Our monthly newsletter is designed to serve as your primary source for navigating the world of alternative investments.

Coming into 2023, commercial real estate (CRE) continued to face significant pressure, resulting from a rapid increase in interest rates and weakened post-pandemic demand, combined with fears of an economic slowdown.

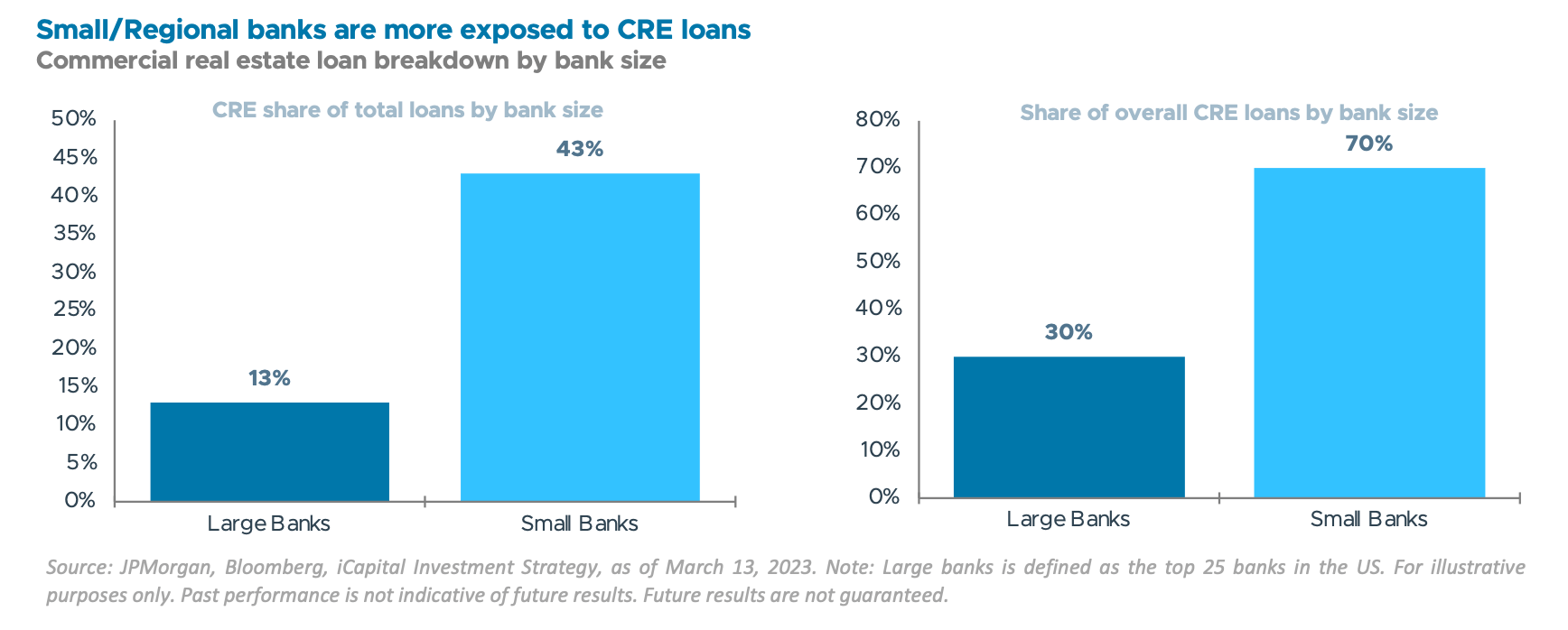

At the same time, the banking sector, particularly regional banks, is contributing to growing CRE concerns. Regional banks account for 70% of total bank CRE loan exposure. Given the increased strain on regional banks over the past two weeks, there is further concern that these banks may retreat from being an important source of capital to operators and developers.

As a result, we expect CRE to face more downward pressure. Real estate operators will encounter increased challenges in financing projects, including refinancing of existing credit facilities. Further, expectations of an economic slowdown will force weaker operators to accept significantly less attractive forms of financing.

But these challenges are creating opportunities for value-minded real estate investors.

We believe opportunistic real estate presents investors with an attractive buying opportunity, as fund managers can purchase quality properties at discounted levels.

Steve Houston

Managing Director,

Head of Investment Products

CHART OF THE MONTH

Regional banks account for 70% of total CRE loan exposure, with CRE loans representing 43% of all loans for small banks (versus only 13% for large banks). Coupled with an upcoming wall of maturities in CRE loans, it is easy to see the potential for rising default risk in CRE portfolios of smaller banks.

MONTHLY MARKET ROUNDUP

IN CASE YOU MISSED IT

NEW AT iCAPITAL

PODCAST: MONEY LIFE

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available.

Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC- registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01