The economy is cooling, but it’s not cratering. What’s also cooling is inflation. And together with the credit contraction that’s underway, the Fed is likely to end its rate hike cycle with a final raise in May. This bodes well for the markets. As for the month of April, which we wrote about here, we are sticking with stocks, namely through tech and dividends.

Today’s inflation print provides the market with some good news, and serves as an indication that inflation is continuing to moderate.

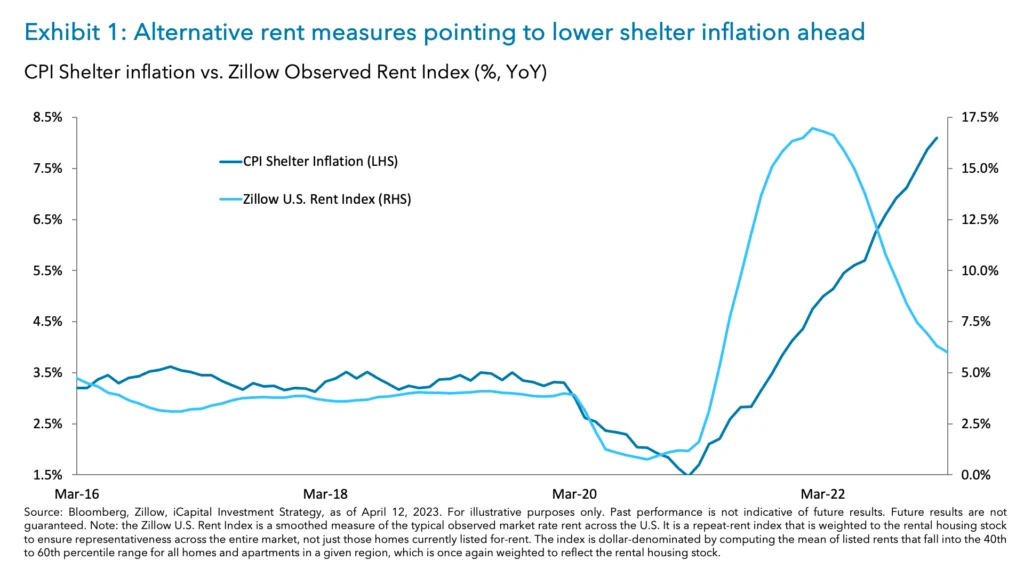

Firstly, according to the month-on-month (MoM) change in headline CPI (Consumer Price Index), inflation decelerated to +0.1% in March from +0.4% in February; with core CPI decelerating to +0.4% and +0.5%, respectively.1 This marks a sequential decline in the MoM figures since January. Secondly, we saw a big drop in headline year-on-year (YoY) inflation, falling a full percentage point to 5.0% in March from 6.0% in the preceding month.2 And thirdly, while the core CPI YoY number was less encouraging, as it rose to 5.6% in March from February’s 5.5%, components in the core basket indeed suggest moderation.3 For example, the core services excluding shelter measure (coined “Supercore inflation”) eased to +0.3% MoM in March from +0.5% in February, and declined to +5.8% YoY versus +6.2% the month prior.4 And shelter itself, which accounts for nearly half of the core CPI, also came in lower – at +0.6% MoM in March versus +0.8% in February.5 Indeed, based on alternative web-based measures which are showing a slowdown in the U.S. rent index, we would expect the shelter component to continue to moderate over the coming months and give way to easing core CPI inflation.6

In addition to the deceleration in inflation – which may help breathe new life into Chair Jerome Powell’s “disinflationary” narrative from February’s FOMC meeting – the visible emergence of a slowdown in credit availability should limit the need to hike rates further.7 In our view, now is the time for the Fed to sit back and let the lagged effect of the fastest and steepest tightening cycle in history play out.

Credit conditions have noticeably tightened everywhere you look

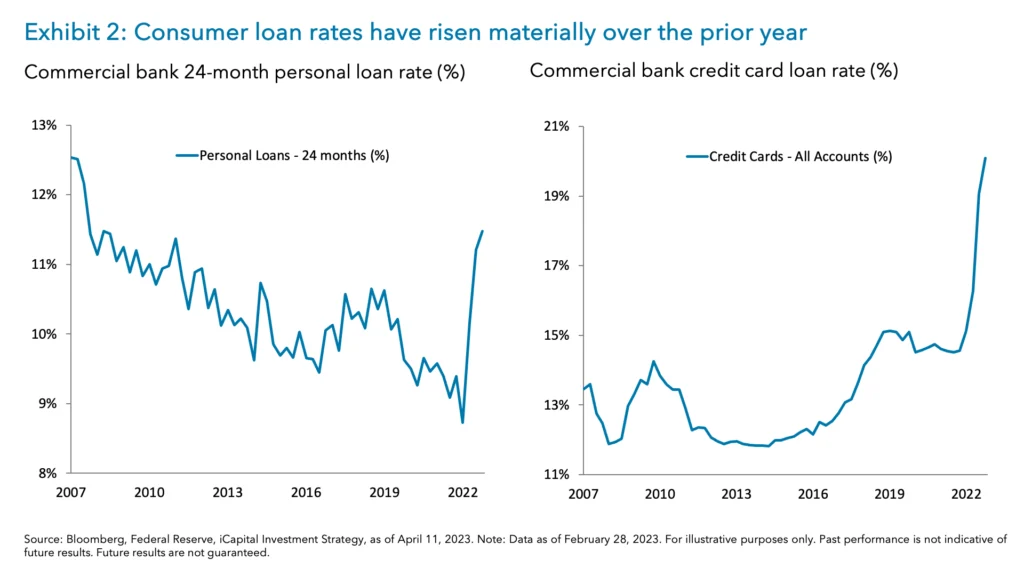

Even before the recent regional banking distress, signs of deteriorating credit conditions were emerging. The Federal Reserve Senior Loan Officer survey, along with consumer and small business surveys, began showing signs of deteriorating access to credit.8 The percentage of banks tightening lending standards for Commercial Real Estate (CRE) and Commercial and Industrial (C&I) loans was nearing 2020 levels. What’s more, roughly 60% of consumers believe it is a bad time to buy a home.9 And for small businesses, the average rate paid for short maturity loans is near 8% – back to March 2020 levels.10 Elsewhere, loan rates have risen materially. The average rate on a 24-month personal loan has risen nearly three percentage points since May of last year, from 8.7% to 11.5% today, and now sits at its highest level since 2008.11 Meanwhile, credit card loan rates have surged to north of 20% – the highest level since data was first tracked 50-years ago.12 We would expect this to dent demand for credit overtime.

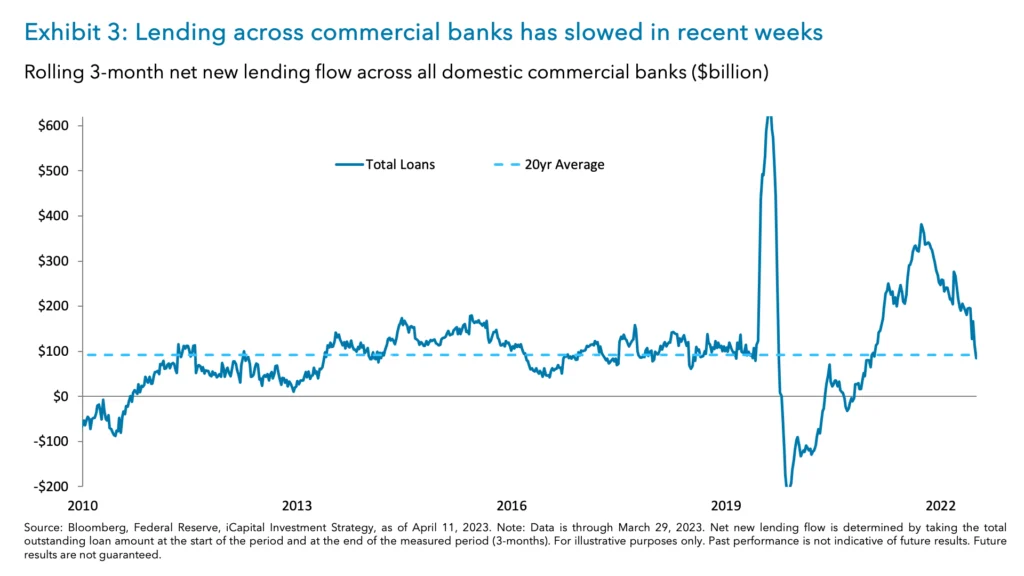

Moreover, the recent banking turmoil has impacted the actual credit extended with the rolling three-month net new flow of lending by commercial banks falling below its 20-year average.13 Interestingly, on a four-week rolling basis, net new lending for U.S. commercial banks has turned negative, driven by the fall in CRE and C&I loans.14 The details also reveal that small domestic banks are the primary drivers behind this fall in net new lending. And this is likely just the beginning: with net interest margin under pressure, as funding costs rise and the need to safeguard against potential deposit outflows continues, lending will likely have further room to fall as banks lend out less of their deposits.

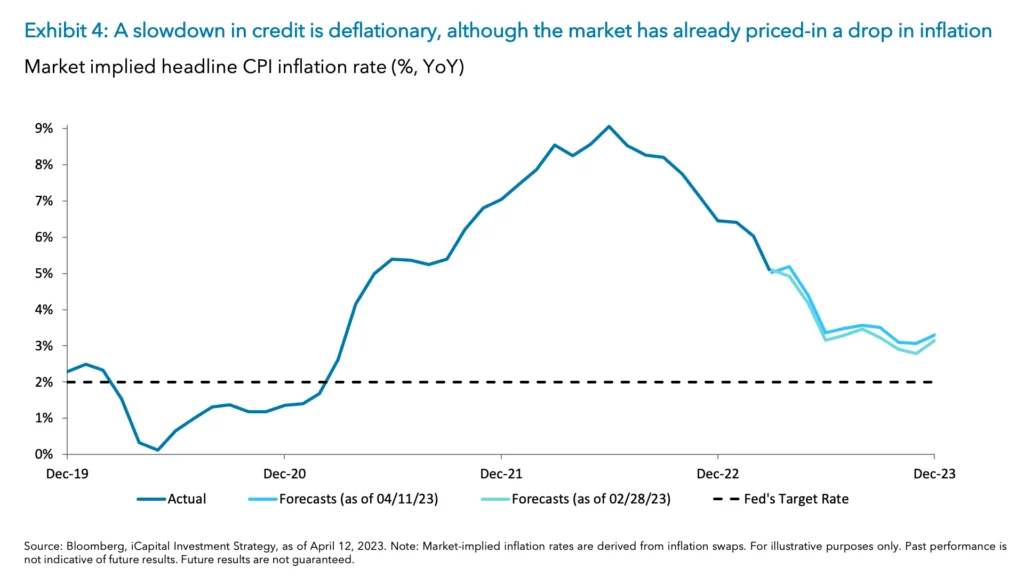

This current and expected credit retrenchment means that the Fed should be getting an assist in its fight against inflation in the coming months; a slowdown in credit is deflationary.

In the meantime, even without this credit episode, inflation was already expected to fall. Market pricing implies that the headline CPI will fall to 3.3% by year’s end.15 As we wrote late last year, we may finally be approaching the point where fed funds rate will be above the rate of inflation in the coming months, allowing for a Fed pause.

The potential end of Fed tightening bodes well for markets

Historically, after a Fed tightening phase was over, markets rallied in late cycle “euphoria,” which in this case was defined by an economy that is still okay despite the rate hikes. Indeed, last week’s payrolls report alleviated fears of a “bad is bad,” “hard landing,” and “recession” that were everywhere earlier in the week. The 236,000 jobs created and unemployment rate of 3.5% suggest that recession is not imminent, unlike what was being priced into rates.16 And over the coming months, we wouldn’t be surprised if the consensus shows consumer resilience. As long as the labor market is solid, consumption is not likely to fall off a cliff. One caveat, however: credit card fueled spending should slow, as it now costs much more to run up those balances given that consumers pay a floating rate on credit card debt. Still, this looks like an economy that’s cooling, but not cratering. And that’s exactly what the Fed wants to see. The current market resilience is therefore understandable. The lesson here for investors is that we shouldn’t pre-trade the recession just yet.

1. Bloomberg, iCapital Investment Strategy, as of April 12, 2023.

2. Bloomberg, iCapital Investment Strategy, as of April 12, 2023.

3. Bloomberg, iCapital Investment Strategy, as of April 12, 2023.

4. Bloomberg, iCapital Investment Strategy, as of April 12, 2023.

5. Bloomberg, iCapital Investment Strategy, as of April 12, 2023.

6. Bloomberg, iCapital Investment Strategy, as of April 12, 2023.

7. Bloomberg, iCapital Investment Strategy, as of April 11, 2023.

8. Bloomberg, Federal Reserve, University of Michigan, NFIB, iCapital Investment Strategy, as of April 11, 2023.

9. Bloomberg, University of Michigan Consumer Sentiment Survey, iCapital Investment Strategy, as of April 11, 2023.

10. Bloomberg, NFIB Small Business Survey, iCapital Investment Strategy, as of April 11, 2023.

11. Bloomberg, Federal Reserve, as of April 11, 2023.

12. Bloomberg, Federal Reserve, as of April 11, 2023.

13. Bloomberg, iCapital Investment Strategy, as of April 11, 2023.

14. Bloomberg, iCapital Investment Strategy, as of April 11, 2023.

15. Bloomberg, iCapital Investment Strategy, as of April 11, 2023.

16. Bloomberg, iCapital Investment Strategy, as of April 11, 2023.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.