Liquidity is improving across private markets—a trend we expect to continue into 2026. Private equity transactions accelerated in Q3, and real estate pricing recovery could drive more property turnover. Still, stress remains in certain areas. Our latest release highlights:

- Secondaries on the Rise: Expanding beyond private equity into credit and infrastructure, creating new liquidity pathways.

- Private Equity Exits: Volumes up, but lower exit values suggest sponsors may lean on secondaries or continuation vehicles.

- Private Credit Challenges: Spread compression and deployment difficulties persist amid fierce competition for deal flow.

- Infrastructure Outlook: Digital and power assets driving uncorrelated returns.

- Flow-of-Funds Data: Proprietary insights into allocation trends across the iCapital platform.

-

Introduction keyboard_arrow_down

-

iCapital Flow-of-Funds keyboard_arrow_down

-

Overview keyboard_arrow_down

- Overview 08

- Assets Under Management 09

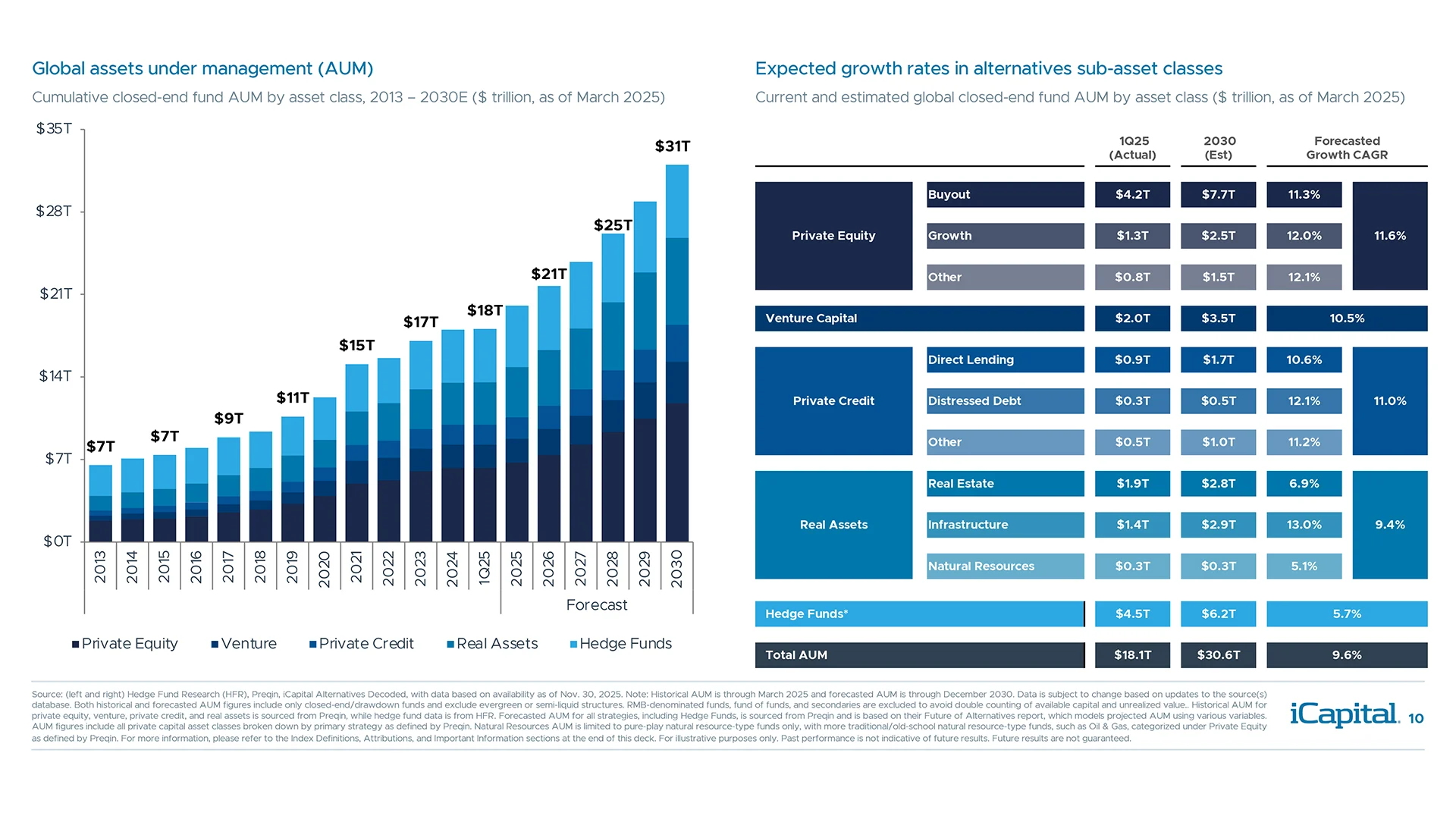

- AUM by Asset Class 10

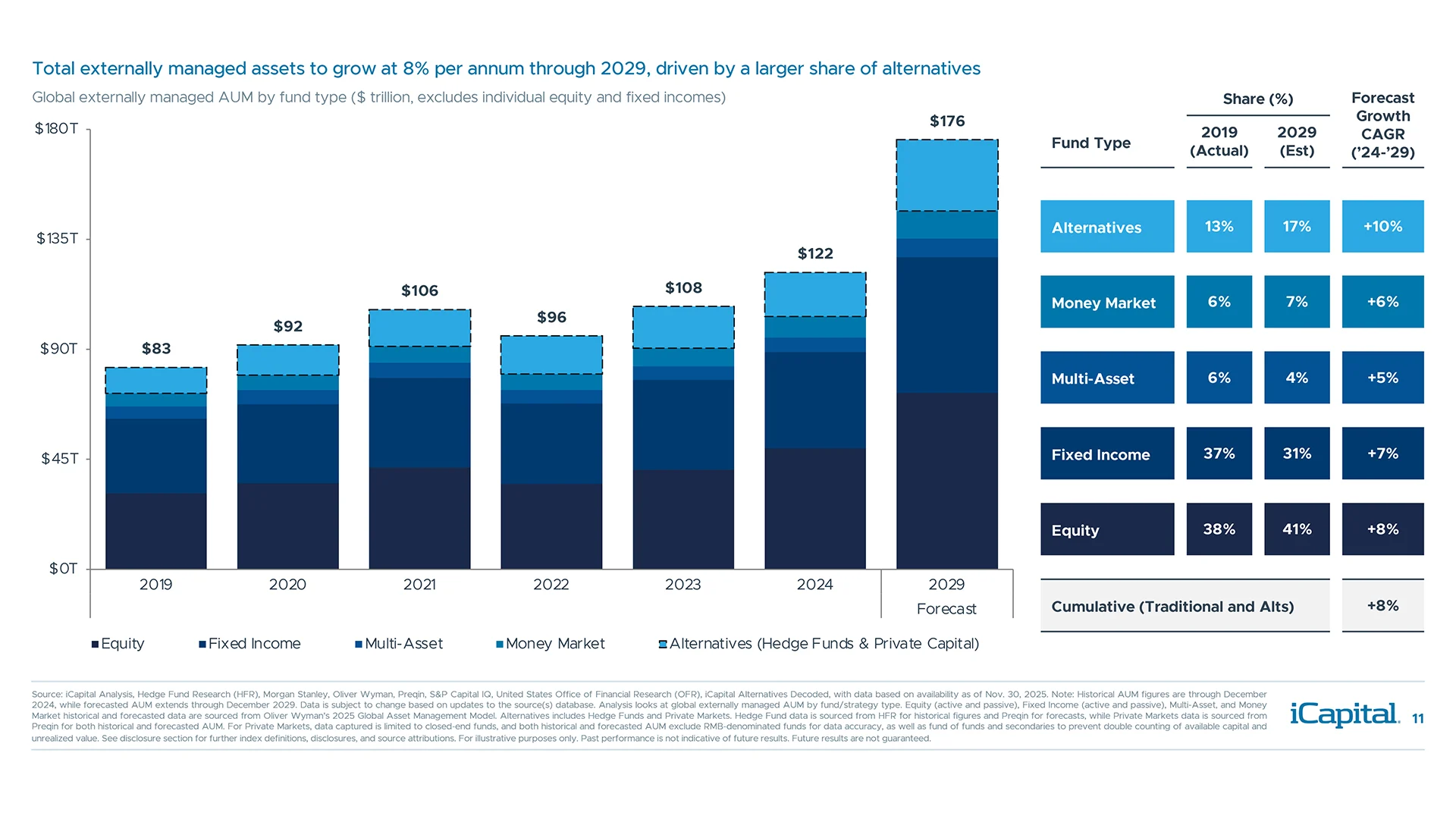

- Alts vs. Tradition AUM 11

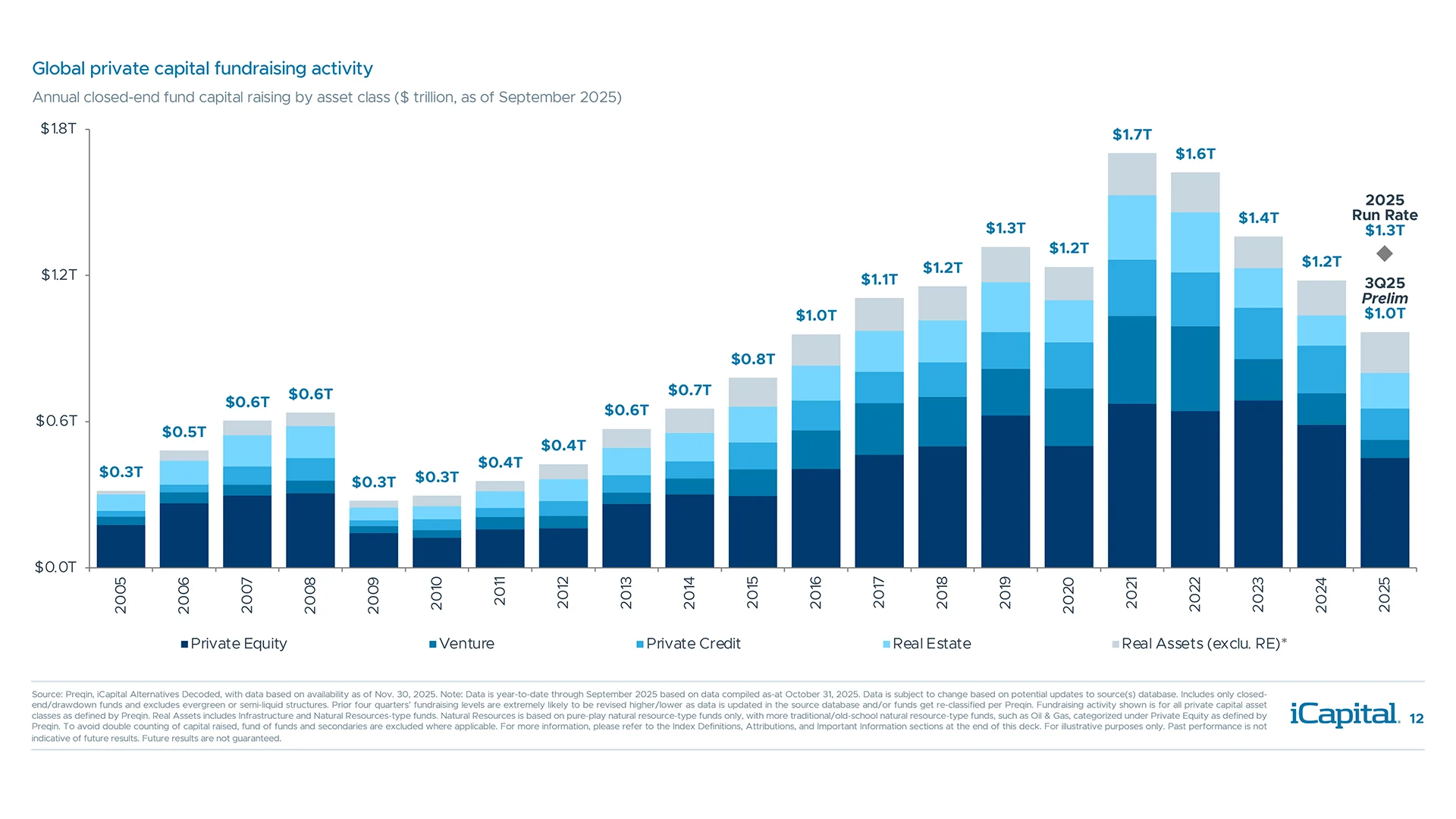

- Fundraising 12

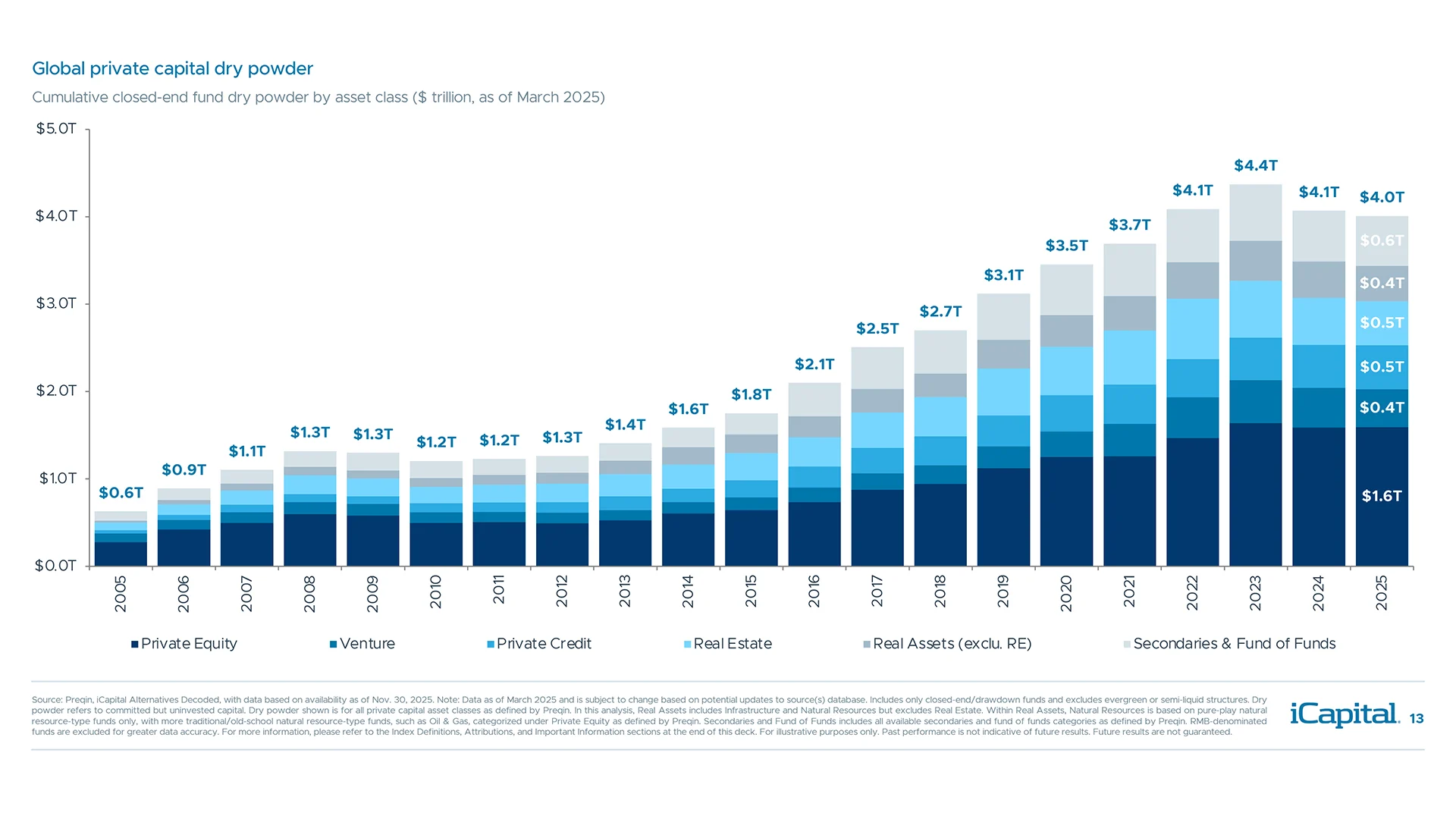

- Dry Powder 13

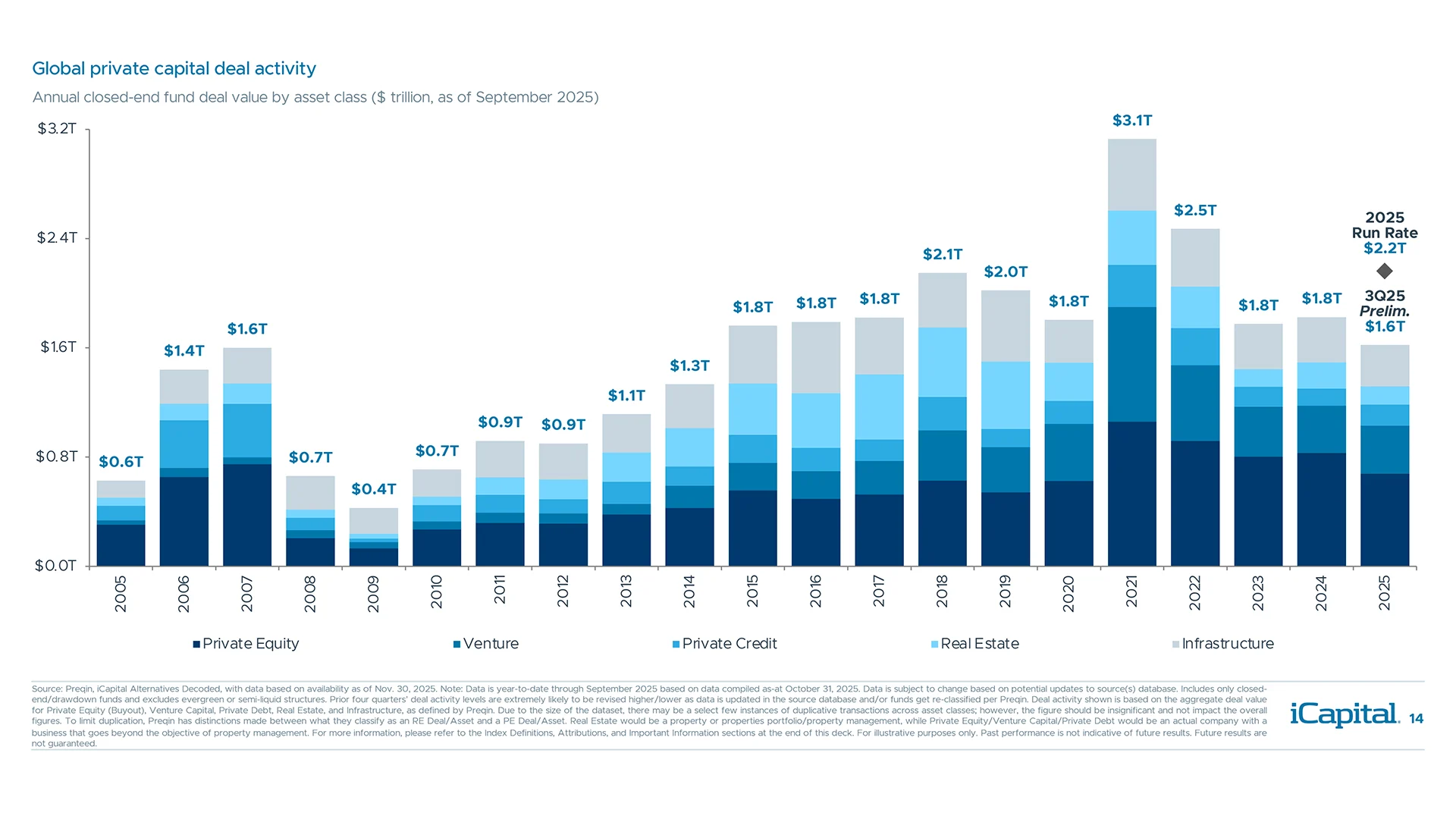

- Deal Activity/Entries 14

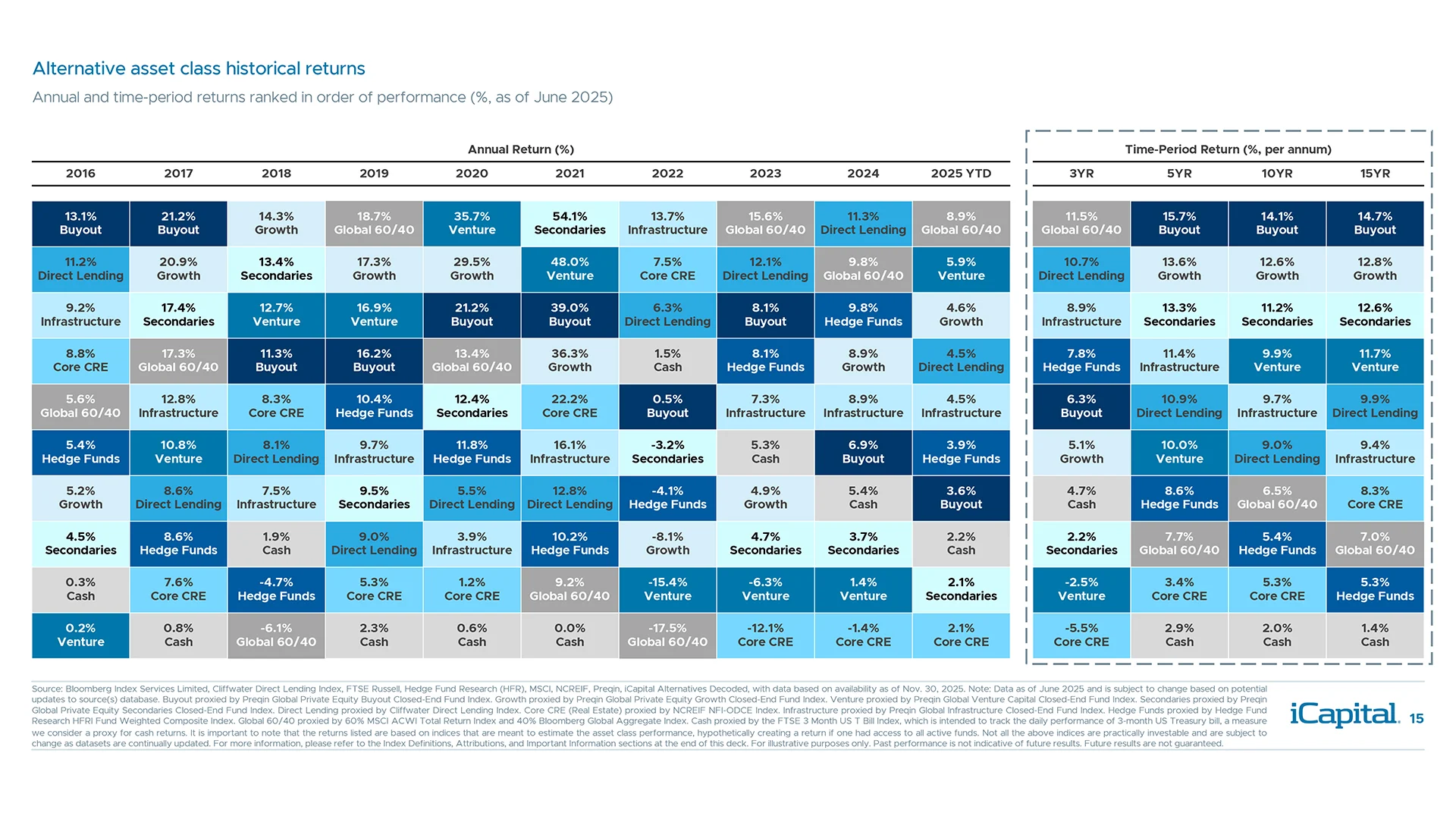

- Returns by Strategy 15

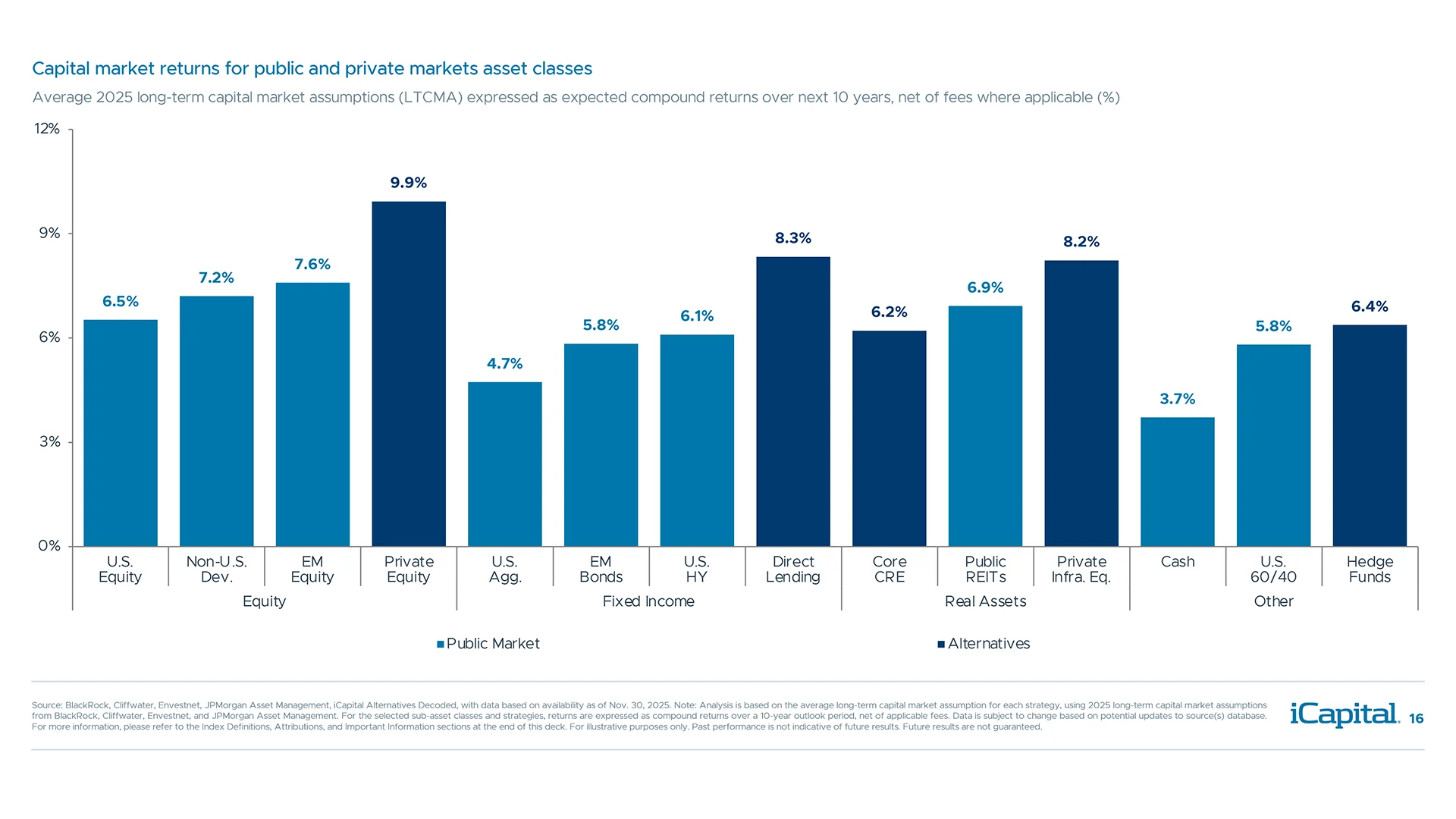

- Projected Performance 16

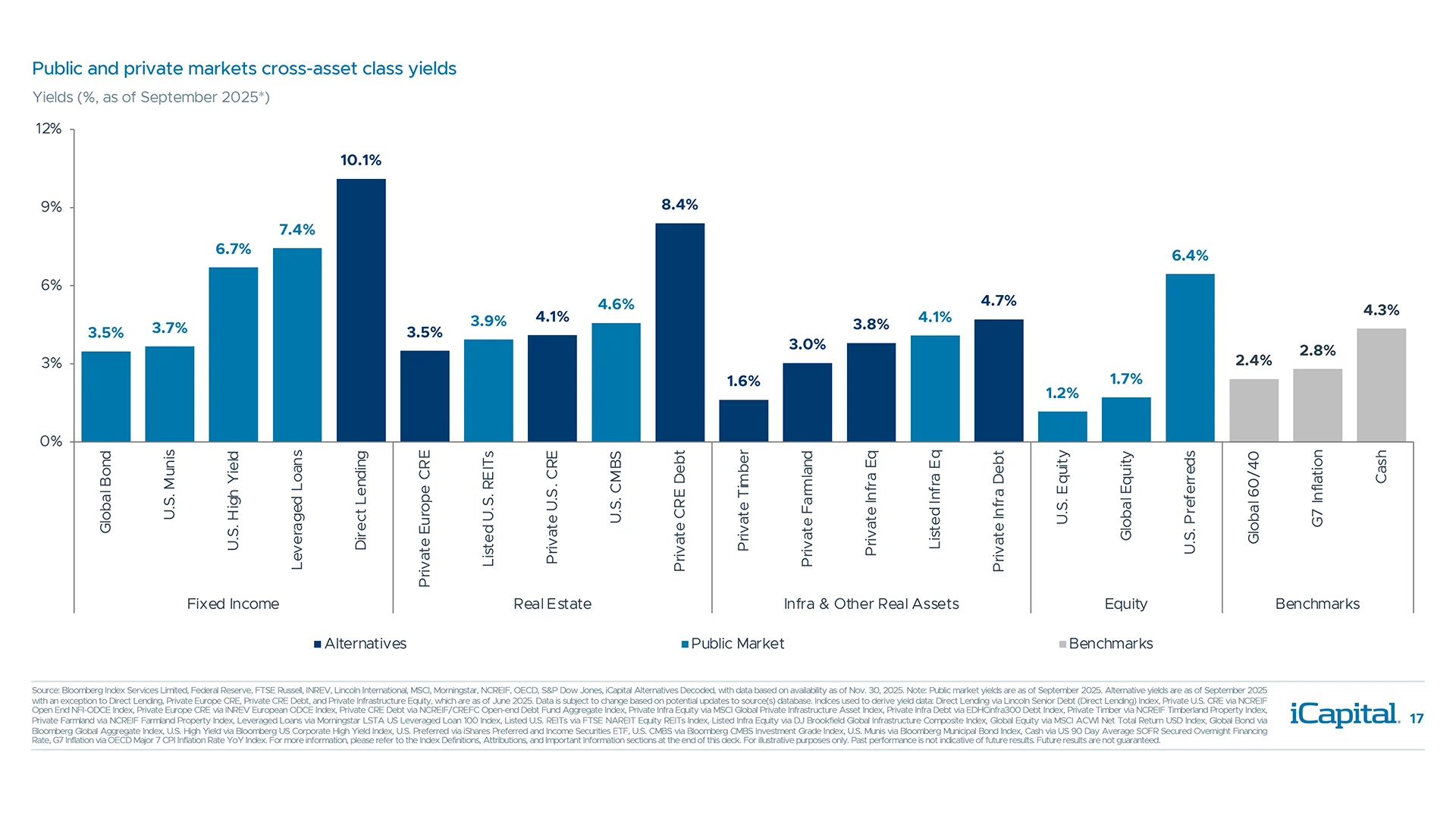

- Yields 17

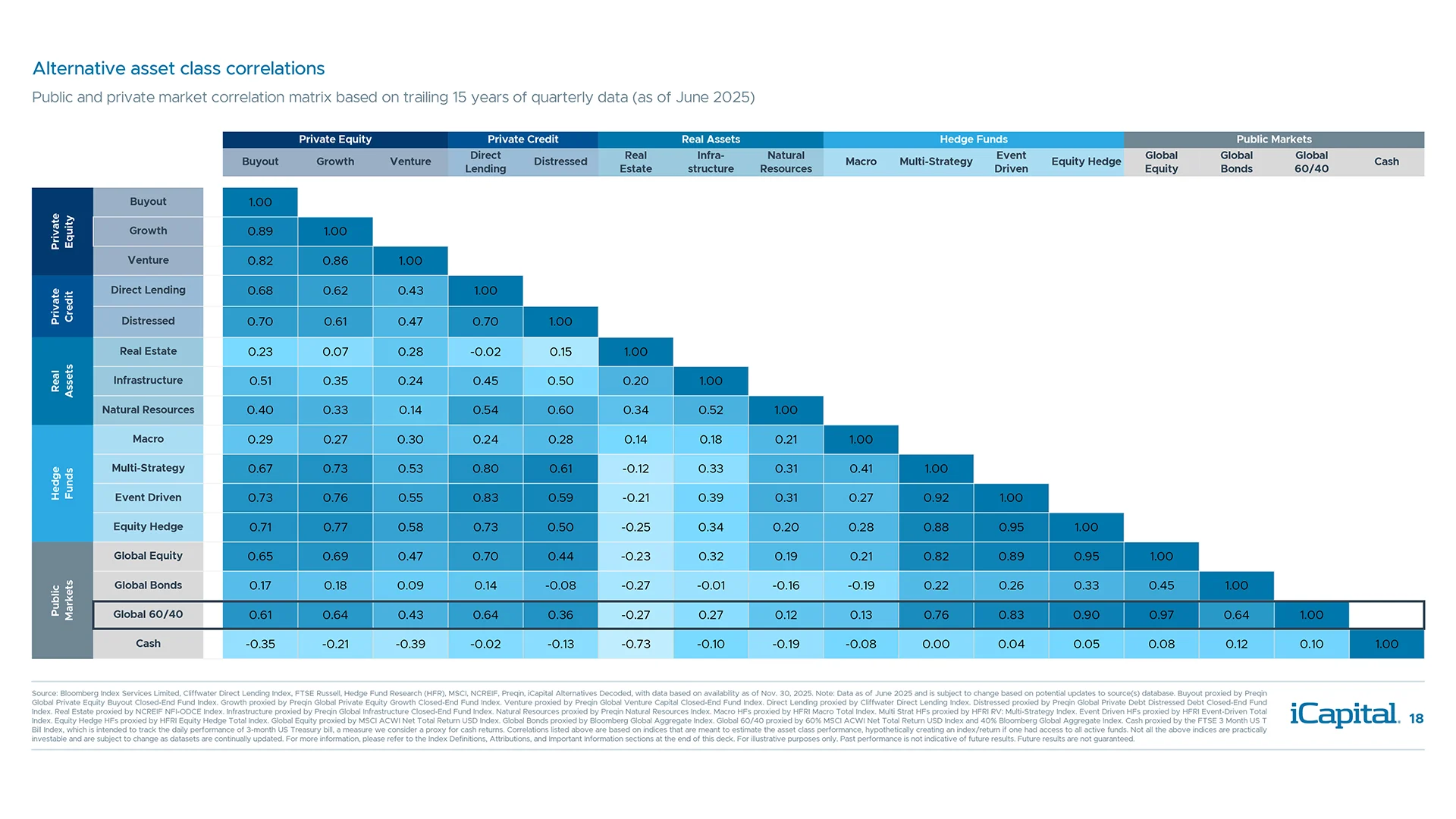

- Cross Asset Correlations 18

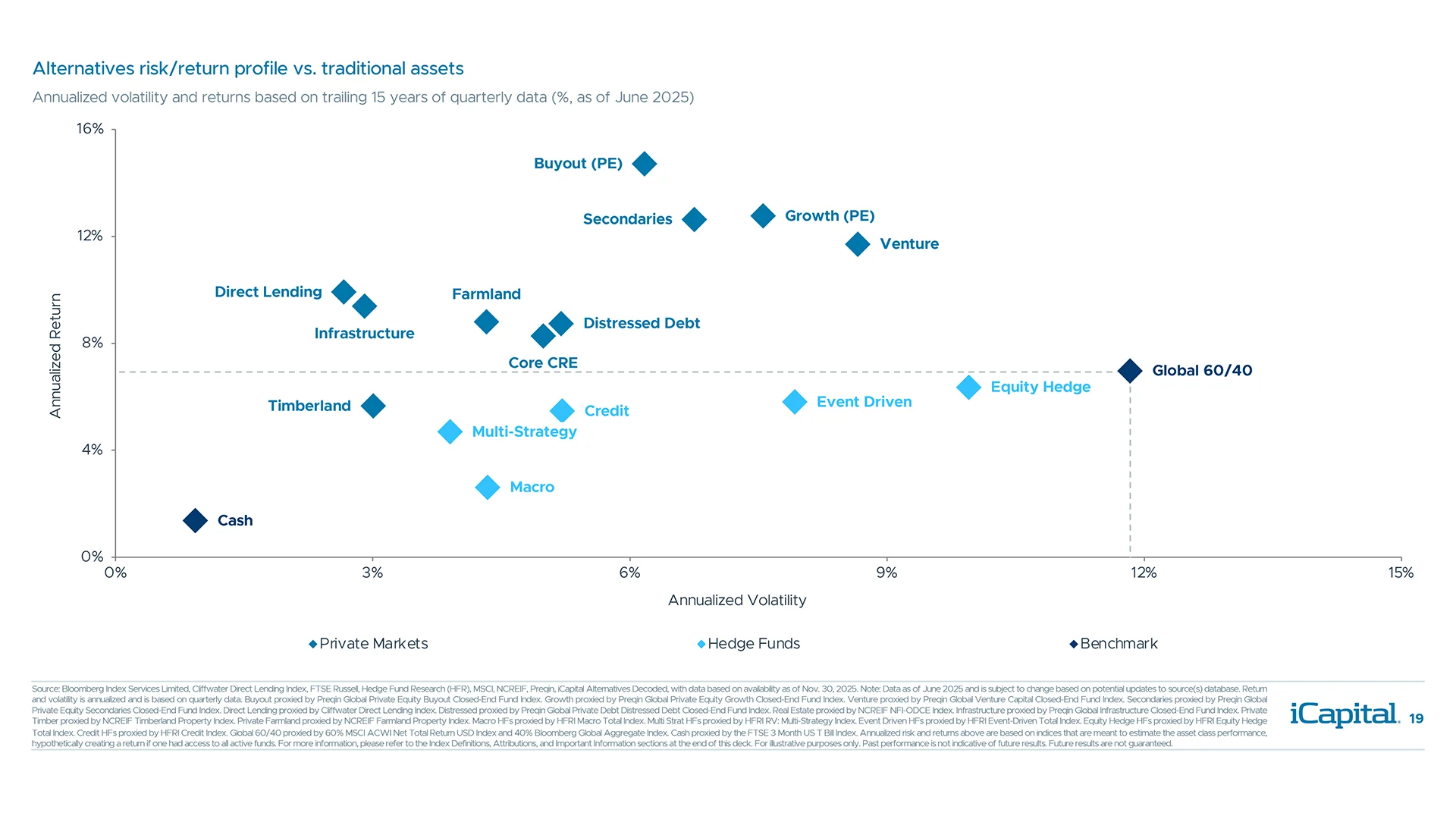

- Risk/Return 19

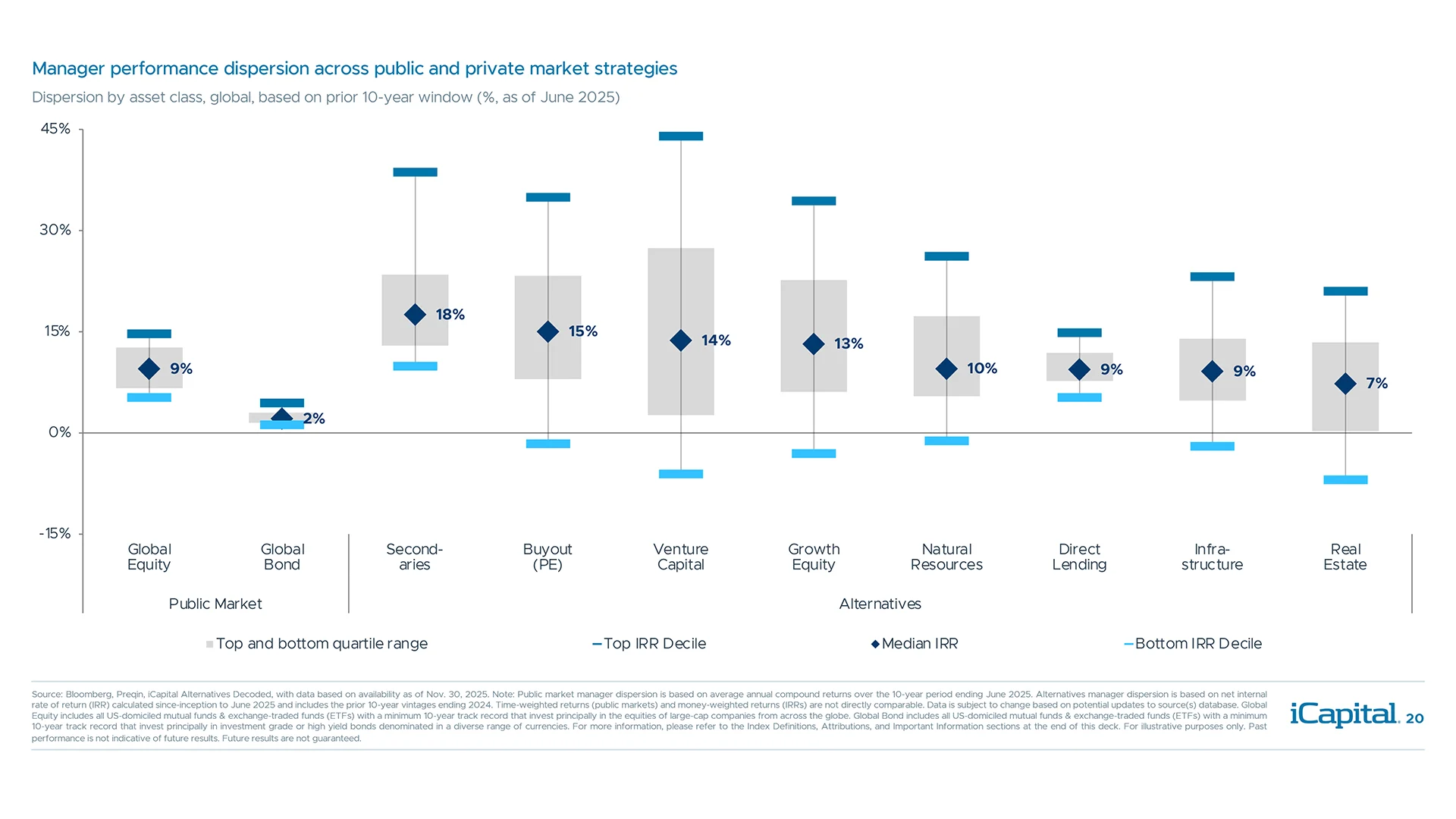

- Dispersions 20

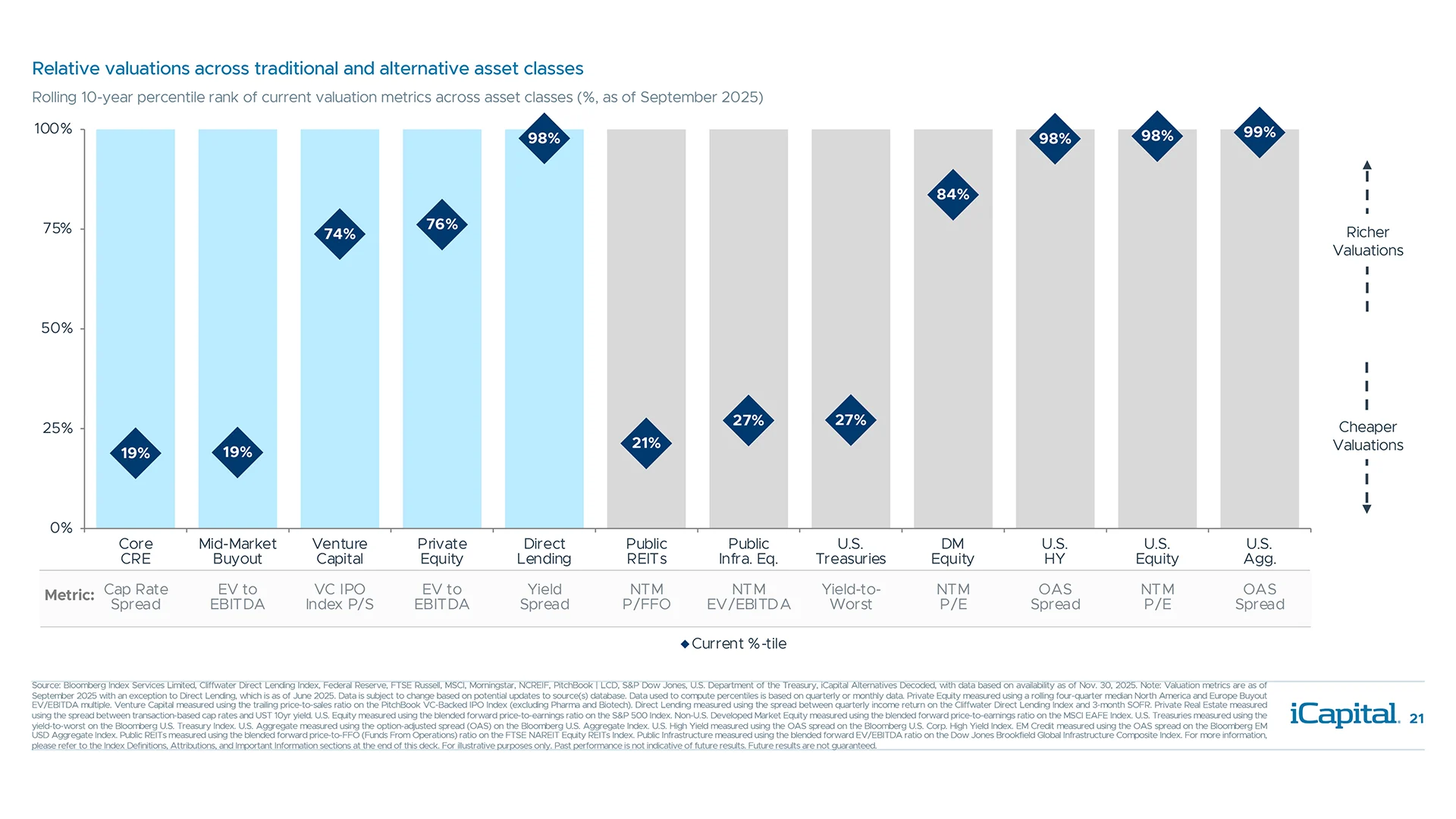

- Relative Valuations 21

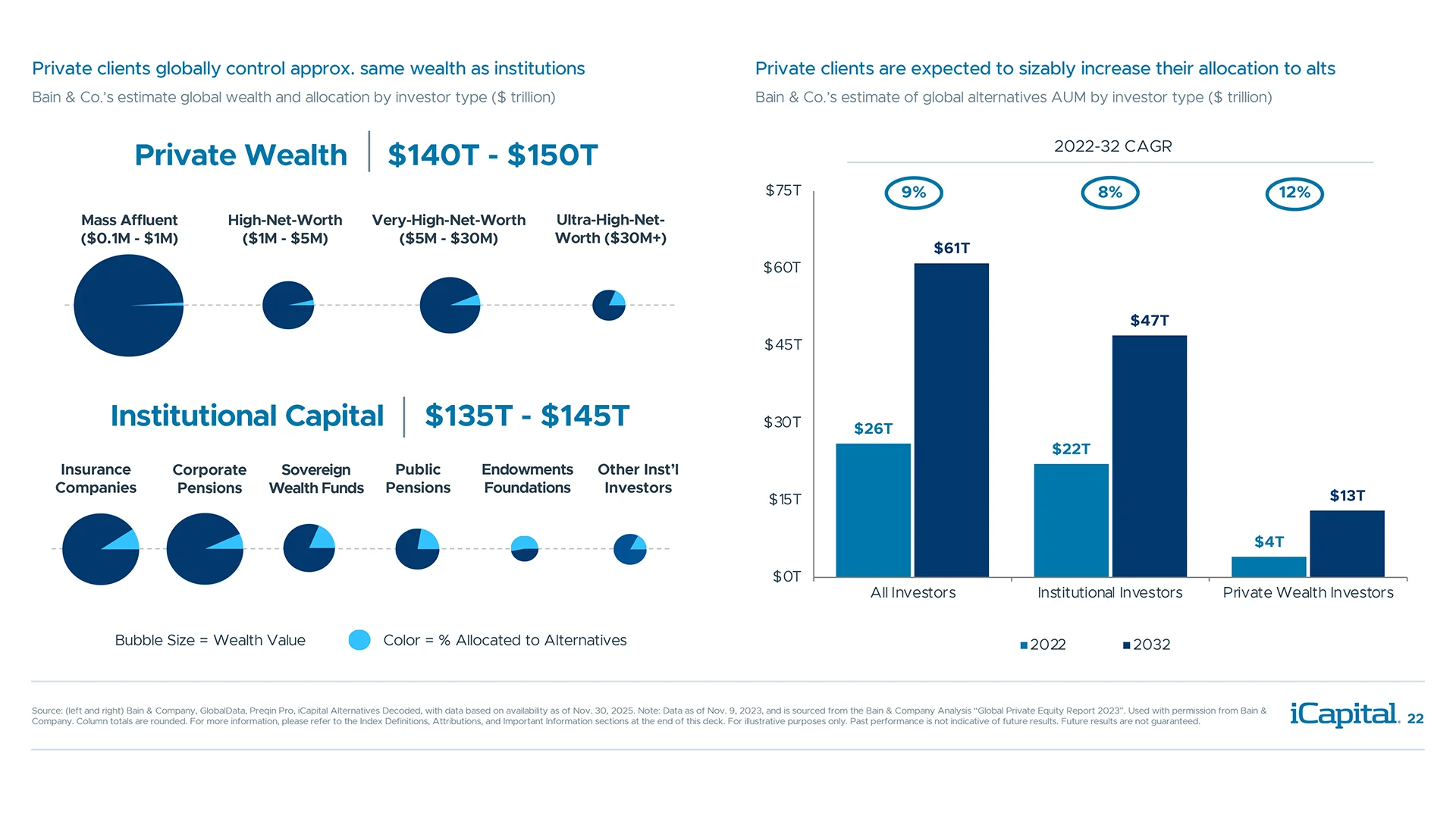

- Private vs. Institutional 22

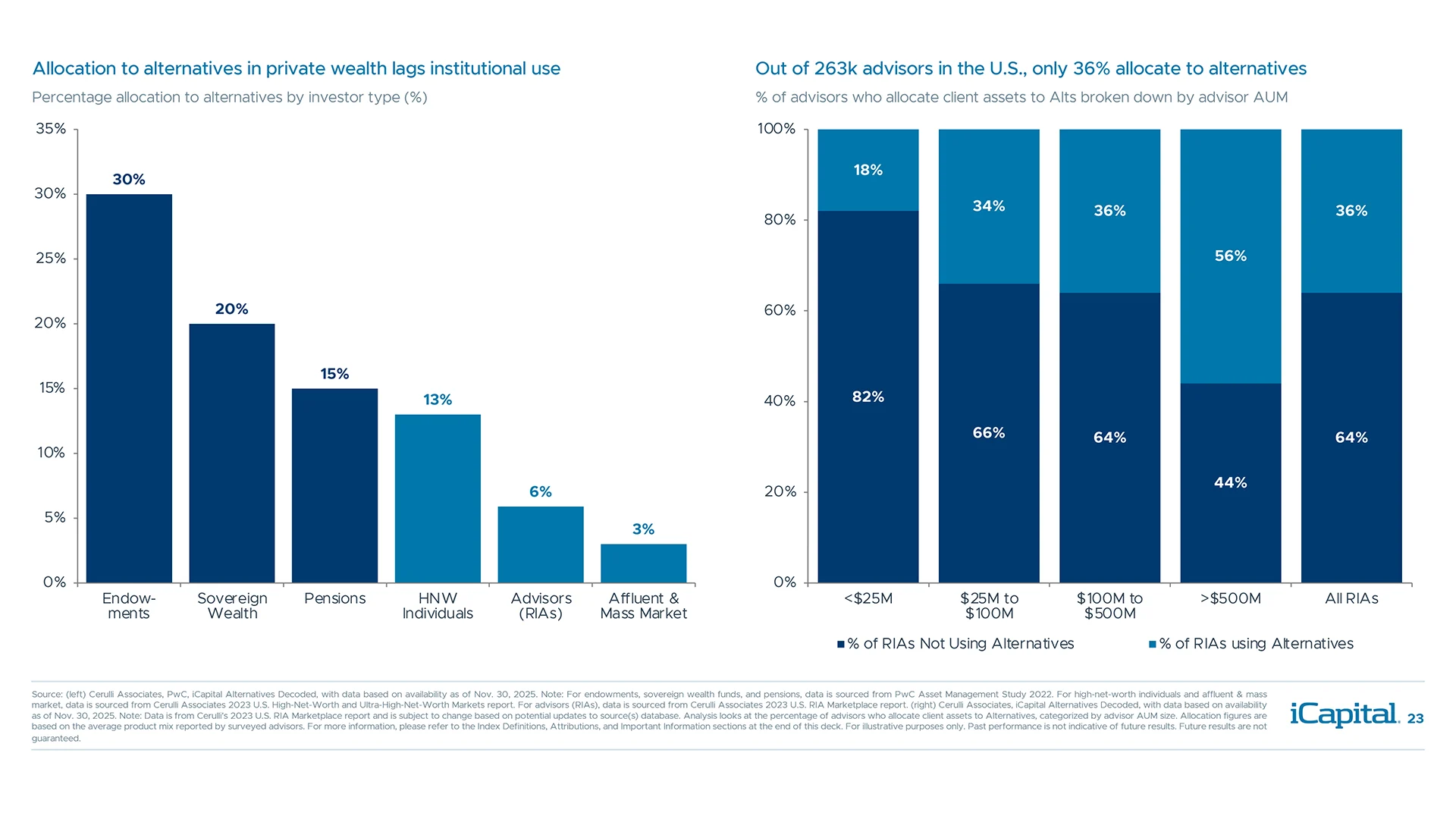

- Allocation to Alternatives 23

-

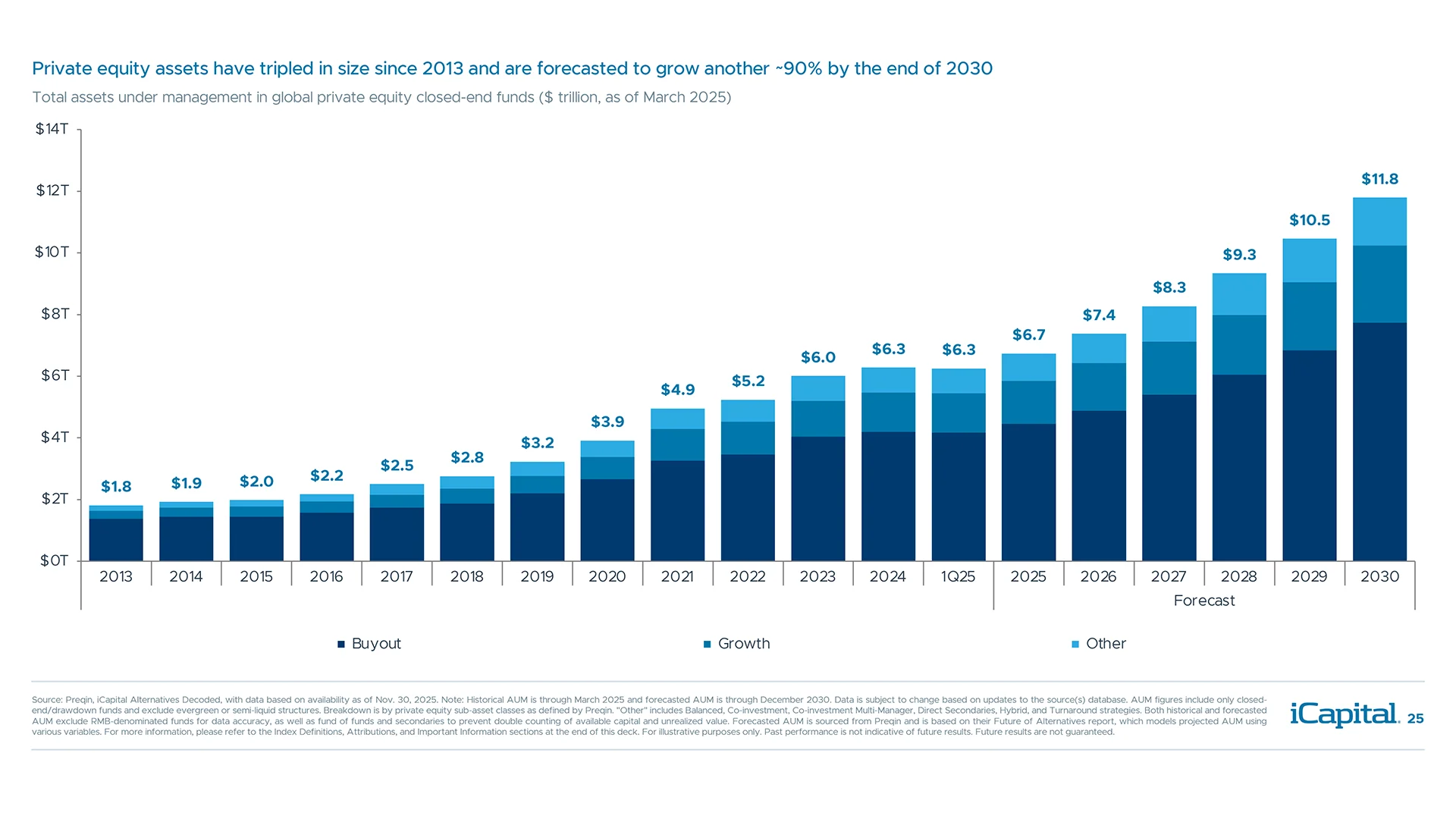

Private Equity keyboard_arrow_down

- Private Equity 24

- Assets Under Management 25

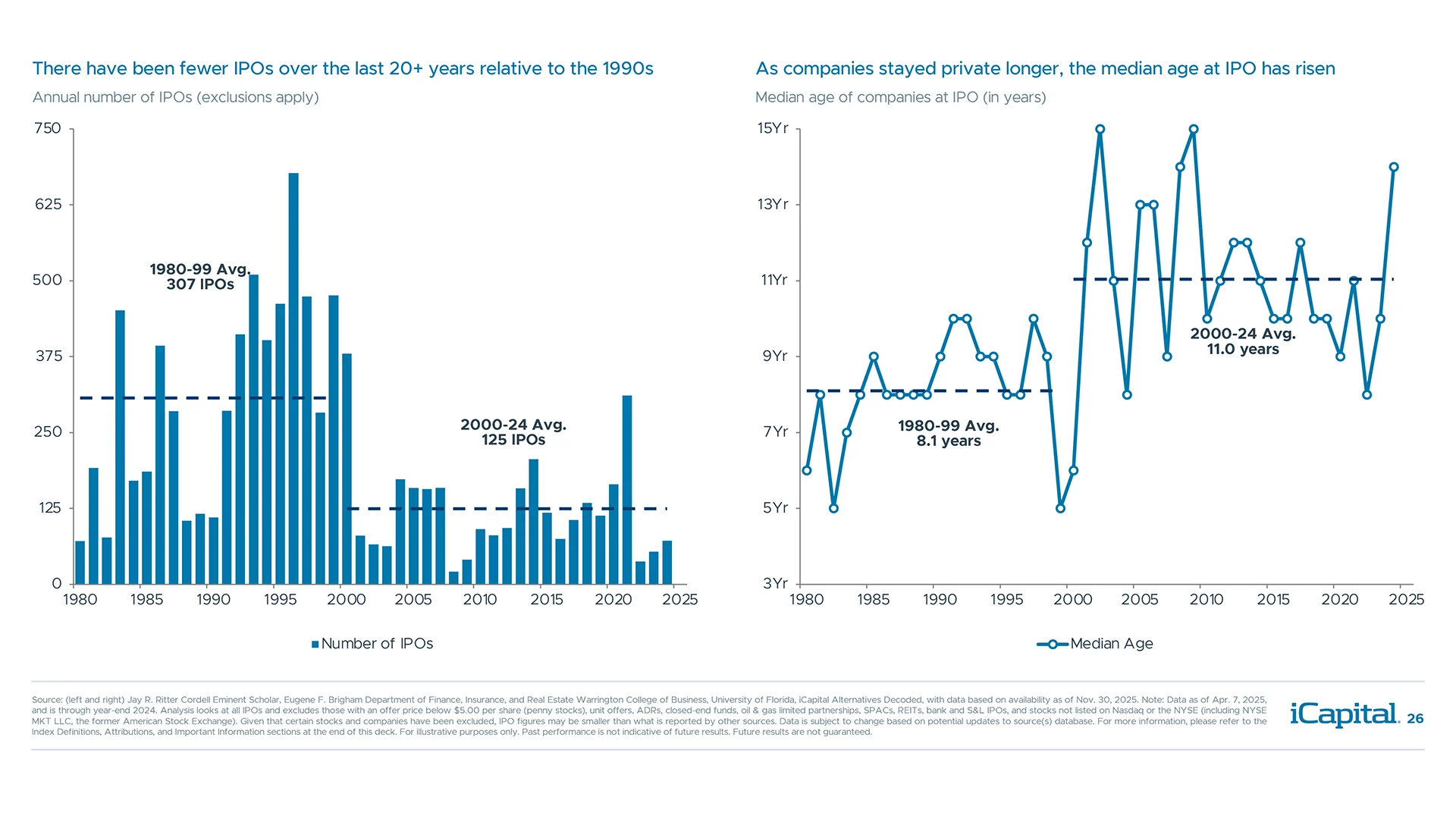

- IPO Trends 26

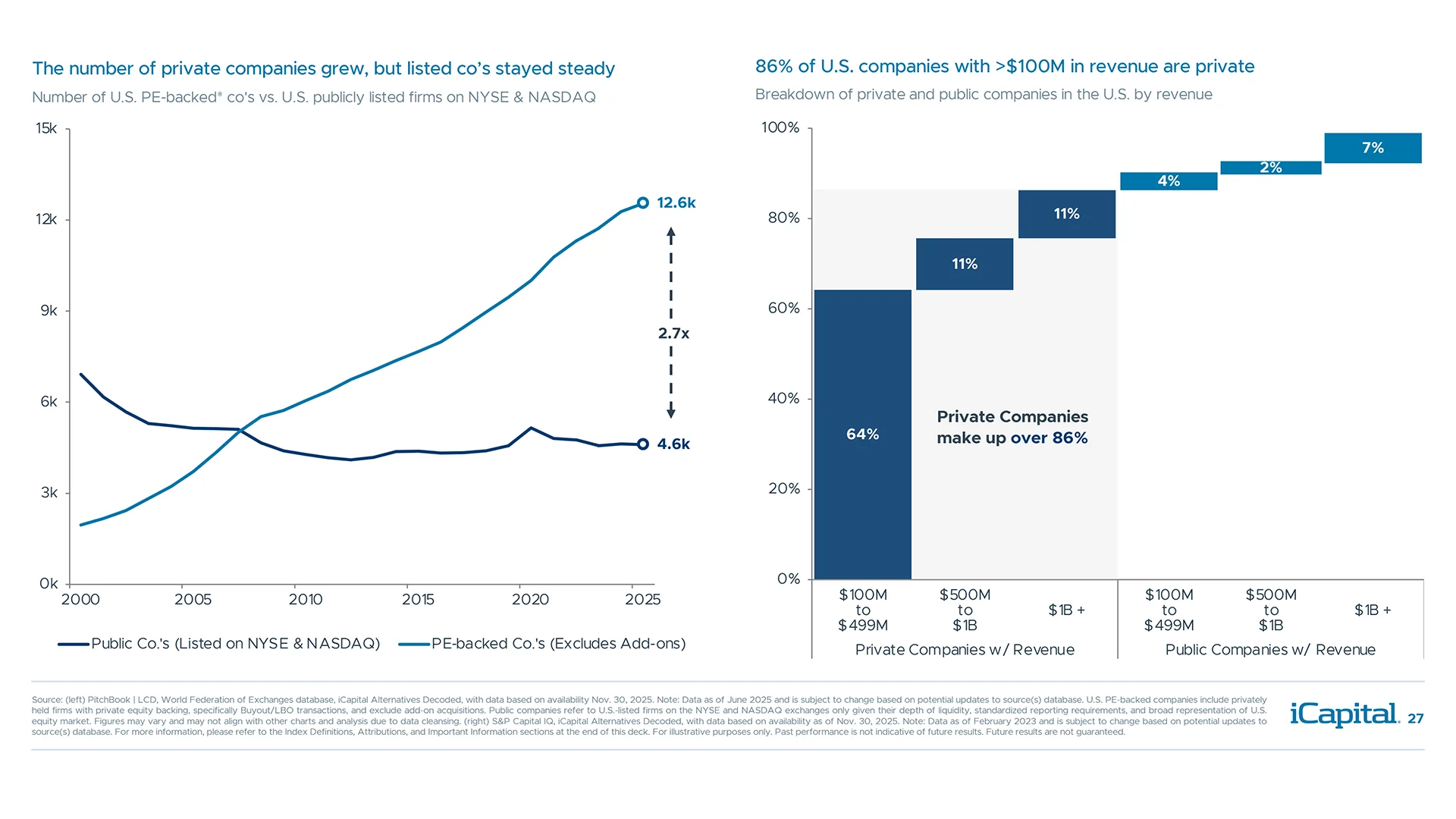

- Private Company Trends 27

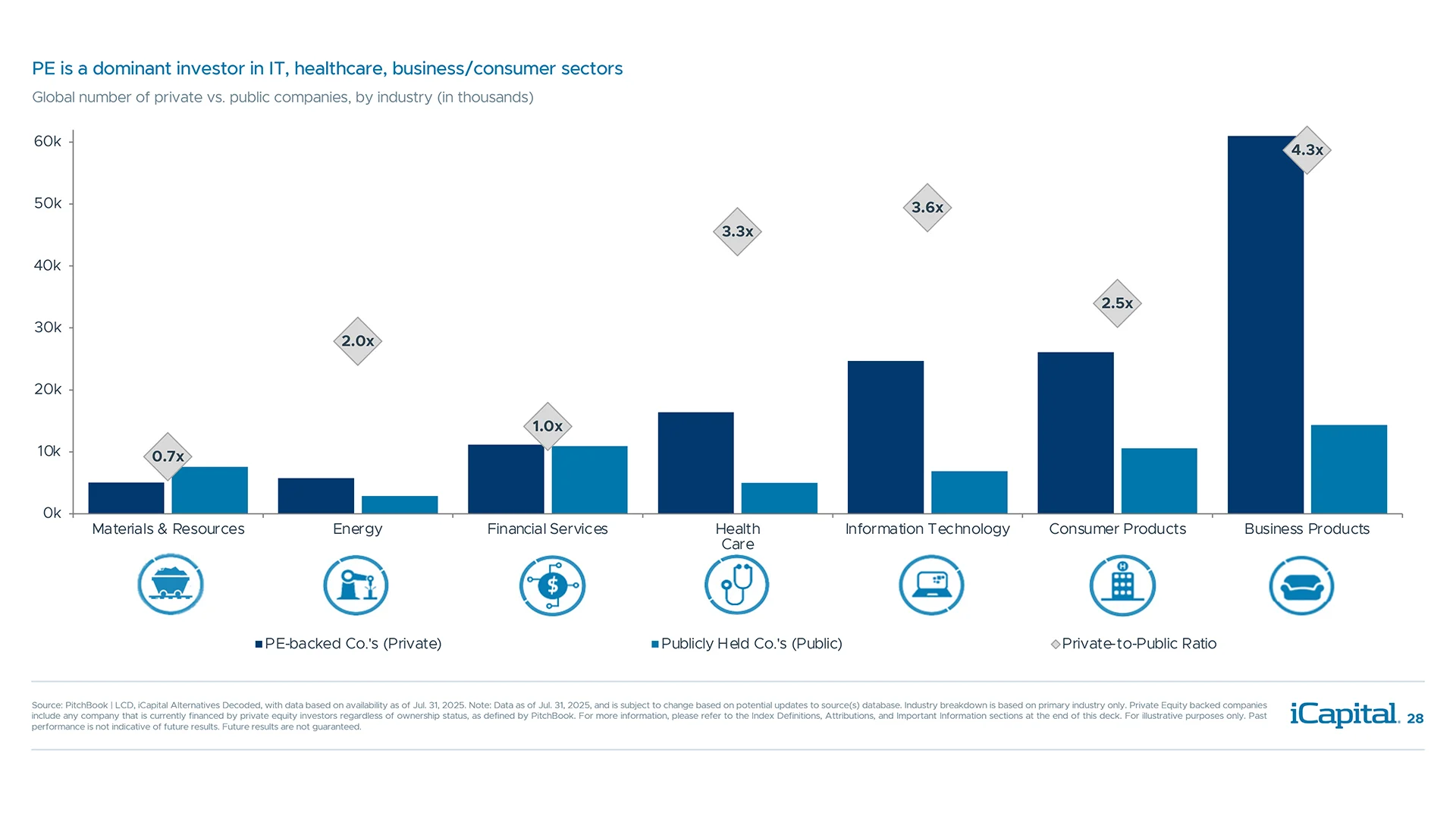

- Private-to-Public Company Ratio 28

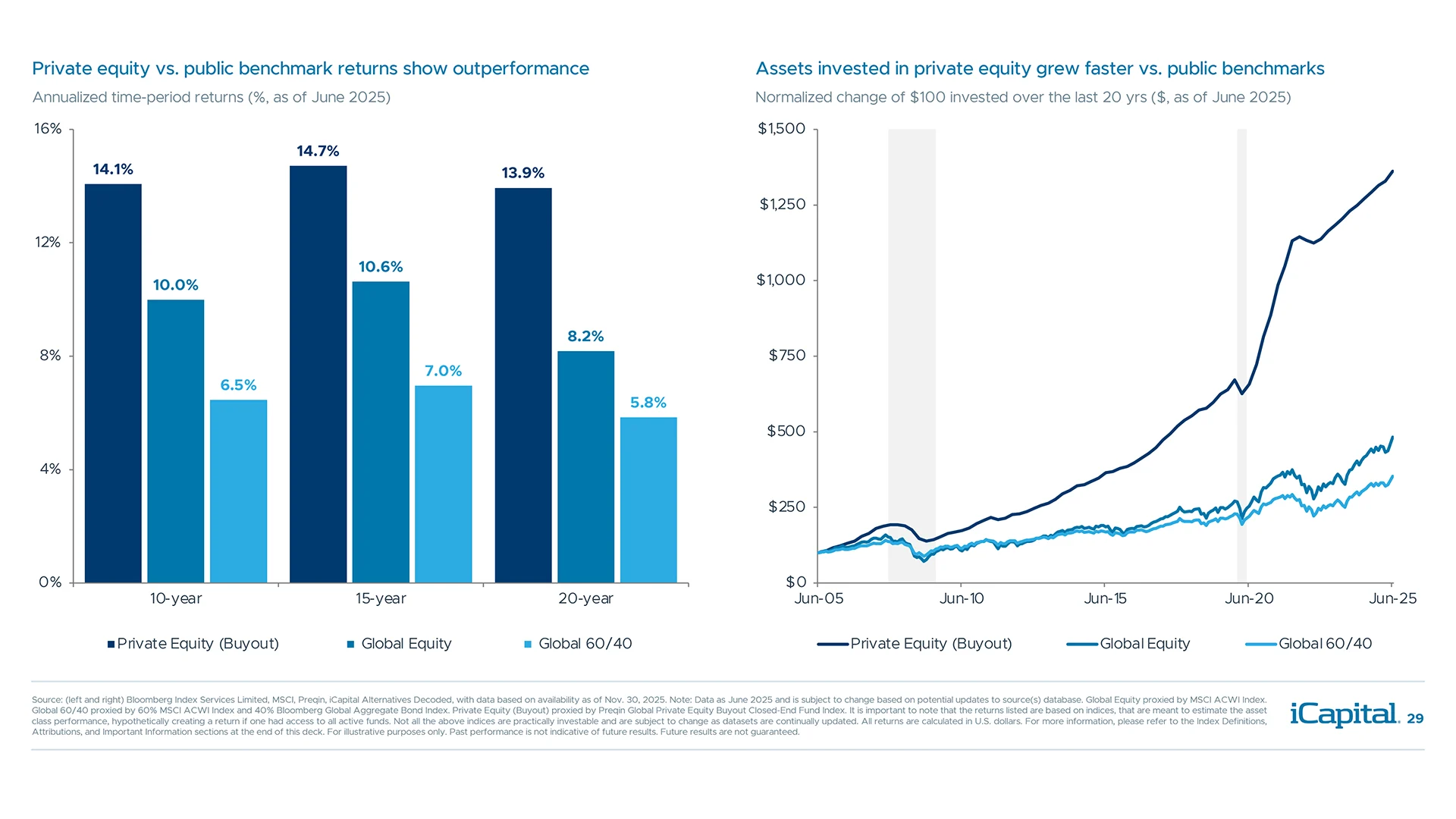

- Returns 29

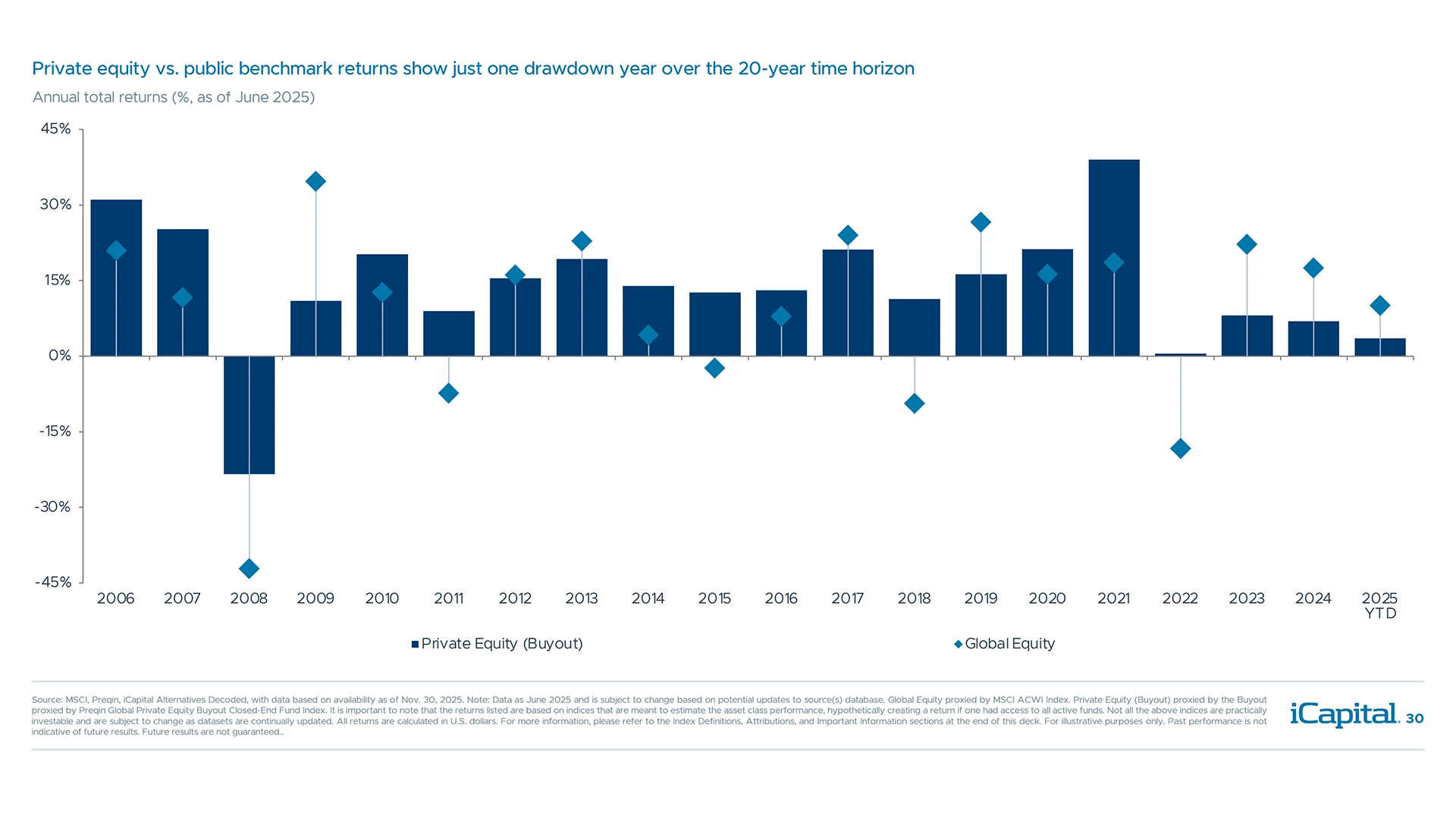

- Downside Protection 30

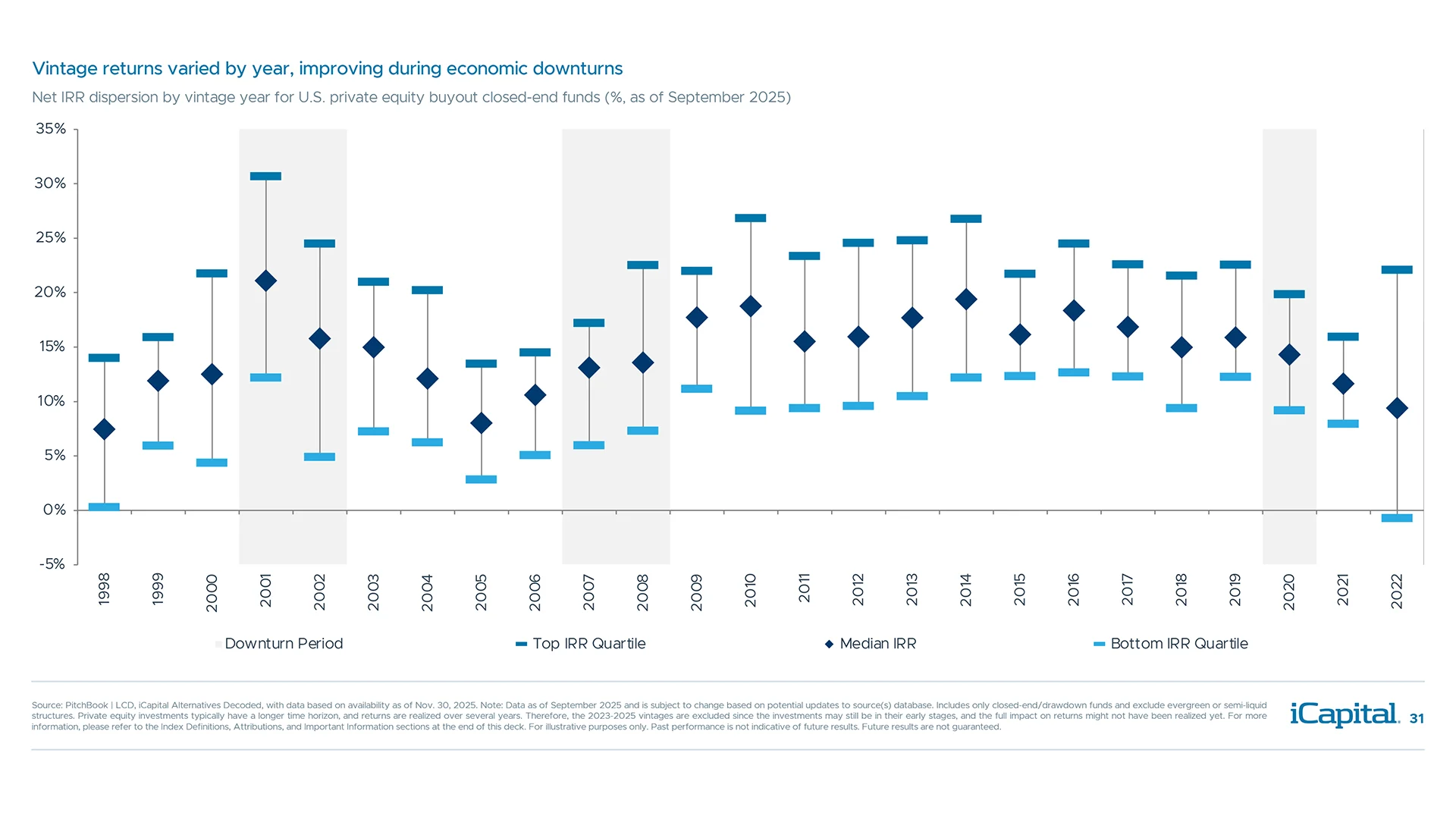

- Return Dispersion 31

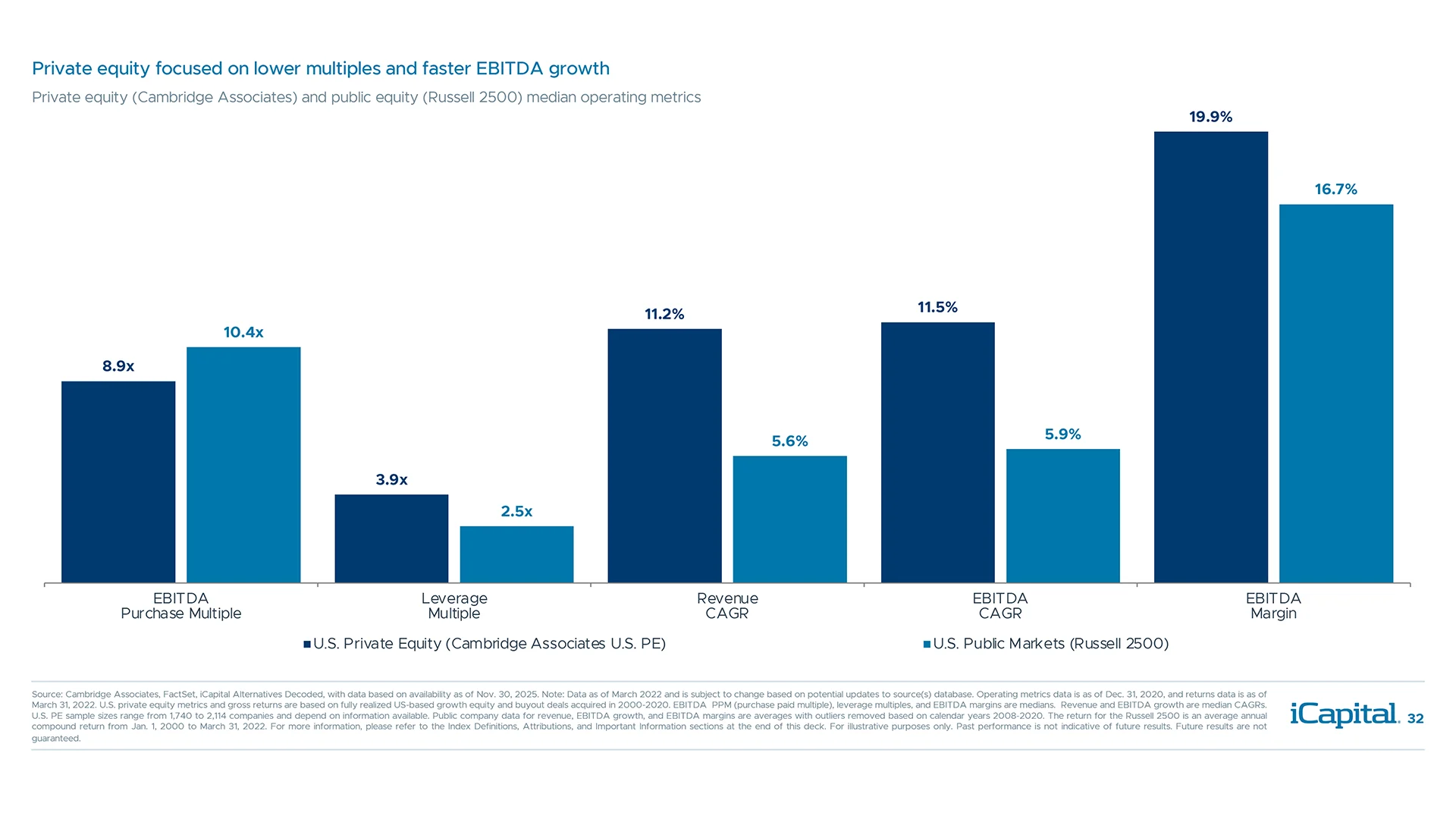

- Value Creation 32

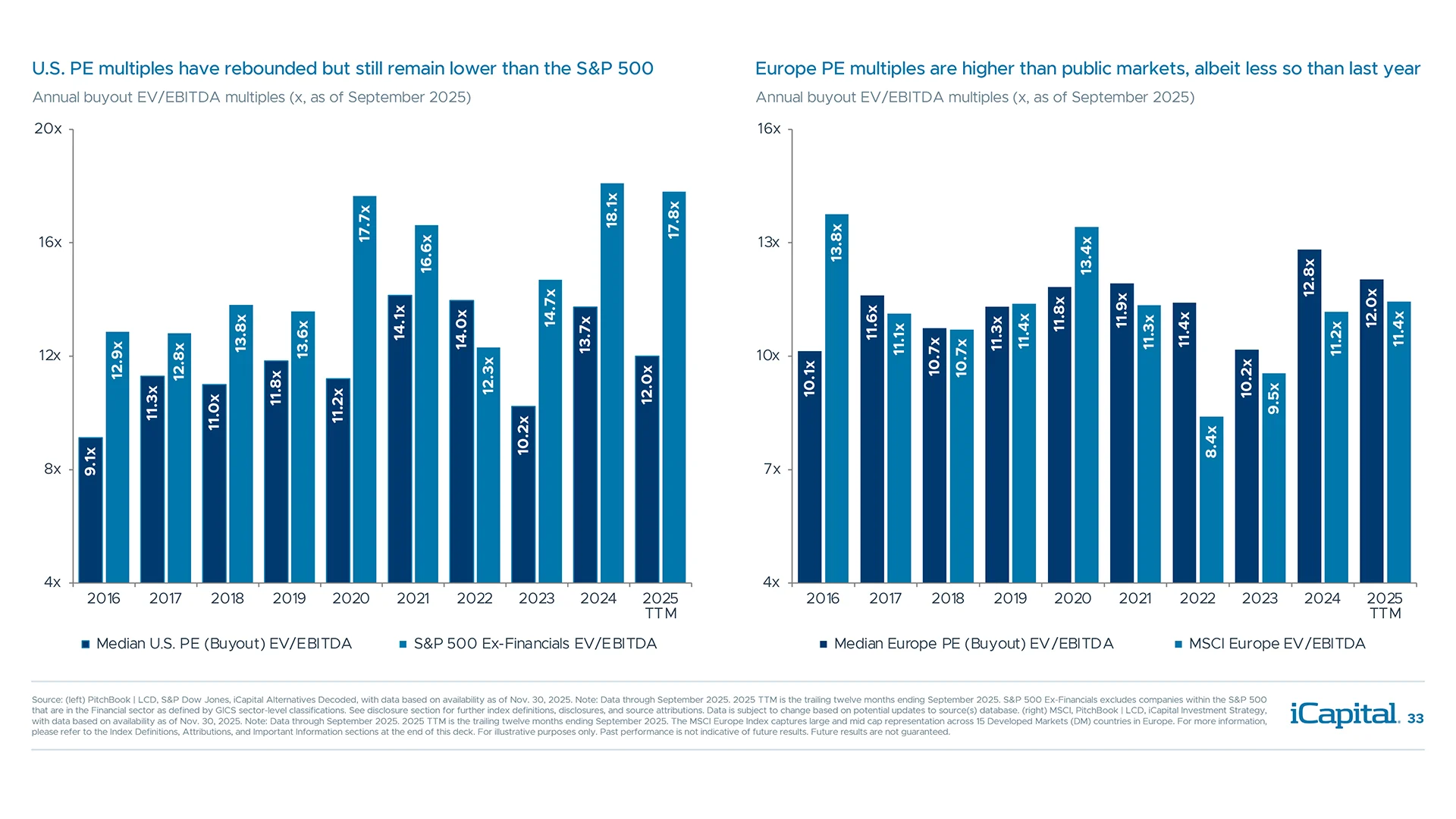

- Valuations 33

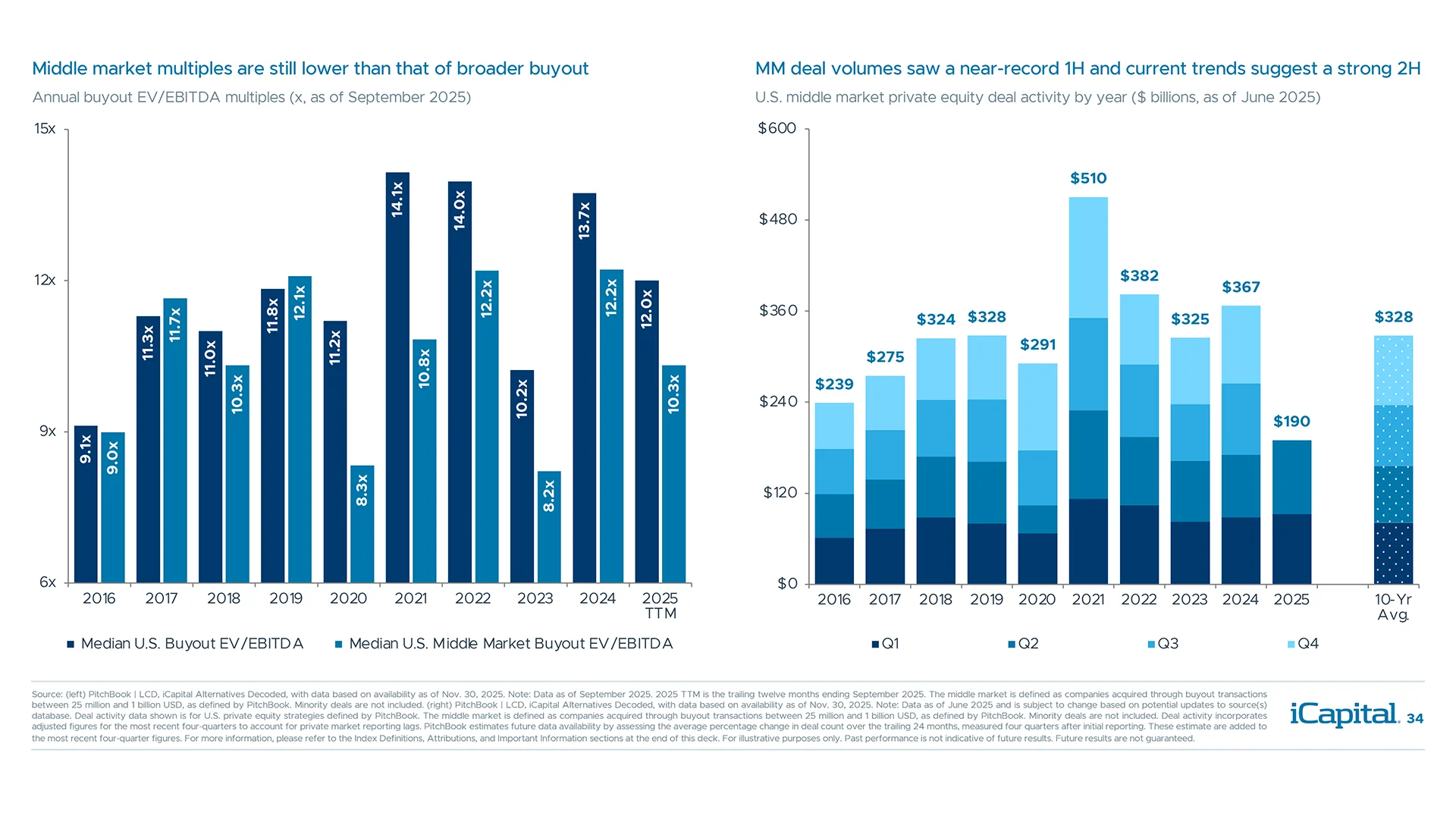

- Middle Market Buyout 34

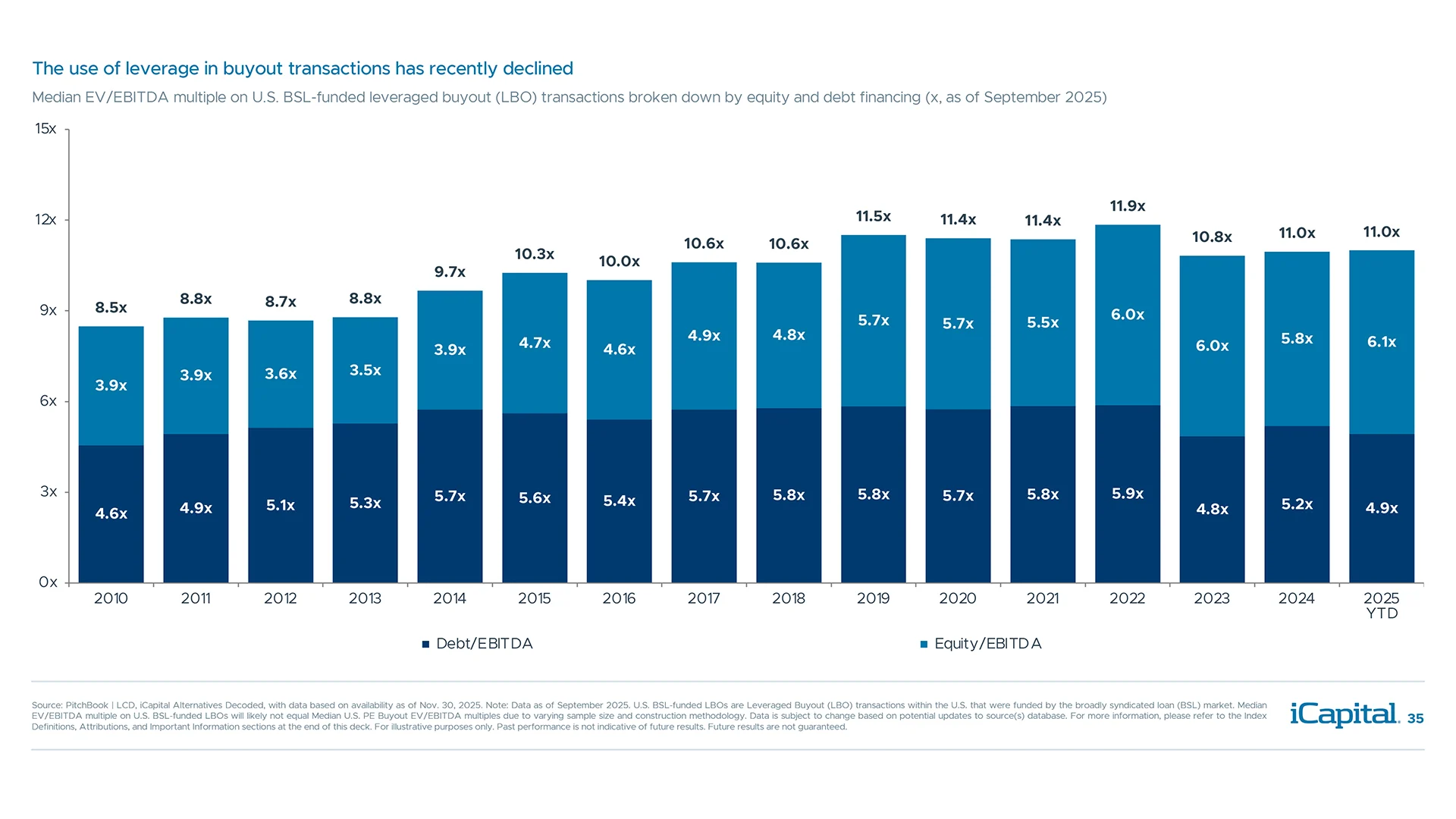

- Leverage 35

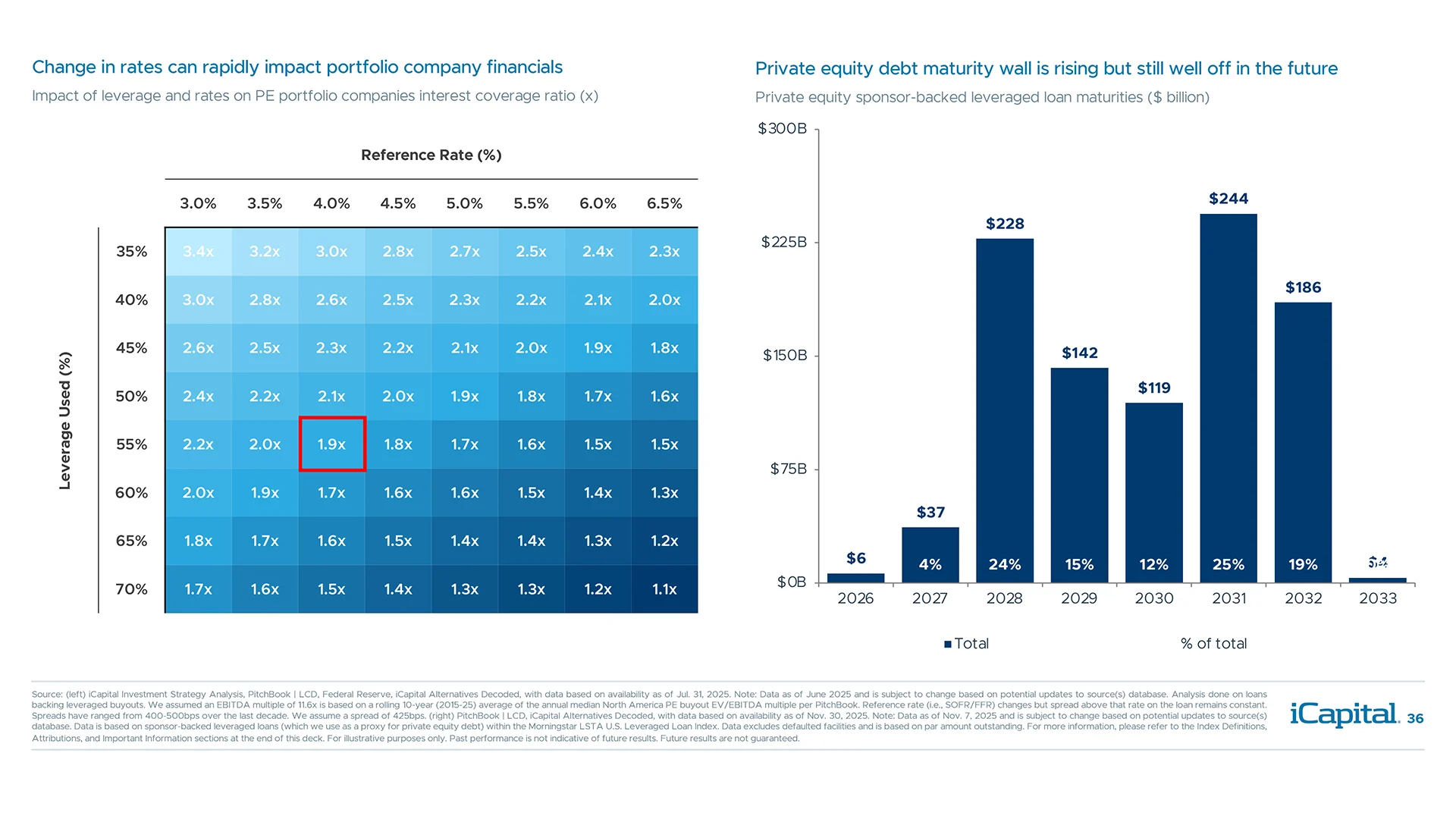

- Leverage/Rate Sensitivity 36

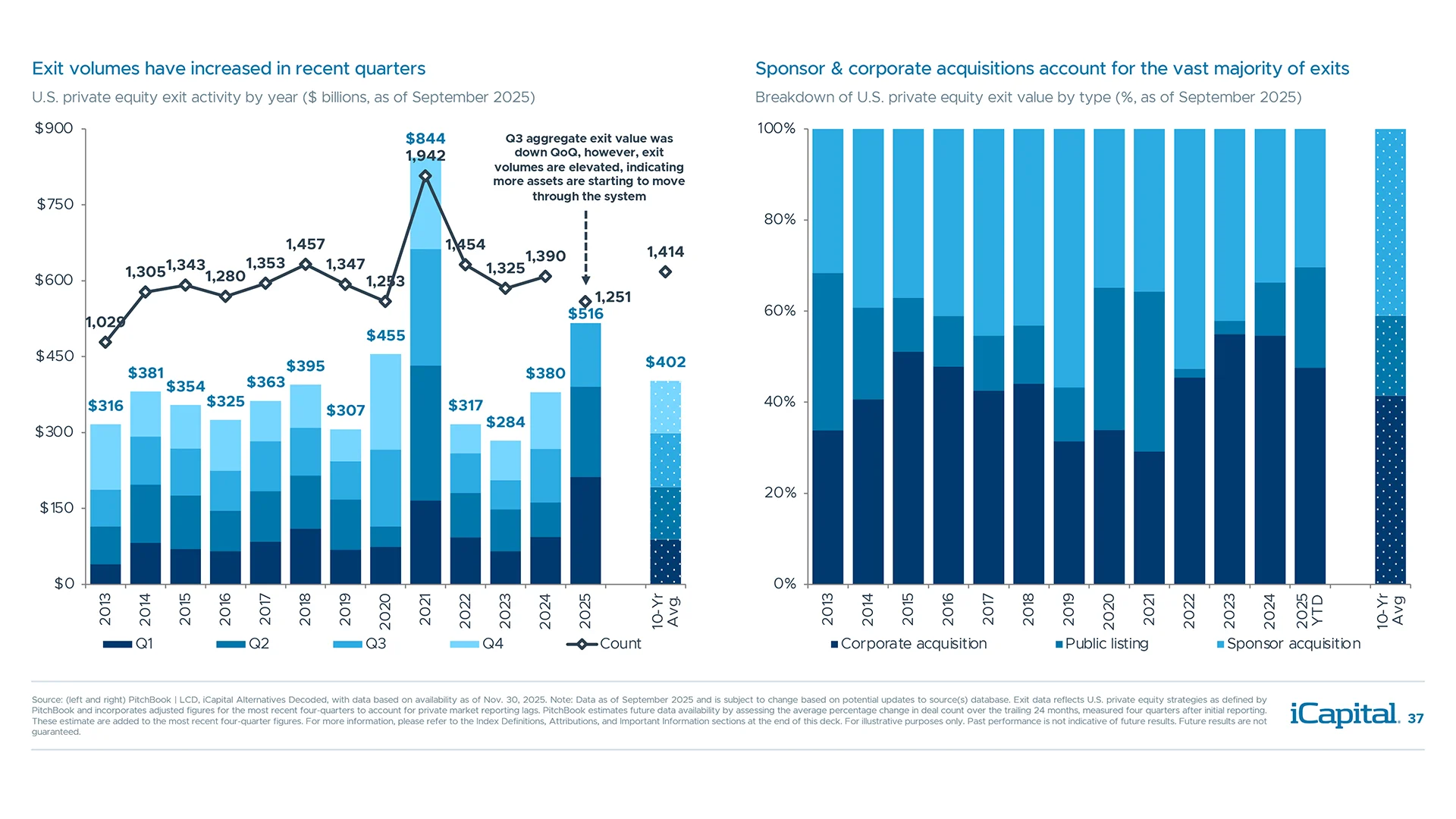

- Exit Activity 37

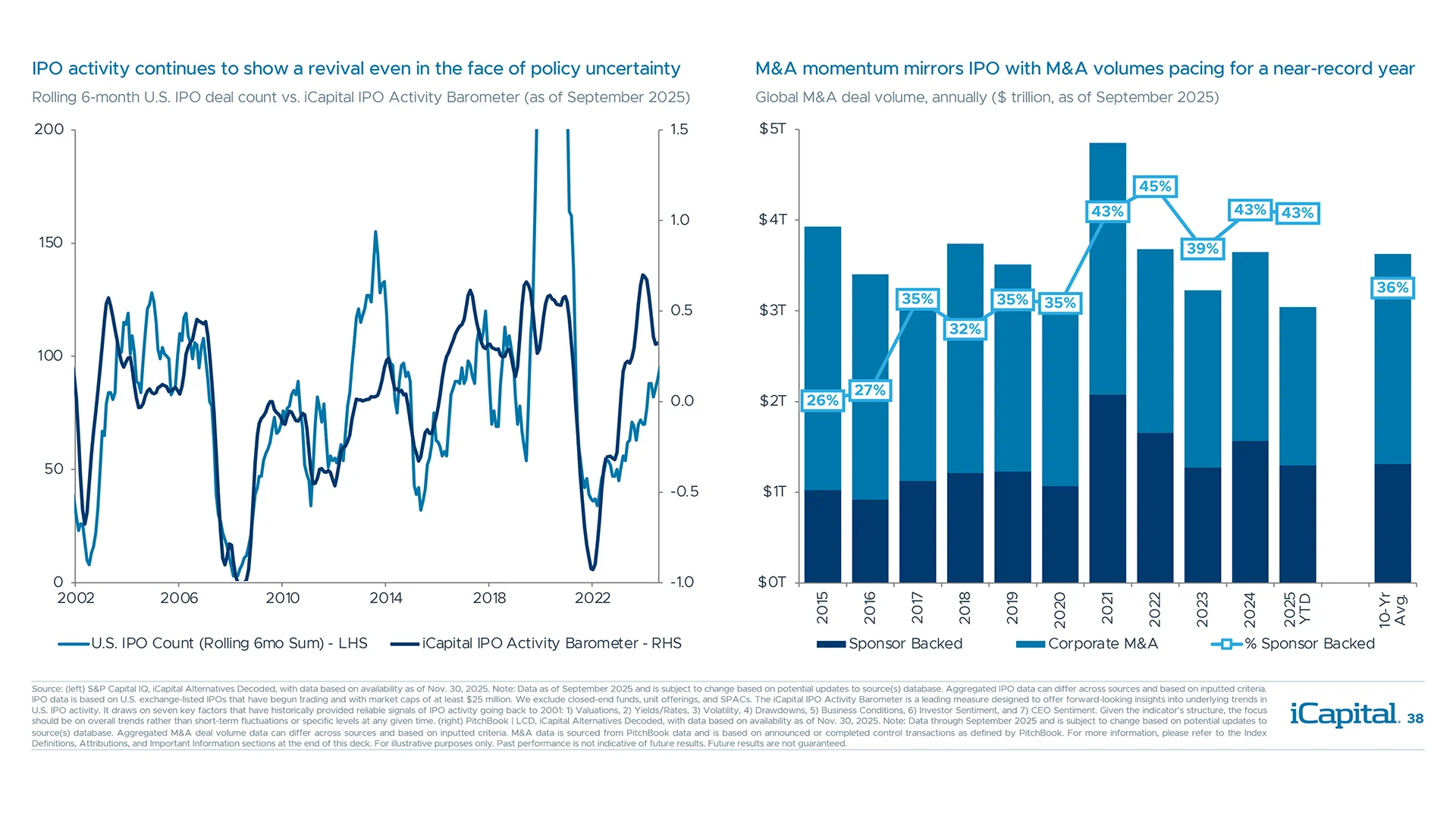

- IPO and M&A Activity 38

-

Venture Capital keyboard_arrow_down

-

Private Credit keyboard_arrow_down

- Private Credit 51

- Assets Under Management 52

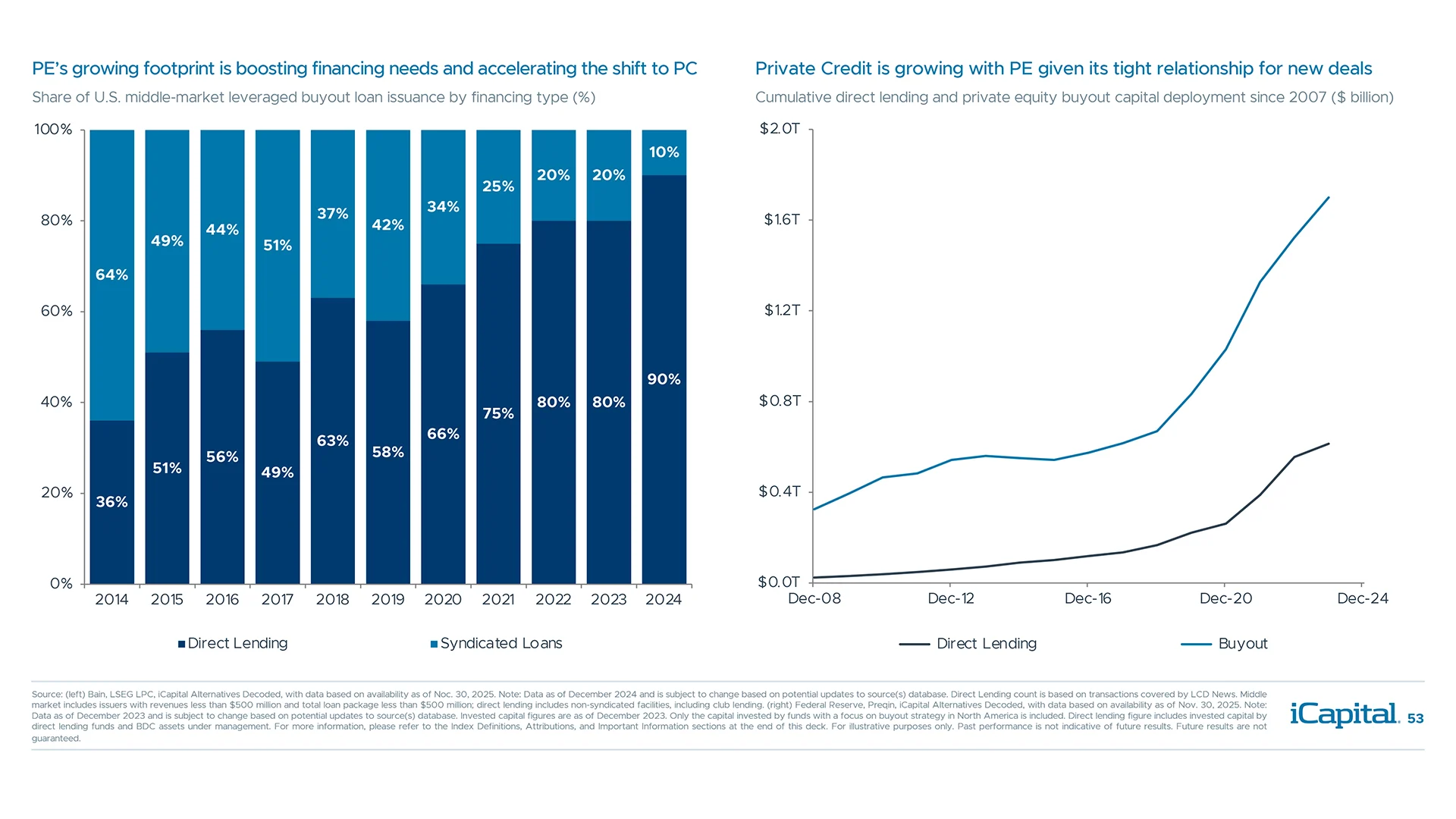

- Dry Powder/Lending 53

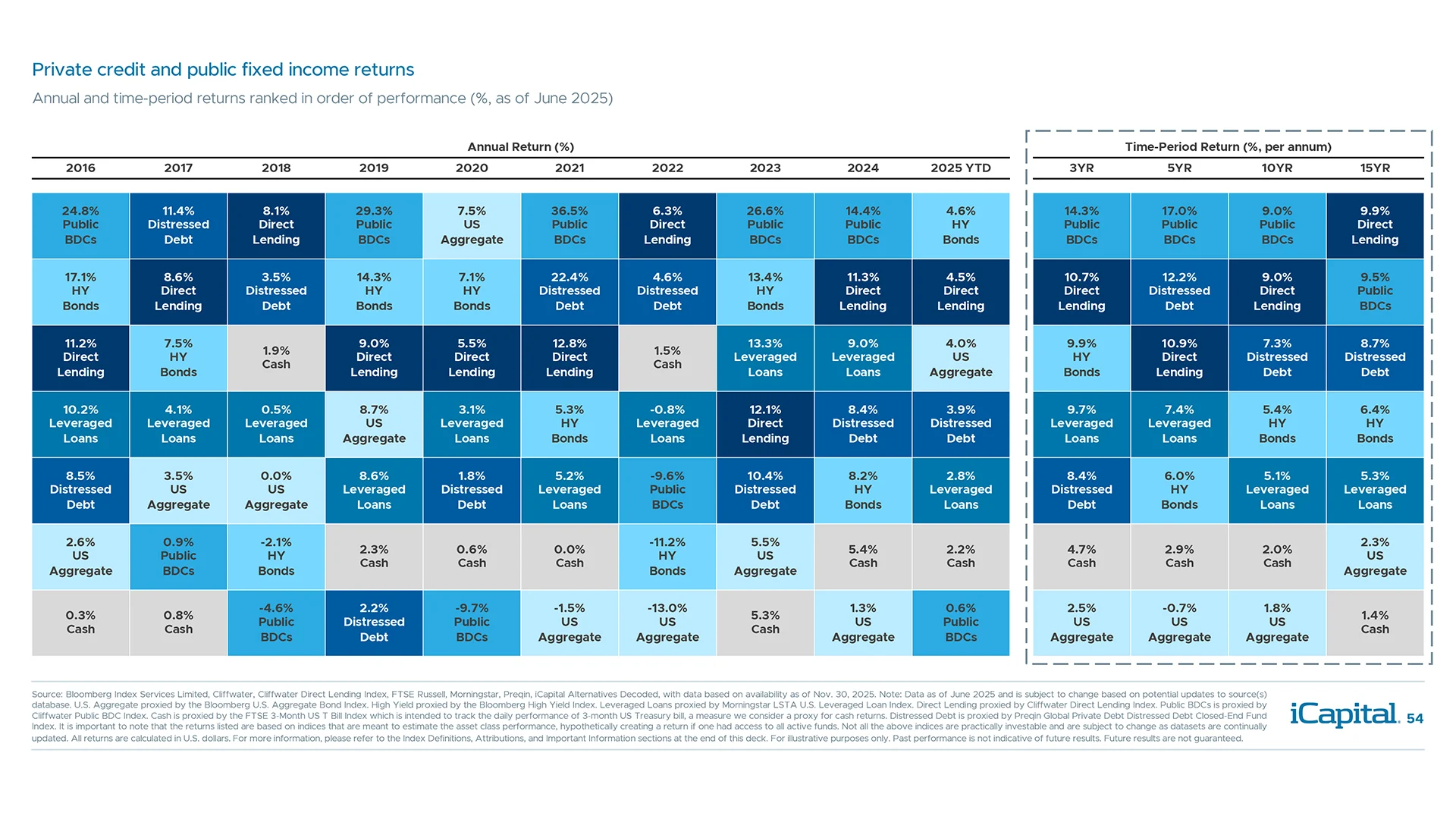

- Returns by Strategy 54

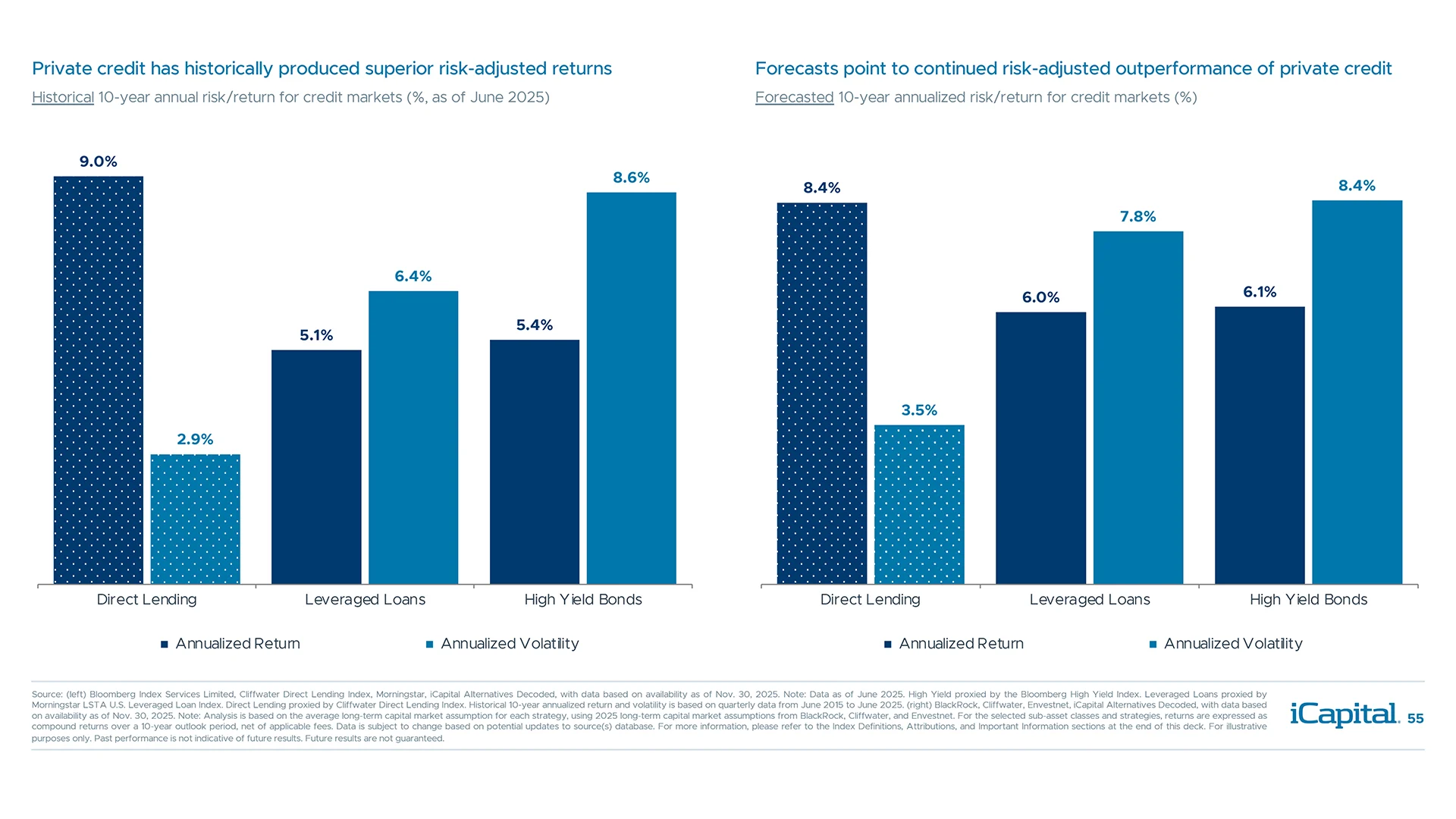

- Risk-Adjusted Returns 55

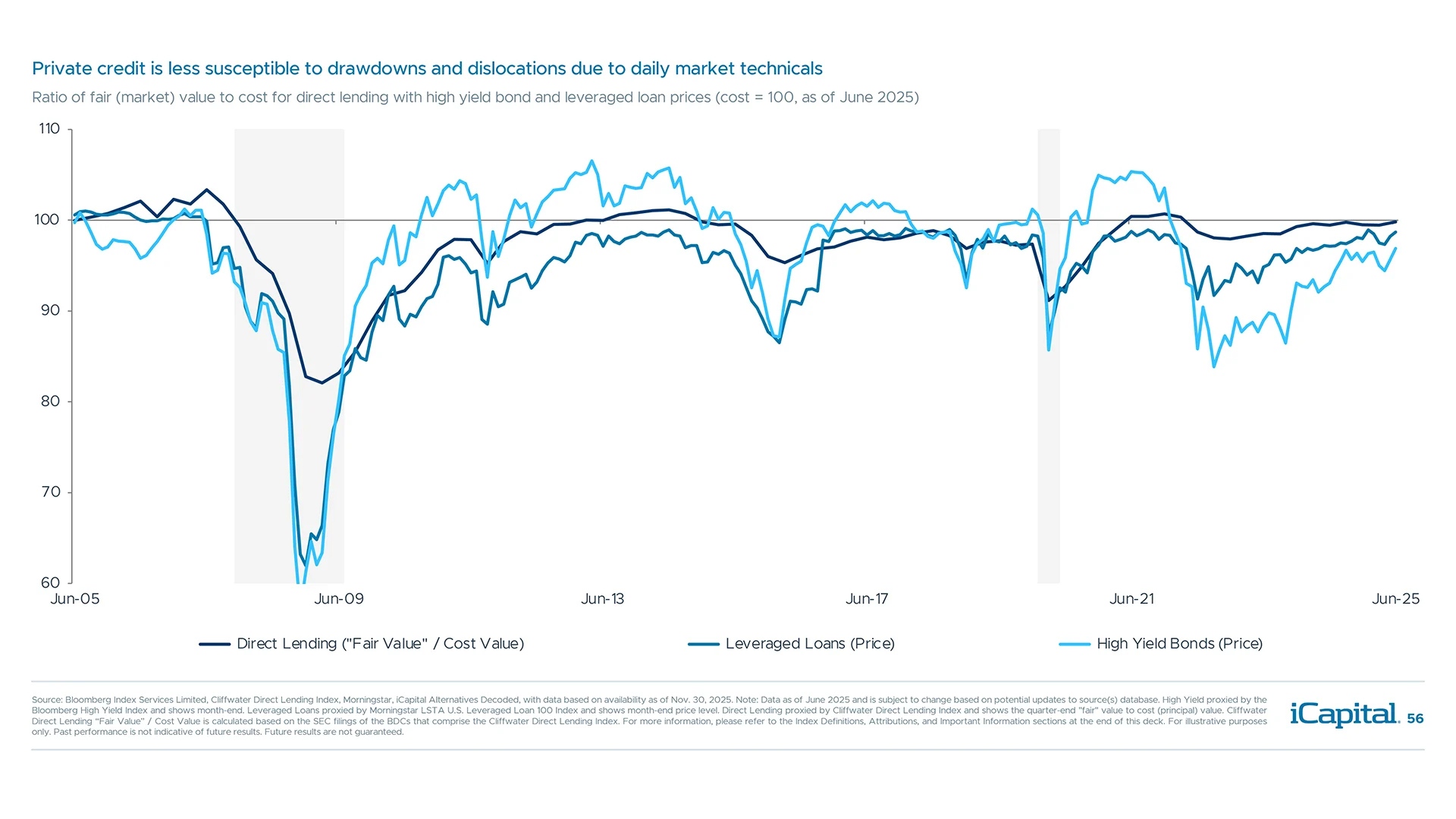

- Drawdown Risk 56

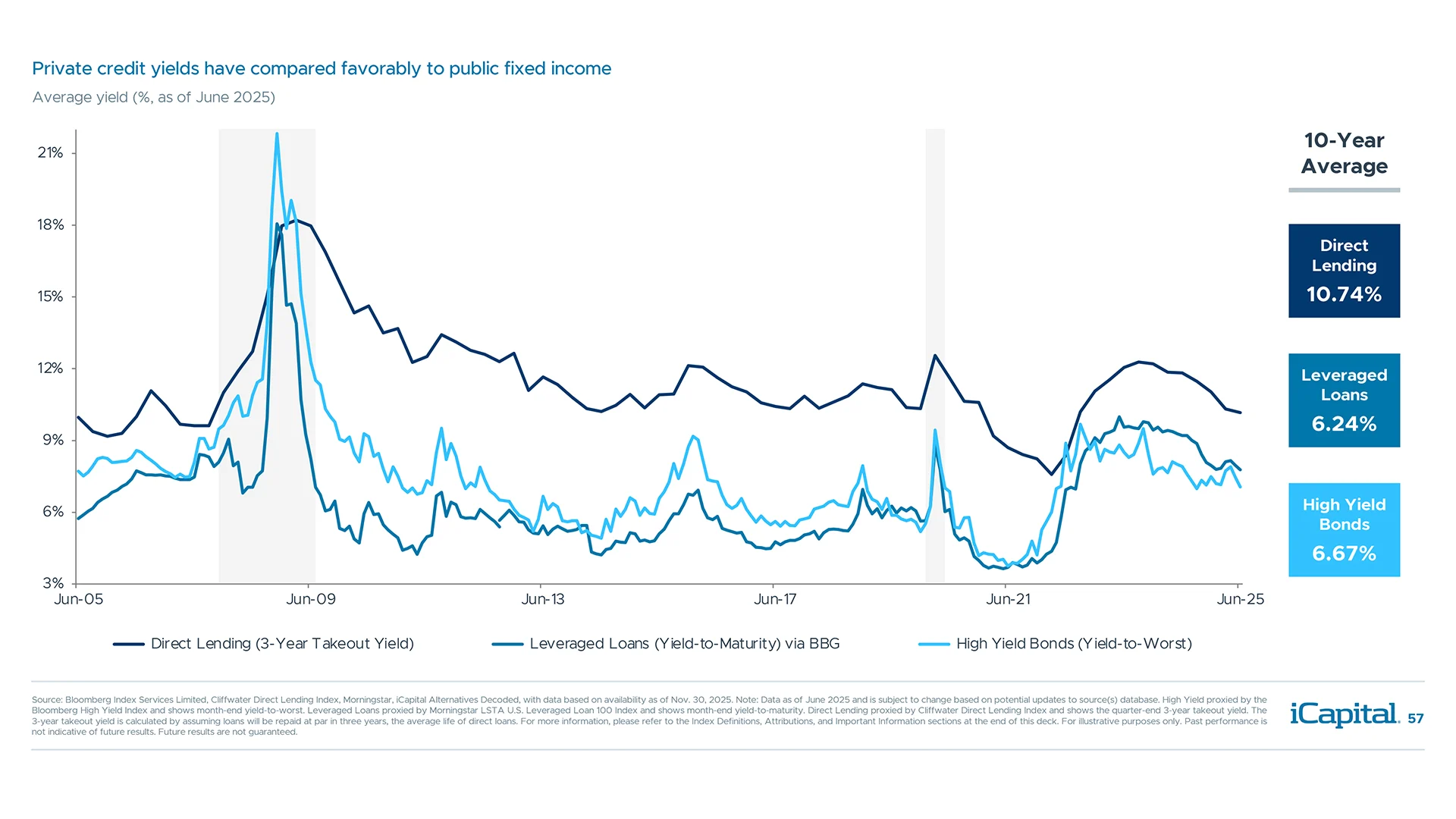

- Yields 57

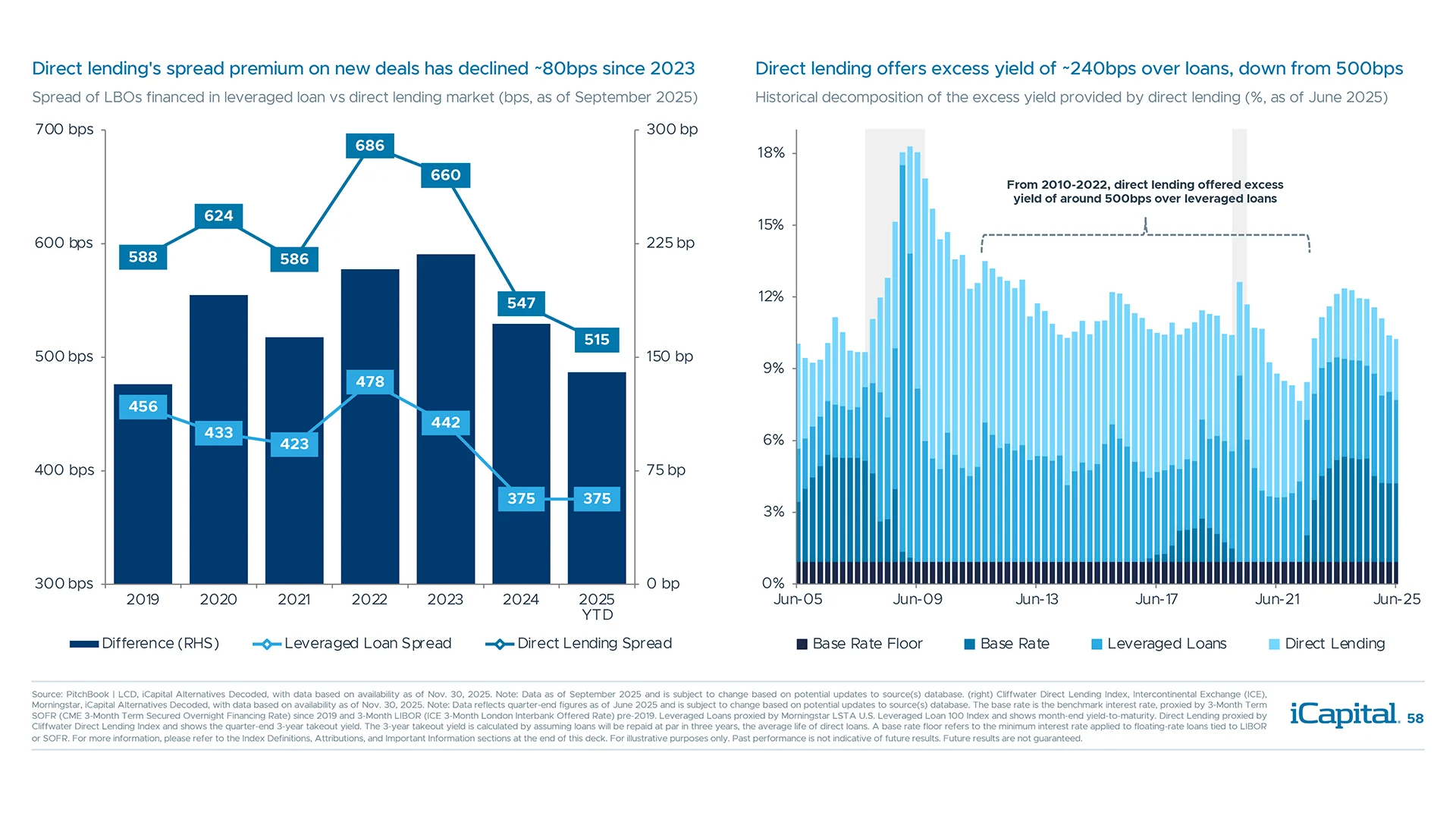

- Yield Decomposition 58

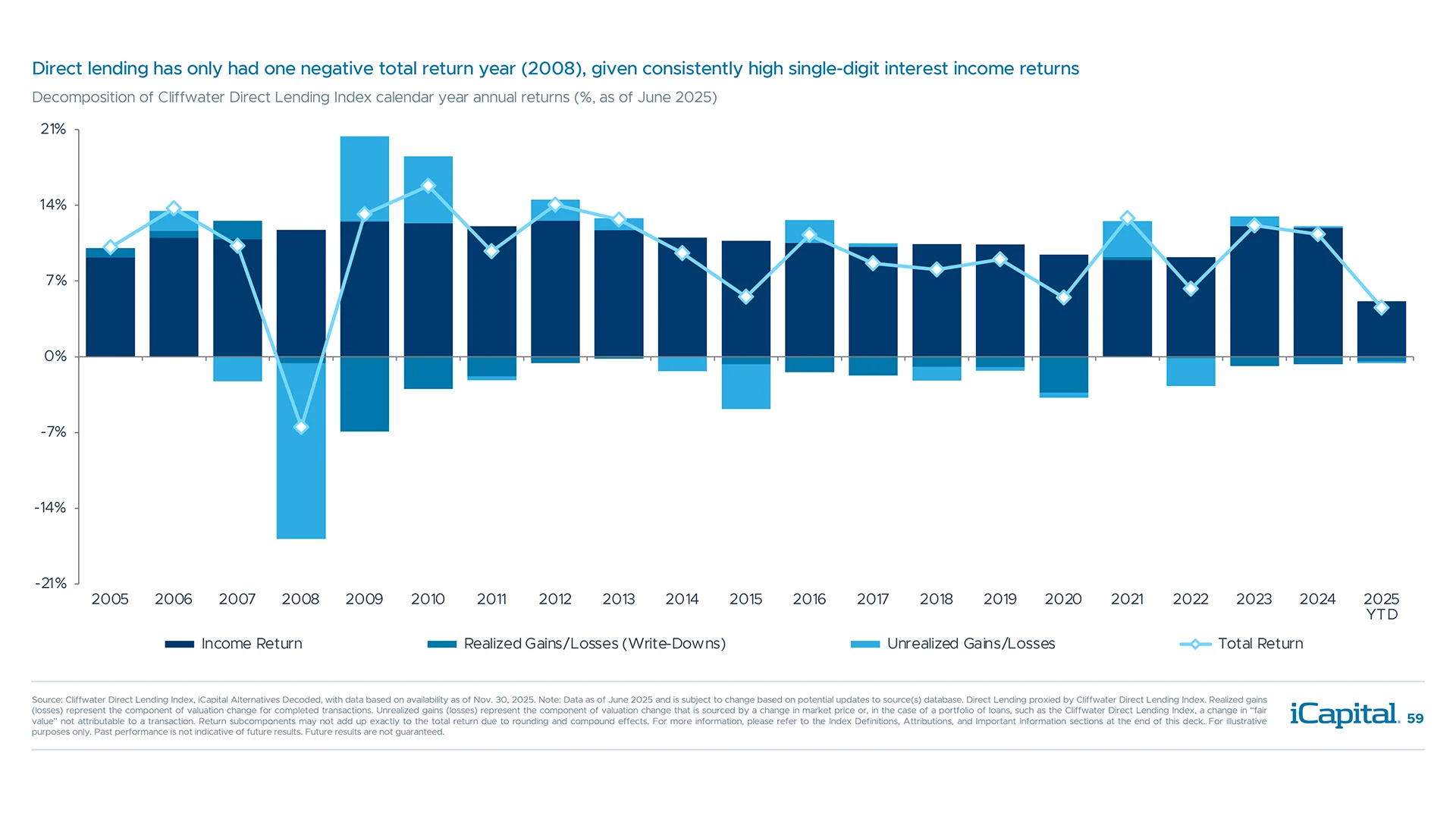

- Return Decomposition 59

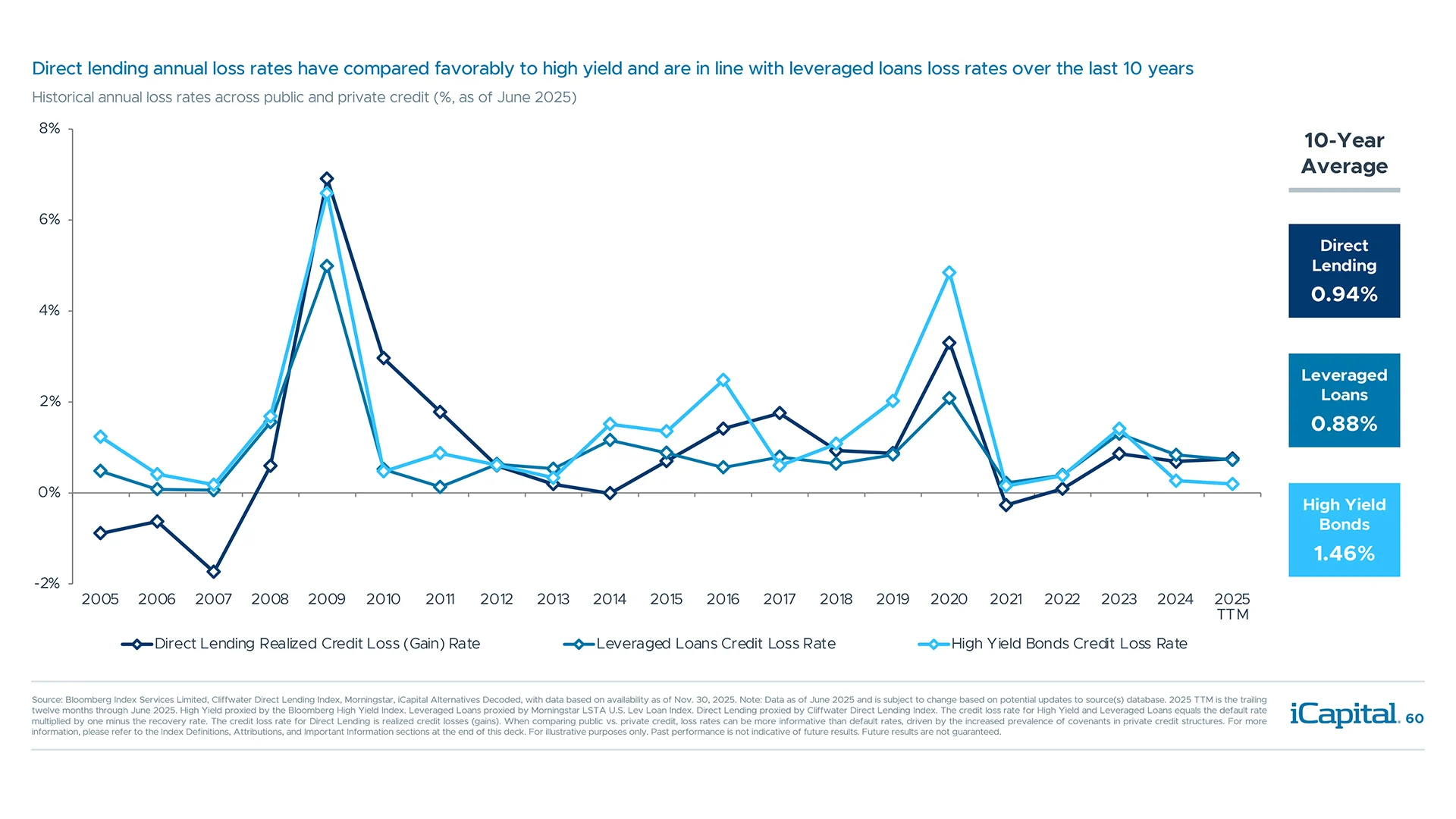

- Credit Losses 60

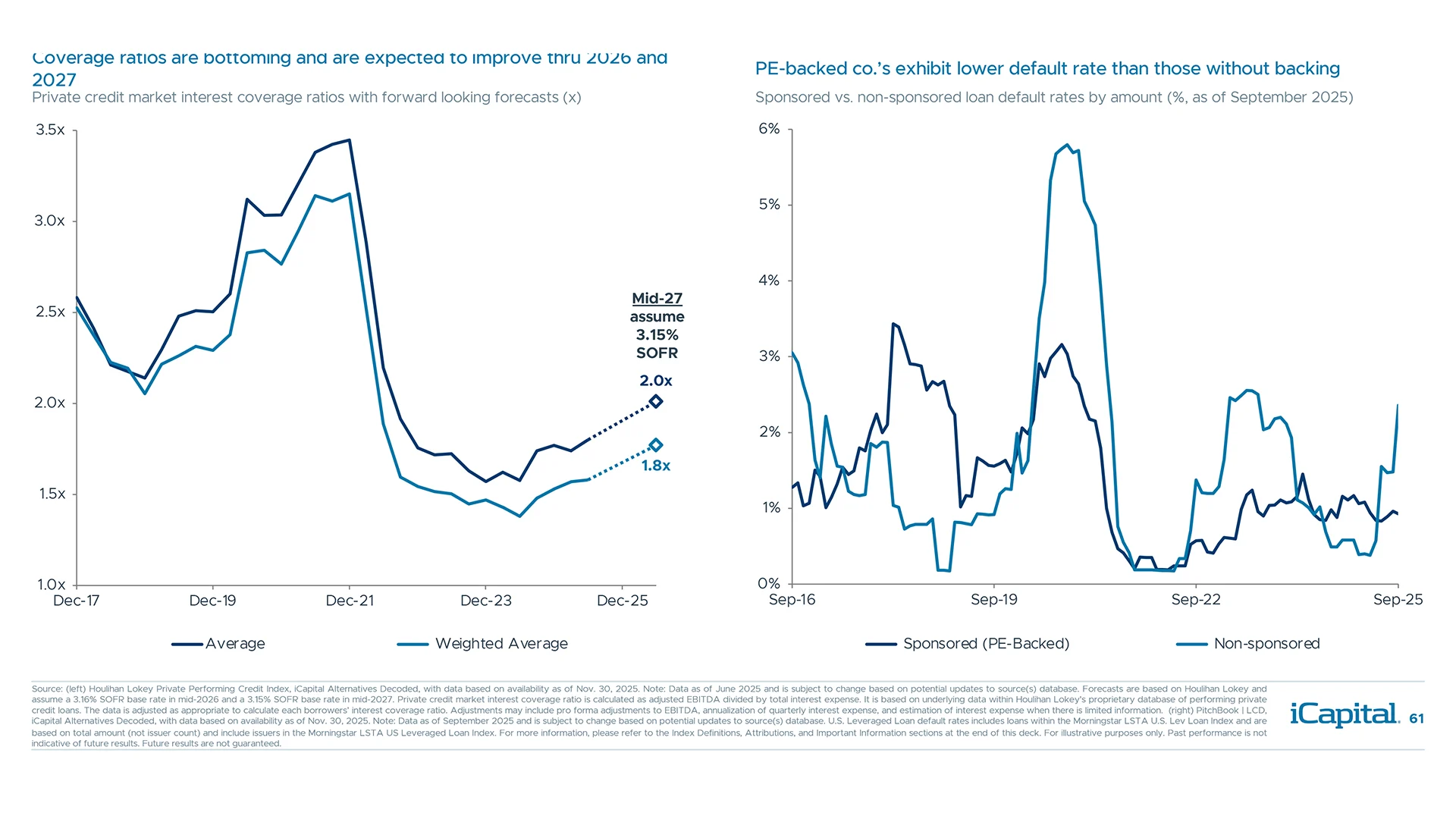

- Coverage Ratios 61

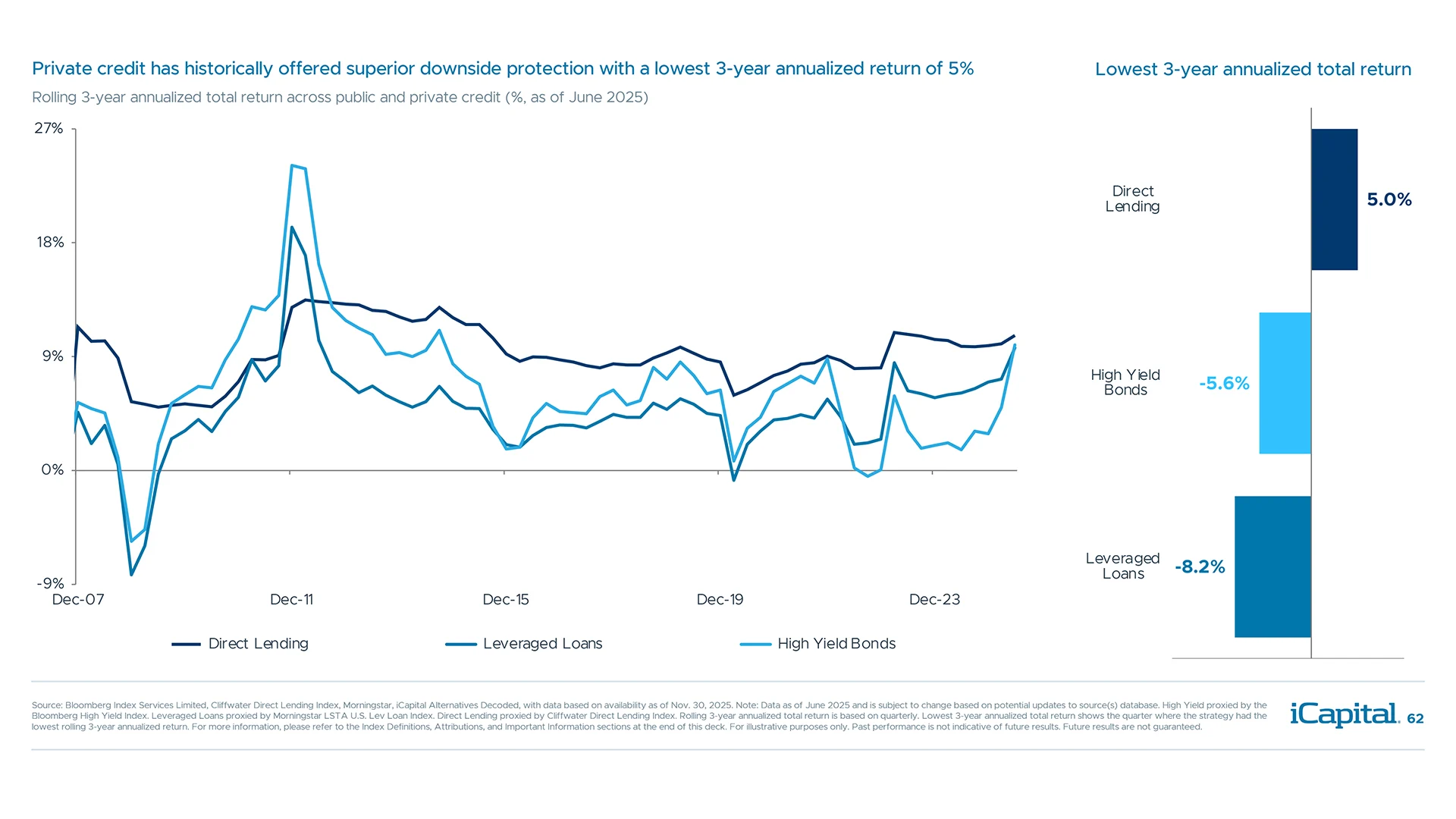

- Total Returns 62

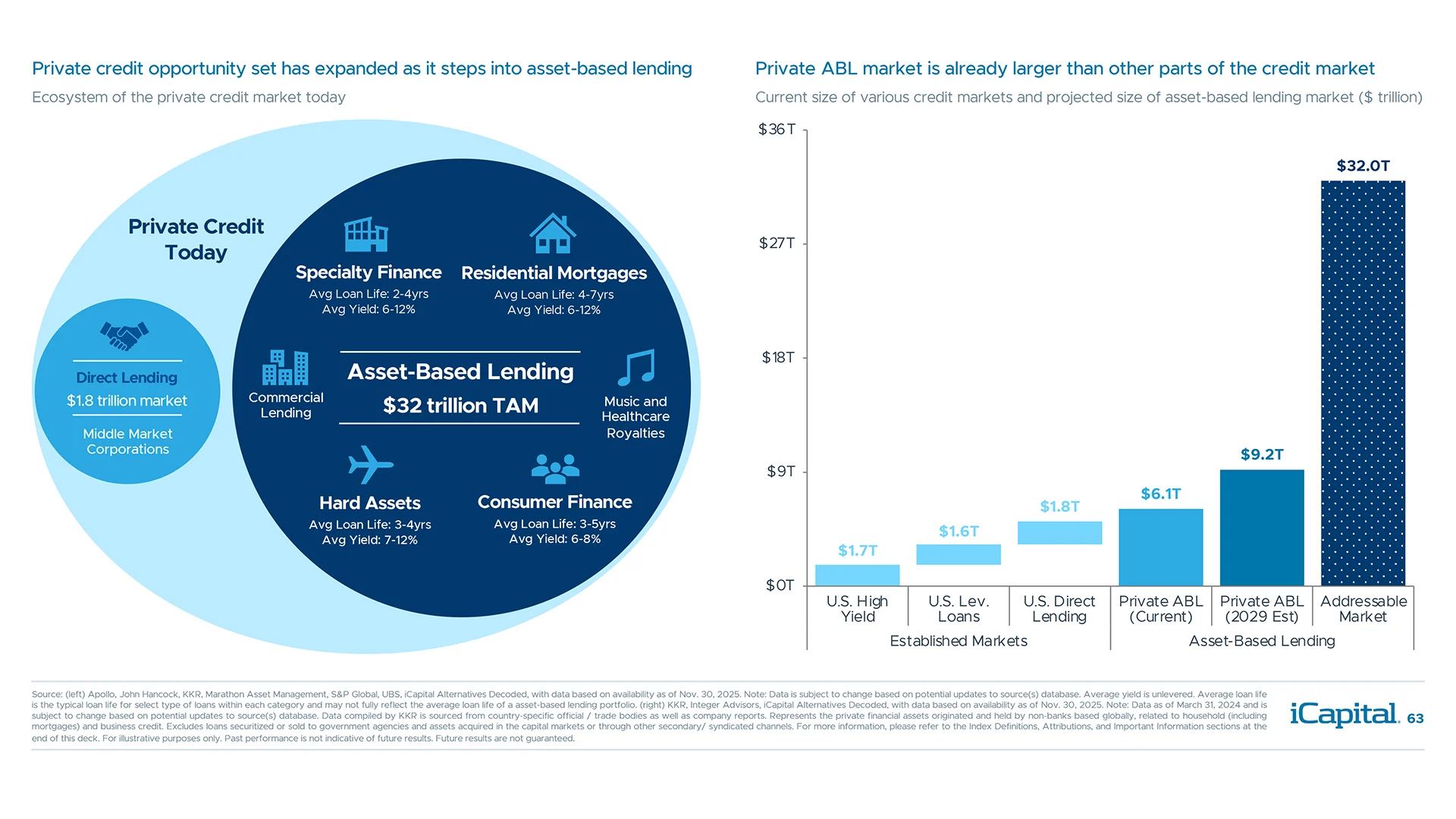

- Asset-based Lending Opportunity 63

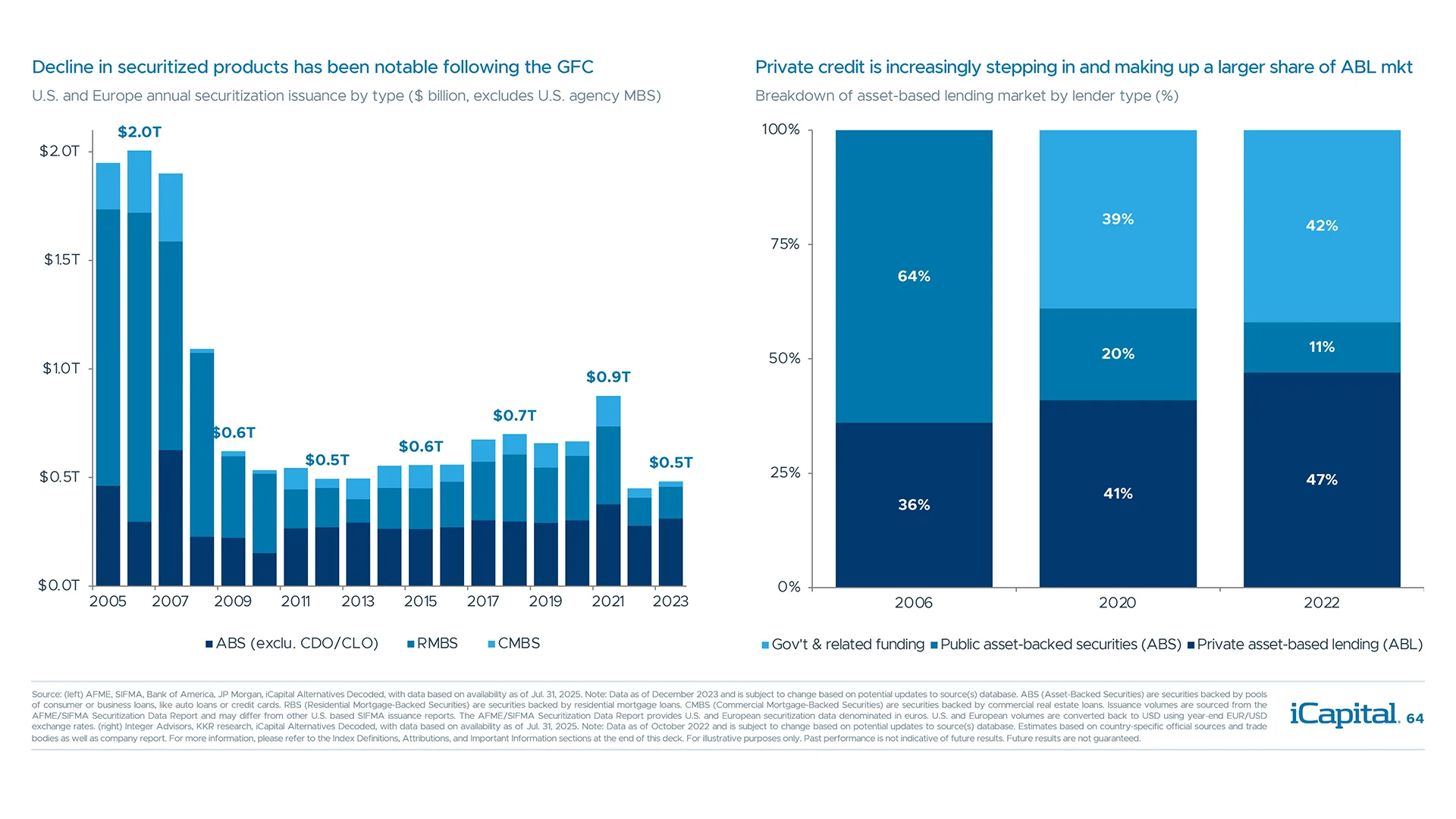

- Private Credit in ABL 64

-

Commercial Real Estate keyboard_arrow_down

- Commercial Real Estate 65

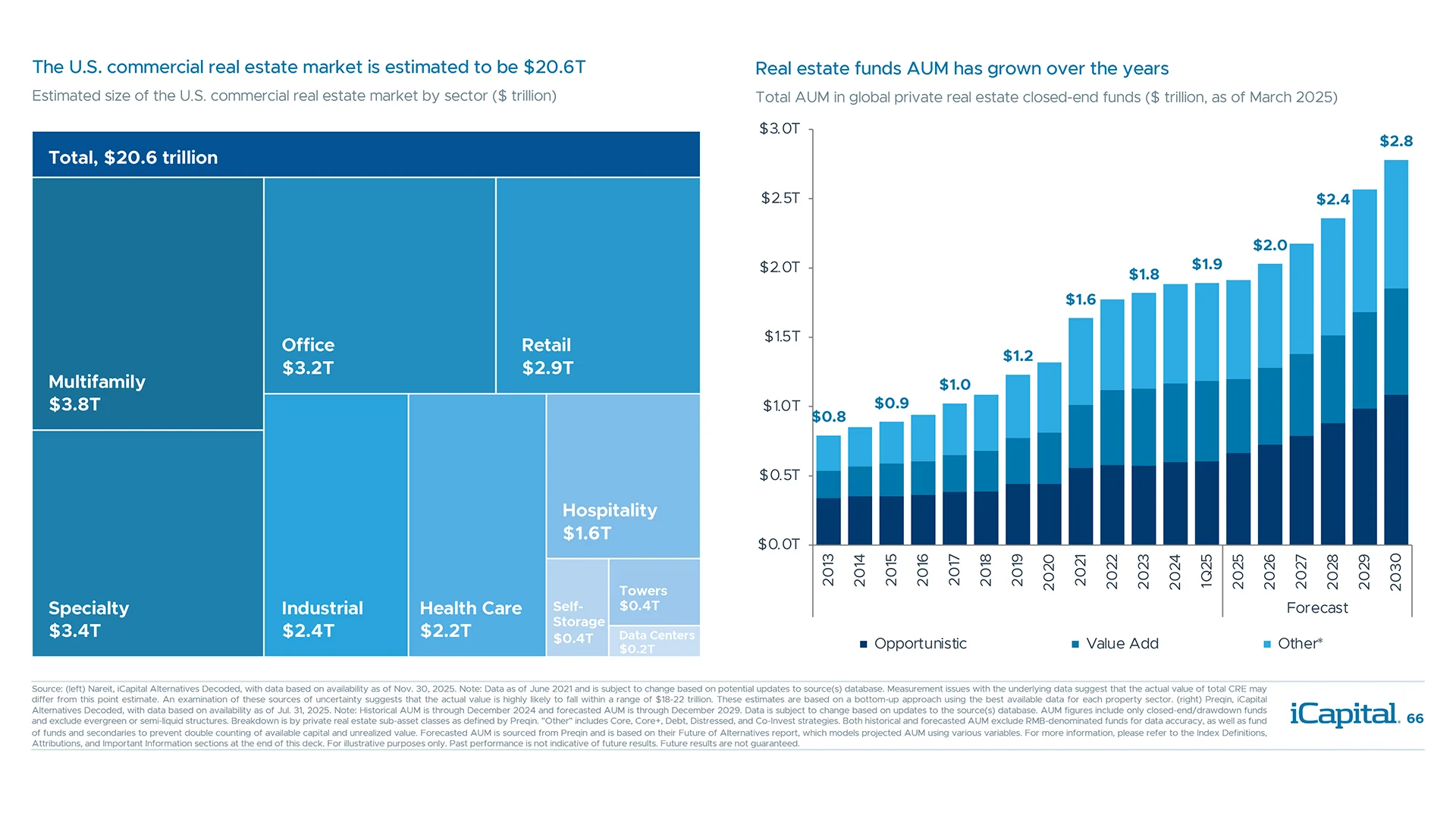

- Market Overview 66

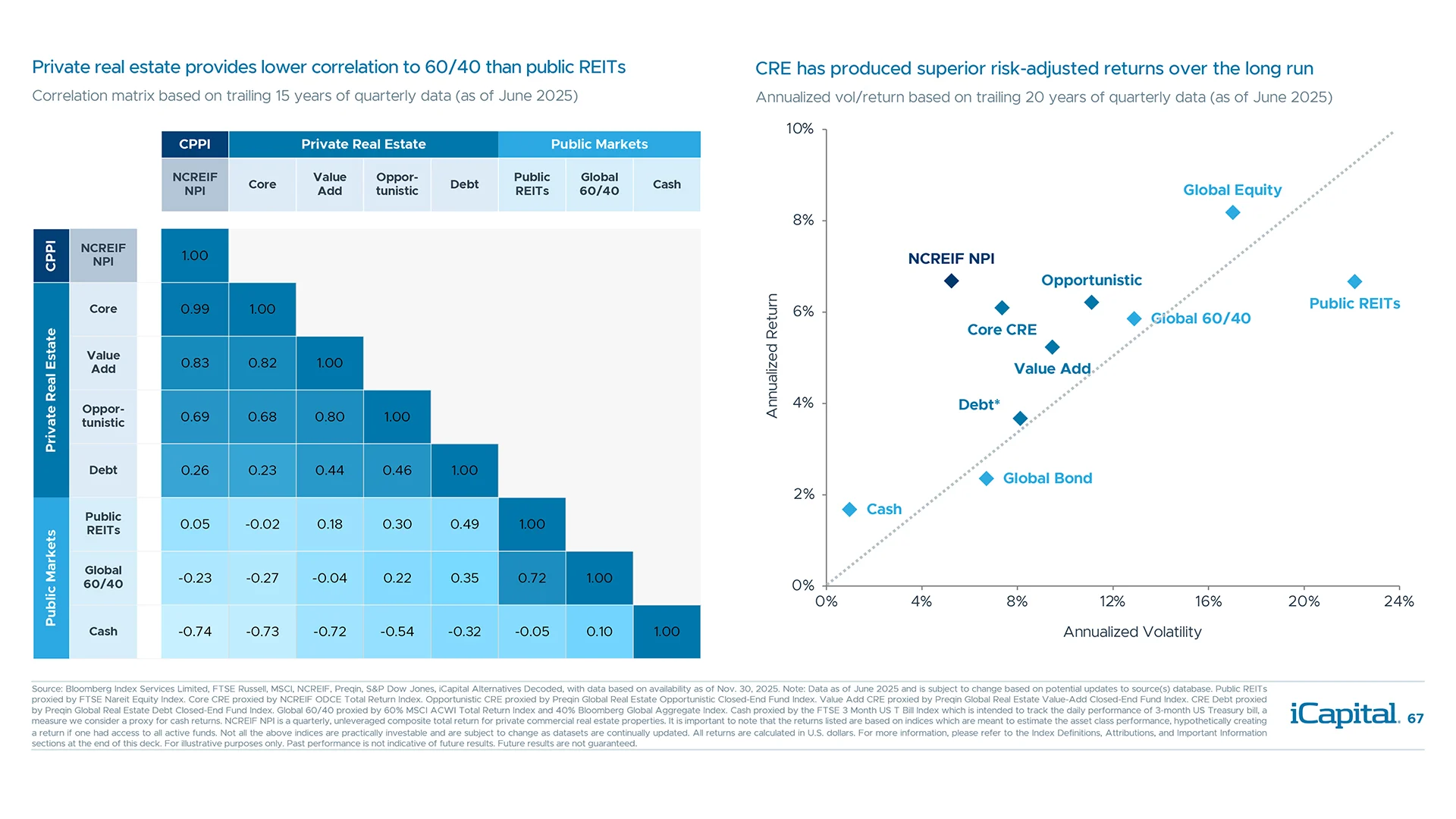

- Correlations and Returns 67

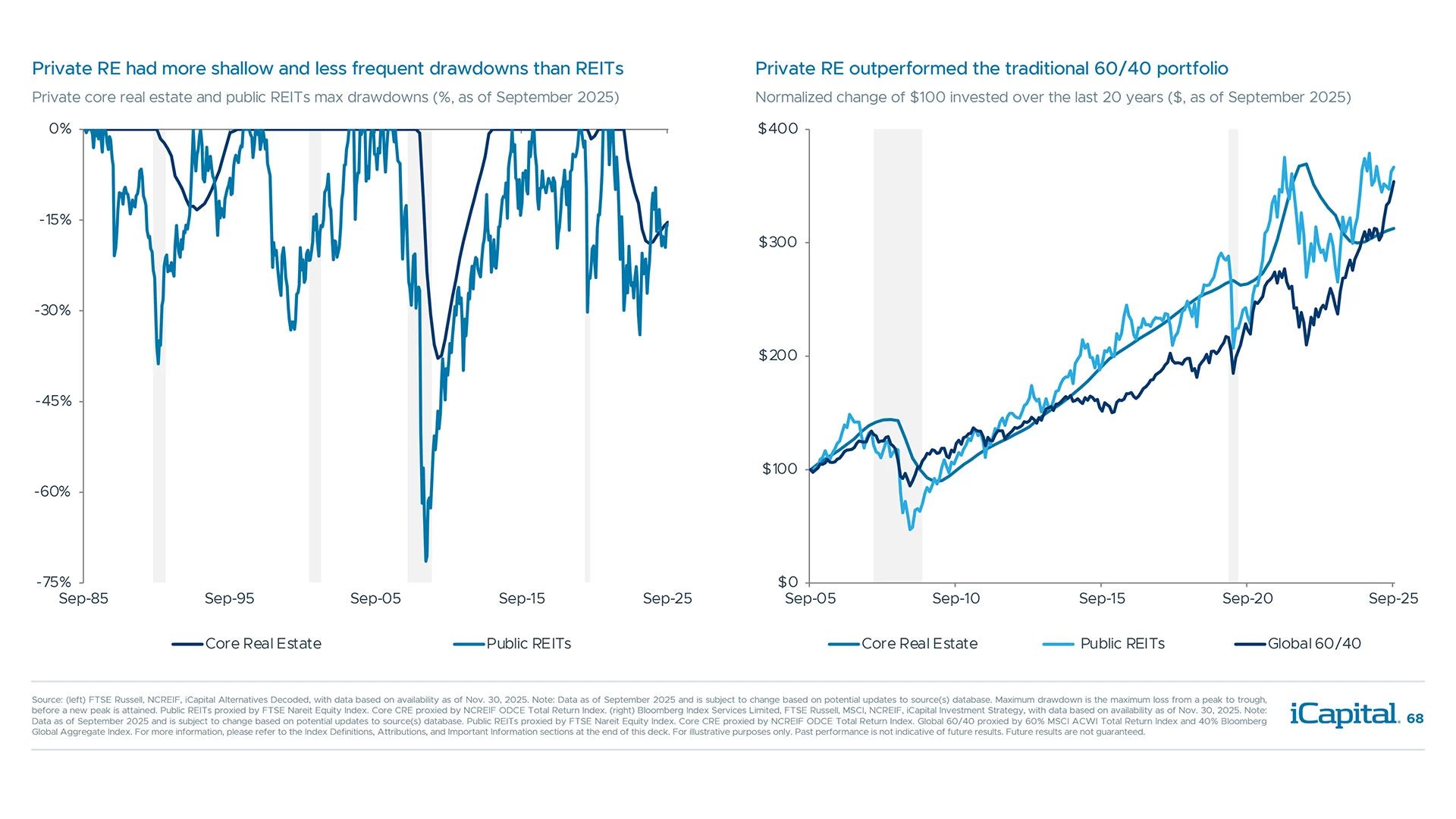

- Drawdowns and Returns 68

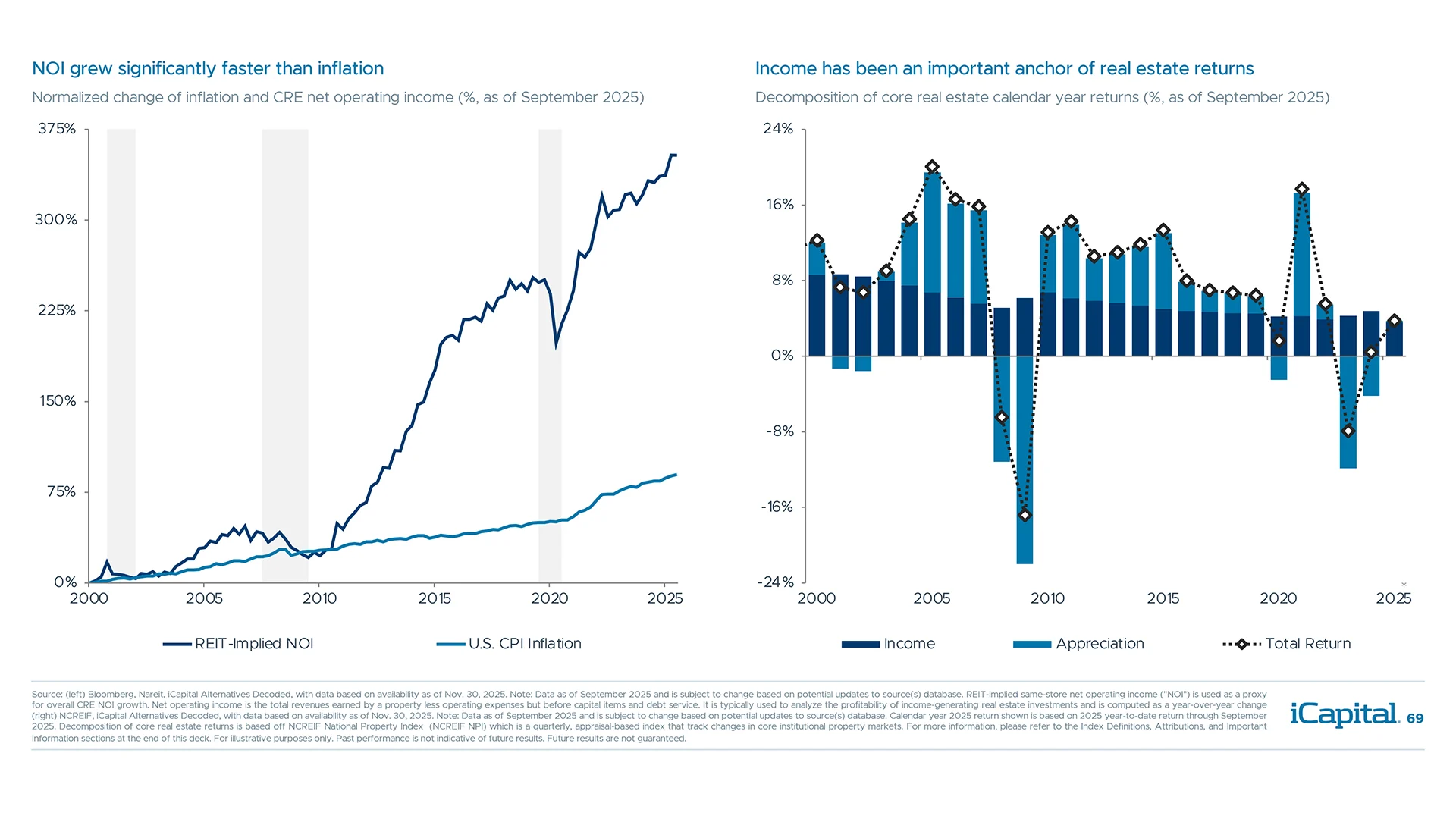

- Net Operating Income (NOI) 69

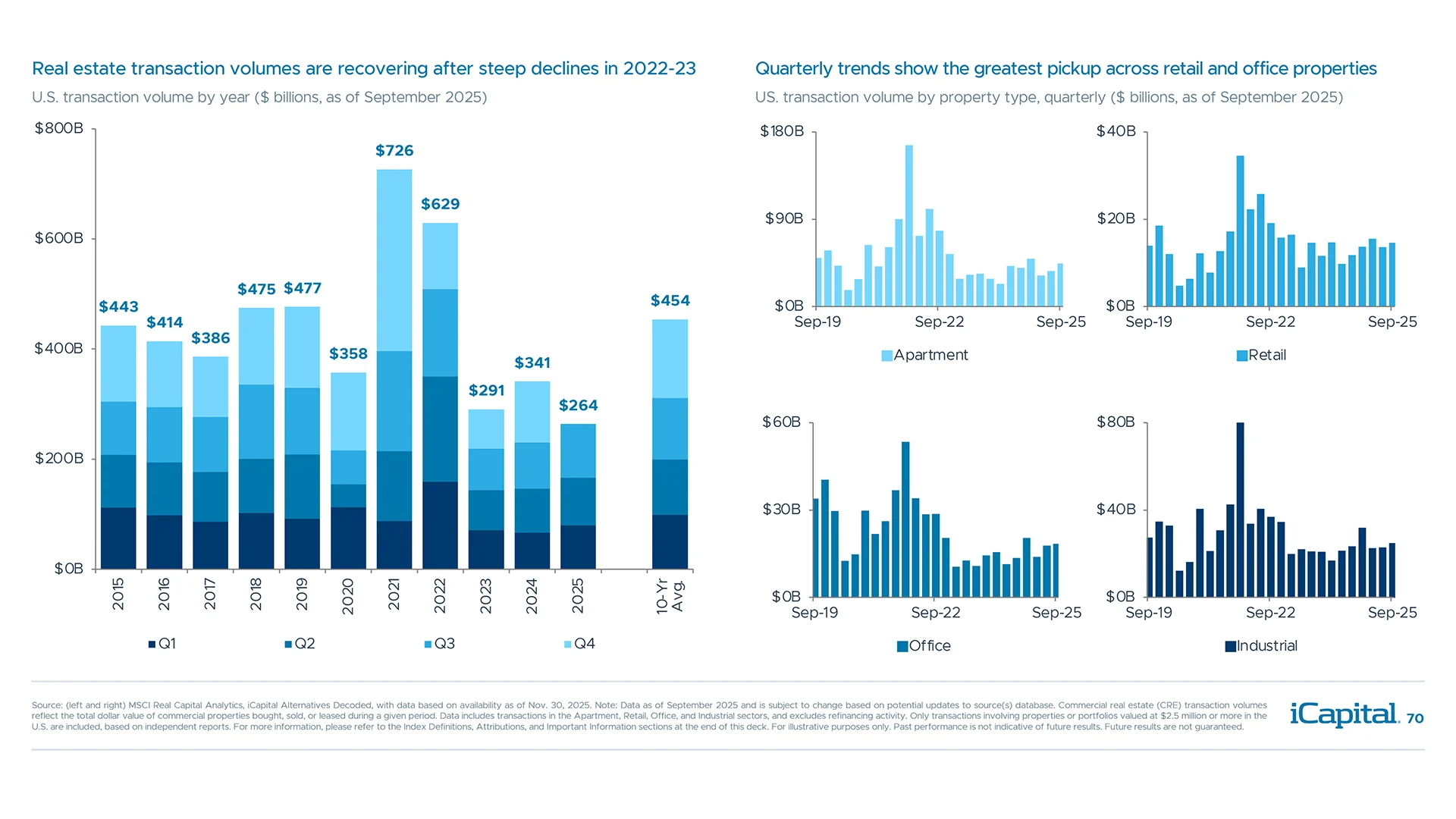

- Transaction Volume 70

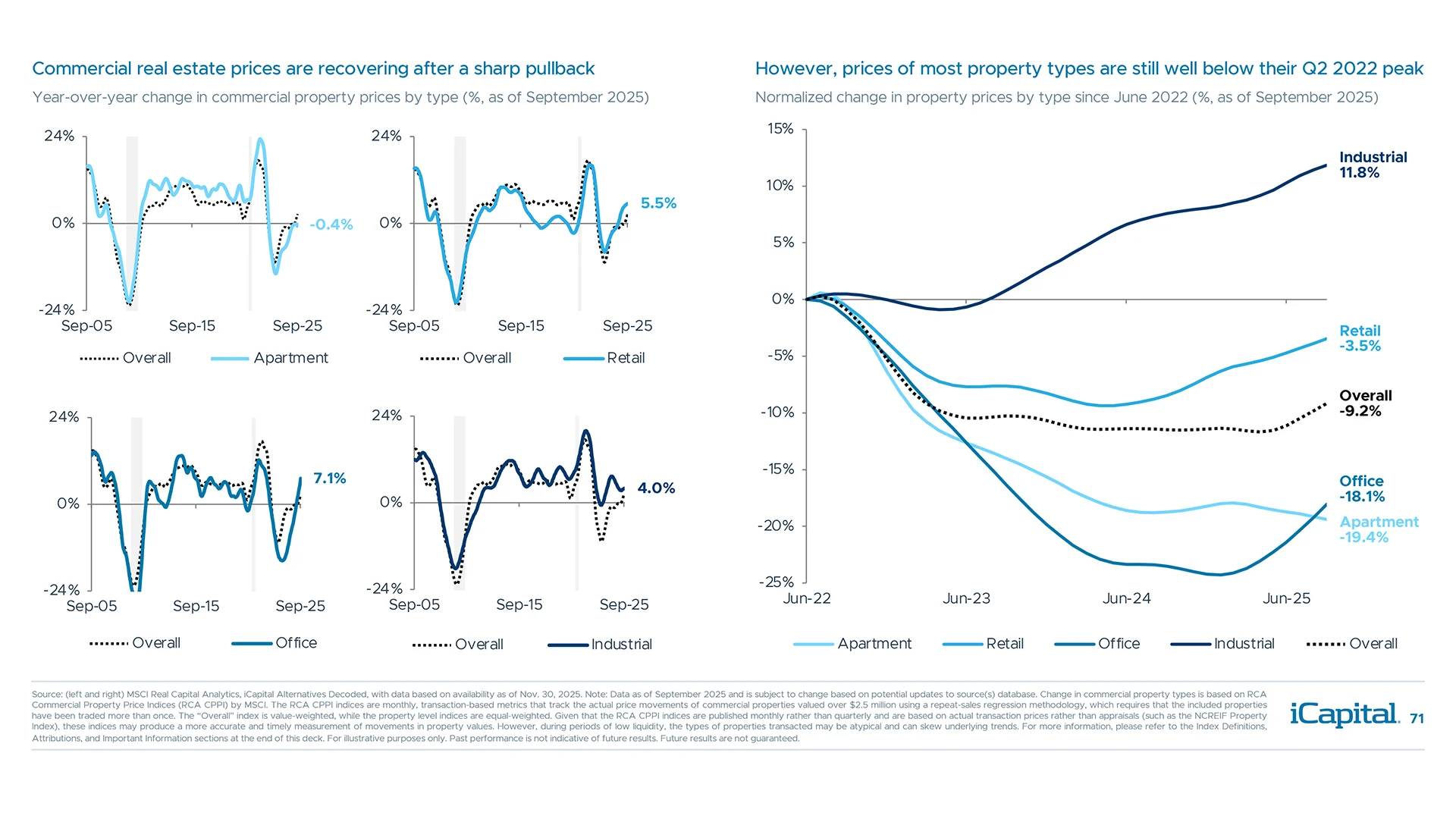

- Property Prices 71

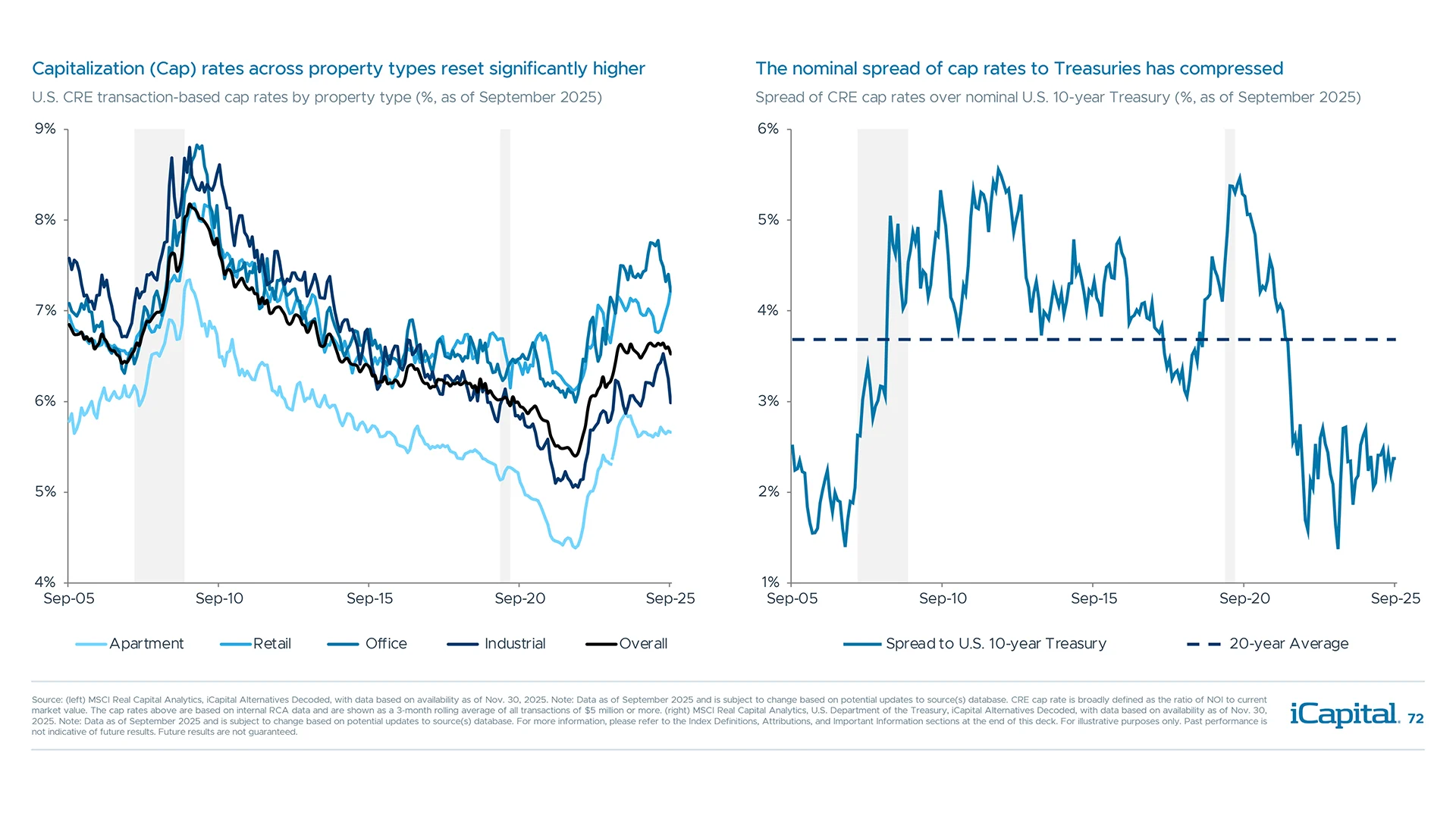

- Cap Rates 72

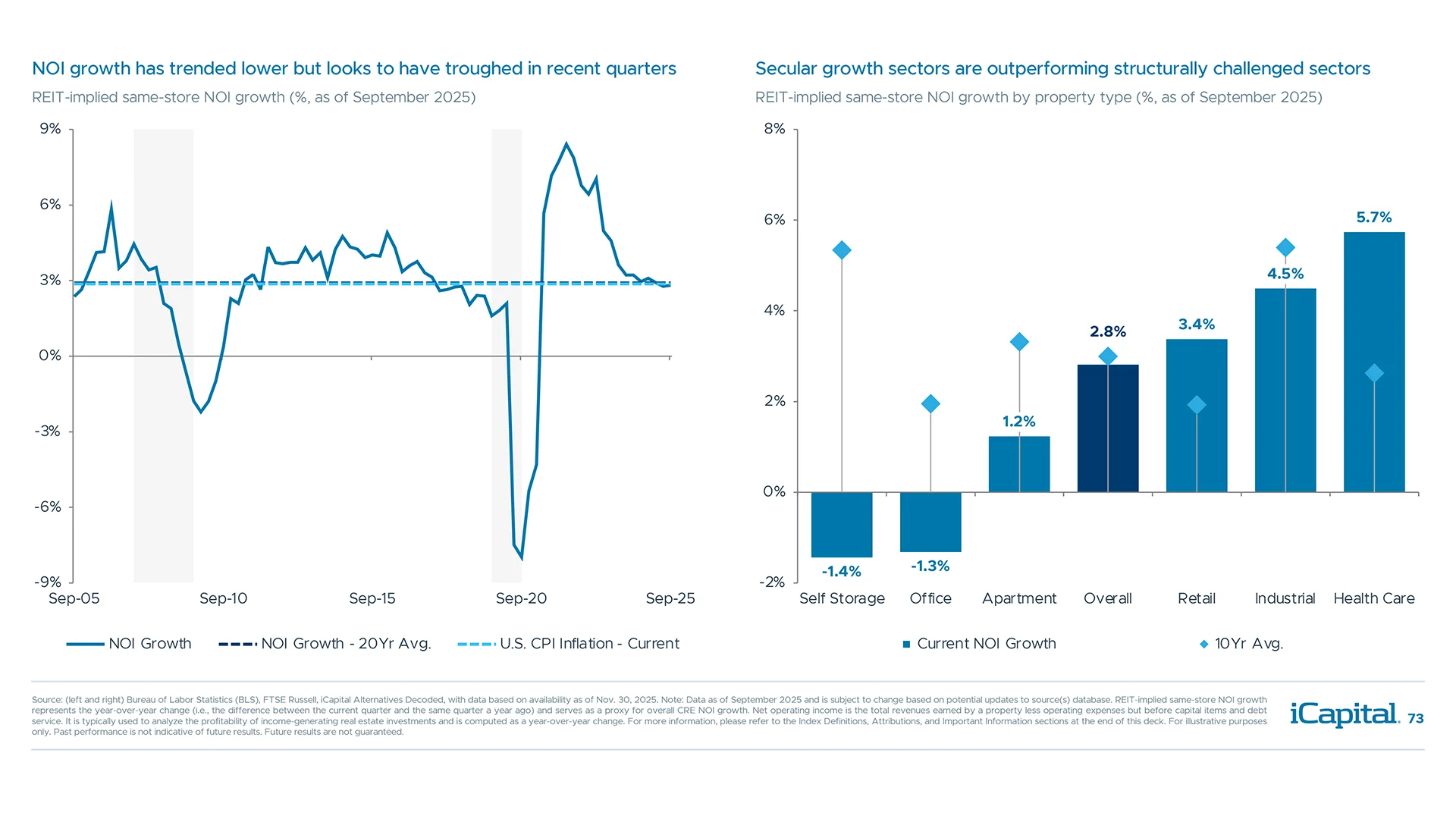

- NOI by Property Type 73

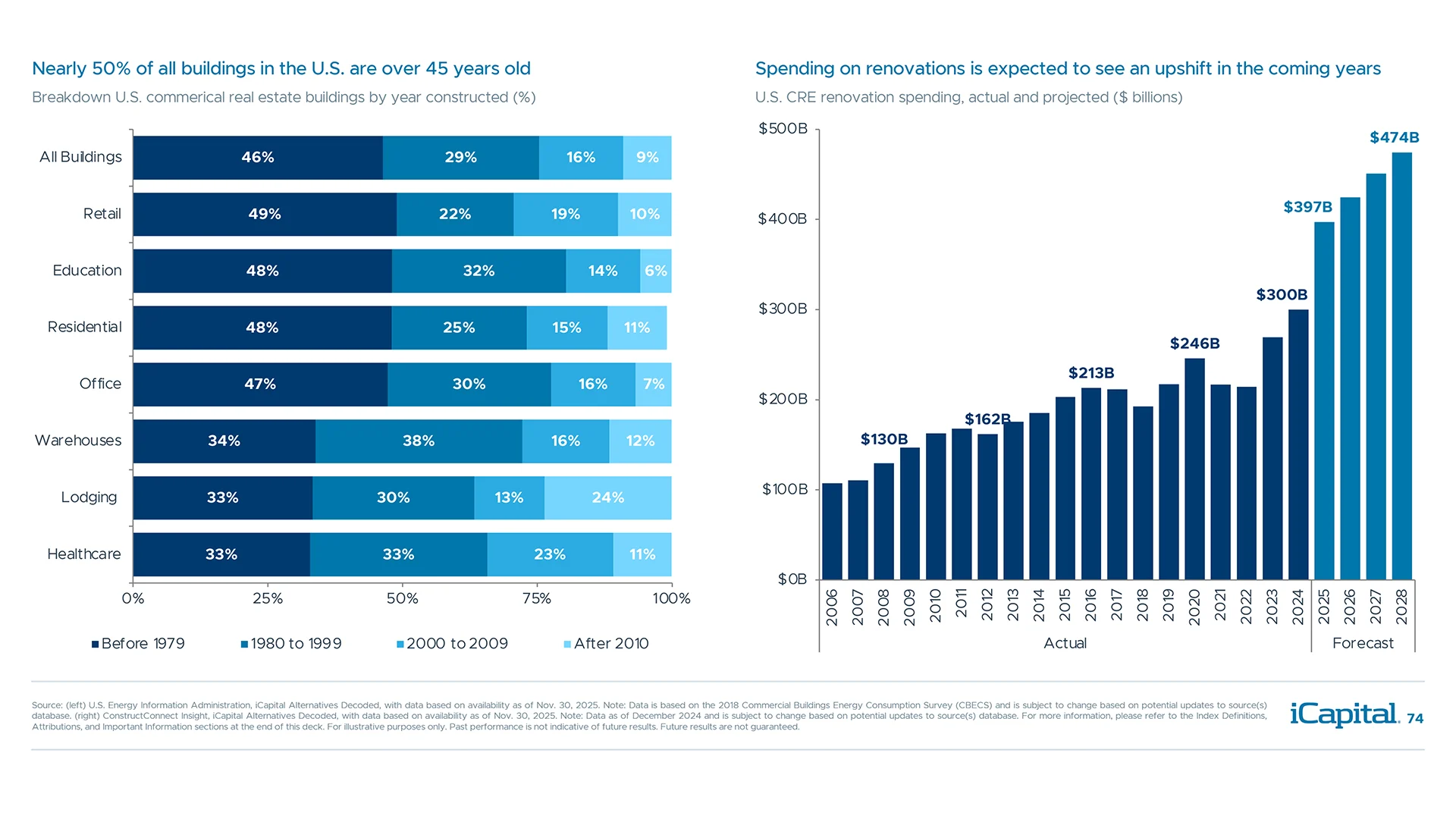

- Case for Value-Add 74

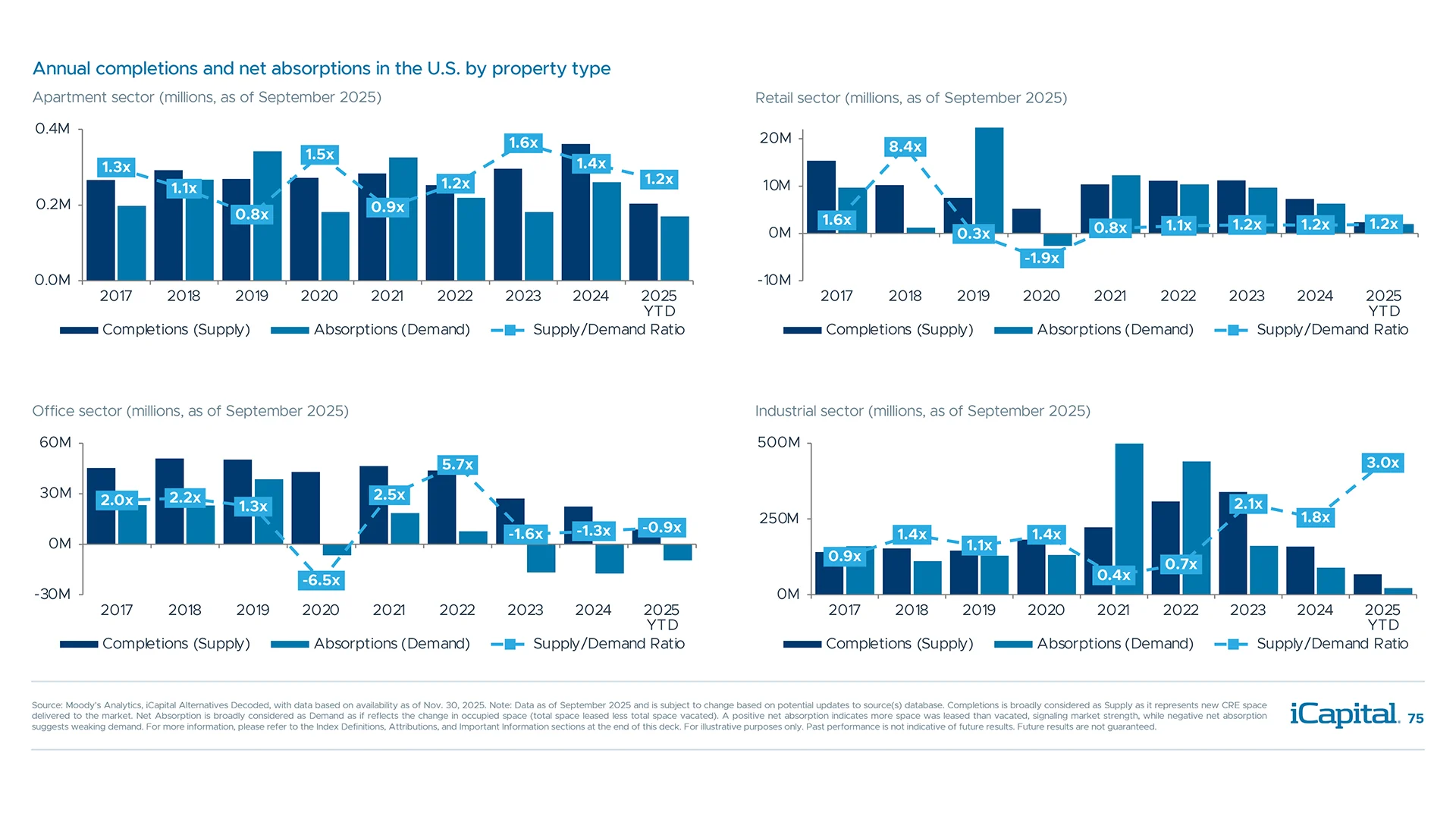

- Supply and Demand 75

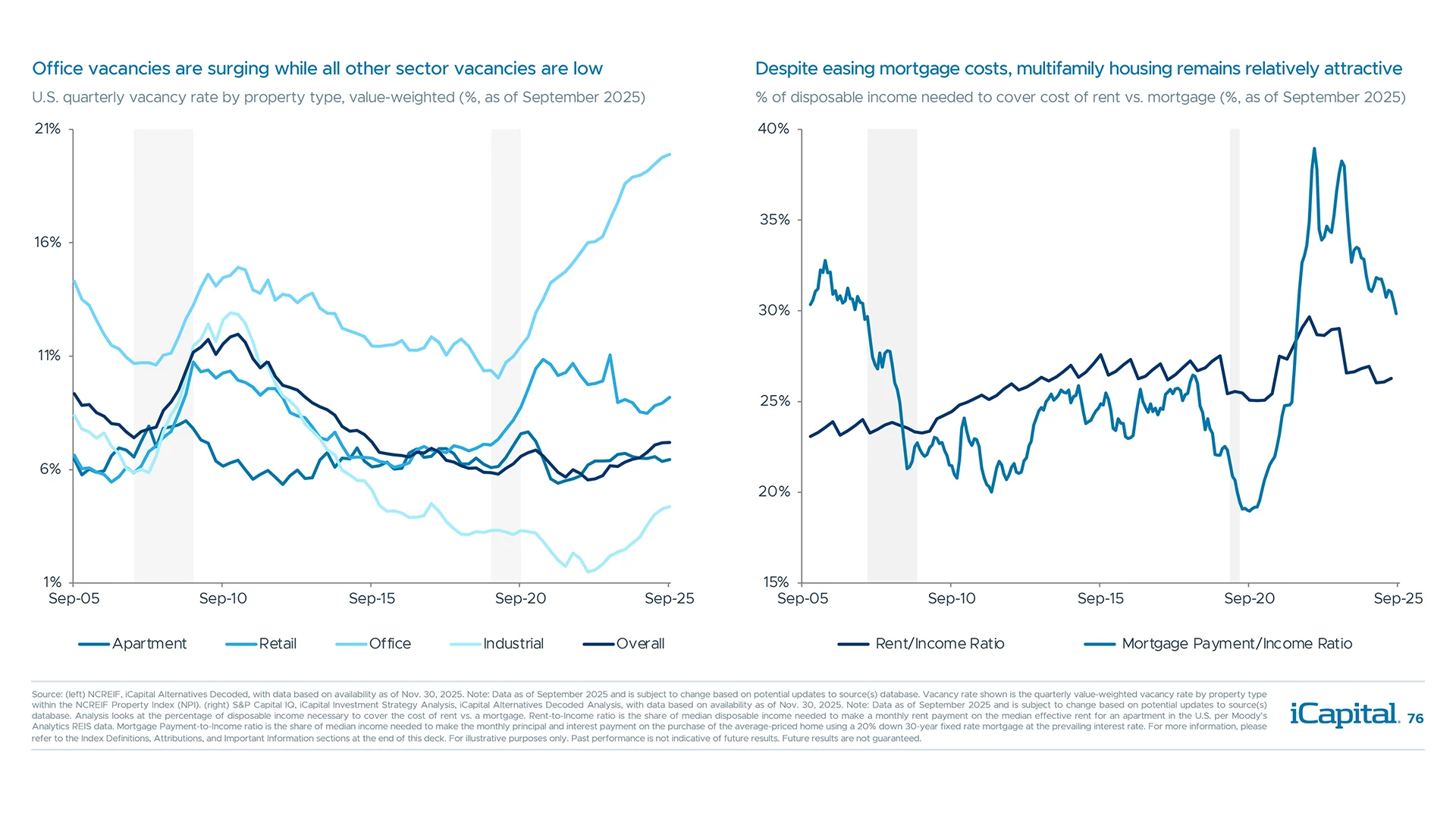

- Sector Fundamentals 76

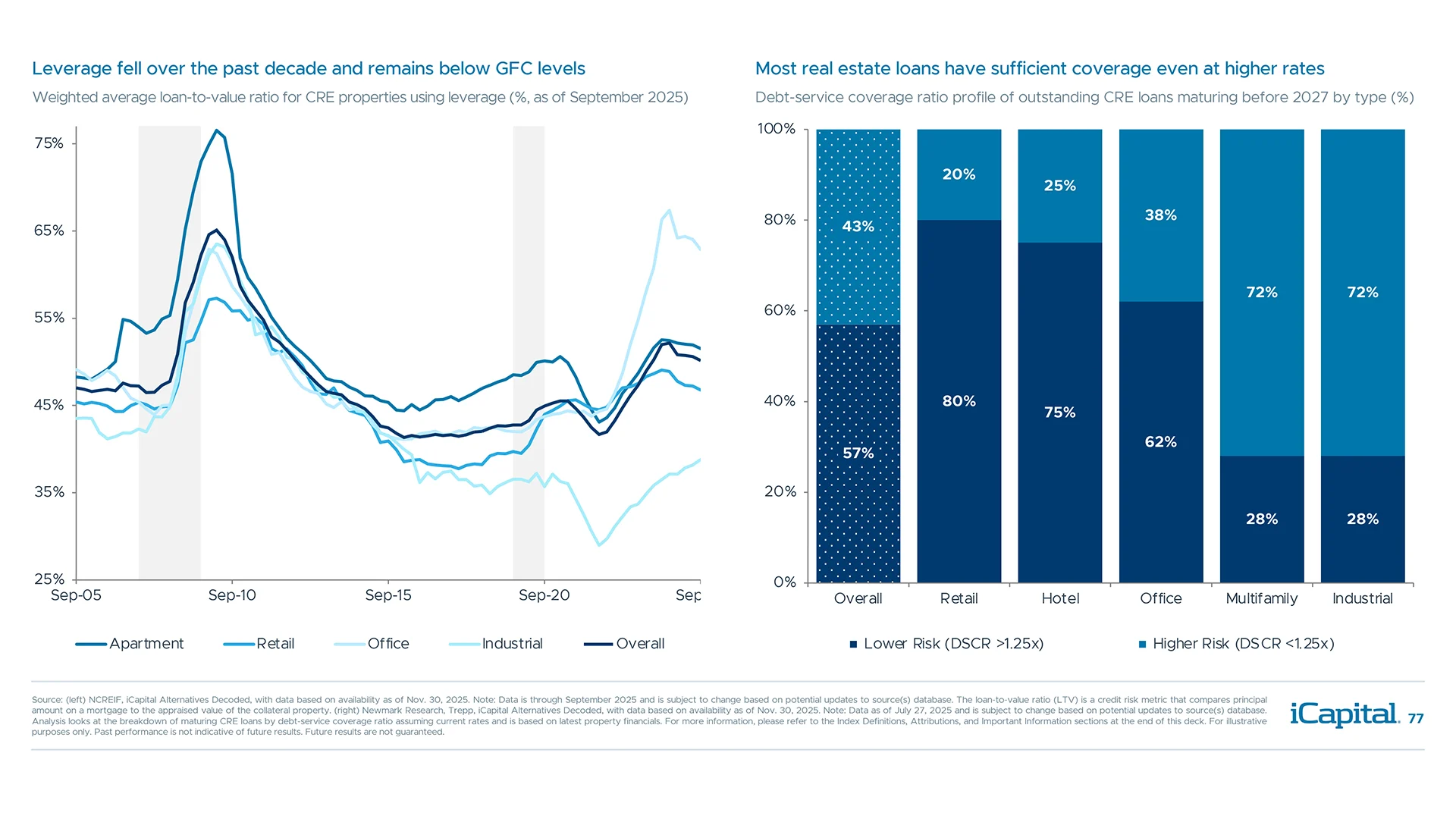

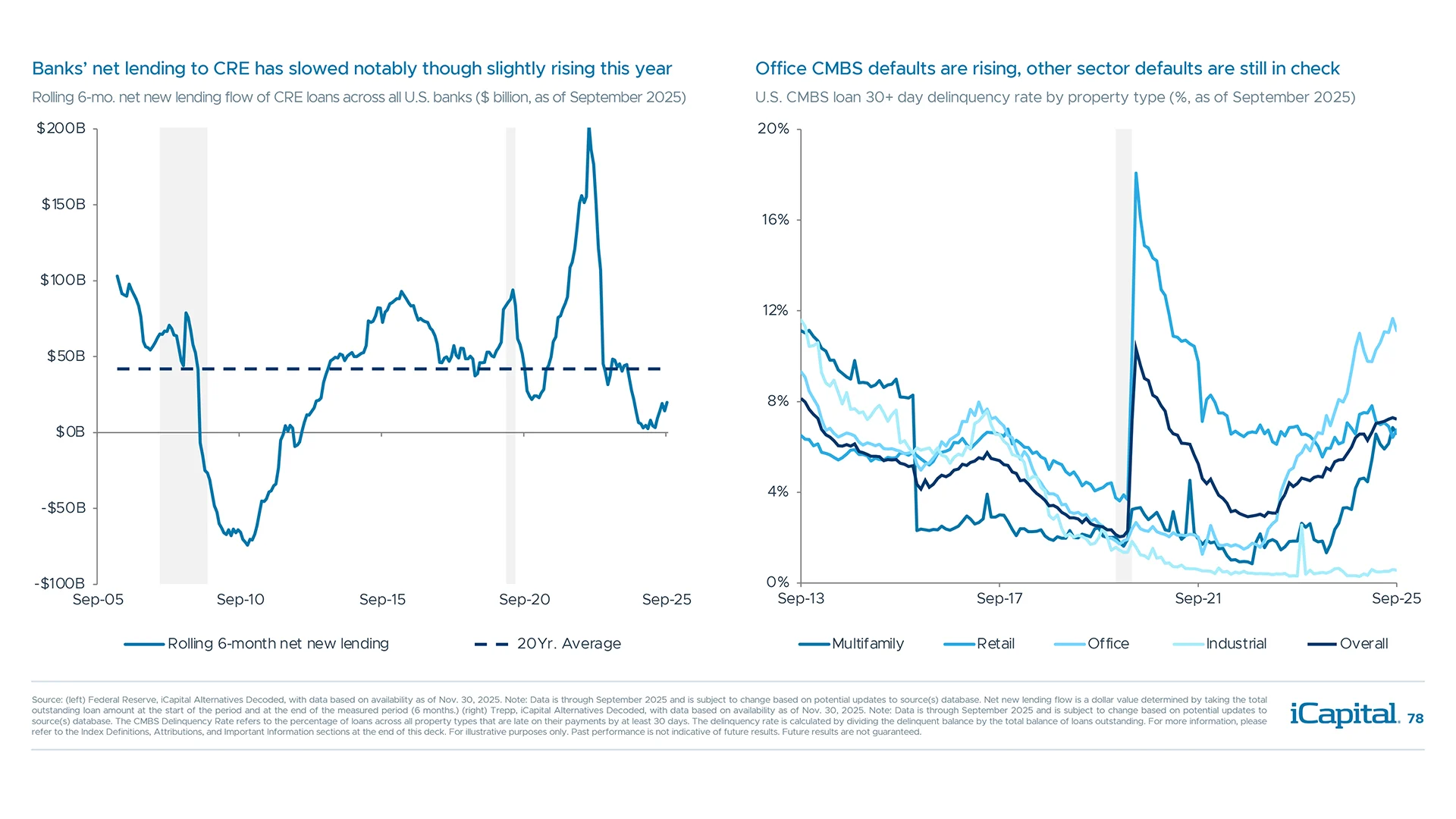

- Maturities and Delinquencies 77

- CRE Loans/Office Delinquencies 78

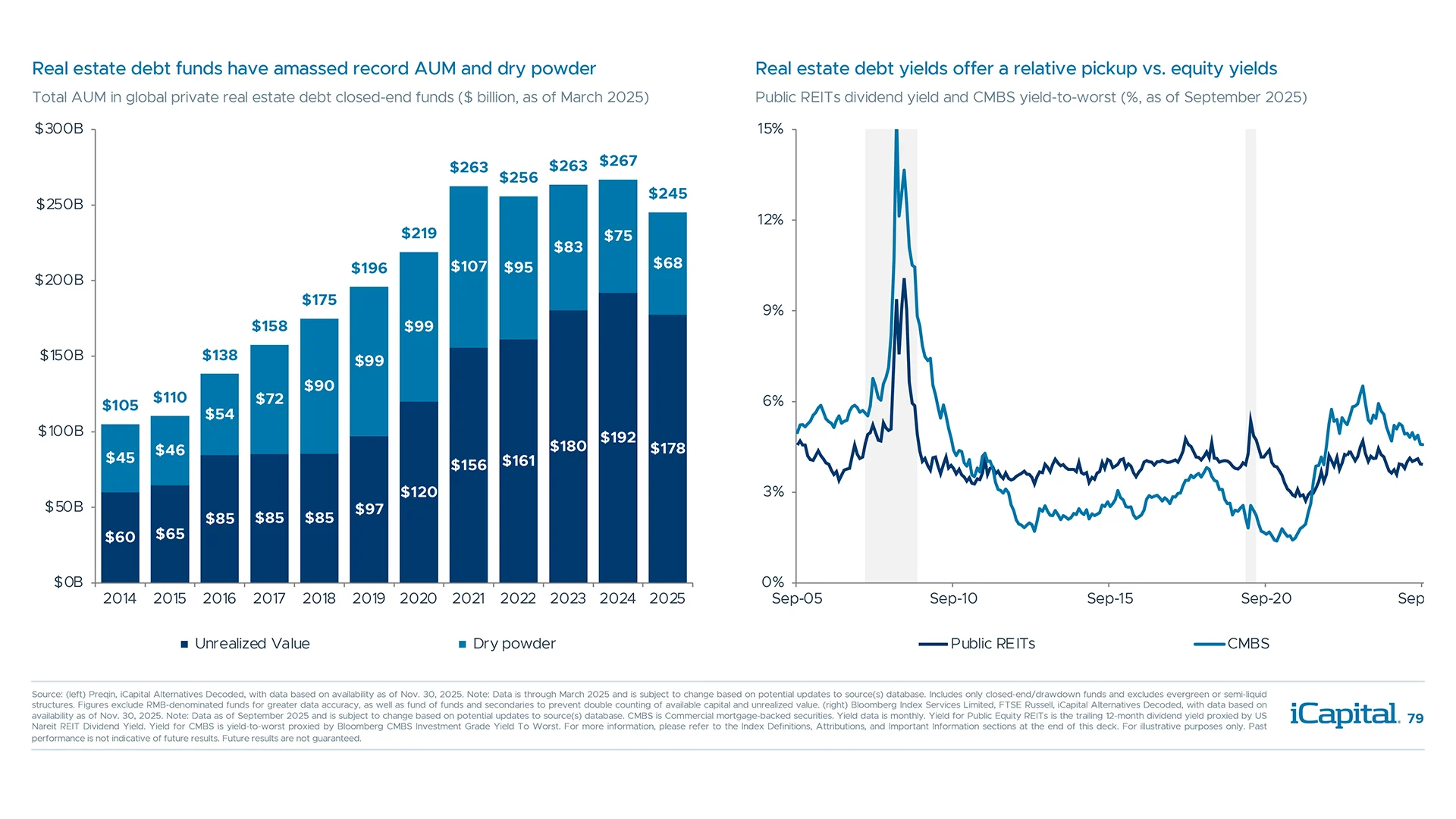

- Debt Funds and Yields 79

-

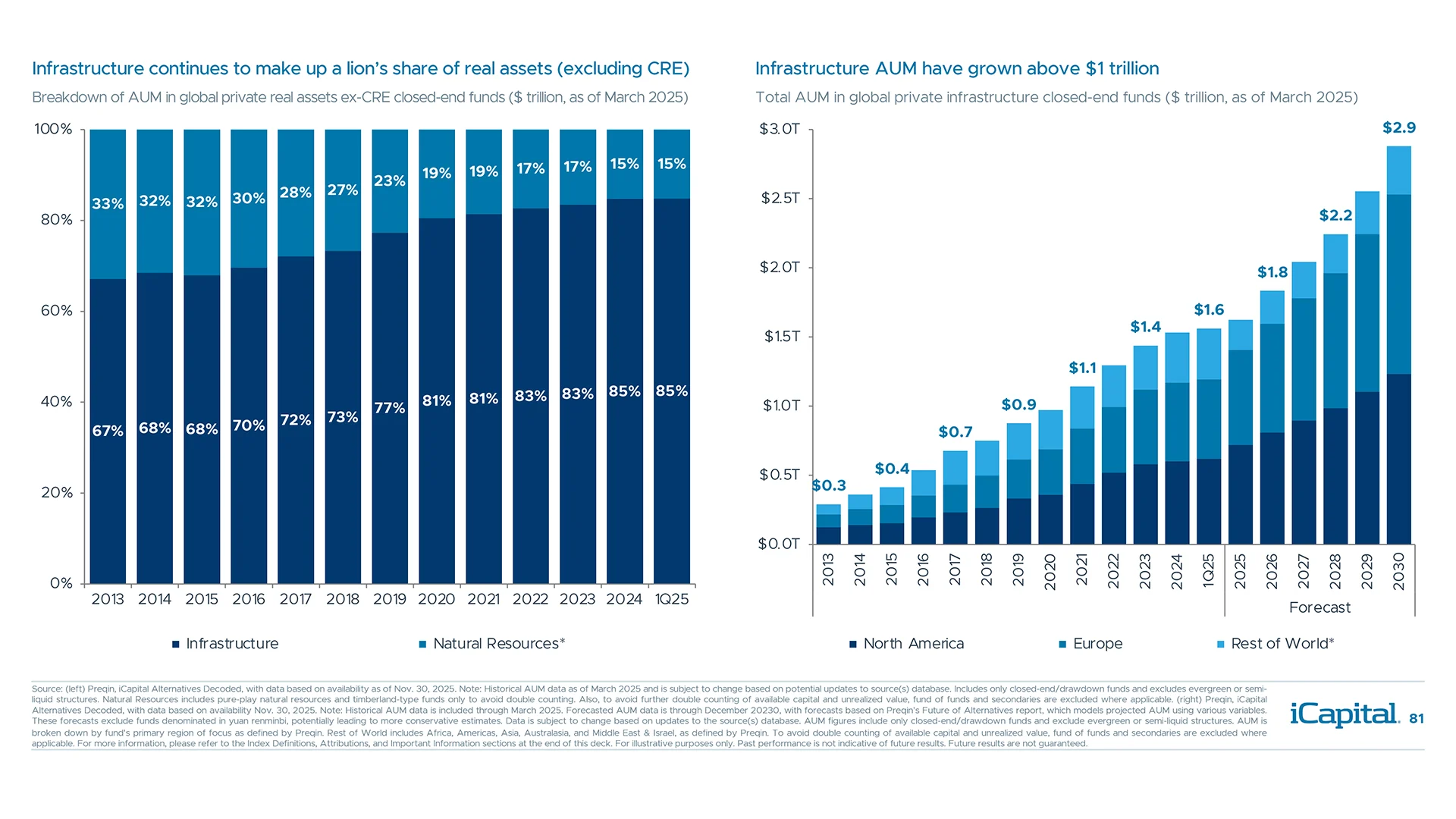

Infrastructure & Other Real Assets keyboard_arrow_down

-

Secondaries keyboard_arrow_down

-

Hedge Funds keyboard_arrow_down

- Hedge Funds 98

- Assets Under Management 99

- Returns by Strategy 100

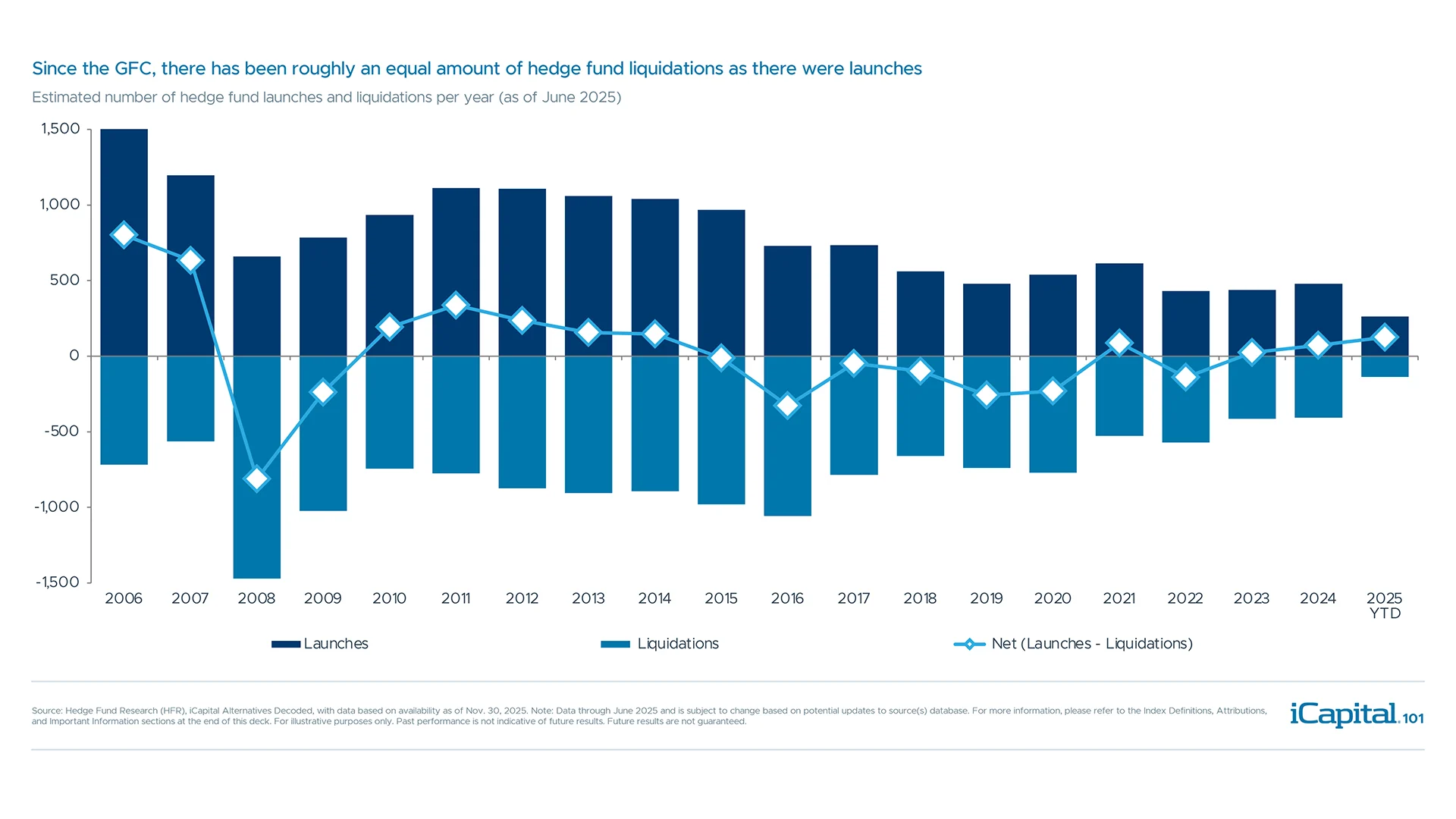

- Fund Launches and Closures 101

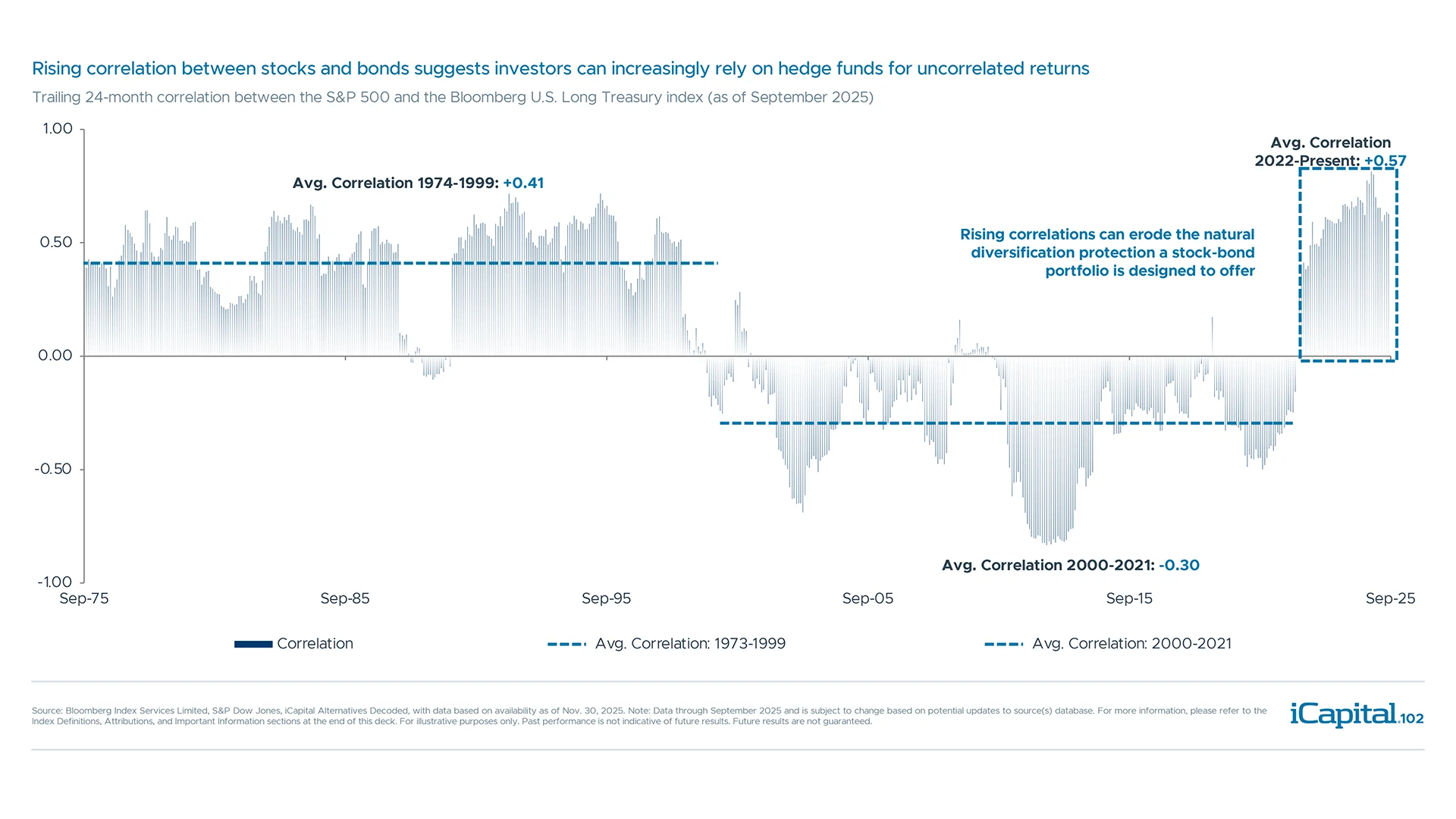

- Stock/Bond Correlation 102

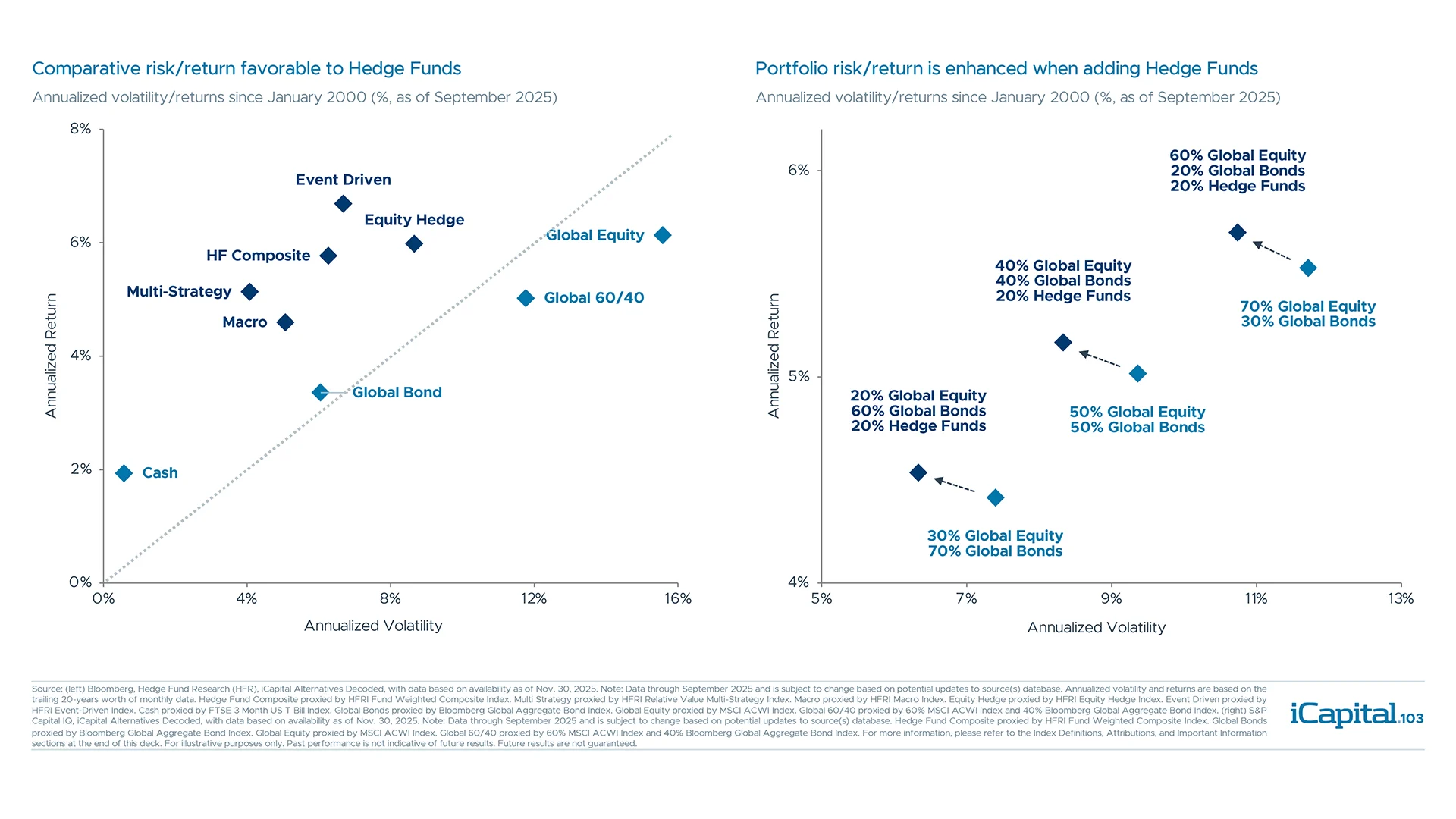

- Comparative Risk/Return 103

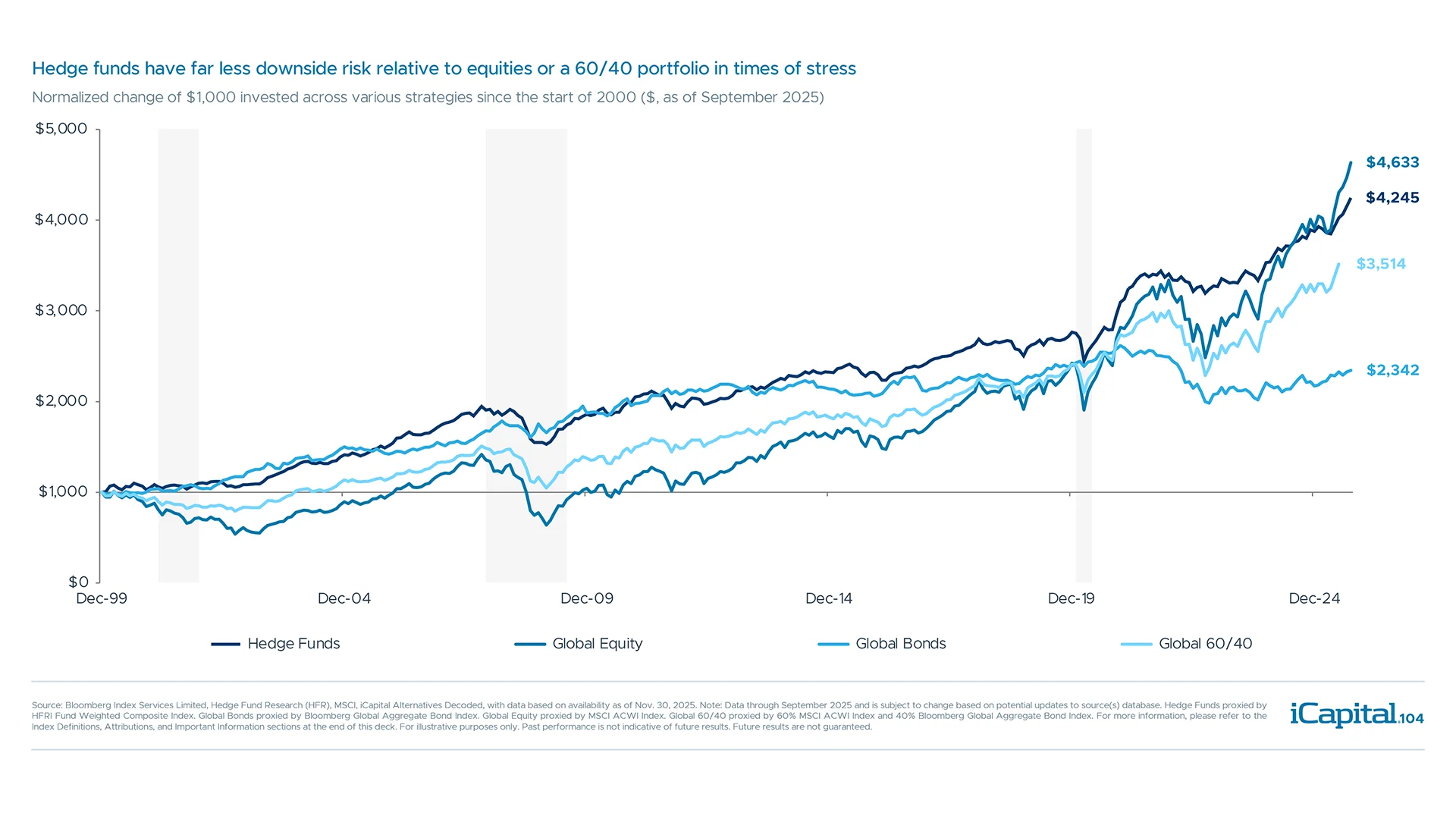

- Historic Performance 104

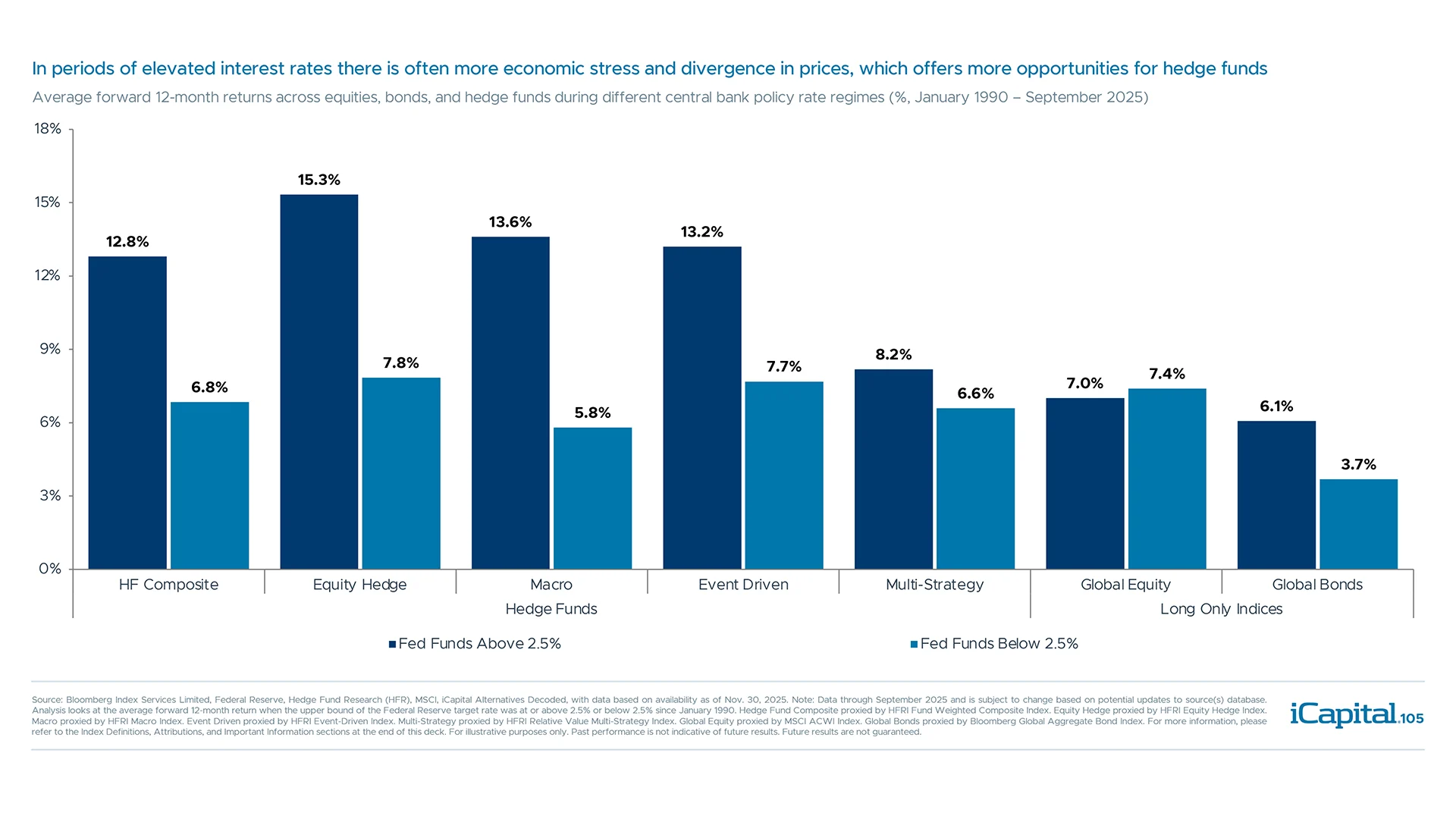

- Performance in Higher Rate Periods 105

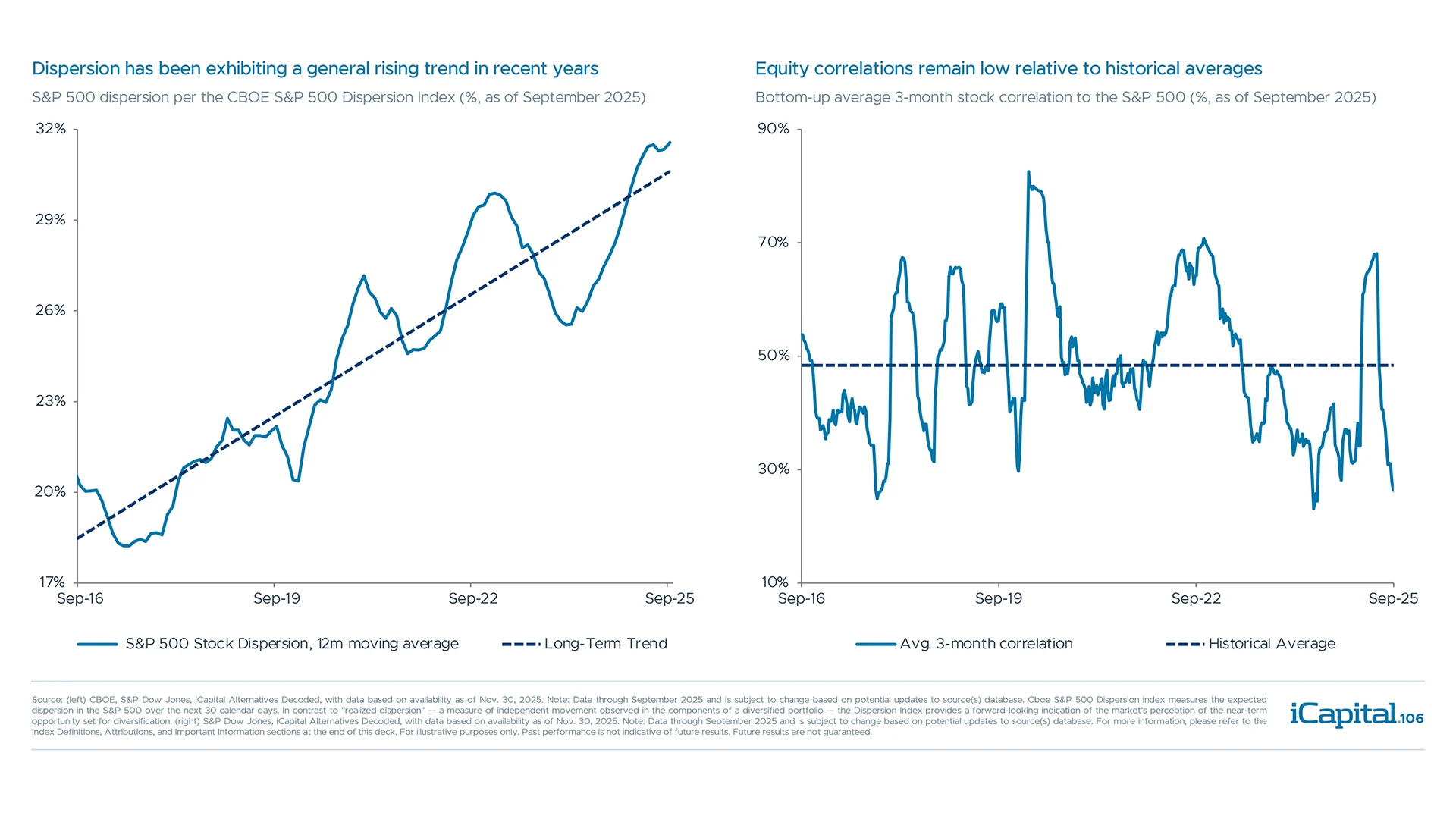

- Stock Dispersion 106

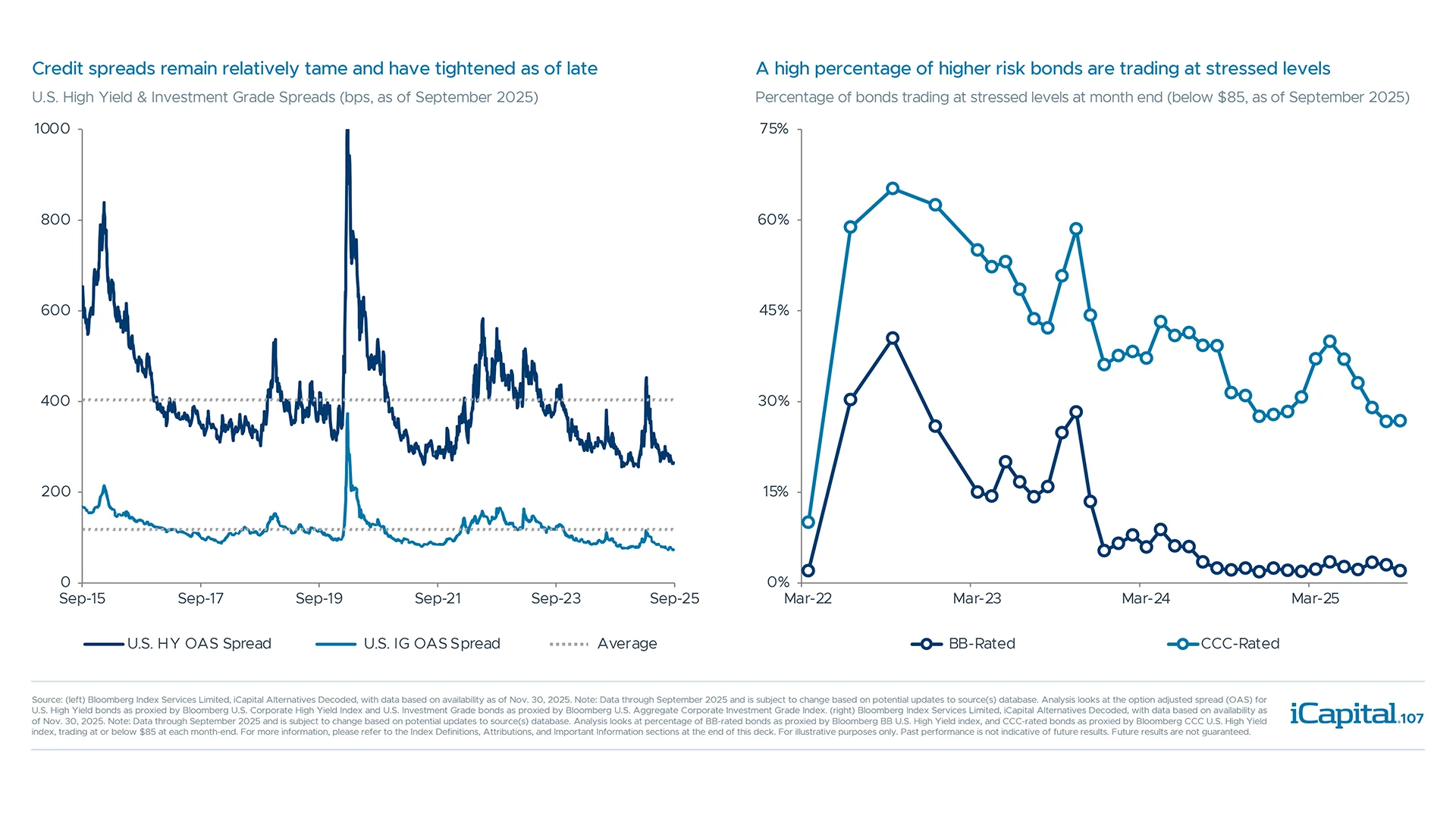

- Credit Stress and Strategy 107

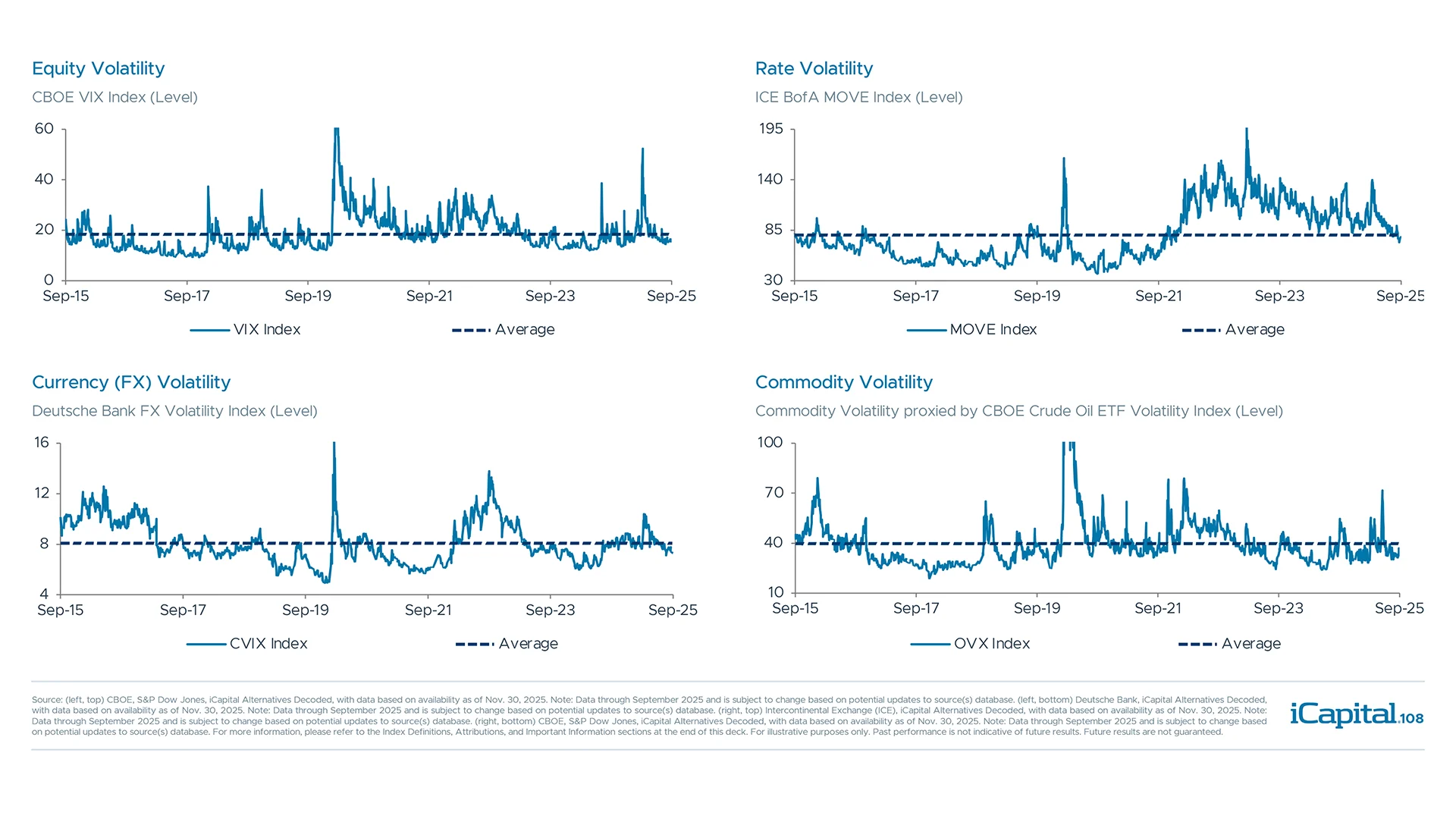

- Asset Volatility 108

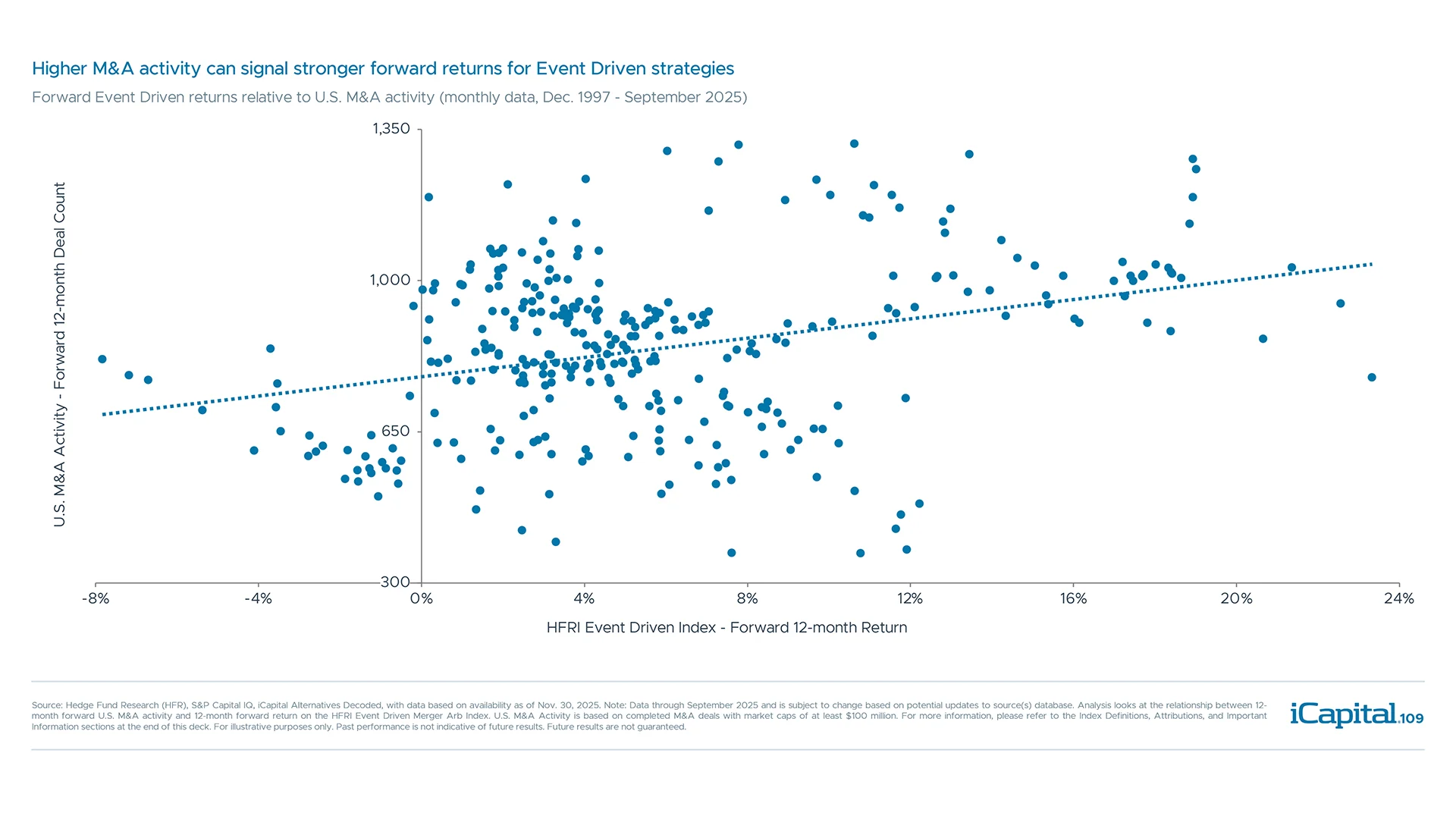

- M&A Activity Indicator 109

-

Structured Investments keyboard_arrow_down

-

Index Definitions keyboard_arrow_down

- Definitions 120

- Definitions (con'd) 121

- Definitions (con'd) 122

-

Attributions keyboard_arrow_down

- Attributions 123

-

Important Information keyboard_arrow_down

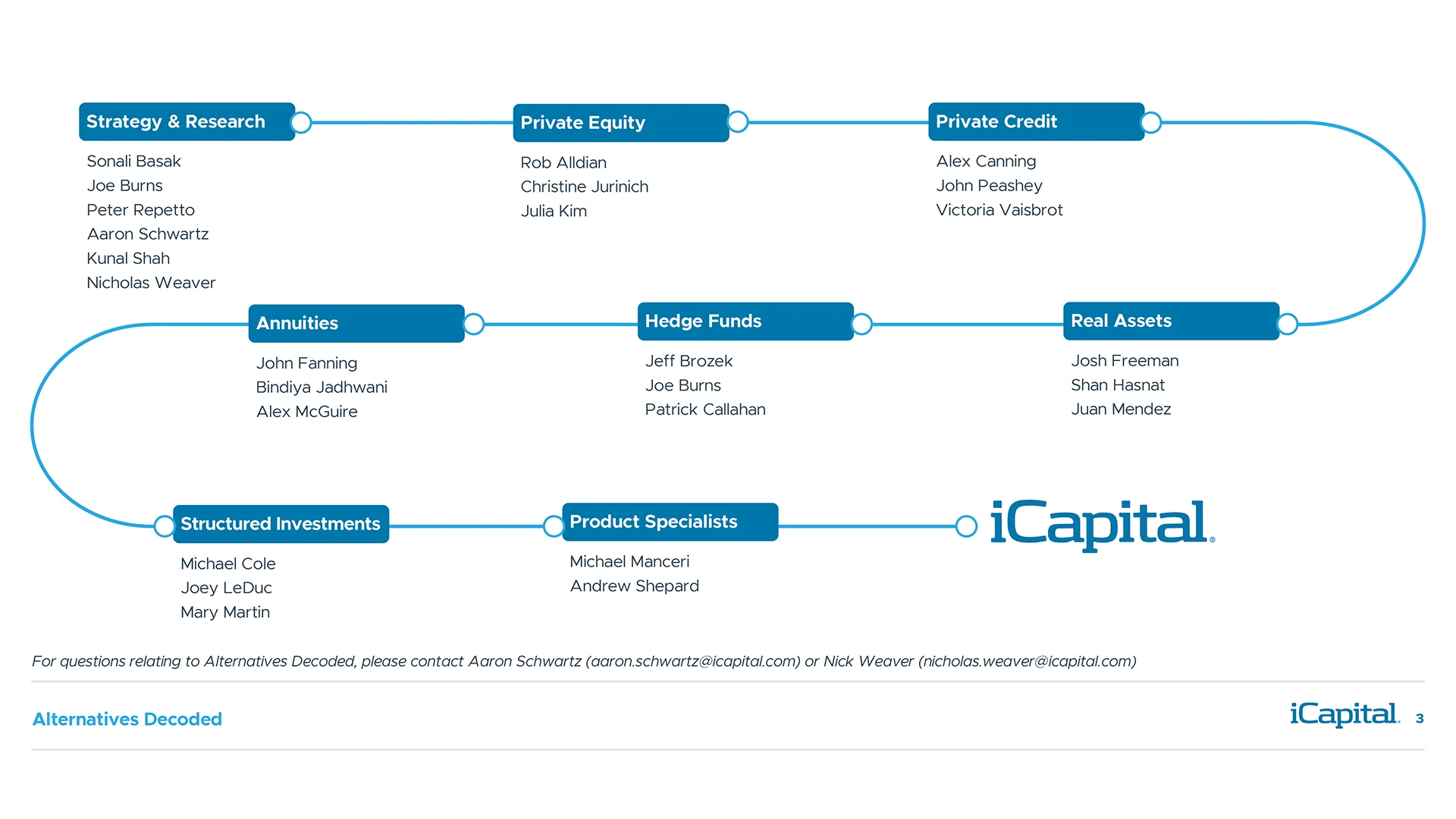

Global Research, Strategy, and Insights Team

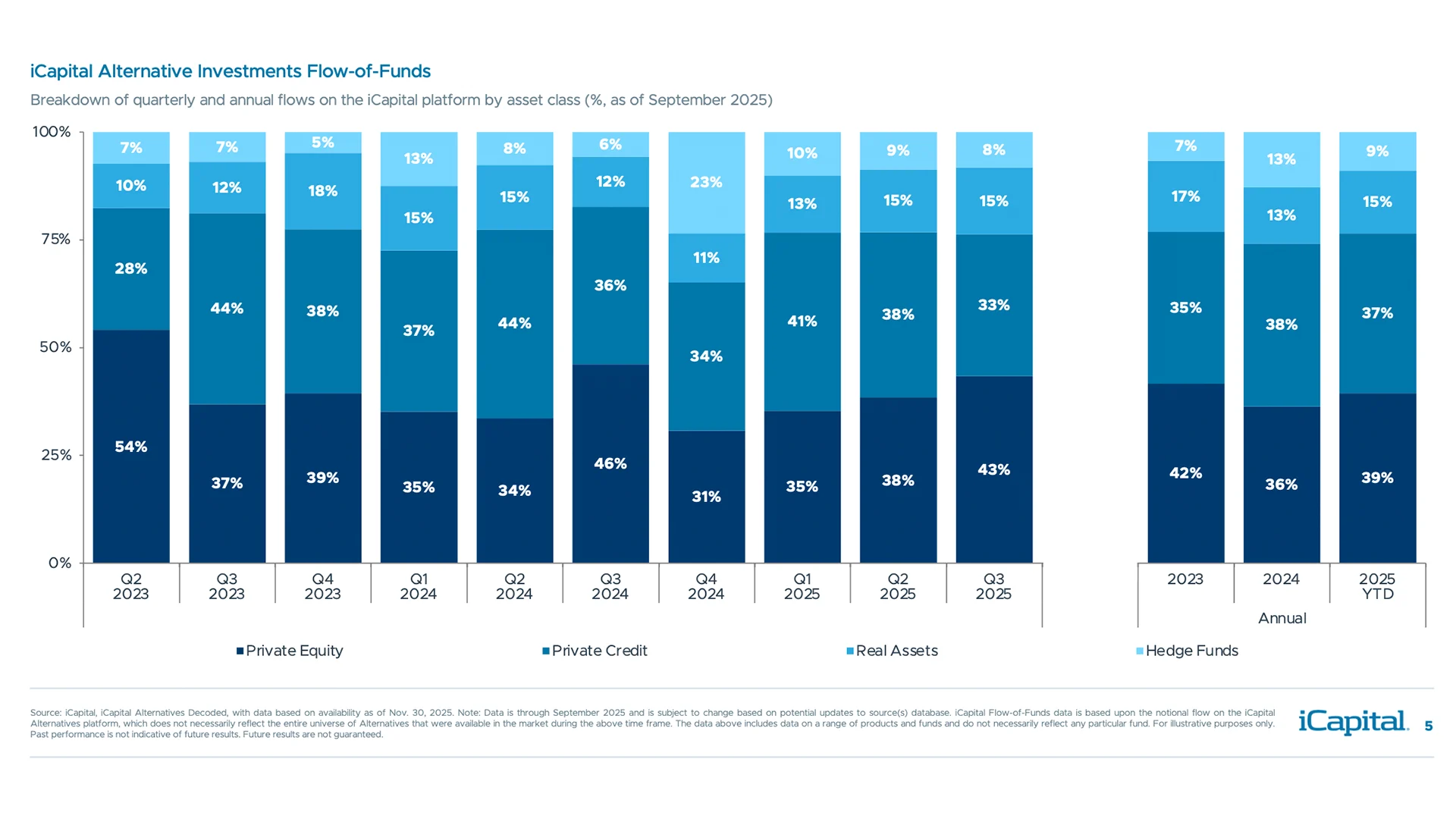

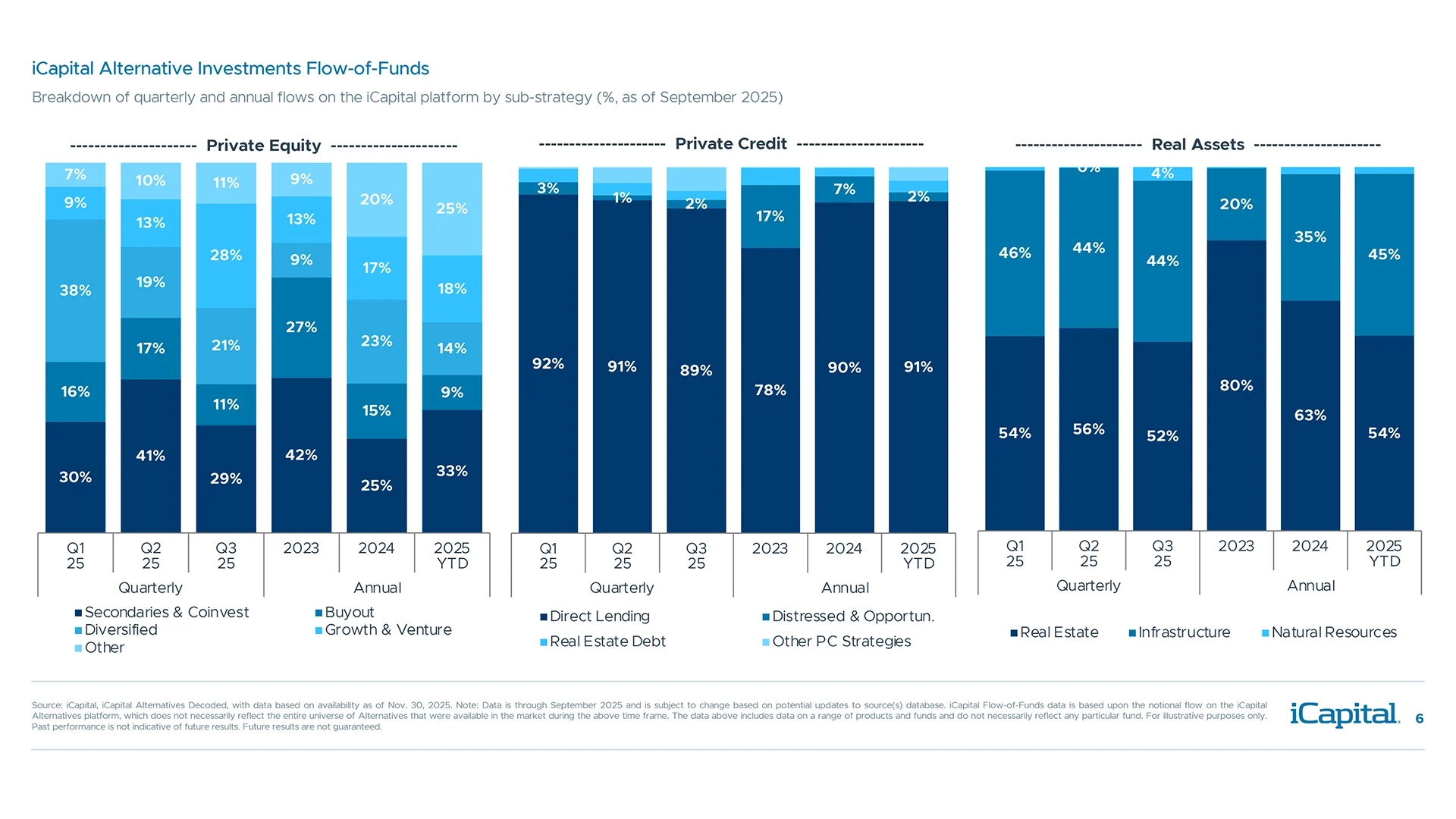

Private wealth clients continue to favor private equity and private credit in the second quarter

Clients are increasing allocations to direct lending and infrastructure at a sub-strategy level

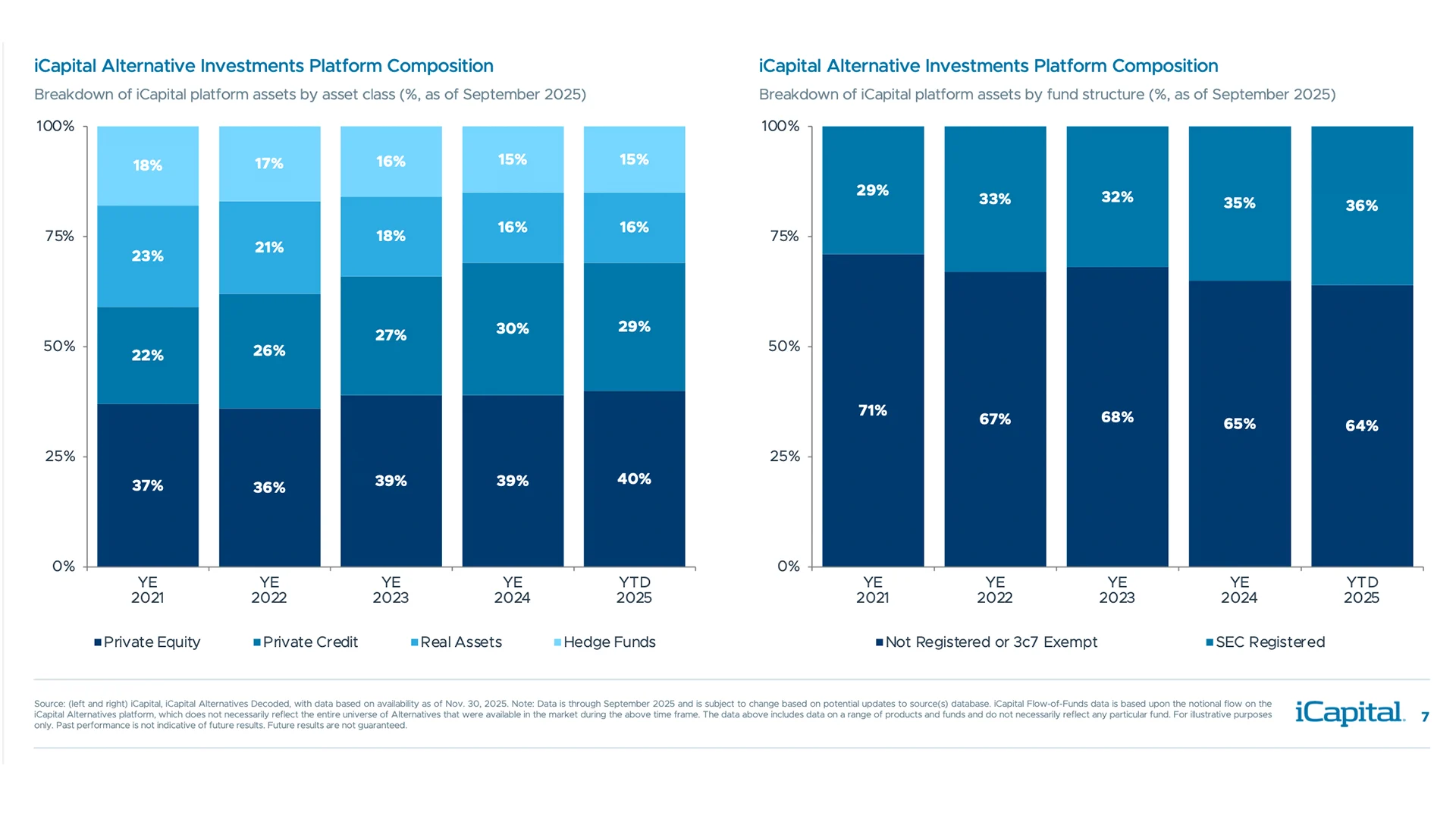

Over the last five years, clients increased allocations to private credit, registered funds

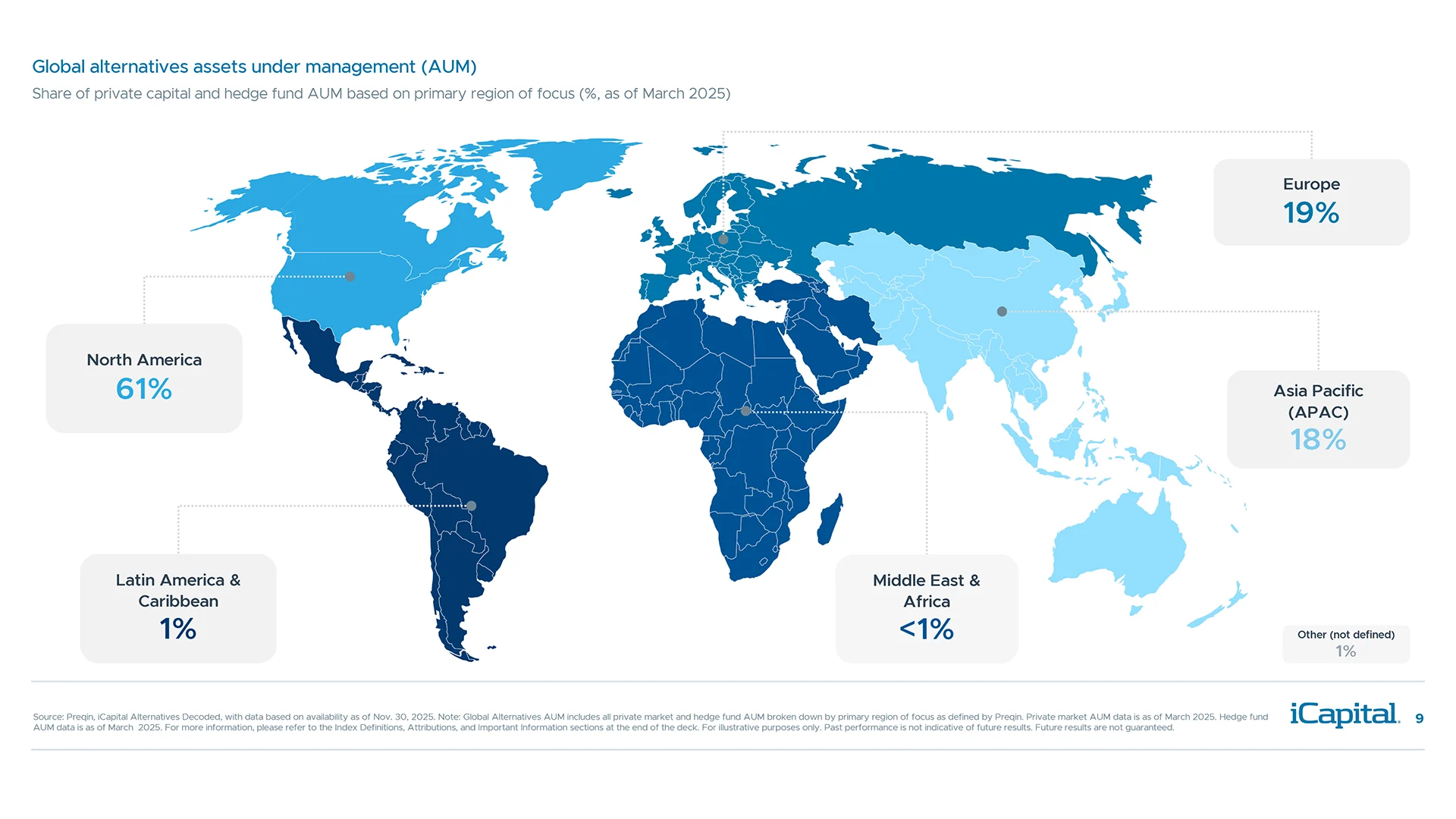

Alternative managers hold $18.1 trillion in global assets under management

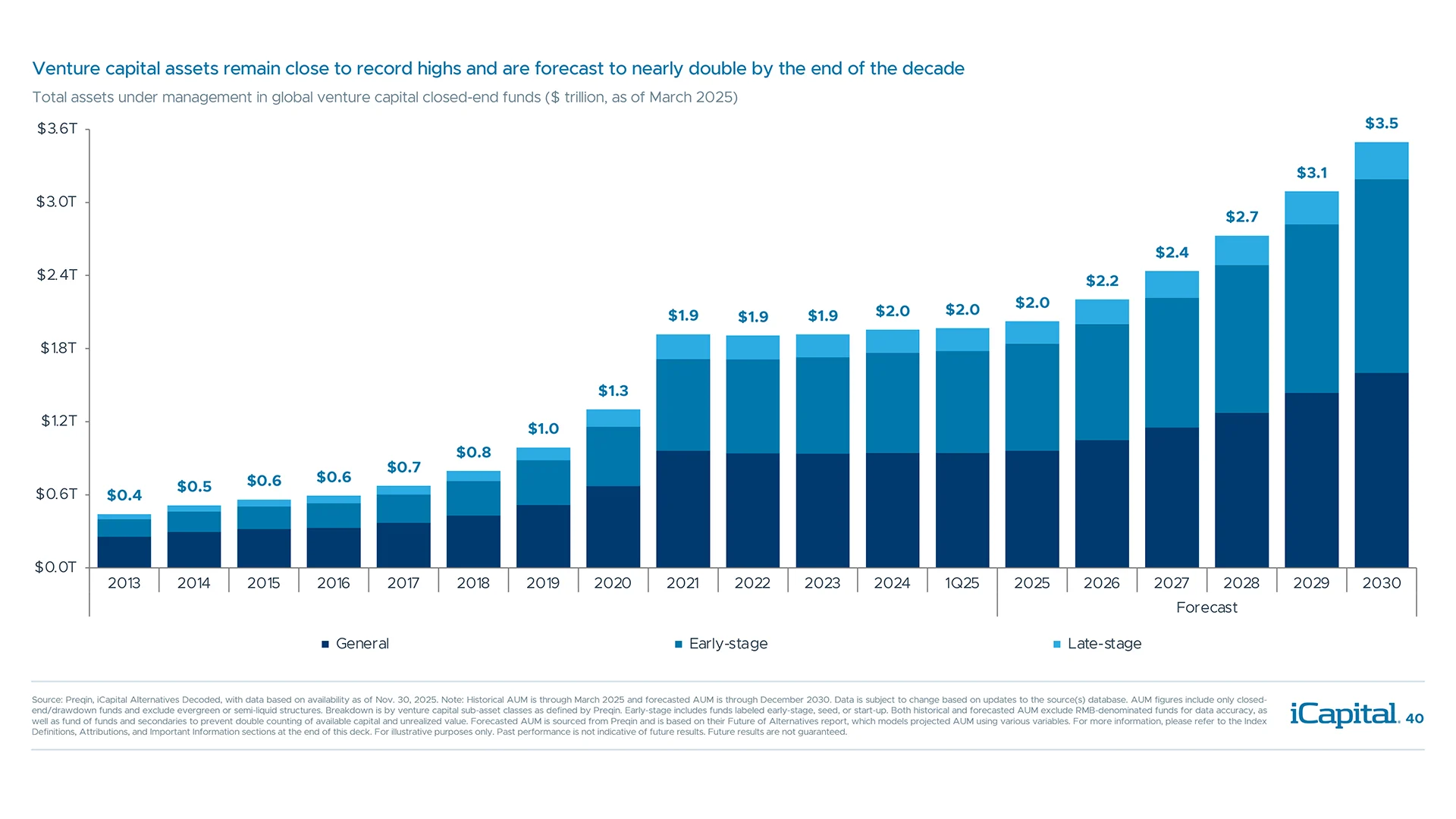

Alternatives have grown significantly and are projected to increase further in years ahead

Alternatives are expected to have the highest growth rate compared to traditional assets

Aggregate fundraising levels likely bottomed in 2024 with positive momentum seen in 2025

Dry powder has declined to $4.0 trillion as capital deployment is starting to recover

Dealmaking gained momentum in Q2 and Q3 2025, supported by improving corporate confidence

Alternatives have offered strong, long-term outperformance vs. a traditional 60/40 portfolio

Over the next decade, alternatives are projected to outperform their public counterparts

Several private market strategies offer higher yields than those available in public markets

Alternatives can be a powerful diversifier due to their low correlation to public markets

Alternatives offer higher returns and lower volatility vs. a traditional 60/40 portfolio

Manager selection has been an important driver of return outcomes in alternatives

Select private market strategies are trading at valuations below their historical averages

Private clients to increase alternatives allocation from $4T to $13T by 2032

The opportunity to increase allocations is sizable given low portfolio allocation and advisor use

Private equity is the largest asset class within alternatives and has grown significantly

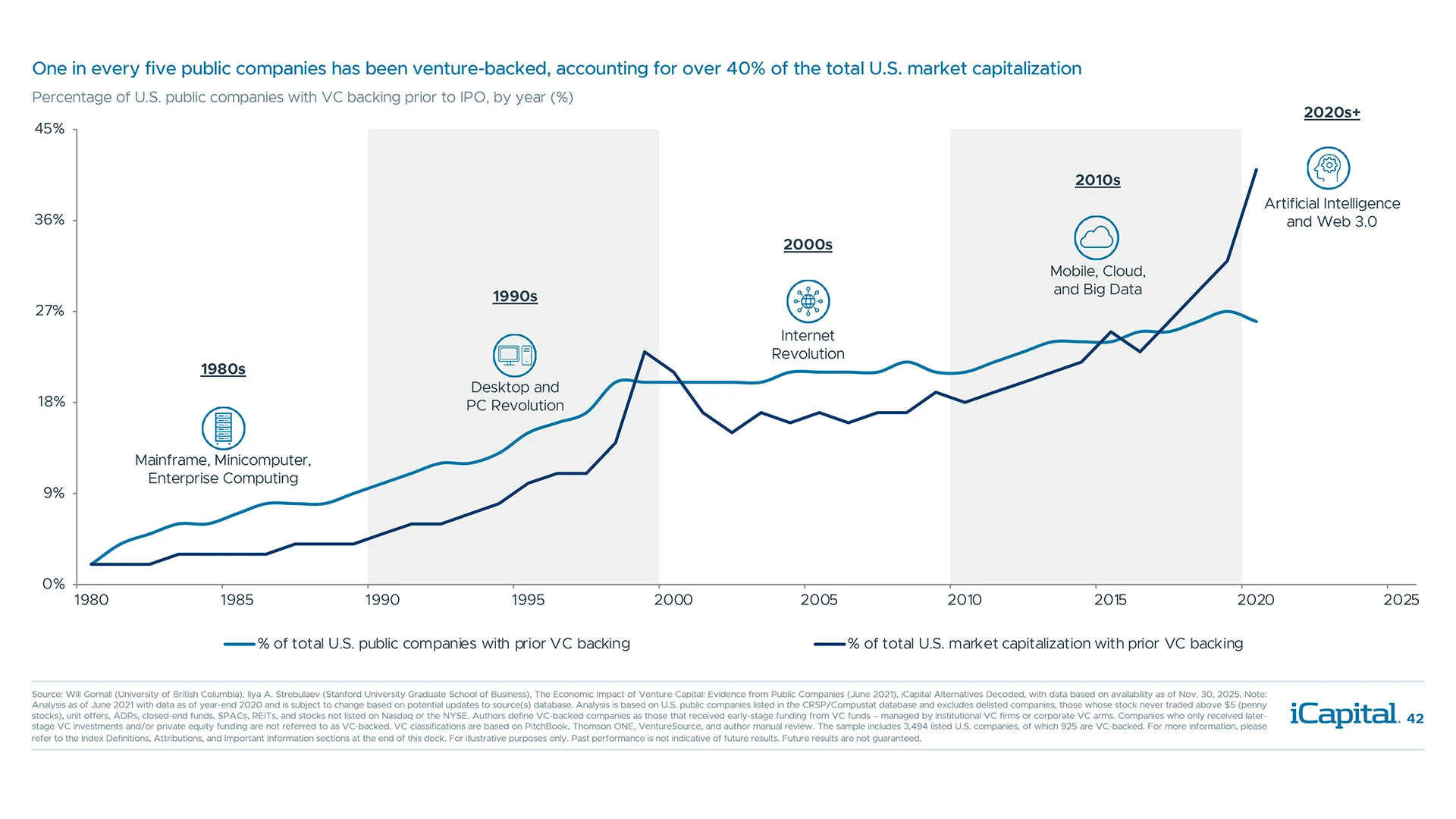

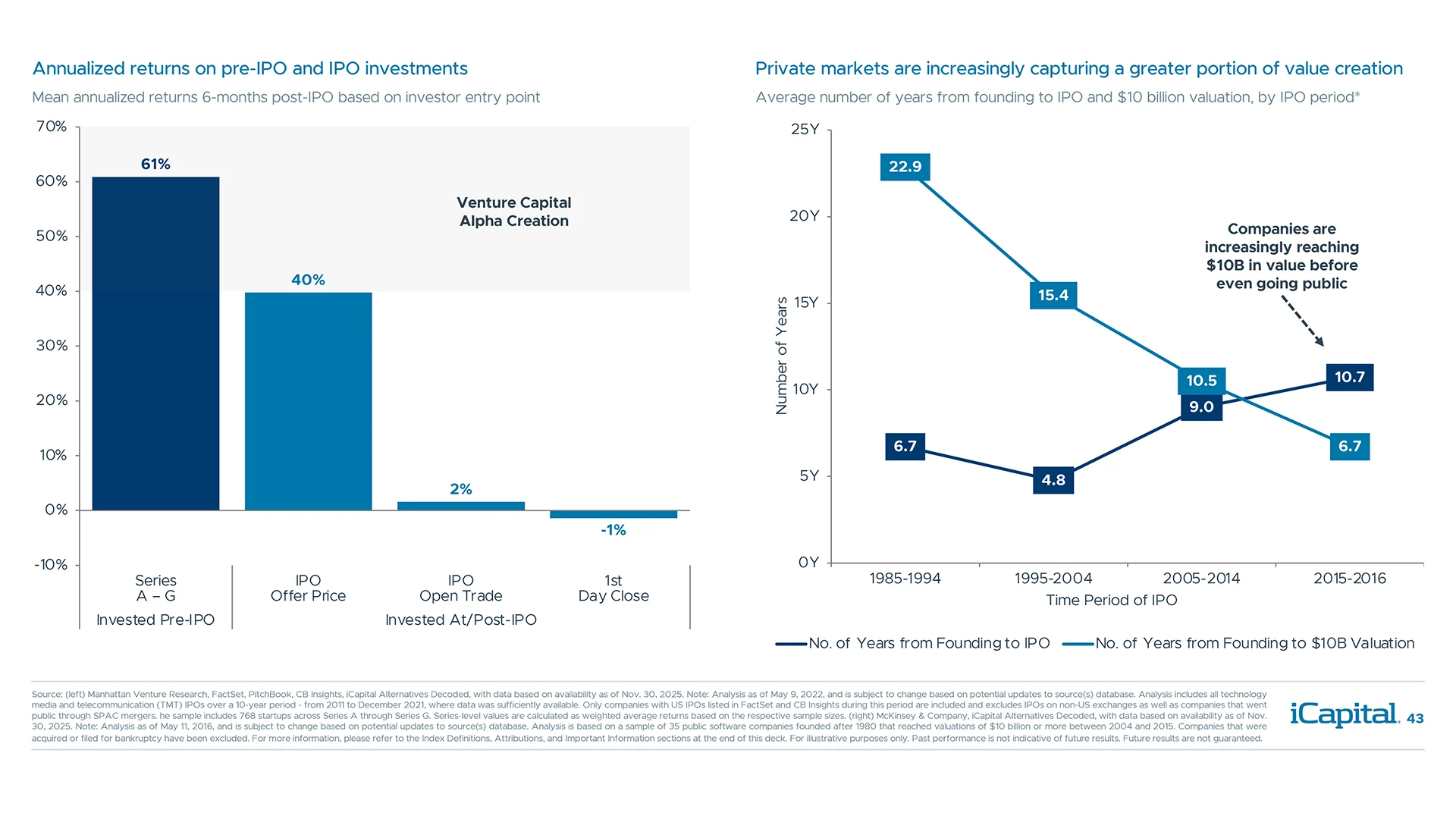

IPO activity is not what it used to be as companies are staying private for longer

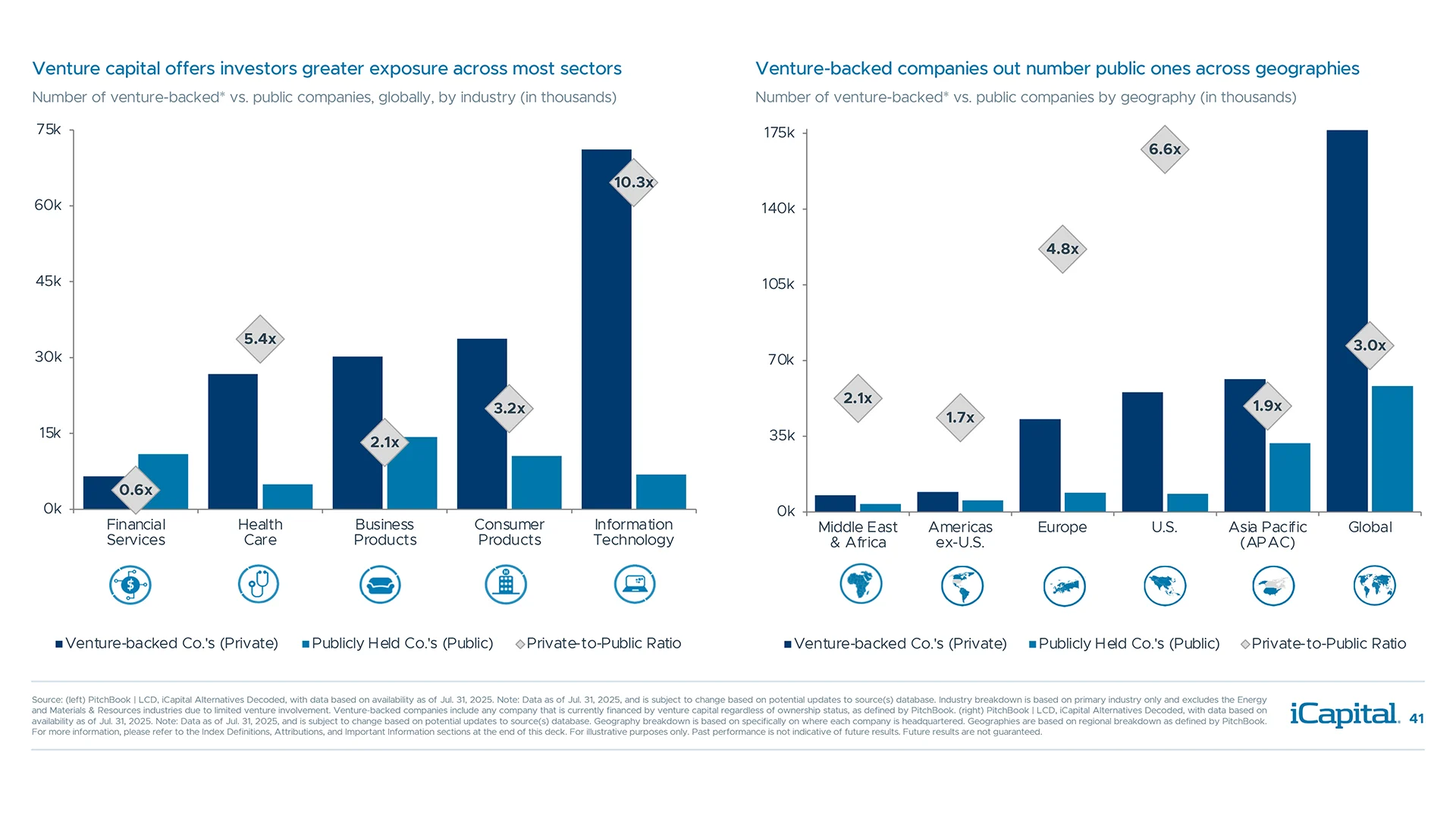

Private companies outnumber publicly traded ones, across most revenue segments

Private markets offer investors an opportunity to tap into a larger pool of innovation

Private equity has outperformed public equities over various time horizons

Private equity has delivered more consistently positive returns with fewer negative years

Private equity performance generally improves when investing during downturn year vintages

Private equity fund managers have multiple ways to create value vs. public markets

PE valuations consistent with pre-pandemic norms, and at or below public market comps

While lower rates may steer GPs toward large buyouts, middle market still offers opportunities

Managers adjusted to higher cost of capital by reducing leverage, though this is starting to change

Realization of further rate cuts may help improve levered company credit ratios

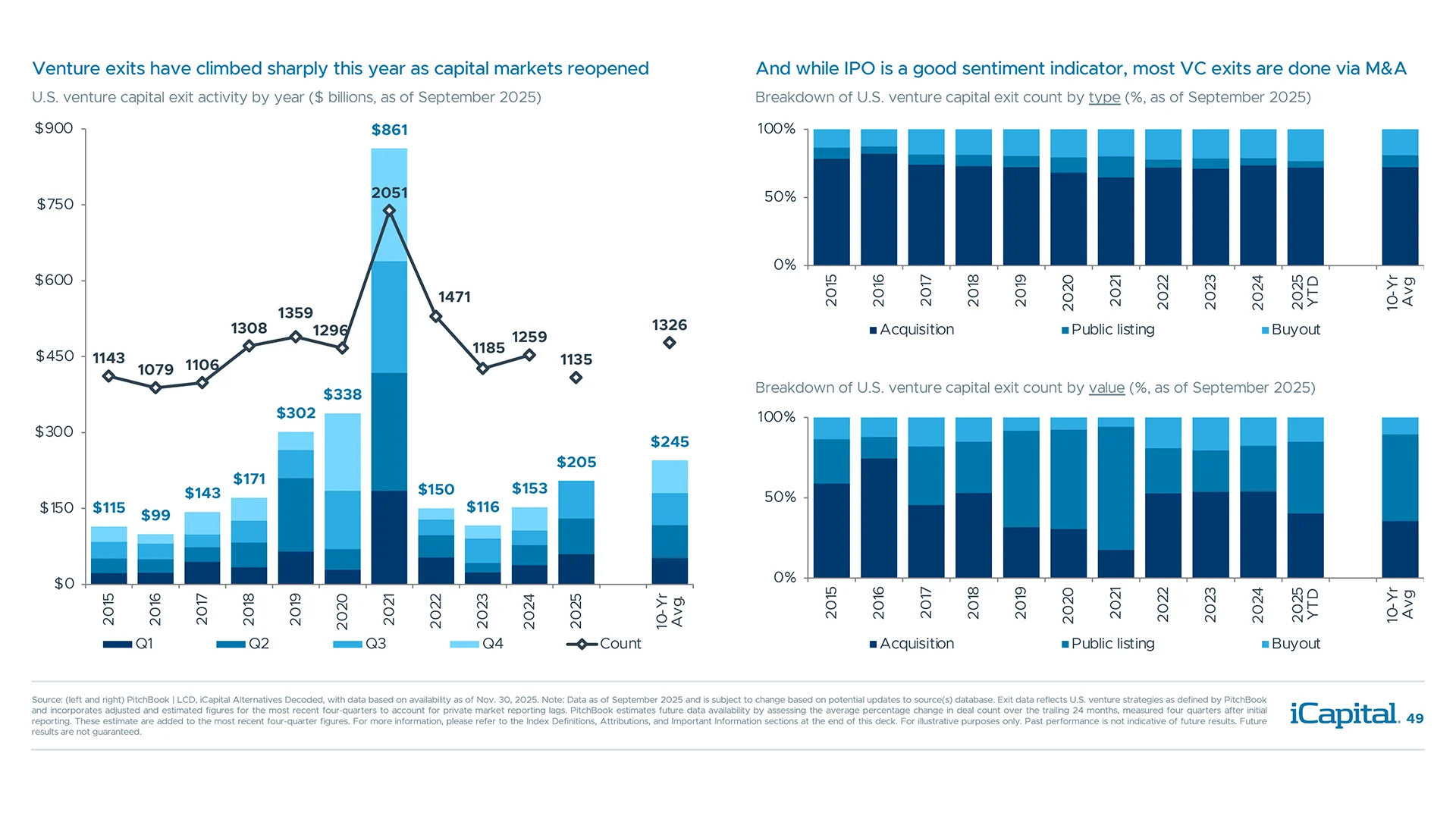

Though exit values declined in Q3, higher volumes suggest more assets moving through the system

Robust 2025 deal activity signals GPs and corporates see policy and trade risks as passing storms

Venture capital AUM is expected to grow at a ~11% CAGR through 2030

Venture capital offers access to vast opportunities and high-growth sectors like technology

Venture capital is a dominant force in the financing of innovation and growth

Private markets drive most of the value creation, meaning most returns are captured pre-IPO

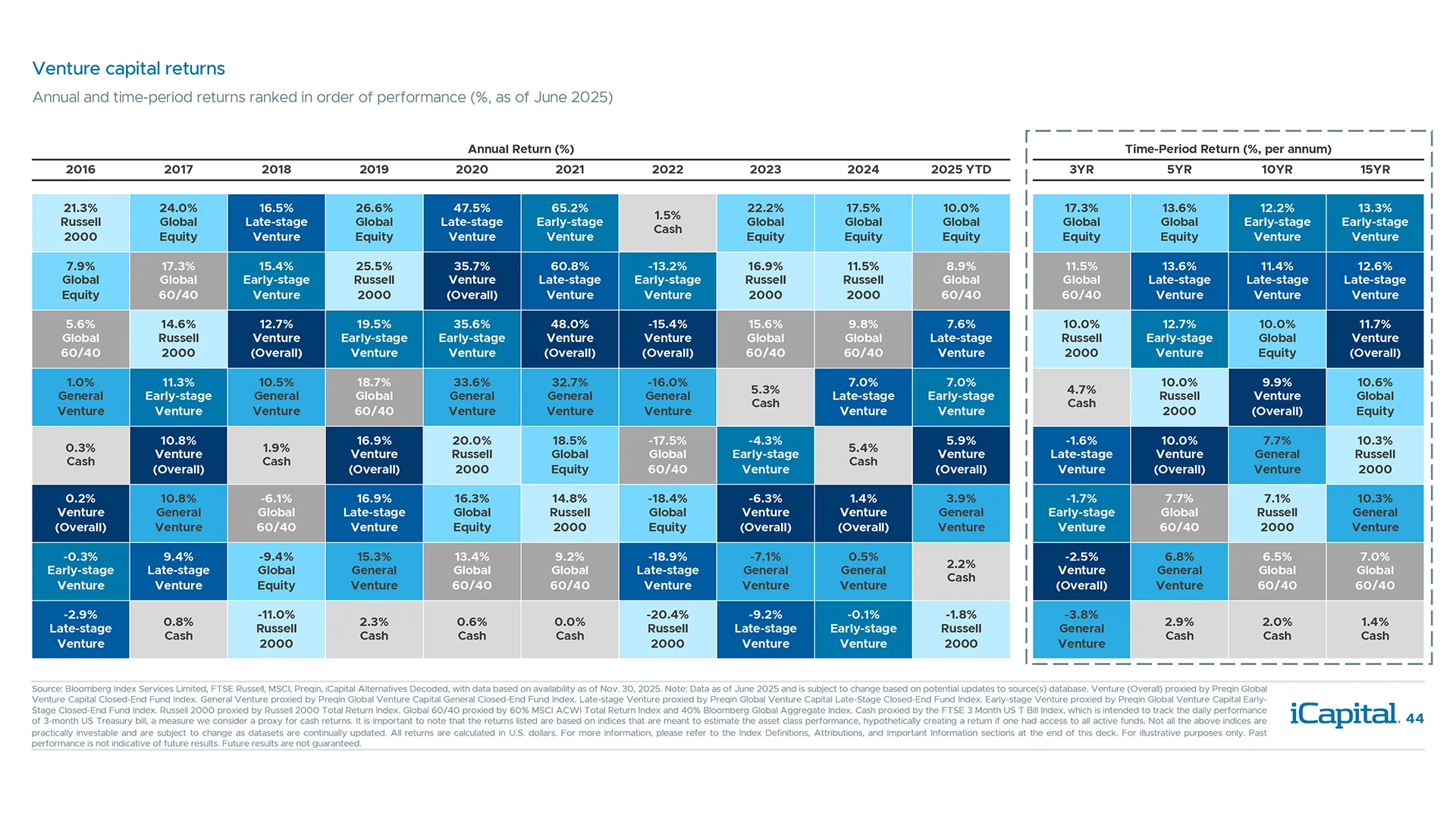

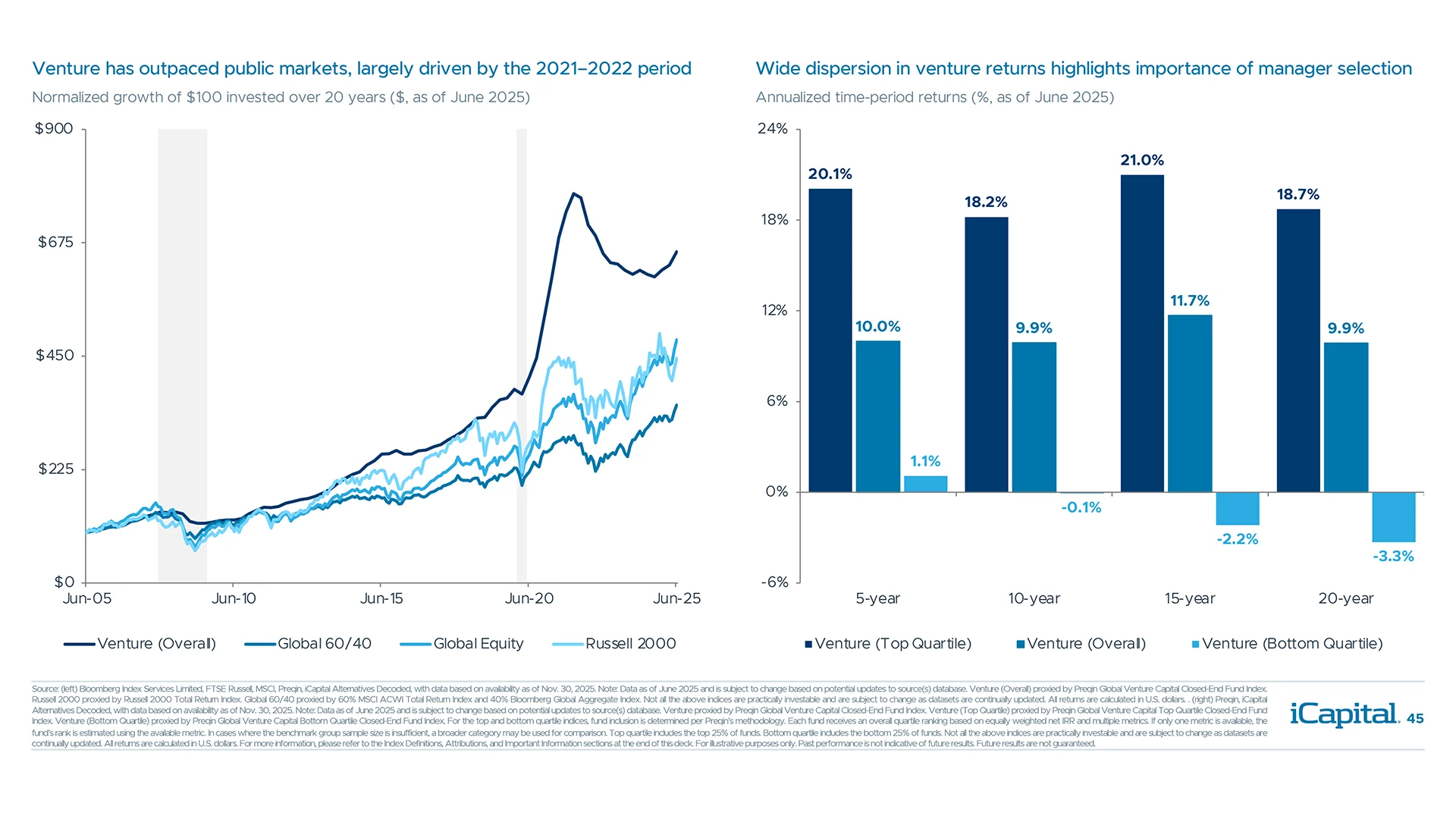

Despite underperformance since 2023–24, venture has outpaced equities over the longer term

Manager selection is key when investing in VC as top quartile funds significantly outperform

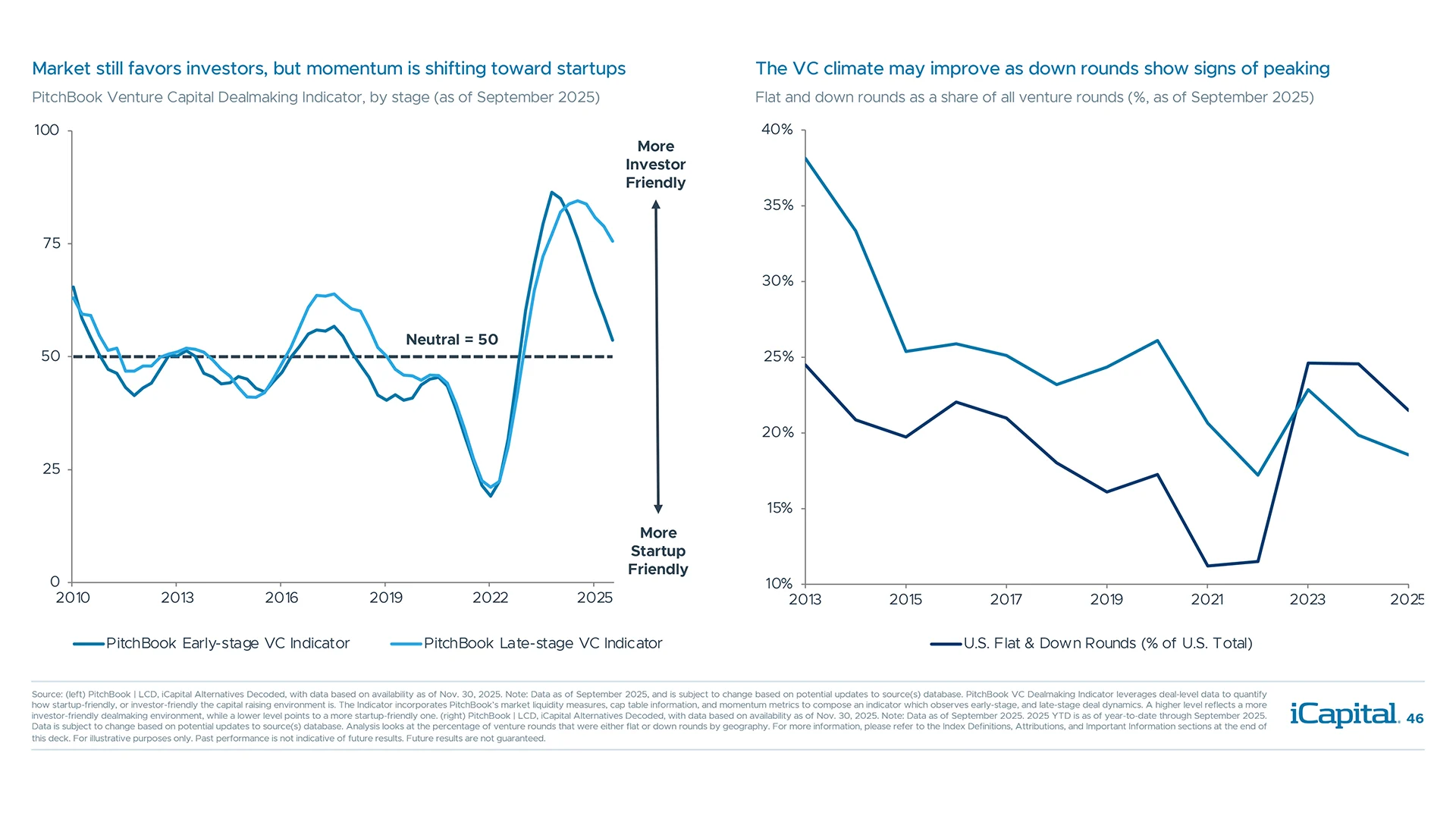

Signs point to strong tailwinds for venture capital, partially driven by AI

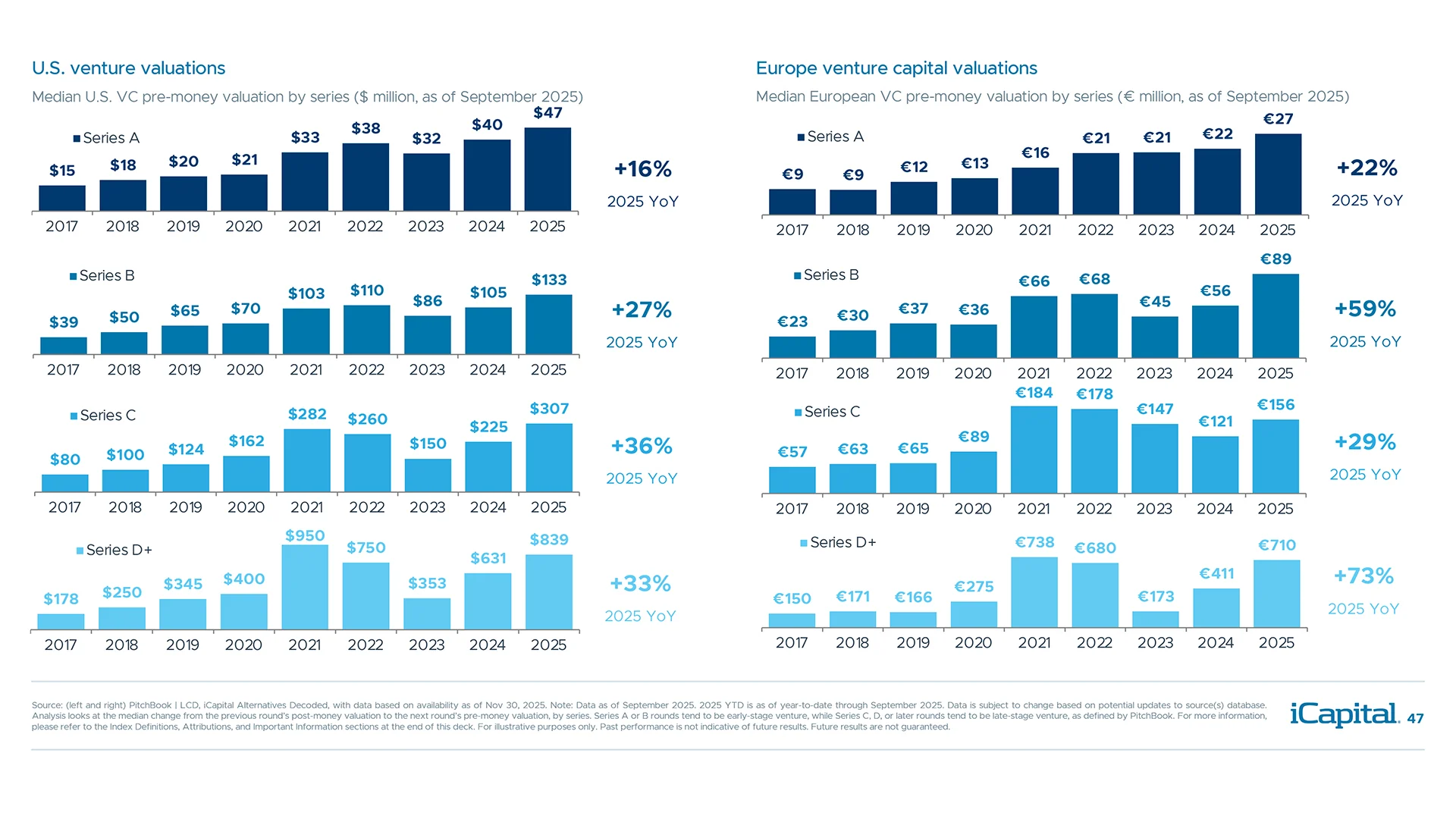

Venture valuations are elevated but are more reasonable than they appear

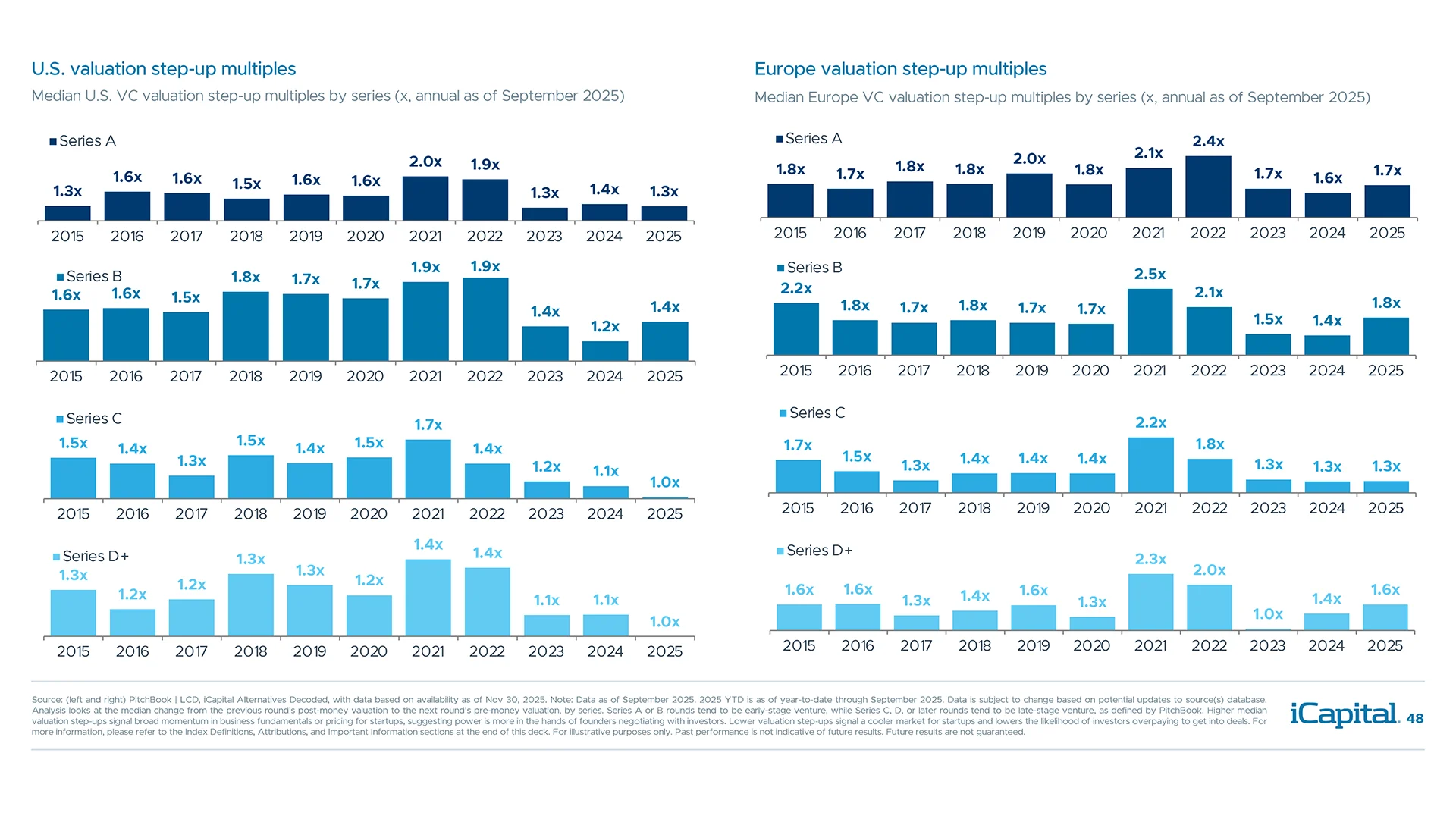

Lower valuation step-ups signal a cooler VC market but better entry points for investors

High-profile IPOs continue to boost exits YTD, though M&A remains primary exit path for startups

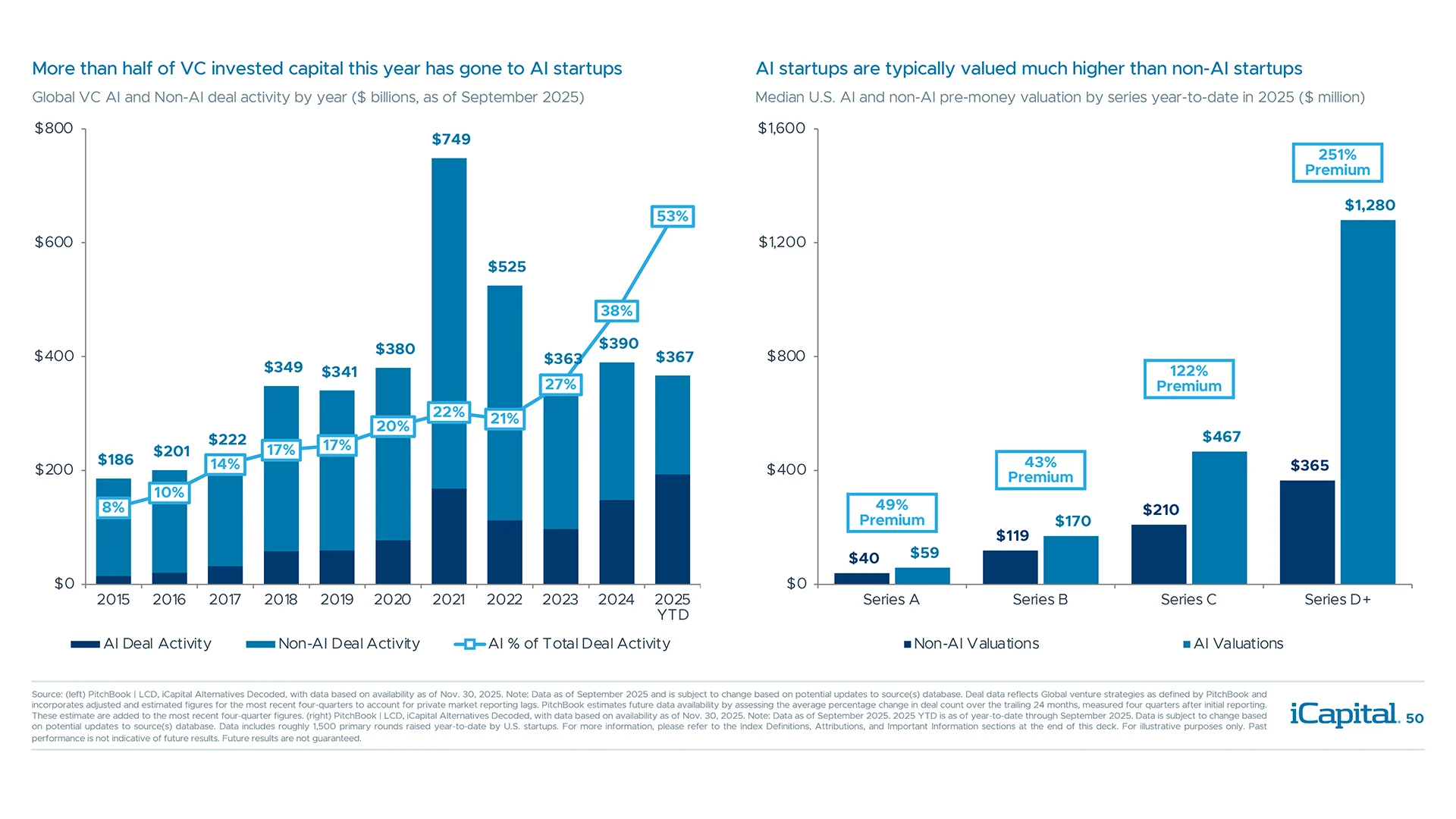

AI startups are driving a funding resurgence, with significant valuation premiums

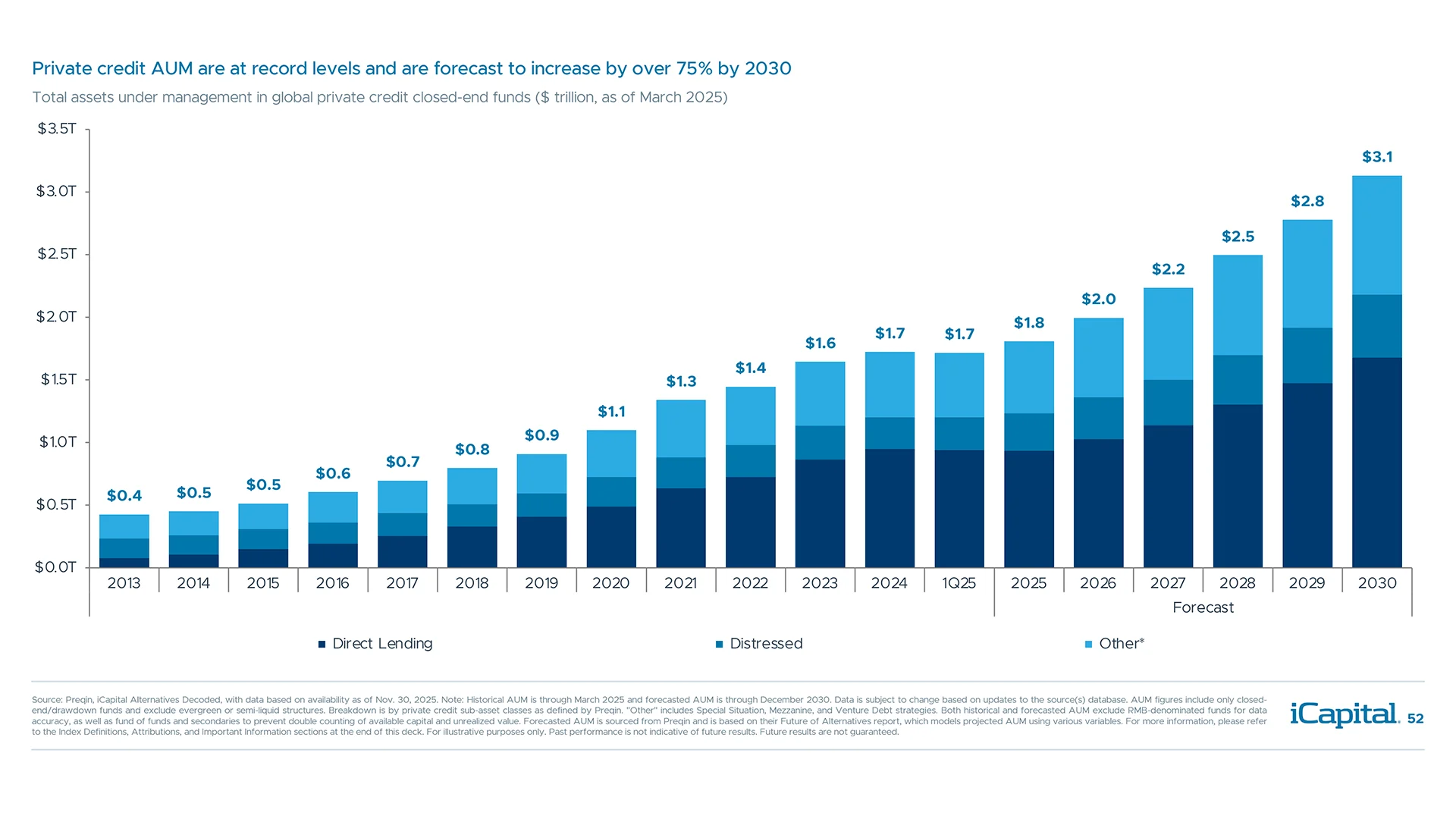

Private credit assets have grown rapidly, in part due to share gains from bank lending

Private credit demand is climbing, as private equity is funding a larger share of the economy

Private credit strategies historically outperformed public fixed income sectors

Direct lending has offered favorable risk-adjusted returns versus public fixed income

Private credit drawdown risk is moderated by buy-and-hold nature, fewer dislocations

Risk premium, complexity and market inefficiencies provides a backdrop for attractive yields

Despite some spread compression in recent years, direct lending remains at a premium to loans

Income has been a steady component of private credit returns over time

Credit losses for private credit have been in line with high yield and bank loan issuers

Coverage ratios in private credit are strengthening, which may limit defaults despite headlines

Lower volatility, high income led to more consistently positive results for private credit

The emergence of asset-based-lending in private credit unlocks a vastly larger opportunity set

Asset-based lending is becoming a meaningful alternative as banks pulled back post-GFC

CRE is a large, diversified asset class with growing interest from private capital investors

CRE has had a low correlation to and better risk-adjusted returns than public markets

Private real estate had less frequent drawdowns, which helped deliver returns overtime

Growth in net operating income (NOI) has outpaced inflation and served as a core return driver

Transaction volumes are recovering and should help with more realistic pricing in future quarters

A pricing recovery is underway after a sharp post-pandemic price correction

Cap rates reset higher as the Fed raised interest rates, but remain low relative to bond yields

NOI growth has moderated but has roughly stabilized above long-term averages and inflation

Value-add funds can help improve NOI given the growing need to improve aging structures

Supply and demand dynamics remain relatively healthy and should also support NOI

Most CRE sectors have solid fundamentals, except for office where weakness persists

Lower use of leverage and higher debt coverage ratios offset some of these concerns

Banks are still retrenching from commercial real estate lending amidst rising defaults

CRE debt funds with ample dry powder should help partially fill the void

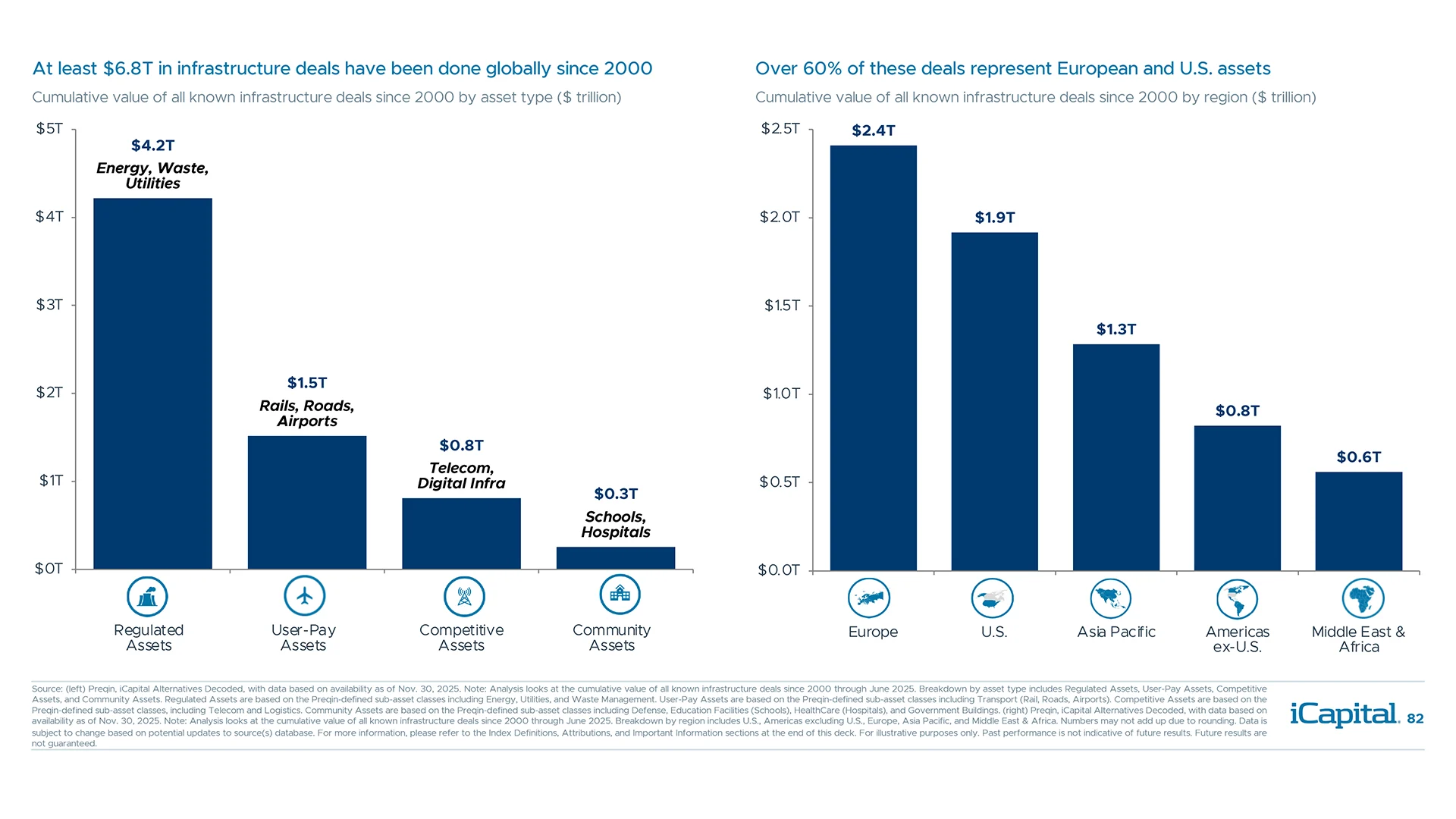

Infrastructure is a globally diverse asset class with assets primarily in North America and Europe

Investors can consider four broad categories of infrastructure with varying characteristics

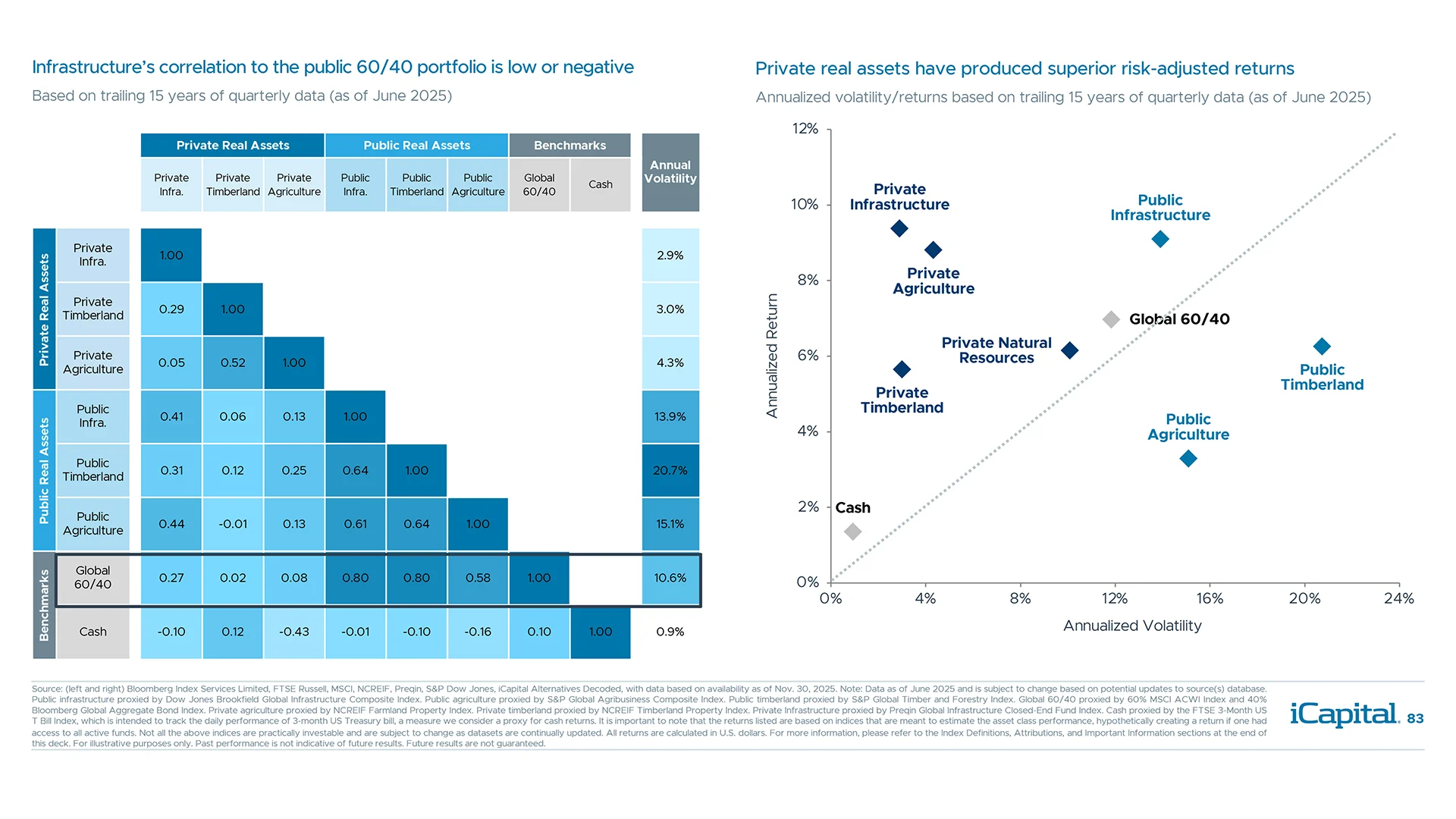

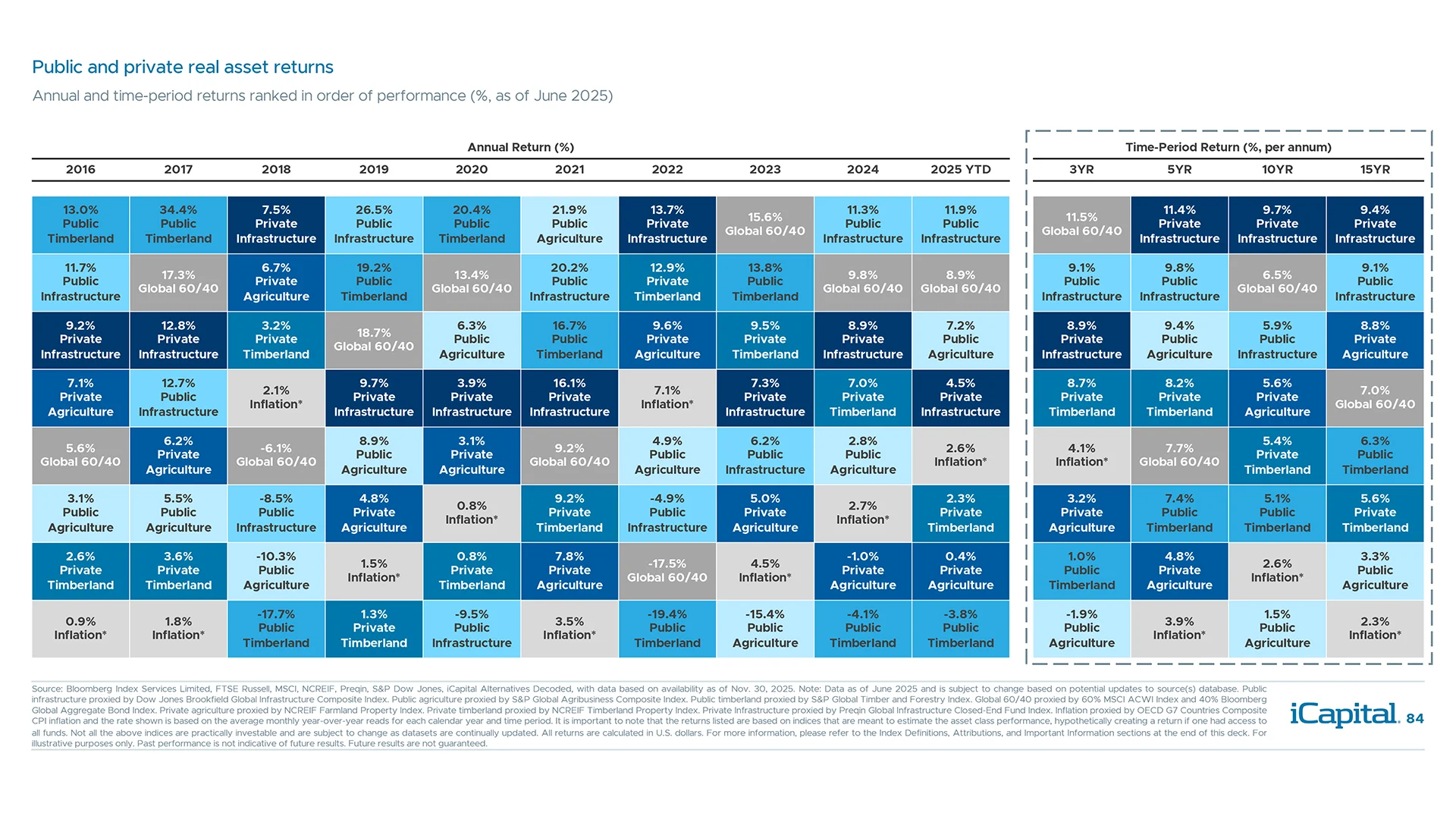

Private real assets have produced superior risk-adjusted returns with low correlation

Real assets have delivered returns outpacing developed market inflation

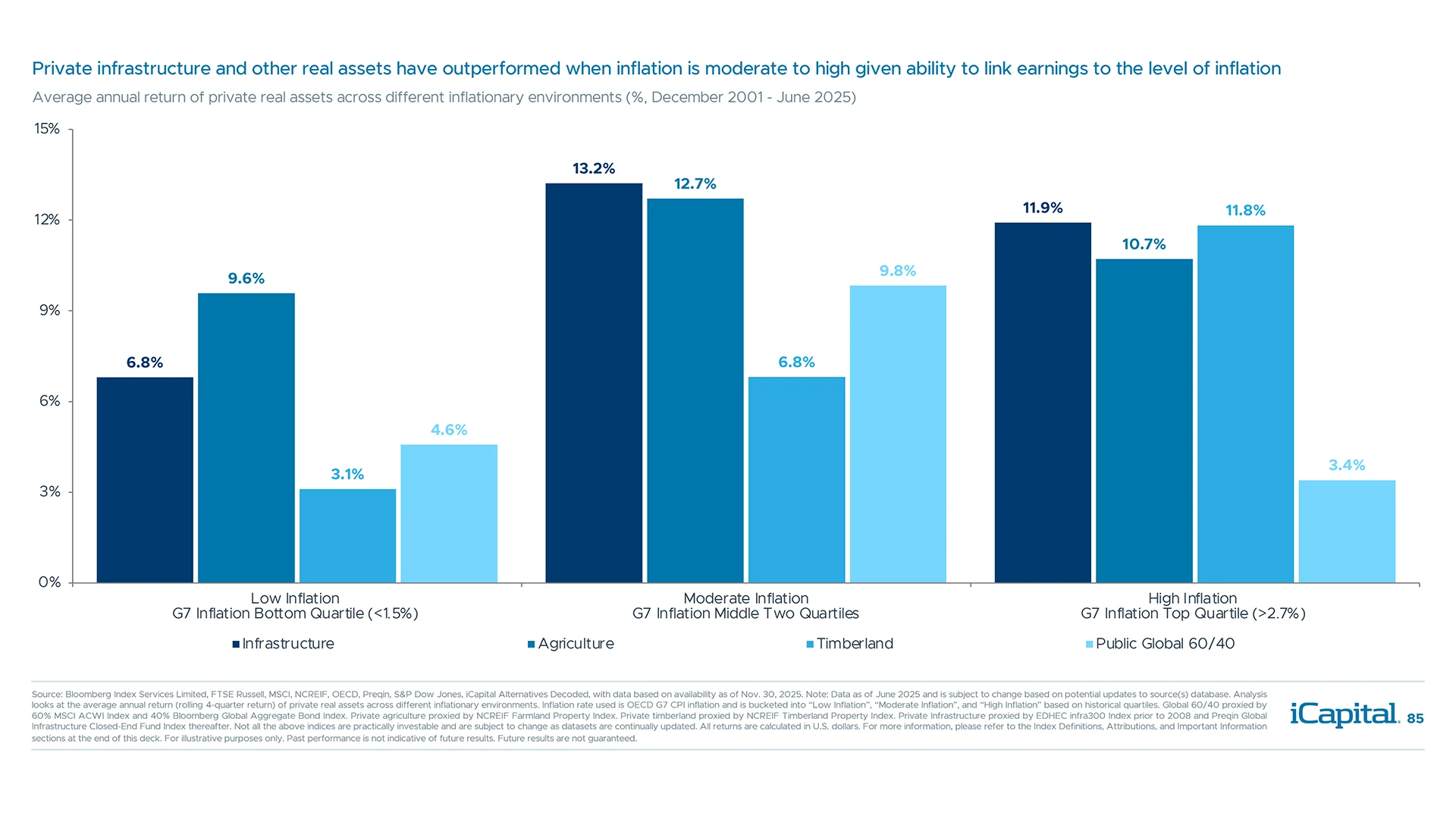

Real assets provided higher returns during periods of moderate to high inflation

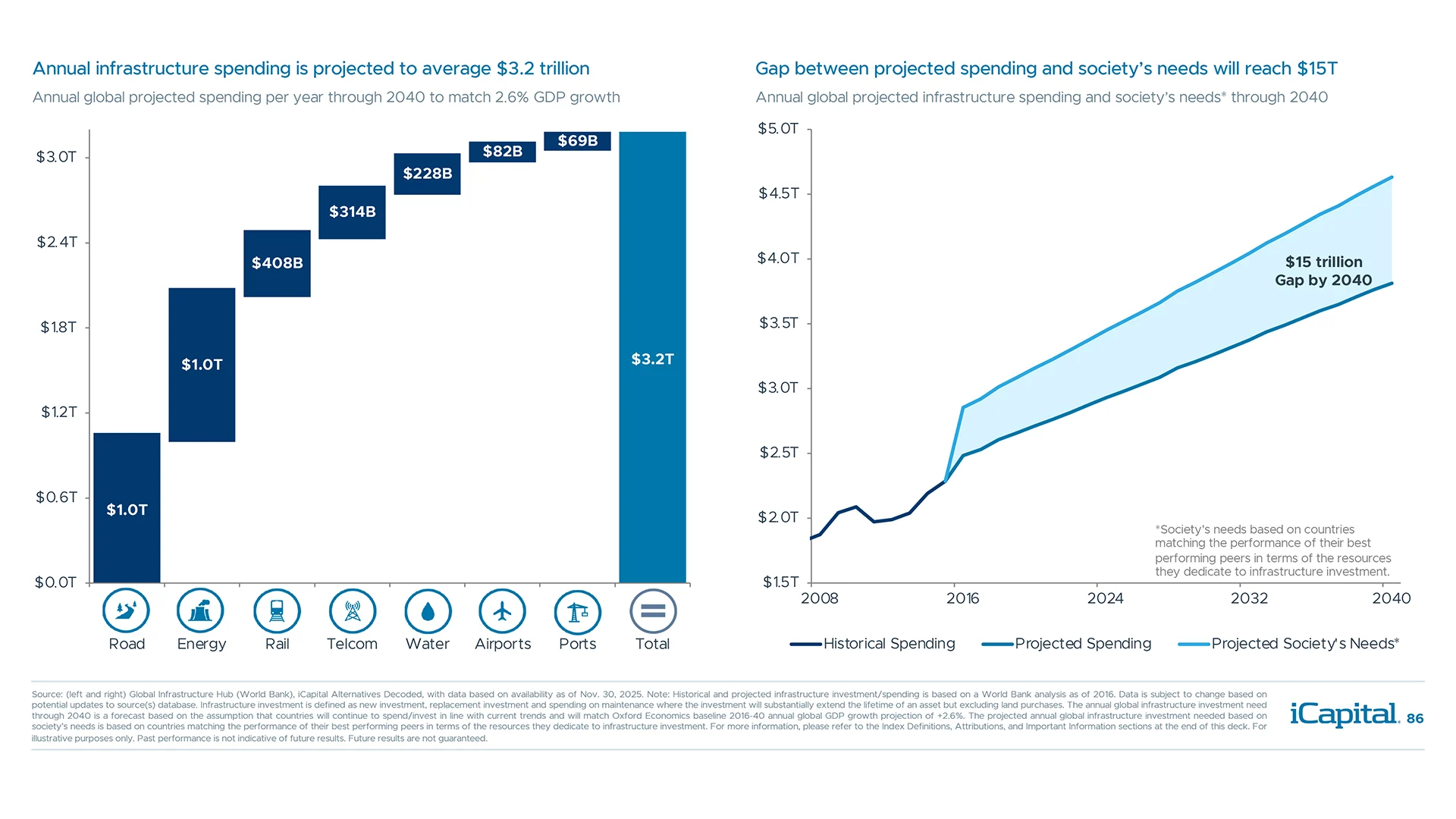

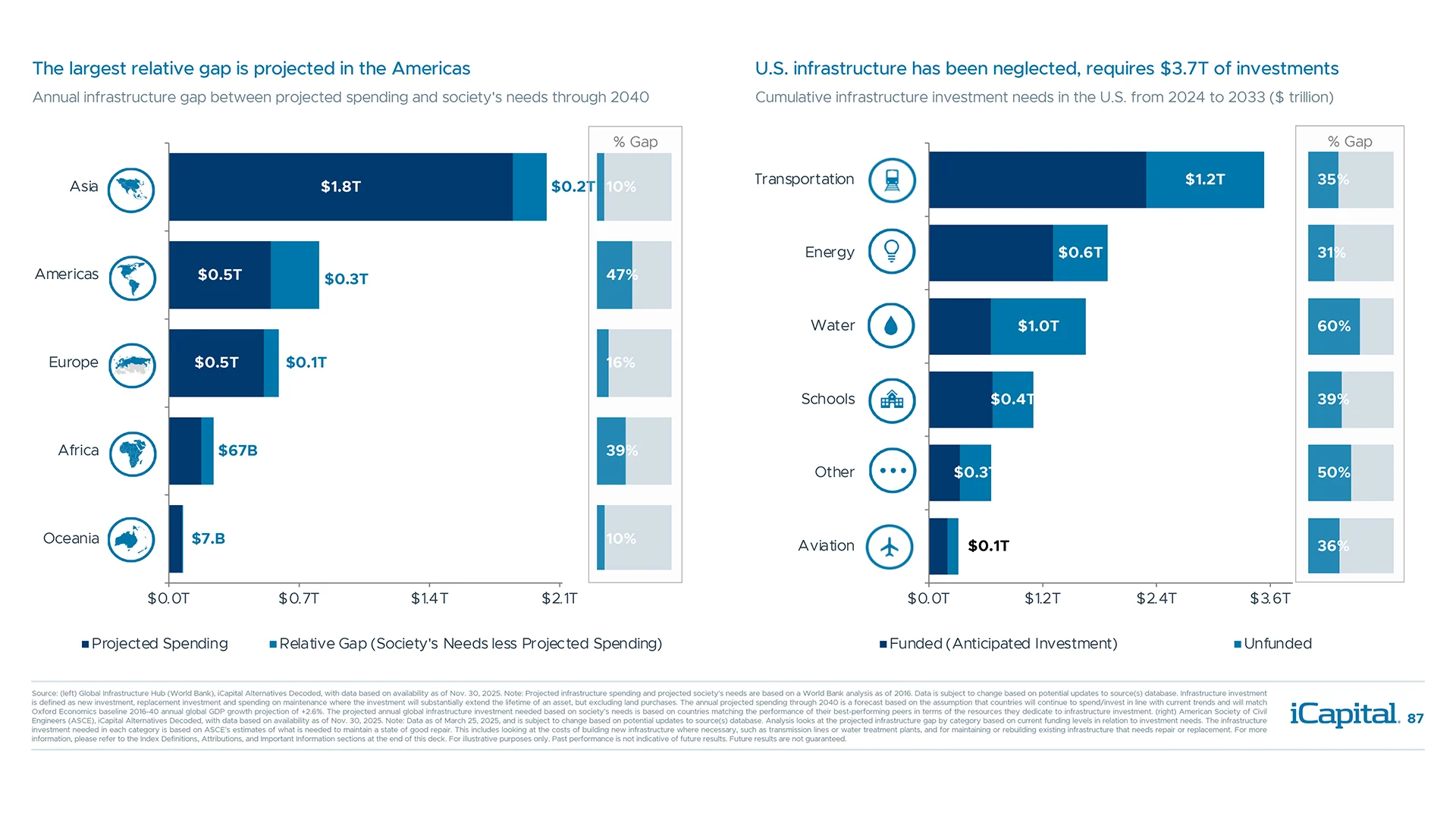

Global economies are set to spend $3.2 trillion per year on infrastructure through 2040

There is a widening gap between projected infrastructure spending and society’s needs

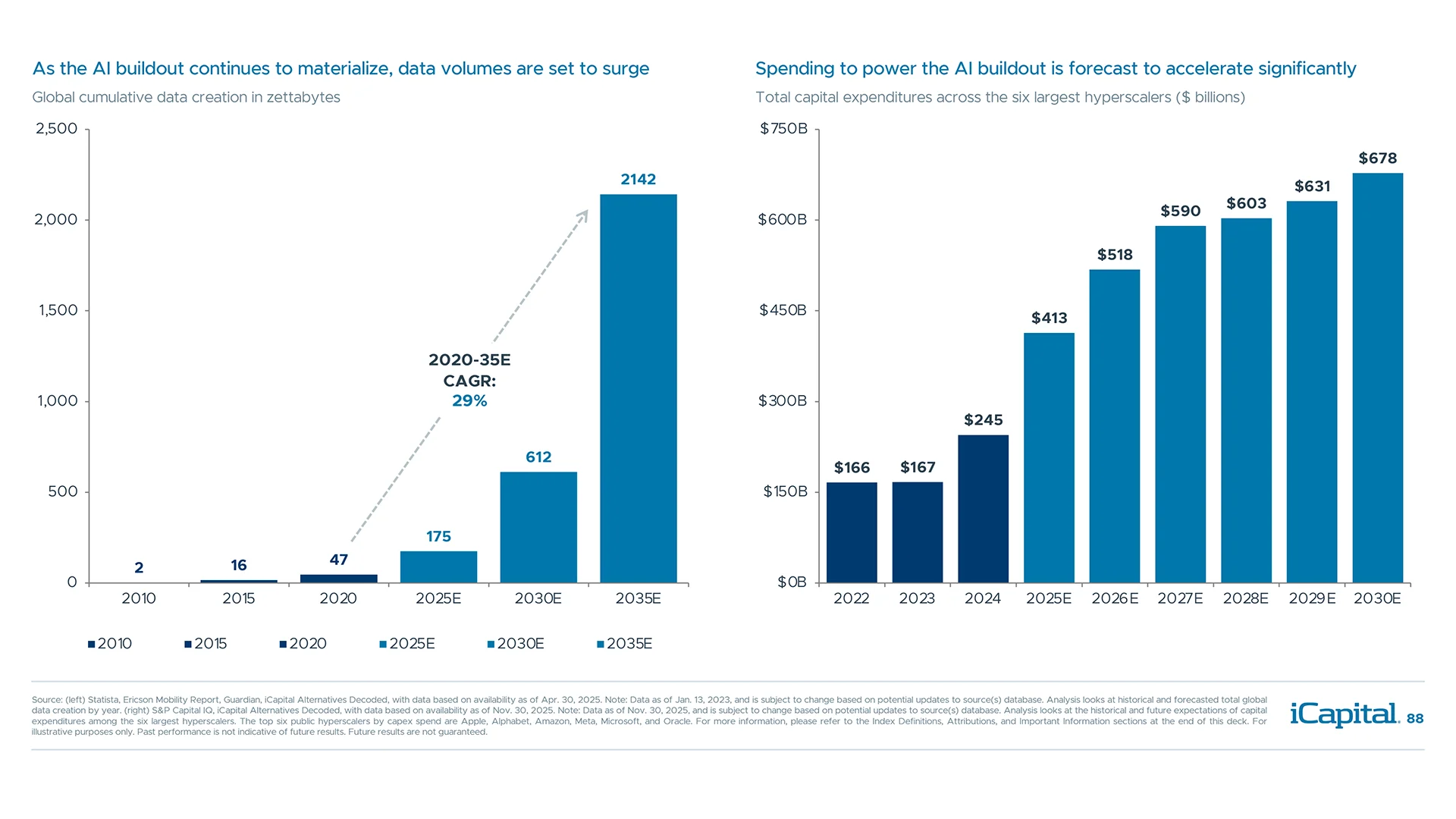

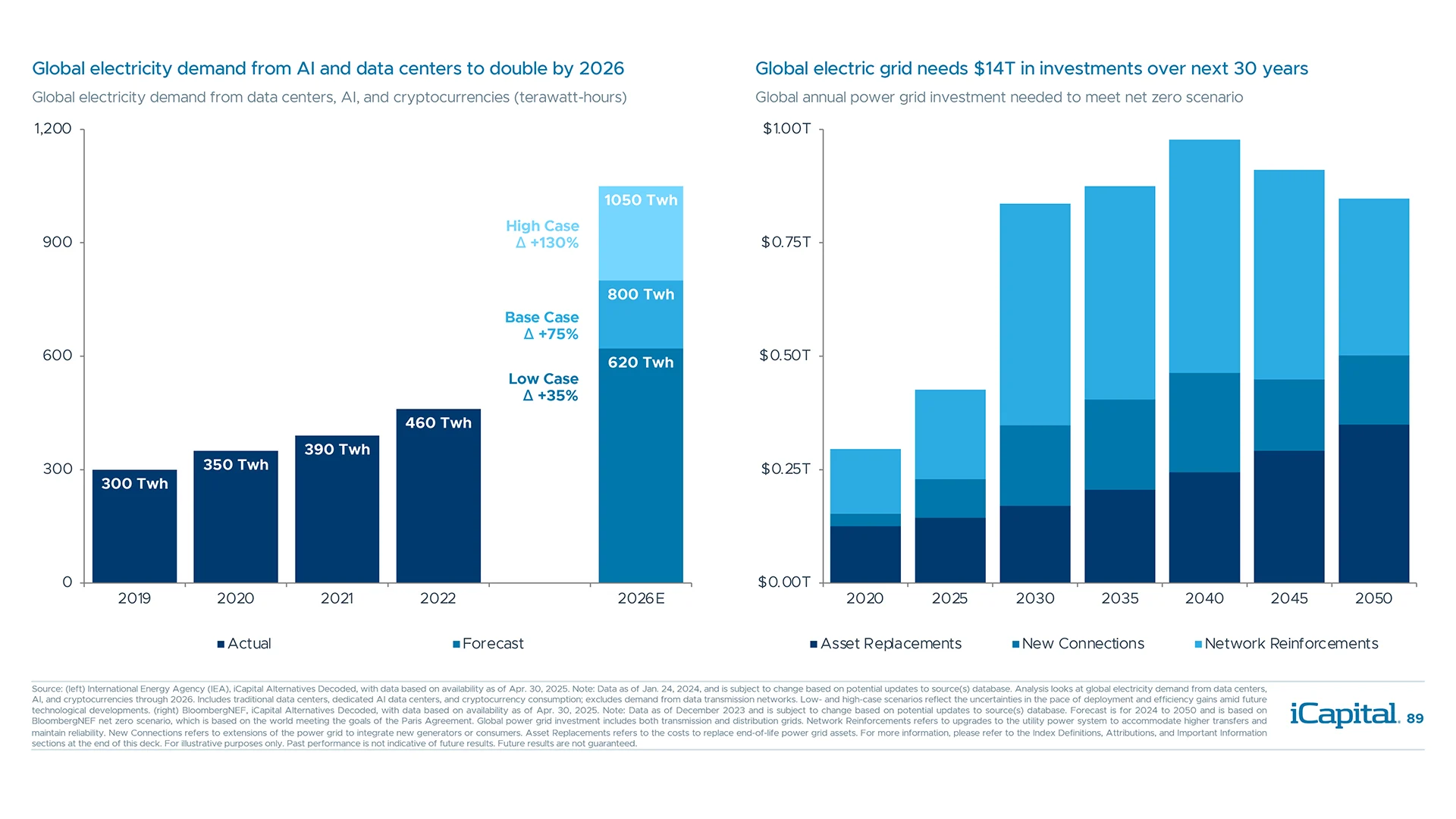

AI buildout is fueling digitization and data center growth – a prominent theme in infrastructure

The investment need for additional decarbonized power generation is growing

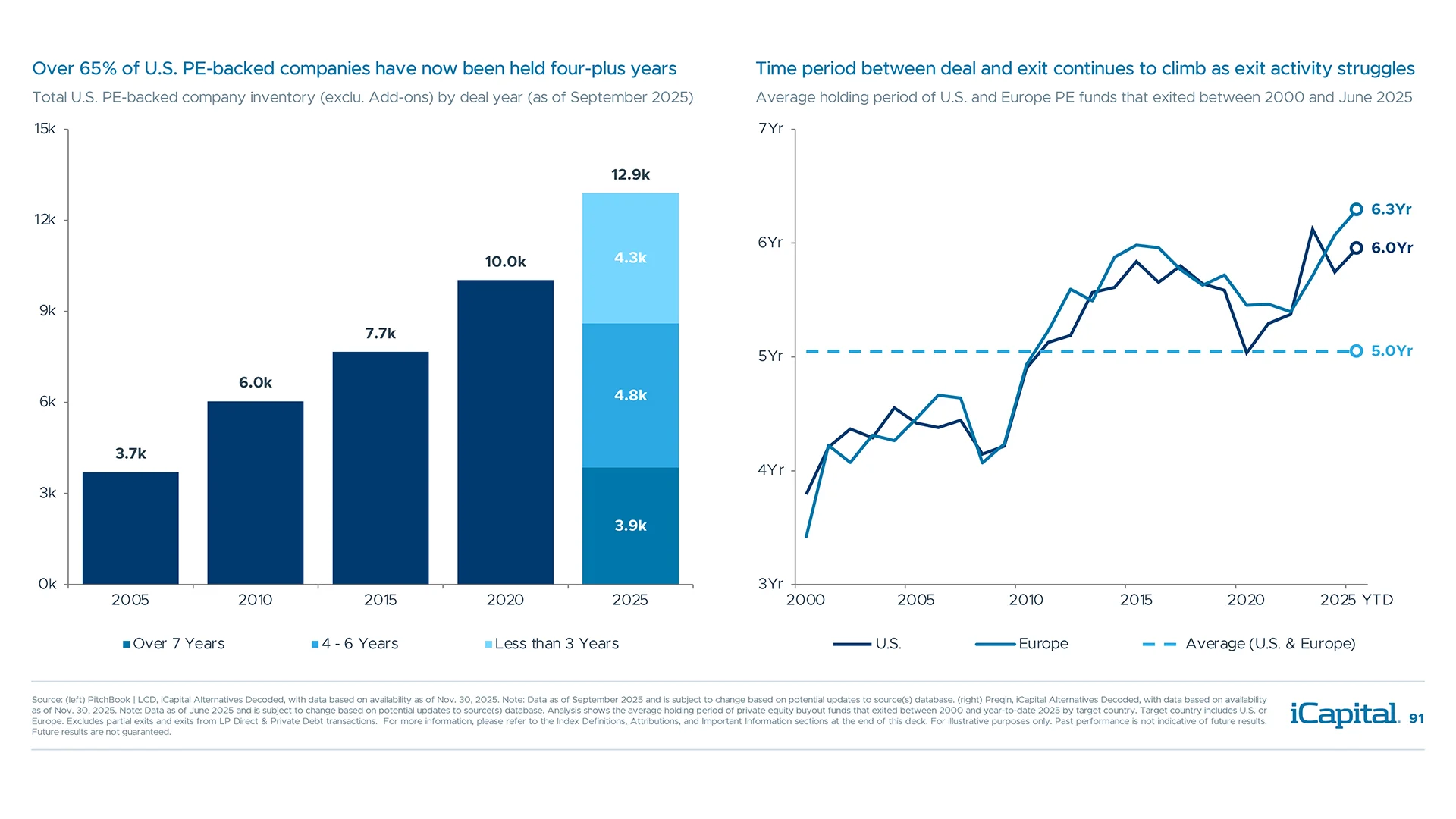

The private equity exit overhang is growing, with a significant backlog of unrealized value

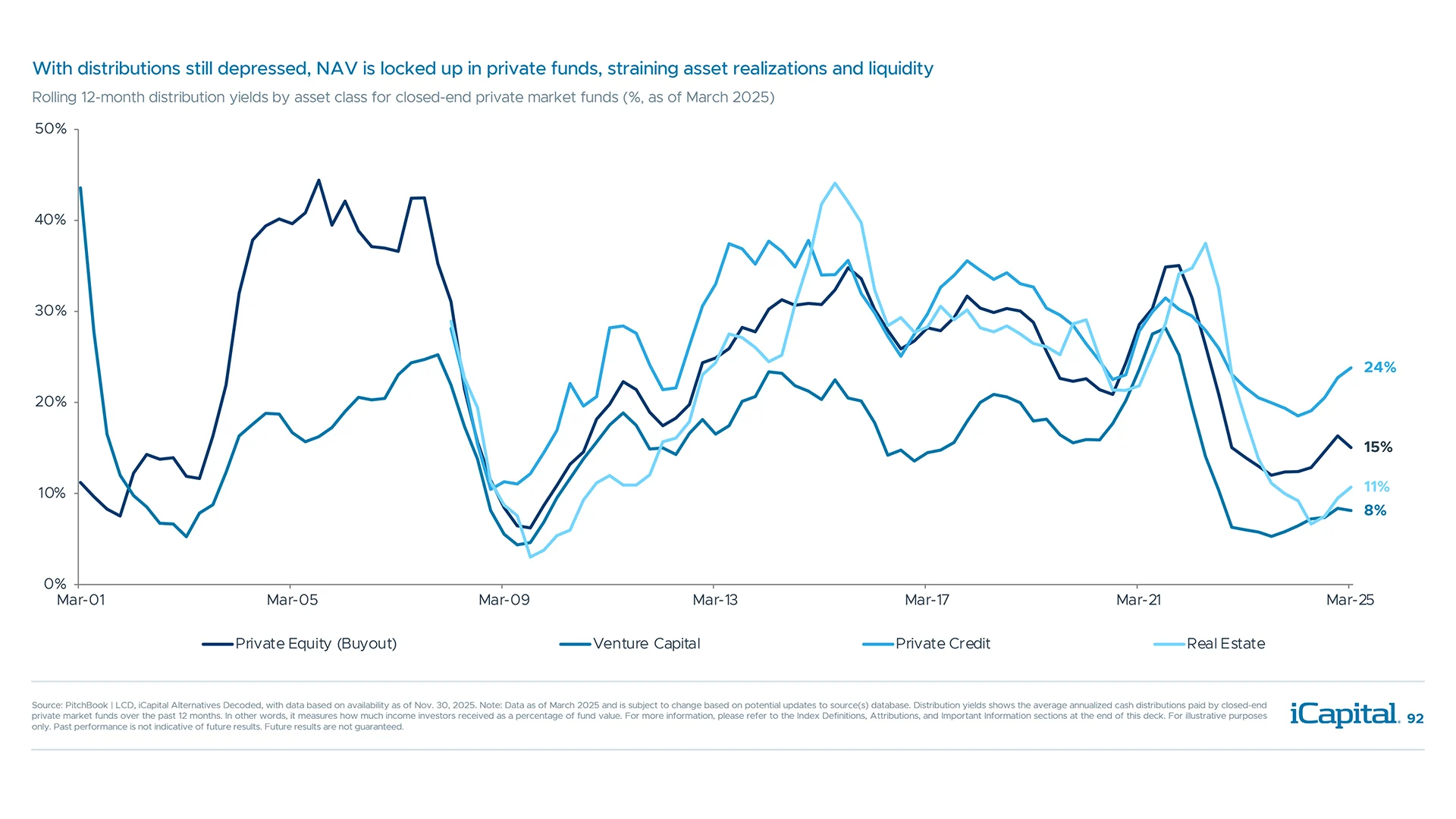

Distributions are recovering but still suggests a challenging environment for realizations

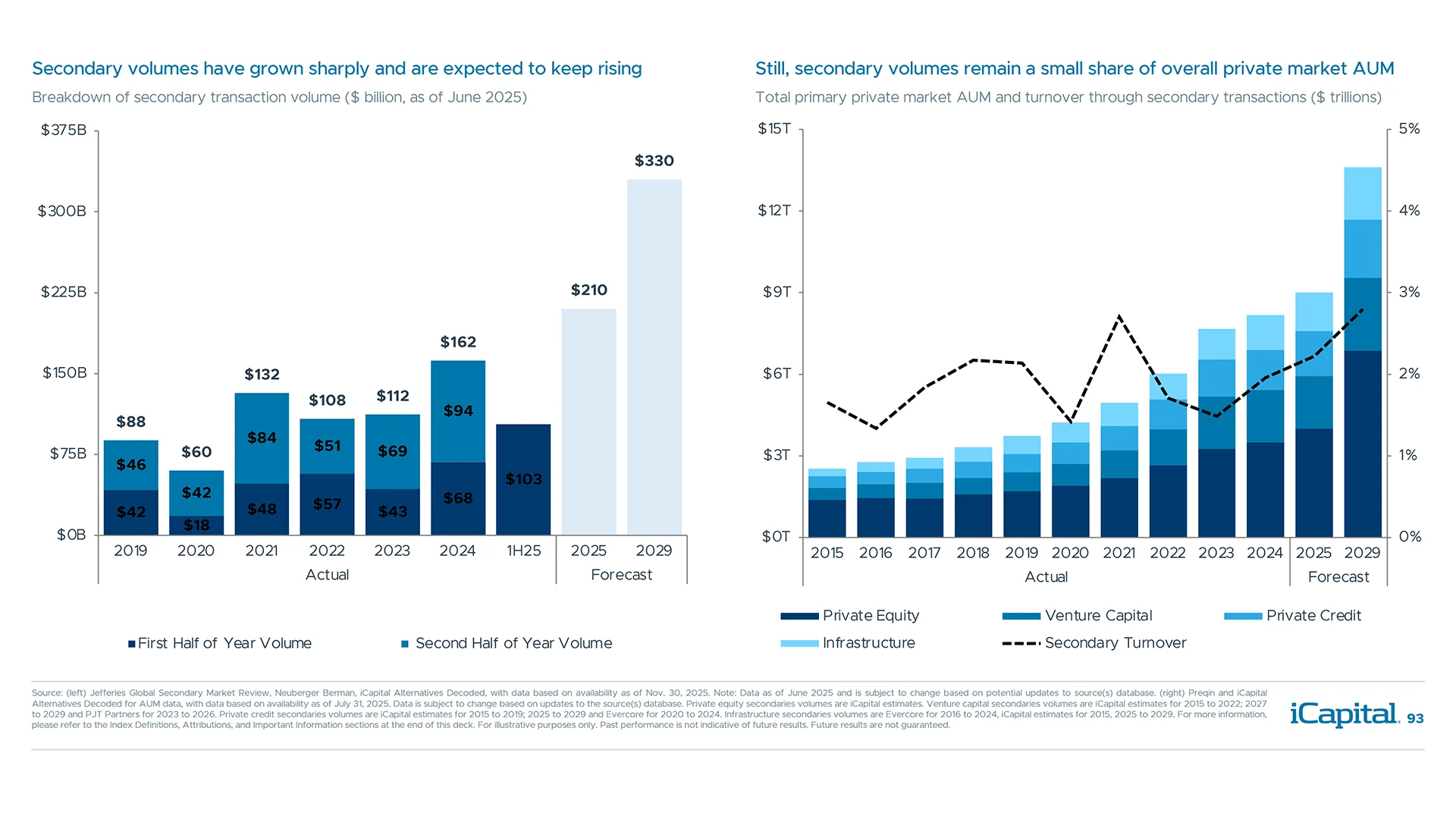

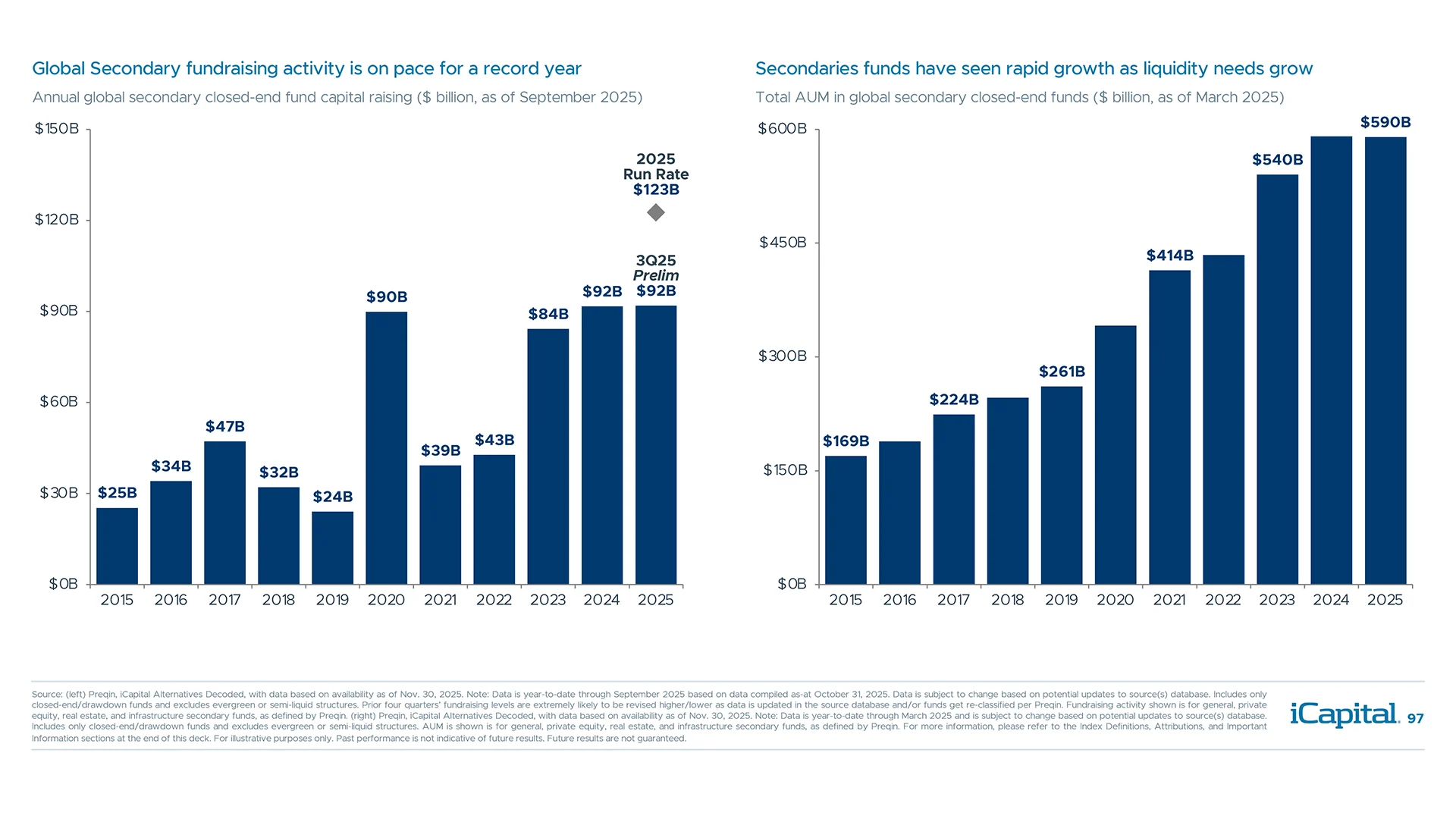

With the growth in private market capital, secondaries are one option to alleviate the overhang

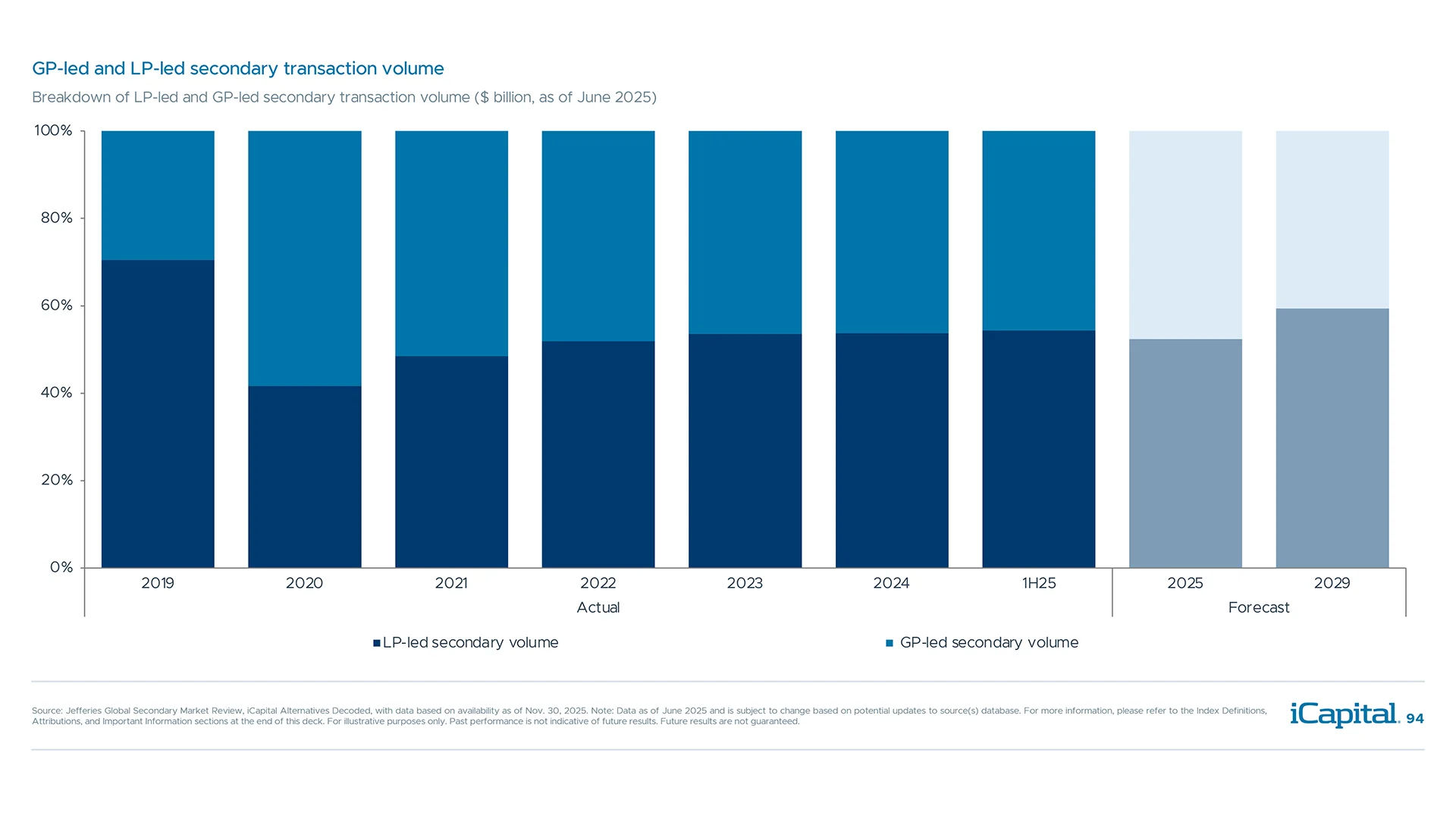

Both LPs and GPs have entered the secondary market, though LP-based volume has increased

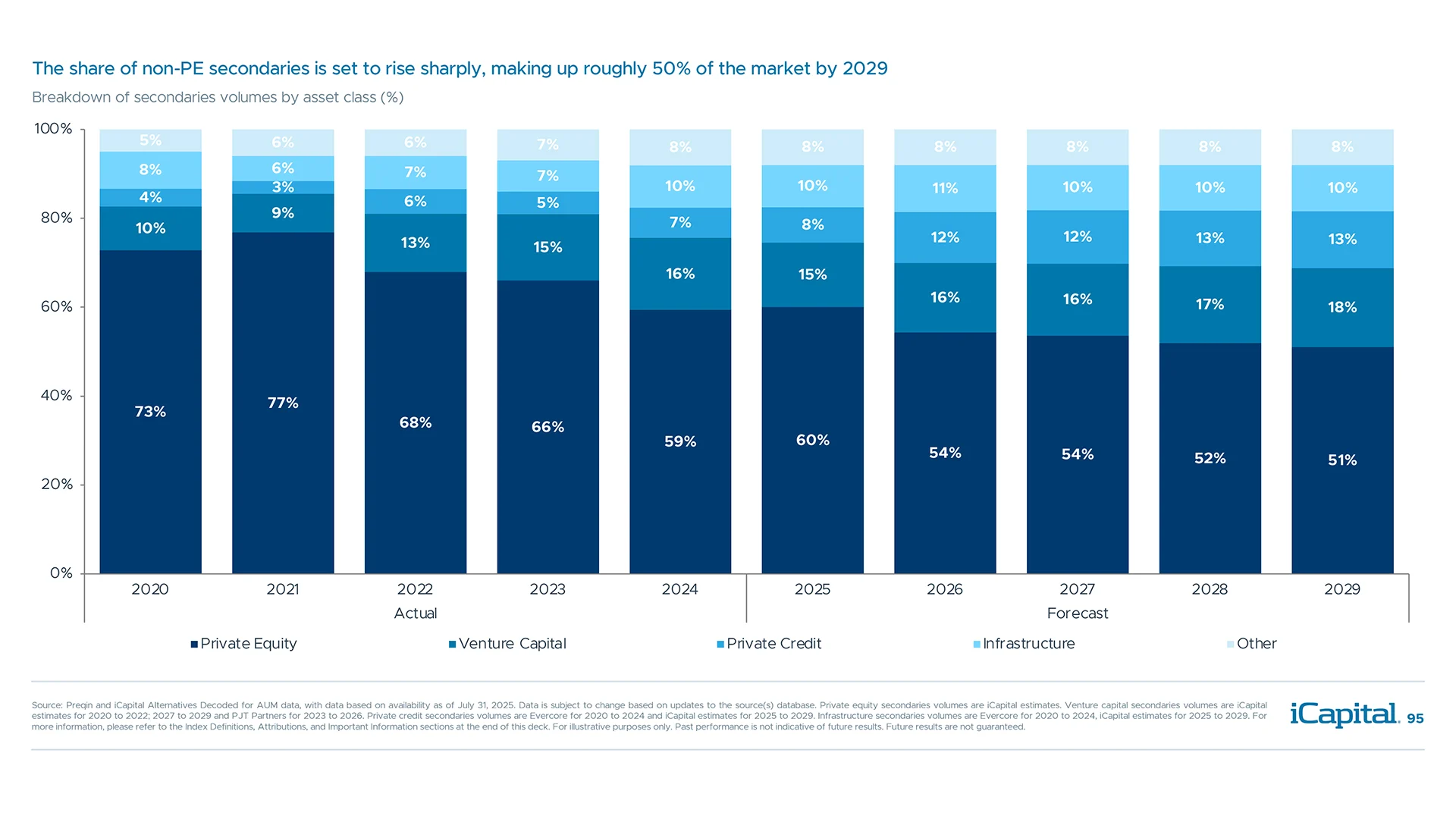

As PE capital grew and created a need for secondaries, other asset classes are now following

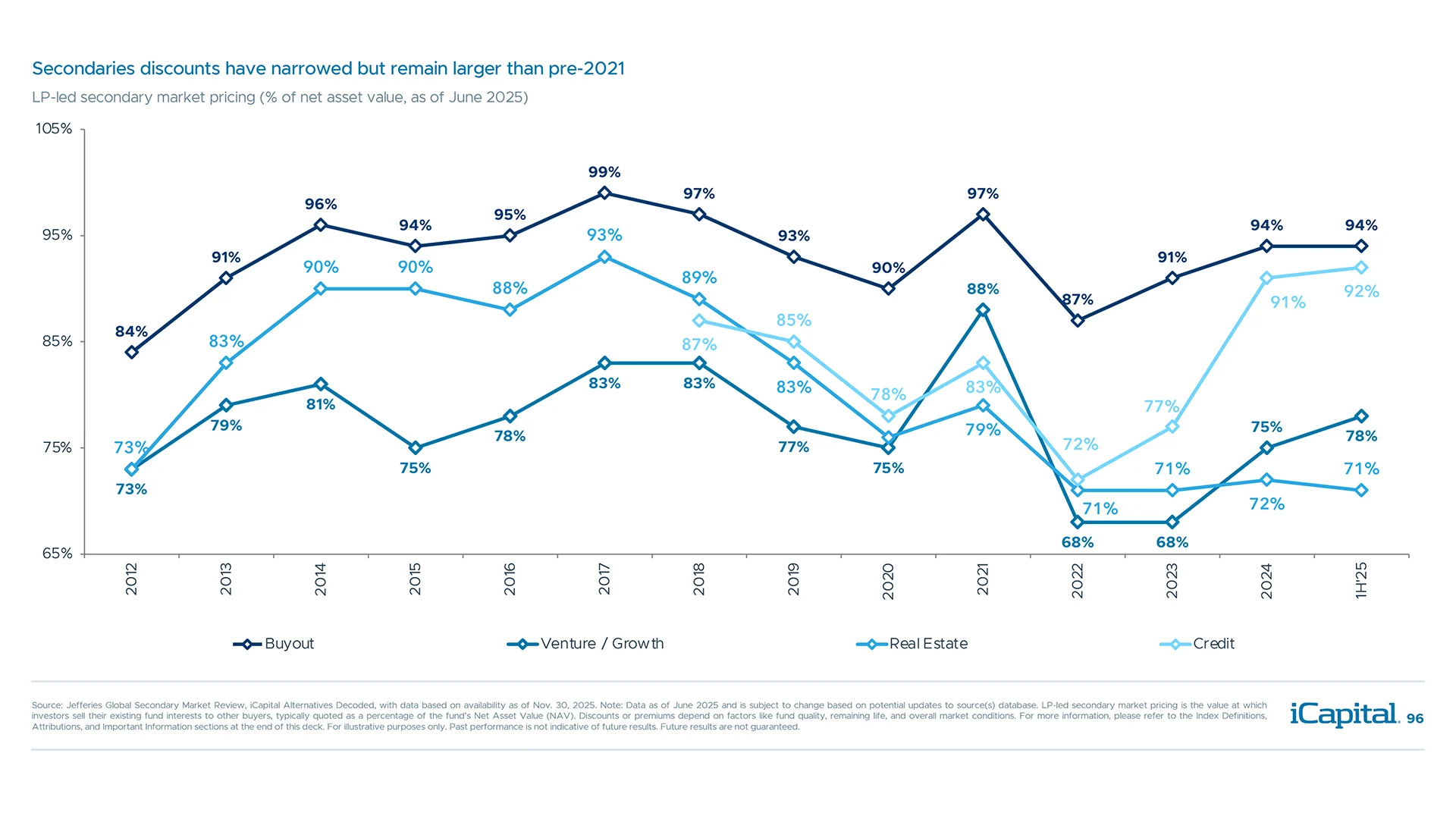

Secondary discounts have narrowed, but remain attractive on a longer-term view

Growth in primary capital and an expanding use of secondaries creates a strong backdrop

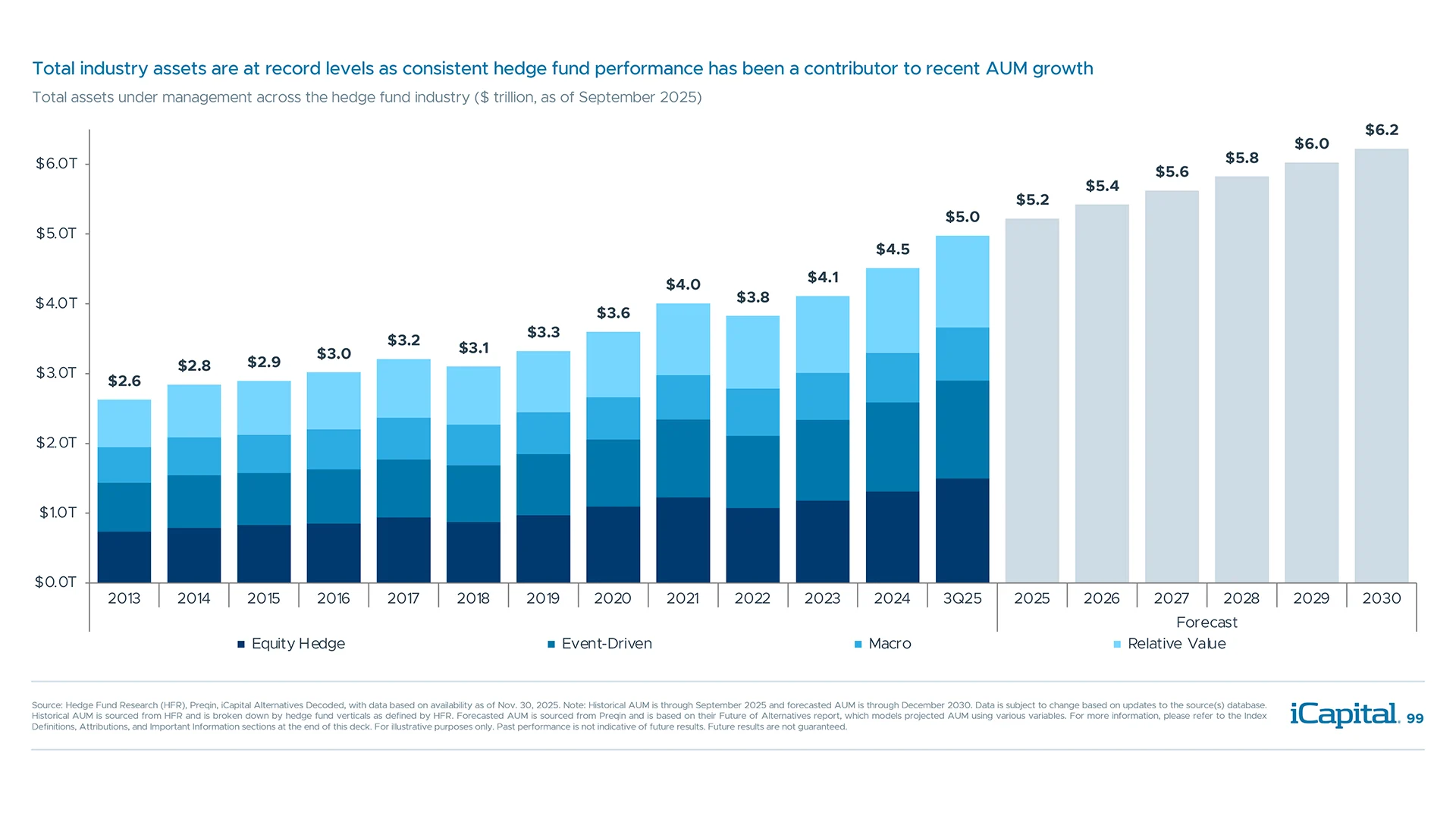

Hedge fund AUM has rebounded and is at record levels

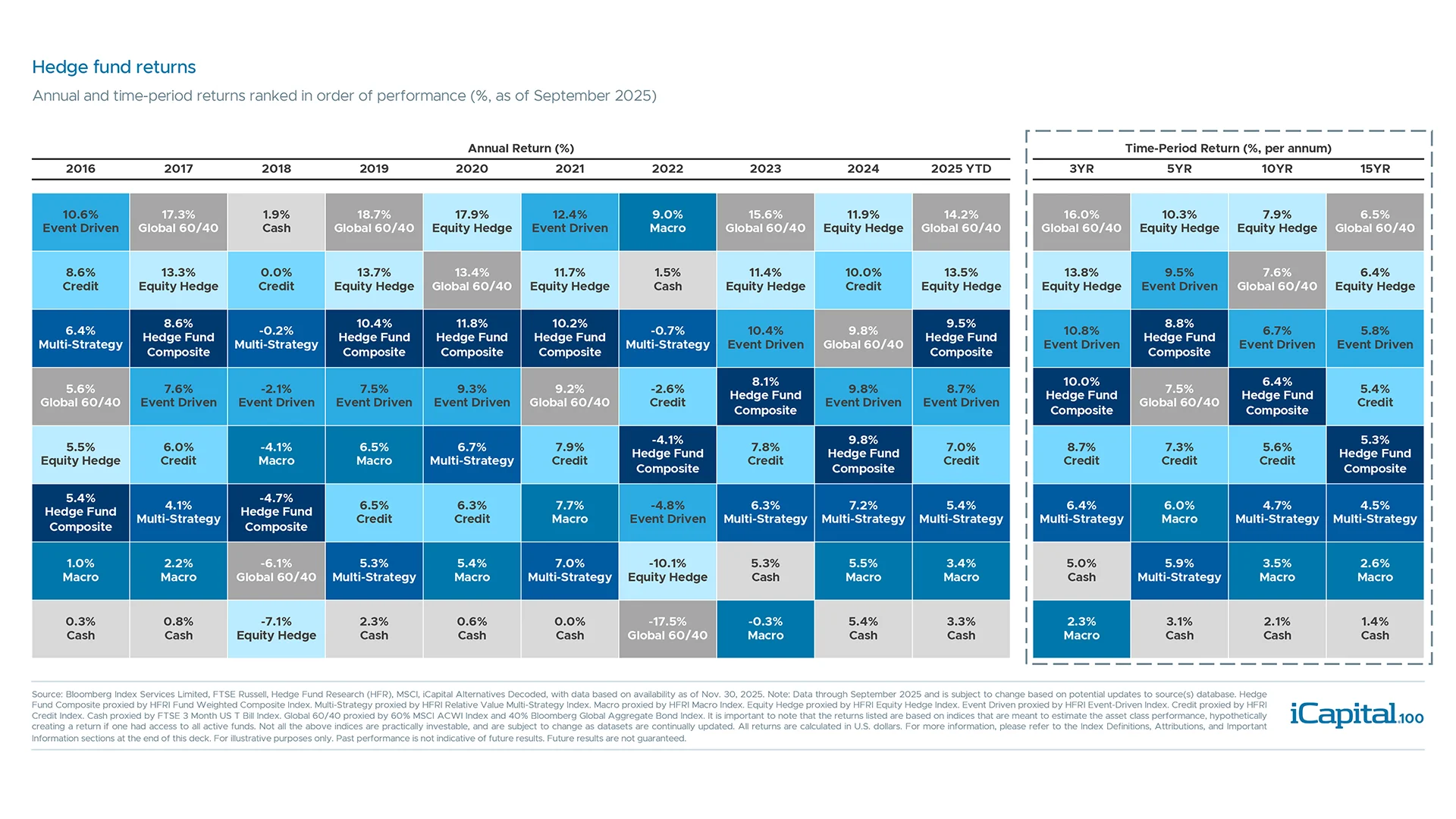

Different hedge fund strategies can help position for various market conditions

Similar number of hedge fund launches and liquidations highlight selection importance

Traditional 60/40 portfolio is not offering the “natural” diversification it use to, especially today

Historically, adding hedge funds to traditional portfolios has improved risk/return

Over time, hedge funds offer equity-like results with less downside risk

Hedge funds have generally performed better during periods of elevated rates above 2.5%

Hedge fund opportunities increase in periods of higher equity dispersion, low correlation

Despite the recent compression in index spreads, distressed credit opportunities exist

Volatility can be a driver of returns for hedge funds

Event Driven strategies may benefit from the expected pick-up in capital markets activity

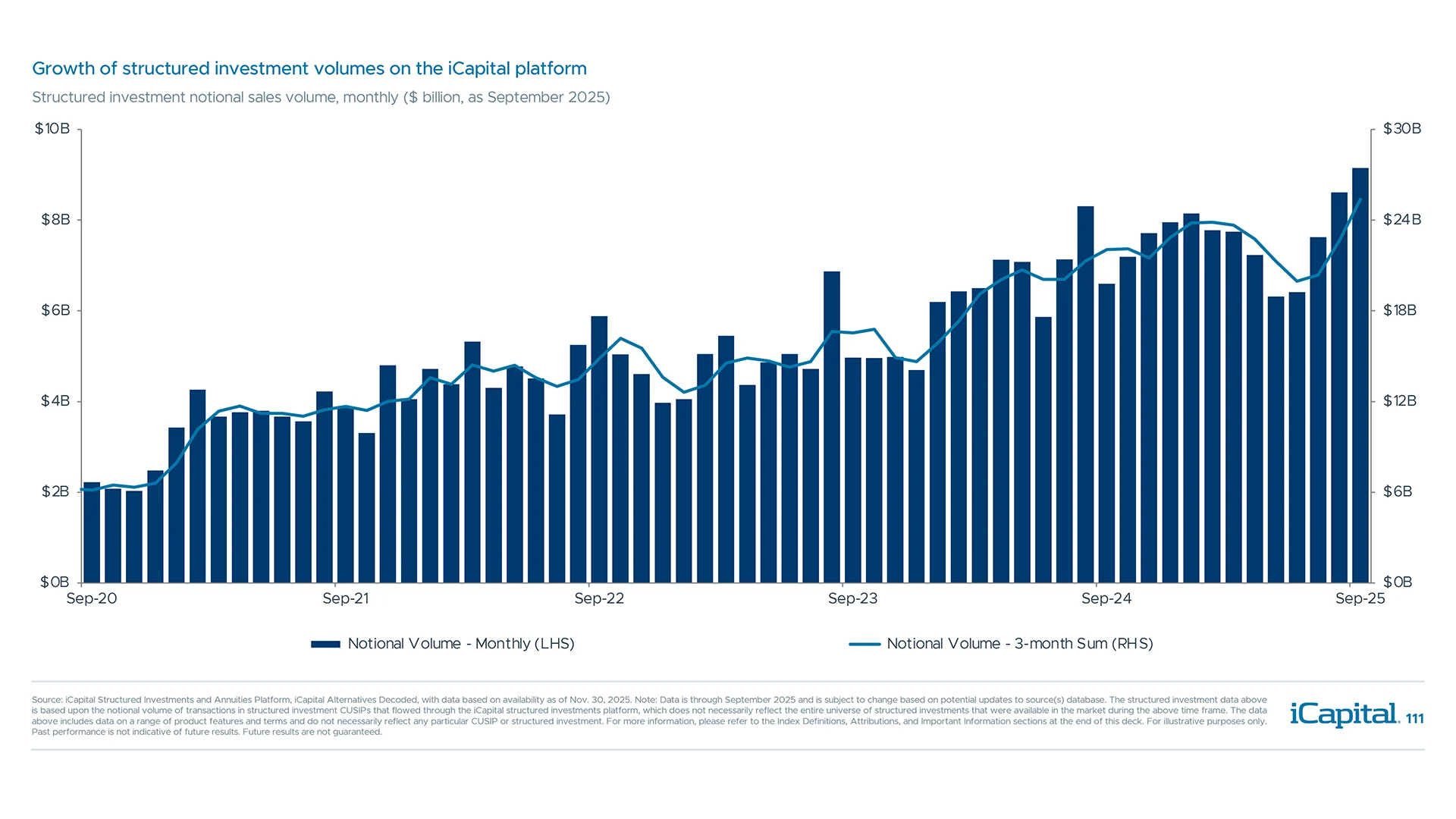

Structured investment volumes in the private wealth channel have grown over time

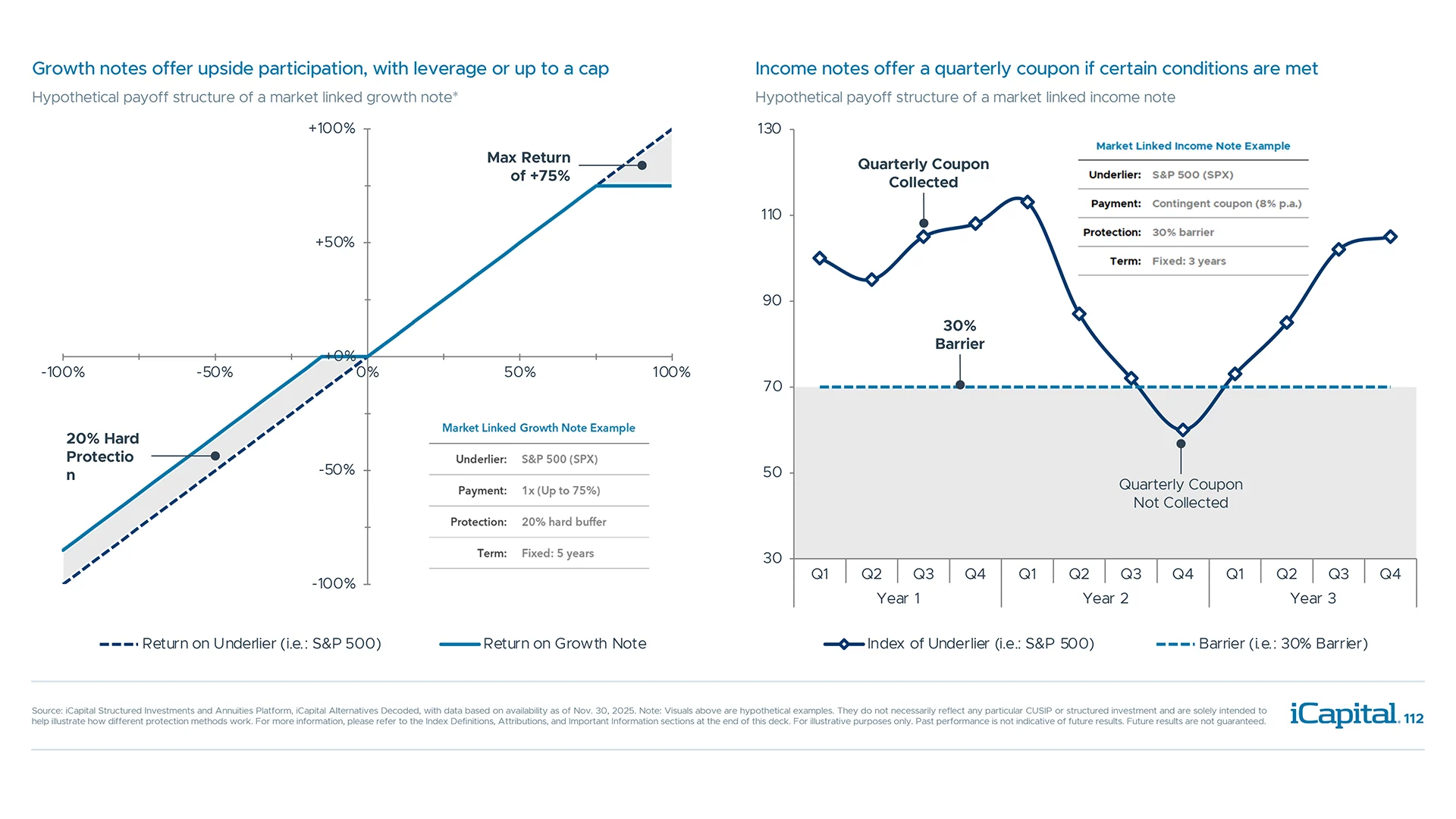

Payoff structures for market-linked growth and income notes

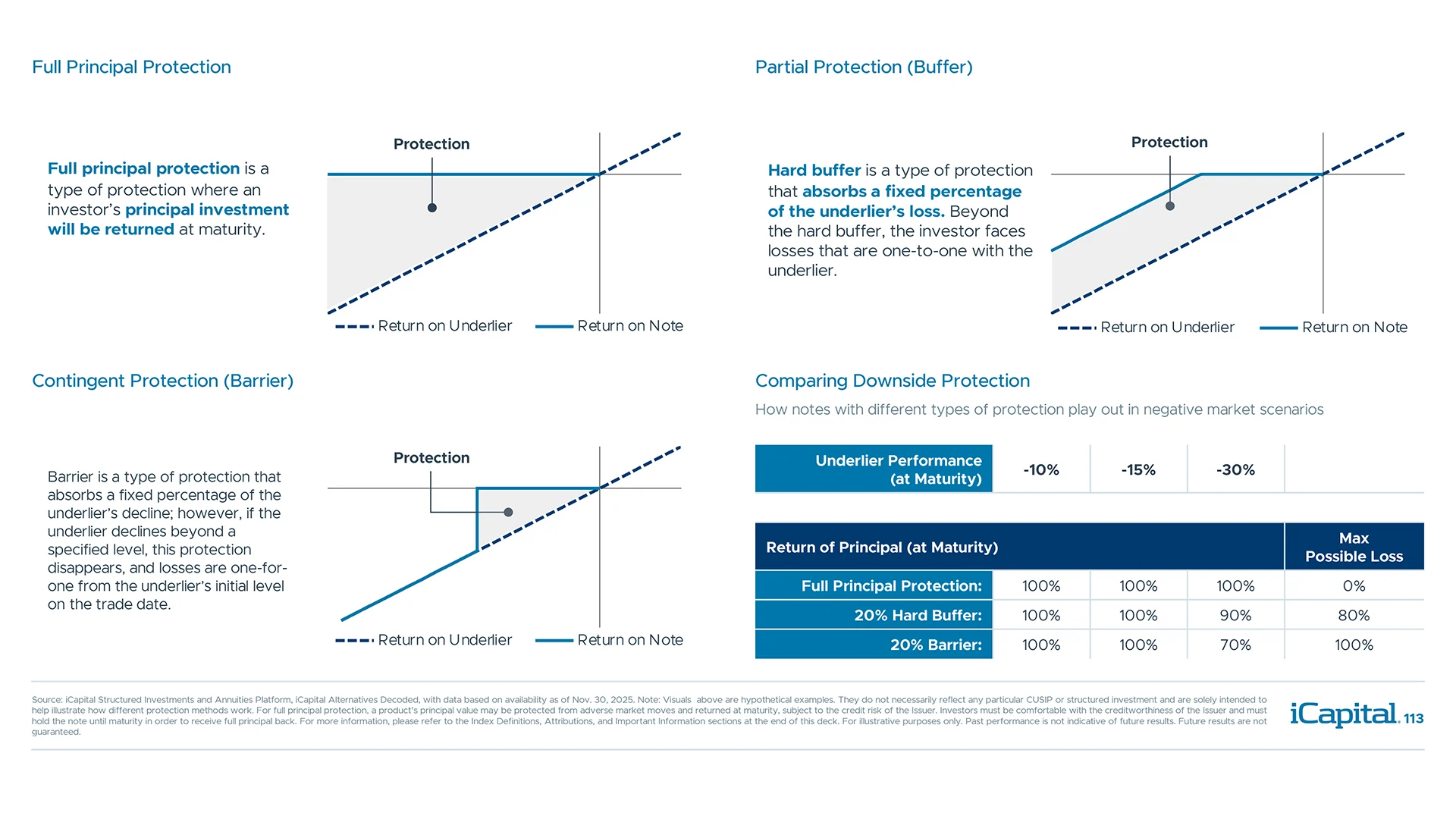

Types of protection available in structured investments

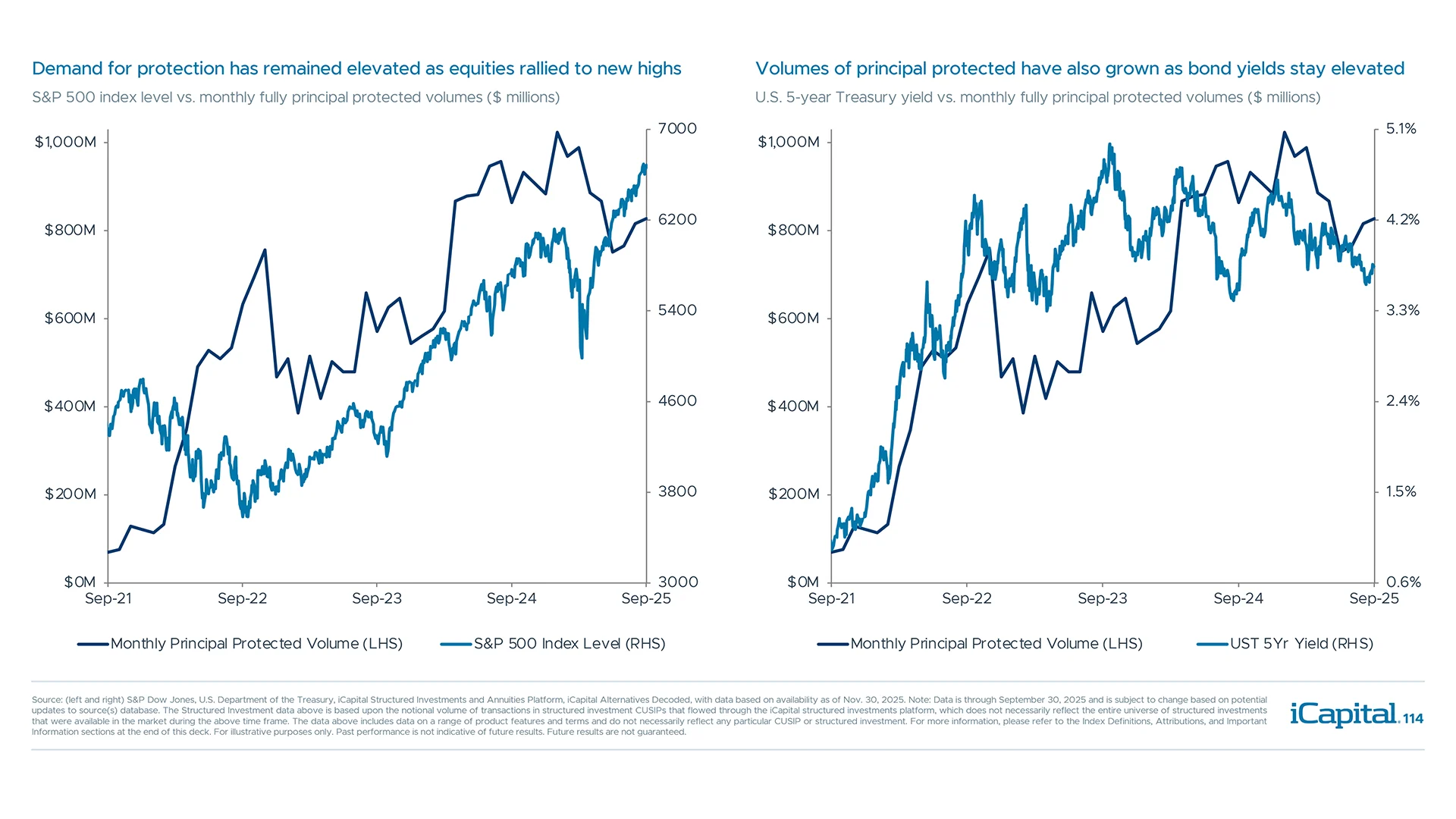

Full principal protection demand is a function of equity levels and bond yields

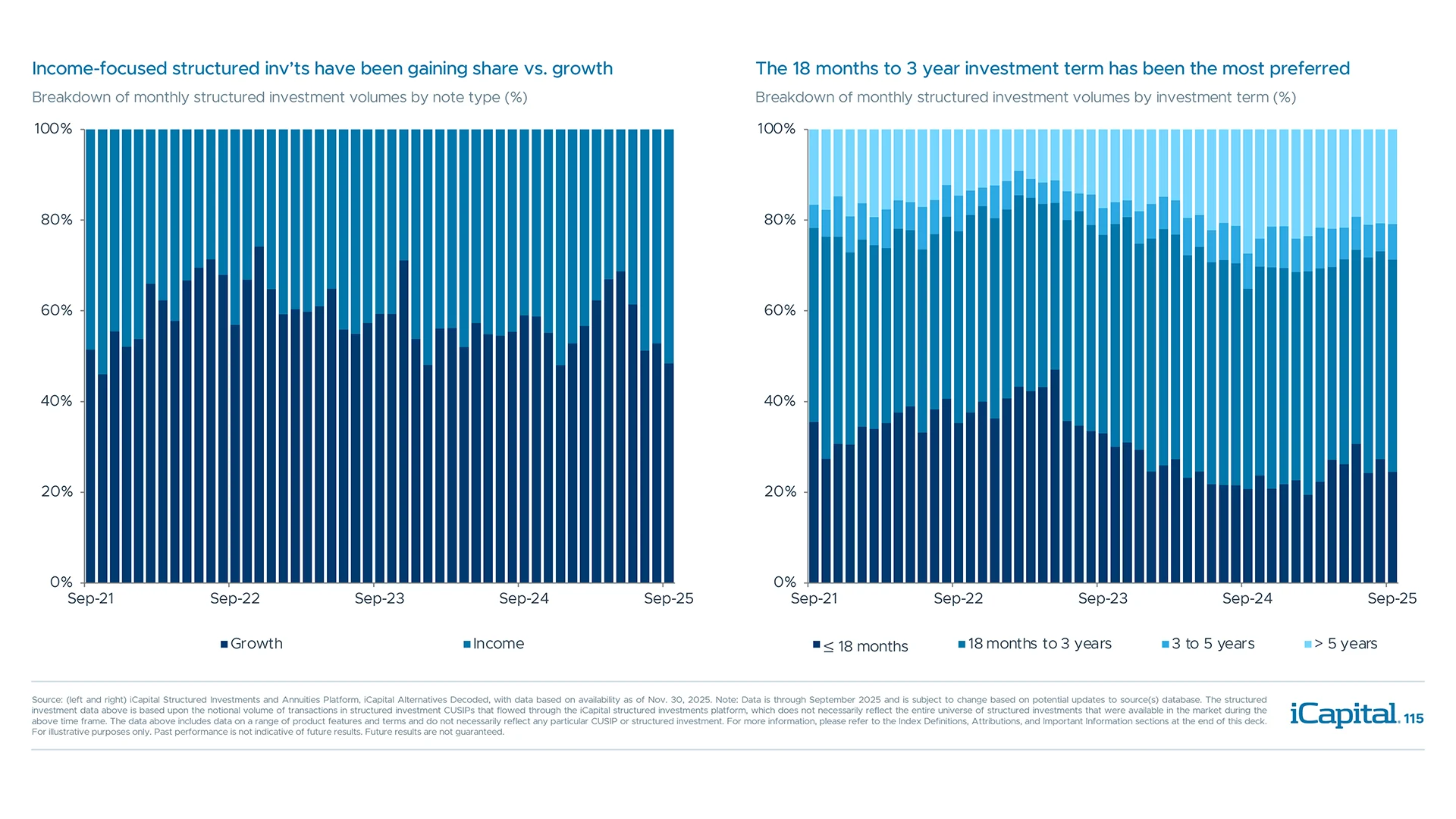

Preference for types and investment terms of structured investments varied over time

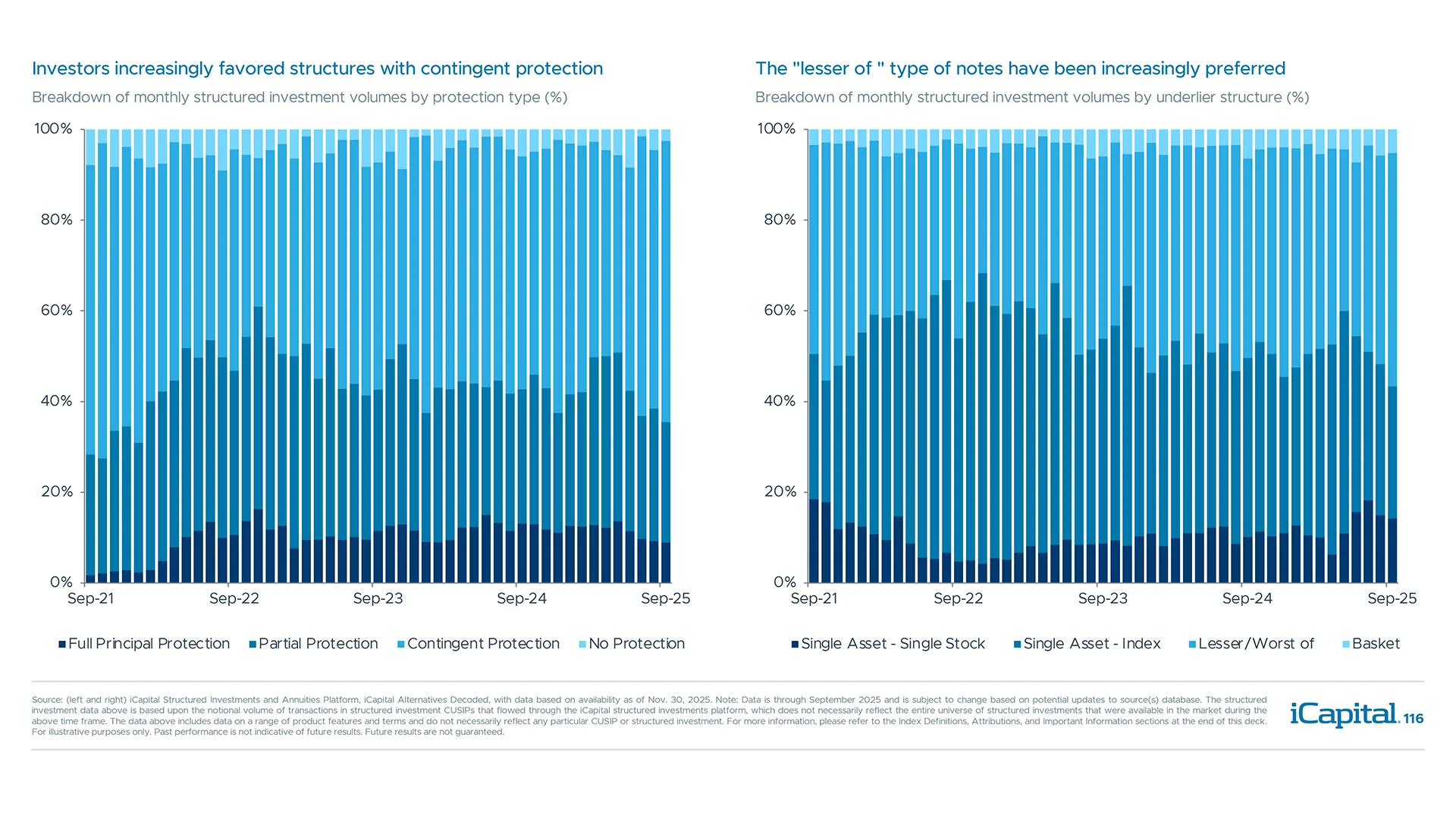

Preference for type of protection and type of underlying asset evolved over time

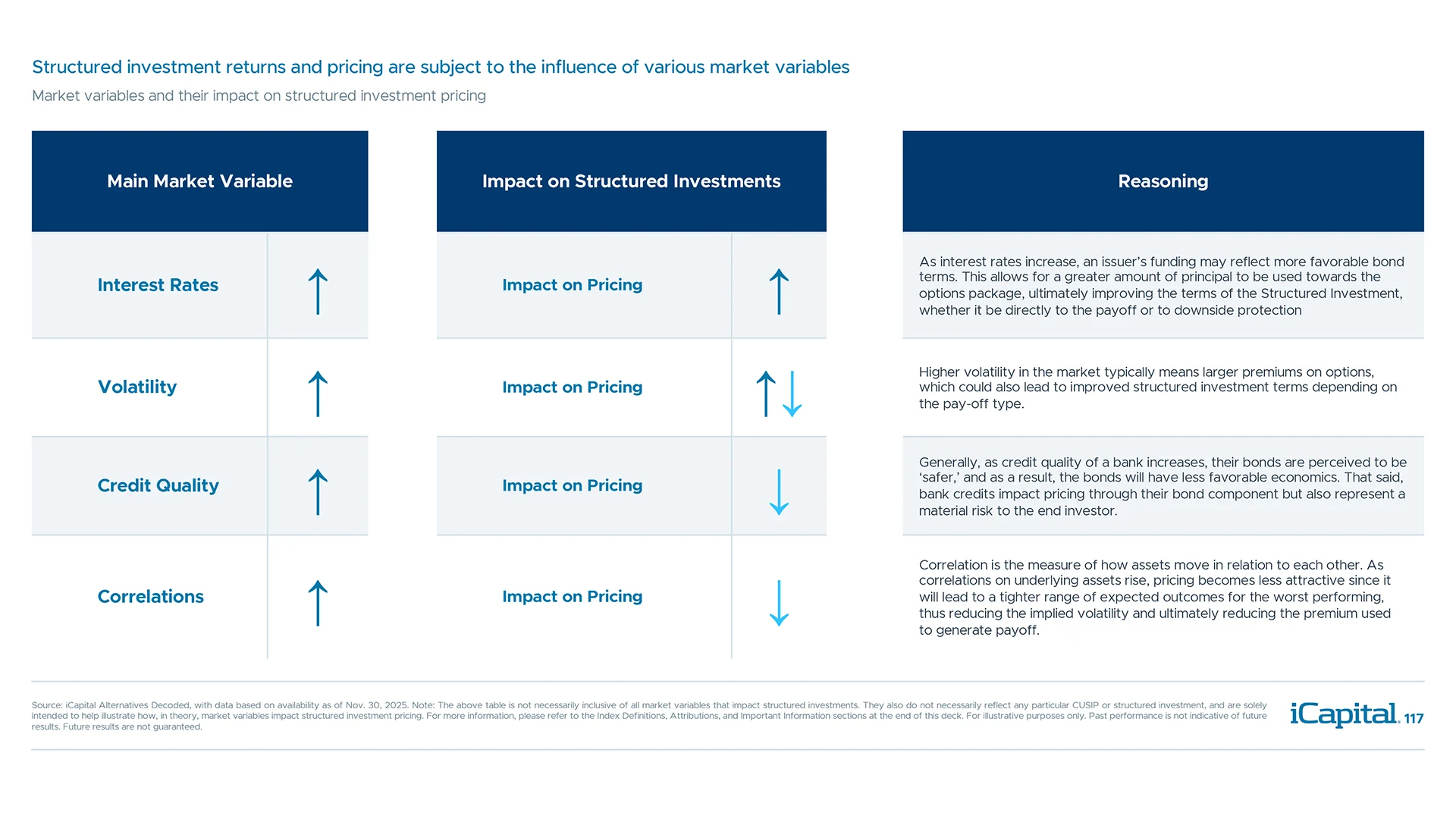

Structured investment returns and pricing are dynamic, fluctuate with market conditions

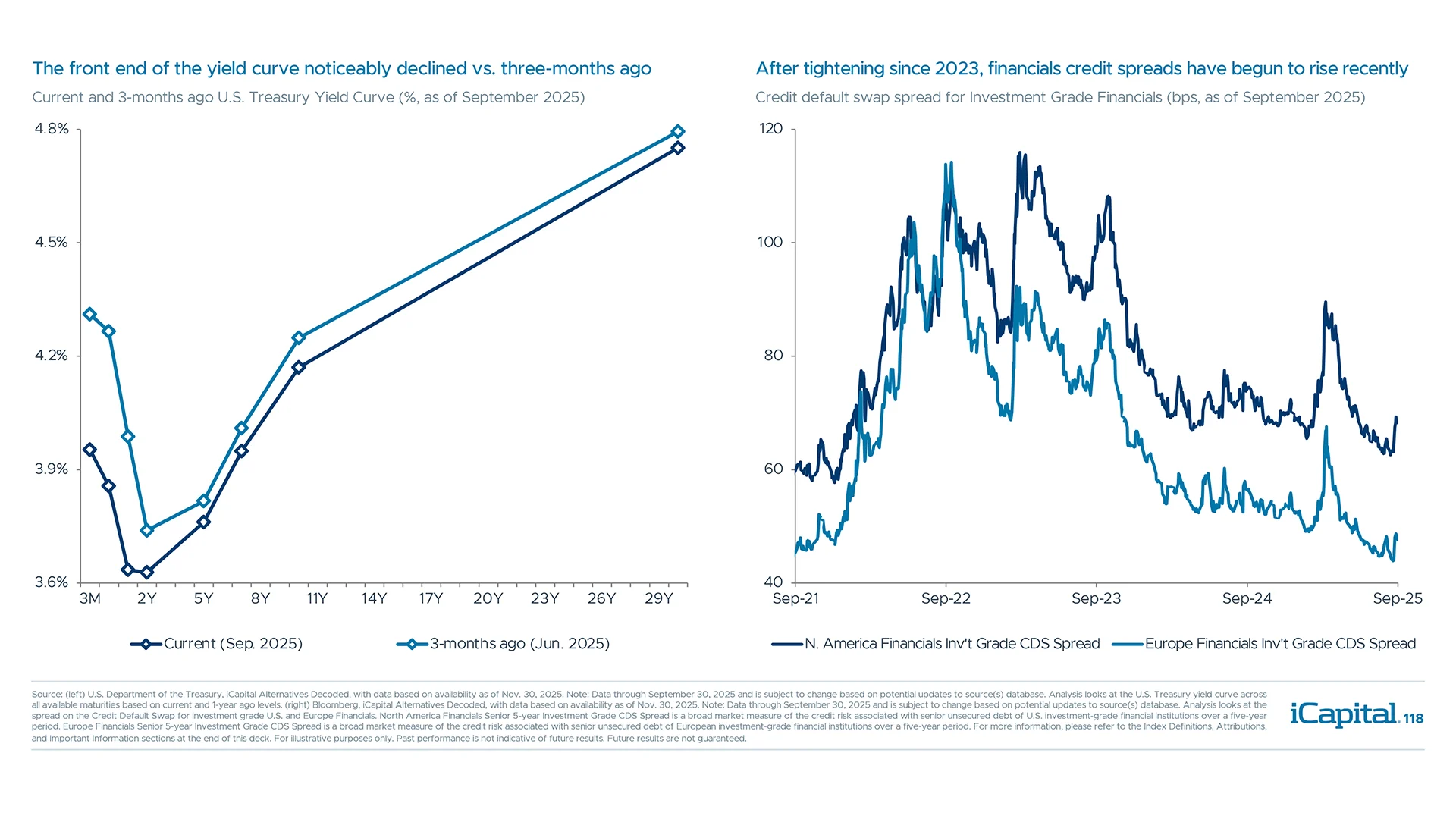

Rates have moved lower, though credit spreads have widened on the back of market jitters

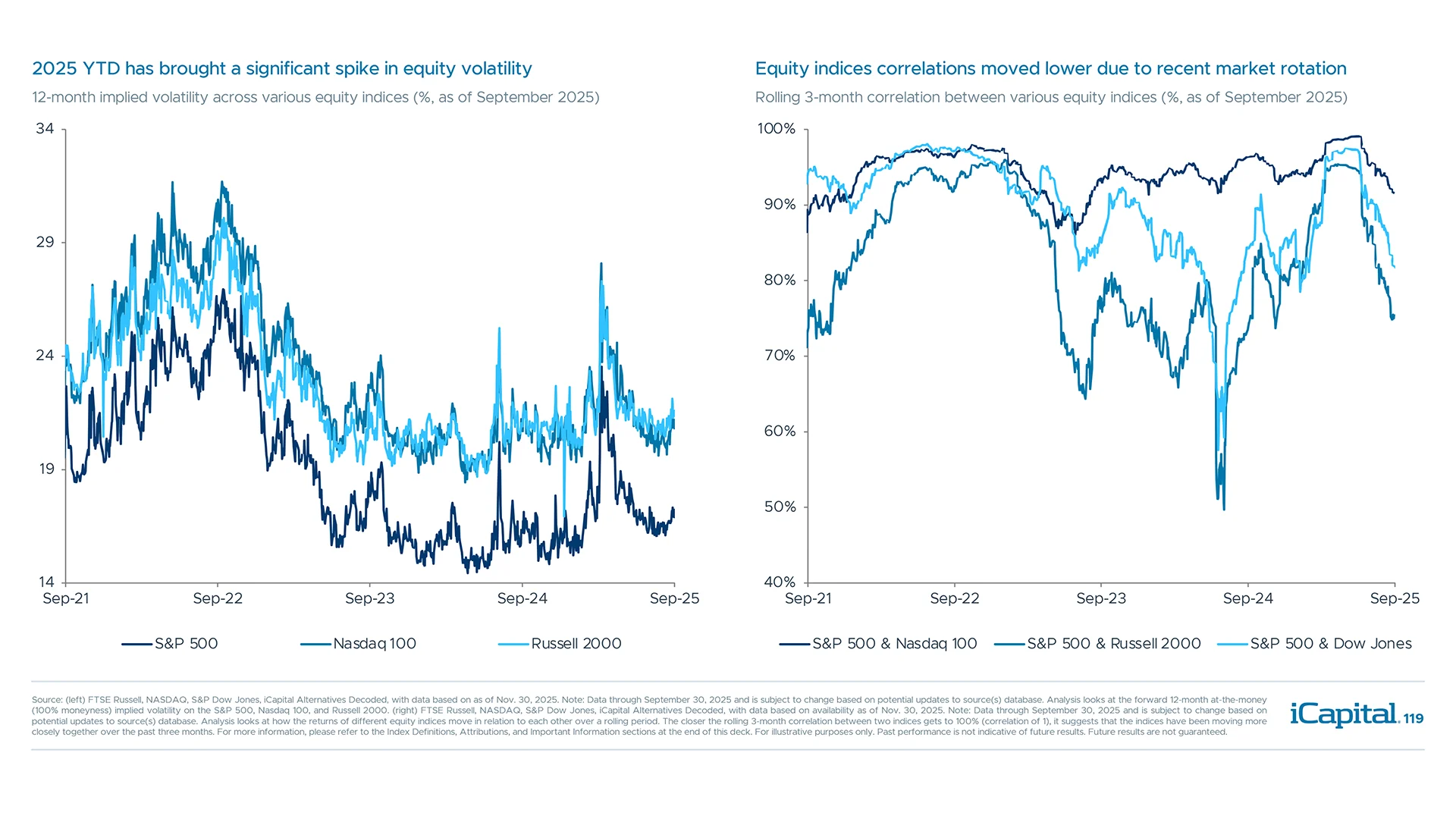

Volatility remains below 2021-22 levels but has trended higher in recent months

Definitions

Definitions (con'd)

Definitions (con'd)

Attributions

Important Information

Previous Releases

Alternatives Decoded – Q2 2025

Alternatives Decoded – Q1 2025

Featured Posts

IMPORTANT INFORMATION

iCapital and its affiliates provide various services through a number of affiliated entities – please refer to Certain iCapital Entities for a full list of entities. iCapital entities are collectively referred to as “iCapital”, and they all are affiliated with iCapital, Inc. and Institutional Capital Network, Inc. Among these affiliates, iCapital Markets LLC (“iCapital Markets”), an SEC-registered broker-dealer, member FINRA and SIPC, offers securities products and services. The registrations and memberships listed in Certain iCapital Entities in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services provided by iCapital. Additional information is available upon request.

This website is for informational purposes only. This website is the property of iCapital and may not be shared, reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This website and any information included on it are not intended, and may not be relied on in any manner, as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. Financial products, including investment funds and structured investments, are complex and may be speculative and are not suitable for all investors. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This website and the information contained on it is not intended to, and does not, address the financial objectives, situation or specific needs of any specific investor.

iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc.