The investment landscape is changing for financial advisors as they move beyond traditional 60/40 portfolios, according to the 2023 iCapital Financial Advisor Survey. Financial advisors are leveraging alternative investments to diversify portfolios, driven by client demand and the expectation of better performance from private markets. The iCapital survey explores the dynamics of this shift, the importance of financial literacy and education, and the industry’s potential challenges and opportunities.

“We have seen a significant increase in appetite for alternative investments, but until relatively recently, a lack of access, understanding, and education was impeding advisors’ ability to put these assets in clients’ portfolios in a thoughtful manner,” said Lawrence Calcano, iCapital Chairman and CEO. “I believe investors will come to see these assets not as alternative, but as a core part of their allocation. That’s why it is important for iCapital and others to develop the tools, research, and education required for advisors to create core portfolios that are inclusive of alternatives for their clients.”

KEY TAKEAWAYS

We surveyed U.S. registered financial professionals using or considering alternative investments and found:

- Almost all advisors surveyed who currently use alternative investments say they plan to allocate the same or more to alternative investments in the coming year.

- Over 60% of advisors who currently use alternative investments said they invest in private equity on behalf of their clients.

- Just over one-third of advisors who currently use alternative investments said they plan to allocate more to private credit strategies in the coming year.

- Half of all advisors said client interest in alternative investments has increased over the past two years.

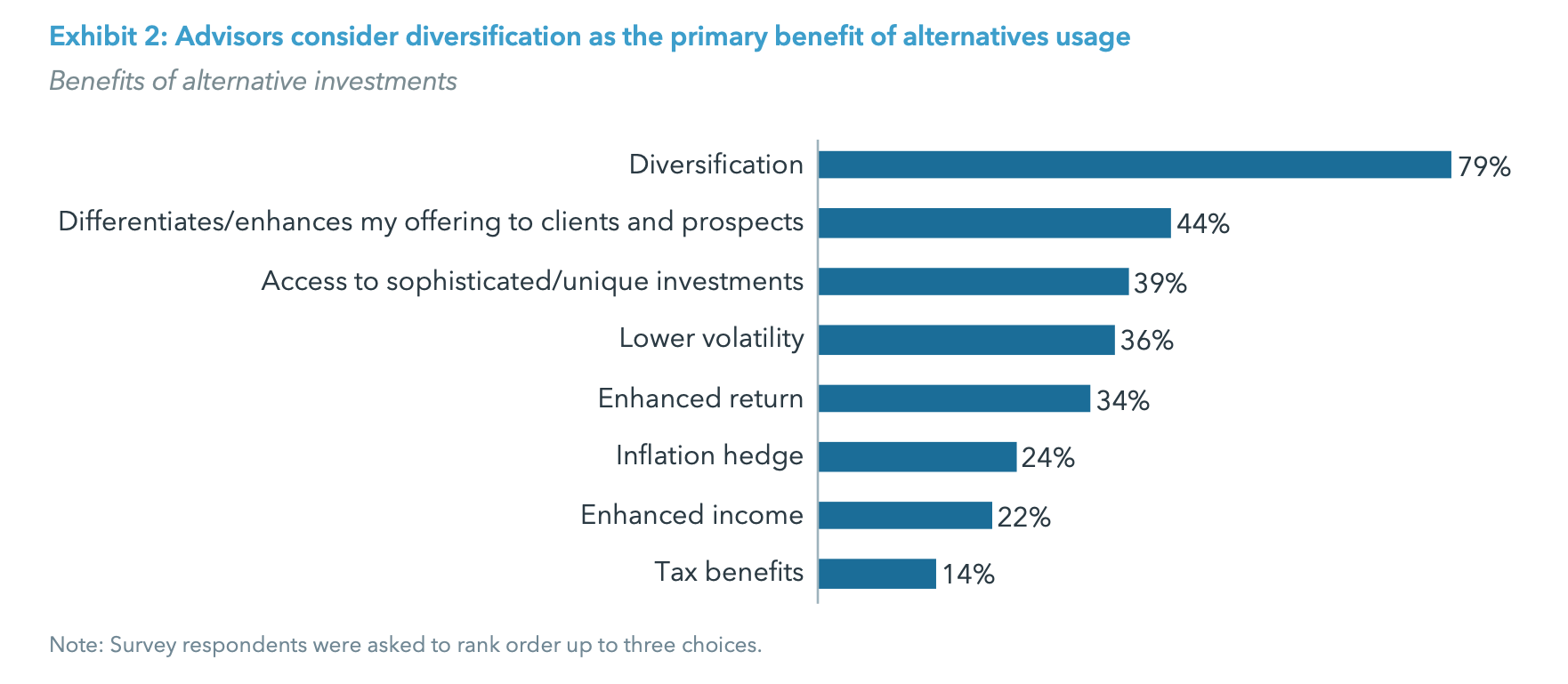

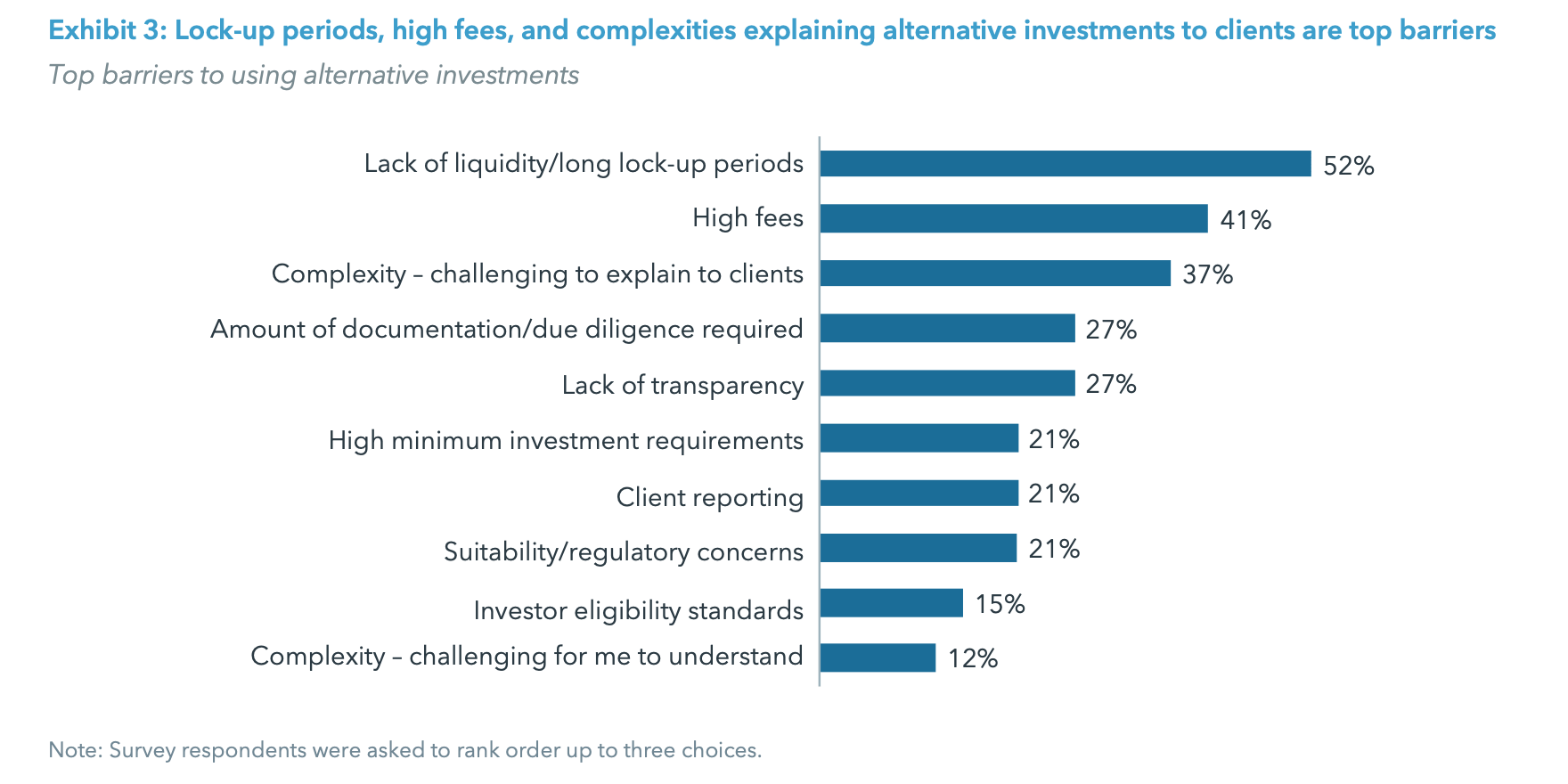

- Financial advisors cite diversification as the top benefit of using alternative investments, and lack of liquidity/long lock-up periods as the top barrier.

THE GROWING ALLURE OF ALTERNATIVE INVESTMENTS

Over the past decade, the amount of capital invested in private markets has increased dramatically, nearly tripling from $4.5 trillion in 2012 to $12.4 trillion by year end 2022.1 Historically, the majority of this capital has been from institutional investors. Bain & Company’s 2023 report on private equity highlights that just 5% of assets under management (AUM) in alternative investments is held by individual investors.2

While institutions continue to outpace individual investors in alternatives, the gap has narrowed. One of the drivers of this trend has been an increase in individual investor access to alternative investments. Combined with advancements in technology, product innovation, and lower minimum investment thresholds, alternative investments have increasingly become more of a core component in individual investor portfolios.

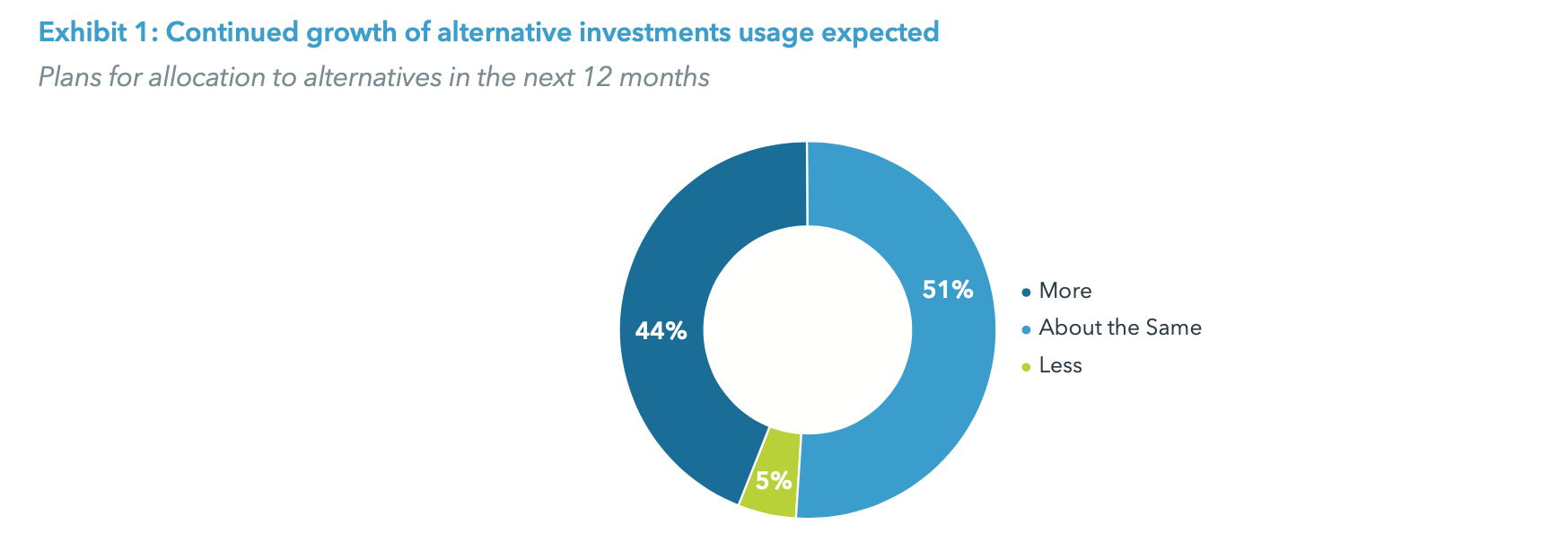

The findings from our survey suggest that continued growth in the use of alternative investments by the individual investor segment is expected. The majority of advisors surveyed indicated they expect private markets to outperform public markets in the coming year. When asked about future intentions, 95% of all survey respondents said they plan to maintain or increase allocations to alternative investments in the coming year, with 44% planning to increase (see Exhibit 1). That figure jumps to 58% among advisors with at least $500 million in AUM.

Fund managers are also responding to the increasing demand from the individual investor market. Bain & Company projects a 12% annual increase in private wealth investor capital allocated to alternative investments over the next decade, with an estimated $13 trillion in alternative investments AUM from this segment by 2032.3 This presents a significant opportunity for both alternative fund managers and financial advisors, with many of the largest fund managers expecting to expand their private wealth capital AUM in the coming years.

The survey found that alternatives are appealing investment opportunities, both to advisors currently using them and those likely to start using alternatives over the next 12 months.

- Advisors who use alternative investments do so on average with 36% of their clients, allocating between 5–15% of these portfolios to alternatives.

- On average, our survey showed advisors who use alternatives allocate 11% of their total AUM to alternatives. This will likely increase, as 44% plan to increase allocations to these strategies in the next 12 months (with just 5% who plan to decrease).

- A majority (60%) expect private markets to outperform their public counterparts over the next 12 months, while just 14% expect private markets to underperform.

THE BENEFITS AND BARRIERS OF USING ALTERNATIVE INVESTMENTS

Advisors highlight many advantages when it comes to incorporating alternative investments in their clients’ portfolios. Diversification is the top benefit of alternative investments selected by financial advisors, followed by the ability to offer a differentiated product set, and having access to unique investments (see Exhibit 2).

Survey respondents also opined on the various challenges with this asset class, citing lack of liquidity, high fees, and complexities explaining these products to clients as additional barriers to using alternative investments (see Exhibit 3).

A CONTINUED IMPORTANCE AND RELIANCE ON ALTERNATIVES

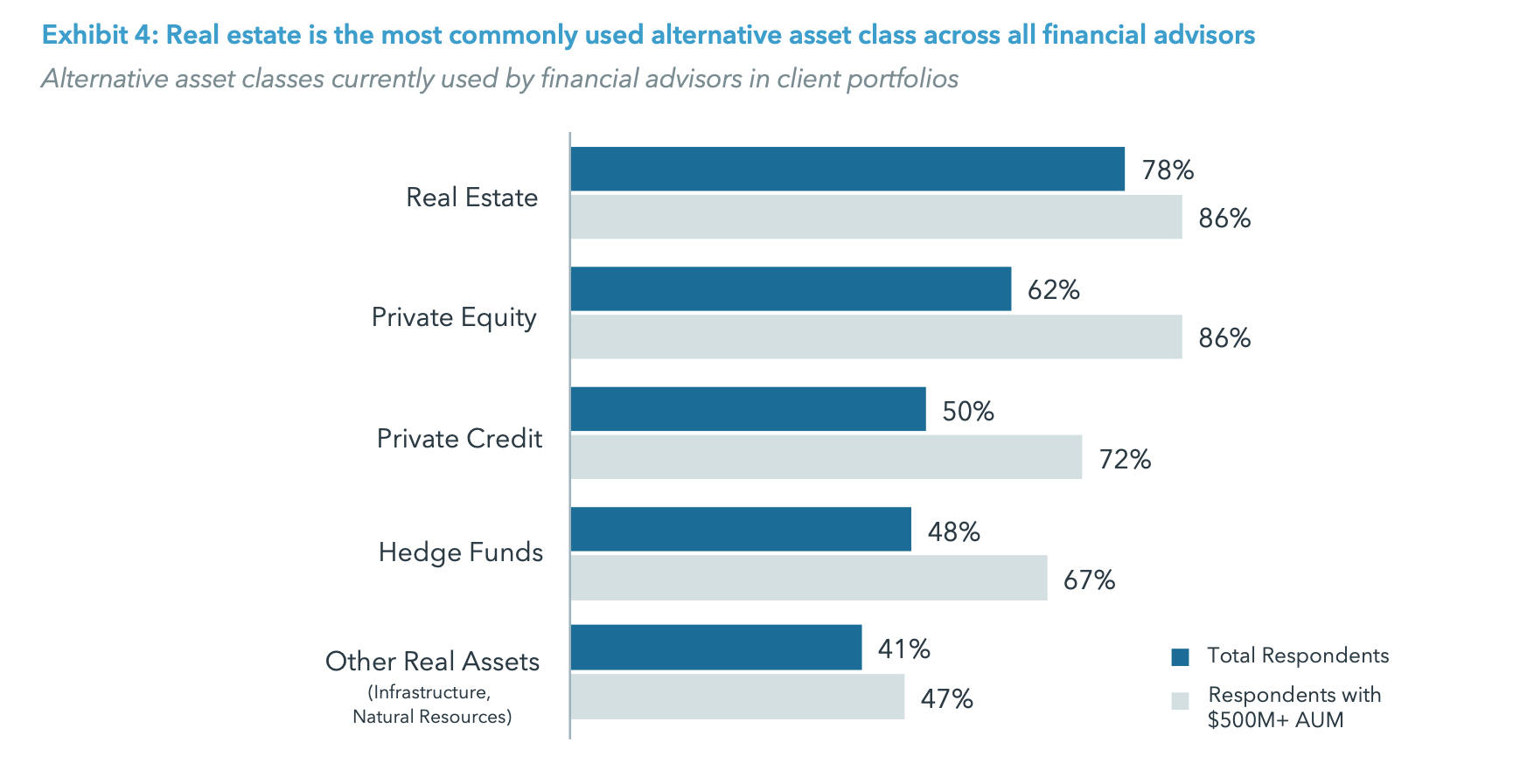

Across all alternative investment asset classes, our survey results found that real estate was the most widely used with 78% of respondents confirming an allocation to real estate in their clients’ portfolios. Private equity was the second most used, with 62% of respondents noting an allocation to private equity in their clients’ portfolios (see Exhibit 4). However, when looking at the proportion of advisors with at least $500 million in AUM, over 85% reported a current allocation to private equity, demonstrating wider use of this asset class among advisors with higher AUM. In addition, half of the advisors surveyed said they use private credit and/or hedge funds.

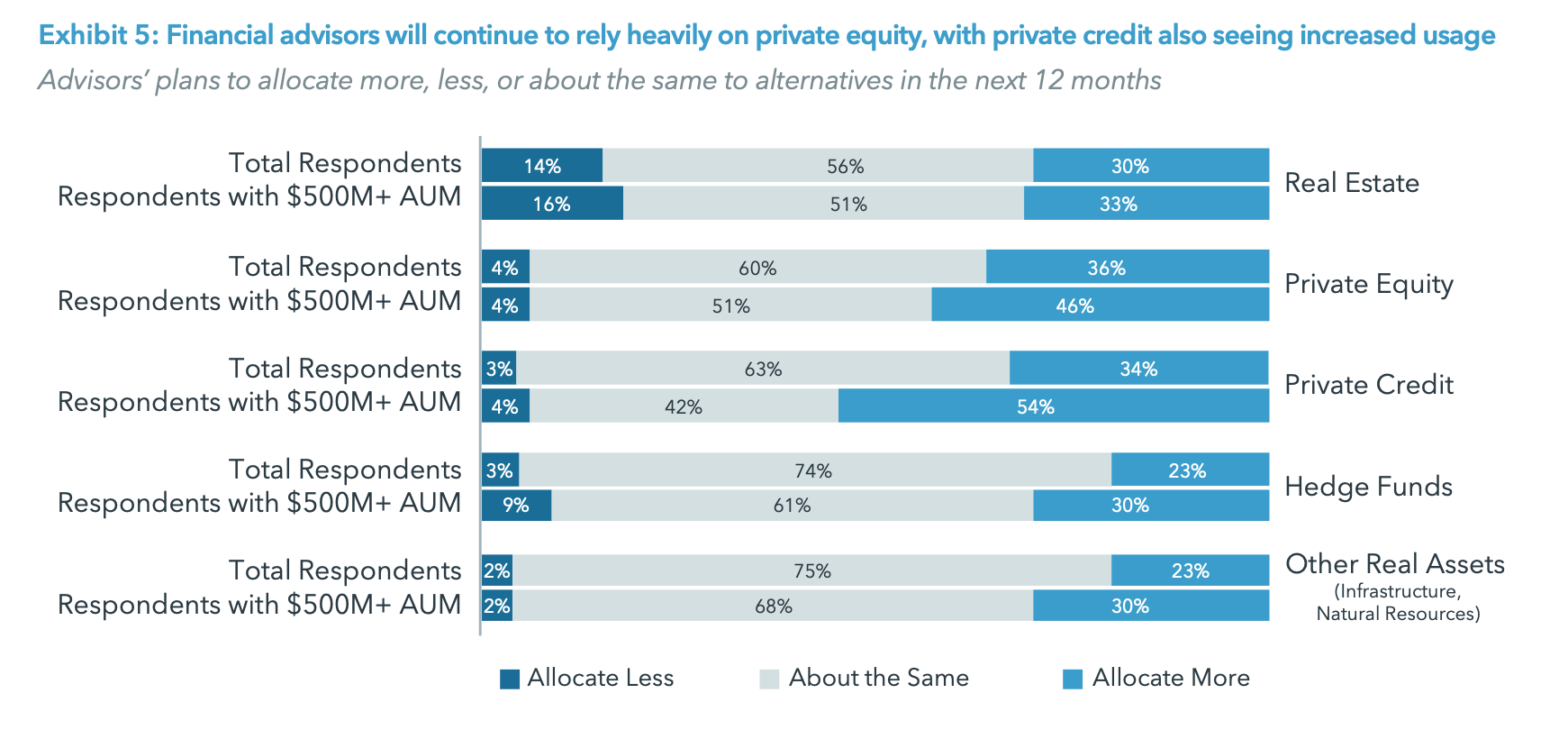

Our survey revealed that a vast majority of advisors plan to maintain or increase their allocations across alternative investment asset classes. Private equity and private credit are the two asset classes with the highest proportion of survey respondents indicating they are likely to increase allocations to in the next 12 months, (36% and 34%, respectively) (see Exhibit 5). Those figures are even higher among advisors with at least $500 million in AUM (46% and 54%, respectively).

Allocations to real estate, on the other hand, showed the most dispersion across respondents, with 14% planning to decrease and 30% planning to increase allocations over the next 12 months. While some advisors are more opportunistic when it comes to the real estate sector, current market conditions in the commercial space may account for more advisors planning to decrease allocations to this asset class.

- Real estate is the most widely used alternative asset class with 78% of survey respondents confirming a current allocation to it in their clients’ portfolios.

- Private equity is the second most used alternative asset class with 62% of respondents noting a current allocation in their clients’ portfolios. However, when looking at advisors with at least $500 million in AUM, the usage rate increases to 86% of respondents.

- More than one-third of financial advisors said they are most likely to increase allocations to private equity (36%) and private credit (34%) in the coming year. Compared to the total respondent base, advisors with at least $500 million in AUM have an even higher likelihood of increasing allocations to private equity and private credit.

THE NEED FOR EDUCATION ON ALTERNATIVE INVESTMENTS

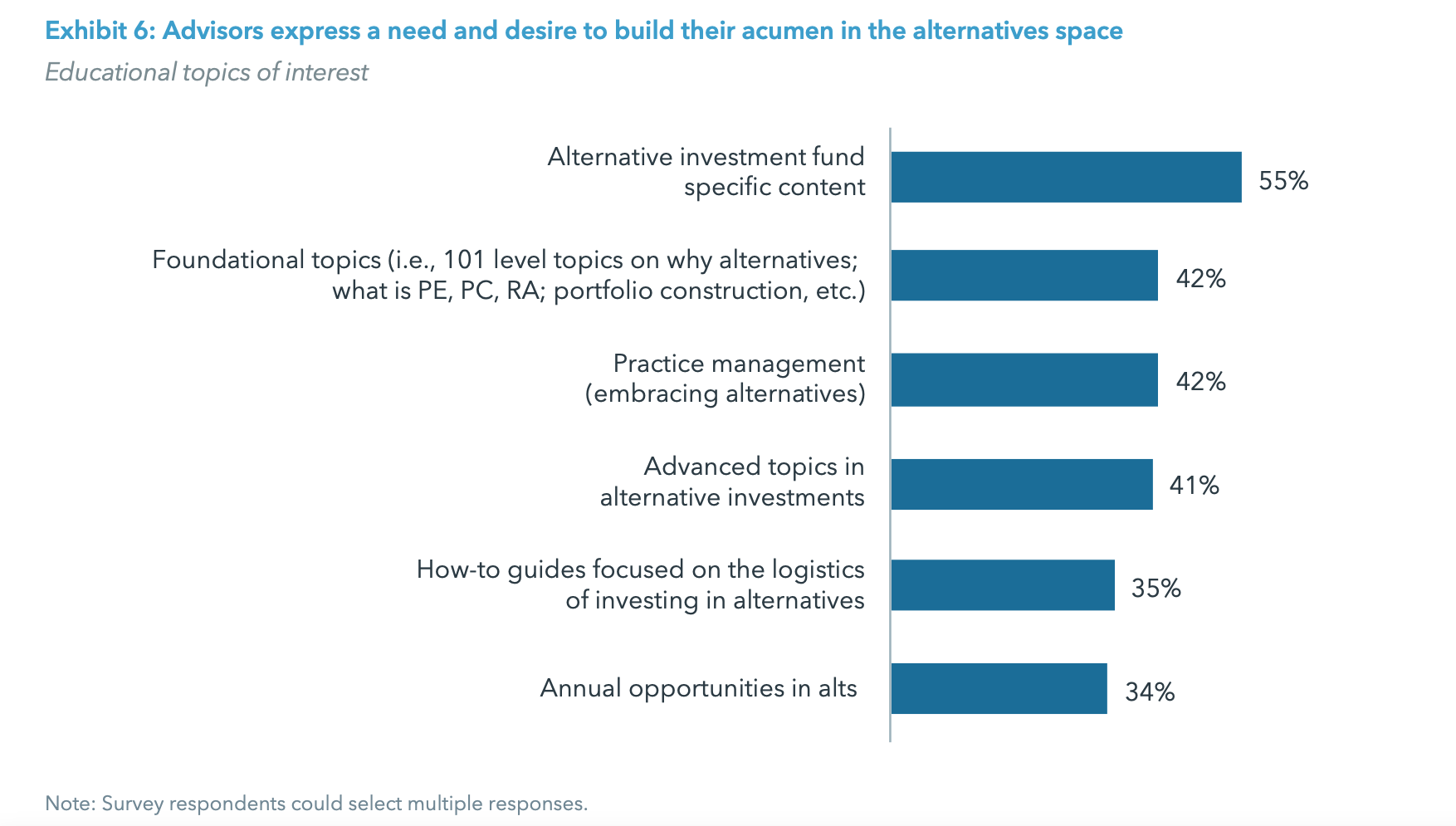

Despite the growing interest, only a quarter of advisors surveyed consider themselves “very knowledgeable” when it comes to alternative investments. To address this, almost all advisors (95%) express interest in educational content on alternatives. This includes different types of education, most notably, information and insights on fund specific content. However, advisors are also looking for content in the form of foundational 101 level courses, more advanced courses, as well as practice management and “how to” guides (see Exhibit 6). Advisors are open to receiving education in a variety of formats, from webinars and whitepapers to short form videos and online courses. That said, education delivered in the form of ”investor- friendly materials” is highly sought after by advisors.

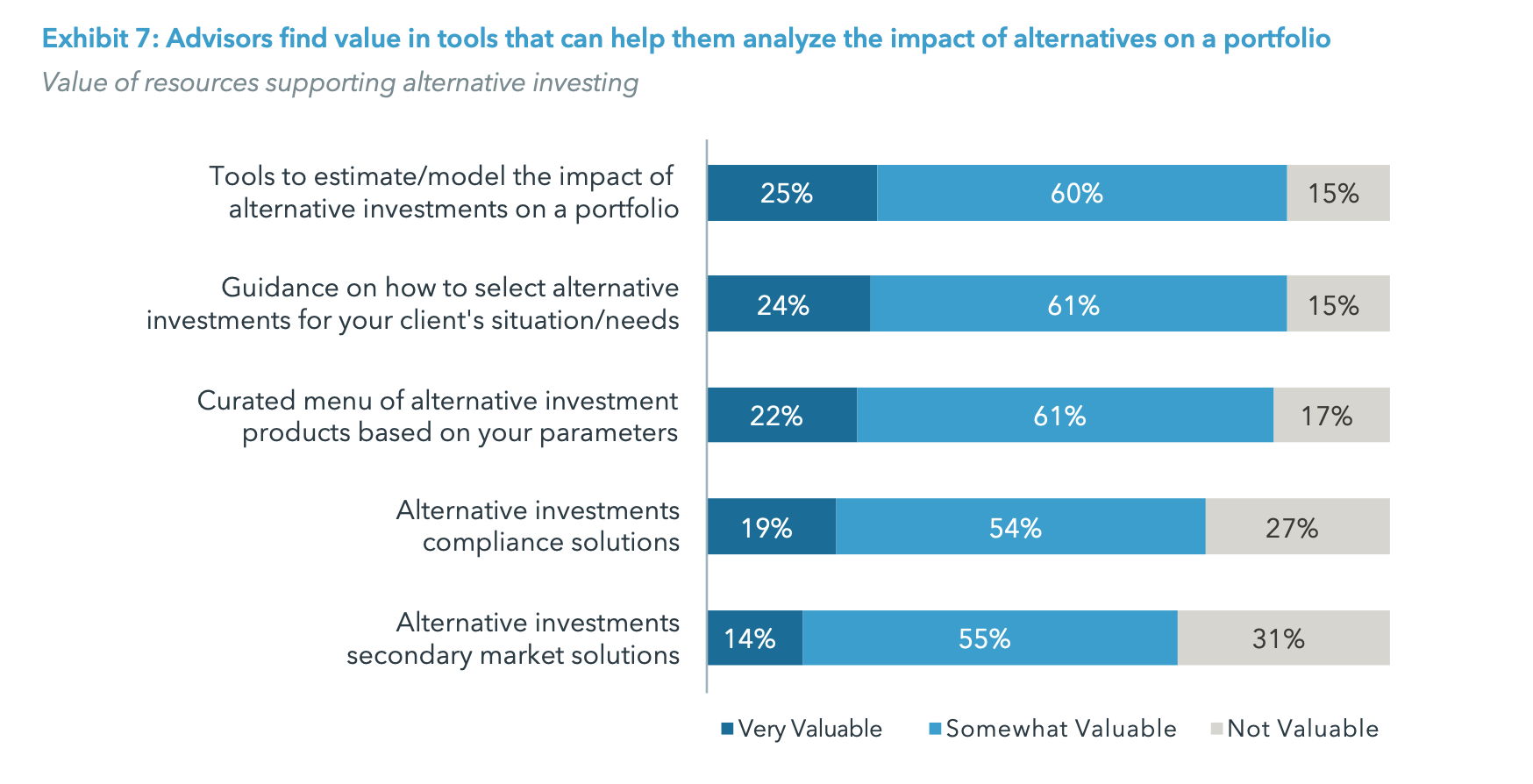

They also see value in resources that can support their workflow, such as tools to analyze the impact of alternatives on a portfolio and guidance on selecting alternative investments. More than 80% of advisors rated these types of resources “very” or “somewhat valuable” when it comes to supporting their alternative investments business (see Exhibit 7).

ALTERNATIVES USAGE INCREASES WITH AUM

While the broader themes emerging from the survey results are relatively consistent across the total sample, it is important to highlight nuances in the data when analyzing advisors with high AUM levels, compared to those managing fewer assets (i.e., below $500 million). This is particularly the case when looking at product usage and future allocations.

Advisors with high AUM are generally more likely to:

- Use private equity and private credit strategies.

- Increase their allocations to alternatives across all asset classes in the coming year.

- Say they will “allocate more” to alternative investments in the coming year.

These examples are relevant for the entire survey population. However, data points are amplified when looking at financial advisors with over $500 million in AUM.

In conclusion, the use of alternative investments is on the rise. The trend is being fueled by increased client interest, the potential for portfolio diversification, and expectations of outperformance from private markets. However, the industry faces some challenges, including liquidity issues, perceived high fees, and the complexity that comes with these types of investments. These challenges underscore the importance of education about alternative investments and the need for comprehensive resources to empower advisors to better serve their clients.

METHODOLOGY

The 2023 iCapital Financial Advisor Survey was conducted by 8 Acre Perspective, an independent market research firm. The survey was conducted from March 27 – April 16, 2023. A total of 400 U.S. registered financial professionals who currently use, or are likely to consider, alternatives over the next 12 months participated. Note that 80% of the sample currently use alternative investments in client portfolios. The data for this study was collected through an online survey that targeted registered financial professionals based in the United States with individual/ families comprising at least 50% of their client base. The survey targeted advisors across a mix of channels, including wirehouses, national and regional broker-dealers (BDs), independent BDs, and RIAs, as well as a mix of AUM levels. For the purposes of this research, alternative investments are defined as both long-term, illiquid products (i.e., private equity, private credit, hedge funds, and real assets) and semi-liquid products (i.e., interval funds, tender offer funds, non-traded REITs).

ENDNOTES

1. PitchBook, “2022 Annual Global Private Market Fundraising Report,” February 2023.

2. Bain & Company, “Global Private Equity Report 2023,” February 2023. Individual investors exclude ultra-high net worth individuals/family offices with $30+ million in AUM.

3. Bain & Company, “Global Private Equity Report 2023,” February 2023. Estimated global alternatives AUM by investor type and projected growth.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01