The equity markets have been choppy to start the year. And yes, while some market positioning has been de-risked as hedge funds, systematic investors and likely private clients sold at the end of last year, overall market positioning certainly doesn’t feel fully washed out – it’s closer to neutral. Indeed, the difference between AAII1 bulls and bears has narrowed and nets out to close to zero.2

Since the technical set-up is not a screaming buy, we have a neutral view on equities for January and expect it to be a choppy, potentially rangebound month. Indeed, it is interesting to note that the average S&P 500 return for the last 15 Januarys is 85 bps.3 This time specifically, investors may be at an impasse because there are two sets of developments that may be at odds with one another. First, we expect solid earnings and AI momentum to be positive for markets. Second, fiscal and monetary policy uncertainty could lead to volatility and drawdowns – like yesterday (January 7th).

All things equal, we’d use January’s policy-related pullbacks to add to our top thematic investment ideas. Here are the top 4 factors that will drive markets this month and a selection of trading ideas we would consider to start the year.

Positive Factors for Markets in January (and beyond)

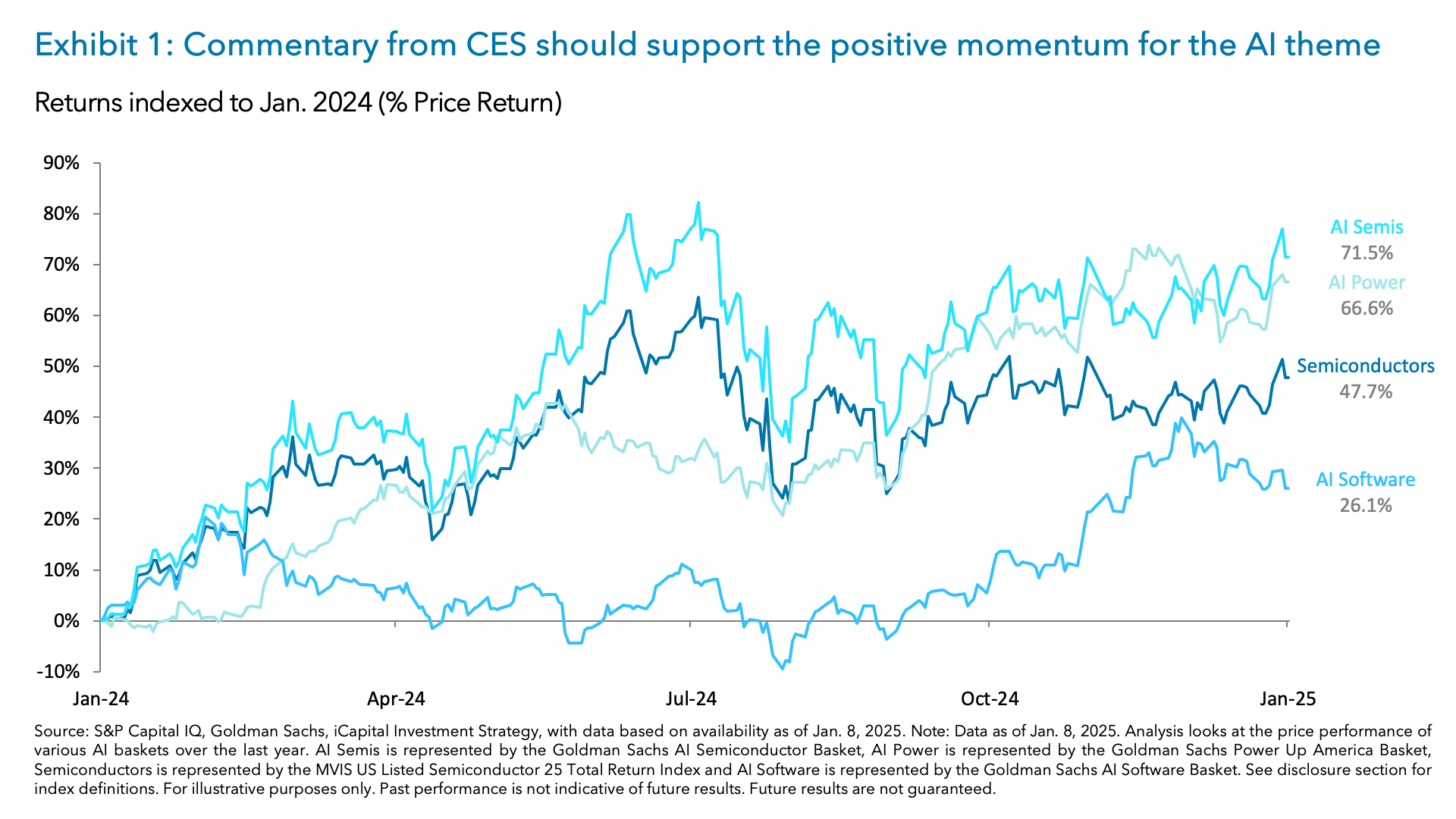

The AI momentum continues and carries over into 2025. The Consumer Electronics Show (CES) which is underway this week is highlighting this theme through various reports, product launches and presentations.

The sub-theme this year is likely to be the broadening out of the AI theme. New products suggest that AI could be embedded in a range of consumer and industrial products – PCs, gaming, TVs, smartphones, autos and more.

Additionally, the proliferation of AI could go beyond the digital and increasingly become a part of the physical world – think not just digital assistants, but physical robots. NVDA is certainly betting on this as Jensen Huang is focused on making chips not only for data centers but for robots and self-driving cars.4

Commentary like this from CES should serve as a reminder that AI is a multi-year secular megatrend with a lot of room to run and significant positive momentum, and we think investors may benefit from broadening their exposure to this theme. Indeed, AI Semiconductors and AI Power are off to a strong start this year and are up by 4.35% and 5.57% year-to-date, respectively.5

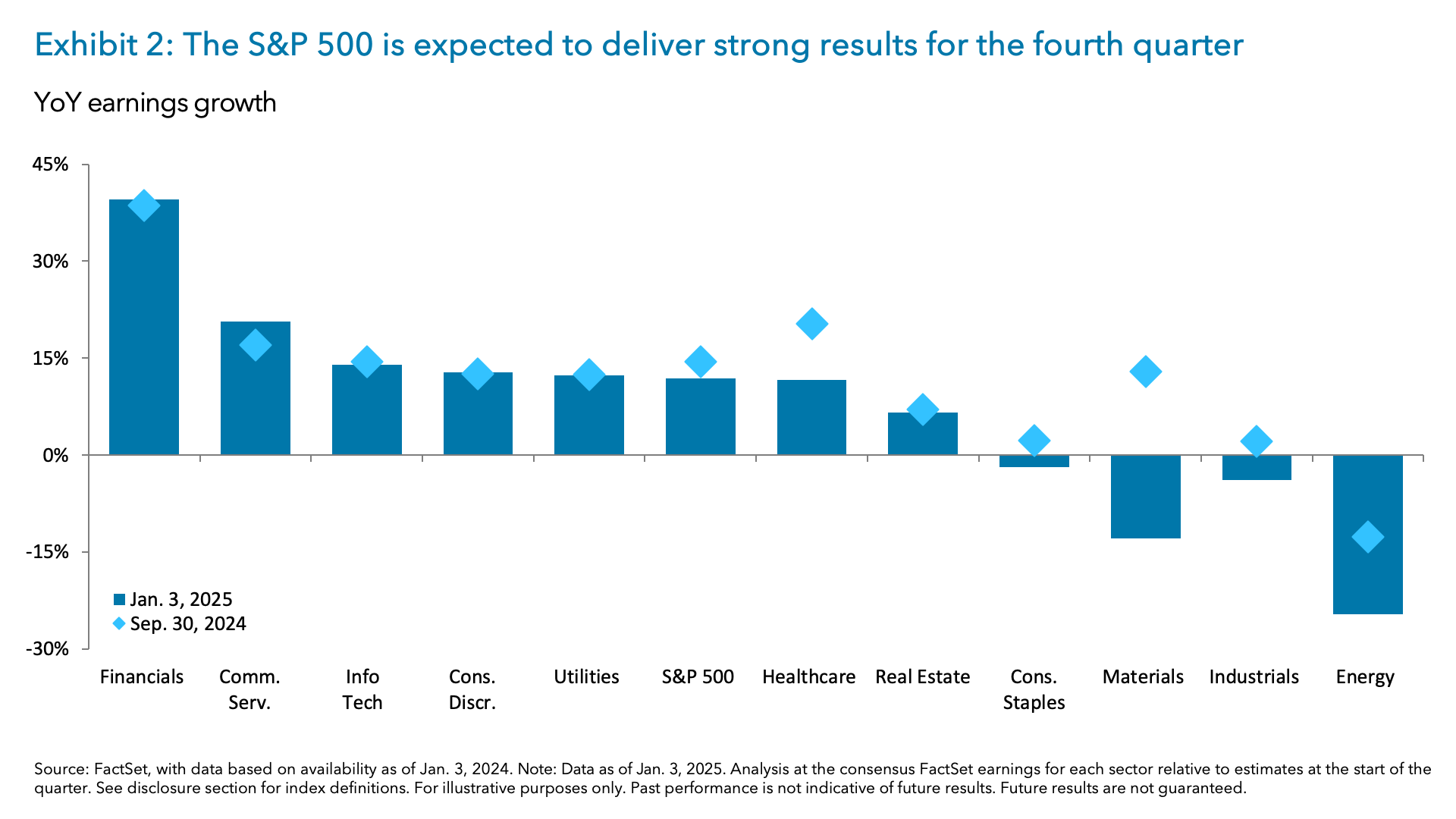

Q4 ’24 earnings point to strong economic momentum. The earnings season will largely begin on January 15th when financials start to report results. Quarterly earnings are likely to post a 11.9% year-over-year (YoY) increase – or the highest since Q4 ’216. Importantly, the strength is broad-based, 7 out of 11 sectors are expected to report YoY growth this quarter, with 6 of those sectors expected to report double digit growth, including financials, communication services, consumer discretionary, utilities and healthcare.7

There has been the typical slew of negative guidance pre-announcements and earnings per share (EPS) estimates have been revised lower. As a result, bottom-up EPS estimates have been revised lower by 2.7% from September 30th to December 31st.8 In line with recent history, this should let most companies clear the bar, as the S&P 500 had an average positive surprise of 4.6% over the last four quarters.9

This solidifies the conviction that companies are entering 2025 with solid earnings momentum. And, based on a 2026 EPS of $305 and a 22x multiple, we see SPX fair value by YE 2025 rising to 6,700 (or ~ 12.5% from here).10

Negative Factors for Markets in January (and beyond)

While these factors should be supportive of equity markets in January, we still see some counteracting risks that could weigh on sentiment and positioning. Specifically, the rise in bond yields as well as monetary and fiscal policy uncertainty could negatively impact stocks.

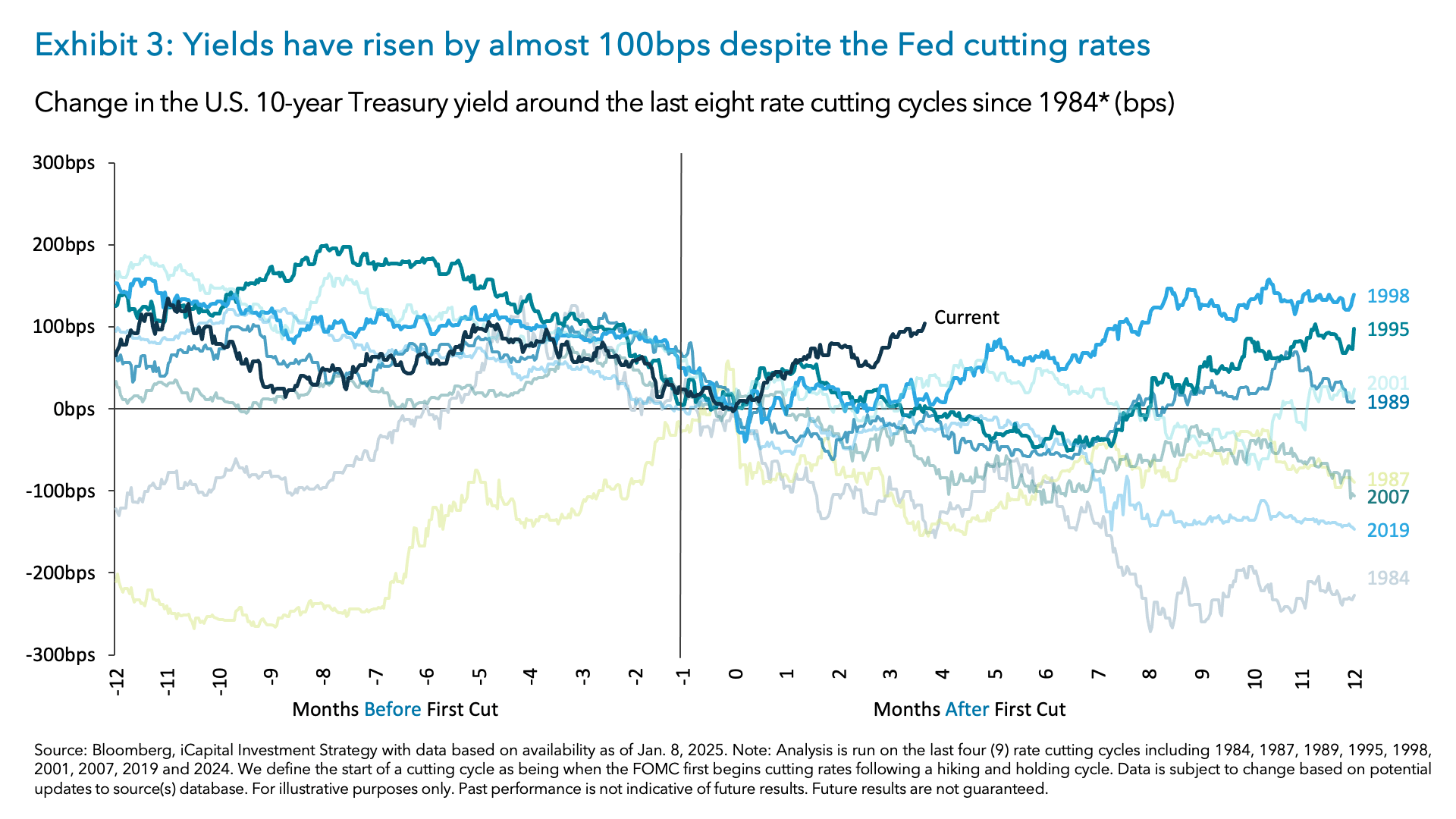

Bond yields, especially the 10-year U.S. Treasury yield, are still moving higher. This yield gauge is now about 100bps higher since the Fed started cutting rates in September 2024 – marking the largest rise in bond yields during the first 80 days of a Fed rate cutting cycle.11

The 10-year Treasury yield is now trading at around 4.70% and is sizably above fair value estimates.12 This is despite the fact that the Fed’s latest dots are now more in line with 2025’s current market pricing and economic surprises have been rolling over.13 This week’s stronger-than-expected ISM report and JOLTs report sent yields higher (and served as a headwind for stocks as even AI momentum faded on higher yields this week). This trend could continue if either payrolls surprise to the upside this week or inflation is higher-than-expected next week.

Bloomberg consensus estimates that the labor market will expand by 163,000 jobs in December,14 and some real-time data is pointing to a stronger than expected payrolls report15. Also, core CPI inflation could firm up in a report next week – 2.9% YoY is expected (vs 2.7% YoY previously),16 – as there is a propensity for higher prints to start the year. All of this could reduce rate cut expectations and push bond yields higher. This could be a negative for stocks, especially interest rate sensitive sectors like real estate and housing which have lagged the S&P 500 since the Fed cut rates in September.17

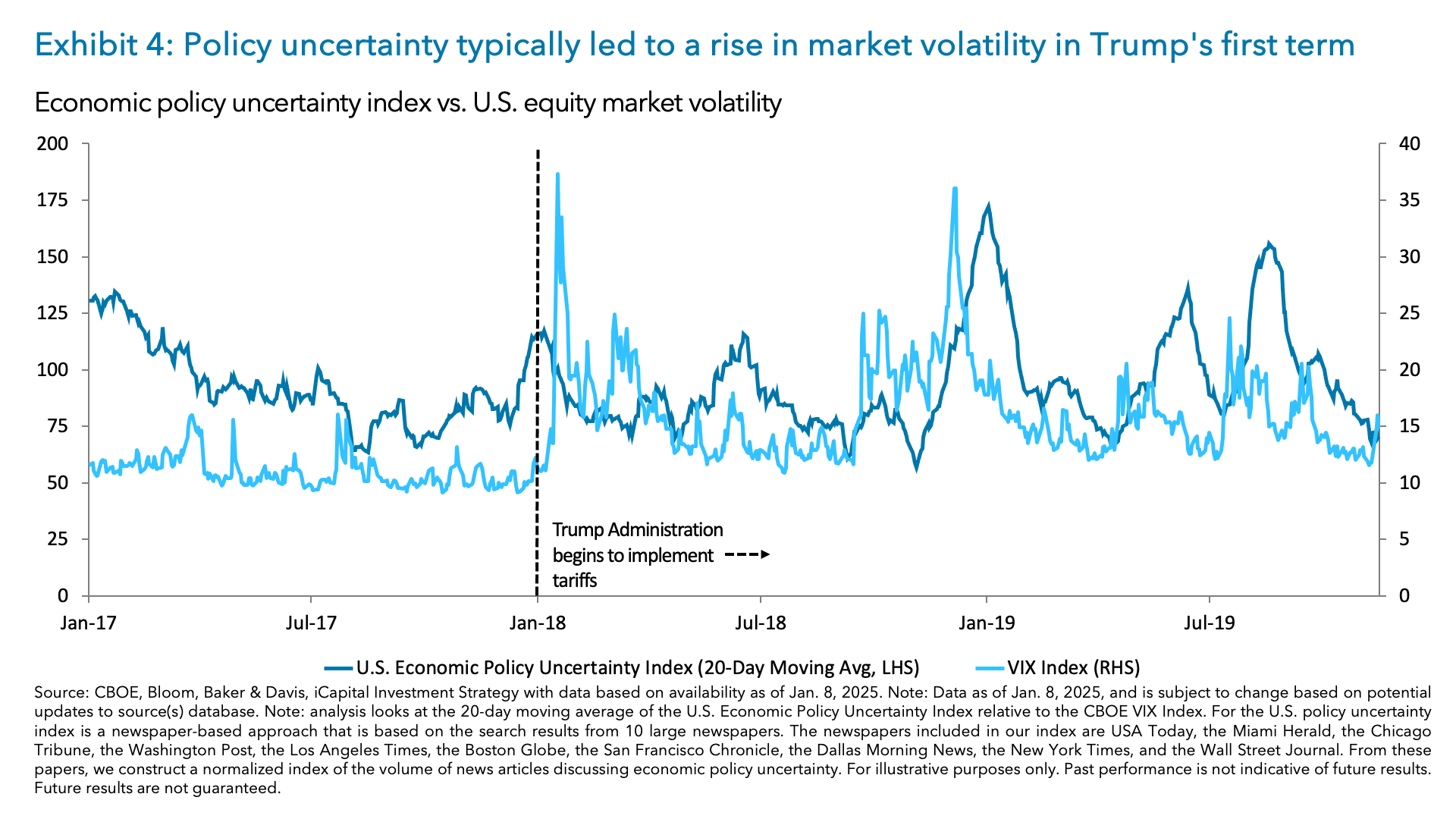

Policy uncertainty could lead to higher volatility. Since December volatility has trended higher and the VIX index is now at 17.6.18 Whether it is the port strikes, the transition from the Biden to the Trump administration, tariffs or the budget deficit/debt ceiling/government funding negotiations that are looming, there is plenty to keep investors guessing. This backdrop could prevent any meaningful gains given elevated volatility.

More broadly, as discussed in our 2025 outlook (linked here), the markets will have to contend with plenty of wild cards throughout the year. Depending on how these wild cards evolve, this could boost volatility, especially compared to 2024 levels, when the VIX averaged 15.5.19 Indeed, when policy uncertainty rose in Trump’s first term, the VIX Index also typically rose during these periods as seen in Exhibit 4.20

While higher treasury yields and volatility could weigh on equity markets and counteract the positive factors we have highlighted, we think investors should use this temporary impasse and any pullbacks to right-size their current portfolio allocations, using some of the investment ideas below.

Use Policy Uncertainty Pullbacks to Add to Thematic Ideas

This month (and December 2024) has already presented a better entry point after a shallow pullback, and it might present additional buying opportunities. We’d use these pullbacks to add to our top investment ideas for 2025.

1. AI Software. After lagging the AI Semiconductor theme since the launch of ChatGPT, AI Software finally started to outperform in the second half of 2024. Gen AI is a significant secular driver of this space and represents a $1 Trillion to $2 Trillion total addressable market (TAM)21. Interestingly, we also see many tactical drivers that could support the theme.

First, given that software has more of a domestic focus relative to the semiconductor industry, we think the theme could provide some insulation from a second trade war. Second, valuations screen attractive for the AI Software theme with the median forward price to sales ratio for the group at 7.7x, which ranks in the 33rd percentile over a 5yr. lookback.22

2. AI Power. We believe the AI Power theme should continue to perform well in 2025. Even after a strong year of gains in 2024 – the Goldman Sachs AI Power basket was up 60.50%23 – we think there is a structural trend in place that should support the theme over the coming years. Indeed, as we discussed here, global electricity demand is expected to double by 2026.24

In addition, the power theme has also gotten off to a strong start in 2025 given the news around Constellation Energy’s 10-year contract with the US General Service Administration (GSA).25 Given the pricing of this deal, as well as other power deals, this suggests that the TAM for the AI Power theme could be larger than initial estimates.26

3. Trump 2.0 Policy Winners. Markets will likely start to reward sectors/industry groups that will benefit from the Trump administration’s “America First” policy agenda. As discussed here, we would look to allocate portfolios toward companies that have a high exposure to U.S. sales and benefit from the administration’s onshoring push. We think the entry point for these groups is attractive, as they have largely unwound their post-election gains.

4. Financials. Financials are expected to grow their earnings by 39.5% YoY in Q4 ‘24 – the highest growth rate of all 11 S&P 500 sectors.27 Capital market activity is expected to rebound and should also help financials this year.

Further, we think the Trump administration’s deregulatory agenda should also support financials. With Michael Barr stepping down as vice-chair for supervision for the Fed, this now casts doubt on the stringent Basel III endgame.28 We expect the Trump administration to focus on easing capital requirements for banks and increasing their return of capital to investors – similar to Trump’s first term when financials outperformed the S&P 500.

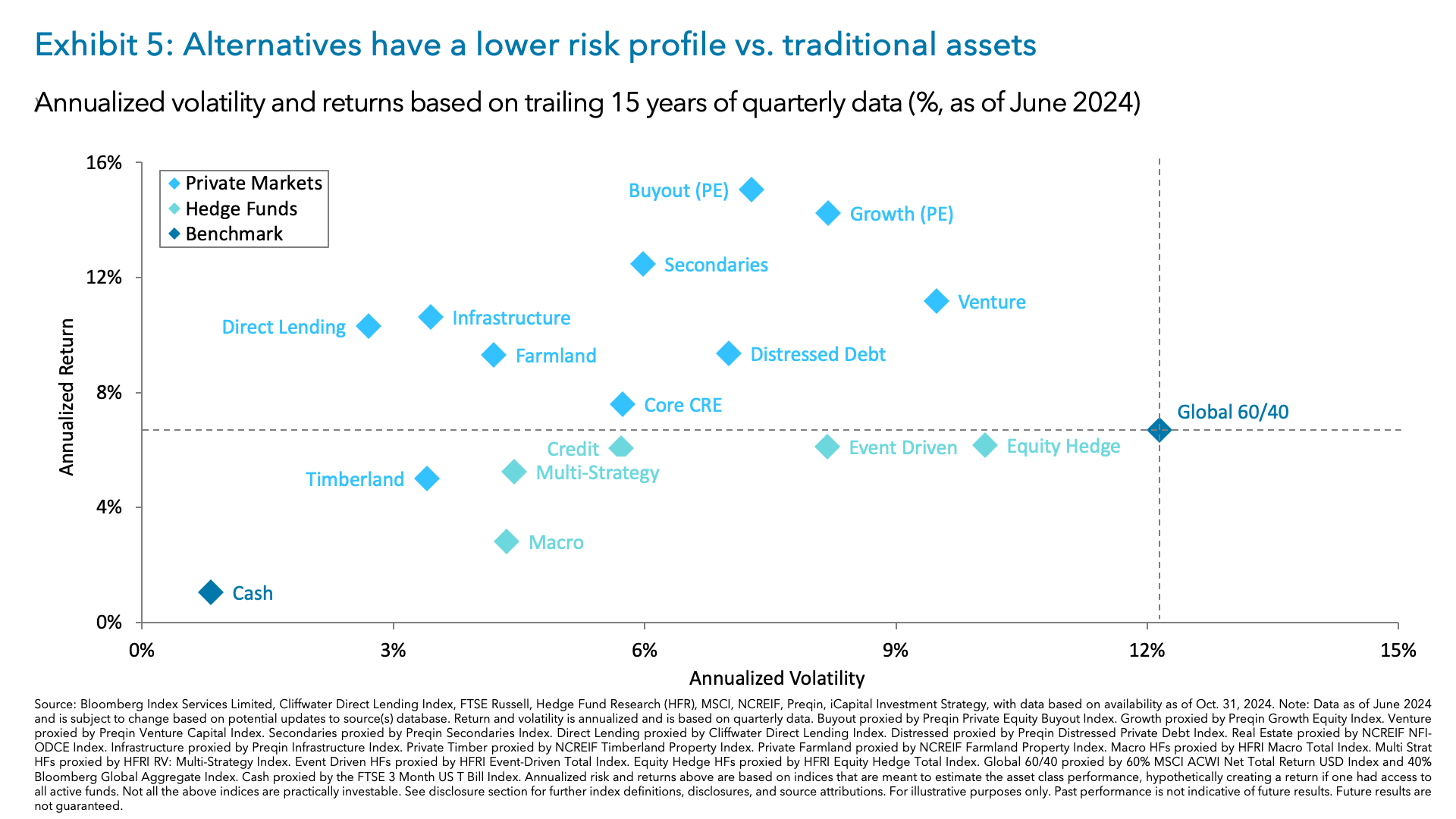

5. Alternatives. We expect higher volatility in public markets and an allocation to private markets and other Alternatives could serve investors well this year as historically Alternatives have often delivered lower volatility and better risk-adjusted returns. Additionally, an expected pick-up in exits bodes well for strategies like private equity and venture capital.

Our top ideas in Alternatives for 2025 include value-add real estate, asset-based lending, event-driven hedge funds, middle market buyout, venture capital and structured notes. Read more in our full 2025 Market Outlook.

1. American Association of Individual Investors

2. American Association of Individual Investors, as of Jan. 2, 2025.

3. S&P Capital IQ, as of Jan. 7, 2025.

4. Reuters, as of Jan. 7, 2025.

5. Morgan Stanley, Bloomberg, as of Jan. 7, 2025.

6. FactSet, as of Jan. 3, 2025.

7. FactSet, as of Jan. 3, 2025.

8. FactSet, as of Jan. 6, 2025.

9. FactSet, as of Jan. 7, 2025.

10. FactSet, as of Jan. 8, 2025.

11. S&P Capital IQ, as of Jan. 7, 2025.

12. Bloomberg, J.P. Morgan, as of Jan. 7, 2025.

13. Bloomberg, Citi, as of Jan. 7, 2025.

14. Bloomberg, as of Jan. 7, 2025.

15. Bloomberg, as of Jan. 7, 2025.

16. Bureau of Labor Statistics, as of Jan. 8, 2025.

17. S&P Capital IQ, as of Jan. 7, 2025.

18. CBOE, as of Jan. 8. 2025.

19. CBOE, as of Jan. 7, 2025.

20. Bloomberg, as of Jan. 7, 2025.

21. Bloomberg Intelligence, Goldman Sachs, as of Dec. 6, 2024.

22. S&P Capital IQ, as of Jan. 7, 2025.

23. Morgan Stanley, as of Jan. 7, 2025.

24. International Energy Agency (IEA), as of Jan. 24, 2024.

25. Reuters, as of Jan. 2, 2025.

26. Morgan Stanley, as of Jan. 2, 2025.

27. FactSet, as of Jan. 3, 2025.

28. Financial Times, as of Jan. 6, 2025.

INDEX DEFINITIONS

CBOE Volatility Index (VIX Index): The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500 Index (SPX) call and put options.

Goldman Sachs Power Up America Basket: composed of unregulated energy producers and related industries that benefit from the rising demand of power.

Goldman Sachs AI Semiconductor Basket: composed of semiconductors names with the potential for AI to drive incremental earnings, and excluding analog semiconductors.

Goldman Sachs AI Software Basket: composed of software names with the potential for AI to drive incremental earnings, which include infrastructure, platform and security layers of the stack.

MVIS US Listed Semiconductor 25 Total Return Index: MVSMHTR covers the largest and most liquid companies listed in the US, which are active in the semiconductors sector. The index is reviewed semi-annually, modified float market capitalization weighted, and the maximum component weight is 20%.

S&P 500 Index: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.