Key Takeaways:

- Nvidia’s next earnings release comes at a time when investors are recalibrating their exposure to AI-focused companies.

- Methods of financing the AI boom are increasingly coming under question, particularly given the drag to free cash flow expected in the coming year.

- The pace of expense growth across leases, borrowing costs and depreciation will be watched closely among investors, in addition to the ROI.

The AI trade is at an inflection point. Over the past few years, the AI buildout has centered around growth-at-any-cost with the spotlight squarely on chip demand. That demand remains robust, but the narrative is starting to evolve. The question now isn’t just how much AI can scale—it’s how it will be financed and whether the returns justify the spending spree.

As capital expenditure (CapEx) intentions surge among hyperscalers, the conversation is switching from speed and scale to balance sheet strength and free cash flow (FCF) durability. With enormous CapEx needs to sustain the next phase of the AI buildout, we believe investors will need to be selective in this space—taking more of a quality-bias.

Nvidia’s upcoming earnings on November 19 is shaping up to be more than just a headline—it’s a stress test for the ecosystem. While the results could help build confidence in AI demand, investors will look for any clues of complications arising from Nvidia’s client base—some of whom are beginning to feel the winds of changing investor sentiments.

Three key shifts in the next phase of the AI build

- Rising leverage/debt to finance CapEx: Borrowing needs are expanding rapidly for what had previously been a low leverage business model, by and large. Of the $164 billion in debt raised for data center development in the year to date through end of October, roughly $97 billion was raised in the last month alone.1

- A turn in investor preferences: After a strong run up in valuations, investors are becoming selective in picking companies that will have a more durable path. This is evidenced by the changing leadership among the Magnificent 7’s (Mag-7)2 stock performance in 2025.

- Focus on free cash flow: Durability in part will be assessed through a strong buffer of FCF, which is slated to decline industrywide in the next year, but still has the potential to expand as AI can begin to offer greater returns on invested capital.

Changing Trends: Leverage Is Rising but Still Early Days

AI’s CapEx boom isn’t slowing down. By the end of 2026, hyperscalers3 are expected to allocate 70–75% of cash flows to CapEx, up from 40–50% in recent years.4 That level of spending will almost certainly push them deeper into debt markets, tightening their financial flexibility.

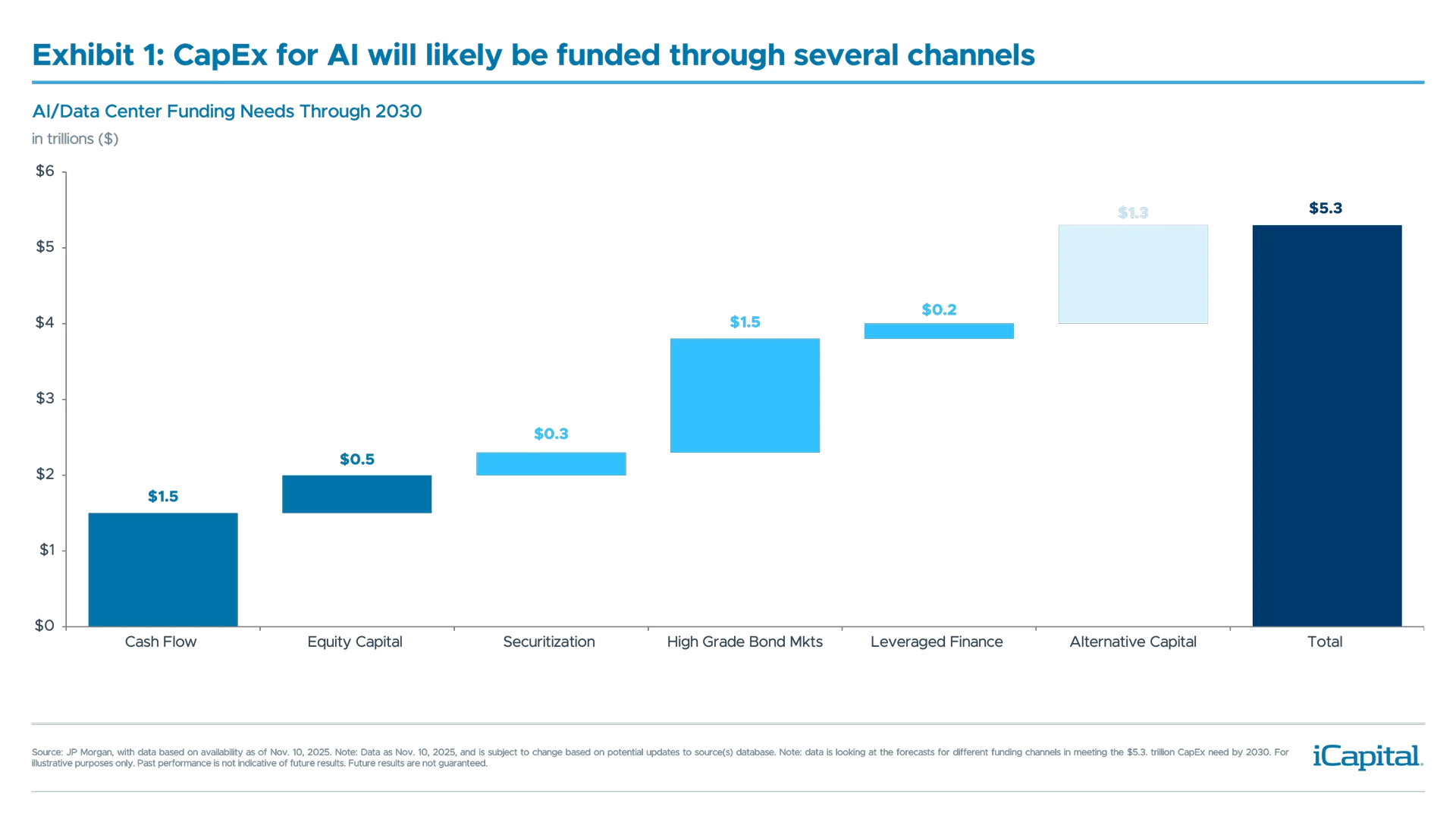

Between now and 2030, roughly $5.3 trillion is expected to be spent building out AI and data center capacity (Exhibit 1).5 Cash flows will cover only about $1.5 trillion of that, leaving a significant funding gap.6 To bridge it, high-grade bond markets will likely shoulder a similar share, while the rest will come from off-balance-sheet financing, private credit, and securitizations.7

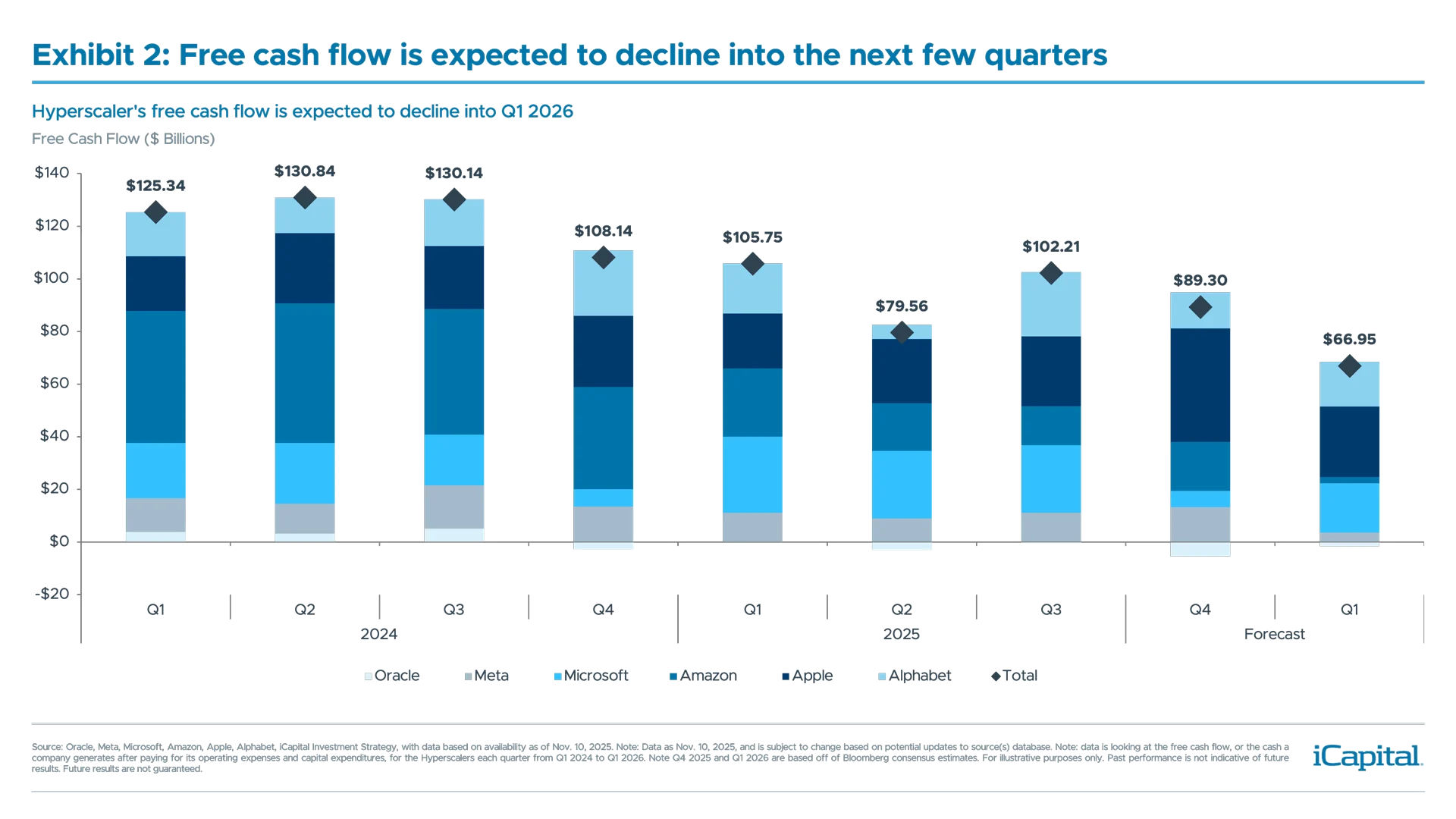

At the same time, free cash flow is under pressure. Hyperscalers FCF is projected to compress through the end of 2025 and into 2026, before rebounding in late 2026 (Exhibit 2).8 But Meta and Oracle stand out as exceptions, with continued weakness expected into 2026—underscoring the need for debt financing.9

At the same time, free cash flow is under pressure. Hyperscalers FCF is projected to compress through the end of 2025 and into 2026, before rebounding in late 2026 (Exhibit 2).8 But Meta and Oracle stand out as exceptions, with continued weakness expected into 2026—underscoring the need for debt financing.9

Still, leverage ratios remain low compared to prior cycles. Only 7% of industry CapEx is debt-funded today, versus 32% during the telecom boom in 2000.10 While, we expect leverage to tick higher in coming quarters, we believe we are still in the early innings of the leveraging cycle from an aggregate perspective and does not signal a broad-based concern or bubble.

Still, leverage ratios remain low compared to prior cycles. Only 7% of industry CapEx is debt-funded today, versus 32% during the telecom boom in 2000.10 While, we expect leverage to tick higher in coming quarters, we believe we are still in the early innings of the leveraging cycle from an aggregate perspective and does not signal a broad-based concern or bubble.

Depreciation Schedule Is the New Talking Point

Rising (and accelerated) depreciation is becoming a bigger topic in markets as the useful life of AI chips comes under scrutiny. While we see this as more noise than a structural risk, it’s worth monitoring.

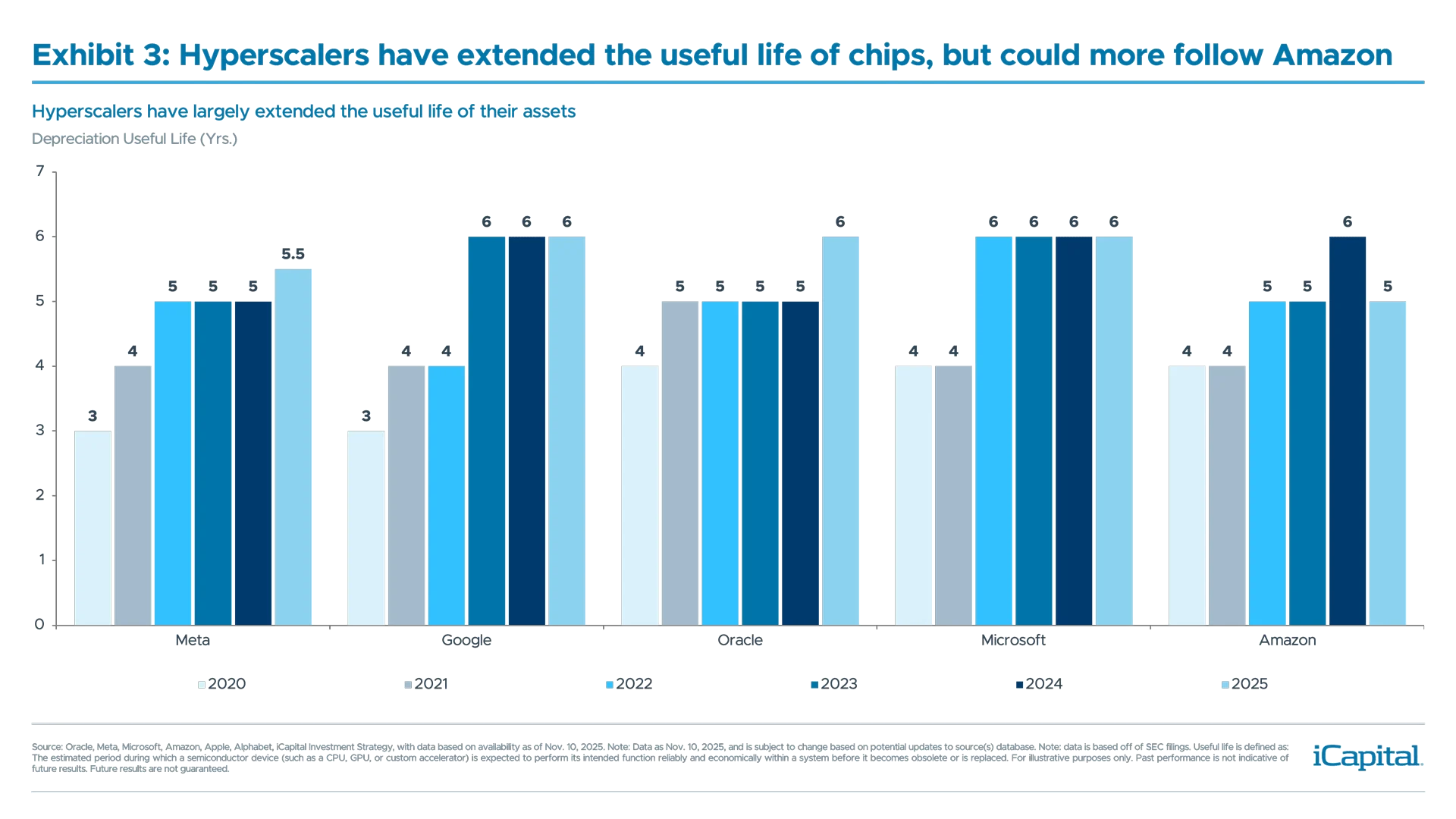

Historically, servers and data center GPUs have had useful lives of roughly five to seven years.11 A growing debate is emerging that chips used for AI-workloads may last closer to two years, given intense utilization rates.12 While the verdict is still out on what the true useful life is, companies may need to adjust their depreciation schedules in the coming years.

Take Amazon, for example. The company recently shortened the useful life of its servers and networking gear back to five years – reversing last year’s extension – citing the “accelerating pace of AI and machine learning” (Exhibit 3).13 That shift matters as shorter depreciation schedules mechanically mean higher expenses and lower earnings per share (EPS), even if firms benefit from enhanced tax deductions under the One Big Beautiful Bill Act.

Still, there are signs that some companies are mitigating the impact by repurposing older chips and hardware, extending their usability where possible. For these companies, these measures may soften potential headwinds to profits but emphasize the importance for investors to be more selective of how they approach the AI theme going forward.

Still, there are signs that some companies are mitigating the impact by repurposing older chips and hardware, extending their usability where possible. For these companies, these measures may soften potential headwinds to profits but emphasize the importance for investors to be more selective of how they approach the AI theme going forward.

Investors Are Getting More Selective

Investors are still rewarding the AI theme, but to varying degrees. The easy-money phase of the AI trade is over, in our view. As the conversations shift from speed and scale to balance sheet strength, cash flow durability, and ROI visibility, investors are becoming increasingly selective.

Nowhere is this clearer than within the Mag 7. While every Mag-7 company posted positive returns in 2024, 2025 has told a different story.14 Over the past month, Meta has lagged its peers by nearly 19 percentage points (pp), and Oracle – though not part of the Mag-7 – has underperformed the group by more than 27pp.15

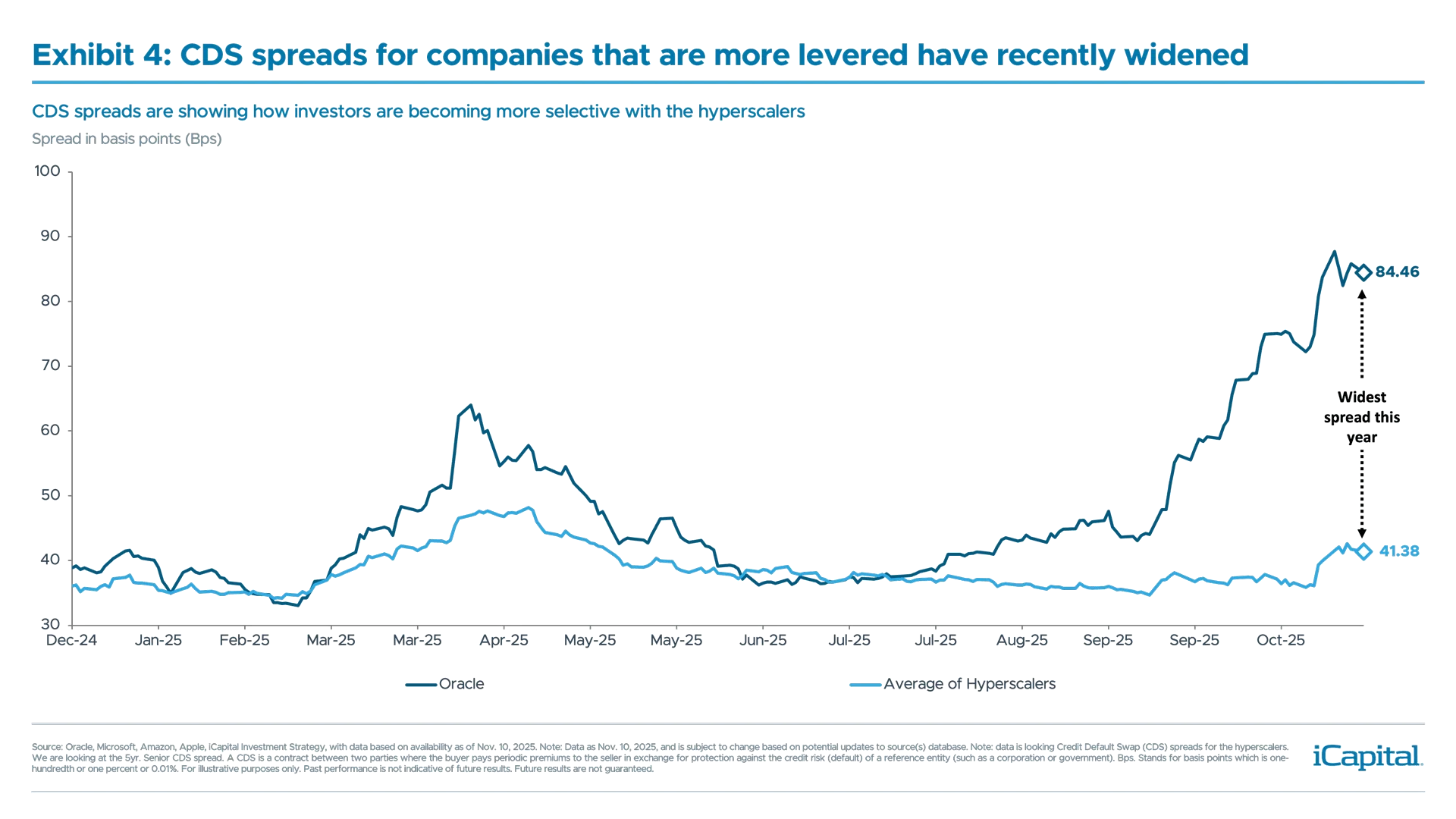

Oracle, in particular, offers a clear example of this shifting investor mindset. Its stock jumped roughly 45% in early September after the company announced that its backlog for Remaining Performance Obligations (RPOs) tied to AI-demand would exceed $500 billion.16 But the rally was short-lived. Weeks later, Oracle raised $18 billion in debt to fund further AI expansion, and since then, shares have fallen by more than 30%.17 Meanwhile, Oracle’s credit default swaps (CDS) have climbed to their highest levels this year among hyperscalers, reflecting investor concern around leverage FCF pressure (Exhibit 4).18 In our view, this has become a real-time barometer of investor sensitivity to balance sheet risk and capital discipline in the next phase of the AI cycle/buildout.

Investment Implications:

Investment Implications:

Investors, both debt and equity, are rewarding companies that can sustain spending without overleveraging. We see opportunities across both public and private markets – yet with a quality bias and a selective approach. In conversations with clients, we’ve seen a willingness to forfeit some upside in order to mitigate downside risks across single names and across capital structures.

In private markets, we continue to favor digital infrastructure as the most direct and defensible way to participate in the AI buildout. Given our view that we are still in the early innings of this leveraging cycle, we think many hyperscalers will turn to digital infrastructure and private credit managers to help finance the current funding gap that exists.

In public equity markets, we believe selectivity is key with a focus on FCF and future financing needs. We also believe there are beneficiaries of the AI cycle, such as infrastructure software that can support the success of an AI buildout. You can find our recent piece on the software industry here.

In public credit markets, large AI players – many still rated investment-grade – continue to offer attractive yields with limited default risk, even as debt issuance ramps.

And here at iCapital, we are seeing investors gain exposure through structured notes that provide access to single name stocks as well as the broader indices. Such notes provide various levels of downside protection (full, partial or contingent) while providing monthly or quarterly coupons/yield or returns based on the underlying index.

On Watch: Nvidia’s Earnings, Which Should Re-Affirm the AI Trend in The Near-Term

But, now all eyes shift to Nvidia, which reports earnings after market close on November 19. These earnings come at a critical juncture. While the bar might be slightly higher heading into the print – positioning seems somewhat stretched, and valuations are trading in-line with their one-year average – expectations are for another beat and raise quarter. We believe Nvidia’s earnings should help re-affirm the strong underlying demand for AI, as investors focus on the trajectory of Nvidia’s $500 billion Datacenter revenue forecasts and the ramp up of their new chips (Rubin).19

While this should put a floor under AI stocks, there are questions about how increased financing needs and the potential for accelerated depreciation could impact many AI-related companies, particularly the largest hyperscalers.

In the near-term, we believe that we are early enough in this leverage cycle that Hyperscalers will still have ample financing availability to dedicate toward AI data centers through 2030. The broadening of capital sources should serve as a near-term tailwind for the semiconductor industry.

Bottom Line:

These changing trends of financing and depreciation expenses will be key focal points for investors as we enter 2026. But, unlike the last few years, we think investors will need to be more selective in how they approach the AI theme, and take a more quality approach, as markets will likely reward companies with smaller debt balances and strong free cash flow growth.

END NOTES

- Wells Fargo, as of Nov. 3, 2025.

- Note: Magnificent 7 includes Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla.

- Note: Hyperscalers include Alphabet, Amazon, Apple, Meta, Microsoft, and Oracle.

- Wells Fargo, as of Nov. 3, 2025.

- JP Morgan, as Nov. 10, 2025.

- Ibid.

- Ibid.

- Bloomberg, S&P Capital IQ, Company Filings, as of Nov. 11, 2025. Note: Hyperscalers include Alphabet, Amazon, Apple, Meta, Microsoft, and Oracle.

- Ibid.

- Wells Fargo, as of Nov. 3, 2025.

- Seeking Alpha, Michael Burry, as of Nov. 12, 2025.

- Tom’s Hardware, as of Oct. 24, 2024.

- Amazon Company Filings, as of Nov. 10, 2025.

- S&P Capital IQ, as of Nov. 11, 2025.

- S&P Capital IQ, as of Nov. 11, 2025.

- S&P Capital IQ, as of Nov. 11, 2025.

- S&P Capital IQ, as of Nov. 11, 2025.

- Bloomberg, as of Nov. 10, 2025.

- Nvidia GTC Washington, as of Oct. 28, 2025.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.