Despite being aware of the potential benefits of alternatives, high-net-worth (HNW) investors and their advisors are poorly represented in the alternative investment capital base. For a variety of reasons, institutions have had a much easier time investing in alternatives, and have ramped up allocations—and reaped the rewards—as a result.

We think that needs to change. HNW investors and their advisors deserve the same advantages that institutions enjoy when accessing alternatives. Without equal access to alternatives like private equity and hedge funds, many HNW investors are working with an incomplete toolkit as they navigate a tricky investment landscape.

Outperformance and Risk Mitigation

Institutions like pensions and insurance companies have made alternatives a core portfolio component, more than doubling their allocations in the last decade.1 Educational endowments, for example, allocated a dollar-weighted average of 53% of their portfolios to alternative strategies in 2016.2

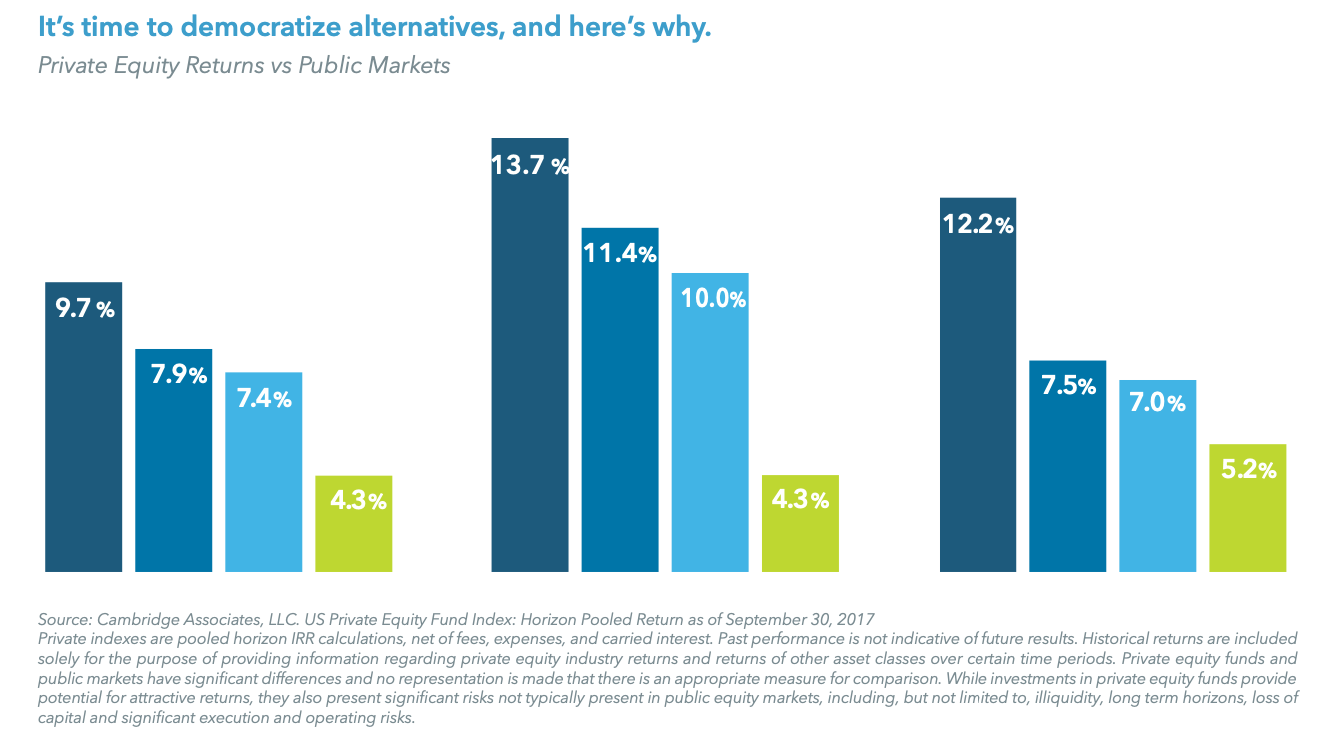

Why the surge in appetite for alternatives? One important reason: the potential for long-term outperformance. Private equity—one of the most popular alternative investments among institutions— has outperformed public markets and most major asset classes over 10, 15 and 20-year periods.

Alternatives can also play a critical role in risk mitigation and diversification. Compared to traditional publicly-traded, long-only equity and bond investments, alternative strategies can generate different performance profiles, increasing the potential for uncorrelated sources of return.

Can HNW investors catch up?

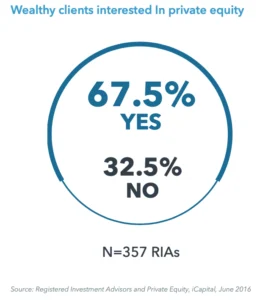

The case for alternatives is well understood by HNW investors: for instance, 67.5% of the registered investment advisors we surveyed said their HNW clients are interested in private equity. And yet, on average only 10% of their client base is investing in private equity funds.3

The problem? HNW investors and their advisors face significant headwinds when it comes to investing in alternatives—challenges like large investment minimums, limited choices, illiquidity, and cumbersome processes. Even when investors overcome these obstacles, they still struggle to see how alts fit into their broader portfolios due to a lack of education, information and inadequate technology.

The problem? HNW investors and their advisors face significant headwinds when it comes to investing in alternatives—challenges like large investment minimums, limited choices, illiquidity, and cumbersome processes. Even when investors overcome these obstacles, they still struggle to see how alts fit into their broader portfolios due to a lack of education, information and inadequate technology.

Just as endowments must grow and pensions must manage payouts through good markets and bad, individuals need their portfolios to weather volatility, compound wealth and fund specific goals like paying for a child’s education and providing retirement income. More so than ever, a lack of efficient access to alternatives means that individual investors are working with an incomplete set of tools as they try to achieve their goals.

“HNW investors and their advisors face significant headwinds when it comes to investing in alternatives— challenges like large investment minimums, limited choices, illiquidity, and cumbersome processes.”

HOW TO DEMOCRATIZE ALTERNATIVES

We believe it’s time to level the playing eld and give HNW investors and their advisors the same access, transparency and infrastructure enjoyed by institutional investors.

We see three key requirements to achieving this democratization:

1. Increase Access

Give HNW investors the same investment opportunities as institutions.

Today, the average HNW investor does not have access to a range of high-quality options across alternative investment strategies. In addition to limited choice, high minimums and fees still present impediments for most retail investors.

CHOICE: Historically, HNW investors have only seen a small slice of the alternative investment spectrum. Many of the most talented managers work exclusively with institutional investors, leaving the large pool of retail dollars largely untapped. Even investors with advisors at large private banks are typically only able to access a very small percentage of the private equity and hedge fund opportunities available in the market at any given time. HNW investors need a fuller picture of their alternative investment options, from venture capital, buyout and turnaround funds to real estate, distressed debt and hedge funds.

MINIMUMS: HNW investors have also been restricted due to high investment minimums. The standard industry minimum for a private equity fund is $5 million, but some managers have minimums as high as $20 million, making them o limits for even ultra-wealthy investors. Access to feeder funds and other structures that enable the construction of a diverse alternatives portfolio is critical.

FEES: Investors building out alternatives programs can find themselves paying several layers of fees, depending on how and where they are sourcing products. Until a simple, accessible fee structure across the range of alternative investments exists, retail investors will have difficulty constructing strong alternatives allocations that serve their intended role in a portfolio.

2. Improve Transparency

Show HNW investors and their advisors how alternative investments fit into their portfolios.

Manager and product selection are paramount in alternative investing. HNW investors and their advisors need the right education and information to make smart, strategic decisions.

DUE DILIGENCE: For institutional investors, managers are happy to provide customized pitch books, arrange one-on-one meetings and spend many hours handling follow-up calls. But this model is not applicable to the fragmented HNW investor market—it simply can’t scale. Even if this system were workable across thousands of individual investors, most do not have the ability to perform the investment and operational due diligence that is necessary for investing successfully in alternatives. Investor education paired with thorough and objective due diligence is a prerequisite for the democratization of alternatives.

“Without equal access to alternatives… many HNW investors are working with an incomplete toolkit as they navigate a tricky investment landscape.”

PORTFOLIO CONSTRUCTION AND ANALYSIS: To the extent individual investors have gained access to alternatives like private equity and hedge funds, they’ve often not understood how integrating a particular product will impact their overall investment strategy. HNW investors and their advisors need better tools to understand where alternatives fit in a portfolio, how they interact with existing investments, and how they shift overall exposures and risk. In addition to robust portfolio modeling that integrates alternatives into overall analysis, alternative investment performance statements and reporting should be simplified and streamlined for the retail investment community.

3. Upgrade Infrastructure

Make the process of investing in alternatives less cumbersome for HNW investors and their advisors.

Currently, the core machinery of alternative investing is built to suit large institutional investors. HNW investors and their advisors face roadblocks in several areas, including burdensome paperwork requirements, a lack of integrated reporting, and limited liquidity options.

LABOR-INTENSIVE PAPERWORK: A high volume of manual administration is involved in reviewing and signing subscription documents, completing investor accreditation, and handling drawdowns and distributions. While the system is workable for a small number of big-ticket institutions, it falls apart when applied to a large number of individual investors. The labor-intensive process is burdensome and inefficient for investors and managers alike. Individual investors and their advisors need a simplified process, that is automated wherever possible, to mimic the more streamlined processes associated with traditional investments like stocks, bonds, mutual funds and ETFs. They also need support to resolve issues along the way, especially as they take their first steps into the alternatives world.

INTEGRATED REPORTING AND ADMINISTRATION: One issue that has plagued even institutional investors until relatively recently is a fragmented view of their portfolios. While many institutions have moved towards consolidated reporting that aggregates all their public and private investments on a single dashboard, individual investors are far behind. Comprehensive reporting that presents a complete picture of the portfolio is key to effective investing in the first instance, as well as to incorporating and managing alternatives. The administrative infrastructure for private equity and hedge funds must be integrated with custodial and other platforms already used by retail investors to ensure streamlined movement of assets and robust portfolio monitoring.

ILLIQUIDITY: While adding some level of illiquidity to portfolios where appropriate has advantages in terms of introducing new drivers of value creation and limiting the amount of capital subject to public market volatility, lock- up periods can present obstacles even for investors who can afford it. Lock-up periods for hedge funds are typically 12 months or less, but private capital lock-ups can range from 4-5 years for a private credit fund to 12-13 years for a venture capital fund. To date, individual investors who need to sell their interests have not had access to a secondary market, in contrast to institutions who can more reliably liquidate private equity fund stakes. Making private equity a more accessible asset class will necessitate providing a similar solution for individual investors.

Without access to high-quality alternatives, individual investors are working with an incomplete investment toolkit. We believe that HNW investors deserve, and need, the same access to the diverse world of alternative investments that institutions have long enjoyed. While HNW investors and their advisors continue to face obstacles in integrating alternatives, these problems are solvable.

It’s time to remove the roadblocks and democratize alternatives.

END NOTES

1. “Split Decisions: Institutional Investment in Alternative Assets”, BNY Mellon, FT Remark, 2016

2. 2016 NACUBO-Common fund Study of Endowments®

3. Registered Investment Advisors and Private Equity, iCapital Network, June 2016

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/ or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC- registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01.