Support Your Business with Accurate and Timely Alts Data

Alternative investments continue to play an ever-increasing role in meeting client objectives. While the iCapital platform makes investing in and managing alternatives easier, most legacy alts data is delivered offline. Our alts data management solution specializes in processing and reporting on these hard-to-track offline assets.

A Better Approach

Built from the powerful combination of the legacy Mirador and AltExchange businesses, iCapital delivers a technology-enabled alts data management service providing data you can trust.

Our alts management model leverages proprietary artificial intelligence and machine learning-powered technology to extract and label alts data, combined with bookend human interaction to enhance data quality.

Our technology and processes enable the collection, structuring, and sharing of alts data with any required system, aiming to reduce time between valuation updates for your clients.

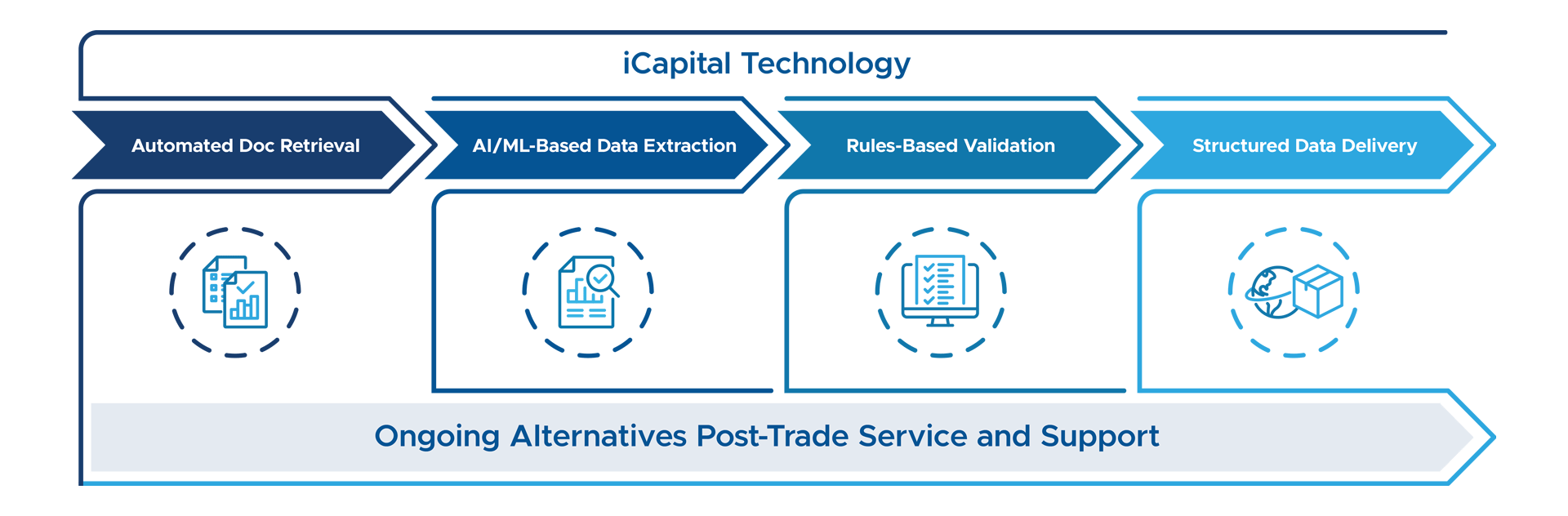

Alternative Data Management Workflow

For illustrative purposes only.

Seamless Document Retrieval

Making hard-to-track assets more accessible

Our proprietary syncworkers leverage APIs, RPA technology and other leading practices to automate the extraction of alts documents, regardless of their source. The documents are then securely stored and can be distributed where you need them. Our alts data management service enables us to pull documents accurately and efficiently and process large position counts.

Sample sources:

- Direct from clients

- Interested third party

- Access to client portal

Accurate Data Extraction

Technology that can deliver a competitive advantage

Our advanced tools are powered by an artificial intelligence and machine learning chassis to intelligently analyze and interpret vast amounts of unstructured data from the varying types of alts documents issued (with most hard-to-track assets documented via PDF). With the ability to identify and extract key information, our solution is designed to enhance the accuracy and timeliness of your data.

- accelerated data processing

- enhanced compliance

- reduced risk of human error

Rules-Based Data Validation

Support your decision-making with data accuracy you can trust

By leveraging advanced technology, iCapital’s alts data management solution seeks to streamline efficiencies and improve data accuracy. Here’s where our approach is different, providing you with a dedicated team that monitors for exceptions and deploys our five (5) rules-based litmus tests.

Please contact us to learn more.

Structured Data Delivery

Convenient access to your alts data without the headaches

Once your alts data has been “normalized” our platform integrates seamlessly with existing downstream systems, providing real-time data delivery where you want it and when you need it. By standardizing data formats and ensuring secure, efficient access, we empower you to focus on strategic decision-making rather than administrative tasks.

Data delivery destinations could include:

- custom client eco-systems

- reporting platforms

- fund admins

In addition to seamless document extraction, data extraction and delivery, our solution includes secure document storage for future reference.

Dedicated Support on Your Team

As your partner, we will provide a dedicated team who will adopt your firm processes and reporting requirements. Avoid key person risk associated with the loss of an internal “power user.” We will always be at your side.

Let us show you how we can help.

Why Clients Turn To Us

Go Beyond Valuation

Comprehensive reporting goes beyond mere valuation, and alts make it complicated. We provide consolidated balance sheet reporting across all asset classes.

Support Scalability

As your alts portfolio expands, your success depends on your ability to scale your operation. We track and consolidate disparate data points across your entire portfolio, no matter how large it becomes.

Align Your Priorities

As an advisor, your priority is interpreting data and guiding your clients on making the best investment decisions. Simply put, we get you out of the data game.

Featured Articles

IMPORTANT INFORMATION

iCapital and its affiliates provide various services through a number of affiliated entities – please refer to Certain iCapital Entities for a full list of entities. iCapital entities are collectively referred to as “iCapital”, and they all are affiliated with iCapital, Inc. and Institutional Capital Network, Inc. Among these affiliates, iCapital Markets LLC (“iCapital Markets”), an SEC-registered broker-dealer, member FINRA and SIPC, offers securities products and services. The registrations and memberships listed in Certain iCapital Entities in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services provided by iCapital. Additional information is available upon request.

This website is for informational purposes only. This website is the property of iCapital and may not be shared, reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This website and any information included on it are not intended, and may not be relied on in any manner, as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. Financial products, including investment funds and structured investments, are complex and may be speculative and are not suitable for all investors. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This website and the information contained on it is not intended to, and does not, address the financial objectives, situation or specific needs of any specific investor.

iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc.