Hedge funds represent a diverse group of investment strategies that can offer investors enhanced returns, capital preservation, risk mitigation, and greater portfolio diversification across various market conditions.

Flexibility

Hedge fund managers have considerable investment flexibility. Unlike mutual funds, hedge funds are not publicly traded, allowing hedge fund managers to invest in stocks, bonds, commodities, currencies, futures, swaps, or other derivatives. In addition, hedge fund managers may use leverage to increase return potential, and/or short selling to help hedge the risks of individual stocks or a portfolio.

This ability to hedge market risk has historically resulted in hedge funds delivering greater risk-adjusted returns relative to public markets (particularly in down markets or periods of macroeconomic uncertainty) and reducing overall volatility when added to a portfolio of traditional stocks and bonds.1

Types of Hedge Funds

Hedge fund managers may follow a wide range of investment strategies that target an equally diverse range of investment objectives. These strategies include, but are not limited to:

BENEFITS

![]() Hedge funds provide access to a broad array of strategies available to meet various investment objectives.

Hedge funds provide access to a broad array of strategies available to meet various investment objectives.

![]() Hedge funds can offer an opportunity to pursue enhanced returns and/or downside protection, while providing diverse sources of return relative to traditional stocks and bonds.

Hedge funds can offer an opportunity to pursue enhanced returns and/or downside protection, while providing diverse sources of return relative to traditional stocks and bonds.

![]() Hedge funds have historically delivered greater risk-adjusted returns relative to public markets, particularly during periods of market volatility, high interest rates, and macroeconomic uncertainty.2

Hedge funds have historically delivered greater risk-adjusted returns relative to public markets, particularly during periods of market volatility, high interest rates, and macroeconomic uncertainty.2

![]() Hedge funds are accessible to a greater number of investors given today’s innovations in product development and technology.

Hedge funds are accessible to a greater number of investors given today’s innovations in product development and technology.

KEY RISK CONSIDERATIONS

Key risk considerations may include, but are not limited to, the following:

![]() Manager Selection: Not all hedge fund managers are the same. The experience, skill level, and track records of managers may vary greatly, and as a result, there can be a wide dispersion (or difference) in returns. It is critical to have a thorough diligence process in place to evaluate hedge fund managers.

Manager Selection: Not all hedge fund managers are the same. The experience, skill level, and track records of managers may vary greatly, and as a result, there can be a wide dispersion (or difference) in returns. It is critical to have a thorough diligence process in place to evaluate hedge fund managers.

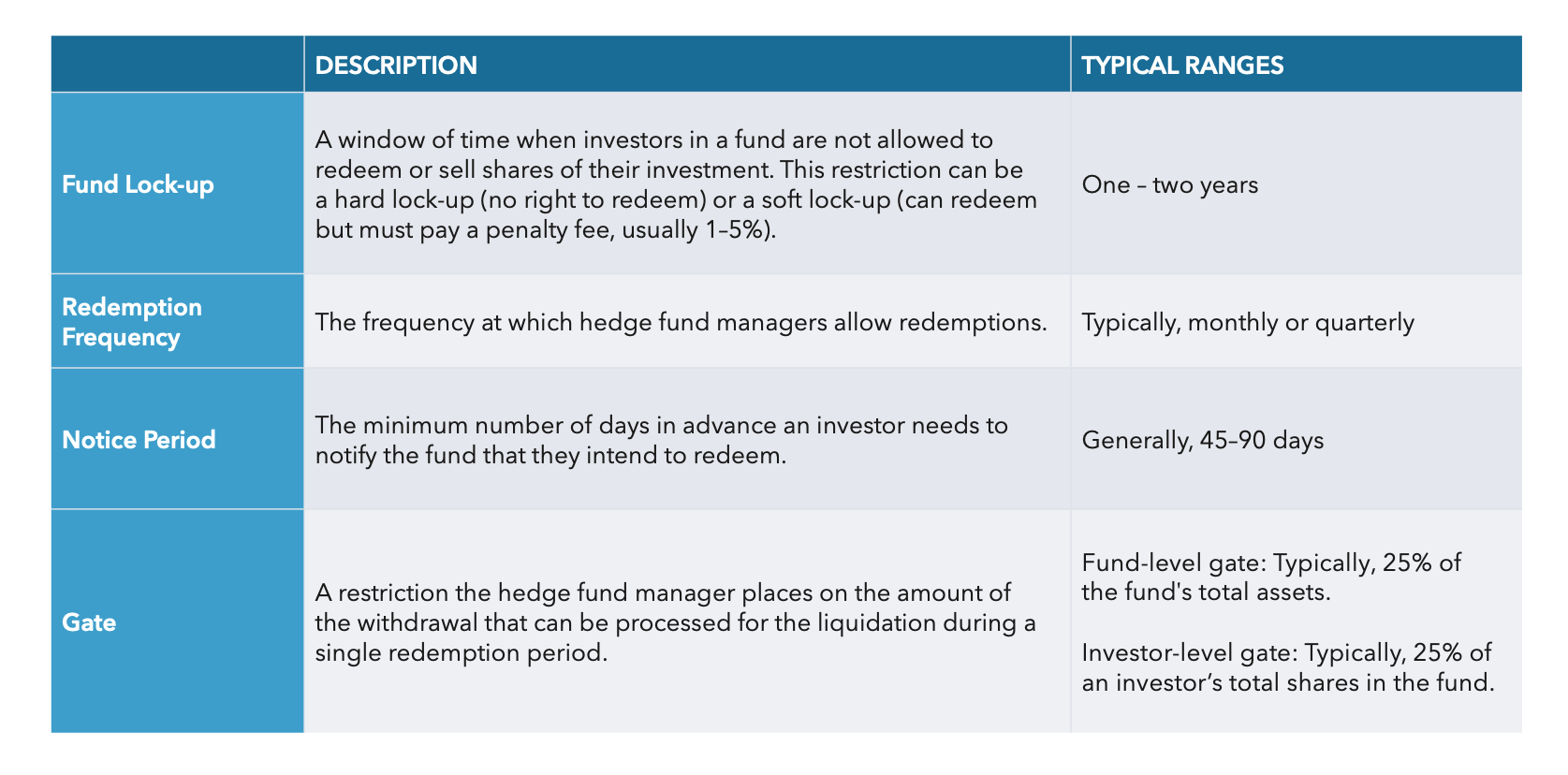

![]() Liquidity: While hedge funds typically offer redemptions on a periodic basis, investors may be subject to a lock-up period which will prevent them from redeeming their capital for a period of time. In addition, investors must give written notice of their intention to redeem, with notice periods typically ranging from 30 to 90 days in advance. The manager may impose a gate, or a redemption limit, on the amount that can be withdrawn during a given redemption period.

Liquidity: While hedge funds typically offer redemptions on a periodic basis, investors may be subject to a lock-up period which will prevent them from redeeming their capital for a period of time. In addition, investors must give written notice of their intention to redeem, with notice periods typically ranging from 30 to 90 days in advance. The manager may impose a gate, or a redemption limit, on the amount that can be withdrawn during a given redemption period.

![]() Transparency: Hedge funds may not offer the same level of transparency as traditional investments, which are required to provide frequent and full disclosures.

Transparency: Hedge funds may not offer the same level of transparency as traditional investments, which are required to provide frequent and full disclosures.

![]() Fees: Hedge fund managers charge their investors an annual management fee, typically 1–2% of assets under management. Fund managers also typically charge an incentive, or performance fee, which traditionally represents 15–20% of fund profits.

Fees: Hedge fund managers charge their investors an annual management fee, typically 1–2% of assets under management. Fund managers also typically charge an incentive, or performance fee, which traditionally represents 15–20% of fund profits.

![]() Leverage: Hedge funds often use leverage, which offers the potential for higher returns, but may also increase volatility or downside risk.

Leverage: Hedge funds often use leverage, which offers the potential for higher returns, but may also increase volatility or downside risk.

![]() Concentration: Hedge funds may hold concentrated positions or focus on a specific market, sector, and/or geographic region.

Concentration: Hedge funds may hold concentrated positions or focus on a specific market, sector, and/or geographic region.

Please contact your financial professional or a fund manager to learn more.

1. Source: eVestment, as of March 2023. Based on HFRI Fund Weighted Composite Index versus S&P 500 Index and Bloomberg US Aggregate Index, from Jan. 1990 to Feb. 2023. Past performance is not indicative of future results. Future results are not guaranteed.

2. Source: eVestment, as of March 2023. Based on HFRI Fund Weighted Composite Index versus S&P 500 Index and Bloomberg US Aggregate Index, from Jan. 1990 to Feb. 2023. Past performance is not indicative of future results. Future results are not guaranteed.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01