There has been relative calm in the markets lately. No one is particularly excited about chasing stocks higher near-term given the precarious economic backdrop, but at the same time, no one is panicking about an imminent recession. The question is—is it a calm before a coming storm or could it last a while longer? We think the main reason for the relative peace of mind is a higher chance of a soft landing than previously perceived—and this could remain the case for weeks or even months. As a result, we see an opportunity in financial stocks as a cyclical trade that can perform as concerns about an end-of-cycle recession get pushed back and the benefits of rising rates ripple through into second quarter earnings.

A higher chance of avoiding a crash landing

What specifically has been giving the markets this peace of mind lately? Three things, all of which seem to show that, as narrow as a path is to a soft or “soft-ish” landing, there is a path.

First, growth is slowing but not falling off a cliff. Sure, GDP expectations have been revised down but they are not in negative territory yet. The 2022 consensus forecast is for growth to slow to 2.6% and fall marginally to 2.0% in 2023.1 And that might be precisely what is needed to cool the jobs markets but avoid an outright contraction.

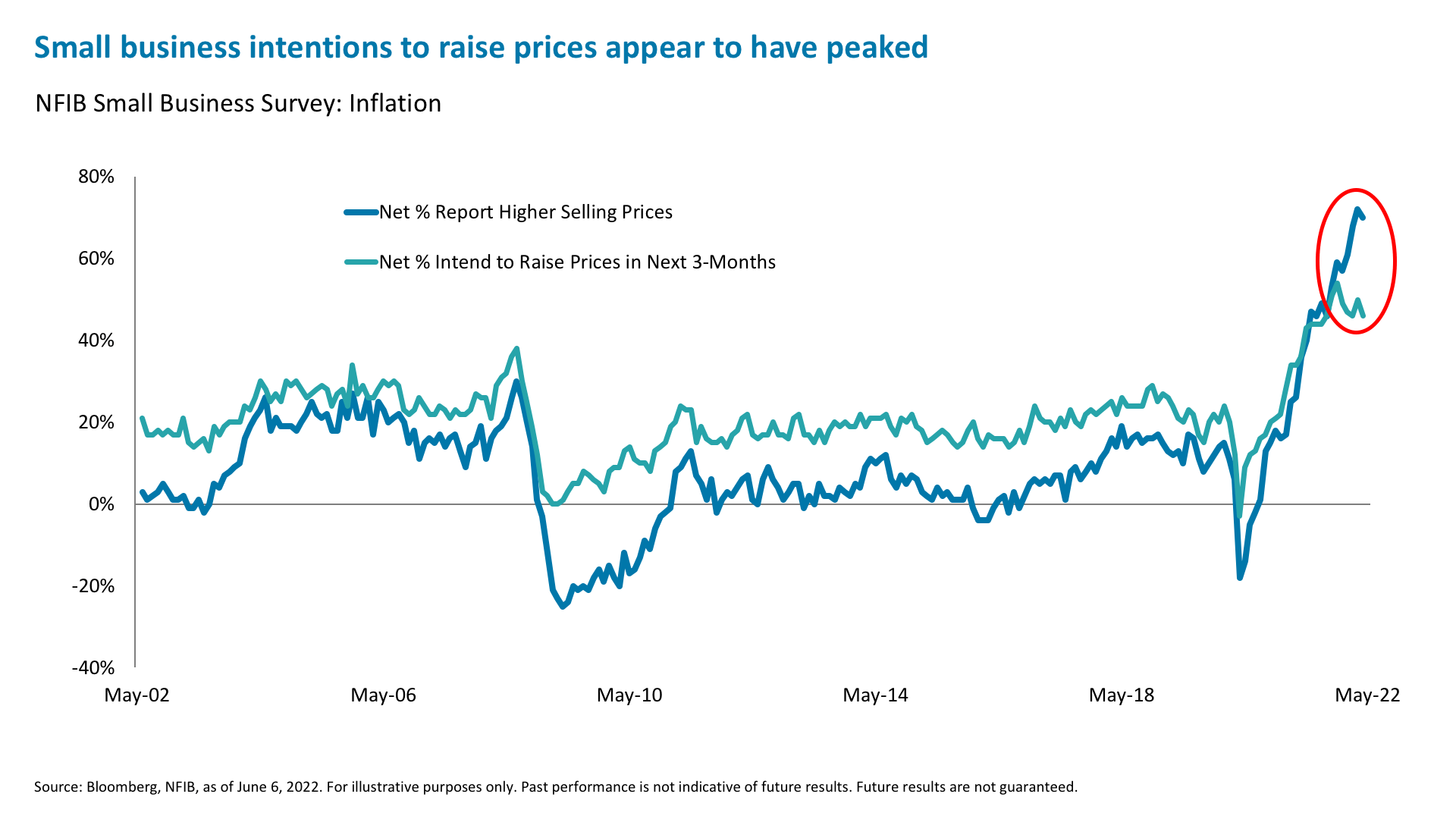

Second, there are signs that suggest inflation could be peaking. For one, this Friday the core Consumer Price Index is expected to come in at 5.9% in May vs 6.2% in April.2 Year-over-year wage growth cooled to 5.2% in May from 5.5% in April.3 The index of supply chain bottlenecks has shown definitive signs of easing and the return to relative normality in Shanghai should also help.4 Used car price growth is falling.5 Lastly, businesses are finally flagging a pause in price rise intentions.6

Third, the U.S. Federal Reserve (Fed) seems willing to entertain a slower approach to tightening that balances growth and inflation concerns. The Fed minutes hinted that the committee may want to pause rate hikes and re-assess after getting back to neutral by the fall.7 This is significant because if the Fed does not exclusively lean on the “blunt instrument” of rate hikes to slow inflation, but also lets higher prices and wealth erosion naturally bring down demand and inflation, then a soft landing may be in fact achievable and this may end up as a mid-cycle pause rather than an end-of-cycle recession.

The Fed is clearly aware of the risk of repeating the rate hikes and recessions of the seventies. Bold moves now could allow for slower ones later. Indeed, the Fed seems content with the slower growth trajectory it has already achieved, one necessary to cool off inflation. The rate path discounted in the markets now closely aligns with that of the Fed and achieves the objective of getting back to neutral as soon as possible.8 Financial conditions have also already tightened measurably, almost back to pre-COVID levels.9 This again suits the Fed well.

Stocks remain trapped in a range

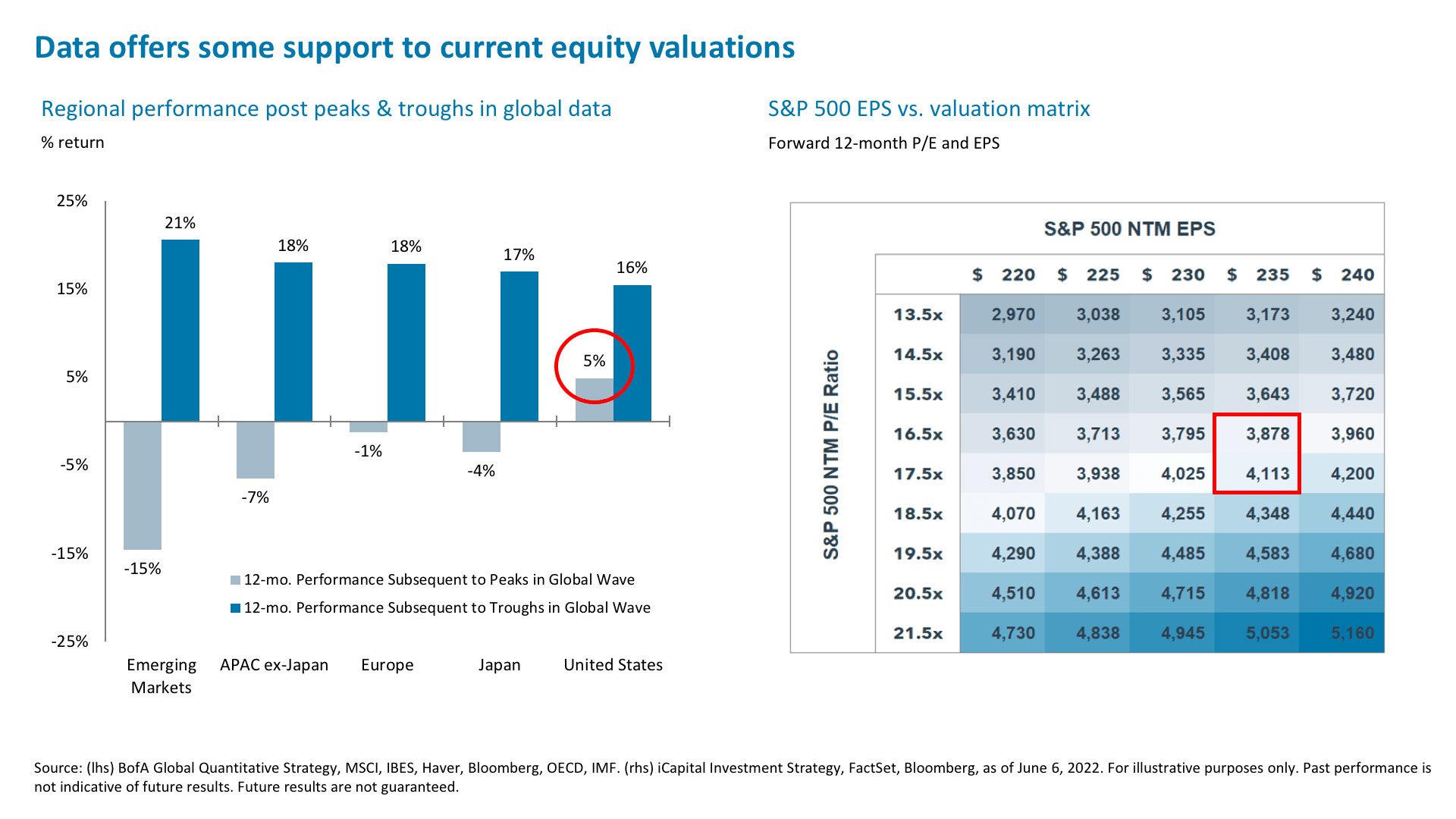

In May, the S&P 500 bounced off the 3,900 level.10 One reason for this is because this level coincided with indicators that the S&P 500 was oversold, another is that it represents at least an interim fundamental level of support—a 16.5x multiple on $235 earnings per share (EPS) on next-twelve-month (NTM) earnings.11 This multiple is “fair” based on the current path of Fed policy and rates expected to return to pre-COVID levels (last time we saw the 16.5 multiple).12 Further, a $235 EPS level appears reasonable with earnings coming in much better than expected in the first quarter.13 Also, the NTM earnings level could start to rise as we incorporate more 2023 earnings estimates.

A growth slowdown is definitely still ongoing—on the consumer side, autos, housing, and trucking demand are all weakening, and travel might follow.14 On the corporate side, there is a clear emphasis on cost control and hints that hiring intentions are slowing.15 So more downward revisions are possible. Downward revisions are clearly not a bullish signal as they tend to depress or cap equity returns. But they are not necessarily outright bearish either. For example, U.S. equities have still managed to return an average of 5% over 12-month periods subsequent to peaks in global data—which is when downward revisions become apparent.16 And while downward earnings revisions weigh on stocks when they push earnings growth into negative territory, that is not yet the case today. EPS growth for 2022 is projected to remain positive, at 10.2%, and stay positive at 7.8% in 2023.17

Nevertheless, we think that stock market upside is limited—how much more would investors really be willing to pay for stocks in this environment? So we are, for now at least, trapped in a range. In order for us to turn decisively bullish and advocate for significantly increasing equity exposure, slowing GDP growth would need to flatten. That will likely take months. Still, we see an attractive potential trade for investors in a sector that swiftly went from one of the favorites to own to a favorite one to short: financials.

The case for financials

A mid-cycle slowdown, rather than a recession with a steep rate hiking cycle, could be a double positive for financials. Sector stocks are down 10.8% year-to-date as concerns have mounted about an economic slowdown and a potential increase in non-performing loans.18 Assuming that concern can be pushed down the road, here is what we like about banks:

1. Rising net interest margins: The net interest margin is expected to rise sharply in the second quarter to 15bps, from 4bps in the first quarter, benefiting from the March and May rate hikes.19 Additional rate increases will help again in the third quarter. Also, the yield curve that is more pertinent to banks is the 3-month-to-10-year curve, which has been steepening as of late and is around 170 bps, versus 26bps for the more widely cited 2-year-to-10-year curve.20 That is because banks borrow short-term via deposits and lend them out longer-term, with the average duration of the liability in the five-year range.21 Additionally, deposit betas—what banks have to pay on deposits—tend to be slow to rise for the first few rate hike as banks raise interest paid on deposits slower than interest charged on loans.22

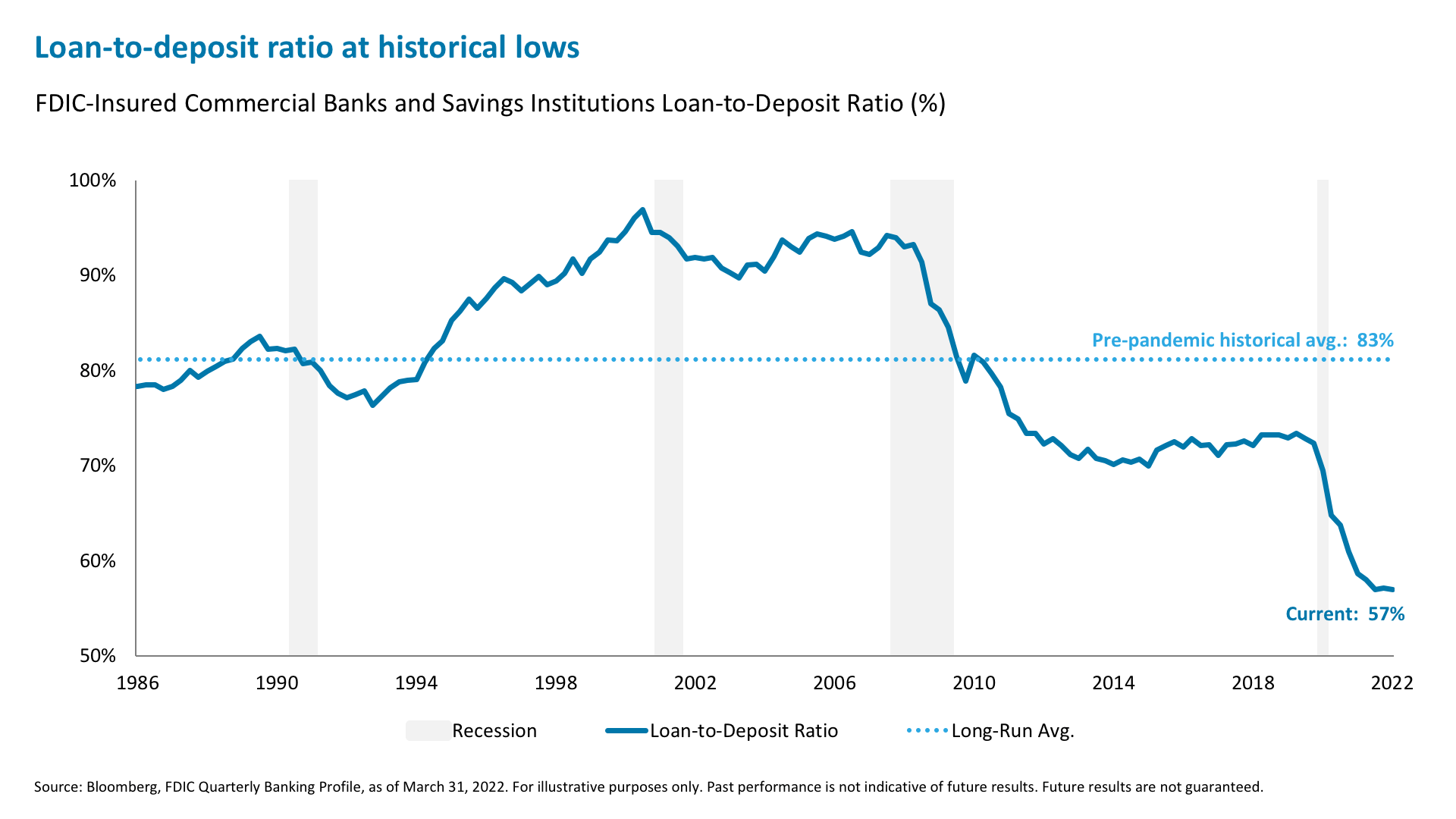

2. Stable loan growth and no increase in non-performing loans: Lending has been picking up with credit cards and commercial and industrial loans particularly strong, despite the softness in autos and refinancings, and expected declines in residential mortgages. Still, overall loan growth is 8.24% year-over-year, while loans 30 to 89 days past due (approaching non-performing status of 90 days past due) are just 0.48% of total loans—below the 10-year average of 0.98% and long-run historical average of 1.17%.23 Additionally, the industry-level loan-to-deposit ratio is at historical lows of 57% vs a pre-pandemic historical average of 83%.24 Even if we assume that deposit growth slows or declines with the tapering of quantitative easing, bank balance sheets should still be large enough to increase lending.

3. Potential for capital markets activity to come back to life: The IPO market has evaporated this year and M&A activity has been weak. But there is a large backlog of M&A deals, lots of cash on corporate balance sheets, and many valuations have reset. If some stability returns to markets, we could see a pick-up in capital markets activity once more, which would benefit financials.

As we always do with investment ideas, we look for a good contrarian setup in valuations and positioning and a catalyst to the upside. Today, financials are trading at below long-term average on both an absolute basis and relative to the S&P 500, and are its second cheapest sector (after energy).25 The sector also continues to suffer steep outflows (versus inflows into tech and, finally, high yield debt).26 This trade is certainly not without risks—non-performing loans could rise from low levels, the reserves-to-loan ratio is currently low, and depleted capital ratio buffers could mean more conservative loan book management.27 However, given the above setup and our cautious expectation that recession can for now be avoided, we think it is a risk worth taking, in addition to select oversold tech stocks.

1. Bloomberg, as of June 6, 2022.

2. Bloomberg, as of June 6, 2022.

3. Bloomberg, as of June 6, 2022.

4. Bloomberg, as of June 6, 2022.

5. Bloomberg, as of June 6, 2022.

6. Bloomberg, NFIB, as of June 6, 2022.

7. Minutes of the Federal Open Market Committee for May 3-4, 2022 Meeting, as of May 25, 2022.

8. Bloomberg, iCapital Investment Strategy, as of June 6, 2022.

9. Bloomberg, as of June 6, 2022.

10. Bloomberg, as of June 6, 2022.

11. Bloomberg, FactSet, iCapital Investment Strategy, as of June 6, 2022.

12. Bloomberg, iCapital Investment Strategy, as of June 6, 2022.

13. Bloomberg, iCapital Investment Strategy, as of June 6, 2022.

14. Bloomberg, iCapital Investment Strategy, as of June 6, 2022.

15. Bloomberg, iCapital Investment Strategy, as of June 6, 2022.

16. BofA Global Quantitative Strategy, MSCI, IBES, Haver, Bloomberg, OECD, IMF, as of March 2022.

17. FactSet, as of June 3, 2022.

18. Bloomberg, as of June 6, 2022.

19. JPMorgan, as of May 4, 2022.

20. Bloomberg, as of June 6, 2022.

21. Bloomberg, iCapital Investment Strategy, as of June 6, 2022.

22. Bloomberg, iCapital Investment Strategy, as of June 6, 2022.

23. Bloomberg, Federal Reserve: Assets and Liabilities of Commercial Banks in the United States - H.8, as of June 3, 2022.

24. FDIC, as of June 1, 2022.

25. Bloomberg, as of June 6, 2022.

26. EPFR, as of June 2, 2022.

27. Bloomberg, iCapital Investment Strategy, as of June 6, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.