U.S. inflation came in at 8.5% in March, another record high, yet markets initially rallied, apparently focusing on a lower-than-expected 6.5% core consumer price index (CPI) reading and concluding that the Federal Reserve will not have to as aggressively hike rates.1 We think this conclusion might be premature. A closer look reveals that the step-down in core CPI from 0.5% month-over-month in February to 0.3% in March was entirely due to the fall in used car prices, which fell 3.8% month-over-month.2 Stripping out used cars, the reading would have been 0.5% again.3

This begs the question—with inflation running hot, is the consumer starting to feel the pinch of high prices and higher interest rates? We have previously highlighted that consumer expectations for the state of their personal finances are near 10-year lows4, and in this week’s commentary, we look at four consumer sectors that suggest some moderation in activity and one that is not, all of which are important to watch in coming months:

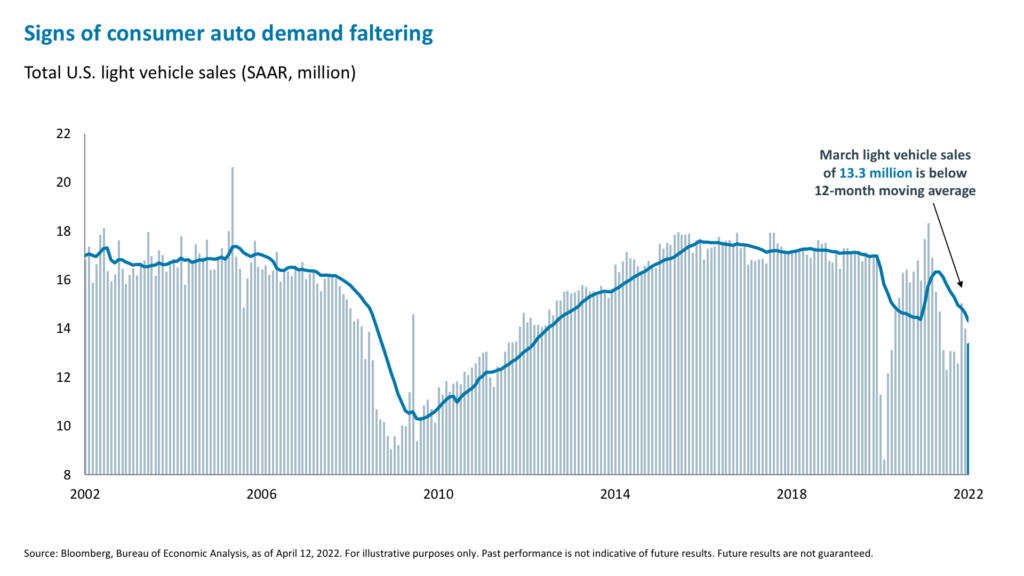

1. Autos

Did used car price inflation fall in March because supply chain issues eased or because consumer demand moderated? We find evidence of the latter. For example, in its fourth quarter earnings report, CarMax noted that its retail used unit sales declined 5.2% and comparable store used unit sales fell 6.5%.5 The press release cited a number of reasons for these declines, including weaker consumer confidence, the Omicron-fueled surge in COVID cases, vehicle unaffordability, and negative base effects from the stimulus benefits paid a year prior.6 Notably, the report also cites, “The substantial increase in the provision for loan losses, which was a more normalized $54.4 million in the current year’s fourth quarter versus $4.6 million in the prior year’s fourth quarter.”7 These are some red flags to watch. Interestingly, overall vehicles sales moved higher in January, but eased in February and March. With the average used car price rising over 35% year-over-year and dealer inventories well below historical levels, it is unsurprising that consumers are feeling the pinch.8 Currently, the average rate on a 60-month new car loan is 4.55%.9 While this is still below the level seen in 2019, we expect the recent rise in interest rates to gradually spillover to auto loan rates.

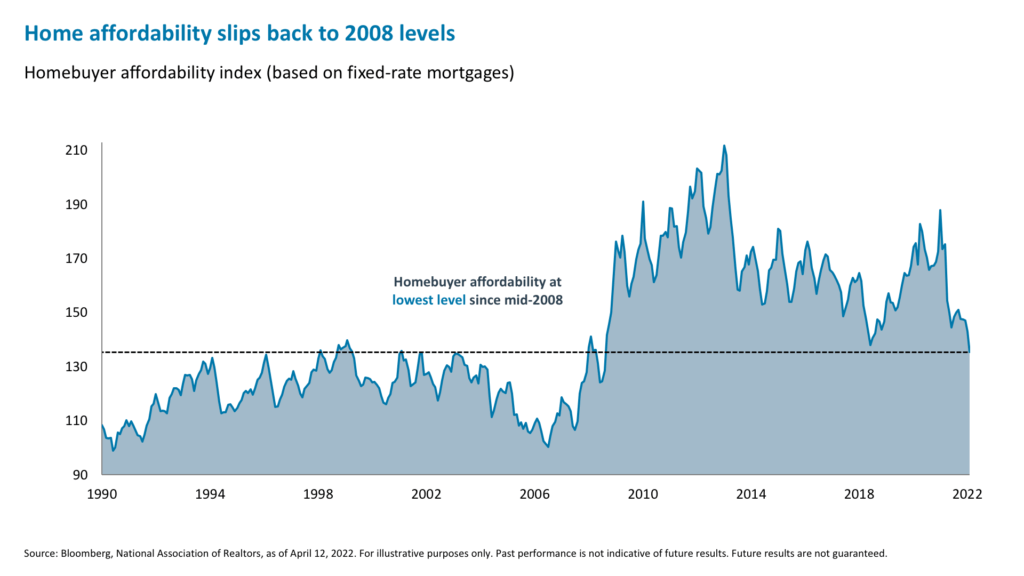

2. Housing

The 30-year mortgage rate has surged to 5.14%, up 187 basis points since the start of the year to reach its highest rate since early 2010.10 Meanwhile, the median existing home price is now $357,300, 30% higher than at the end of 2021.11 As a result, the housing affordability index has slumped below the lows of mid-2018 to levels last seen in mid-2008.12 The mortgage payment-to-income ratio has risen sharply and converged with the rental-to-income ratio of 25%.13

This appears to be denting housing activity. Pending home sales fell 4.1% month-over-month in March.14 We do not necessarily see a material deceleration in home prices given how little housing supply there is—the volume of single-family homes for sale is at its lowest level since 199115 —but a slowdown in housing turnover bears watching, as well as the potential knock-on effects on retail sales. Furniture, electronics and appliances, and building materials and garden equipment and supplies—which benefit strongly from housing demand—account for 9.6% of overall retail sales.16 Last month, the retail control group measure of sales declined 1.6% and is expected to be flat when March data is released on Wednesday.

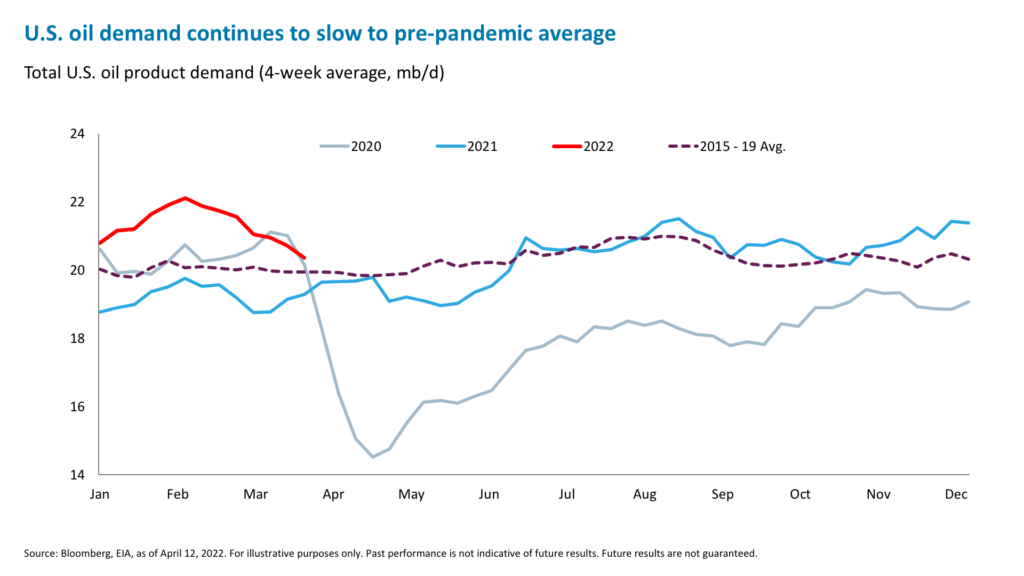

3. Energy

In the latest CPI report, gasoline prices surged 48% year-over-year and fuel oil was up a whopping 70%.17 As a result, credit card spending on gasoline rose 6.5% month-over-month in March, following an 8.2% increase in February.18 Will this begin to destroy demand for gasoline and other oil products? Amid the surging prices, U.S. total oil demand, which started the year well above pre-pandemic averages, recently came under pressure.19

Where precisely is this weaker demand coming from? First, there has been a slowdown in gasoline consumption, with the volume supplied now 0.3% lower than a year ago.20 Demand for distillate fuel oil—used for on-highway trucks and off-highway railways—has also weakened, trending downwards on a weekly basis since late January.21 However, demand for jet fuel has strengthened, up 28.9% on a four-week average basis for the period ending April 1 versus the period ending April 2, 2021.22

Notably this overall weakening happened at a time of typically elevated seasonal demand.23 This suggests some possible demand destruction, which needs to be monitored.

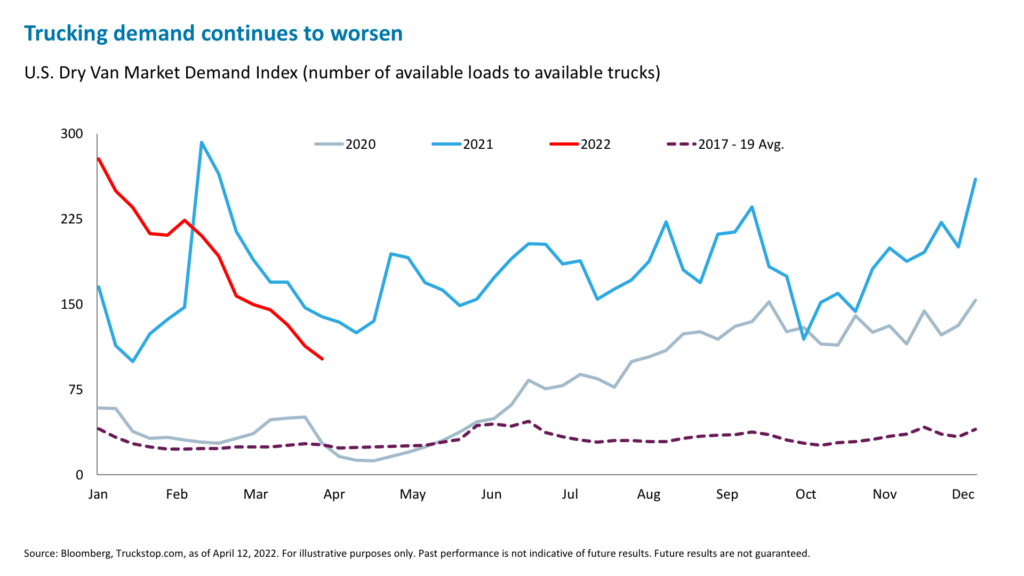

4. Trucking and freight

The slowdown in distillate demand is likely reflected in a notable weakening of trucking market conditions. Outbound tender volumes—a proxy for real-time trucking demand—are now down roughly 14% from a peak in mid-March24; truck availability has climbed 19% in this same period25; and trucking spot rates (excluding fuel surcharges) continue to decline, down 14% since the start of the year or roughly 22% from a January peak26. The rapid softening in this data again goes against historical seasonality, with spring generally one of the best times for trucking demand.27

Over the course of the last year, pandemic-induced inventory run-down caused a surge in freight demand as businesses tried to rebuild inventory and add buffer stock. With this rebuild now largely complete—real inventory levels ex-autos are 5% above trend and 9% above pre-pandemic levels28 —it is reasonable to expect a leveling off or decline in demand. Retail sales numbers will be a key gauge of whether there is enough consumer demand to match rebuilt inventory.

5. Travel

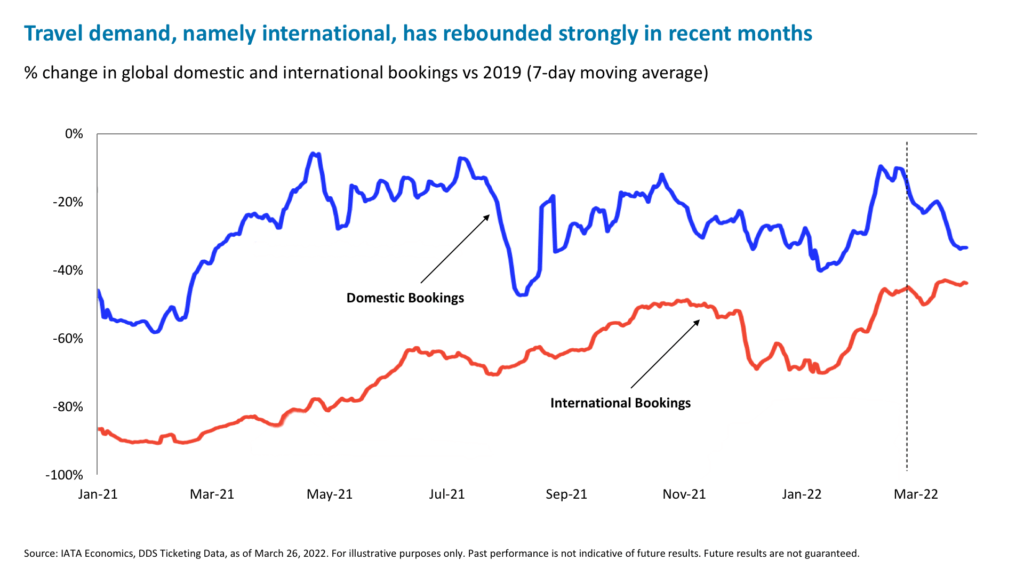

This is one area where we have yet to see any hint of a demand slowdown. Rather, it is ramping up, as strong jet fuel demand suggests. TSA travel throughput shows air travel closely approaching 2019 levels29, while international ticket sales are now down only 19% from 2019 levels, having been down 50% at the start of the year30. U.S. airlines’ credit card data shows flight spending up 9% and lodging spend up 17% in March versus the same month in 2019.31

The switch from durable goods consumption to services may finally be underway. In a recent Bank of America travel survey, 62% of respondents expected to travel more than usual in the next 12 months.32 The key metric to watch to make sure that these intentions translate into spending are bookings for future travel. Globally, bookings for international future travel (at any point) have picked up since the beginning of the year, with the rise pausing but not reversing since the start of the conflict in Ukraine.33 Domestic ticket sales have dipped globally, though that is largely due to a drop in China as it fights a COVID surge, and a fall in domestic bookings within Russia.34

Investment Implications

It is premature to suggest that we are heading for a full-blown consumer-led recession. However, we view the evidence above as early signals of a consumer-led slowdown. With consumption representing 60% of the U.S. economy, there will be knock-on effects on other sectors. For investors, this likely means that consumer discretionary stocks (down 16% from 52-week highs35) may not quickly recover. Trends such as recent downside earnings revisions, expected earnings declines for calendar year 2022, and net profit margins below five-year averages may persist.36 Perhaps travel stocks may prove an exception, but are unlikely to be enough on their own to avert a slowdown.

1. Bloomberg, as of April 12, 2022.

2. Bloomberg, iCapital Investment Strategy, as of April 12, 2022.

3. Ibid

4. Bloomberg, as of April 6, 2022.

5. CarMax earnings press release, April 12, 2022

6. CarMax earnings press release, April 12, 2022

7. CarMax earnings press release, April 12, 2022

8. Bloomberg, as of April 12, 2022.

9. Bloomberg, Federal Reserve, as of February 2022.

10. Bloomberg, Bankrate.com, as of April 12, 2022.

11. Bloomberg, National Association of Realtors, as of April 12, 2022.

12. Bloomberg, National Association of Realtors, as of April 12, 2022.

13. Goldman Sachs Research, as of April 8, 2022.

14. Bloomberg, National Association of Realtors, as of April 12, 2022.

15. National Association of Realtors, as of April 12, 2022.

16. Bloomberg, U.S. Census Bureau, as of April 12, 2022.

17. Bloomberg, Bureau of Labor Statistics, as of April 12, 2022

18. BofA Global Research, as of April 11, 2022

19. Bloomberg, U.S. Energy Information Administration, as of April 8, 2012.

20. EIA Weekly Petroleum Status Report, as of April 1, 2022; Bloomberg, as of April 12, 2022

21. Ibid

22. Ibid

23. Ibid

24. FreightWaves, as of April 9, 2022.

25. Bloomberg, Truckstop.com, as of April 11, 2022.

26. Bloomberg, Truckstop.com, as of April 11, 2022.

27. FreightWaves, as of April 9, 2022.

28. Bloomberg, as of April 11, 2022.

29. Bloomberg, TSA, as of April 12, 2022

30. ARC, as of March 18, 2022

31. BofA Global Research, as of April 11, 2022

32. BofA Global Research, Survey Monkey, as of April 1, 2022

33. IATA, as of April 2022.

34. Ibid

35. Bloomberg, as of April 12, 2022

36. FactSet, April 8, 2022

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.