Key Takeaways

- Automation fears have driven a sharp selloff in software, but investors are ignoring where AI can be beneficial to software companies, specifically those that have invested in AI and have wide moats through long-standing enterprise relationships.

- The sell‑off in software appears advanced across equities and credit, with valuations, momentum, and breadth suggesting we are closer to the later innings than the early stages.

- Software credit exposure appears more contained than headlines suggest, with risk concentrated in select borrowers and strategies rather than broadly across high‑yield and private credit markets.

- Market dislocations are starting to create opportunities especially for high quality companies across both private and public markets.

Anthropic’s automation efforts have thrust the future of software into question. The technology industry’s relative newcomers now promise to bring fast change to clerical, finance and legal work that might have previously been served by software. Software stocks have dropped 10% since Anthropic’s January 30 rollout of new capabilities, and are now down roughly 20% year-to-date, the worst start to the year in history.1

The sell-off has not been limited to public equities. Publicly traded Business Development Companies (BDCs) have sold off in tandem given the extent of loans outstanding to software portfolio companies. This has turned investors’ attention to private markets as they assess the exposure across private equity and credit. The ultimate concern: How many portfolio companies will be deemed obsolete moving forward?

Investors are extrapolating the notion that AI will “eat” software, yet it is premature to say that all software is dead.

There is no doubt that competition is shaping the technology industry. Yet the current dislocations could ultimately present an opportunity – similar to the DeepSeek announcement early last year. We believe investors will need to be selective and favor software infrastructure names and companies with sticky ecosystems and deep integration.

Is AI going to be the Death of Software?

The Anthropic release of legal plug-ins on January 30 has called into question whether AI will be able to replace existing software. While AI will inevitably disrupt sectors, industries and jobs – software included – investors are likely overstating the impact on the software industry at large. In fact, Nvidia CEO Jensen Huang recently addressed this in an interview: “It’s the most illogical thing in the world, there’s this notion that the tool (software) is in decline and being replaced by AI. Would you use a screwdriver or invent a new screwdriver?”2

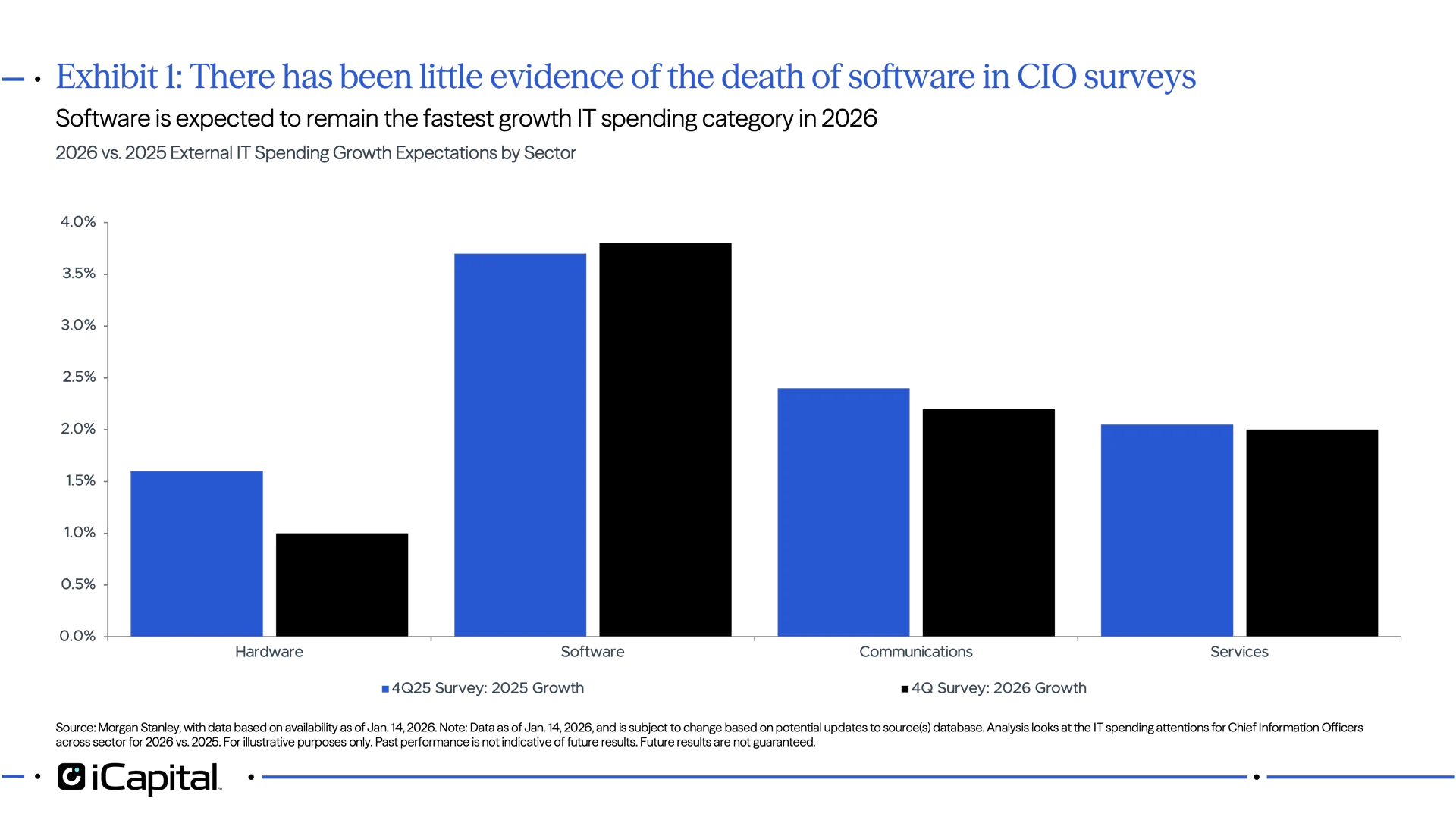

Another reason why we think it is premature to declare the death of software when looking at CIO surveys, which show little evidence that CIOs are pulling back on software spending. Looking in the Morgan Stanley CIO survey, software is expected to be the fastest growing IT spending category in 2026 – with no material change in growth rates compared to last year.3 CIOs noted that they see areas of opportunity in software for hyperscaler consolidators, data management vendors and application platform vendors.4

Incumbents that have also invested in AI are likely to maintain an advantage, especially given the long-term enterprise relationships that exist across the industry. At the same time, newer software companies native to agentic AI have meaningfully improved workflows, with new products reaching $100 million in annual recurring revenue faster than incumbents have.5

How Far Along Are We In The Sell-Off?

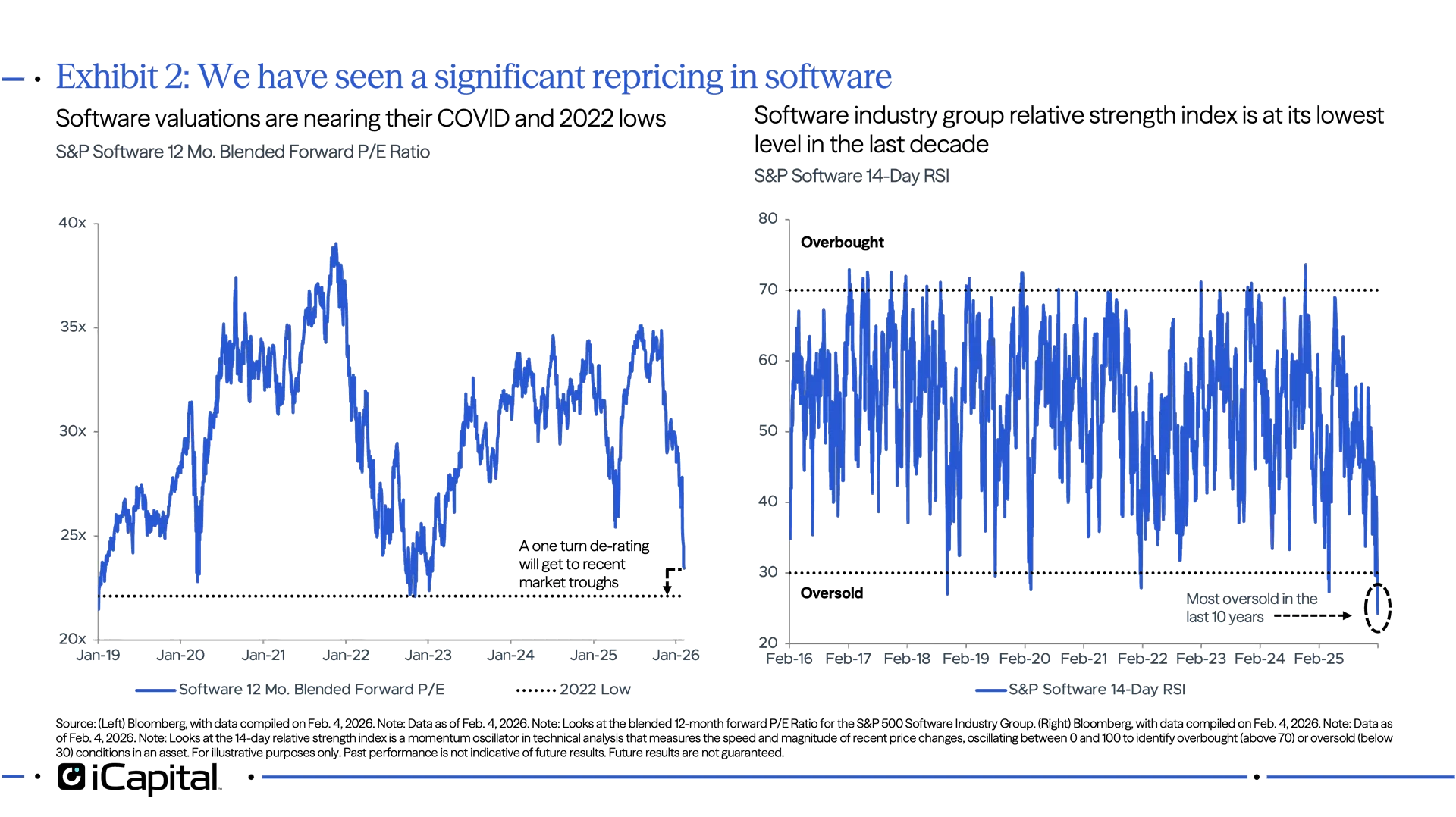

While software stocks have already sold off sharply, we think much of the negativity is likely reflected in prices. This is very apparent when looking at current valuations and momentum measures (see in exhibit 2). Not only does it reflect oversold conditions, but they also reflect levels where we have seen the group historically trough – suggesting we could be closer to the end of the sell-off rather than the beginning.

- Valuations: The forward multiple of the S&P 500 Software industry group, is currently 23.7x, the lowest level since 2022 when it traded at 22.1x and the COVID low of 22.8x.6 Even looking back over the last 10 years, the forward multiple is in its 20th percentile, which is pretty remarkable given the significance run-up in the years heading into COVID.7

- Momentum: The relative strength index (RSI) for the median stock in the industry group is 24.7 – well below the oversold reading of 30.8 To put this in perspective, this is the lowest reading we have seen in the last 10 years.9

- Breadth: Certain breadth measures are getting closer to signs of a washout. Currently, zero members of the software industry group are trading above their 200-day moving average – the lowest reading in history.10 In addition, new lows are also spiking with the group with 70% of members making new 65-day lows – the highest since the Liberation Day announcement last year.11

Credit spreads have also widened. Since the Anthropic news, technology and specifically software, high yield spreads have widened to ~340 basis points (bps) and ~400 bps, respectively.12 However, technology only makes up about 8% of the high yield credit market, with software specifically being about 3-4%.13 This is one of the reasons why we have seen a very limited spillover into spreads broadly, which remain at 264 bps – 30 bps lower than the average seen in 2025.14

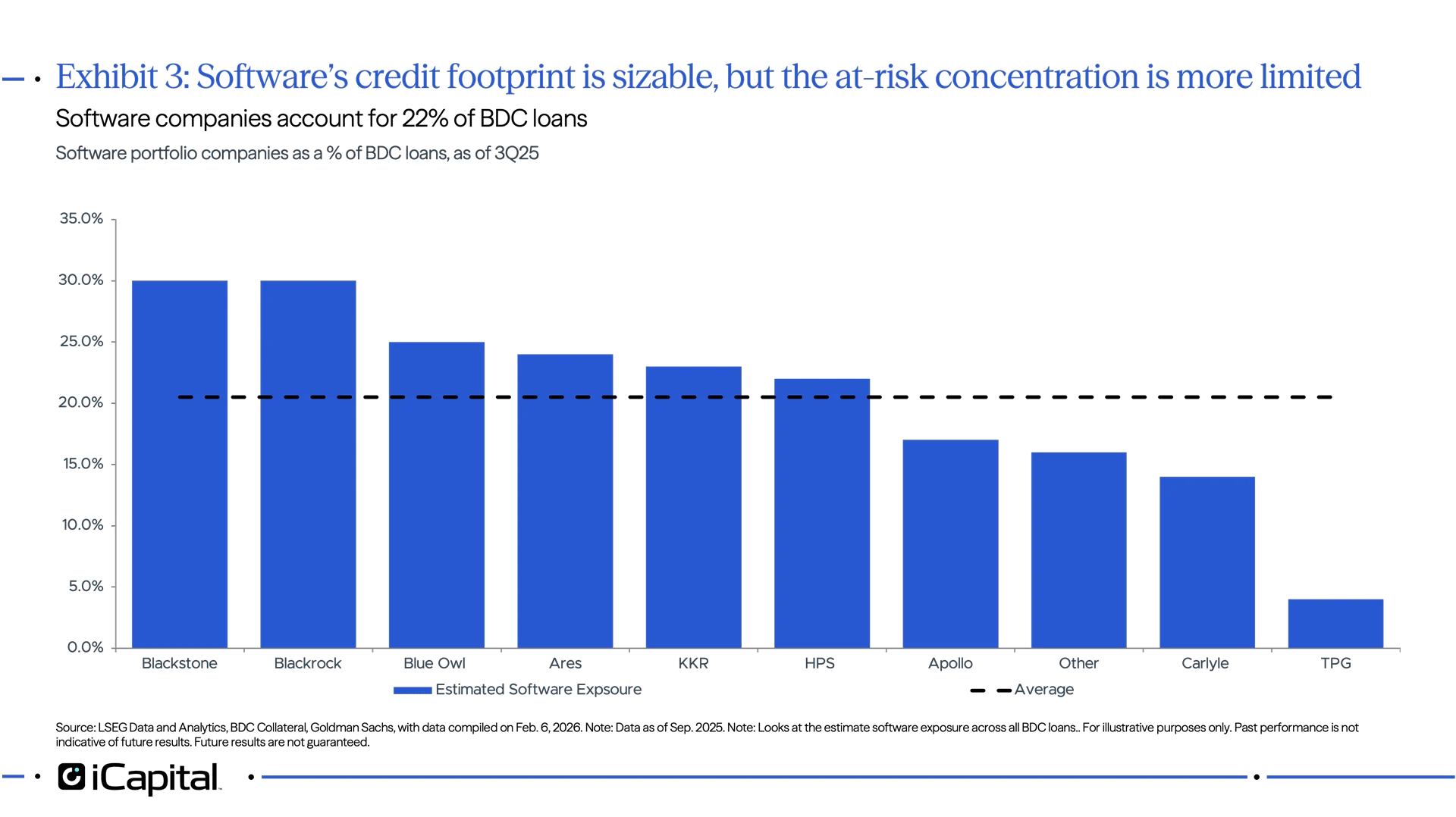

The weakness in software has also brought a lot of focus back on publicly traded BDCs, where software portfolio companies represent ~20% of BDC loans, as seen in Exhibit 3.15 But, the exposure to software varies widely across funds with the Blue Owl Technology Fund having about 65% technology exposure, compared to 1% for the SLR Investment Corporation.16 With software representing a subset of the technology allocation, the actual exposure to software loans, particularly those at risk of disruption, is likely lower.

What’s more, the sentiment seems divorced from the reality of the largest fund managers. Blue Owl’s co-CEO, Marc Lipschultz, explained that the technology portfolio is not only lacking major issues, it’s actually showing “largely green flags,” according to a conference call this week with analysts.17 “The tech portfolio continues to be the most pristine amongst all of our portfolios.”18

While individual BDCs may be more weighted toward software, this is far from true at the company level for the biggest firms. For Ares, Carlyle, KKR and Blue Owl, software represents between 6-8% of total firmwide assets under management – highlighting that the largest private credit incumbents have manageable exposures, and have already been mitigating pressures that would otherwise stem from AI’s impact on software.19

Private Market Implications:

Given the private market exposure to software companies, there has been a focus on what this disruption could mean for portfolio companies and returns going forward. This concern is evident from the performance of alternative asset managers, which are down -12% year-to-date.20 We believe the selloff has been overdone, though broader investor sentiment may remain muted until public markets begin to recover more holistically.

Private Equity & Venture: Information Technology makes up a large share of deals, currently accounting for ~25% of deals.21 When you strip out venture capital, this falls to 16%.22 The correction in valuations can present significant buying opportunities for PE and VC firms. As one example, KKR’s own co-CEO this past week, when speaking with analysts, signaled a desire to deploy dry powder.23

The risk for private equity more broadly would be if we see a continued weakness in public equity valuations and performance, which may reduce the incentive to monetize these holdings – further complicating an already challenging exit environment for the industry. Given that the median company in the S&P 500’s software index has dropped to levels not seen since Covid and 2022, sponsors would be incentivized to wait for valuations to recover before pursuing exits.

It’s true that not every company will succeed, and scale matters. Consider the dispersion that could exist in the middle-market alone. There are more than 15,000 software companies with revenue less than $100 million, but only 170 that are bringing in more than $1 billion annually.24 The efficiencies of scale will likely spur consolidation. Publicly-traded counterparts are likely to be affected more immediately than private market rivals, given the flightiness of capital seen of late.

Private Credit: With sentiment remaining so weak, it is likely to impact fundraising in the near term, especially given the redemption uptick in the fourth quarter of 2025 seen on average across the industry. While the largest managers have largely mitigated risk for the past few years, the surge in lending against annual recurring revenue (ARR) in recent years may leave mid-sized managers with tough decisions to make about borrowers in the coming years.

Given that these ARR loans are tied to future subscription revenue, they may have finite ability to renew future business should such contracts begin to taper. This is not to say that all ARR is bad, just that private debt funds will likely have to reduce their exposures to a meaningful range of companies, if they have not done so already. This process could create dispersion across BDCs with technology exposure.

Should issues arise in portfolios, equity holders would be far more impacted than lenders, at least as a first order effect. We recommend a focus on high quality managers who have specialization and a meaningful track record in the industry, and can work with their portfolio companies to navigate the rapid pace of change brought on by AI.

Investment Implications: Later Innings, But Focus on Being Selective and Having a Quality Bias

As stated in our 2026 Outlook , we felt that it was going to be important to be selective with how to get exposure to the technology sector – which also extends to software. Specifically, as stated in a piece we wrote last year, we believe it will be important to focus on infrastructure software, which should be a structural winner and benefit from the rising reliance on AI agents and data rather than being disrupted by it.

While application software could face disruption from AI, we think there are a few things to focus on:

1. Platforms with sticky ecosystem and deep integration should be able to defend their moats.

2. Leaders in the space are already likely using AI to help improve their software and product offerings.

All else equal, despite the uncertainty, given current valuations and spreads, we think the current sell-off will present an attractive opportunity for select names that are well entrenched and have resilient recurring revenue streams – rather than just focusing on ETFs and indices that do not represent a pure play for software.

In addition, we think there will be opportunities for BDCs that are trading at a discount as well as direct lending funds. We believe these vehicles should provide attractive yields, which could be competitive with equity markets this year, where we expect mid-single digit returns and for volatility to spike throughout 2026.

Bottom line:

While the current drawdown in the software industry group across a number of asset classes may have some room to run, we believe we are in the mid- to late-innings of this sell-off. While the software landscape will likely remain bifurcated as some businesses will face disruption, we think this sell-off will ultimately represent an opportunity for high quality companies with deep integration and strong enterprise client relationships.

1. Bloomberg, Morgan Stanley, as of Feb. 4, 2026.

2. Bloomberg News, as of Feb. 4, 2026.

3. Morgan Stanley as of Jan. 14, 2026.

4. Morgan Stanley as of Jan. 14, 2026.

5. Bain, as Sep. 23, 2025.

6. Bloomberg, as of Feb. 5, 2026.

7. Bloomberg, as of Feb. 5, 2026.

8. Bloomberg, as of Feb. 5, 2026.

9. Bloomberg, as of Feb. 5, 2026.

10. Bloomberg, as of Feb. 5, 2026.

11. Strategas, as of Feb. 5, 2026.

12. iBoxx, as of Feb. 4, 2026.

13. iBoxx, as of Feb. 4, 2026.

14. iBoxx, as of Feb. 4, 2026.

15. LSEG Data, Bloomberg as of Sep. 30, 2025.

16. Company data, as of Sep. 30, 2025.

17. Blue Owl Company Conference Call, as of Feb 5, 2026.

18. Blue Owl Company Conference Call, as of Feb 5, 2026.

19. Company data, as of Feb. 6, 2025.

20. Bloomberg, as of Feb. 5, 2026.

21. Preqin, as of Feb. 5, 2026.

22. Preqin, as of Feb. 5, 2026.

23. KKR Company Call, as of Feb. 5, 2026.

24. Bain, as of May 2025.

INDEX DEFINITIONS

S&P Software GICs Level 3 Group: The S&P 500 Software industry includes companies that develop and sell application and systems software, excluding IT services and hardware providers.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2026 Institutional Capital Network, Inc. All Rights Reserved.