Key Takeaways:

- Liquidity in private markets is improving, with exit volumes and multiples trending higher, though distribution rates remain subdued.

- Secondary transactions continue to play a critical role for investor liquidity and a growing role in portfolio management—and are likely a permanent fixture.

- Direct lending spreads on new deals have compressed, but returns remain resilient, supported by strong deal flow and underlevered portfolios.

- Commercial real estate is seeing more pricing recovery and improving transaction volumes.

- Investor flows are shifting within private markets, with growing interest in asset-based finance, multi-asset credit, infrastructure debt, and evergreen private equity strategies.

As we look ahead to 2026, the private market is being shaped by a combination of structural shifts (private wealth access, evergreen vehicles) and cyclical dynamics (declining rates, capital market reopening). Below, we address five key questions around private markets that are top of mind across client conversations and investors.

1. Is liquidity improving in key areas of private markets?

Liquidity is improving, though pressures remain amid a still-elevated exit backlog and low distribution rates—a trend that we expect to persist into 2026, but with incremental gains as the year progresses.

In Q3, publicly-traded alternative managers reported strong realizations across asset classes.1 During Blackstone’s Q3 earnings call, CEO Jon Gray even noted that “the deal dam is breaking, and it should lead to more realizations over time,” supporting our view of a robust pipeline and an acceleration ahead.2

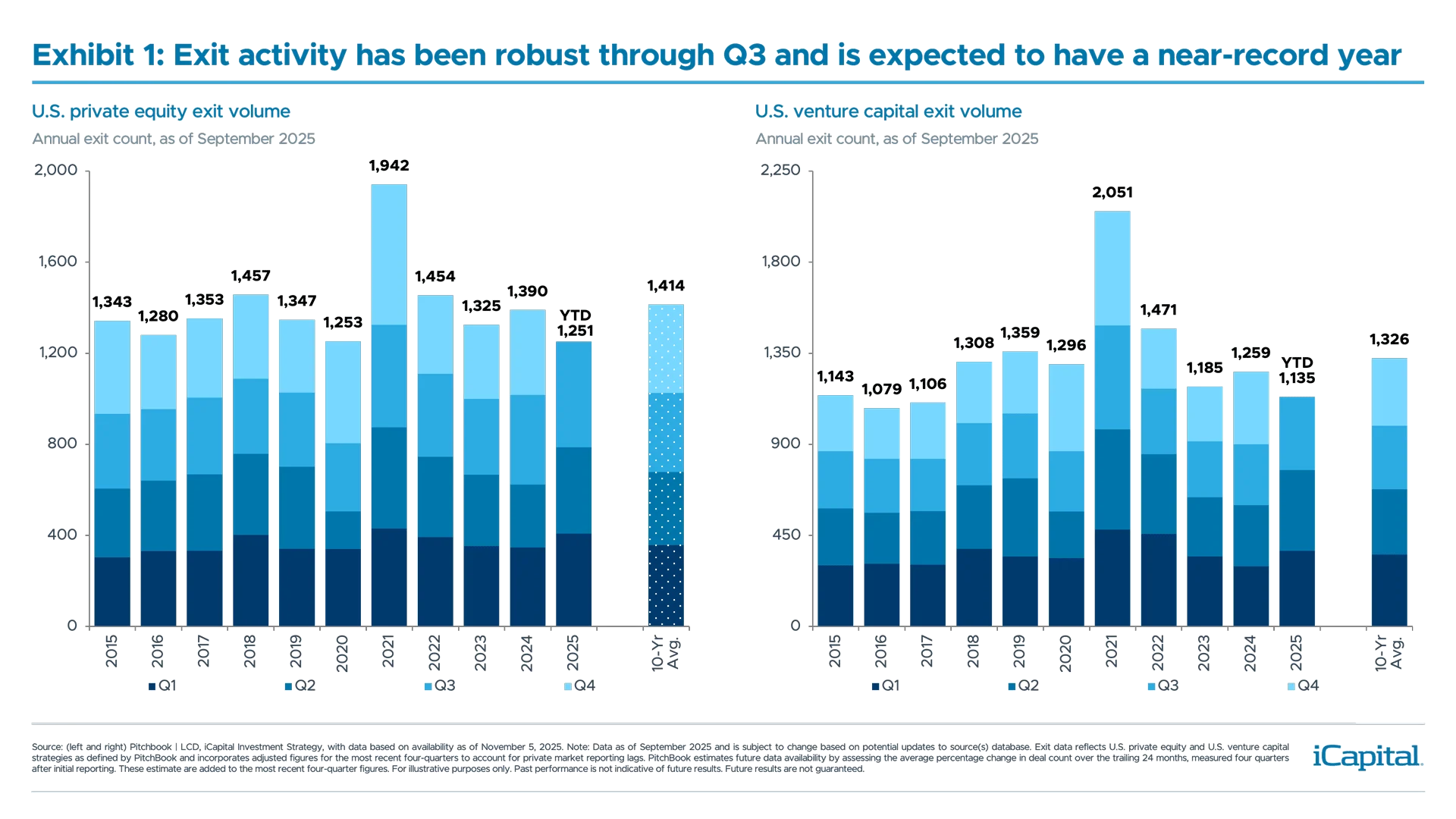

More broadly, buyout multiples, specifically exit multiples, continue to improve off their 2023 lows, reflecting a growing willingness from buyers to transact with sponsors.3 And exit volumes for both buyout and venture capital, on an annualized basis, are on pace to exceed 2024 levels, indicating more assets are starting to move through the system (Exhibit 1).4

That said, ~85% of U.S. private equity-backed companies have now been held eight-plus years.5 Realizations are occurring, but often at discounts to prior 2021-22 peak valuations, keeping distributions near multi-year lows. However, we see capital market activity continuing to strengthen into next year, and the reopening of IPO windows and M&A should support continued momentum in exit volumes and valuations—a positive sign for liquidity and distributions in the quarters ahead.

That said, ~85% of U.S. private equity-backed companies have now been held eight-plus years.5 Realizations are occurring, but often at discounts to prior 2021-22 peak valuations, keeping distributions near multi-year lows. However, we see capital market activity continuing to strengthen into next year, and the reopening of IPO windows and M&A should support continued momentum in exit volumes and valuations—a positive sign for liquidity and distributions in the quarters ahead.

2. Are secondary transactions easing the industry’s liquidity crunch?

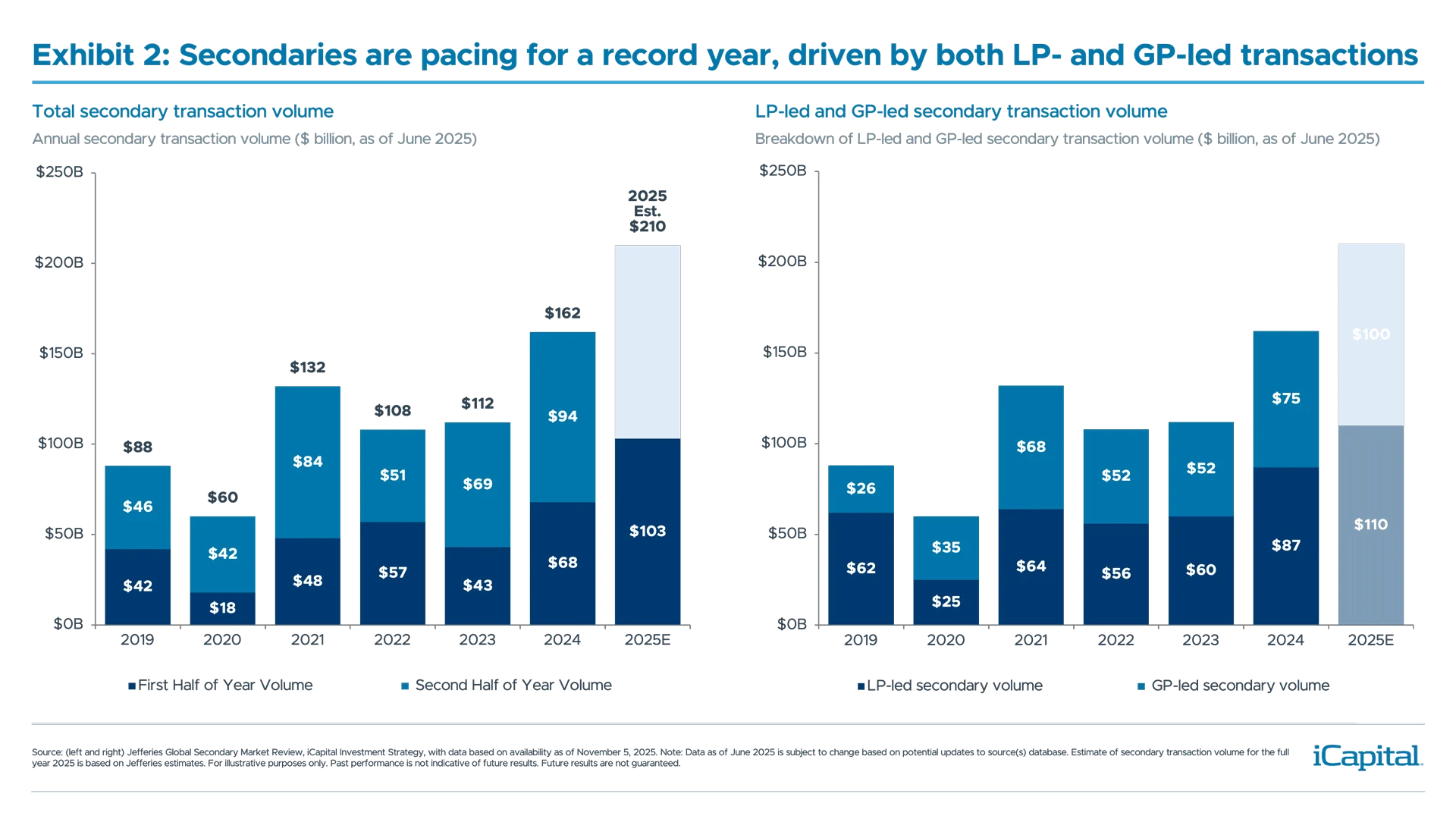

Secondary volumes surpassed $103bn in the first half of 2025 and are on pace have a record year (Exhibit 2).6 Secondaries have continued to serve as a key release value to both Limited Partners (LPs) and General Partners (GPs) over the past couple of years, despite the recent pickup in exit activity. For LPs, the secondary market has become increasingly efficient and attractive—bid-ask spreads are narrowing and pricing is improving—allowing them to unlock capital without waiting for GPs to exit. On the GP side, sponsors are leveraging secondaries to retain control of high-performing assets while offering liquidity to existing investors.

Looking ahead, we expect secondary transaction volumes to remain elevated, even as traditional exits pick up more meaningfully next year. At the current rate of exit activity, it would take roughly 7.7 years to exit all current private equity-backed investments.7 Even assuming exit volumes double next year, it would still take three to four years to run through the inventory.8 This means many sponsors will continue to turn to the secondary market to manage aging portfolios and meet investor liquidity needs. And as we’ve noted here, secondaries are likely a permanent fixture of private markets.

Looking ahead, we expect secondary transaction volumes to remain elevated, even as traditional exits pick up more meaningfully next year. At the current rate of exit activity, it would take roughly 7.7 years to exit all current private equity-backed investments.7 Even assuming exit volumes double next year, it would still take three to four years to run through the inventory.8 This means many sponsors will continue to turn to the secondary market to manage aging portfolios and meet investor liquidity needs. And as we’ve noted here, secondaries are likely a permanent fixture of private markets.

3. How are investors assessing return compression in direct lending?

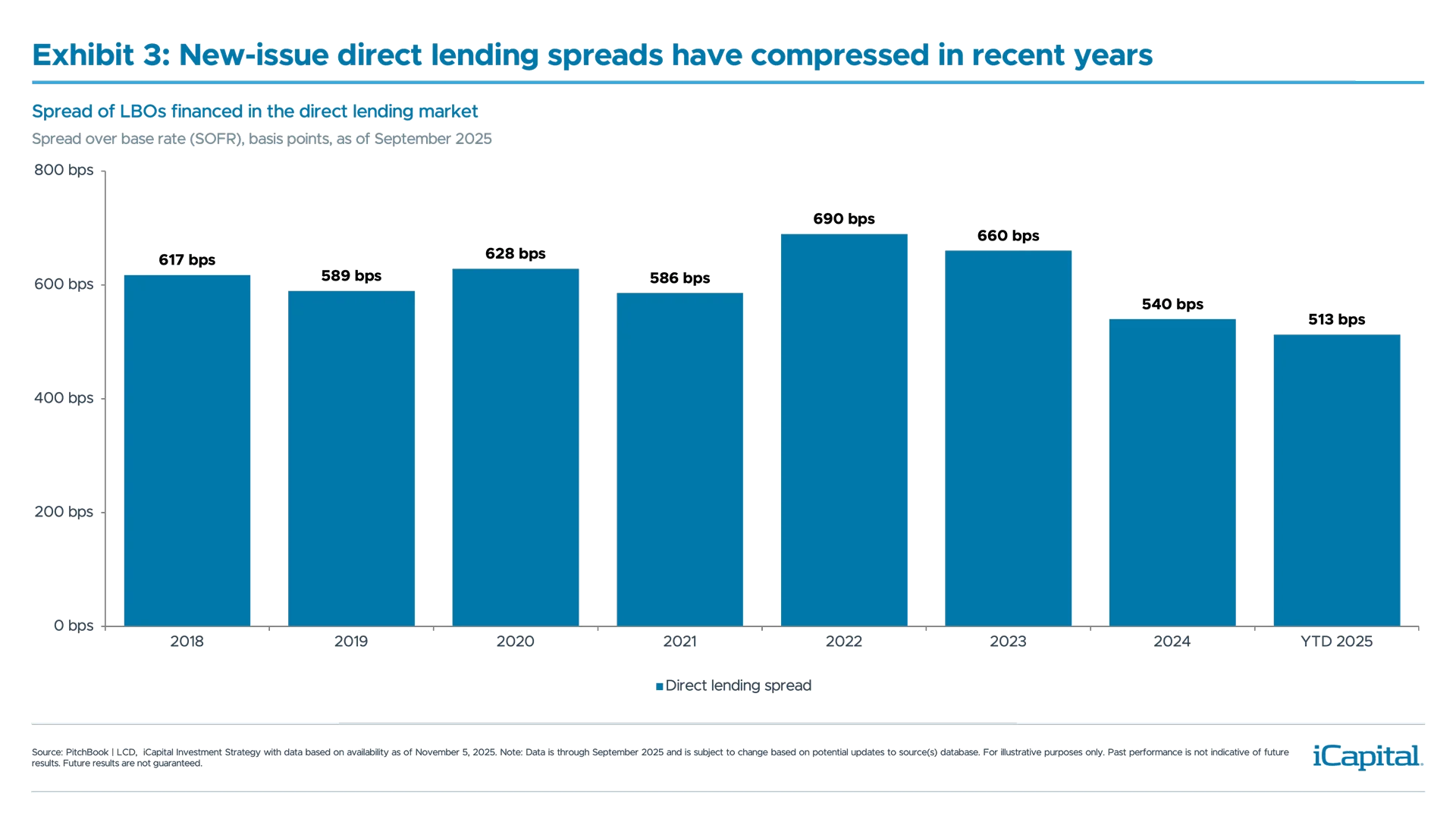

Spreads in direct lending have compressed by roughly 200 basis points (bps)9 over the past few years—from SOFR + 700bps to closer to SOFR10 + 500bps today (Exhibit 3).11 While increased competition from banks re-entering the syndicated loan market has played a role, a less discussed factor was the rise in base rates. As SOFR rose from effectively 0% in 2020 to around 5% in 2023-24, it became unrealistic for high-quality borrowers to pay 11–12% all-in yields (SOFR + 700bps spread), making some spread compression natural.12

Yet performance has held up well—unlevered annualized returns have averaged roughly 11% over the past five years.13 Looking ahead, we still think direct lending could maintain its relative attractiveness, with gross yields in the 8–9% range, roughly 200bps above leveraged loans.14 We see this for a few reasons:

Yet performance has held up well—unlevered annualized returns have averaged roughly 11% over the past five years.13 Looking ahead, we still think direct lending could maintain its relative attractiveness, with gross yields in the 8–9% range, roughly 200bps above leveraged loans.14 We see this for a few reasons:

- Many lenders still have capital deployed at wider spreads, which should help cushion the impact of recent tightening.

- The pick-up in deal flow and our expectation for continued strength through 2026 should help stabilize spreads and may even push them slightly wider.

- Many lenders remain underlevered, having achieved strong returns without relying heavily on financing. As the cost of leverage declines with anticipated Fed rate cuts, lenders may be able to lean more on financing to preserve high-single to low-double-digit returns.

4. What trends could give us conviction on a rebound in Commercial Real Estate?

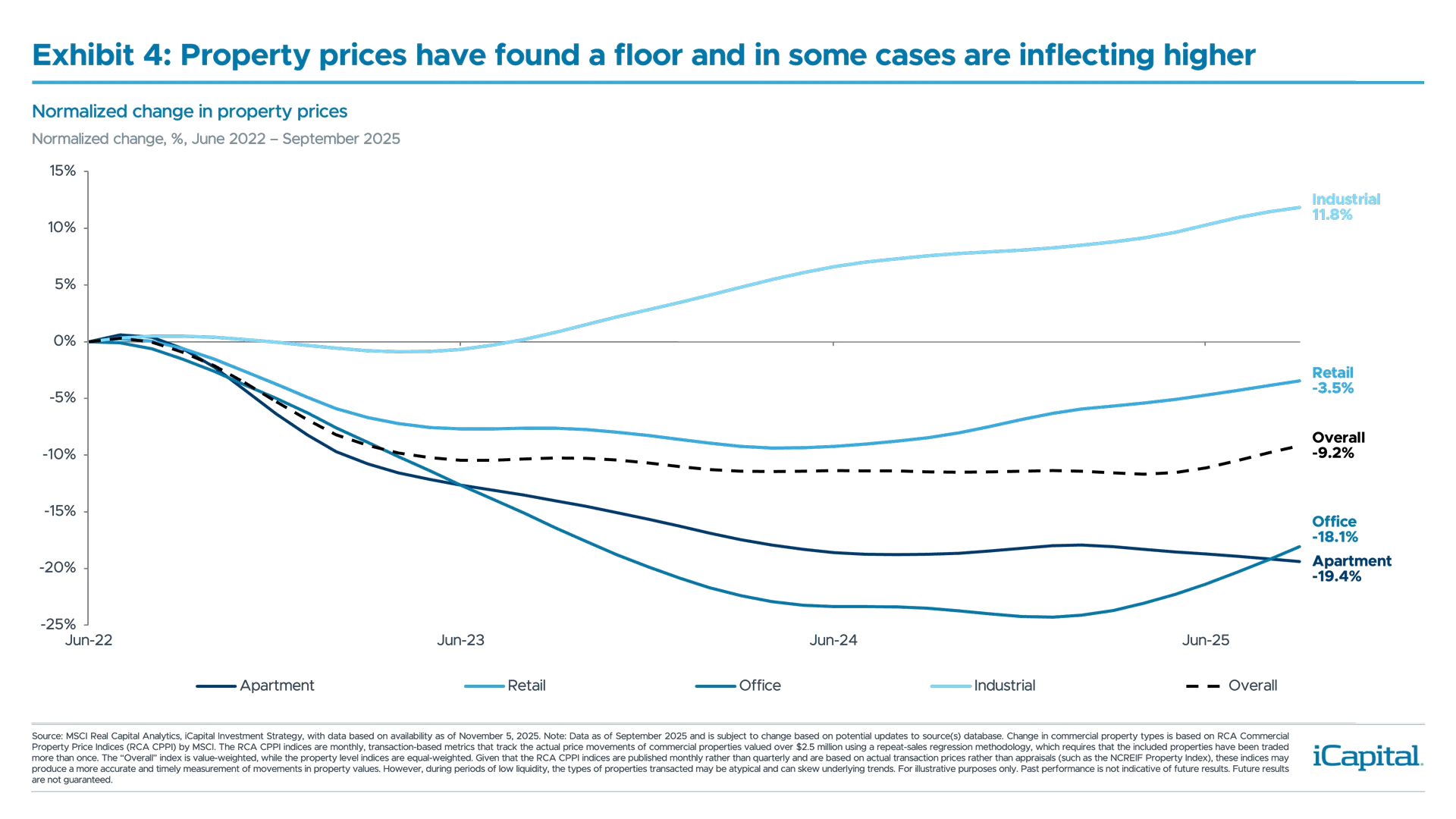

After roughly three years of adjustment, commercial real estate (CRE) continues to show signs of broad-based stabilization. Property prices have found a floor and in some cases inflected higher (Exhibit 4), and transaction volumes through Q3 remain healthy—an encouraging sign that buyers and sellers are beginning to meet on pricing expectations.15

We’re watching for cap rate stabilization. Cap rates, which move closely with interest rates, are leveling off.16 As the market gains greater conviction around the ~75bps of rate cuts priced-in through year-end 202617, funding costs should decline, supporting asset valuations and making transactions more feasible.

We’re watching for cap rate stabilization. Cap rates, which move closely with interest rates, are leveling off.16 As the market gains greater conviction around the ~75bps of rate cuts priced-in through year-end 202617, funding costs should decline, supporting asset valuations and making transactions more feasible.

We’re also watching supply-demand dynamics, which are improving. Even though completions remained strong through Q3, construction pipelines have slowed which should help absorb existing inventory.18

Yes, there’s still noise around policy uncertainty and tariffs, but most managers have already adjusted. If rates move as expected and fundamentals keep improving, we could see a more durable recovery

5. Where are investors allocating capital in private markets at this juncture?

Investor demand for private markets remains strong, especially within the private wealth channel. Private wealth holds $145tn19 in assets but with an average allocation to private markets of less than 5%20 , remains heavily under-allocated to private markets. As access improves, flows are shifting across asset classes.

Private credit continues to dominate allocations though capital is gradually shifting from traditional direct lending strategies to asset-based finance (ABF) and multi-asset, or hybrid, credit strategies.21 As direct lending matures and capital becomes more crowded, we expect this trend to persist—especially as the largest GPs expand private lending beyond middle-market loans to include private investment-grade and ABF opportunities (see our ABF white paper here).

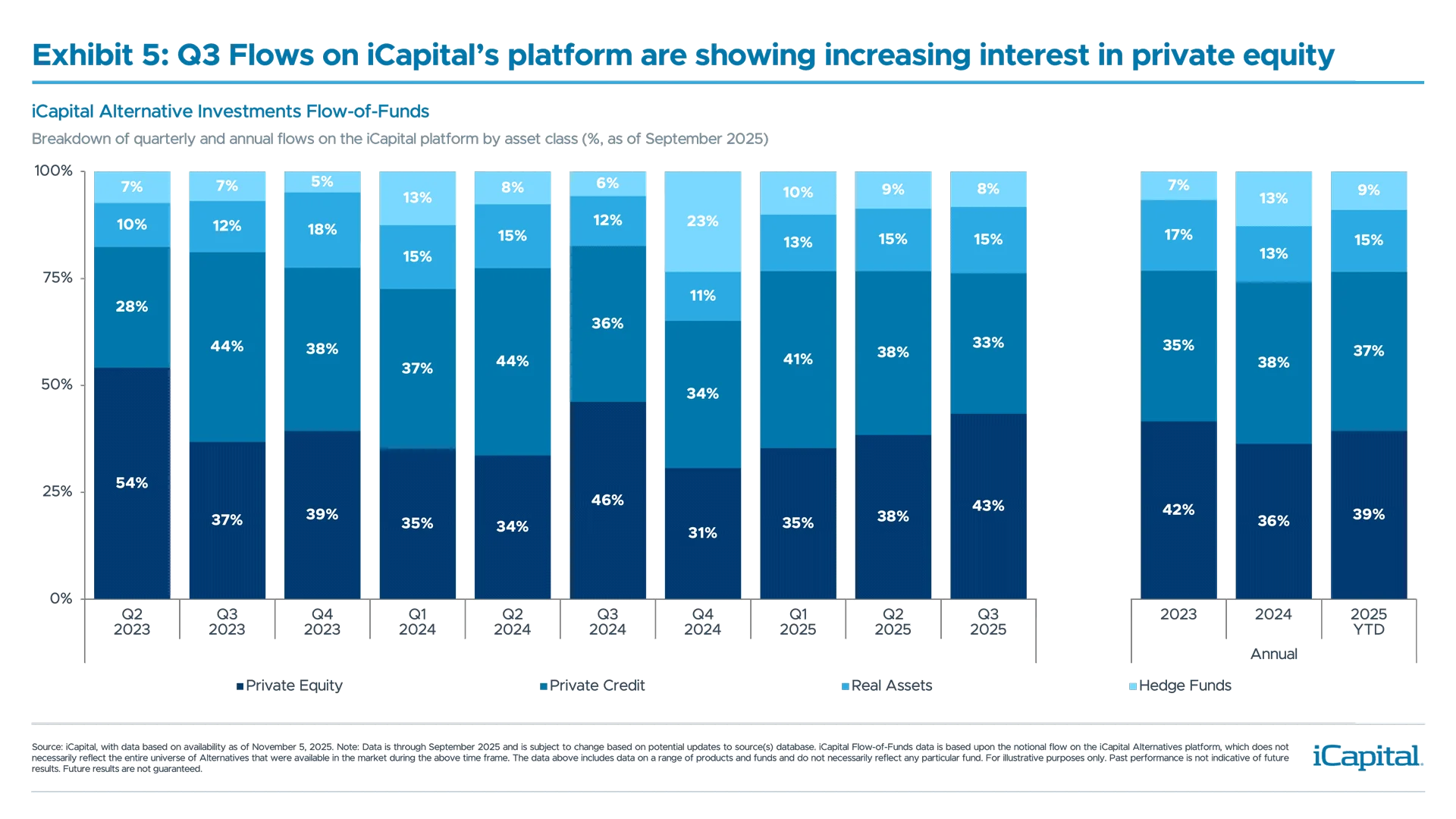

At the same time, private equity is also capturing a growing share of flow. PE-focused evergreen funds now account for ~25% of total evergreen NAV, up from 13% a year ago.22 Our own iCapital Flow-of-Funds data, which tracks $227bn+ in global assets serviced on our private markets platform, shows a similar trend. While demand remains broad-based across private markets, investors are increasingly allocating toward PE, particularly growth equity and venture capital.23 In Q3, 43% of new allocations on iCapital platform went to private equity, up from 35% in Q1 (Exhibit 5).24 This shift makes sense—as investors diversify their private market sleeves, private equity aligns with major secular themes such as AI.

END NOTES

- Company filings, iCapital Investment Strategy, as of Nov. 5, 2025. Note: Publicly-traded alternative managers are referring to those that have reported Q3’25 earnings including Apollo Global Management, Ares Management, Blackstone, Carlyle Group, and TPG.

- Company filings, iCapital Investment Strategy, as of Nov. 5, 2025.

- MSCI Private Capital Benchmarks Summary, as of Oct. 2, 2025.

- PitchBook | LCD, as of Nov. 5, 2025. Note: Exit volumes (count) for both Buyout and Venture are for U.S. only.

- PitchBook | LCD, as of Nov. 5, 2025.

- Jefferies Global Secondary Market Review, as of Jul. 2025.

- PitchBook | LCD, as of Nov. 5, 2025.

- Ibid.

- Note: A basis points is 1/100th of a percentage point

- Note: SOFR (Secured Overnight Financing Rate) is a benchmark interest rate that reflects the cost of borrowing cash overnight using U.S. Treasury securities as collateral. Many private credit deals now use SOFR as the reference rate for floating-rate loans.

- PitchBook | LCD, “US Private Credit Monitor”, as of Oct. 7, 2025. Note: Spread over base rate is based on LBOs financed in the syndicated market (BSL) vs the direct lending market

- S&P Global, iCapital Investment Strategy, as of Nov. 5, 2025.

- Cliffwater, iCapital Investment Strategy, as of Jun. 30, 2025.

- Cliffwater, Morningstar, iCapital Investment Strategy, as of Jun. 30, 2025.

- RCA, Moody’s Analytics, iCapital Investment Strategy, as of Jun. 30, 2025.

- NCREIF, as of Sep. 30, 2025.

- CME FedWatch, as of Nov. 5, 2025.

- S&P Global, iCapital Investment Strategy, as of Nov. 5, 2025.

- Bain & Company, GlobalData, Preqin Pro, Q3 2025 iCapital Alternatives Decoded Slide 22, as of Jul. 31, 2025. Note: Data as of Nov. 9, 2023, and is sourced from the Bain & Company Analysis “Global Private Equity Report 2023”.

- Cerulli Associates, Q3 2025 iCapital Alternatives Decoded Slide 23, as of Jul. 31, 2025.

- Goldman Sachs, Company filings, as of Oct. 10, 2025.

- Ibid.

- iCapital, as of Sep 2025. Note: iCapital Flow-of-Funds data is based upon the notional flow on the iCapital Alternatives platform, which does not necessarily reflect the entire universe of Alternatives that were available in the market during a given time frame. The data is on a range of products and funds and do not necessarily reflect any particular fund.

- Ibid.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.