I’m traveling this week for conferences in Nashville and Berlin. When I showed up at the airport on Monday morning, what greeted me (and everyone) was a complete frenzy. The departures hall was packed, security lines stretched outside the doors, and there was little room to move around. Yet people were still in high spirits considering the circumstances, relieved to finally be able to travel.1

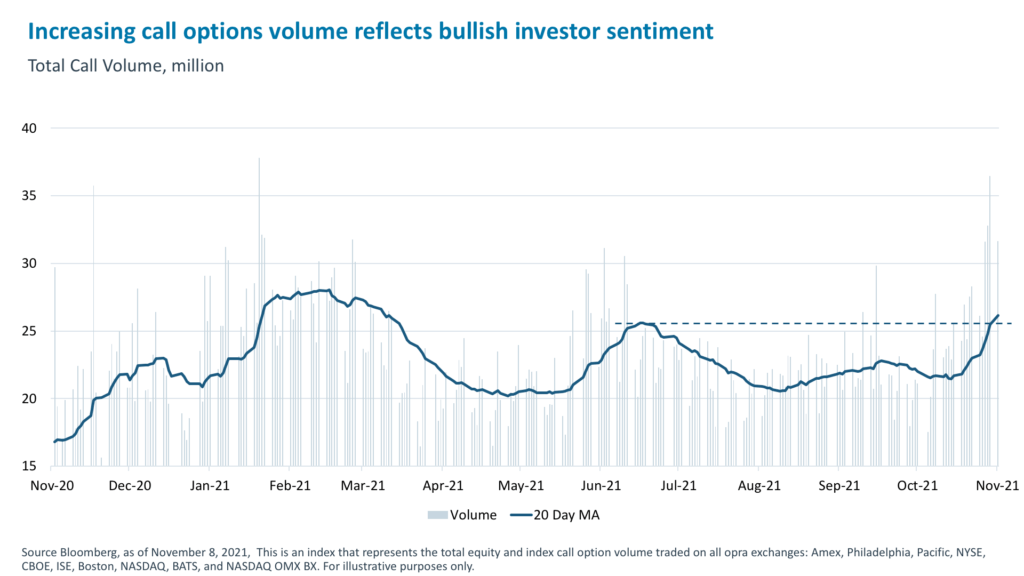

There’s another frenzy happening recently, but it’s in the financial markets, with performance chasing in full effect. Many types of investors – including hedge funds and individuals — have elevated long risk positions and are adding to them through the options market. Speculative call buying is hovering around the highest levels on record, both as a percentage of volume and market capitalization. Last week, retail and institutional investors bought a near-record amount of call options2 and net call buying to open — a gauge of bullish bets — was in the top 2% since the year 2000.3

Has the sentiment now gotten too bullish and, heading into year-end, are we primed for a pullback or a Santa Claus rally? In this week’s commentary, we explore market sentiment and three potential near-term concerns that could trigger a partial unwind of recent bullishness. Still, given the solid economic backdrop and strong fundamental support for earnings growth, we would only selectively look to take profits and use any potential pullback to add back to positions.

Here are the three potential negative catalysts to risky assets to be aware of: another decline in China’s mobility as it pursues its zero-COVID policy, a number of headline risks that could move oil lower, and a possibility of a more hawkish Fed in December.

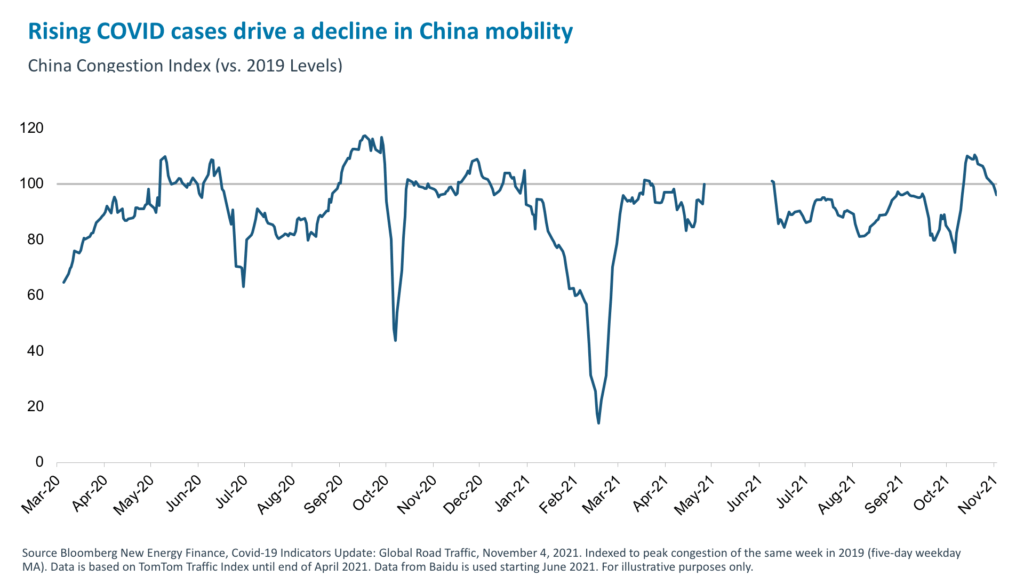

1. China COVID risks are on the rise again, denting prospects for Q4 growth

China COVID cases currently stand near the three-month high with the country’s current outbreak responsible for more than 900 cases.4 More worrying is that cases are now spreading in 20 out of 31 provinces – the country’s most widespread outbreak since the start of the pandemic.5 Given China’s zero-COVID policy, mobility restrictions are back. As a result, we’ve seen a significant drop in congestion levels in China for the second week in a row and mobility is back below pre-pandemic levels (see chart below). In stark contrast to U.S. travel scheduling which is ramping up, China cancelled almost 24,000 flights for the coming 11-week period.6 It is estimated that it may take China close to 30 days to get this wave of cases under control, given the duration of previous outbreaks, so we anticipate a further decline in mobility.7

As a result of COVID developments, regulatory tightening in property and other sectors, and limited easing measures to support economic growth, economists are starting to downgrade Q4 growth in China. The current consensus forecast for Q4 GDP growth in China is now 3.5% year over year.8 This is an obvious risk to growth globally and raises concerns that supply chain challenges may continue while global oil demand could falter. One silver lining that we are watching for this week is whether China’s total social financing (TSF), a broad measure of credit growth in the economy, will pick up as expected, to 10.1% year over year in October.9

2. Oil market faces several headline risks into year-end

Oil rallied more than 60% year to date to over $80 per barrel on the back of growing demand and a slower response in supply.10 However, there are several potential headline risks on the horizon that could portend more volatility into year-end.

- Growing tension between the US and OPEC+ could spur a U.S. Strategic Petroleum Reserve (SPR) release. If this occurs, we expect some modest downside pressure on oil prices. A release of 60 million barrels, or roughly 10% of the total reserve supply from the SPR, for example, would shave off a mere $3 per barrel.11 Still, retaliatory rhetoric poses a near-term bearish risk.

- Resumption of Iran nuclear talks. On November 29, Iran and other world powers that are signatories of the Joint Comprehensive Plan of Action (JCPOA) are expected to meet in Vienna to discuss the potential of reviving the Iran nuclear deal. The United States, which has imposed oil sanctions on Iran, has said it is willing to lift key sanctions if Iran returns to its JCPOA obligations. This could allow for up to 1.4 million bbl/d of Iranian oil to return to market12 and help ease the global energy crunch while simultaneously putting downward pressure on oil prices. Although we expect negotiations to be lengthy and not result in immediate sanction relief, we do note that headline risk remains the key downside pressure going into this meeting. This may further exacerbate the volatility expected from U.S.-OPEC+ tensions.

- Upcoming December OPEC+ meeting could see participants change their tune. When OPEC+ set a recent policy of 400,000 bbl/day monthly increases in production,13 it also agreed to re-evaluate in December. With expected deficit of 2.3 million bbl/day by December 2021,14 inventories well below five-year averages, and no rush by U.S. producers to invest more in scaling U.S. production, it is possible that OPEC+ may be more open to increasing production for 2022, especially amid calls for them to do so.

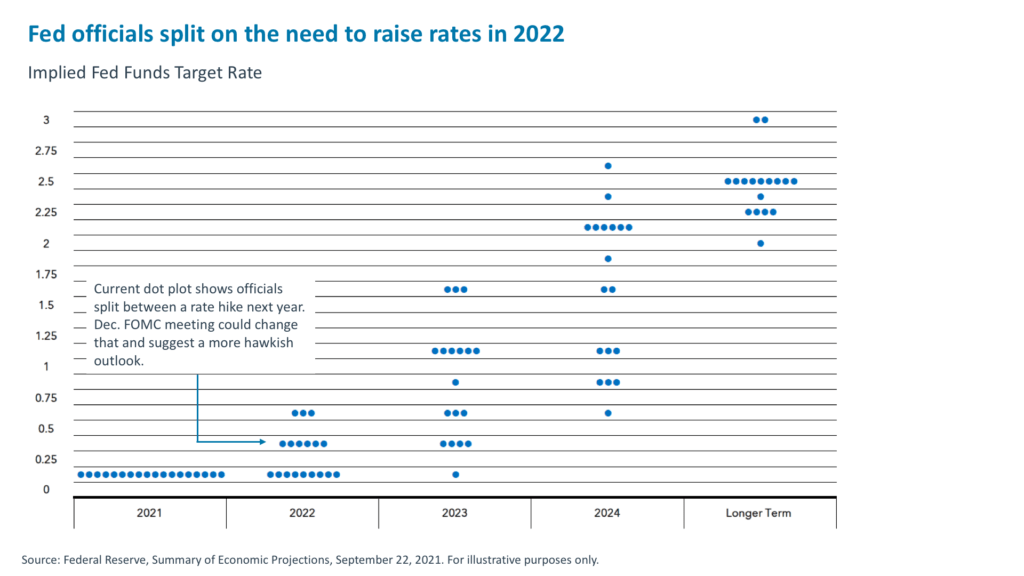

3. December FOMC meeting could be more hawkish on rate hikes than November

Finally, the December Federal Open Market Committee (FOMC) meeting is expected to draw significant attention to the new dot plot summarizing its outlook for the federal funds rate. The current dot plot shows Fed officials evenly split on the need to raise rates in 2022, with most expecting rate hikes in 2023 and beyond. But this could change in December. With the labor market regaining momentum in October and inflation persisting at near 30-year highs, some FOMC participants could pull forward their rate hike expectations. FOMC Vice Chair Richard Clarida said on Monday, for example, that based on his current outlook for the economy, the necessary conditions for rate increases will have been met by the end of 2022. St. Louis Fed President James Bullard also remarked that two rate hikes should be on the table for next year. There is scope for a hawkish surprise at December’s FOMC meeting.

Crowded positioning is not a reason to leave, but it is a reason to be alert

Who doesn’t love the current rally? We too were expecting a strong Q4 given historical seasonality and other supports. The average Q4 return over the past 20 years was 4.11% (or 7.72%, excluding negative years).15 But the S&P 500 is now up nearly 9% in Q4 and there are still two months to go.16 Is this the cause for concern?

To draw a parallel once more to the crowded airport, despite the frenzy, none of us were leaving, because we had places to go and people to see, and that helped overcome the inconvenience of long lines and a big crowd. Similarly for markets, everyone knows that everyone else is long but that is not a reason to leave — until a negative catalyst emerges.

We don’t know when or if that negative catalyst will come or what it will be. For that reason, I certainly wouldn’t recommend selling the market outright. But after such a strong rally and some technical indicators that suggest the market is overbought, it would be wise to acknowledge potential concerns on the horizon and selectively take profits. Even the Federal Reserve opined on this topic this week – warning that the prices of assets defined as risky keep rising and that “asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate.”

1. When we wrote “Return to (Somewhat) Normal” in July and “Travel Reopening” in August, this is what we meant. The continued strong demand for domestic travel, opening up of international borders, and uptick in business travel demand should all be a feature of the end of 2021. We are here.

2. Sundial Capital Research, Sentiment Trader November 8, 2021.

3. Sundial Capital Research, Sentiment Trader November 8, 2021.

4. The New York Times, Coronavirus Briefing, November 8, 2021

5. National Health Commission of the People’s Republic of China, November 7, 2021.

6. Bloomberg New Energy Finance, Covid-19 Indicators Update: Global Aviation, November 3, 2021.

7. South China Morning Post, China’s Delta outbreak spreads to two more provinces, November 4, 2021.

8. Bloomberg, November 8, 2021.

9. Goldman Sachs Economic Research, November 4, 2021.

10. Bloomberg, as of November 5, 2021.

11. Goldman Sachs Economic Research, October 6, 2021.

12. Platts Analytics, as of November 5, 2021.

13. JPMorgan Commodities Research, October 28, 2021.

14. Ibid.

15. Bloomberg, as of November 5, 2021.

16. Bloomberg, as of November 5, 2021.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by iCapital, Inc. (“iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This material does not intend to address the financial objectives, situation or specific needs of any individual investor. Alternative investments are complex, speculative investment vehicles and are not suitable for all investors.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2023 Institutional Capital Network, Inc. All Rights Reserved.