Enjoy the rally, but perhaps don’t get too comfortable with it—that was our message of caution last week. And this week has illustrated why investors need to adopt a more defensive stance. There are two main reasons: first, the U.S. Federal Reserve (Fed) is going to be a persistent headwind for equities for the time being and, second, rising recession probabilities are not yet priced in.

Parallels to the seventies do not bode well for equities

Just when the markets seemed convinced that they had priced in maximum hawkishness from the Fed—with the Fed funds rates expected/projected to rise to 2.5% by the end of 20221—it has signaled it will do more. This week, the Federal Open Market Committee minutes revealed the Fed’s intention to start using balance runoff and quantitative tightening (QT) tools as soon as its May meeting, somewhat sooner than markets expected. Notably, the minutes allowed for the sale of T-bills if the maturities in certain months were below certain caps and discussed outright sales of mortgage-backed securities once the runoff is well under way.2 As long as inflation is elevated and shows no signs of abating, the risk from a market perspective is that the Fed will err on the hawkish side. So, for the time being, expect the Fed to be a persistent headwind to equities at best. At worst, it risks repeating the 1970s.

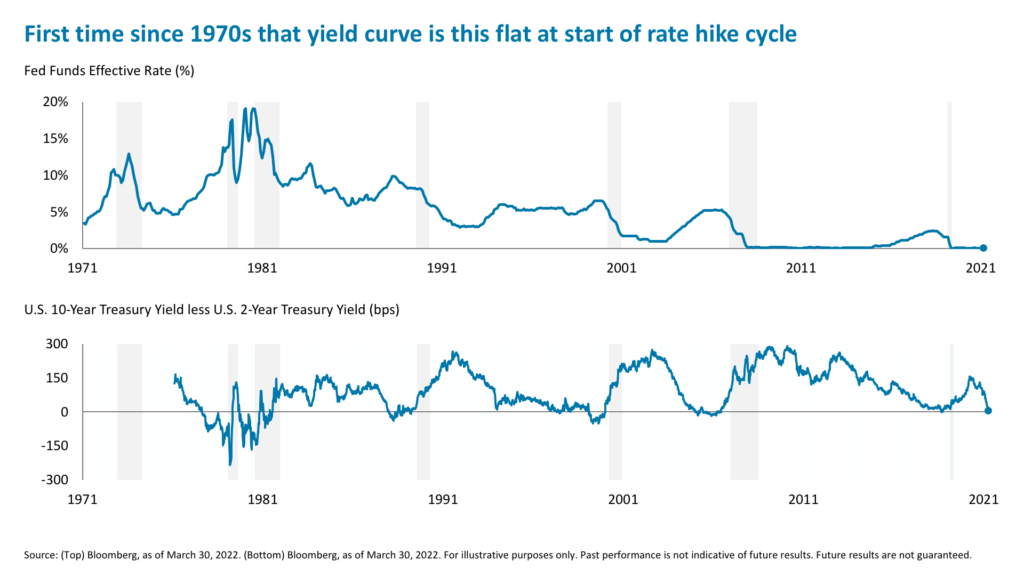

When was the last time the real two-year to 10-year treasury yield curve and the nominal yield curve diverged so sharply? The 1970s.3 And when was the last time the Fed began a rate hiking cycle when the yield curve was this flat or inverted? Again, the 1970s.4

At that time, the Fed raised rates aggressively to combat inflation just as high prices were starting to bite, prompting a recession and a stock market decline.5 The S&P 500 was down 17.37% in 1973, down 29.72% in 1974, and again down 11.50% in 1977.6 The risk today is that the Fed is again hiking into a slowdown and the combination of high prices and higher interest rates will trigger a consumer-led recession. Notably, Fed chair Jerome Powell recently said that he is willing to do what it takes to bring prices under control even if that means hurting the economy.7 This risk is not currently being priced in and suggests additional downside.

At that time, the Fed raised rates aggressively to combat inflation just as high prices were starting to bite, prompting a recession and a stock market decline.5 The S&P 500 was down 17.37% in 1973, down 29.72% in 1974, and again down 11.50% in 1977.6 The risk today is that the Fed is again hiking into a slowdown and the combination of high prices and higher interest rates will trigger a consumer-led recession. Notably, Fed chair Jerome Powell recently said that he is willing to do what it takes to bring prices under control even if that means hurting the economy.7 This risk is not currently being priced in and suggests additional downside.

Recession probabilities are not priced in, suggesting additional downside

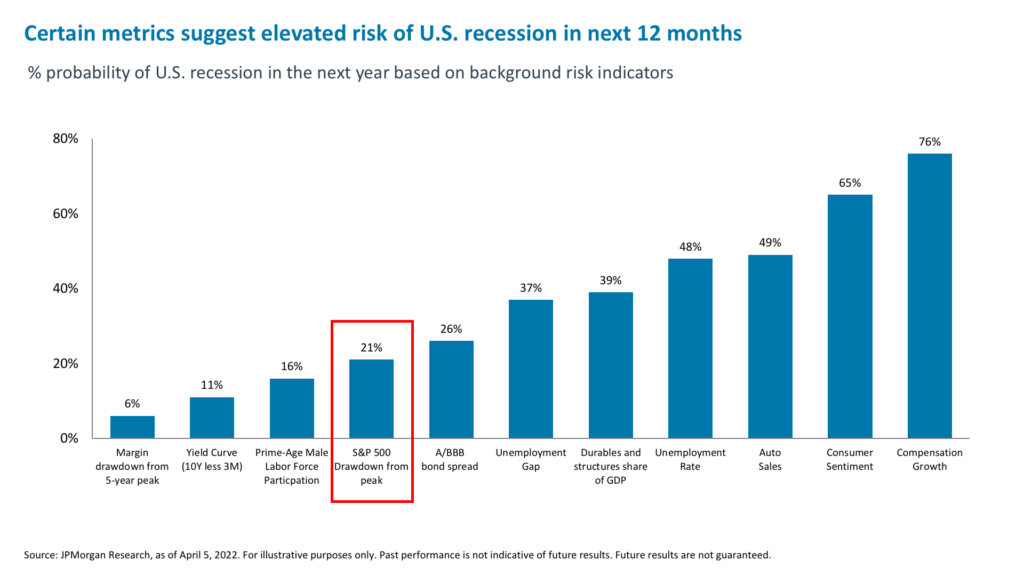

It seems to us that we have the recipe for a consumer-led recession already. Real average weekly earnings growth is running at a negative 2.3% year-over-year.8 Consumer expectations for the state of personal finances are nearing a 10-year low.9 Mortgage rates have surged 160bps since the start of the year to almost 5%.10 And at the current pace of rate hikes priced in by markets, the Fed will push real rates into restrictive territory in 2023.11 It is likely just a matter of time before a pullback in consumer spending starts to show up in data. And that is something that markets are not prepared for. For example, the S&P 500-implied probability of a recession is now 21% (down from a recent high of 40%) while the probability of a recession is 76% based on compensation growth and 48% based on the unemployment rate.12

Whether a recession ultimately transpires in 2023 or the Fed manages to skillfully achieve a soft landing, we think the elevated probability of a recession is a tail risk worth hedging.

Expect a more difficult path to equity returns

Expect a more difficult path to equity returns

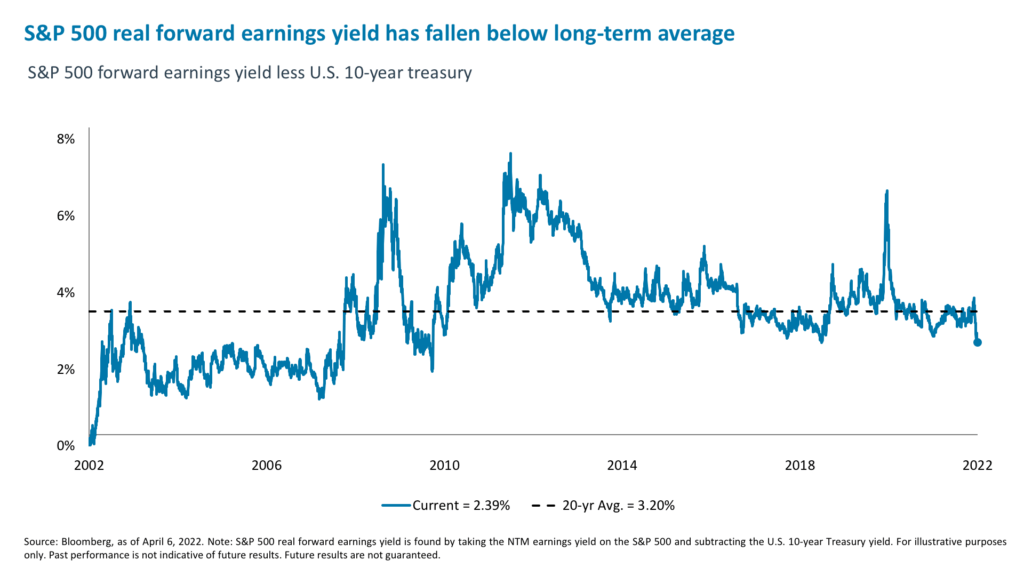

We expect market returns to be muted over the next 12 months and the path to returns to be more difficult to navigate. For example, performance in the 12 months preceding peaks in global data has historically averaged 5% for the S&P 500.13 Trailing MSCI six-month performance tends to be negative during periods when forward earnings estimates have trended down.14 The S&P 500 and Nasdaq have returned a modest 6% and 3% respectively in the 12 months after the first rate increase in previous hiking cycles.15 The S&P 500 is just about at fair value today assuming a 20x multiple of next-twelve-months earnings of $230.16 And the recent rise in bond yields changes the risk-reward balance for stocks—the spread between the S&P 500 dividend yield and the 10-year U.S. treasury yield is now negative and the earnings yield versus 10-year treasuries has fallen to 2.46%, below a 20-year average.17 For now, equities are just not as attractive as they once were. Muted returns is now our base case, and the tail risk of a sooner-than-expected recession cannot to be ignored.

Investors have made a lot of money in equities in the last two years. The S&P 500 is now up 33.1% from its pre-pandemic top on February 18, 2020 and has risen 100.7% from its pandemic bottom on March 23, 2020.18 However, given the above, it no longer makes sense to have a unidirectional, long-only bet on equities. We reiterate last week’s advice to layer in some hedges and adopt a more defensive portfolio stance. How can investors do that?

Investors have made a lot of money in equities in the last two years. The S&P 500 is now up 33.1% from its pre-pandemic top on February 18, 2020 and has risen 100.7% from its pandemic bottom on March 23, 2020.18 However, given the above, it no longer makes sense to have a unidirectional, long-only bet on equities. We reiterate last week’s advice to layer in some hedges and adopt a more defensive portfolio stance. How can investors do that?

One way to de-risk a portfolio is by adding in options or structures with a different payment profile than long-only equity exposure. For example, an investor might want to consider put options. An investor can sell a call to finance the purchase of a put, which would cap upside but add protection below the put strike price. This strategy makes a lot of sense to us in an environment where we expect forward returns to be muted at best and the risks to the downside are significant but not fully priced in. De-risking part of your equity exposure this way would also allow greater risks to be taken elsewhere—potentially buying the dips on favored tech, biotech, or crypto stocks with an eye on the longer term.

Finally, investors can also potentially get paid to wait out the volatility in dividend-paying stocks (such as healthcare and energy) and private credit, which may generate annual yields of 8% to 10%, most of which is also floating rate to protect against inflation.19

1. Bloomberg, as of April 6, 2022.

2. Minutes of the Federal Open Market Committee, March 15-16, 2022

3. Bloomberg, as of April 6, 2022.

4. Bloomberg, as of April 6, 2022.

5. Bloomberg, as of April 6, 2022.

6. Bloomberg, as of April 6, 2022.

7. Transcript of Chair Powell to the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, on March 3, 2022.

8. Bloomberg, as of April 6, 2022.

9. Bloomberg, as of April 6, 2022.

10. Bloomberg, as of April 6, 2022.

11. Bloomberg, as of April 6, 2022.

12. JPMorgan Research, as of March 25, 2022.

13. BofA Global Quantitative Strategy, MSCI, IBES, Haver, Bloomberg, OECD, IMF, as of April 6, 2022.

14. iCapital Investment Strategy, Bloomberg, as of April 6, 2022.

15. iCapital Investment Strategy, Bloomberg, as January 3, 2022.

16. Bloomberg, as of April 6, 2022.

17. Bloomberg, as of April 6, 2022.

18. Bloomberg, as of April 6, 2022

19. Oaktree Capital, “Direct Lending: Benefits, Risks and Opportunities”, May 13, 2021.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.