As investors, sometimes we must face reality—we are living through a period of elevated uncertainty on two separate fronts that are unlikely to be quickly resolved.

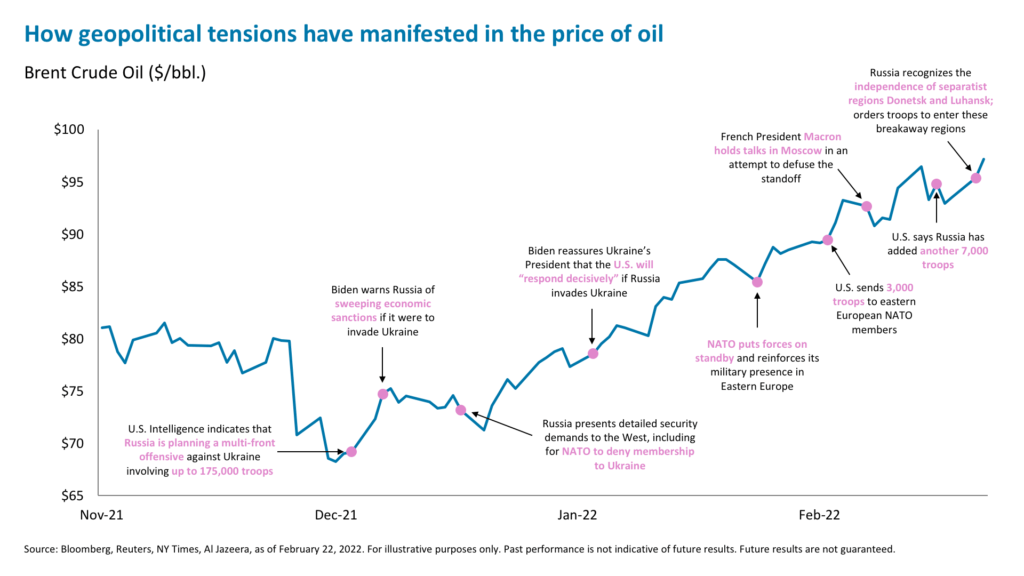

The first front is the Ukraine-Russia conflict. The markets badly want to see de-escalation and appear to be relieved (for now) that Russia has stopped short of a full-scale invasion and hopeful that the recognition of the separatist republics of Donbass will be the full extent of its plans. Oil prices—the best barometer of market sentiment regarding the prospect of a war (as discussed in last week’s blog)—have moved upwards as the crisis has come to a head, but actually fell from overnight highs on Tuesday, reflecting slightly more positive expectations.1

If the current flare-up follows the pattern of 2014—assuming no serious escalation—the market impact may be relatively short-lived after a flurry of speeches, negotiations, and sanctions. At that time, the S&P 500 fell 5% but recouped those losses in just three weeks, and even Russian stocks managed to rebound in about six months.2

If the current flare-up follows the pattern of 2014—assuming no serious escalation—the market impact may be relatively short-lived after a flurry of speeches, negotiations, and sanctions. At that time, the S&P 500 fell 5% but recouped those losses in just three weeks, and even Russian stocks managed to rebound in about six months.2

Our base case scenario is for a series of incremental steps from Russia and incremental sanctions from the West along a long road to a negotiated diplomatic solution to replace the now clearly failed Minsk Agreements from 2014 and 2015. The significant economic linkages (particularly in oil and gas) between Russia and the European Union (E.U.) mean both parties will desperately want to avoid a full-fledged war. The E.U. cannot afford a spike in gas prices or a sustained disruption in supply, and Russia would face severe economic consequences if its oil and gas revenue fell sharply.

What should an investor do? Our advice remains consistent with last week’s post, which is to stay long energy stocks. Irrespective of the current uncertainty, underlying structural factors suggest upside for oil prices throughout and beyond this year. However, Russian assets remain un-investible in the short term at least.

The second front is how far and how quickly the U.S. Federal Reserve (the Fed) will raise rates. With the Fed making clear its firm intention to fight inflation, we should be prepared for more rate hikes, not fewer. But we are unlikely to know until the March Federal Open Market Committee (FOMC) meeting exactly how many rate hikes to expect. Irrespective of the Fed’s decisions, investors need to acknowledge two things right now—we are starting to see signs of a slowdown in economic data and earnings revisions and we are in the tightening phase of the cycle. Judging from prior experience, this means we should expect a period of lower returns.3

Until these two uncertainties are resolved, we will likely be in a challenging market stretch where directional returns do not deliver. For example, historically speaking returns have been flat or negative in the three months before and after the first rate hike of a hiking cycle.4 With both the Nasdaq and the S&P 500 trading below their 200-day moving average5, until we see a convincing positive catalyst (like abating inflation, a less hawkish Fed, or peace in Ukraine), we are likely to only see short-lived tactical relief rallies.

Five approaches to consider when little else is working

So what’s an investor to do in the meantime? Here are five investment ideas that could work when little else is.

1. Dividend-paying equities. Dividend yield stocks have performed well during periods of policy tightening and when economic growth has started to decelerate. During this phase, directly following a peak, defensive styles have outperformed: dividend-paying stocks, for example, have on average returned 2.6% peak to trough.6 Dividend stocks remain a solid defensive allocation in periods of uncertainty. For example, so far in 2022 the iShares Select Dividend ETF is up 0.64% versus negative 9% for the S&P 500 and negative 14% for the Nasdaq.7 The 12-month yield on the fund is 3.1%, with a price-to-sales ratio of only 1.46x.8

2. Multi-family commercial real estate (CRE). The housing market is showing tentative signs of slowing, with the share of Americans saying it is a ‘good time to buy’ falling to 25%.9 This is unsurprising given the surge in the 30-year fixed-rate mortgage rate to 4.22% and the 15.4% increase in the median existing home price in the past year.10 However, given a low home vacancy rate of 0.9% and a record-low stock of housing11, we still expect home price appreciation. The mortgage-to-income ratio remains below the rent-to-income ratio, though it has risen to 23%, putting it on a path to convergence.12 Given the lack of inventory and rising costs, excess housing demand should spill over into the multi-family housing and apartment markets. With vacancies and stock also at record lows in multi-family, we expect market rents to rise, helping drive net operating income (NOI) growth and benefiting investors holding CRE. Over the past 20 years apartments have on average delivered 8.22% total returns, with 5.14% of that from income.13 For more on CRE, which was one of our top ideas for 2022 ideas, see our 2022 Outlook.

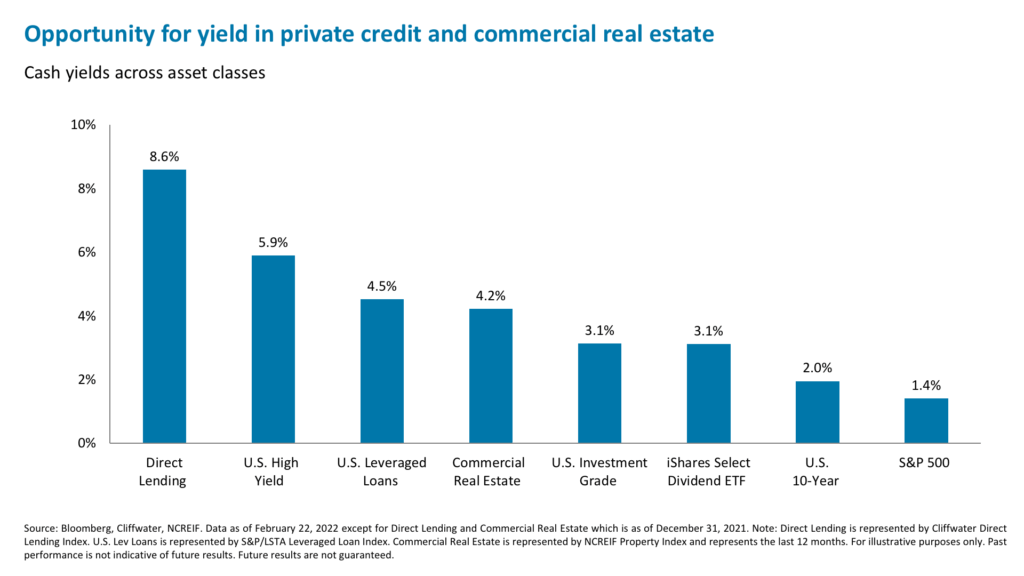

3. Private credit. As anticipated, 2022 has been a very poor year so far for fixed income. The U.S. Bloomberg Barclays Aggregate Index is down nearly 4%, with most sectors, including High Yield, in the red.14 However, the leveraged loan sector, which is primarily comprised of floating rate debt, is roughly flat for the year.15 Unsurprisingly, investors have been pouring money into these floating rate bonds lately. Net inflows hit a nine-year high in the first two weeks of the year, and have totaled $8-9bn year-to-date.16 However, as we again highlighted in our 2022 Outlook, Private Credit can produce even more income than leveraged loans—the Cliffwater Direct Lending Index yield was 8.6% as of December 2021, versus 4.5% for the S&P/LSTA Leveraged Loan Index17—and serve as a rate shock-absorber in a portfolio: 85% of private credit debt is floating rate.18 With the economy slowing but still expected to grow 2.9% this year on a year-over-year basis19, default rates expected to stay at around 0.75%20, and more than $375 billion of capital available to invest21, it is not too late to increase allocations to private credit.

4. Relative value hedge funds. Relative value arbitrage continues to provide opportunities for uncorrelated performance, with the current volatility and issuance velocity supportive of fund performance.22 Indeed, so far in 2022, relative value arbitrage strategies, using the HFRI Relative Value Multi-Strategy Index as a proxy, have delivered a 0.89% return, beating a 9% fall in the S&P 500.23 Historically during volatile periods, relative value strategies have outperformed the broader index. For example, over the three-year period from 2007 to 2009, relative value returned roughly 0.5%, while the S&P 500 was down roughly 15% on a cumulative basis.24 When both equities and fixed income fell across calendar year 2018, relative value remained flat.25

5. Take advantage of stock discounts and elevated volatility. We highlighted a couple of weeks ago that rate hikes are likely to weaken demand and our preference is to lock in gains in cyclicals and rotate back into now-unloved tech. Admittedly, buying the dip in software and cybersecurity stocks has not yet worked, and even individual stocks with solid fundamentals have been swept up in the broader tech sell-off. One way to potentially improve this outcome is to buy stocks (or an ETF) and sell a covered call against it. With implied volatility on the iShares Expanded Tech-Software ETF 3-month 105% call option in the 97th percentile over the last year, a generous premium can be collected for selling this option.26 Currently, this approach would let the seller collect 4.5% in an options premium, or roughly 19% annualized27, meaning that even if the software sector stays flat or declines further, this would be offset by the premium income. And should the ETF be called away (if it rises above the strike prices), the premium collected would enhance the potential return. This strategy is well suited to the current environment, in which equity returns are unlikely to be outsized but elevated volatility creates higher options premiums.

1. Bloomberg, as of February 22, 2022

2. Ibid.

3. iCapital, Bloomberg, as of February 22, 2022.

4. Ibid.

5. Bloomberg, as of February 22, 2022.

6. Bank of America Research, as of December 17, 2021.

7. Bloomberg, as of February 22, 2022

8. Bloomberg, as of February 22, 2022

9. Bloomberg, Fannie Mae, as of January 31, 2022.

10. Bloomberg, National Association of Realtors, as of January 31, 2022.

11. Bloomberg, U.S. Census Bureau, as of December 31, 2021.

12. Goldman Sachs Research, as of January 31, 2022.

13. NCREIF

14. iCapital, Bloomberg, as of February 22, 2022.

15. Ibid

16. Bank of America Research, as of February 11, 2022.

17. Bloomberg, Cliffwater, Standard & Poor’s, as of September 30, 2021.

18. CEF Advisors BDC Data, as of February 22, 2022. Note: the percentage of floating-rate debt is found by using a proxy of a composite of lending-oriented, exchange-traded business development companies (BDCs).

19. Bloomberg, as of February 22, 2022.

20. JPMorgan, Default Monitor, December 1, 2021.

21. Goldman Sachs Research, February 7, 2022.

22. Neuberger Berman, “Uncorrelated Through COVID”, October 15, 2020.

23. Bloomberg, as of February 22, 2022.

24. Ibid.

25. Ibid.

26. Ibid.

27. Ibid.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.