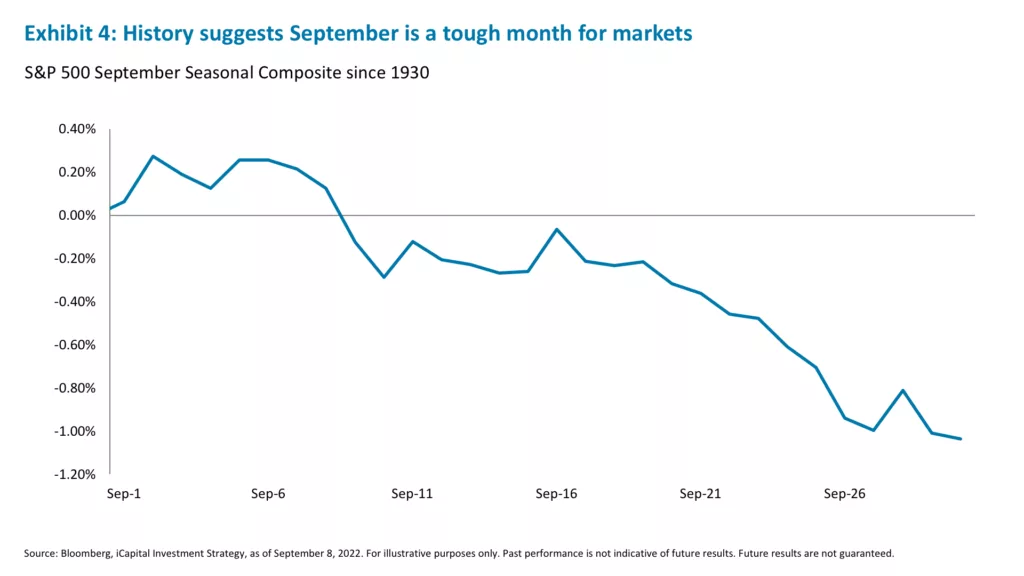

1. Seasonality: Seasonality is not supportive in September, which is historically the worst month of the year.6 Since 1930, September 2 has tended to be the top day of the month for the market (See Exhibit 4), with an average monthly return of -1.04%.7 In fact, during this time period, September has been a down month roughly 60% of the time – the highest percentage of any month.8 Given this historical negative seasonality, Macro hedge funds might also engage in short trades, which could add further downside pressure to markets.

2. Systematic Strategies: Long demand has faded in the systematic trading community and is turning net-negative. Systematic strategies, including risk-parity, volatility-control, and CTA/trend-following strategies, were large contributors to the summer rally. From mid-July to mid-August this community was a net buyer of roughly $159 billion worth of global equities.9 As of the start of last week, many of the indicators used by these strategies turned negative and the community became a large seller.10 At present, CTA/trend-following strategies are short $29.3bn worth of global equities and if equities are down over the next month then the community will make net sales of $86bn.11

3. Buybacks: Buybacks are running strong, but they are set to slow over the coming weeks. U.S. corporations have been some of the largest buyers in the market, having authorized more than $850bn in share buybacks year-to-date – more than any other year since 2006.12 Roughly 97% of S&P 500 companies are still in their open window, but this number falls to about 51% by September 15.13 Demand is expected to drop 35% during this period, with daily demand of $5.5 billion falling to $3.5 billion.14

If a negative catalyst does come into play, the current technical situation could prompt a risk-off move in markets. The closer we get to 3,800 on the S&P 500 – roughly 5% below current levels – the more we would encourage buying. The blended next-twelve-month price-to-earnings ratio on the S&P 500 has fallen from 18.2x in mid-August to 16.7x today, but should it slip back to 15.5x (where it was in June), the entry point becomes quite compelling.15 It is not a recessionary valuation (and for now, does not need to be) but is comparable to pre-COVID levels when the Fed funds rate was similar to today. For earnings, 2023 estimates have dropped roughly 2.5% over the past month and that might be sufficient for now.16 Technical pricing levels should flip to oversold near 3,800. So, my advice for September is to be patient and get your shopping list ready in equities and high yield/investment grade bonds. In the meantime, we see value in short-duration high-quality fixed income, with yields in the 1-3 year range attractive at roughly 3.5%.17

1. Bloomberg, as of September 7, 2022.

2. Bloomberg, as of September 7, 2022.

3. Bloomberg, iCapital Investment Strategy, as of September 7, 2022.

4. Ibid.

5. Bloomberg, Reuters, iCapital Investment Strategy, as of September 7, 2022.

6. Bloomberg, iCapital Investment Strategy, as of September 7, 2022.

7. Ibid.

8. Ibid.

9. Goldman Sachs Global Markets Division, as of August 19, 2022.

10. Ibid.

11. Ibid.

12. Bloomberg, as of September 7, 2022.

13. Bloomberg, iCapital Investment Strategy, as of September 7, 2022.

14. Goldman Sachs Global Markets Division, as of September 2, 2022.

15. Bloomberg, as of September 7, 2022.

16. Bloomberg, as of September 7, 2022.

17. Ibid.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.