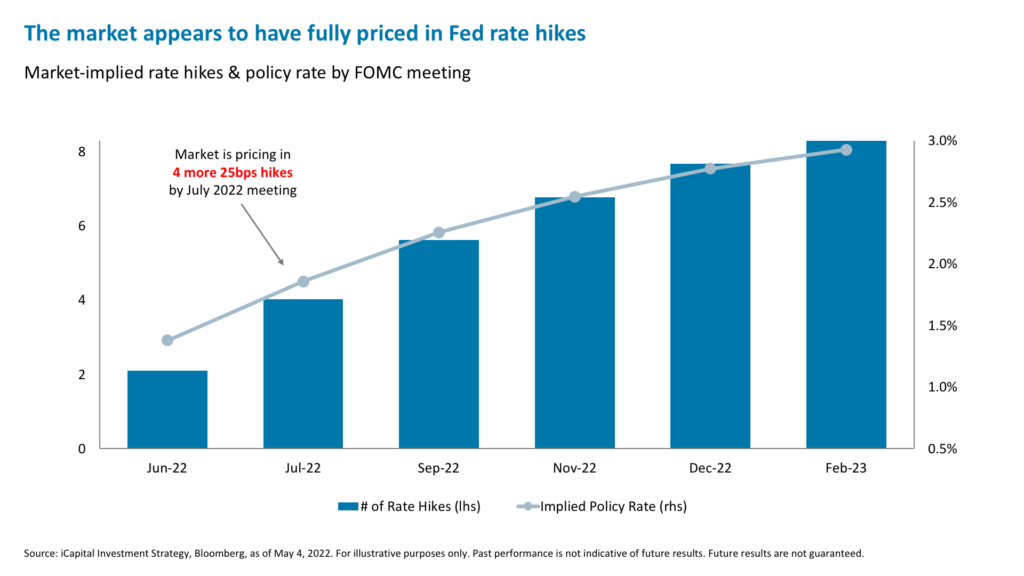

The markets initially reacted positively to yesterday’s press conference by U.S. Federal Reserve (Fed) Chair Jerome Powell. There were no hawkish surprises, the committee said it was not actively considering a 75 basis point hike, and appropriate Fed rate hike expectations had already been priced in, especially at the front end of the curve.1 Combined with low positioning, extremely bearish sentiment, and the resumption of corporate buybacks as earnings season tapers off, investors appeared to anticipate a near-term rally. The chair had looked to reassure markets that there is a “path to a … soft-ish landing,” by striking a balance between addressing inflation and maintaining reasonable economic growth.2

Investors clearly don’t share Mr Powell’s optimism, as markets slumped heavily today.3 Elevated market volatility appears entrenched in the short-term. Nevertheless, there are three things that we would buy in the current valuation and market environment.

1) Oversold tech stocks

We flagged last week that the valuations of select semiconductors, software, and communication services stocks have fallen towards five-year lows.4 Many of them are technically oversold.5 Many of them have expected 2023 to 2025 earnings per share growth in excess of 10%.6 Furthermore, recent earnings reports highlight that activity in software, cloud computing and semiconductor end markets remains strong.7 Importantly, many of these stocks have volatility around the 90th percentile of their five-year ranges.8 These are the stocks that we would be looking to buy right now and/or sell a put option on them to monetize their elevated volatility.

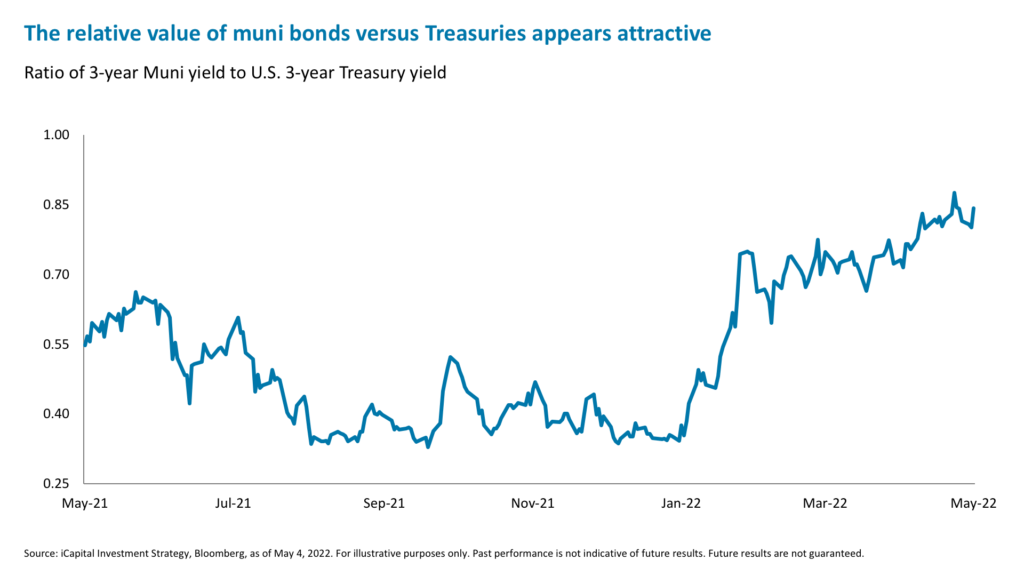

2) Short-dated municipal bonds

With markets seemingly pricing in an appropriate number of rate hikes, we expect the front end of the U.S. Treasury curve to be more stable. The three-year U.S. Treasury yield is now 2.817%, but another way to position here is to look at short-duration municipal bonds (munis), with three-year AAA munis yielding 2.38% or almost 4% taxable equivalent yield.9 With low duration risk and the highest yield since fall of 2018, munis can help anchor a portfolio in a still uncertain environment.10 The relative value of munis versus Treasuries is also now attractive: the ratio of muni yields to Treasuries in the three-year part of the curve is 0.84, up from 0.34 to start the year.11

3) Add to income-producing fixed income and alternatives

With the Fed less hawkish than feared and the details of the balance sheet runoff unveiled, we also have a bit more confidence in adding to other parts of fixed income. As highlighted two weeks ago, we would be adding to U.S. high yield, which now has a yield-to-worst of over 7%.12 With the economy still expected to grow 3.2% this year and default rates in check, publicly traded leveraged loans and private credit are also good places to be.13

These three ideas span the risk spectrum. The Fed is struggling to strike a balance between being decisive but not overly aggressive. As investors we also need to strike a balance between taking calculated risks (in places like tech stocks) and adding more certainty to portfolios (through income) in a still-precarious environment. Fortunately, the valuation and yield environment is finally presenting opportunities for us to do so.

1. Bloomberg, iCapital Investment Strategy, as of May 4, 2022.

2. FOMC Press Conference, as of May 4, 2022.

3. Bloomberg, as of May 5, 2022.

4. Ibid

5. Bloomberg, iCapital Investment Strategy, as of April 28, 2022.

6. Ibid

7. Ibid

8. Ibid

9. Bloomberg, as of May 4, 2022.

10. Bloomberg, iCapital Investment Strategy, as of May 4, 2022.

11. Ibid

12. Bloomberg, iCapital Investment Strategy, as of May 4, 2022.

13. Bloomberg, as of May 4, 2022

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.