Key Takeaways:

- Federal Reserve is likely to pause rate cuts early in 2026, similar to last year

- Labor markets show signs of stabilization, while inflation remains a wild card – seasonal factors and a payback from the government shutdown could keep upcoming prints sticky

- A pause could put upward pressure on rates in the near-term, supporting cyclicals but potentially weigh on small caps and rate-sensitive sectors

- In private markets we would favor infrastructure, while the current environment should support private credit’s yield advantage relative to public market

To return policy to a more neutral stance, the Federal Reserve lowered its policy rate by 75 basis points (bps) in 2025.1 As we enter 2026, however, the Fed has signaled an increased likelihood of pausing further rate cuts. This was confirmed in the latest Fed minutes and by comments from John Williams who stated: “No sense of urgency to act further on monetary policy.”2

This pause would be similar to what was experienced at the start of last year. Coming into the year, the inflation trajectory remains a wild card, and the disagreement on the Federal Open Market Committee (FOMC) may only worsen with more hawkish members joining.

Markets are currently priced for a pause, as the first full rate cut is not expected until June 2026.3 But, we still think a delay in further cuts could put upward pressure on rates in the near-term. Looking at the pause last year, the 10-year Treasury yield increased by roughly 30bps through most of January. Historically sharp increases in yields have weighed on equity markets. However, we still believe markets can perform well, as a pause often signals resilient growth, stable labor markets, or inflation moving back toward target. Looking back at prior Fed pauses, the S&P 500 increases by 3.6% in the 3-months after a pause, which compares to the 2.6% rolling 3-month average going back to 1989.4

The duration of the pause will ultimately be determined on how labor and inflation data unfold.

The Debate Between Inflation and Labor Continue

With the Fed likely set up for a pause, as discussed in our 2026 Market Outlook, we believe the debate between labor and inflation will continue in the new year.

For the Fed to return to a rate cutting stance, it will ultimately hinge on the trajectory of labor markets. If labor markets continue to weaken, it will become more challenging for the Fed to get ahead of further weakness – falling behind the curve would likely not be market positive and fall under our definition of “bad cuts”.

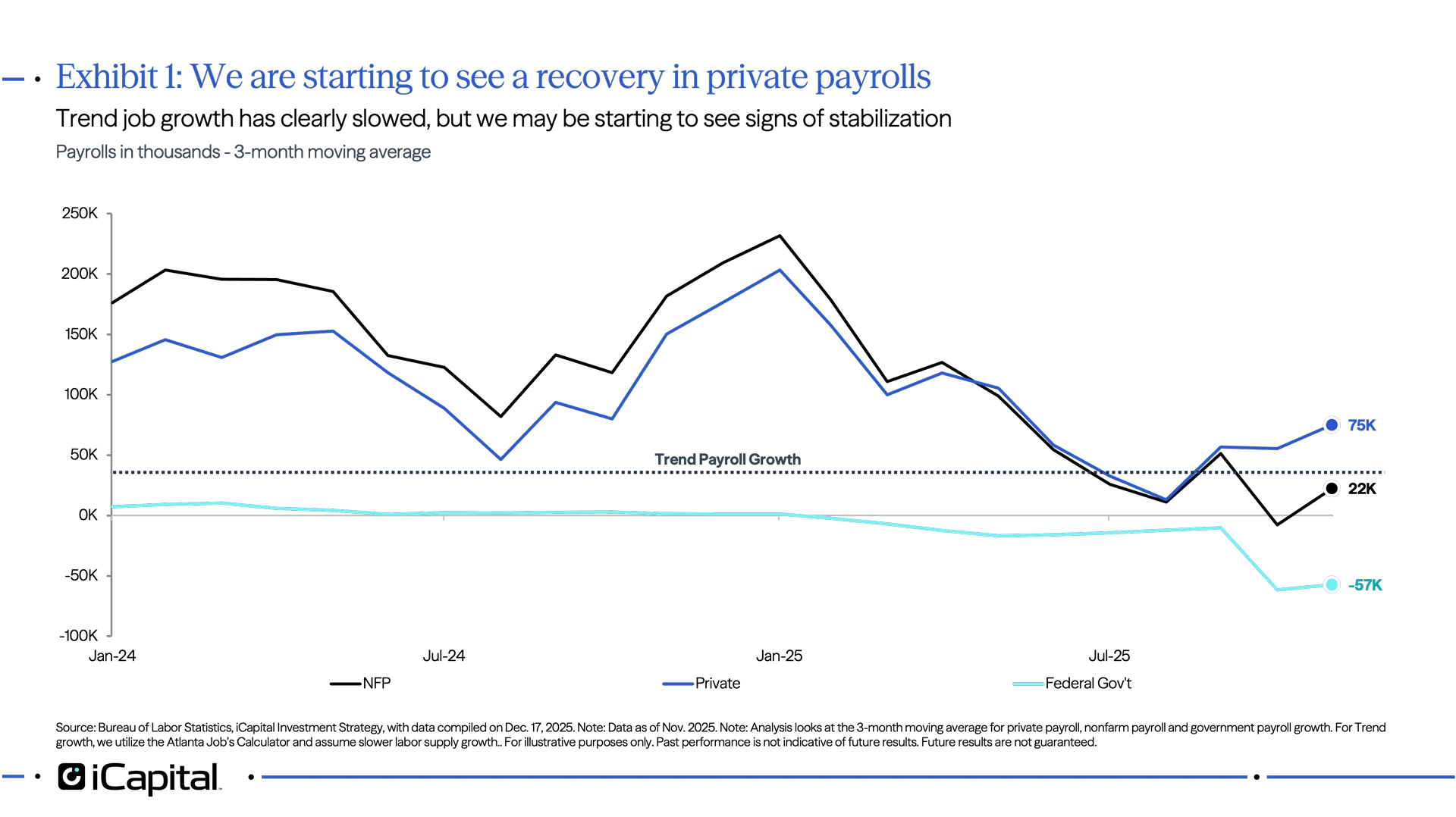

However, green shoots appear to be forming in labor markets. Specifically, high frequency indicators are starting to stabilize – notably the weekly ADP time series, though we would note the data is still noisy. Another indication is the pick-up in private payrolls, with the 3-month trend rising to 76K, up from 13K in August (as seen in Exhibit 1).

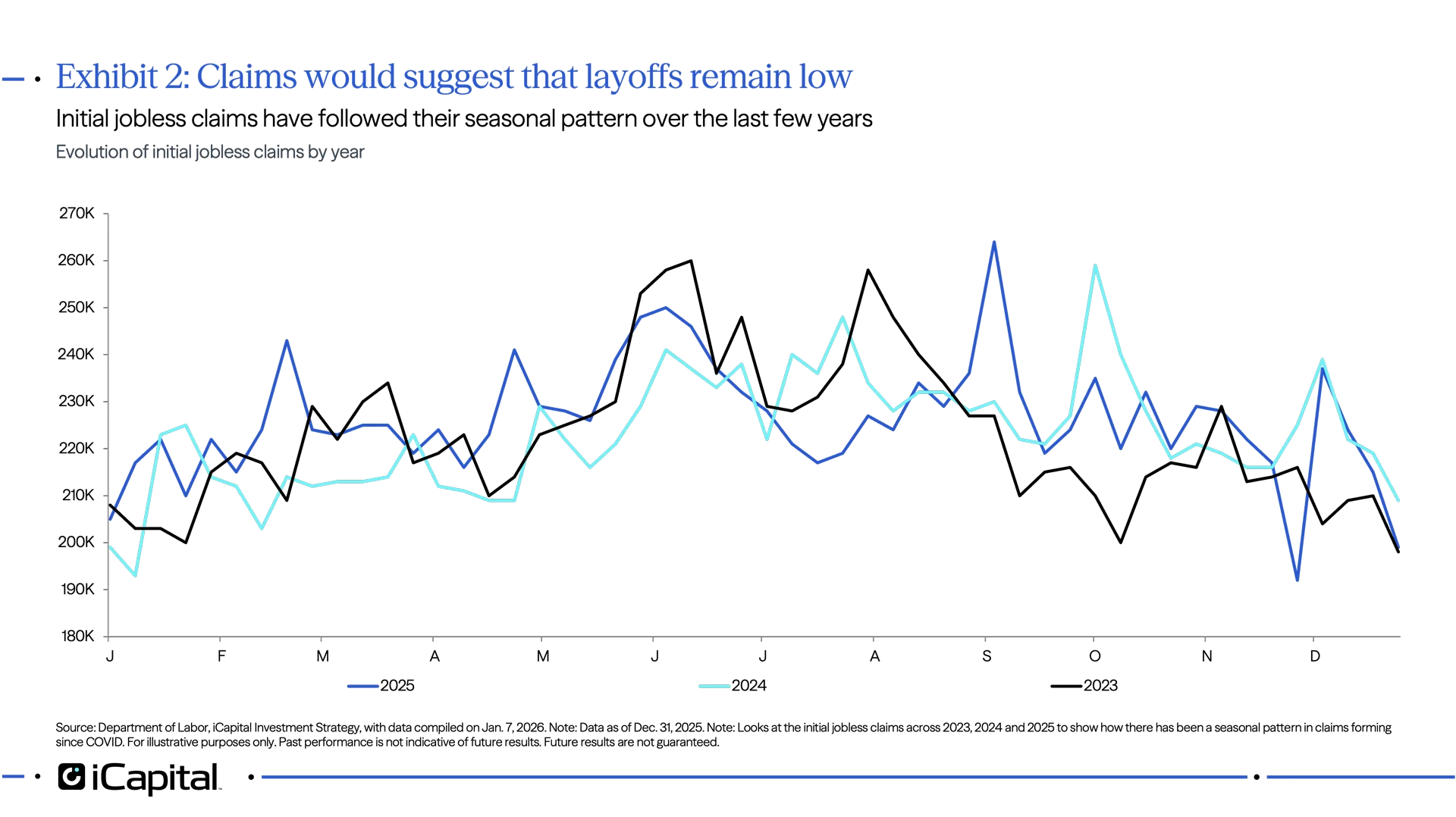

We feel it is important to monitor private payrolls at this juncture because headline job growth is being impacted by the reduction in force for federal government jobs. Indeed, since 2025, federal government jobs have declined by -268K.5 Despite this weakness, we still appear to be operating in a “low hire, low fire” job market, as initial jobless claims have followed their seasonal pattern and remain near their lowest level going back to 1970 (as seen in Exhibit 2).6

We feel it is important to monitor private payrolls at this juncture because headline job growth is being impacted by the reduction in force for federal government jobs. Indeed, since 2025, federal government jobs have declined by -268K.5 Despite this weakness, we still appear to be operating in a “low hire, low fire” job market, as initial jobless claims have followed their seasonal pattern and remain near their lowest level going back to 1970 (as seen in Exhibit 2).6

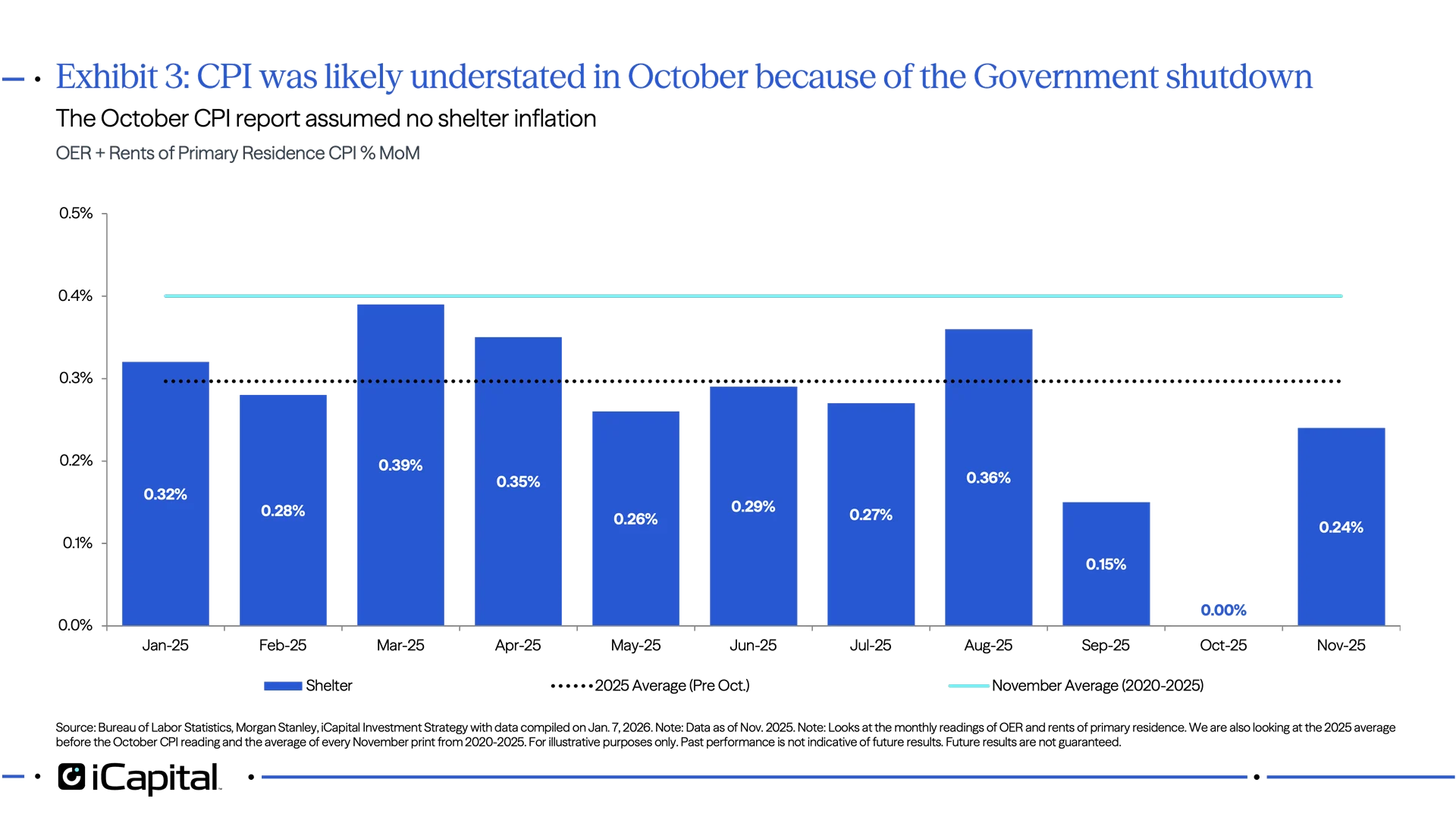

Inflation on the other hand remains a bit of a wild card. The latest reading showed a sharp drop towards the Fed’s target – declining to 2.6% year-over-year (YoY) from 3.1% YoY. 7 However, there are two reasons to believe this print may be artificially low.

Inflation on the other hand remains a bit of a wild card. The latest reading showed a sharp drop towards the Fed’s target – declining to 2.6% year-over-year (YoY) from 3.1% YoY. 7 However, there are two reasons to believe this print may be artificially low.

- Shelter cost imputations were low. Shelter costs were assumed at 0%, which is below the average of 0.3% month-over-month (MoM) in 2025 and the 0.4% MoM average for November going back to 2020 (as seen in Exhibit 3).8

- Prices were collected in the second half of the month. This could likely reflect larger holiday discounts, which likely kept the reading low.

We expect inflation to continue back towards the Fed’s target in 2026 but think it will happen at a gradual pace. Indeed, given the November print, we could see some payback later in 2026. In addition, we know that January tends to be a “hot” month for inflation, as January has averaged 44bps month-over-month (MoM) going back to 2020, 12bps higher than the 32bps average for all other months over that timeframe.9 Therefore, seasonal factors may also support a pause in the Fed’s rate‑cutting cycle, similar to what occurred in 2025.

We expect inflation to continue back towards the Fed’s target in 2026 but think it will happen at a gradual pace. Indeed, given the November print, we could see some payback later in 2026. In addition, we know that January tends to be a “hot” month for inflation, as January has averaged 44bps month-over-month (MoM) going back to 2020, 12bps higher than the 32bps average for all other months over that timeframe.9 Therefore, seasonal factors may also support a pause in the Fed’s rate‑cutting cycle, similar to what occurred in 2025.

But the Focus Will Shift to the Fed Chair Announcement

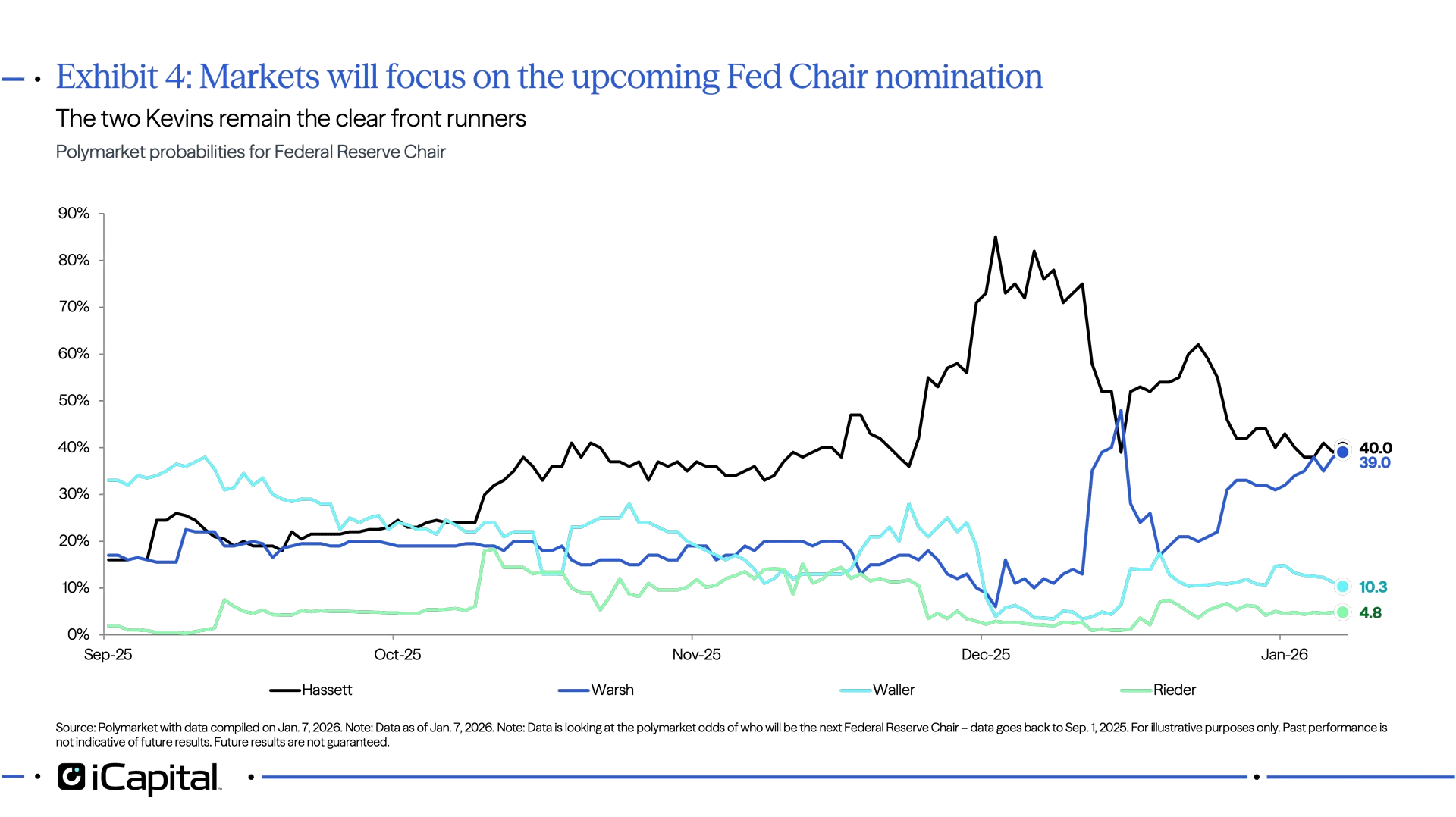

While incoming data will dictate the path of policy, the upcoming Fed Chair announcement will likely have more of an impact on market pricing, especially in the second half of the year.

Currently, the two Kevins – Hassett and Warsh – are favored, with their odds standing at 40% and 39%, respectively (as seen in Exhibit 4).10 Based on recent speeches and interviews, it seems like both candidates would support easier policy, which could present downside risks to current market pricing of the one rate cut that is priced in from June to December 2026.11

Hassett: “If you look at central banks around the world, the U.S. is way behind the curve in terms of lowering rates”12

Warsh: “We can lower interest rates a lot, and in so doing get 30-year fixed-rate mortgages so they’re affordable so we can get the housing market to get going again.”13

This could create an interesting tug-of-war in the near-term as it essentially creates a lame duck period for Chair Powell. Given the likely pause – barring any significant changes to incoming data – markets may care more about the comments from the newly nominated Fed Chair, which could ultimately impact Treasuries and market pricing for expected policy changes.

This could create an interesting tug-of-war in the near-term as it essentially creates a lame duck period for Chair Powell. Given the likely pause – barring any significant changes to incoming data – markets may care more about the comments from the newly nominated Fed Chair, which could ultimately impact Treasuries and market pricing for expected policy changes.

Market Implications: Maintaining a Cyclical Bias

With growth holding up, signs of labor market stabilization, and the potential for hotter inflation prints in the near term, this could put upward pressure on both short- and long-term rates while the Fed remains on pause. This environment should continue to support cyclical sectors, though it may weigh on small caps and other interest-rate-sensitive areas. We are closely monitoring small caps, which have outperformed the S&P 500 by roughly 1.5% since the Williams speech in November that helped set up the December rate cut.14

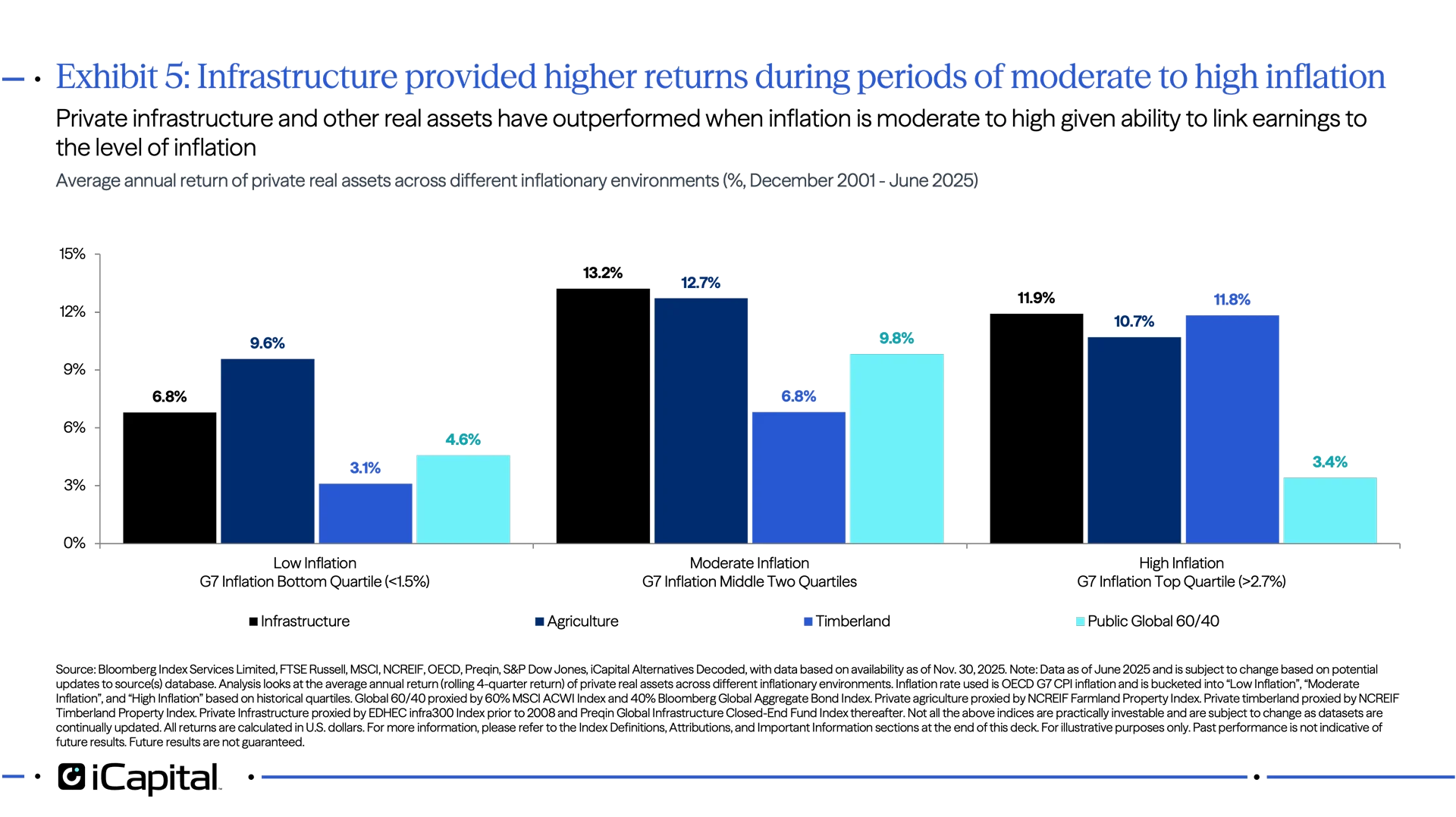

In private markets, while many of these factors discussed above are short-term in nature, we would continue to favor infrastructure. Given the fact that inflation could remain sticky to start 2026 – seasonals plus a payback from the government shutdown – inflation is projected to remain above target. Historically, in this environment, infrastructure and real assets tend to outperform the returns of a Global 60/40 portfolio (as seen in Exhibit 5, a chart from iCapital Alternatives Decoded).

Beyond that, several secular tailwinds – particularly in areas like digital infrastructure (data center buildout) and the energy transition – should support both existing investors and new investors in upcoming vintages.

Beyond that, several secular tailwinds – particularly in areas like digital infrastructure (data center buildout) and the energy transition – should support both existing investors and new investors in upcoming vintages.

Elsewhere, if the macro backdrop holds and base rates stay near current levels, private credit should retain its yield advantage over public market counterparts. While there were several idiosyncratic issues during the fall of 2025, we have seen fundamentals improve. Notably, non-accruals remain below their 10-year average and payment-in-kind as a percentage of income has declined.15

INDEX DEFINITIONS

Bloomberg Global Aggregate Bond Index: A flagship measure of global investment grade debt from a multitude local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Edhec Infra300 Index: measures the performance of 300 unlisted infrastructure equity investments in both corporates and project companies. It tracks the TICCS® segments of the investable universe.

MSCI ACWI Index: MSCI’s flagship global equity index is designed to represent performance of the full opportunity set of large- and mid-cap companies from developed and emerging markets around the world.

NCREIF Farmland Property Index: A property-level, value-weighted, gross-of-fees (portfolio-level asset or investment management fees) index denominated in USD, covering ~1,000 individual U.S. agricultural farmland properties (annual and permanent croplands) acquired in the private market for investment purposes only, representing ~$15-20 billion in market value. A time-weighted return index.

NCREIF Timberland Property Index: A property-level, value-weighted, gross-of-fees index denominated in USD, covering ~500 individual U.S. timberland properties acquired in the private market for investment purposes only, representing ~$30 billion in market value. A time-weighted return index.

Preqin Global Infrastructure Closed-End Fund Index: A fund-level, capitalization-weighted, net-of-fees index denominated in USD covering ~750 closed-end Infrastructure (Core, Core-plus, Debt, Opportunistic, and Value-Add) funds (as defined by Preqin) since Q3 2006, representing ~$1.0 trillion in capitalization and ~60% of the Preqin Infrastructure universe. Calculated using a Modified Dietz formula, approximating time-weighted returns. Values for the latest three quarters may be revised as new fund data is reported. Earlier values are frozen but may be updated for methodology changes.

ENDNOTES

- Federal Reserve, as of Dec. 10, 2025. Note: a basis point is 0.01% (or 1/100th of a percent).

- CNBC, as of Dec. 19, 2025.

- Bloomberg, as of Jan. 2, 2026.

- Bloomberg Index Services, iCapital Investment Strategy, as of Jan. 2, 2026.

- Bureau of Labor Statistics, as of Dec. 16, 2025.

- Bureau of Labor Statistics, as of Dec. 27, 2025.

- Bureau of Labor Statistics, as of Dec. 18, 2025.

- Bureau of Labor Statistics, as of Dec. 18, 2025.

- Bureau of Labor Statistics, as of Dec. 18, 2025.

- Polymarket, as of Jan. 7, 2026.

- Bloomberg, as of Jan. 4, 2026.

- CNBC, as of Dec. 23, 2025.

- Fox Business, as of October 28, 2025.

- Bloomberg Index Services, as of Jan. 7, 2026.

- Cliffwater, as of Sep. 31, 2025.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.