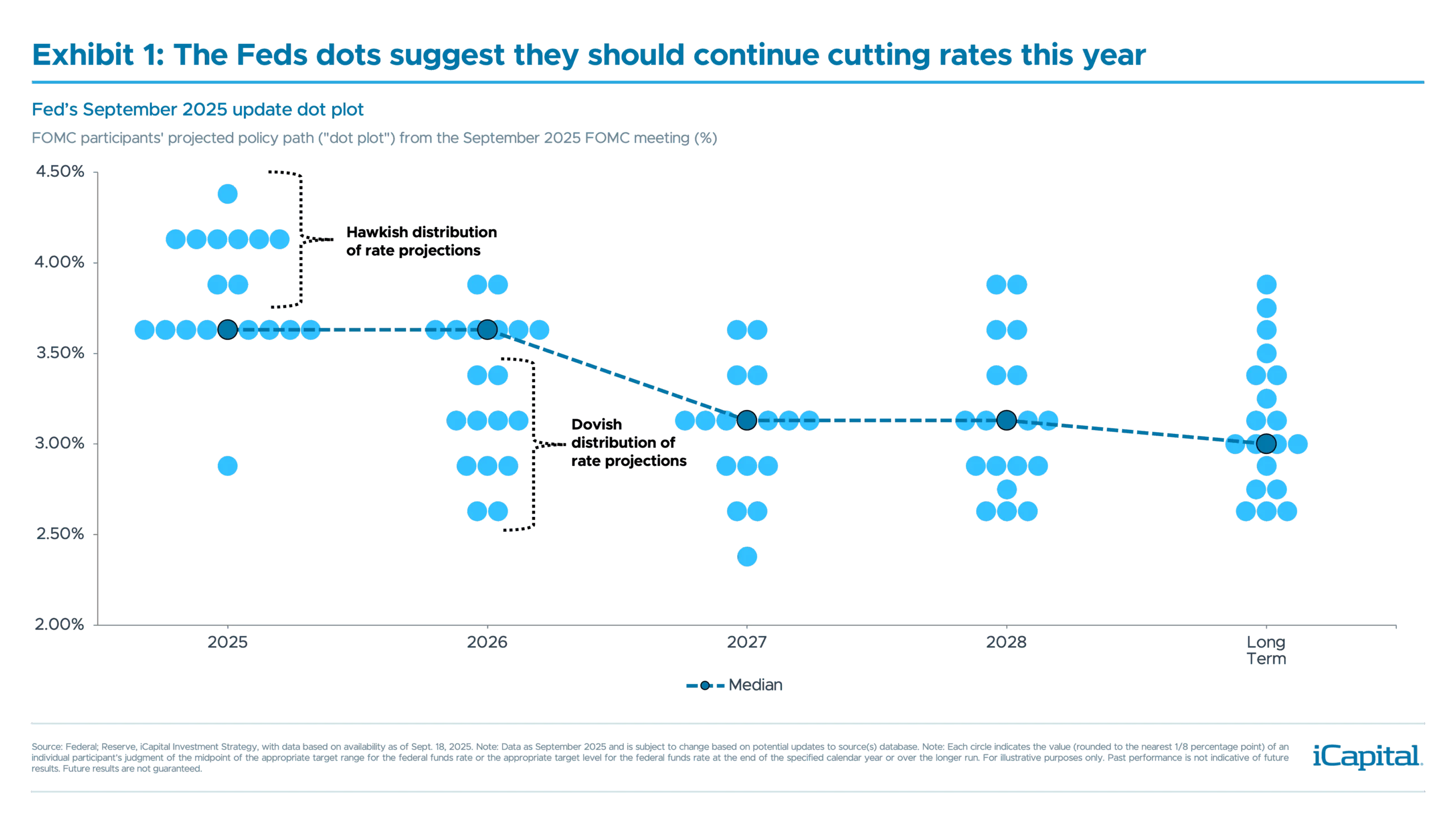

As expected, the Fed cut rates by 25 basis points (bps), but a notable divergence emerged between the dot plot and the Summary of Economic Projections. While financial markets interpreted the decision and Chair Powell’s press conference as slightly hawkish – evidenced by a nearly 6bps rise in the U.S. 10-year yield – we viewed the tone as modestly dovish. Despite the mention of a “risk management cut”, we would expect the Fed to continue to cut rates for the remainder of this year and into 2026.

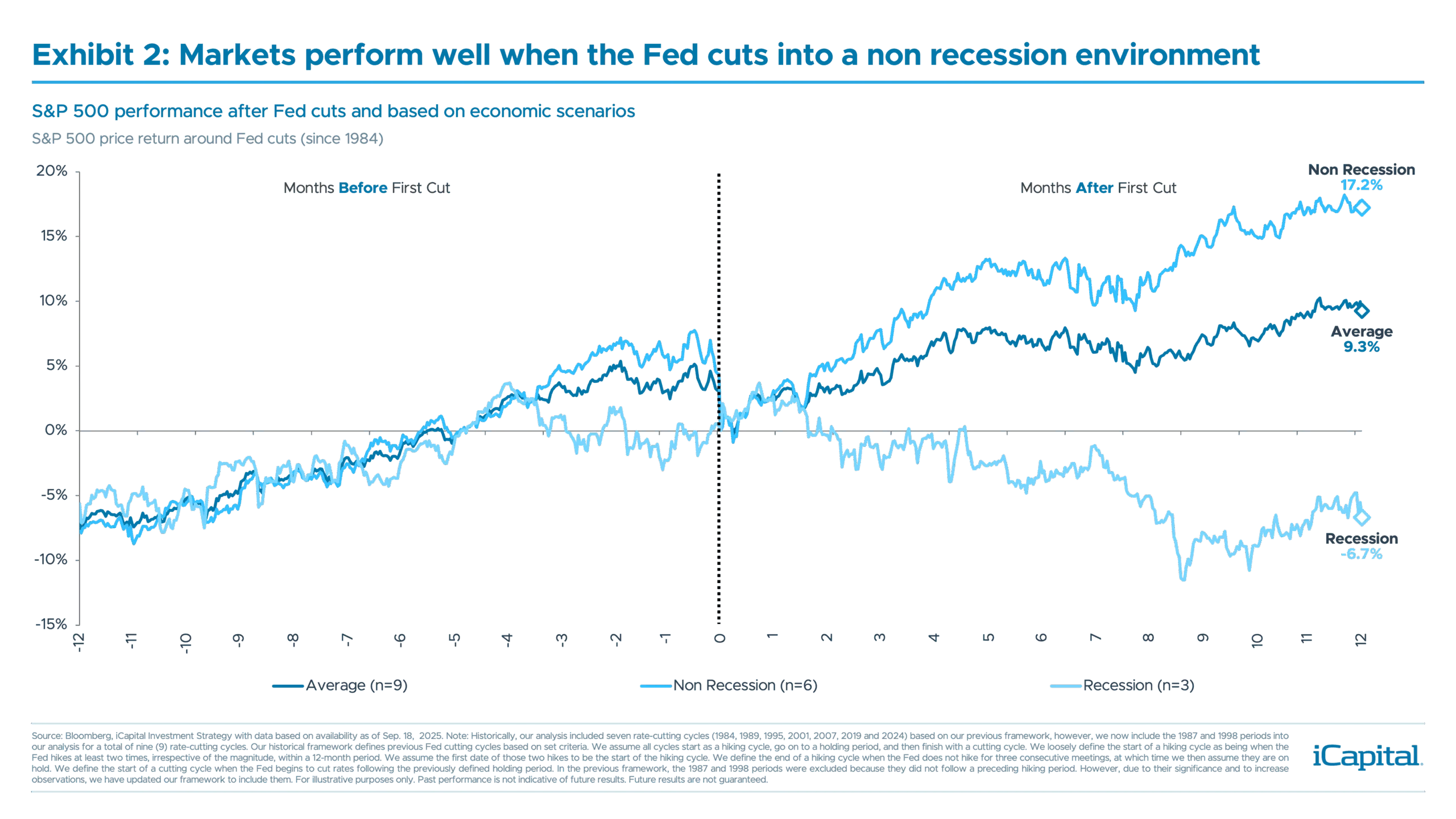

With the Fed easing and growth remaining resilient – the Atlanta Fed’s GDPNow model currently estimates Q3 2025 growth at 3.4% – we believe this backdrop should be supportive for equity markets. Historically, when the Fed is cutting rates in a non-recessionary environment, the S&P 500 has delivered above-average returns.1

The outlook for Treasuries is more nuanced. While uncertainty remains, we still see some near-term upside to yields.

What is meant by “risk management”?

Markets were closely focused on Chair Powell’s characterization of this week’s (9/17) rate cut as a “risk management” move. While this was interpreted by many as hawkish, attention also turned to the distribution of the 2025 dots: seven FOMC members indicated no further policy changes were needed at this time, and one member even saw the potential for a rate hike before year-end.

However, we don’t necessarily view a “risk management” cut as hawkish in isolation. Historically, when the Fed has delivered these types of cuts – such as in 1995, 1998, and to a lesser extent in 2019 – they’ve typically come in a package totaling 75 basis points, aimed at providing insurance to the outlook.

Another reason we interpreted the tone of the meeting as more dovish was Chair Powell’s expressed desire to move policy toward a more neutral stance.2 While the upward revisions to growth were encouraging – largely a mark-to-market adjustment given recent upside surprises – the current environment doesn’t warrant restrictive policy, especially in light of evolving labor market data. Powell’s emphasis on slowing employment growth during the press conference further reinforced the view that the Fed sees no need for restrictive policy and is instead focused on providing insurance to the labor market.

The policy path going forward

We believe the Fed is not done easing policy this year, and both the October and December meetings should be considered “live.” While the Fed has emphasized a meeting-by-meeting approach, it would likely take a meaningful upside surprise in both labor and inflation data to justify pausing the rate-cutting cycle.

With the preliminary benchmark revisions for payrolls now in hand – showing trend labor growth closer to 71K over the past year, down from 147K3 – we think the Fed may seek to right-size policy. In fact, had this data been available earlier, it’s plausible the easing cycle would have started sooner.

Looking ahead to 2026, the policy path remains uncertain. While the median dot suggests one additional rate cut next year, the distribution skews more dovish, with nine FOMC members projecting rates at or below 3.125%.4 Moreover, with changes expected in the composition of the Fed Board, we see downside risks to the median 2026 dot.

Further upside to markets

Further upside to markets

Given this backdrop, we continue to see upside potential in equity markets. Historically, when the Fed cuts rates in a non-recessionary environment, it tends to be associated with above-average returns for the S&P 500.5 Even when rate cuts occur while the index is trading near all-time highs, the S&P 500 has, on average, been 15% higher over the following 12 months.6

Within equities, we’re closely watching for signs of broader market participation. So far, this has yet to materialize meaningfully. Instead, we’ve seen a rotation into lower-quality segments of the market—such as unprofitable tech, highly shorted names, and companies with elevated debt levels.

Within equities, we’re closely watching for signs of broader market participation. So far, this has yet to materialize meaningfully. Instead, we’ve seen a rotation into lower-quality segments of the market—such as unprofitable tech, highly shorted names, and companies with elevated debt levels.

From a rates perspective, we believe there could be some near-term upside, particularly as the 10-year yield is currently trading near the lower end of our 4.00% to 4.50% range. In our view, the Treasury market may be overpricing downside risks to the growth outlook, especially in the labor market. However, upcoming data releases – namely the jobs report on October 3 and CPI inflation on October 15 – will be key catalysts for rates. Therefore, any upward pressure may prove short-lived depending on the data.

If rates remain anchored around 4%, we believe this could have important implications for private markets—an area we plan to explore in an upcoming piece.

END NOTES

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 18, 2025.

- Federal Reserve, as of Sept. 17, 2025.

- Bureau of Labor Statistics, as of Sept. 9, 2025.

- Federal Reserve, as of Sept. 17, 2025.

- S&P Capital IQ, iCapital Investment Strategy, as of Sept. 18, 2025.

- JP Morgan, S&P Capital IQ, as of Sept. 17, 2025.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.