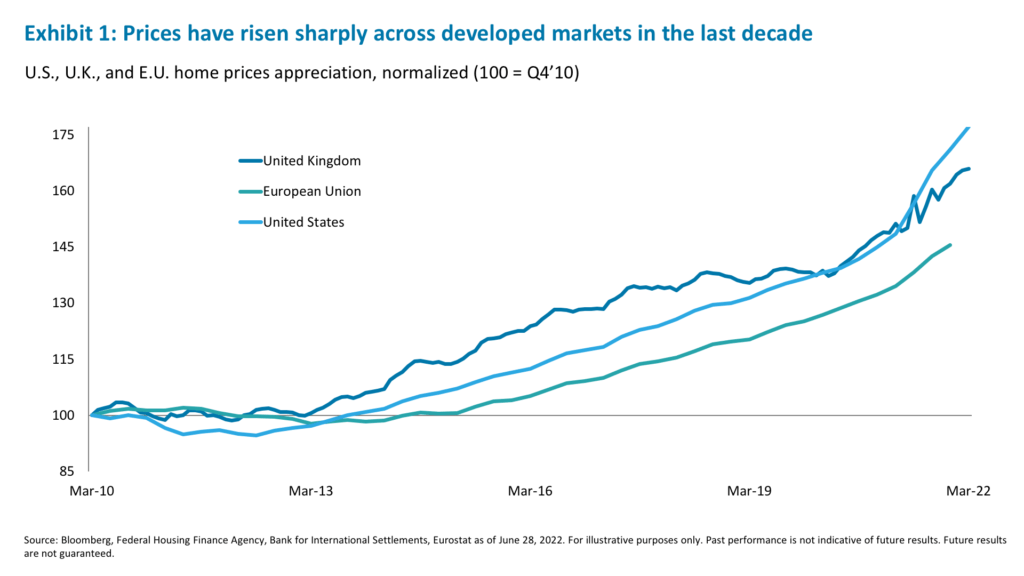

This week, the Federal Housing Finance Agency reported that its U.S. House Price Index rose another 1.6% month-over-month in April, rising 18.8% year-over year and 6.9% since the start of 2021.1 In Europe, in the fourth quarter of 2021 the Euro Area House Price Index rose 10.0% year-over-year and the update expected on July 8 is likely to continue to show home price appreciation.2 United Kingdom home prices have increased 10.5% year-over-year.3 This appreciation was driven by the same set of factors—years of zero or near-zero interest rates, rock-bottom mortgage rates and insufficient new housing supply. For example, the United States is estimated to be short 3.8 million housing units based on population growth over the last eight years.4 In the United Kingdom, the country brought 216,000 new homes to market in 2021, but this is still short of the government’s stated target of 300,000 new homes per year to address shortages.5

However, prices now appear to have reached levels that might soon become unsustainable (See Exhibit 1). The European Central Bank (ECB) recently calculated in its Financial Stability Report that median residential real estate prices in the Euro area are at least 15% overvalued and, in some cases, close to 60%.6 Bloomberg Economics listed New Zealand, the Czech Republic, Australia, Canada, Portugal, and the United States among the top 10 countries with significant property risk based on price-to-rent ratio, price-to-income ratio, and the pace of price appreciation, among others.7

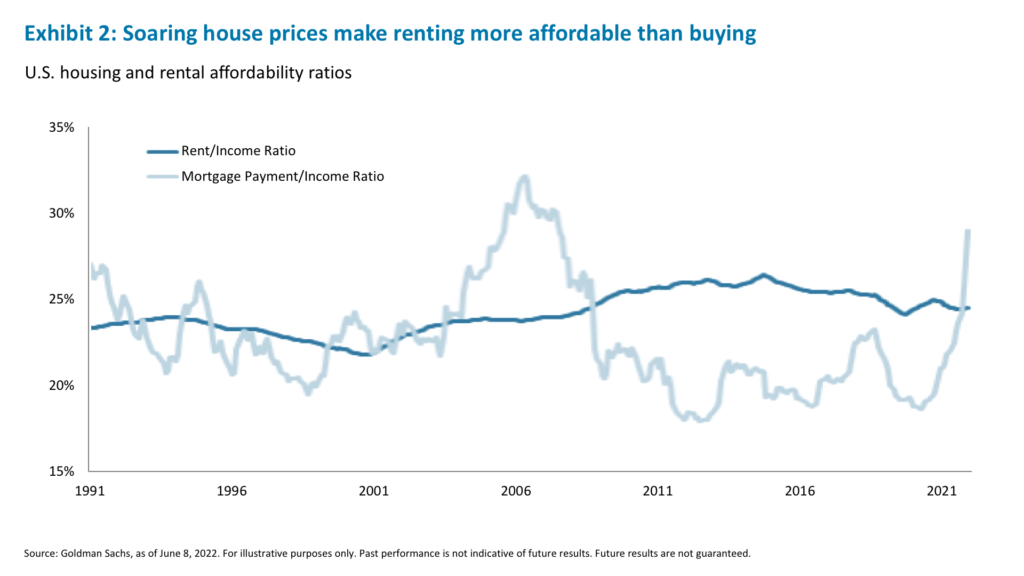

Now add to that mix sharply rising rates, and affordability is quickly eroding. In the United States, the cost to own has risen to near 30% of income, well outpacing the 25% cost to rent (See Exhibit 2).8 In Europe, housing price appreciation has well outpaced the growth in rents since 2017, and this trend accelerated in 2021.9

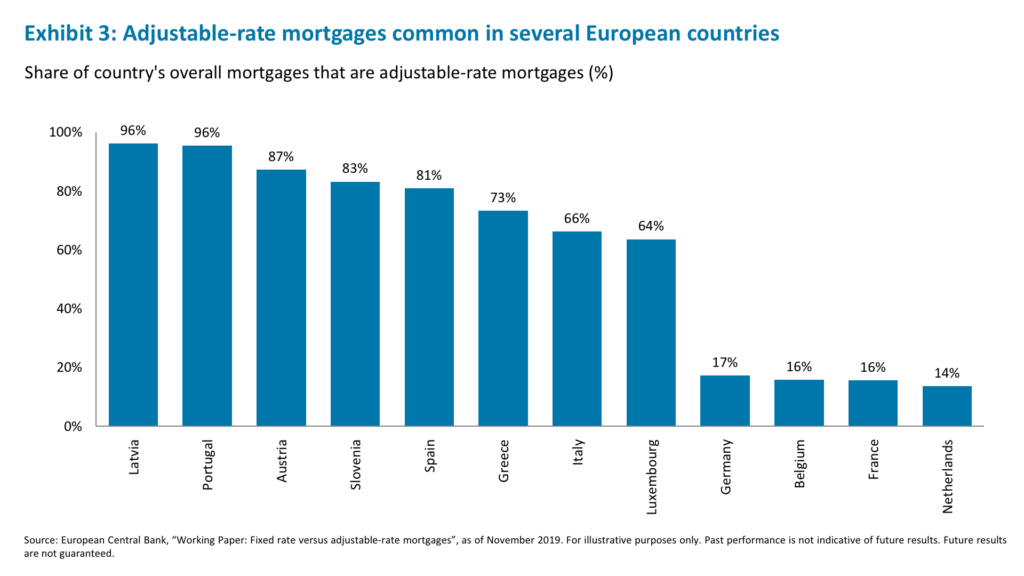

Furthermore, while most mortgages in the United States are fixed rate (FRMs), with weekly data showing adjustable rate mortgages (ARMs) averaging just 5.7% of all loan volumes over the past 10 years, in parts of Europe ARMs comprise a majority (See Exhibit 3).10

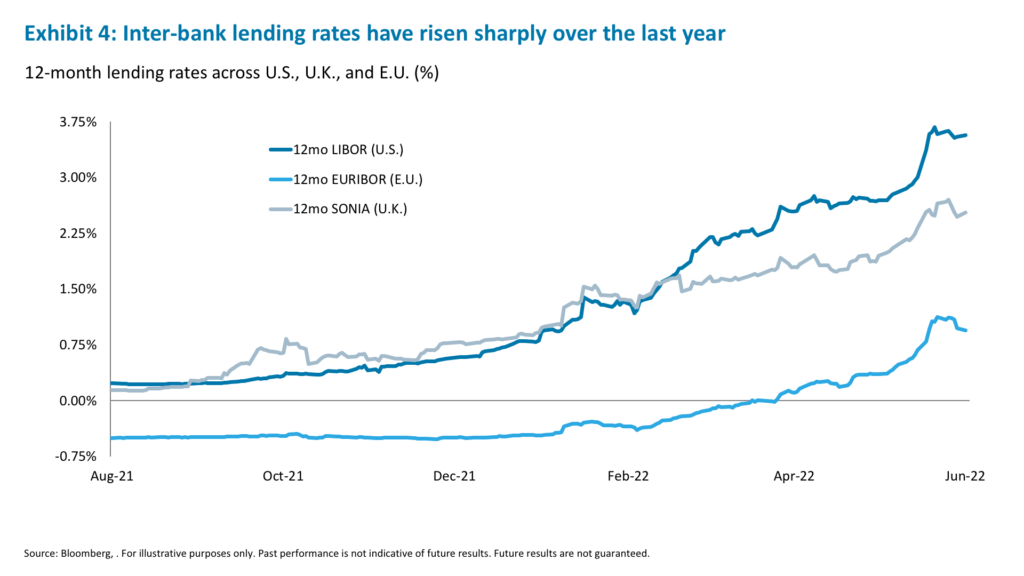

For example, in Spain, FRMs account for just 19.1% of the total, and in Portugal just 4.5%.11 Rising rates therefore put additional strain on existing mortgage holders. With the 12-month Euribor12 rising from minus 50 basis points (bps) at the beginning of the year to positive 95 bps as of today (see Exhibit 4), this is a real risk to both these economies and their residential property markets.13

Consequently, we expect two things—one, in the medium term, property prices in both the United States and Europe are at risk of correcting given higher rates; and two, in the near term, more would-be homebuyers are likely to get pushed towards renting, supporting the residential multi-family apartment market.

Indeed, the ECB recently estimated that for every 10 bp increase in real mortgage rates, house prices could decline by 1.17%.14 The rate on FRMs with a fixation period of over ten years in the E.U. rose 20 bps between December 2021 and April 202215, while the rate on ARMs has risen 9 bps in the same period, suggesting possible price declines of roughly 1%, for now. In the United States, home price appreciation is expected to moderate from 18.1% in 2021 to 9.4% and 1.8% in 2022 and 2023, respectively.16

However, we would expect rental price increases to persist given likely growing demand for rentals amid tight supply in the residential multi-family space, although at a slower pace than the 10-15% new and renewal rent increases recorded in late 2021/early 2022.17 The multi-family vacancy rate in the United States hit a record low of 2.3% in the first quarter of 2021, with European markets also showing similar trends.18 This should support pricing power for landlords.

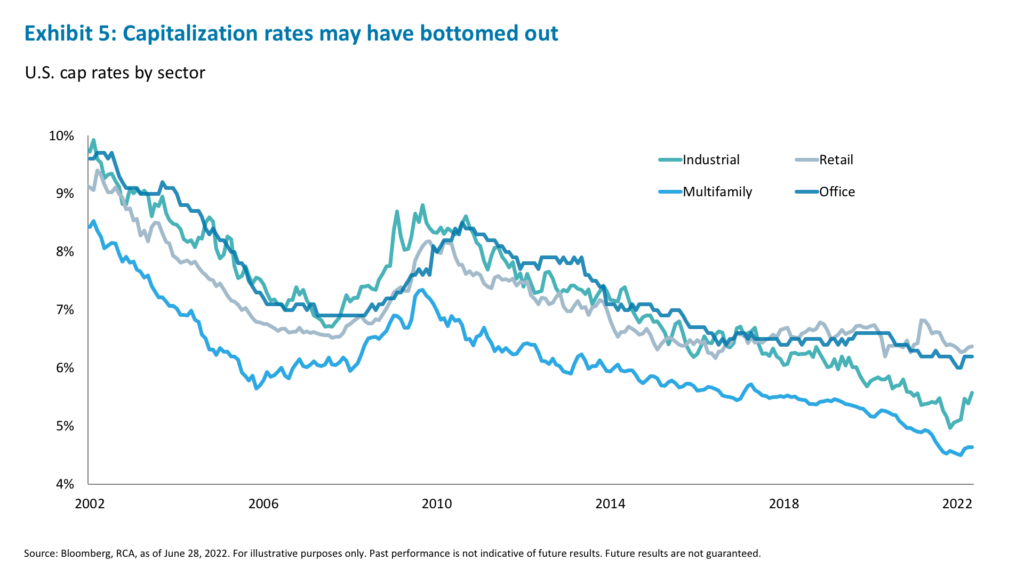

However, we would still expect price appreciation in multi-family housing to slow down, even as net operating income (NOI) growth persists. In the first quarter of 2022, the apartment sector returned 5.3% in the United States, bringing the trailing one-year return to 24.1%, notably, 4.3% and 19.8% of these returns, respectively, were from price appreciation.19 The torrid pace of price appreciation is unlikely to be sustained, given higher rates. Capitalization (cap) rates are no longer falling and could rise (See Exhibit 5).20

Despite the likely slowdown in appreciation potential and possible property value declines, multi-family residential remains a preferred real estate sector, given the supply-demand imbalance and the relative rent affordability described above. The sector also offers a defensive posture in the event of a meaningful economic slowdown. NOI could slow to 0% in the event of a recession, down from a predicted 12.9% for U.S. residential REITs in 2022.21 This is not an ideal scenario, but better than numerous asset classes that will likely post negative returns in a downturn. However, on the rental side, recession or not, income is likely to be dependable: rent collections for residential real estate remained in the sub-95% range even during the depths of the 2020 pandemic.22 With these defensive characteristics in mind and given that the overheating housing market might crack under the pressure of higher rates, we continue to advise an allocation to multi-family real estate.

1. Bloomberg, as of June 28, 2022.

2. Bloomberg, Eurostat, as of June 28, 2022.

3. Blomberg, Halifax, as of June 28, 2022.

4. NCREIF, Freddie Mac, as of March 31, 2022.

5. UK Parliament, “Government ambitions for new housing supply,” February 4, 2022.

6. European Central Bank, “Financial Stability Review,” as of May 2022.

7. Bloomberg Economics, “Global Insight: Housing Gauges Flash Res as Low-Rate Era Ends,” as of June 21, 2022.

8. Goldman Sachs, as of June 8, 2022

9. Eurostat, as of June 28, 2022.

10. Bloomberg, Mortgage Bankers Association, as of June 28, 2022.

11. European Central Bank, “Working Paper: Fixed rate versus adjustable-rate mortgages”, November 2019.

12. Euribor is the Euro Interbank Offered Rate, a daily reference rate based on averaged interest rates at which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market.

13. Bloomberg, as of June 28, 2022.

14. European Central Bank, “Financial Stability Review,” as of May 2022. Note: ECB estimates were based on a non-linear model factoring in the Q4 2021 real mortgage rate level of -0.69%.

15. ECB Statistical Data Warehouse, as of June 28, 2022.

16. Goldman Sachs Research, as of June 8, 2022.

17. JPMorgan, Bloomberg, as of June 2022

18. CBRE Econometric Advisors, as of June 23, 2022.

19. NCREIF, NIC Research & Analytics, June 6, 2022.

20. Bloomberg, RCA, as of June 28, 2022.

21. JPM Research, June 2022

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.