The secondaries market is very different than it was just a few years ago—and in more ways than one. Though this market is often seen as a last resort for liquidity, fund managers and investors are increasingly tapping into secondaries as part of regular portfolio management. One outcome is that assets other than private equity are starting to trade in the secondaries market with significant venture capital, private credit, and infrastructure volume on the way. Making sense of it all requires looking at the nuances between different asset classes and the benefits they can provide to existing portfolios.

How Secondaries Are Evolving

Secondaries are an inevitable part of the private markets. As primary capital in the private markets increases, measured in assets under management, larger amounts of unrealized value can also accumulate. This ultimately creates pent-up pressure for the buying and selling of existing commitments to better manage what would otherwise be illiquid investments. In fact, secondaries tend to see more activity in periods when exits are difficult. In the context of the overall private market, secondaries are small but one of the fastest-growing categories. Transaction volumes are on pace to exceed $200 billion in 2025, up from $40 billion in 2015.1

This jump in size has validated the market and expanded its role beyond just a source of liquidity. Not only are investors (LPs) initiating private market transactions, but funds (GPs), are also leveraging the secondaries market to manage duration, rebalance exposures, or sell and extend investments. For some managers, secondaries are becoming a routine part of proactive portfolio management.

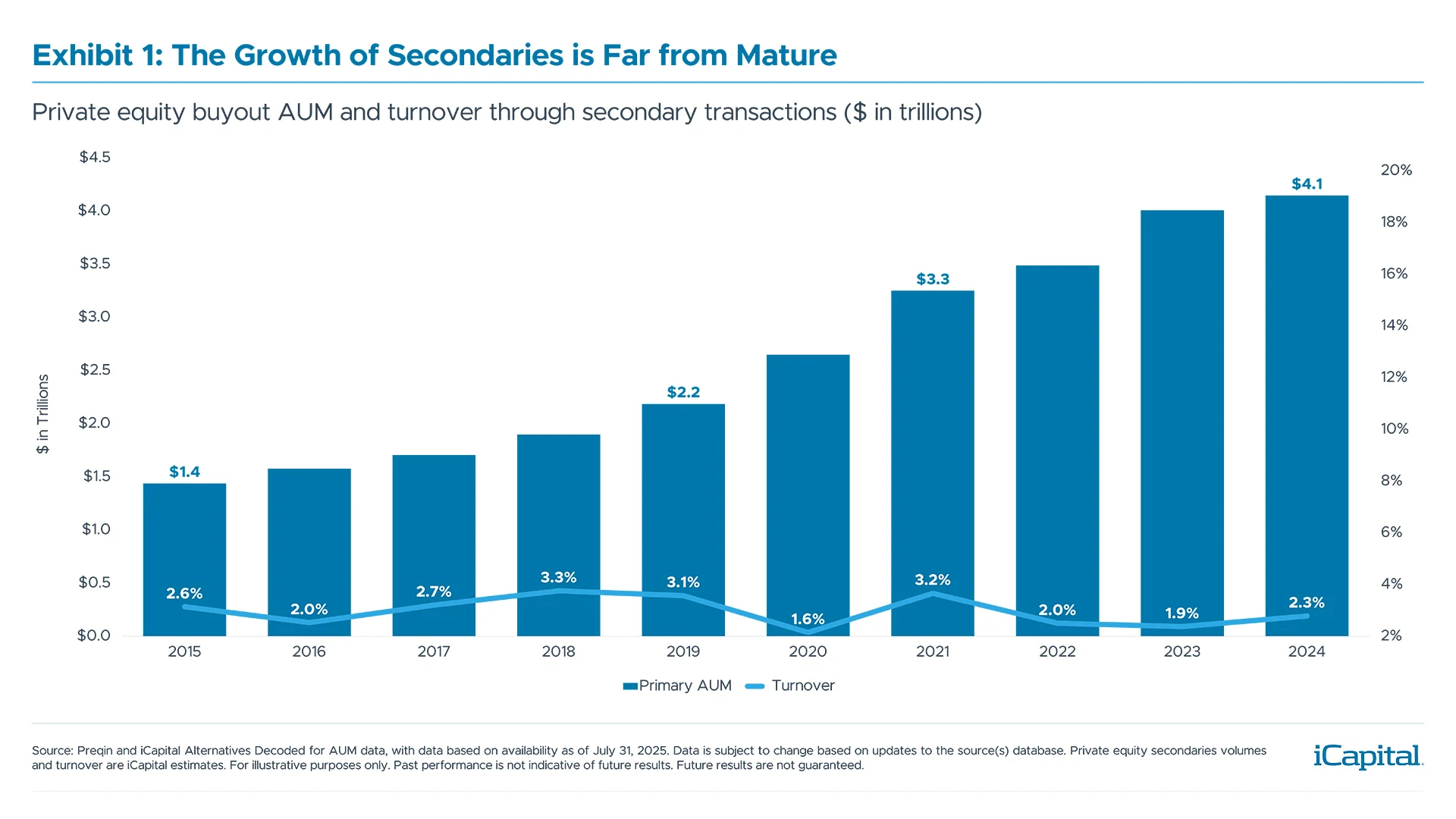

Looking forward, the expansion of primary capital combined with an expanding use of secondaries creates a strong backdrop for growth. For example, private equity buyout strategies ended 2024 with about $4 trillion in assets, up threefold over the last ten years, with growth expected to double by 2029.2 Yet turnover of these assets is negligible—about 2% of primary assets have traded in the secondaries markets each year (Exhibit 1). In private equity, where the use of secondaries is most established, both growth in primary capital and the room for turnover to increase provides a basis for sustainable, multi-year growth.

LP-led secondary: An LP in a fund seeks an early exit and sells its interests. Buyers are typically other existing LPs in the fund, new investors, or dedicated secondary funds.

GP-led secondary: A GP may look to the secondaries market as a way to manage its portfolio(s) more proactively. These transactions often involve the sale of a single or small number of portfolio assets to a new investment vehicle (continuation vehicle) where buyers are a mix of current or new investors.

What is an arguably reasonable level for turnover to go? According to Churchill, 5% is a conservative estimate.3 This is based on a comparative scenario analysis of housing – a far more illiquid asset – in which the data shows around 5% of homes in the U.S. are for sale at any given time. A 5% turnover of primary private equity capital would imply a 5x increase in secondary volumes if this turnover level were reached by 2030.

What is an arguably reasonable level for turnover to go? According to Churchill, 5% is a conservative estimate.3 This is based on a comparative scenario analysis of housing – a far more illiquid asset – in which the data shows around 5% of homes in the U.S. are for sale at any given time. A 5% turnover of primary private equity capital would imply a 5x increase in secondary volumes if this turnover level were reached by 2030.

Expansion to Other Asset Classes

All secondary strategies provide common benefits to individual investors. They mitigate the so-called J-curve, are easier to manage, and are much more diversified. Investments also tend to be in known assets, meaning there is less blind pool risk.

There are also differences. For example, private equity involves assets that are likely to appreciate. So, the price at which a buyer acquires a private equity asset in the secondaries market – measured at a discount to net asset value (NAV) – matters, but not as much as other assets. Upside for private credit, for example, is capped at par, so secondary pricing (or the ability to buy at a discount) matters more. As private credit, infrastructure, and other assets increasingly make their way to the secondaries market, these types of differences will play a role in returns.

There are a few other characteristics that differ across asset classes:

- Secondaries offer diversification, but this can vary by asset class. Buying into a secondaries fund offers faster and diversified exposure to existing investments across managers, industries, strategies, and vintage years. This can be an appealing way for individuals to gain exposure to the private markets.

However, diversification is not the same across asset classes. Private credit secondaries tend to be the most diversified and are often arranged as multi-asset transactions or large diversified credit portfolios. And while all asset classes can have broad-based LP portfolio transactions, single-asset deals are part of the market. Private equity is increasingly leveraging single-asset vehicles as sponsors may want to hold on to prized assets. And direct secondaries in venture capital are generally more concentrated.

- The importance of discounts depends on potential asset appreciation. Secondary transaction pricing should relate to the degree of potential asset appreciation. As mentioned, the cap on credit values makes discounts more important. And investors looking at infrastructure assets should likely expect appreciation, but at a slower rate relative to private equity. Of course, pricing is also influenced by the overall market environment where uncertainty and volatility can bring larger discounts. Across several secondary players, we’ve seen roughly 65% to 80% of total gains historically driven by asset appreciation rather than purchase discounts.

- Price discovery relies on the level of intermediation. Secondary transactions can be restricted to a small number of potential buyers. For some LP-led transactions, the underlying GP may have a list of approved buyers. In these scenarios, true price discovery can be more difficult to determine due to a less competitive market, and transactions may occur at significant discounts.

Private equity buyout is the most intermediated part of the secondaries market, as it’s the most mature. A broader set of buyers (institutional investors, interval funds, dedicated secondary funds) is resulting in larger and more competitive bidding and narrower discounts for private equity secondaries, particularly in this time of improving market conditions. The presence of established secondary funds also allows for a greater ability to seek liquidity, price discovery, and faster deployment of capital relative to other asset classes.

Additional nuances between secondary asset classes are included in Exhibit 2:

Exhibit 2: Provide Consistent Benefits Across Asset Class, and Several Differences

| Private Equity | Infrastructure | Private Credit | Venture Capital | |

| Similarities |

| |||

| Differences |

|

|

|

|

| Pricing Secondary pricing defined as discount to NAV |

|

|

|

|

| Return Profile

|

|

|

|

|

Source: Capital. PJT Partners for pricing data based on 1H 2025 Secondary Market Insight, July 2025

Exhibit 2: Provide Consistent Benefits Across Asset Class, and Several Differences

| Private Equity | |

| Similarities |

|

| Differences |

|

| Pricing Secondary pricing defined as discount to NAV |

|

| Return Profile

|

|

Source: Capital. PJT Partners for pricing data based on 1H 2025 Secondary Market Insight, July 2025

Exhibit 2: Provide Consistent Benefits Across Asset Class, and Several Differences

| Infrastructure | |

| Similarities |

|

| Differences |

|

| Pricing Secondary pricing defined as discount to NAV |

|

| Return Profile

|

|

Source: Capital. PJT Partners for pricing data based on 1H 2025 Secondary Market Insight, July 2025

Exhibit 2: Provide Consistent Benefits Across Asset Class, and Several Differences

| Private Credit | |

| Similarities |

|

| Differences |

|

| Pricing Secondary pricing defined as discount to NAV |

|

| Return Profile

|

|

Source: Capital. PJT Partners for pricing data based on 1H 2025 Secondary Market Insight, July 2025

Exhibit 2: Provide Consistent Benefits Across Asset Class, and Several Differences

| Venture Capital | |

| Similarities |

|

| Differences |

|

| Pricing Secondary pricing defined as discount to NAV |

|

| Return Profile

|

|

Source: Capital. PJT Partners for pricing data based on 1H 2025 Secondary Market Insight, July 2025

The Value-Add for Investors

In addition to the above-mentioned benefits that generally apply to all secondaries, it’s worth mentioning a few asset-specific differences.

- Infrastructure secondaries as a whole may present a similar profile to primary investments but with lower risk. Purchasing an infrastructure asset in the middle-stages of its lifecycle provides immediate access to stable inflation-linked cash flow while avoiding a period of heavier development costs that are typical for the early years of a project. However in this scenario, primary investors likely see the upside benefit from the development.

There are even nuances within the asset class. More opportunities are generally seen with opportunistic infrastructure, which carry higher risk as they target the higher asset appreciation. Here, returns for primary investors are primarily derived from asset appreciation rather than relying on income generation. On the other hand, core infrastructure secondaries typically provide buyers with similar returns relative to primary investments depending on the discount.

- Direct lending secondaries can offer higher return potential relative to primary investments. In direct lending, upside is inherently capped at par. So, acquiring a loan at a discount provides a higher total return compared to what the primary investor would earn. However, given that underlying assets are likely to include senior sponsor-backed direct loans with low loss rates, the discount is likely to be small (94% to 98% seen in Exhibit 2).

The benefits that come with direct lending secondaries are the lower-risk entry point (i.e., discount), access to performing assets and an opportunity to re-underwrite a loan based on current market inputs.

- Venture capital consists of several structures including direct secondaries and portfolio sales. LP or GP-led portfolio transactions are more diversified and can look similar to private equity multi-asset deals. Although, venture transactions will generally see a larger discount due to the earlier-stage of underlying portfolio companies.

Direct secondaries can be a path to sought-after opportunities where buyers may be able to target exposure to specific companies that would otherwise be inaccessible or closed to new investments in the primary markets. On the seller side, the trend of companies staying private longer with a backdrop of shorter time horizons for investors holding direct positions is creating demand for secondary capital. Venture secondaries can offer attractive risk-adjusted returns, but the significant asset appreciation is generally earned by primary investors.

As with any asset class, there will be a dispersion of returns. There will likely always be more value capture opportunities with primary originated capital versus secondary. Consequently, manager selection and an ability to acquire assets with appreciation upside – more so than acquiring assets at a discount – will play a larger role in longer-term performance.

When evaluating secondaries, a common pushback involves the mechanics of the pricing discount as an “artificial” component of returns, meaning that buyers acquire secondary positions at discounts and then mark them up to NAV, resulting in immediate gains. Here, returns can be initially influenced by the discount and diminish over time.

Ultimately, the degree of discount will reflect the potential appreciation of the underlying assets and the depth of the secondaries market. Large-scale secondary funds typically have dedicated investment platforms to conduct asset-level valuation diligence. Discounts may often be viewed as downside protection as they represent just a portion of total return. That said, discounts will likely always remain a part of secondaries as compensation is needed for providers of liquidity – especially to closed-end funds.

Market Size and Projections

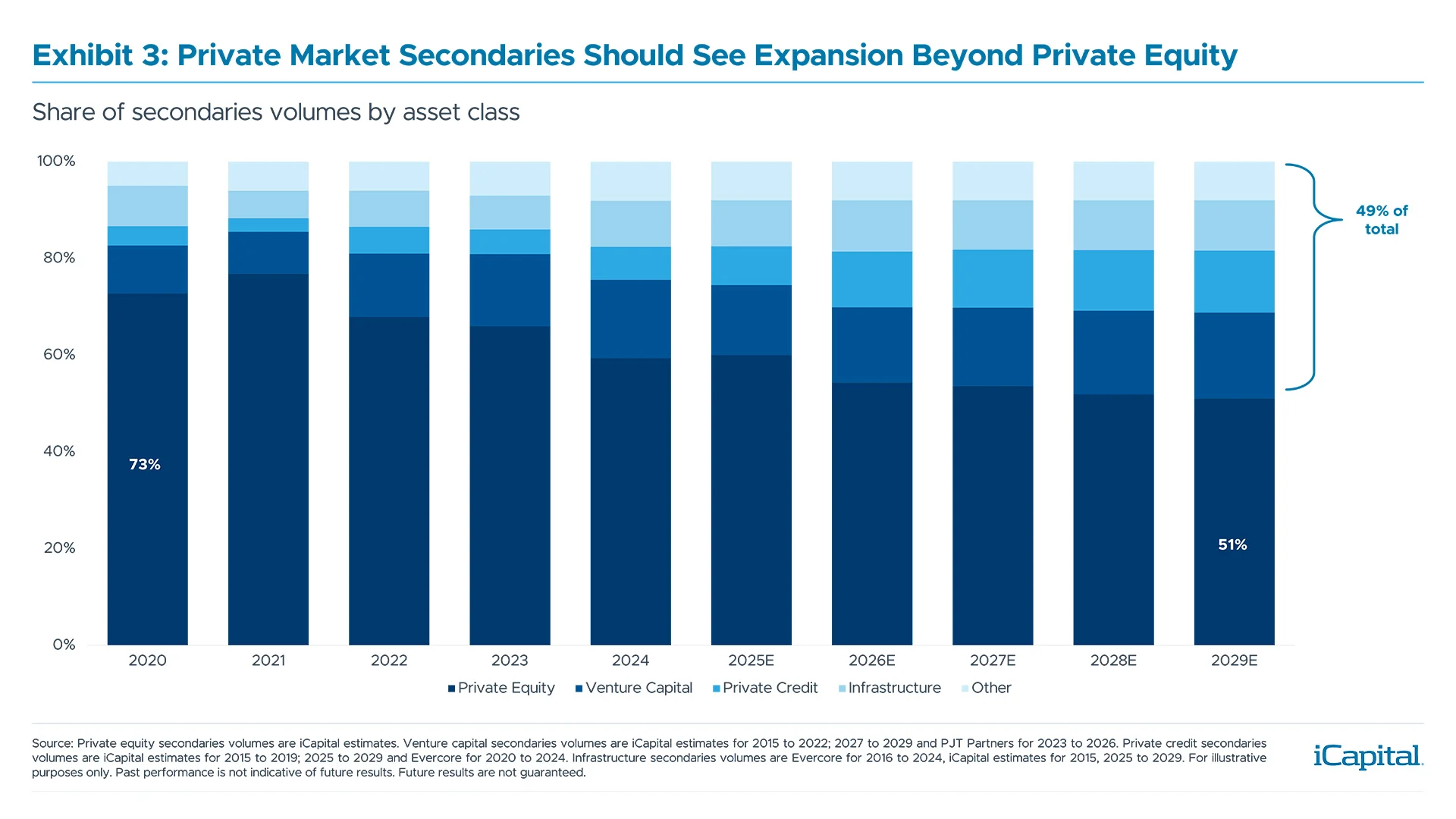

Private equity buyouts are the most prevalent type of secondaries, having accounted for about 75% of total volume since 2015 (Exhibit 3). But just as primary buyout capital grew and developed a need for secondaries, other asset classes will follow—the scale of markets such as venture, private credit, and infrastructure are just behind private equity in terms of timing.

A big narrative that could emerge is how secondary players develop liquidity offerings for open-ended funds. If we define secondaries as a relief valve for liquidity needs in drawdown funds, the built-in liquidity mechanism of open-ended funds can address this need before resorting to a secondary transaction. There hasn’t been much demand for open-ended secondary transactions yet. But as the market evolves, secondary players are likely to address open-ended secondary needs in both regular and stressed market environments.

The other dynamic shaping the market is the entrance of new buyers. In its 1H 2025 market review, Jefferies noted that the growing participation of specialist investors is driving volume momentum in asset classes other than buyout.4

Growth of secondaries volumes is generally expected to remain strong. Estimates for 2025 transactions volumes are generally around $200 billion, which would be 25% annual growth from 2024.5 Our estimates forecast volumes to almost double to $381 billion by 2029, which would imply a 19% compound annual growth rate (2024 to 2029). Even with this growth, the annual secondaries turnover rate would be about 2.2% in 2029, from 1.7% in 2024, highlighting the upside to forecasts and multi-year growth potential (Exhibit 4).

Growth of secondaries volumes is generally expected to remain strong. Estimates for 2025 transactions volumes are generally around $200 billion, which would be 25% annual growth from 2024.5 Our estimates forecast volumes to almost double to $381 billion by 2029, which would imply a 19% compound annual growth rate (2024 to 2029). Even with this growth, the annual secondaries turnover rate would be about 2.2% in 2029, from 1.7% in 2024, highlighting the upside to forecasts and multi-year growth potential (Exhibit 4).

Exhibit 4: Even With Strong Growth, The Opportunity (Turnover) is Early

Primary capital (private market AUM) and secondary transaction volumes ($ in billions)

| 2024 | 2025E | 2026E | 2027E | 2028E | 2029E | |

| Primary Capital | $ 9,298 | $10,393 | $12,036 | $13,603 | $14,946 | $16,922 |

| Secondary Volume | $160 | $200 | $237 | $279 | $326 | $381 |

| Turnover | 1.7% | 1.9% | 2.0% | 2.0% | 2.2% | 2.2% |

Source: Preqin and iCapital Alternatives Decoded for Primary Capital AUM data, with data based on availability as of July 31, 2025. Primary capital includes private equity buyout, venture capital, private credit, and infrastructure. Data is subject to change based on updates to the source(s) database. Secondaries volumes are iCapital estimates. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

Exhibit 4: Even With Strong Growth, The Opportunity (Turnover) is Early

Primary capital (private market AUM) and secondary transaction volumes ($ in billions)

| 2024 | |

| Primary Capital | $ 9,298 |

| Secondary Volume | $160 |

| Turnover | 1.7% |

Source: Preqin and iCapital Alternatives Decoded for Primary Capital AUM data, with data based on availability as of July 31, 2025. Primary capital includes private equity buyout, venture capital, private credit, and infrastructure. Data is subject to change based on updates to the source(s) database. Secondaries volumes are iCapital estimates. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

Exhibit 4: Even With Strong Growth, The Opportunity (Turnover) is Early

Primary capital (private market AUM) and secondary transaction volumes ($ in billions)

| 2025E | |

| Primary Capital | $ 10,393 |

| Secondary Volume | $200 |

| Turnover | 1.9% |

Source: Preqin and iCapital Alternatives Decoded for Primary Capital AUM data, with data based on availability as of July 31, 2025. Primary capital includes private equity buyout, venture capital, private credit, and infrastructure. Data is subject to change based on updates to the source(s) database. Secondaries volumes are iCapital estimates. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

Exhibit 4: Even With Strong Growth, The Opportunity (Turnover) is Early

Primary capital (private market AUM) and secondary transaction volumes ($ in billions)

| 2026E | |

| Primary Capital | $ 12,036 |

| Secondary Volume | $237 |

| Turnover | 2.0% |

Source: Preqin and iCapital Alternatives Decoded for Primary Capital AUM data, with data based on availability as of July 31, 2025. Primary capital includes private equity buyout, venture capital, private credit, and infrastructure. Data is subject to change based on updates to the source(s) database. Secondaries volumes are iCapital estimates. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

Exhibit 4: Even With Strong Growth, The Opportunity (Turnover) is Early

Primary capital (private market AUM) and secondary transaction volumes ($ in billions)

| 2027E | |

| Primary Capital | $ 13,603 |

| Secondary Volume | $279 |

| Turnover | 2.0% |

Source: Preqin and iCapital Alternatives Decoded for Primary Capital AUM data, with data based on availability as of July 31, 2025. Primary capital includes private equity buyout, venture capital, private credit, and infrastructure. Data is subject to change based on updates to the source(s) database. Secondaries volumes are iCapital estimates. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

Exhibit 4: Even With Strong Growth, The Opportunity (Turnover) is Early

Primary capital (private market AUM) and secondary transaction volumes ($ in billions)

| 2028E | |

| Primary Capital | $ 14,946 |

| Secondary Volume | $326 |

| Turnover | 2.2% |

Source: Preqin and iCapital Alternatives Decoded for Primary Capital AUM data, with data based on availability as of July 31, 2025. Primary capital includes private equity buyout, venture capital, private credit, and infrastructure. Data is subject to change based on updates to the source(s) database. Secondaries volumes are iCapital estimates. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

Exhibit 4: Even With Strong Growth, The Opportunity (Turnover) is Early

Primary capital (private market AUM) and secondary transaction volumes ($ in billions)

| 2029E | |

| Primary Capital | $ 16,922 |

| Secondary Volume | $381 |

| Turnover | 2.2% |

Source: Preqin and iCapital Alternatives Decoded for Primary Capital AUM data, with data based on availability as of July 31, 2025. Primary capital includes private equity buyout, venture capital, private credit, and infrastructure. Data is subject to change based on updates to the source(s) database. Secondaries volumes are iCapital estimates. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed.

For investors, secondaries offer several unique benefits, specifically for those seeking to gain private markets exposure but are concerned about the duration or significant gap between making a commitment and receiving distributions. As the market expands beyond primarily buyout transactions, understanding the nuances between different asset classes will be beneficial in realizing the benefits of these strategies.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection, or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.

ENDNOTES

- Jefferies H1 2025 Global Secondary Market Review, July 2025; Evercore FY 2024 Secondary Market Review, February 2025.

- iCapital Alternatives Decoded 3Q 2025, August 2025.

- Churchill, “The love-hate relationship in private equity secondaries”, September 2024.

- Jefferies H1 2025 Global Secondary Market Review, July 2025.

- Jefferies H1 2025 Global Secondary Market Review, July 2025; PJT Partners, 1H 2025 Secondary Market Insight, July 2025.