Last Friday, the arrival of a new COVID-19 variant, Omicron, shocked global markets. Fears of the variant having the potential to elude current vaccines and drive renewed travel restrictions and lockdowns across the globe sent the S&P 500 spiraling downward 2.3%, while crude oil tumbled 13.1%, its ninth worst day on record.1 We saw a partial unwind of these sharp downward moves in the markets’ performance so far this week, but the question remains – was Friday’s selloff an overreaction?

Beyond the lack of liquidity on a holiday-shortened trading day, which no doubt exacerbated the moves to the downside, the truth is that we won’t know for the next few weeks whether we should be fundamentally concerned about Omicron. As a result, the broad markets are not yet a “screaming buy,” in our view, because there is a lack of oversold conditions and if there is anything we’ve learned from COVID-19 thus far, it is that we shouldn’t dismiss it too quickly. Also, should Omicron turn out to be a non-event — or even if it is more transmissible, but less severe than previous variants and / or still responsive to vaccines — a hawkish Fed might be waiting in the wings during the upcoming Federal Open Markets Committee meeting in December.

What can investors do today amid this uncertainty? Biotech is our top idea for the rest of the year and into 2022. Biotech has been a relative underperformer against the broader market year to date, with the iShares Biotech ETF up a mere 4.3% versus the 24.2% gain for the S&P 500.2 In this week’s commentary, we discuss three reasons why we think Biotech is worth a look (and a buy).

Three factors behind biotech’s underperformance this year have reversed

The biotech sector lagged the broader markets this year for three key reasons – all of which have turned a corner.

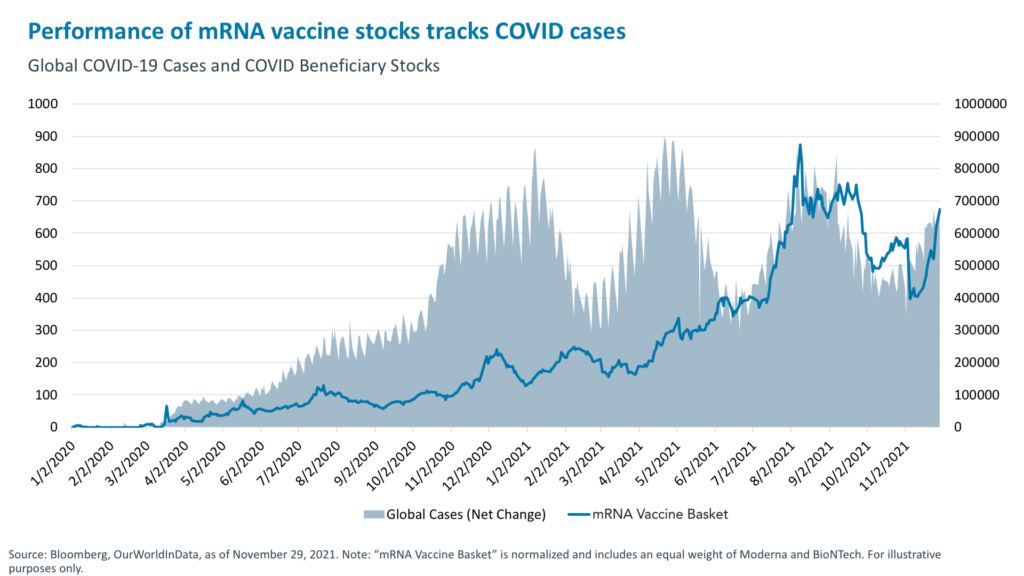

1. Correlation between COVID sentiment and biotech stocks: Since the start of the pandemic, biotech stock prices have moved in tandem with the waves of COVID as investors alternated between fear and relief as case numbers spiked and subsided. Biotech COVID beneficiaries, such as vaccine developers, gained early in the year then gave back some of those gains as pandemic angst declined. Today, however, an uptick of negative virus news and a resurgence of COVID fears are once again driving the upside in COVID biotech stocks.

2. Upcoming resolution of regulatory overhangs: Healthcare stocks breathed a sigh of relief when the initial version of drug pricing reform and uncertainty around it contained in the Build Back Better plan was replaced with a more measured approach. The initial version aimed to replace today’s market-driven drug pricing system with one that controlled prices and substantially lowered reimbursement rates. The current version impacts a narrower subset of drugs and otherwise substantially removes the drug pricing overhang for the sector, which has lingered since Nancy Pelosi introduced her drug pricing proposal more than two years ago. This is a potential boon for biopharma and biotech stocks.

3. More new drug approvals could be coming to market in 2022: While the FDA has managed to approve 46 and 53 new drugs in 2020 and 2021, respectively (within the typical yearly range of 40-50 new drugs), this number could have been higher.3 The inability of the FDA to conduct pre-approval, pre-market, or pre-license inspections due to the pandemic has resulted in delays with 48 drug applications still delayed as of May 2021.4 Additionally, a sizeable number of clinical trials were delayed or suspended. In 2020 alone, approximately 2,000 clinical trials were suspended, compared with roughly 550 suspensions in 2019.5

A potentially meaningful upside to the COVID booster market

The recent spike in COVID-19 cases, concerns about breakthrough infections, and now the emergence of the heavily mutated Omicron variant should underscore the importance of boosters. In our view, the need for boosters was underappreciated by the market prior to last week.

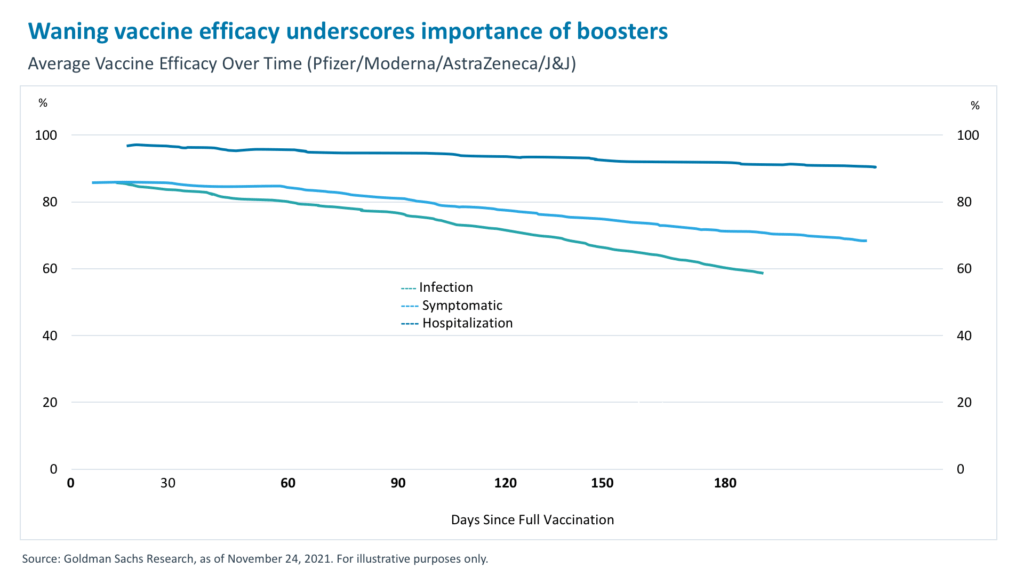

There is significant evidence to support the waning immunity of COVID vaccines and effectiveness of booster shots. Back in July, Pfizer–BioNTech published data showing that their vaccine’s efficacy against symptomatic disease slipped from 96% to 84% after six months.6 Data out of Israel painted a similar picture, indicating that vaccine protection against both infection and disease dropped from above 90% in the early months of its program to around 40% by late June 2021.7 In clinical studies, an additional booster shot restored immunity to 95.6% for individuals who had received the two-dose vaccine.8

One might question the need for a booster shot when the vaccine efficacy levels against hospitalizations remain largely intact, as shown in the chart below. Despite efficacy levels remaining high over a 180-day period, a further decrease is expected at around six to eight months and beyond, which is the recommended waiting period before a booster.9 Additionally, boosters raise antibody levels, which help protect against variants that could have a larger effect if there is waning immunity from the primary series. Further, boosters provide protection not only for the recipient but also to immunocompromised individuals by reducing virus transmission.

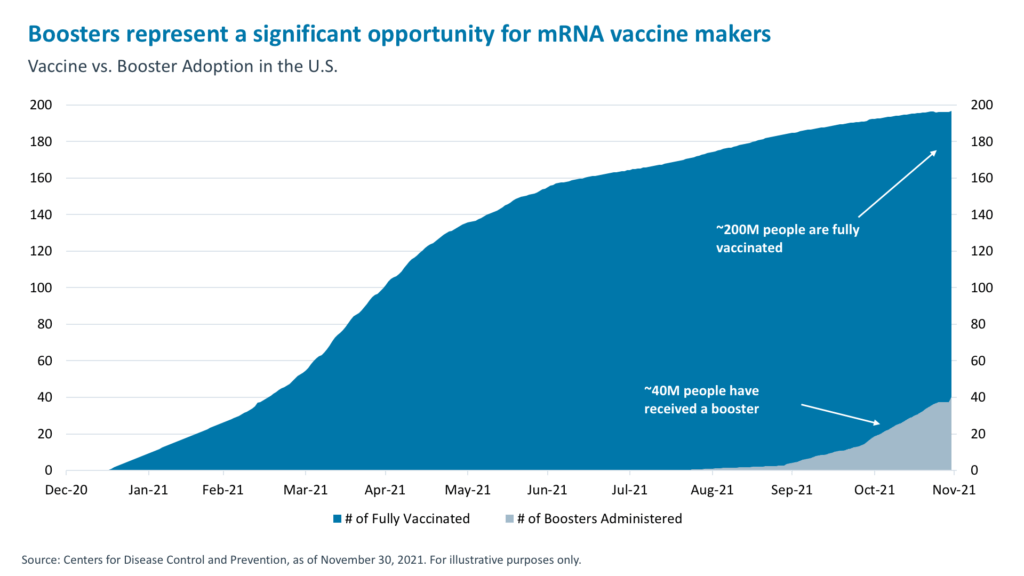

More than 40% of the population in Israel and more than 25% in the UK has received a booster shot. These were among the first countries to make COVID vaccines available to the public. Globally, only 3% of the population has received a booster dose.10 This represents a significant opportunity for the makers of vaccines. But what will boost this uptake percentage? Two things.

First, regulatory approvals and endorsements of boosters already happened in the United States and Europe, but the Omicron variant is leading policymakers to strengthen their rhetoric. In the U.S. on Monday, the CDC strengthened its language around booster shots from saying that anyone over 18 may get a booster shot, to saying that all adults should get a booster shot. A similar change in tone occurred in Europe last week, with the European Center for Disease Prevention and Control recommending boosters for anyone over 18 years old, with priority for those over 40. This was a change from its earlier position that only immunocompromised and elderly adults should receive the booster shot.

Second, even before the discovery of the Omicron variant, the intention of the general public to get a booster was high. At the end of October in the United States, roughly 43% of respondents surveyed said they would definitely get a booster dose, followed by 24% who said they would probably get one.11

One key question that will influence booster uptake is whether Omicron will evade the current vaccine immune response or if it will still help protect against severe disease. The preliminary opinions on this are mixed, but we should know more in the next few weeks. If the variant is vaccine resistant, leading mRNA vaccine companies have said they can produce a reformulated shot within 60-100 days.

All of this suggests that there could be a larger market for COVID vaccine boosters than has been priced in. 238 million booster doses have been administered to date globally.12 Based on recent developments, governments will likely exercise more options to procure additional doses, and more countries may consider switching to Pfizer and Moderna vaccines as they seek out not just any vaccines, but the most effective ones. With time, Moderna expects that it can deliver 2-3 billion Omicron booster shots in 2022,13 and Morgan Stanley Research estimates that together, Pfizer and Moderna can produce up to six billion boosters in 2022. If those six billion doses get produced and procured, it could drive $20 billion to $50 billion in incremental revenues for those two mRNA vaccine companies.14

It is unclear if this will be the only booster shot needed or if boosters will be required annually, like the flu shot. The data will likely provide some clarity in the spring. What we do know today is that most analysts are not forecasting a large-scale annual booster shot market post 2022 and have penciled in a measurable tapering off in COVID vaccine revenues in 2023.15 Should we discover that annual shots are needed, it could be a significant source of upside to consensus valuations.

Beyond vaccines and boosters, there is a growing addressable market for COVID testing and treatments. Not everyone will choose to get vaccines and vaccines will not protect against all severe cases. As a result, treatment options will be needed. Broad neutralizing monoclonal antibody (mAB) treatments and oral pills are very likely to be a part of the solution.

Finally, COVID vaccine companies are just now establishing the value of their mRNA platforms, which are likely to be used to develop vaccines not just for COVID, but also for the seasonal flu, a combination of COVID + flu, cancer, and much more. There is still much innovation potential ahead.

Standout growth opportunities in biotech beyond COVID

Despite the underperformance of biotech stocks in public markets, 2021 has been a strong year for private biotech companies. Global venture capital funding for biotech has reached a record high in 2021, growing 121% since the end of 2019.16 The biotech sector has also seen record IPO activity both in deal count and funds raised. The number of companies going public doubled in 2021 from 2019 and companies raised a record $35.8 billion compared with $8.2 billion in 2019, a 337% increase.17 Biotech M&A activity was also up in 2021, growing roughly 15%. This growth is likely to continue.18 An adage in the biotech space is “what starts in biotech doesn’t end in biotech.” Indeed, large pharma continues to rely heavily on biotech as a source of innovation and the top 12 pharmaceutical companies have a combined $170 billion in dry powder that can fund M&A activity.19

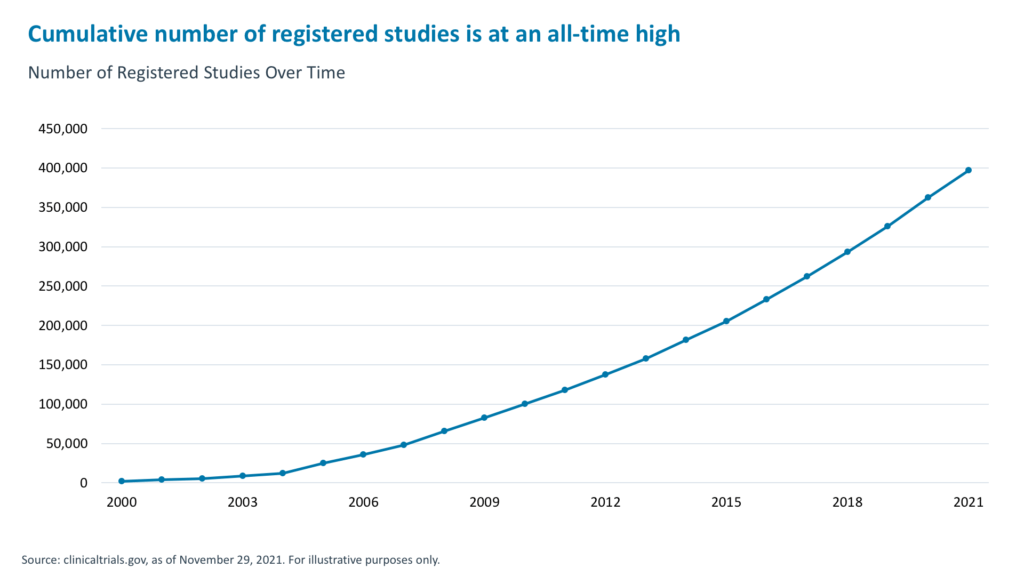

This record flow of funds into biotech can be attributed to advances in the space, particularly those pertaining to mRNA, gene therapy, gene editing, and rare diseases. Despite the temporary suspension of clinical trials in 2020, the cumulative number of registered studies is at a record high.20 And the current level of R&D funding is expected to produce $238 billion in biotech/pharma revenues between now and 2026.21 This should meaningfully accelerate industry revenues and could nearly double the current revenues of the Nasdaq Biotech index.

The story of biotech has largely been one of unbelievable potential but financial performance that comes in fits and starts. The current multiples reflect that investors, while hopeful, are unwilling to pay up to own the sector. The S&P 500 Biotech Index is valued at a 10x forward P/E versus 21x for the S&P 500.22 Still, a combination of COVID-related upside potential, decreasing regulatory risks and delays, and record innovation and breakthroughs should translate to financial results in the coming years. In our view, these factors support a strong case for biotech’s place in the portfolio. Investors watching the sector should tune in to news around the JP Morgan Healthcare Conference in January, which is likely to offer the next big catalyst (and test) for biotech stocks.

1. Bloomberg, as of November 29, 2021.

2. Ibid.

3. FDA, Novel Drug Approvals for 2021, as of November 29, 2021.

4. FDA, Resiliency Roadmap for FDA Inspectional Oversight, May 2021.

5. Evaluate Pharma, Evaluate Vantage, January 19, 2021.

6. medRxiv, Six Month Safety and Efficacy of the BNT162b2 mRNA COVID-19 Vaccine, July 28, 2021.

7. Ministry of Health of Israel, July 2021.

8. Pfizer-BioNTech, October 21, 2021.

9. Goldman Sachs Research, as of November 29, 2021

10. OurWorldInData, COVID-19 Vaccine Booster Doses, as of November 28, 2021.

11. Kaiser Family Foundation, KFF COVID-19 Vaccine Monitor, October 2021.

12. Source: OurWorldInData, COVID-19 Vaccine Booster Doses, as of November 28, 2021.

13. Financial Times, November 30, 2021.

14. Morgan Stanley, “What to Do About Omicron”, November 29, 2021.

15. Goldman Sachs Research, as of November 29, 2021.

16. Pitchbook, as of November 29, 2021.

17. Ibid.

18. Pitchbook, as of November 29, 2021.

19. McKinsey & Company, April 2021.

20. clinicaltrials.gov, as of November 29, 2021.

21. Evaluate Pharma World Preview 2020.

22. Bloomberg, as of November 29, 2021.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.