Equities have been on a wild ride since the start of the year, unfortunately far more down than up. Falls have been sharp and rallies have been brief. This has only intensified of late, with the S&P 500 recording three daily declines exceeding 3% since April 29.1 The index is down more than 16% year-to-date, with the Nasdaq falling even more sharply, off 25% over the same period.2 And though we see some value starting to emerge in pockets of fixed income such as short dated municipal bonds, fixed income as a whole has offered little shelter from the equity slump so far in 2022.3 Indeed, there are signs that we may be entering a new market paradigm, wherein stocks and bonds are actually positively correlated, reversing a two-decade-long negative correlation.4

So the question for investors is, where might be a port in this market storm? Investors with a longer time horizon might want to consider allocating to private equity (PE) and venture capital (VC), for which a downturn may actually be a very good time to invest.5

Private equity managers could exploit value in a downturn

For private fund managers, a downturn represents opportunity. They can deploy capital at more attractive terms and make calculated moves without being hamstrung by the short-termism that afflicts so many public companies.

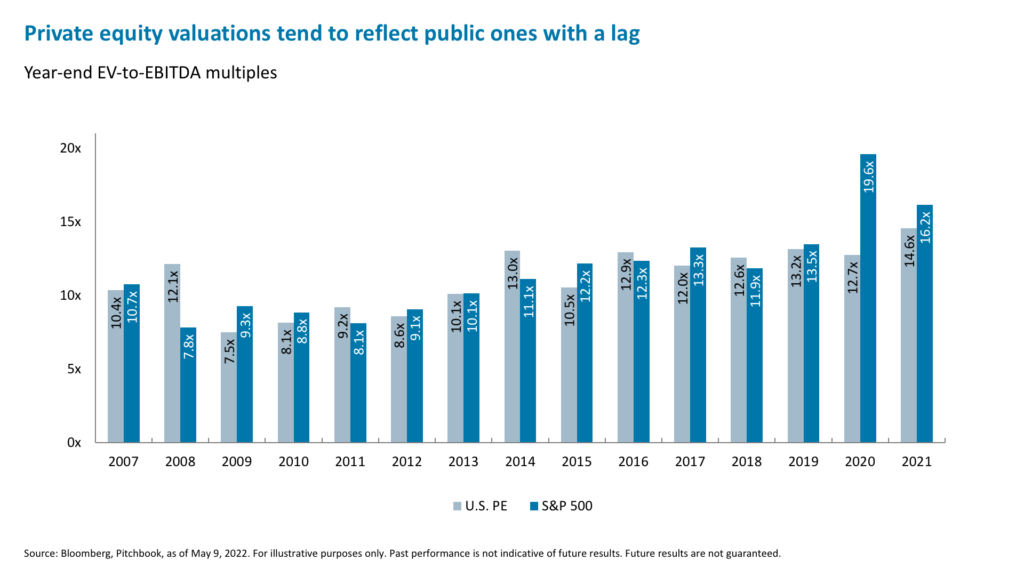

Declines in the valuations of private market deals have yet to show up in the data—though private valuations have remained far more reasonable than public ones during the recent market surge6—but we expect this to happen soon. As the chart below shows, enterprise value-to-EBITDA multiples for U.S. PE deals declined notably following the Global Financial Crisis (GFC), from 12.1x in 2008 to 7.5x just one year later.7

Changes in private market valuations generally lag public ones. First, they are reported at a lag due to the time needed for data collection, and second, the ripple effect from public valuation changes to private markets can take time as fund managers gradually take into account potentially lower exit values for their investments.

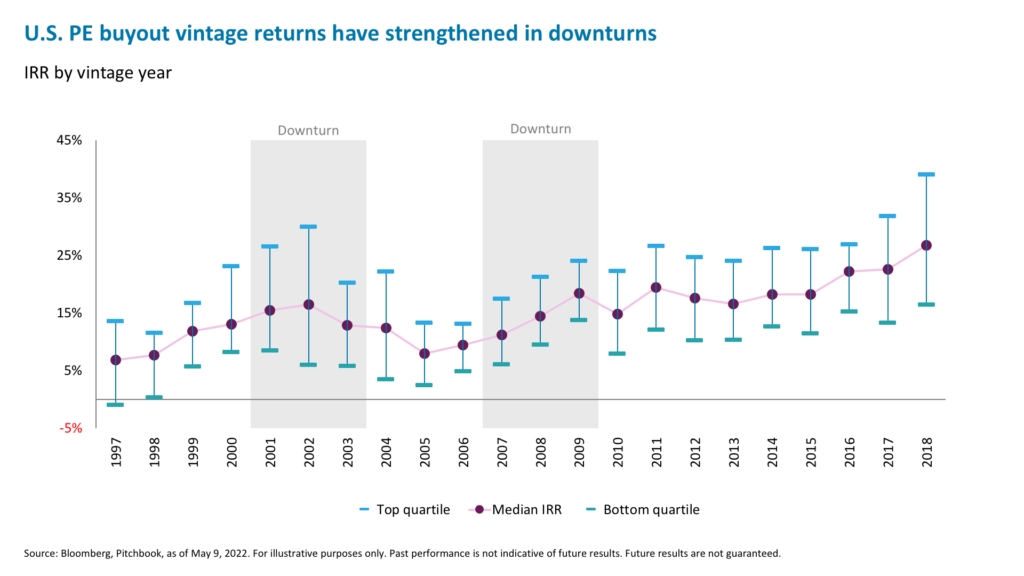

However, valuation declines today show little historical correlation with vintage returns. The data suggests that market slumps have either improved or, at the very least, not harmed, PE and VC fund performance. An analysis of the internal rate of return* (IRR) of U.S. buyout funds across vintages illustrates private equity’s attractive performance during economic downturns.8 In fact, we found that returns had strengthened in recession-year vintages, notably 2001, 2002, and 2009.9 The top-quartile IRR rose to 30% in 2002.10 It is also important to note that downside was relatively limited, even if an investor did not select the best fund. The lowest bottom-quartile IRR during either downturn period was a respectable 5.8%.11

What is behind this stronger performance and greater upside when investing in a downturn? Primarily, this reflects the fact that while falling public valuations can hurt returns from IPO exits, they equally over time create attractive discounts for private investments.

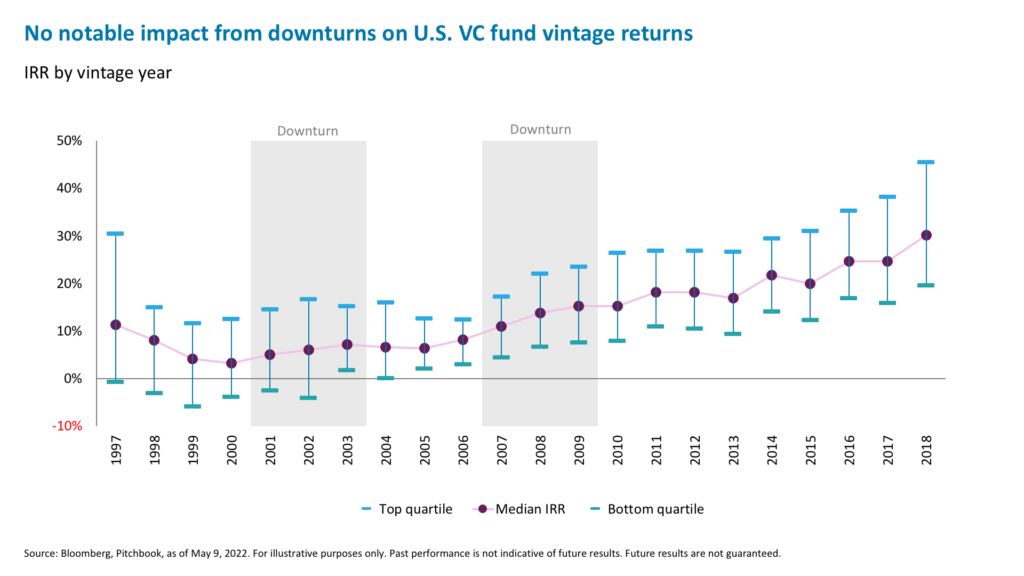

Though the historical patterns of returns are different—inevitable given the dissimilar investment approaches and markedly different target company profiles—the median IRR for U.S. VC fund vintages actually improved through market downturns.12 IRRs improved from 2001 to 2003 after the dot-com bubble burst, and from 2007 to 2009, in spite of the GFC.13

Clearly, VC has entered a new paradigm over the last decade as the secular growth of technology has helped drive performance to new heights. Given that technology (particularly unprofitable tech) has taken the brunt of the recent market correction, there may be concerns that VC will be hit hard. While some compression is likely, technology remains a secular growth driver, while facets of the private investment model mean commitments made now will have limited negative exposure to the ongoing downturn.

Patient capital and active management advantages during bear markets

First, it is important to remember that capital committed to PE and VC funds today is not invested immediately. Rather, it is deployed over time, typically up to four years. This means that valuation declines today will impact exits for those who invested in vintages several years ago rather than those investing now. Even then, managers have the benefit of a multi-year holding period, with the ability to patiently wait for more welcoming market conditions in which to exit their investments. Private equity’s illiquid nature insulates investors from panic selling during the depths of a downturn.

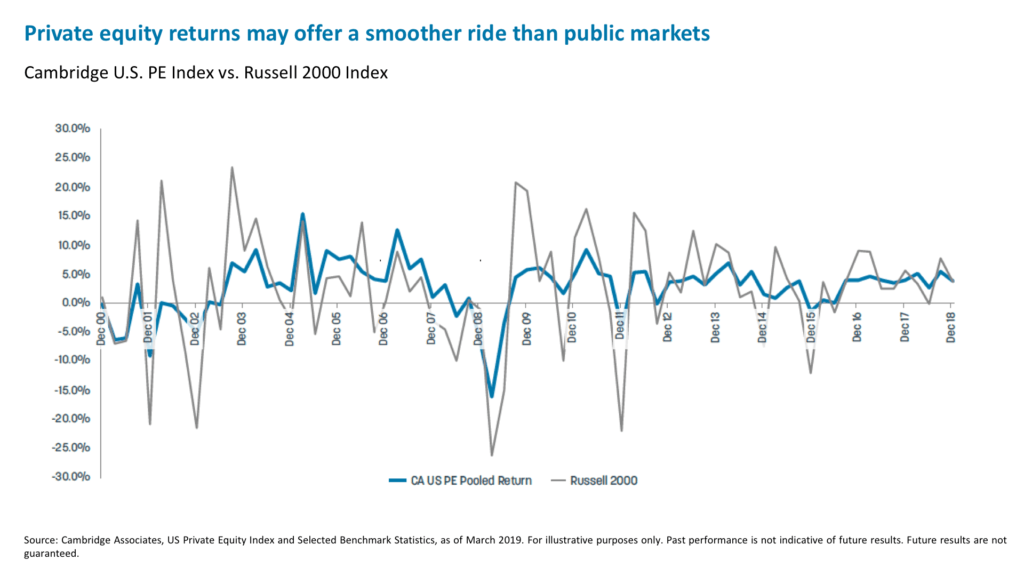

In conjunction with less frequent valuations of assets, this reduces the volatility of returns over time.14

Second, fund managers have an asymmetric information advantage over public market investors and can pivot their approach during downturns to help their companies successfully weather the storm. For example, they can use their available “dry powder” to alleviate any financing concerns, as well as help them renegotiate loan terms and debt obligations. Similarly, they can take a buy-and-build approach to consolidate a sector, using the same dry powder to make add-on acquisitions when purchase price multiples are low and public companies often steer away from M&A activity. PE-backed companies invested 6% more and gained 8% market share versus their non-PE-backed peers during the GFC.15 These factors are advantages in any market environment, but particularly during downturns.

We still believe that there are opportunities in oversold sectors where investors might find value in buying the dip, with appropriate downside protection and/or options income to offset risk. However, the Fed will remain a persistent headwind for equities, particularly in the context of another above-expectation inflation reading for April.16 They have made it very clear that they are squarely focused on taming inflation—despite a growing danger of tipping the economy into recession—so it is tough to yet call a market bottom and real value may be hard to come by in public markets.

All of which is to say that the current downturn—or indeed any downturn—may well be an opportune time to target private markets, provided investors are able and willing to lock up capital for a period of time.

1. Investing.com, as of May 10, 2022.

2. Bloomberg, as of May 10, 2022.

3. Bloomberg, as of May 10, 2022.

4. PGIM, “US stock-bond correlation: what are the macroeconomic drivers?”, May 6, 2021.

5. PitchBook, as of May 10, 2022.

6. PitchBook, Bloomberg. Data as of March 31, 2022, latest available data.

* Internal rate of return is a calculated metric of annualized returns for private funds that takes into account the gradual capital investment and return of capital over a number of years.

7. PitchBook, as of May 10, 2022.

8. Ibid.

9. Ibid.

10. Ibid.

11. Ibid.

12. Ibid.

13. Ibid.

14. Cambridge Associates, “US Private Equity Index and Selected Benchmark Statistics”, as of March 2019.

15. Bernstein, Lerner, Mezzanotti, "Private Equity and Financial Fragility during the Crisis," July 20, 2018.

16. Bloomberg, as of May 11, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.