Stocks are currently trapped in a kind of purgatory as investors are forced daily to second guess how growth and U.S. Federal Reserve (Fed) hawkishness are going to impact the market. The S&P 500 has oscillated in a range from roughly 4,200 to 4,600 since the middle of January.1

Unfortunately, we do not think a quick resolution to either growth concerns or Fed hawkishness is likely, and as long as that is the case, stocks will likely continue to be trapped in this range. A still-growing economy and better-than-feared earnings should provide support at the bottom of the range, but the Fed and slowing growth momentum will cap upside at the top.

We see some scope for stocks to bounce off the newly depressed levels, with earnings and guidance supportive. Big tech and several semiconductor companies reported earnings this week and they largely beat expectations.2 Of the 40% of listed companies that have reported, 81% beat on earnings and close to 60% beat on both top line and bottom line.3 The fair value of the S&P 500 remains 4,600 to 4,700 based on a 20x price-to-earnings (P/E) multiple (and assuming no further multiple de-rating) and $235 next-twelve-month earnings, which would imply 12.3% of potential upside from here.4 Month-end pension rebalancing might help, as could the resumption of corporate buybacks (as earnings blackouts end on April 29).5 With stocks approaching technically oversold levels, we could see a bounce.

However, we are unsure about how much staying power a near-term relief rally might have and cannot rule out a break below the current range. Retail investors seem to have less appetite to buy the dip6 and hedge funds have been accumulating short positions.7 Importantly, the next Federal Open Market Committee meeting looms large next week. It would take a noticeable moderation in the Fed’s hawkish tone to justify a more sustained stock rally, and we find this prospect doubtful—the central bank is intent on bringing down inflation and appears to prefer front-loaded rate increases. Growth would need to slow sharply or inflation would have to show signs of retreat for the Fed to pivot. For now, neither is happening.

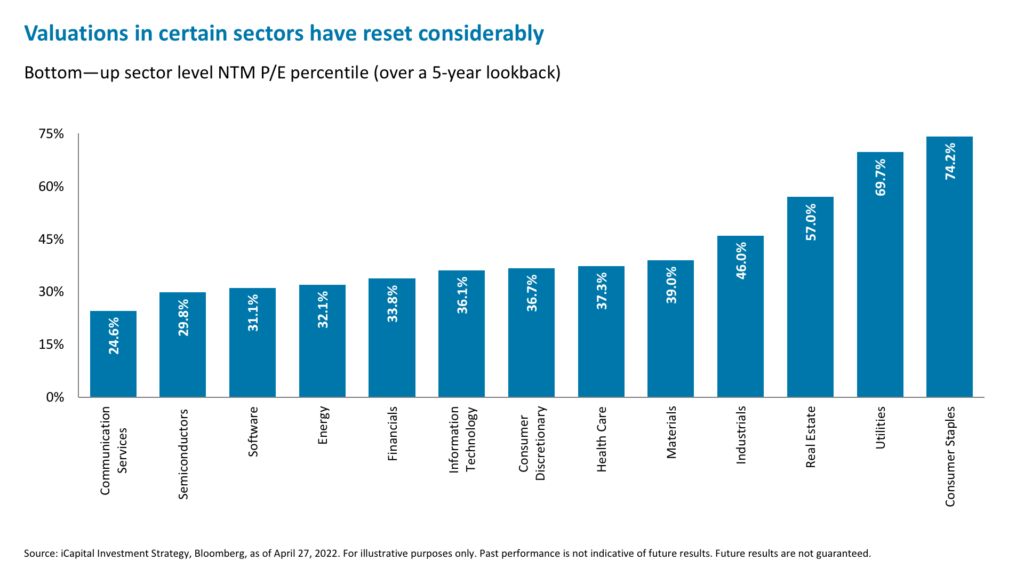

With so many unknowns, we will focus on what we do know—many stock valuations have already reset significantly. On the surface, the broad index valuations are not yet screaming cheap: for example, the S&P 500’s P/E ratio is in the 42nd percentile for the last five years and the Nasdaq’s is in the 55th percentile.8 However, there are pockets where valuations have reset significantly. The average stock in the S&P 500’s Communication Services and Information Technology sectors are now in the 25th and 36th percentile for the last five years, respectively, with Semiconductor and Software stocks in the 29th and 31st percentile.9

Moreover, 61% of S&P 500 companies are trading below the 50th percentile of their five-year valuation range, with 36% trading below the 25th percentile.10 This is a good starting point for selectively finding value. In conjunction with valuations, technical measures show that 13.3% of the stocks trading below their 25th percentile range are—based on a relative strength indicator (RSI) measure of 30 or below—oversold or close to it.11

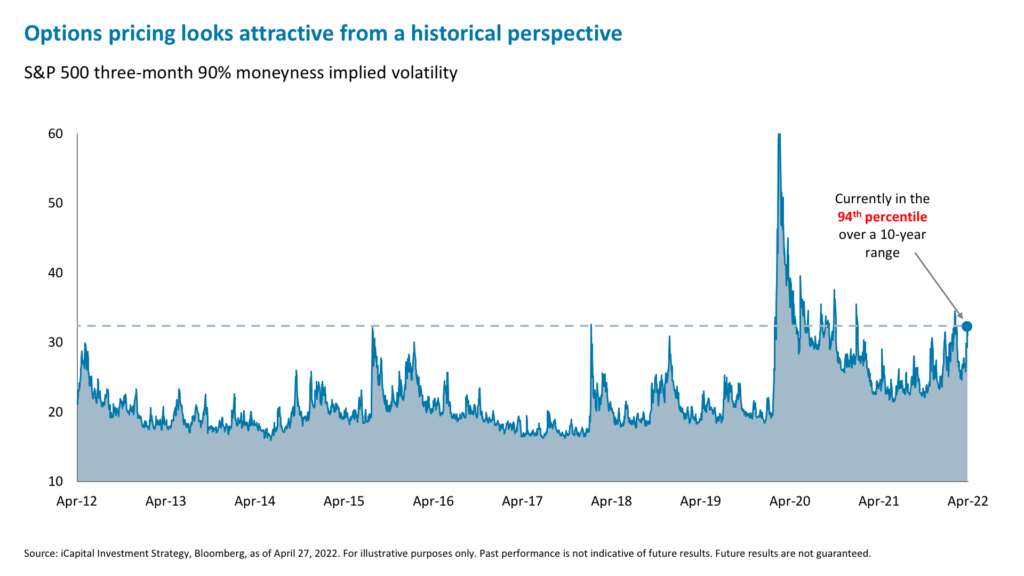

Should investors buy stocks that meet this screen? We recommend looking at one more metric—options-implied volatility. The 90% 3-month S&P 500 put option implied volatility, for example, is in the 94th percentile for the last 10 years, which suggests that put options pricing is attractive.12 Income-focused investors could sell a put option at a lower strike price and capture this historically elevated premium. For those more focused on the future upside potential of inexpensive and oversold stocks, you can consider pairing the sale of a put option with the purchase of a call spread.

Given tempting valuations but a highly uncertain environment, we favor the strategy of buying the dip in these stocks and managing their risk by taking advantage of historically attractive options pricing. For those of us who have accumulated large positions in big tech, software, and semiconductors, a stock replacement strategy could also make a lot of sense. Rather than being directionally long-only, which carries greater risk in today’s environment, you can retain exposure to these stocks but manage risk by incorporating downside protection and/or options income.

1. Bloomberg, as of April 27, 2022.

2. Bloomberg, as of April 27, 2022.

3. iCapital Investment Strategy, Bloomberg, as of April 27, 2022.

4. iCapital Investment Strategy, Bloomberg, as of April 27, 2022.

5. iCapital Investment Strategy, Bloomberg, as of April 27, 2022.

6. JPMorgan Retail Radar, April 27, 2022

7. Goldman Sachs Prime Services, as of April 22, 2022.

8. iCapital Investment Strategy, Bloomberg, as of April 27, 2022.

9. iCapital Investment Strategy, Bloomberg, as of April 27, 2022.

10. iCapital Investment Strategy, Bloomberg, as of April 27, 2022.

11. iCapital Investment Strategy, Bloomberg, as of April 27, 2022.

12. Bloomberg, as of April 27, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.