At yesterday’s rate decision meeting, the FOMC committee delivered a hawkish pause, keeping rates unchanged in June at 5.25% but signaling the potential for two more 25 basis point rate hikes this year. 1 At first, this took the markets by surprise and prompted a sell-off in equity indices, since most investors were looking for just one more rate hike in July.2

But as Fed Chair Jay Powell spoke, the markets turned around. We think this is for two reasons – first, he reiterated progress (though not complete) on inflation but importantly, that conditions are in place for further disinflation; and second, a pause at this meeting and the potential for two more rate hikes for this year signals a much slower pace of increases and a hiking cycle that’s materially closer to the end. That is welcome news for markets.

Indeed, inflation that’s easing, a Federal Reserve that is significantly moderating its pace of rate hikes, and the ongoing economic activity, should continue to support equities. After a bullish call on tech here and here, we are now looking for a catch-up trade in the broader S&P 500, driven by cyclicals, especially as China might be adding more meaningful stimulus to support its economy.3

The Fed is close to done and this historically supported stocks

As noted in yesterday’s Fed press conference and above, the Fed is moving towards the end of its hiking cycle or at least a material slowing. Indeed, to quote Fed Chair Powell’s remarks, “we are not so far from the destination on fed funds rate.”4 Why should we believe that the committee is in fact close to done? Here are three reasons.

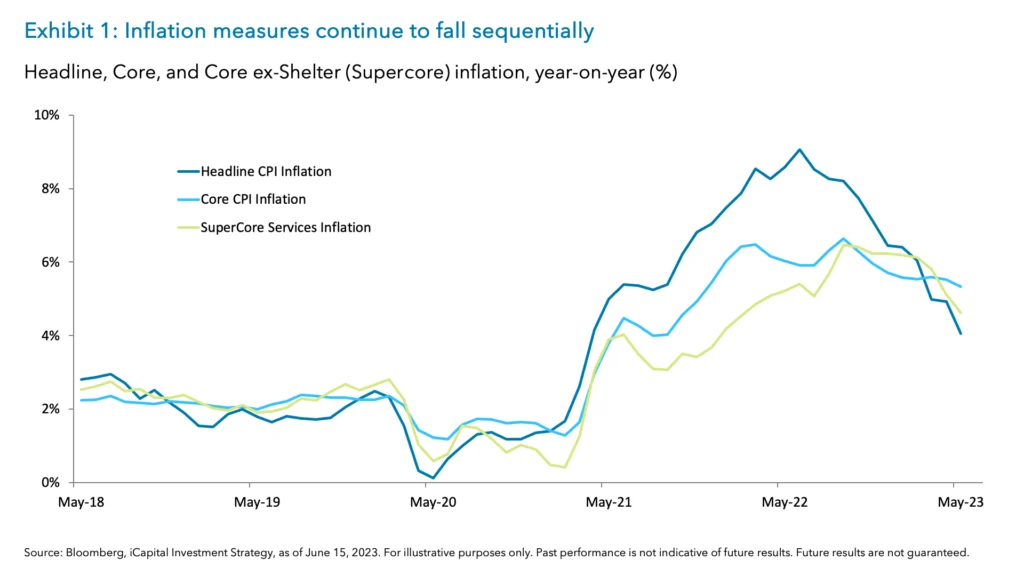

- First, inflation continues to ease at both the producer and consumer level. For consumer inflation specifically, both headline and core CPI continue to point to inflation falling sequentially to 4.0% and 5.3%, respectively, in May (Exhibit 1).5 More importantly, however, is the composition of the recent CPI report, which showed a sustained move lower in shelter (rent and Owners’ equivalent rent) inflation – arguably the stickiest components – and softness in new cars and airfares.6 And another key metric – core services excluding shelter (coined “Supercore inflation”) – continued to moderate with the three-month annualized rate falling to 3.0% in May.7

- Second, the fed funds rate at 5.25% is now above the headline and core personal consumption expenditures (PCE) inflation, something we had expected to happen right around this time of the year.8 This gives the Fed room to pause and hold, especially since the market continues to point to further disinflation with the market-implied inflation rate expected to fall to 3.1% by year-end 2023.9 As a result, the gap between the fed funds rate and inflation will widen materially, a welcome sign.

- Finally, the real fed funds rate is now finally turning restrictive. Recall that back in May the Fed updated (or re-introduced post-pandemic) their estimate for the so-called neutral rate – the real interest rate that neither stimulates nor contracts the economy. In doing so, they lowered the neutral rate in real terms from 1.0% when it was last published for the fourth quarter of 2019 to 0.7% for the fourth quarter of 2022.10 This rate is forecasted to move lower to 0% by the end of 2024.11 Meanwhile, the actual real fed fund rate – derived from the effective fed funds rate less year-on-year core PCE inflation – is currently at 0.4% and will be meaningfully higher, reaching 1.1% in the third quarter of this year as consensus estimates see core PCE inflation falling to 4.0% by this time.12 This expected restrictive stance of policy coupled with lagged effects and ongoing bank credit tightening concerns should give the Fed enough reason to significantly moderate or conclude its rate hiking cycle.

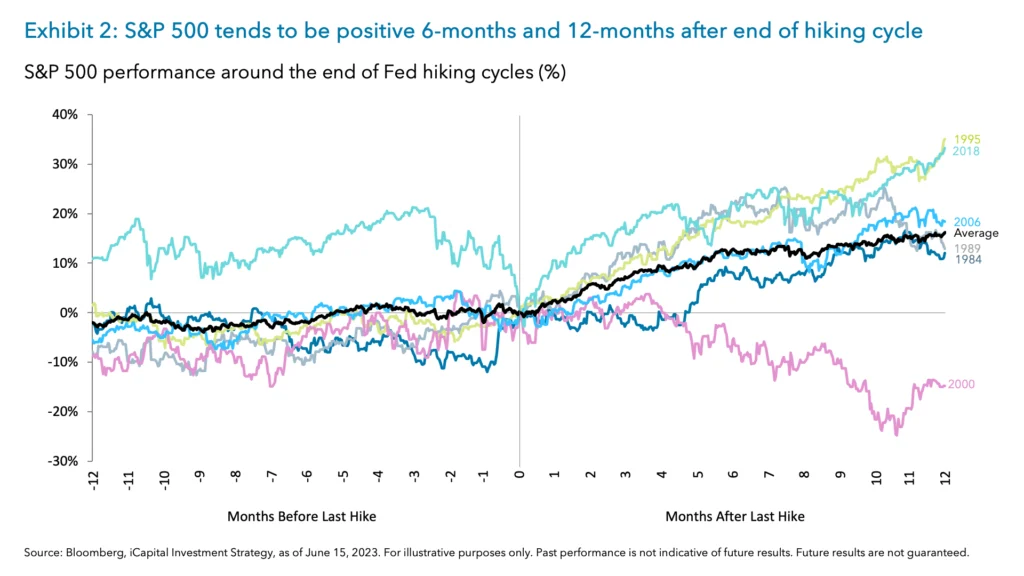

What does this mean for markets? Historically, the end of rate hiking cycles supports continued market upside in the absence of a recession. Since 1989, the S&P 500 has been positive five out of six instances in the subsequent 12-month period following the end of a hiking cycle with an average return of 16.1% (Exhibit 2).13

Economic resilience continues in the U.S. and that is lifting earnings estimates

The consumer, which makes up nearly two-thirds of the U.S. economy, also remains in good standing. As we wrote about here, consumer balance sheets remain healthy with roughly $1.5 trillion in excess savings available, real disposable incomes have risen and are still set to rise by another 3.75% in 2023, and importantly, consumers are still spending albeit at a slightly slower pace.14 Today’s retail sales report confirmed this which showed that headline U.S. retail sales increased by +0.3% month-on-month (MoM) in May, well above the -0.2% MoM decline consensus was expecting, reflecting greater spending on cars and auto parts.15 In fact, high frequency data on credit card spending has confirmed the strength we saw in the retail sales report and has in fact shown continued strength through the first week of June.16

Given the strength and durability of the economic data, recession risks have receded, and the growth outlook has improved. The U.S. economy is once again surprising to the upside in the second quarter of this year, across most sectors – housing, industrial, labor market, and household consumption. Currently, second quarter gross domestic product (GDP) is tracking an annualized rate of +1.8%, which, although being slightly lower than earlier in the quarter, is still above the median consensus estimate of +0.6%.17

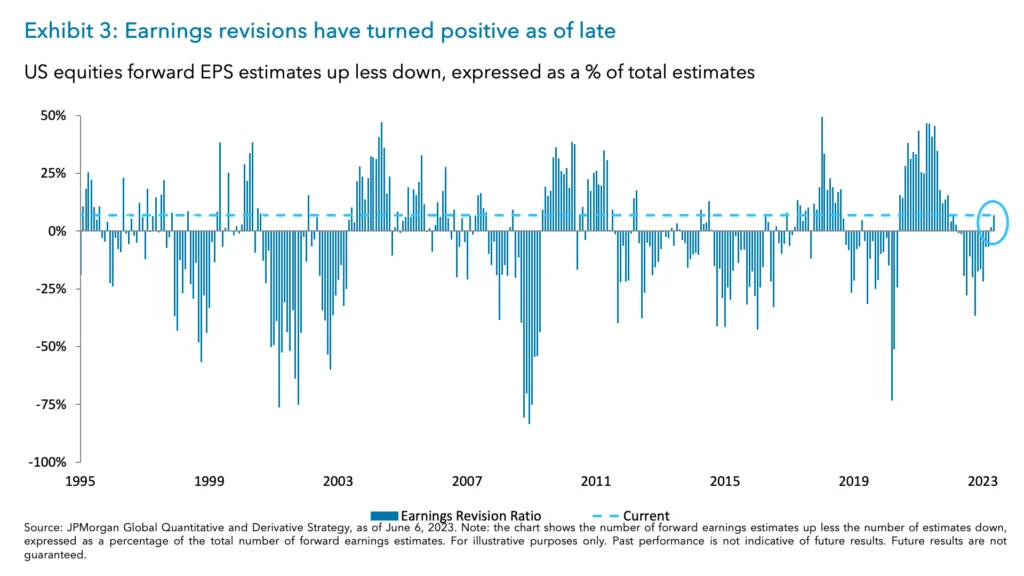

Importantly, as a result of these economic surprises, the earnings revisions ratio has begun to improve and turned positive over the past two months after being negative for over a year (Exhibit 3).18 Moreover, the change in the revisions ratio is most positive for cyclicals like industrials, and real estate.19

China is planning to step up its stimulus measures to counter its weaker-than-expected economy

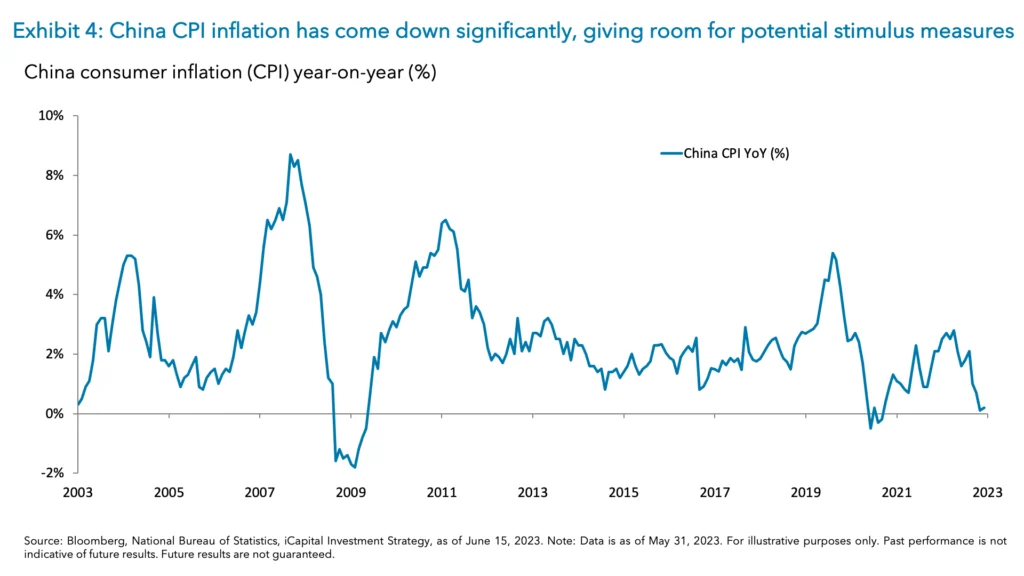

Second quarter GDP in China is on track to come in at an annualized rate of 3.5%, much lower than the stated target of 5%.20 Unlike the U.S. where economic data has been surprising to the upside, many parts of China’s economy have been surprising to the downside – property market, retail sales, manufacturing and more.21 It makes sense then that China is also said to be considering a broad package of measures to support its property market and domestic consumption.22 And the good news is that there is ample room to add stimulus given China’s consumer inflation (CPI) is running at 0.2% year-on-year – near the lowest levels of the past 20 years (Exhibit 4).23

China, for example, could increase infrastructure investment or introduce further supportive real estate policies like a further reduction in the down payment ratio similar to that in February of 2022.24 In fact, China has already begun considering supportive measures with the country preparing to further extend the incentives for the purchase of EVs for another four years.25 The People’s Bank of China Governor Yi Gang also recently pledged to “make all efforts to support the real economy.”26 These efforts indicate the willingness to act. And just this past week China cut its 7-day reverse repo rate for the first time in 10 months27 and just today, cut the rate on one-year loans for the first time since August.28 Not only could the combination of these and other upcoming stimulus measures be supportive for the local economy, but any economic rebound in China is sure to spill over into parts of the global economy.

The catch-up trade in the S&P 500 and cyclicals – which started in June – should have more room to run

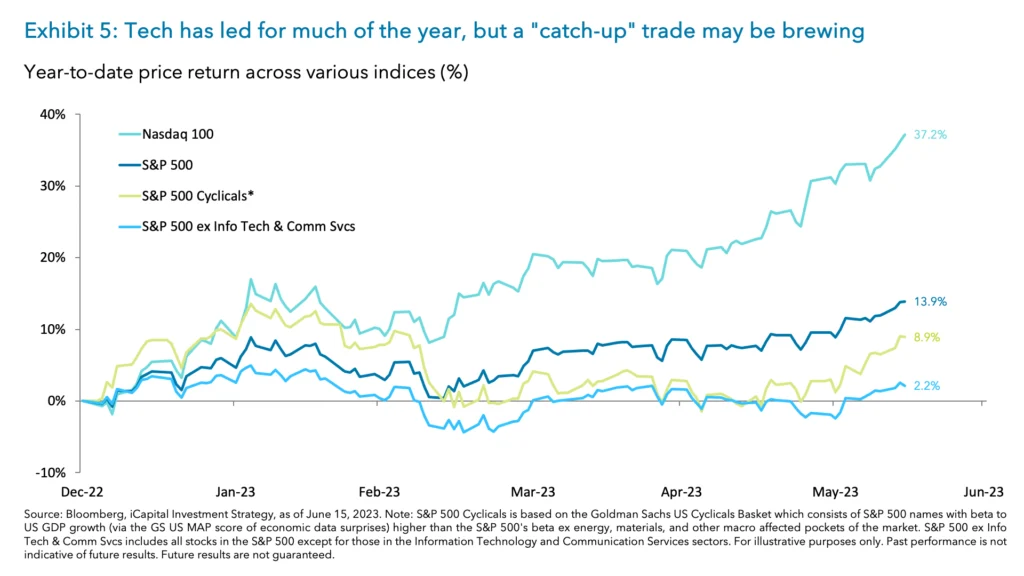

As the economic data in the U.S. remains resilient, the Fed shift towards more stable monetary policy, and China stimulus talk heats up, U.S. equities, namely cyclicals, stand to benefit. Since the beginning of the year, most investors have abandoned the cyclicals trade and have been focusing solely on chasing the outperformance in Big Tech and semiconductors –rightfully so, given the recent AI frenzy and higher earnings growth trends for tech-related names (Exhibit 5).

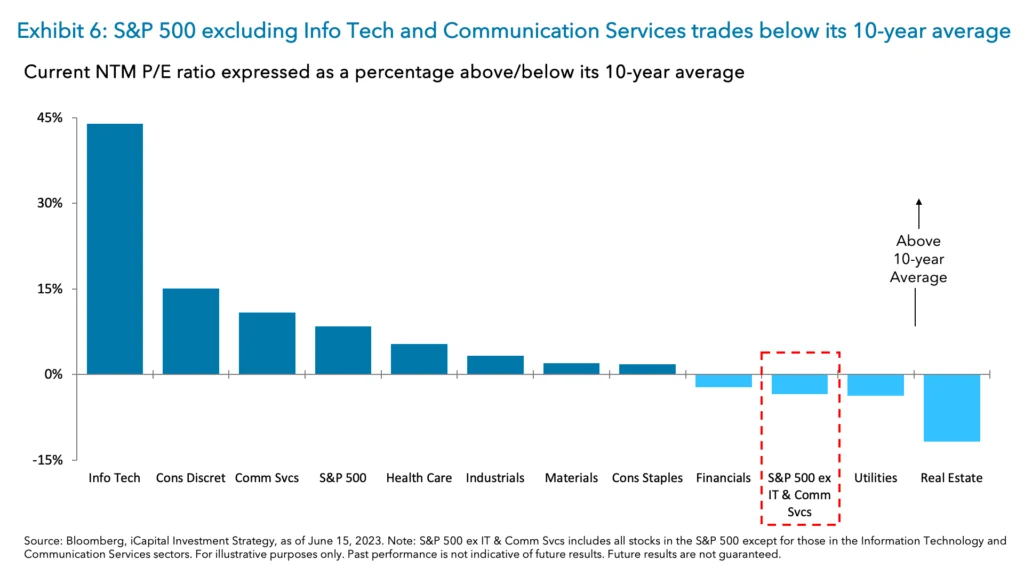

This has created very narrow market breadth over the past few months and as such the S&P 500, excluding the Information Technology & Communication Services sectors, has been up only +2.2% year-to-date compared to +37.2% for the Nasdaq 100.29 To resolve this, many investors are worried that the tech rally has to fade and the overall market has to slump. We think, however, that rather than tech having to fall apart, there is room for the upside market participation to broaden out and the rest of the market (i.e., cyclicals) to catch up, given the fundamental reasons outlined above. The good news for investors is that the valuations or positions of cyclicals aren’t stretched nor are they outside of the Information Technology and Communication Services sectors.30 Excluding these two sectors, S&P 500 valuations are not nearly as rich with the S&P 500 excluding Information Technology and Communication Services trading at 16.9x next 12-month earnings, below its 10-year average of 17.6x.31 Compare that to just the Information Technology and Communication Services sectors, which each trade at 27.3x and 16.8x forward earnings versus their 10-year averages of 19.3x and 15.2x, respectively (Exhibit 6).32

Given bearish positioning, trillions of inflows into bonds and cash, and this emerging FOMO (fear-of-missing-out) for equities, the recent catch-up in cyclicals should be able to continue. We should acknowledge that the recent momentum, even on the S&P 500, has become stretched from a short-term technical perspective. However, as long as the U.S. economy averts a recession this year, which we expect, history suggests that stocks can continue to rally in the months post a Fed pause and dips should present buying opportunities.

1. Federal Reserve Summary of Economic Projections, as of June 14, 2023.

2. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

3. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

4. Federal Reserve FOMC Press Conference, as of June 14, 2023.

5. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

6. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

7. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

8. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

9. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

10. Federal Reserve Bank of New York, as of May 19, 2023.

11. Federal Reserve Bank of New York, as of May 19, 2023.

12. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

13. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

14. Bloomberg, Federal Reserve, Goldman Sachs, iCapital Investment Strategy, as of June 15, 2023.

15. Bloomberg, U.S. Census Bureau, iCapital Investment Strategy, as of June 15, 2023.

16. Bureau of Economic Analysis, iCapital Investment Strategy, as of June 14, 2023.

17. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

18. JPMorgan, Bloomberg, iCapital Investment Strategy, as of June 6, 2023.

19. Bank of America, as of June 14, 2023.

20. JPMorgan, Bloomberg, iCapital Investment Strategy, as of June 6, 2023.

21. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

22. Bloomberg, iCapital Investment Strategy, as of June 13, 2023.

23. Bloomberg, iCapital Investment Strategy, as of June 13, 2023.

24. Goldman Sachs, June 13, 2023.

25. Bloomberg News, as of June 3, 2023.

26. Bloomberg News, as of June 13, 2023.

27. Bloomberg, iCapital Investment Strategy, as of June 14, 2023.

28. Bloomberg, as of June 15, 2023.

29. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

30. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

31. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

32. Bloomberg, iCapital Investment Strategy, as of June 15, 2023.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.