Fund structures operating under the Investment Company Act of 1940 (‘40 Act), in particular interval and tender offer funds (together referred to as “Registered Funds”), are seeing a rapid uptake by alternative asset managers. These funds are looking to tap into new pockets of capital, particularly the $66 trillion in the U.S. wealth management channel.1 Fund managers are approaching this opportunity with ‘40 Act funds, as they offer enhanced investor protections (i.e., SEC oversight) that individual investors have come to expect.

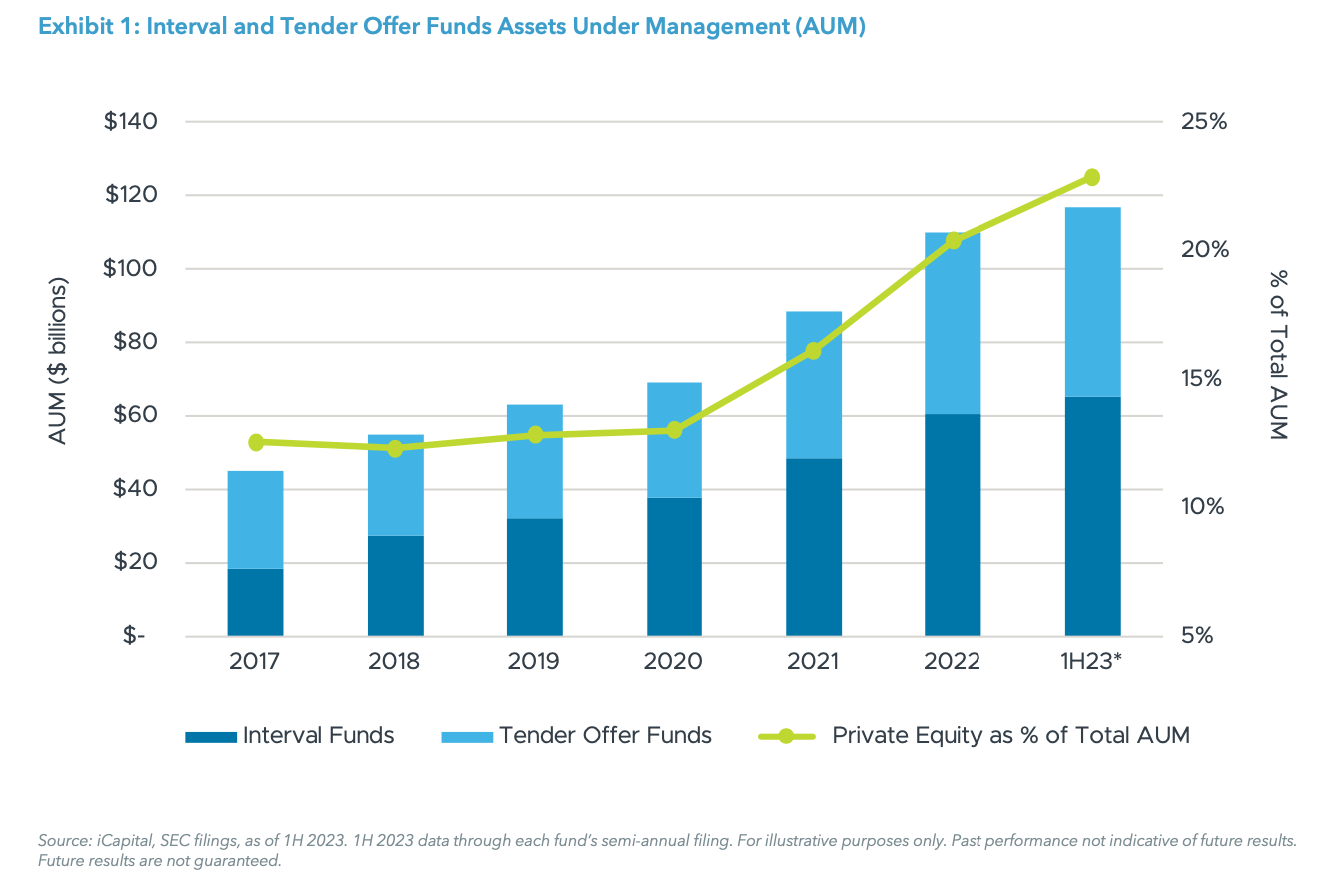

Private equity – initially slower to embrace registered fund structures – is now beginning to scale. One factor that’s powering this growth is the entrance of almost every major fund-of-funds player in recent years. These firms can take advantage of secondaries and free (or low fee) syndicated co-investments to assemble and manage a registered fund. Despite the challenging backdrop for private equity, which has seen deal volumes decline by 20% year-over-year in 2023,2 the category will represent close to 25% of assets in interval and tender offer funds in 2023, up from 12% in 2017 (Exhibit 1).

Since private equity tender offer funds are largely comprised of secondaries and syndicated co-investments, rather than direct investments, a fund’s underlying investments can be diversified across different third-party general partners (GPs). While managers of tender offer funds actively monitor their portfolios, they still rely on underlying valuation information from these GPs – a key reason why valuation timing issues can arise.

Understanding NAV Calculation Approaches

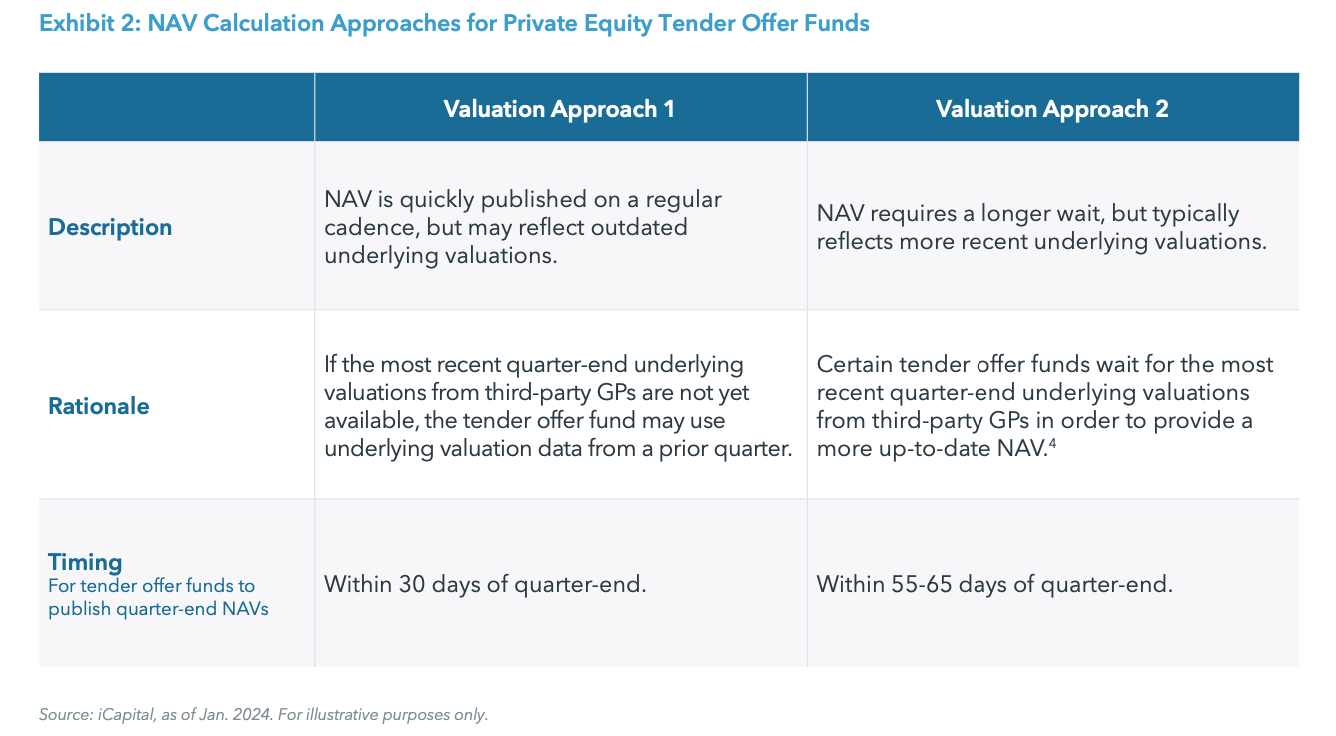

Individual investors looking at private equity funds should be aware and seek clarity on how NAV pricing is published. Even after advisors help investors understand the less liquid nature of private equity, they may not be fully aware of the different approaches that each tender offer fund may take when publishing its NAV. Within the private equity tender offer world, GPs are responsible for making and tracking underlying investments, which they typically report once a quarter. These reports are generally released 45 to 75 days after quarter-end. However, many tender offer fund managers (i.e., fund- of-funds) will publish quarter-end NAVs within 30 days regardless of whether the GPs have reported the underlying valuations.3 In other words, there’s a timing mismatch – in instances where more recent underlying valuations are not available when a tender offer fund publishes its NAV, the underlying valuations from a prior quarter are being used.

With this backdrop, investors should be mindful that valuations on underlying portfolio investments may be stale. An investor looking to redeem shares — based on a December quarter-end NAV, for example — may not realize that the NAV is based on underlying company valuations that were reported at the end of September or even June. If public markets rise or decline in a given quarter, underlying investment valuations may not reflect these events even if the NAV calculation date states a given quarter-end date. In fact, a downside move might be more relevant for private equity investors as they explore new entry points.

Some tender offer funds take a different approach in that they wait for the more recent underlying valuations from third-party GPs before publishing their quarter-end NAVs. Tender offer funds that take this approach generally expect to publish their NAVs 55-65 days after the quarter, compared to 30 days. While this approach does require additional time, these funds typically publish a more up to date quarter-end NAV to their shareholders.

It is important to note that NAVs will reflect some degree of outdated pricing for the vast majority of private equity tender offer funds. Investors considering this asset class should take into account the valuation approach and timing as part of their investment decision.

Ensure You Know the “as of” Date

With a growing number of large, established managers entering the evergreen space, individual investors now have an ability to access private equity return and diversification potential through tender offer funds, which offer investors the ability to redeem their shares on a periodic basis. However, investors looking to take advantage of these liquidity events should understand how the quarter-end NAVs are being calculated and be aware that the underlying valuations might not reflect the most recent information. At a minimum, investors and advisors should ask specific questions so they understand a tender offer fund’s NAV methodology and the “as of” date of the underlying valuations.

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). iCapital Registered Fund Adviser LLC (the “Adviser”), an affiliate of Institutional Capital Network, Inc., serves as the investment adviser to a private equity tender offer fund and other such funds are available on the iCapital Alternatives Platform. iCapital and its affiliates receive compensation for sales of private equity tender offer funds, including the fund it manages. As a result, iCapital has an incentive to present these funds in a favorable light.

ENDNOTES

1. Cerulli Associates, The Cerulli Report. U.S. High-Net-Worth and Ultra-High-Net-Worth Markets 2023, as of Jan. 2024.

2. Pitchbook, iCapital Investment Strategy, as of Dec. 5, 2023. Note: Private Equity deal volume is based on deal value and annualized using year-to-date data through Sept. 30, 2023.

3. Funds publish NAVs within 30 days as a requirement to allow new investors.

4. There is no guarantee that quarter-end NAVs published by these tender offer funds will reflect underlying valuations from the current quarter.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). iCapital Registered Fund Adviser LLC (the “Adviser”), an affiliate of Institutional Capital Network, Inc., serves as the investment adviser to a private equity tender offer fund and other such funds are available on the iCapital Alternatives Platform. iCapital and its affiliates receive compensation for sales of private equity tender offer funds, including the fund it manages. As a result, iCapital has an incentivize to present these funds in a favorable light. This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/ or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC- registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

© 2024 Institutional Capital Network, Inc. All Rights Reserved.