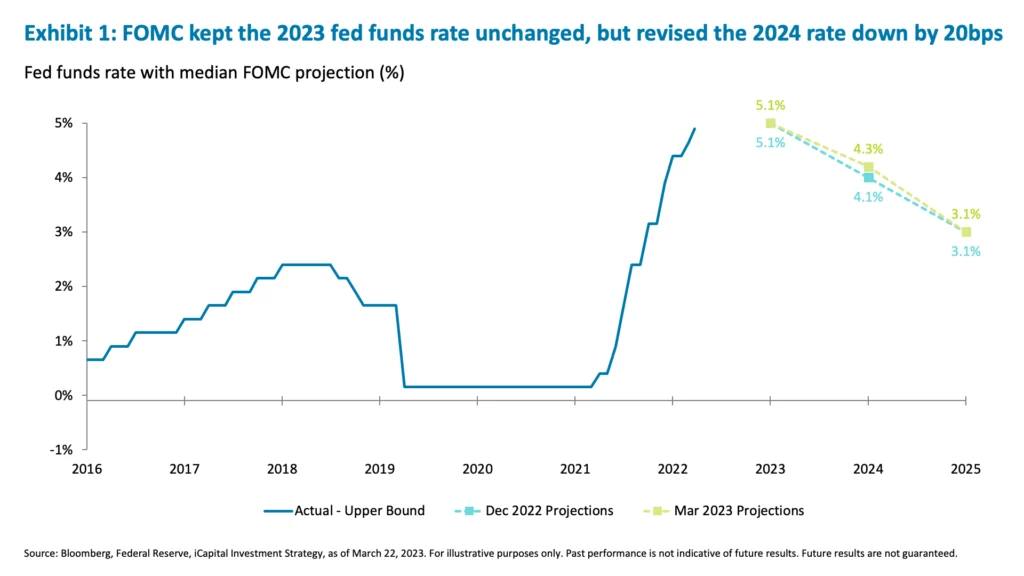

We didn’t get the outright pause as the Fed pressed on and raised the fed funds rate 25 bps to the target range of 4.75% – 5.00%.1 However, we would still call it a de facto pause. The notable change in language in the FOMC statement, from “ongoing increases likely to be appropriate” to “some additional policy firming may be appropriate,” is telling.2

The new language is vague and in our view, an acknowledgement by the Fed of the uncertainty ahead. First, we simply don’t know the full impact of the banking crisis that has unfolded over the last two weeks. Second, it may very well be deflationary as banks tighten lending standards. And third, against that backdrop, we should take a more cautious approach with respect to rate hikes, since tighter credit conditions may do some of the work on inflation for us.

This is not to say that the Fed won’t get back to the business of higher rates sometime this year, but for now, this de facto pause should give markets a reprieve because we are now at or 25 bps within the terminal rate of 5.1%.3 We note that it didn’t feel like that as the S&P 500 closed down -1.6% lower on Wednesday; but this negative reaction was more likely due to the comments made by former Fed chair Janet Yellen on no blanket guarantees for bank depositors broadly.4

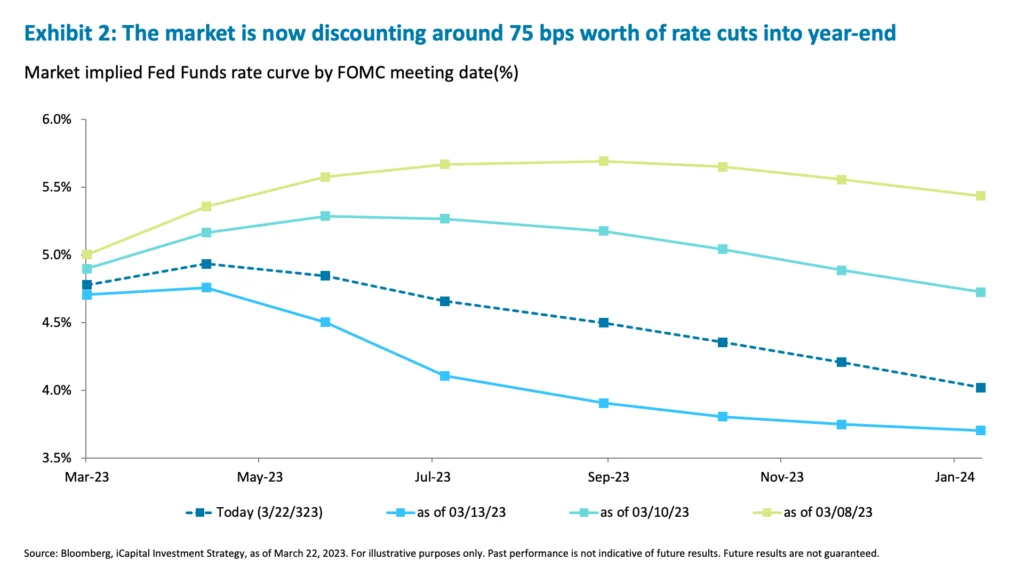

The risk we see to the markets over the coming months is this: while the potential for a pause is one thing, rate cuts are another, and the markets are now discounting around 75 bps worth of rate cuts into year-end 2023 to 4.2%,5 which is same level that the Fed expects to arrive at by end of 2024 not 2023.6 During the press conference Chair Powell was firm in his commitment to “getting to 5.1% by year-end 2023 and staying there.”

So how will we know which is right – the markets or the Fed? And whether rate cuts later this year are warranted? The Fed gave us a new key metric to watch: credit flow to the economy from banks.

All eyes on credit conditions ahead

The markets have been laser focused on inflation for nearly two years. Now, while the upcoming inflation and labor market data will indeed matter, a timely metric of how inflation is likely to evolve might be seen in bank credit conditions. As banks now have to cope with higher funding costs due to competition for deposits, higher rates, and now wider credit spreads, there is increased strain. They are hyper aware that deposits can be fleeting, and outflows can happen at unprecedented speed, which will likely translate to tighter lending standards.

For regional banks in particular, the median loan-to-deposit ratio is 86% versus 51% for large banks, suggesting more loan prudence from these smaller banks.7 Together, we estimate that regional and domestically systematic important banks hold 43% of deposits and 51% of total loans.8

Indeed, as Powell acknowledged at his news conference, “a significant number of people anticipated there would be some tightening of credit conditions” and this would have the “same effect as our policies do.” Here is a look at the charts that we (and the Fed) will be focused on to assess this impact in the weeks and months ahead.

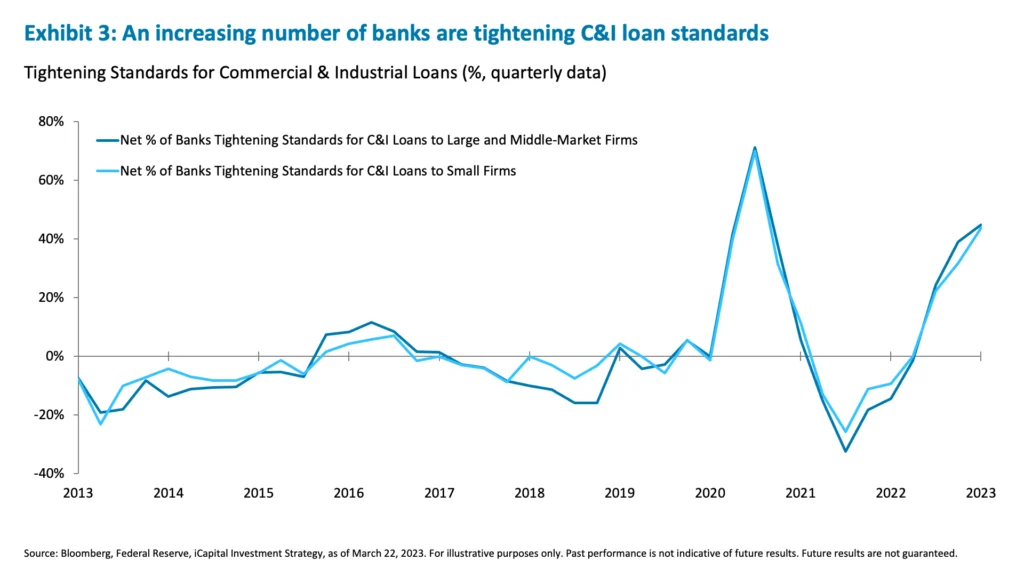

1. Senior loan officer lending standards for various types of loans

Exhibit 3 suggests that the credit standards by banks have already been tightening since June 2022.9 Note that the survey was released on February 6, 2023, and represents survey results from January 2023. No doubt given the recent developments, this trend of credit standards tightening is likely to accelerate.

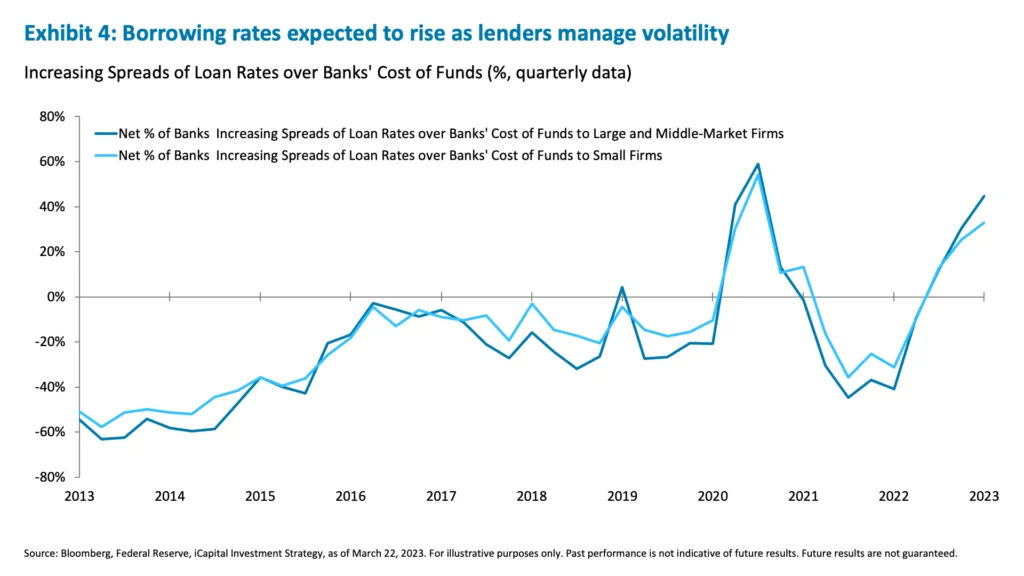

2. Increasing loans spreads over the banks’ cost of funds

Predictably, these spreads have been increasing (as illustrated in Exhibit 4) as banks attempt to manage risk in an uncertain economic environment.

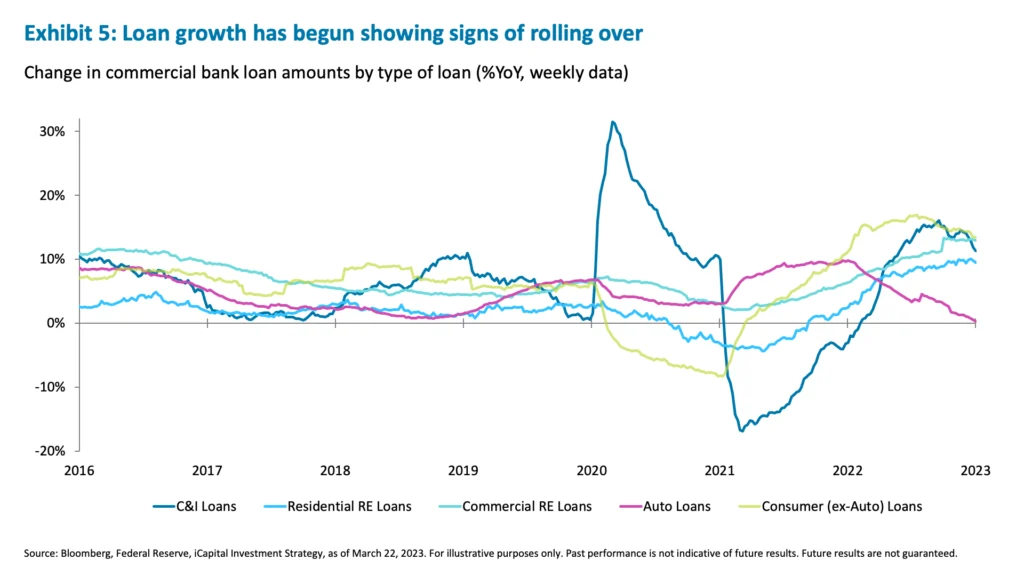

3. Slowing growth across a variety of loans

All things considered, tighter lending standards and higher loan costs are likely to lead to less borrowing and less loan issuance. Indeed, the slower growth in lending is already evident in Commercial & Industrial (C&I) loans, as well as in the auto and consumer ex-auto sectors.10 We suspect other categories of loans will see declines as well; particularly, in Commercial Real Estate (CRE) where 70% of loans are held by smaller regional banks. In fact, despite regional banks seeing +6.4% year-on-year growth in CRE loans in the fourth quarter of last year, it now appears inevitable that this recent growth will roll over for these banks.11

If credit conditions continue to tighten and deteriorate, it will certainly warrant a Fed pause as previous tightening works its way through the economy. For rate cuts to be justified, however, we’d need to see either concrete evidence of cooling inflation (month-over-month figures will be key here) or significant economic weakness. Neither of these are evident today. As a result, we wouldn’t be betting on rate cuts yet, and would stick with floating rate exposure in private credit. Equities will likely remain trapped in a narrow range until either the economy or inflation decisively hits the brakes.

1. Bloomberg, iCapital Investment Strategy, as of March 23, 2023.

2. Federal Reserve FOMC March Statment, iCapital Investment Strategy, as of March 23, 2023.

3. Bloomberg, Federal Reserve Summary of Economic Projections, iCapital Investment Strategy, as of March 23, 2023.

4. Bloomberg, iCapital Investment Strategy, as of March 23, 2023.

5. Bloomberg, iCapital Investment Strategy, as of March 23, 2023.

6. Bloomberg, Federal Reserve Summary of Economic Projections, iCapital Investment Strategy, as of March 23, 2023.

7. Bloomberg, iCapital Investment Strategy, as of March 23, 2023.

8. Bloomberg, iCapital Investment Strategy, as of March 23, 2023.

9. Bloomberg, iCapital Investment Strategy, as of March 23, 2023.

10. Bloomberg, iCapital Investment Strategy, as of March 23, 2023.

11. Goldman Sachs, March 2, 2023

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.