The 2025 iCapital Global Advisor Survey reveals a pivotal transformation in the U.S. wealth management landscape. Alternative investments, once viewed primarily as diversification tools, have evolved into strategic assets that drive client acquisition, deepen relationships, and differentiate advisory practices.

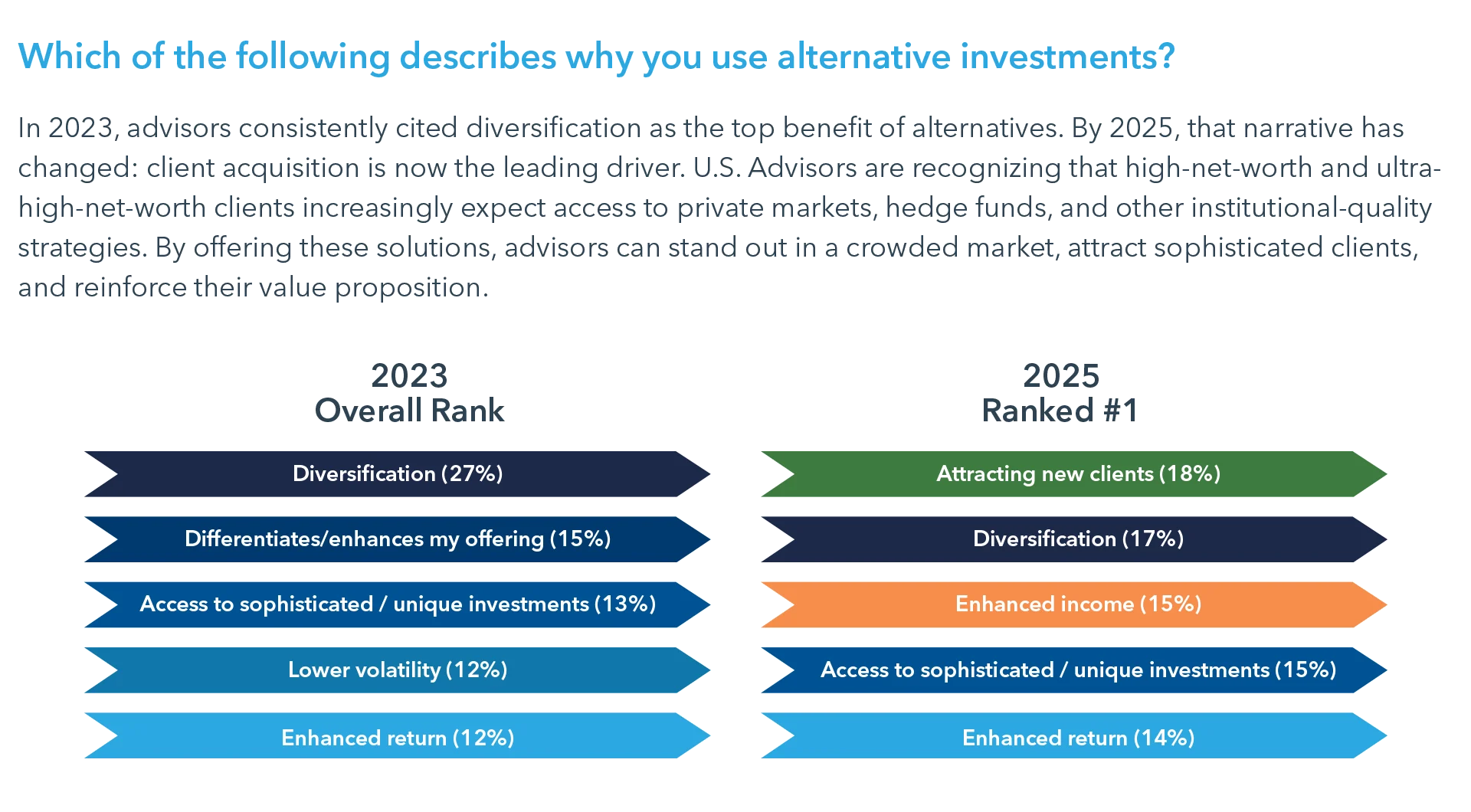

In 2023, diversification was the dominant rationale for using alternatives. By 2025, attracting new clients has emerged as the leading motivator. High-net-worth and ultra-high-net-worth investors increasingly expect access to private markets, hedge funds, and institutional-grade strategies. Advisors are responding by positioning alternatives as core offerings that elevate their value proposition and competitive edge.

Technology is no longer a support function—it is the enabler of growth, scale, and delivery in the next phase of alternative investment adoption. Advisors are shifting from foundational learning to implementation-focused education, with technology and integration now topping the list of priorities. As alternatives become embedded in portfolios, advisors are seeking practical guidance on how to scale these strategies efficiently and compliantly.

As alternatives become embedded in U.S. portfolios, the conversation is shifting from “why invest?” to “how to implement?” Advisors who embrace scalable technology, streamline operations, and invest in advanced education aren’t just keeping pace—they’re setting the standard. To lead in this next phase of alternative investment adoption, firms must evolve their infrastructure and mindset. Download the full report to uncover the insights, strategies, and tools shaping the future of advisory excellence.

Survey Methodology

In 2023, iCapital sponsored the U.S. Financial Advisor Survey to better understand Advisor adoption of alternatives.

The 2023 iCapital Financial Advisor Survey was conducted by 8 Acre Perspective, an independent market research firm. The survey was conducted from March 27 – April 16, 2023. A total of 400 U.S. registered financial professionals who currently use, or are likely to consider, alternatives over the next 12 months participated.

Building on that foundation, the 2025 iCapital Global Advisor Survey expands the scope—capturing a global view of Advisor behavior while diving deeper into the operational and technology needs of firms. The survey was conducted in the first quarter of 2025 by Researchscape, a third-party research firm. The data for this survey was conducted via telephone interviews with online follow-up. A total of 603 financial professionals who currently use alternatives participated. The survey targeted advisors across a mix of channels, including wirehouses, national and regional broker-dealers (BDs), independent BDs, and RIAs, as well as a mix of AUM levels. For the purposes of this research, alternative investments are defined as both long-term, illiquid products (i.e., private equity, private credit, hedge funds, and real assets) and semi-liquid products (i.e., interval funds, tender offer funds, non-traded REITs).

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner, such as legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid losses. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets LLC, a SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2025 Institutional Capital Network, Inc. All Rights Reserved