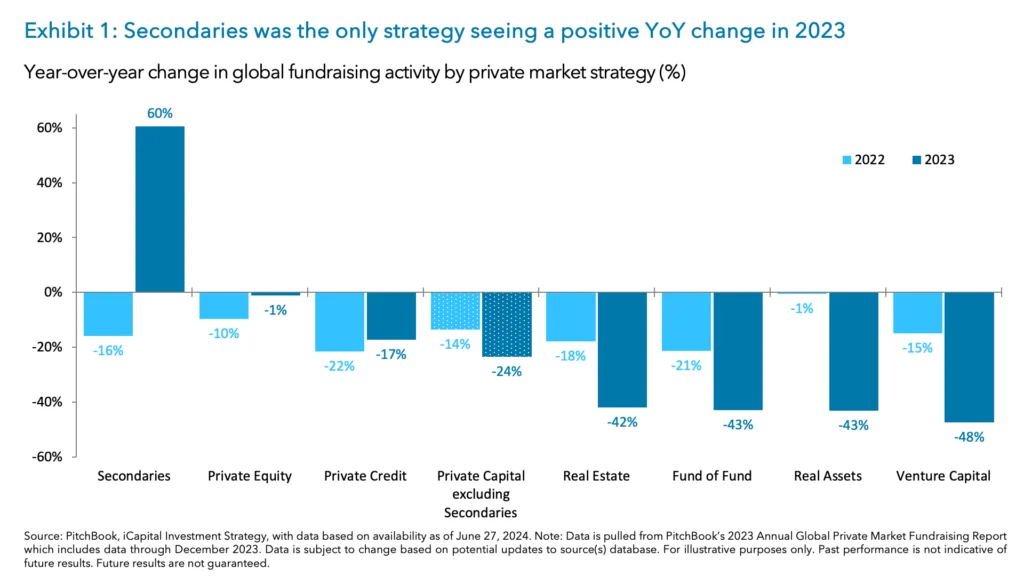

The private equity secondaries market has shown remarkable strength amid the fundraising challenges in the broader private markets in recent years. In 2023, it was the only strategy to register a positive year-over-year change in fundraising, increasing by 60% from 2022, while other private market strategies saw a 24% decline (see Exhibit 1).1 And in the first quarter of this year (2024), secondaries had its highest fundraising quarter going back all the way to 2008.2

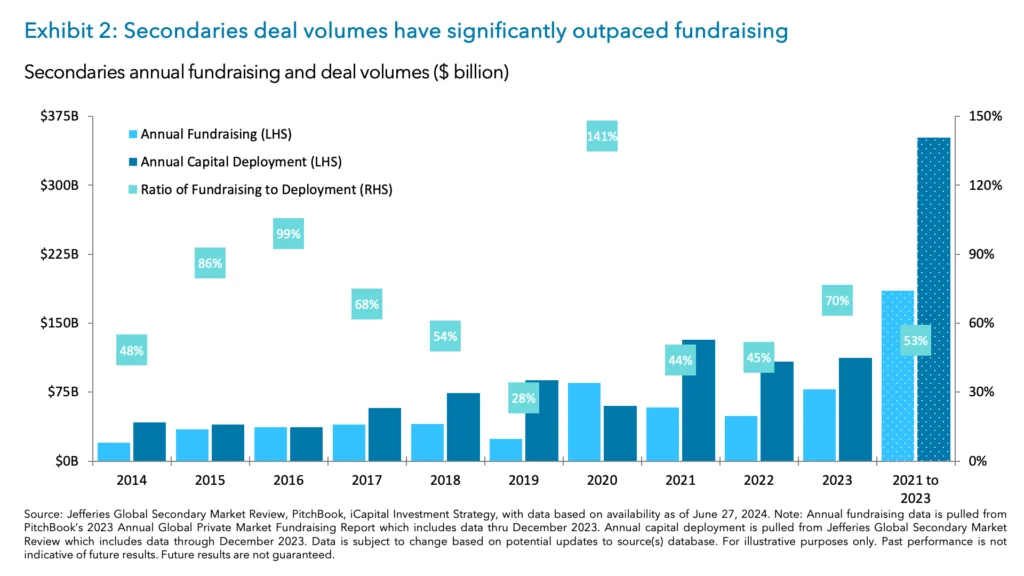

However, despite this robust fundraising, the secondaries market remains severely undercapitalized, with capital being deployed faster than it is raised. Annual deal volumes, or transactions, have consistently outpaced annual fundraising levels every year since 2010, with the exception of 2020.3 And from 2021 to 2023, secondary funds raised roughly $185 billion but deployed around $350 billion.4 This means that only 53 cents was raised for every dollar invested (see Exhibit 2).5

So, what does this imbalance mean? Well, the dry powder in the secondary market, which is currently at $235 billion, is expected to shrink over the near to medium term.6 At the end of 2023, the capital surplus multiple, which is the amount of dry powder divided by annual deal volume, implied that there is roughly two years’ worth of dry powder available to fund secondaries transactions.7 And this aligns with broader expectations of industry experts who expect the availability of capital to range from 20 to 30 months.

And the demand for more secondaries transactions may still grow. For example, buyout GPs hold roughly 28,000 unsold companies worth over $3 trillion in unrealized value and are expected to leverage the secondaries market to sell a portion of those positions.8 This is likely to further tip the supply-demand imbalance in PE secondaries dry powder over the near to medium term.

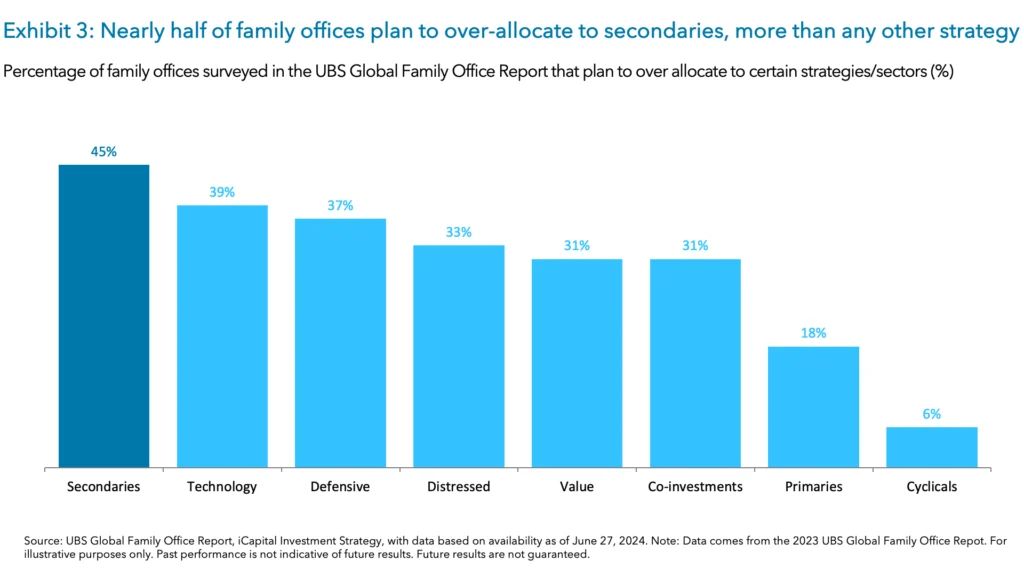

Importantly, the lack of available capital is not due to a lack of investor interest. In fact, investor allocations to secondaries have actually increased approximately two to four times over the past decade.9 And according to Hamilton Lane’s Ryan Cooney – who we previously had on our Beyond 60/40 Episode 3 (see here) – investors are funding those increases by reducing their allocation to primary private equity as well as public equities.

Similarly, according to a recent UBS Global Family Office Report, nearly half (45%) of family offices plan to over-allocate their portfolios to secondaries; that’s more than any other private equity strategy or sector (see Exhibit 3).10

Performance has been one of the reasons driving fresh capital to this undercapitalized strategy. Secondaries delivered stellar returns with a three-year horizon IRR of +20.6%, beating all other strategies, even private equity’s three-year horizon IRR of +19.0% (see Exhibit 4).11 And over the prior ten-year period, secondaries have also produced strong returns with a ten-year horizon IRR of +13.4%. Secondaries are also the only alternative asset class where even the lowest-performing quartile of funds still manage to generate positive returns.12

But beyond just performance, we also see further reasons to be positive on the secondaries markets, including faster capital deployment, more mature assets, and shorter J-curves. For more insights on this, please see iCapital’s “How to Navigate a Growing Secondaries Market.”

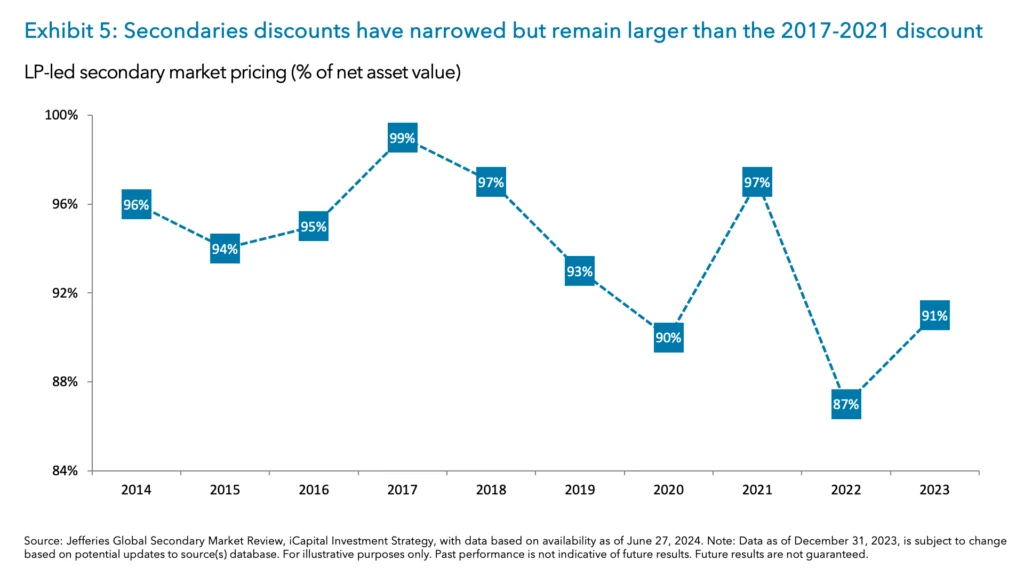

So, where does this leave us? Well, we agree with the investor sentiment that there is a lot to like about the PE secondaries market. Specifically, first off, PE buyout secondaries are still trading at a discount to NAV, after rebounding in 2022 (see Exhibit 5).13 This discount is 9% as of 2023 versus 13% in 2022, but that is still higher than the average 5% discount seen between 2017 and 2021.14

And secondly, the improving global macro backdrop with disinflationary trends and stable GDP growth should support the private equity exit environment, meaning seasoned deals within these secondaries’ vintages may be closer to monetization than they’ve been before. That is likely a solid setup for this strategy.

1. PitchBook, 2023 Annual Global Private Market Fundraising Report, iCapital Investment Strategy, as of June 27, 2024. Note: Data is based on global fundraising activity through 2023.

2. Ibid.

3. Jefferies Global Secondary Market Review, January 2024. PitchBook, 2023 Annual Global Private Market Fundraising Report, as of June 27, 20224. Note: Annual fundraising levels are based on PitchBook data and annual deal volumes are based on Jefferies data.

4. Ibid.

5. Ibid.

6. PitchBook, iCapital Investment Strategy, as of June 27, 2024.

7. PitchBook, Jefferies Global Secondary Market Review, iCapital Investment Strategy, as of June 27, 2024.

8. Bain & Co., Global Private Equity Report 2024, as of March 11, 2024.

9. Hamilton Lane, Private Equity International (PEI) “Behind the growing pool of secondaries capital”, iCapital Investment Strategy, as of May 1, 2024

10. UBS, Global Family Office Report 2023, May 22, 2024.

11. PitchBook, Q3 2023 Global Fund Performance Report, as of May 6, 2024. Note: Horizon IRRs are three-years through Sept. 30, 2023.

12. PitchBook, iCapital Investment Strategy, as of June 27, 2024.

13. Jefferies Global Secondary Market Review, iCapital Investment Strategy, as of June 27, 2024.

14. Ibid.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved.