EXECUTIVE SUMMARY

PRIVATE EQUITY

LARGE BUYOUT

Current Outlook – Neutral

Trend versus Q2 2022 – Same

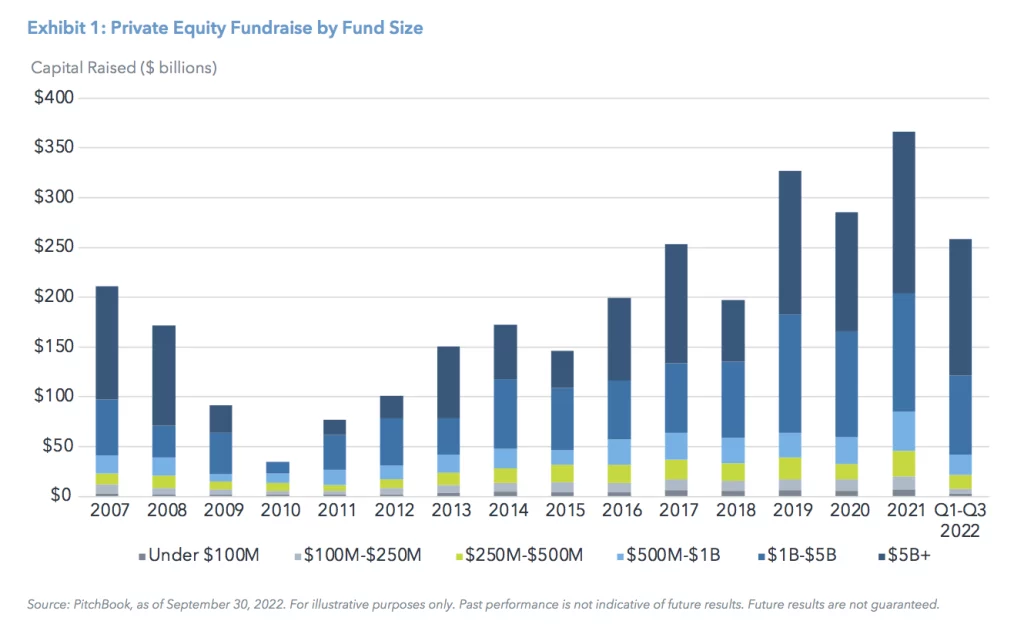

Performance for the large buyout category was strong as its 10-year horizon internal rate of return (IRR) was 16.6%, outperforming the middle market buyout category, which returned 15.9%.1 The relative outperformance reflects a combination of trends, such as outperforming managers raising larger subsequent funds; companies staying private longer to focus on long-term value creation initiatives; and operational benefits of scale. The strong return profile also allows the category to continue to increase its share of the overall private equity (PE) fundraising market. As of September 30, 2022, the capital raised by U.S. PE managers with fund sizes greater than $5 billion exceeded $135 billion, representing a 13.1% year-over-year increase (on an annualized basis).2 If the pattern holds for Q4 2022, large buyout capital raised will account for more than 50% of total PE fundraising for the year for the first time since 2009.3 The trend may continue into 2023 as investors favor larger funds from more experienced managers.

The Fed’s decision to increase the fed funds rate to tame inflation has already led to a significant drop in syndicated financings for larger buyouts, and we are closely monitoring central bank signals. Though this is somewhat cushioned by the rise of direct lending funds, if financing issues continue to persist, it could lead to lower exit valuations. Conversely, a rising interest rate environment (e.g., higher interest expenses) could help mitigate some of the inflated valuations in PE. A reset could create attractive pricing opportunities for large buyout funds with significant dry powder to deploy. As for the exit activities, exit value for large buyouts has dropped by over 80% for the year ending September 30, 2022 (as compared to 72% for the overall sector). Public listing, one of the primary exit routes for the category, accounted for under 2% of the total exit value for the period, a significant drop from the 10-year average of 18%.4 Exit activities are expected to be subdued in the near term as large buyout firms are holding on to their investments, rather than being forced sellers in an unattractive market environment.

Risks: Impact of higher borrowing cost; slower growth; likely valuation multiple contraction at exit; increased energy costs and labor shortages impacting portfolio company performance.

MIDDLE MARKET BUYOUT

Current Outlook – Positive

Trend versus Q2 2022 – Same

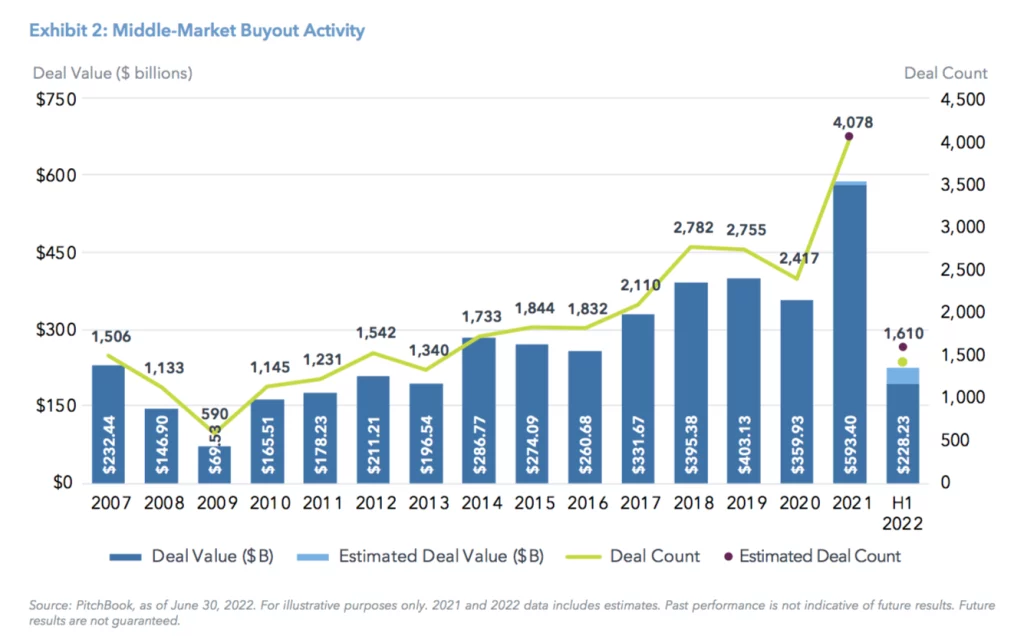

Middle market buyout activity moderated in the first half of 2022 from the record-breaking level of 2021 but remained on pace for a healthy year by historical standards. Factors such as a complex macroeconomic (macro) and geopolitical backdrop, high levels of inflation, and sustained interest rate hikes have led to a slowdown in dealmaking. Through June 2022, U.S. middle market activity totaled approximately $228 billion across an estimated 1,610 transactions, compared to $245 billion over 1,657 transactions in the first half of 2021, a 7% and 3% decrease, respectively.5 Given continued market volatility and increasing interest rates, full year 2022 deal activity is likely to finish materially lower than in 2021.

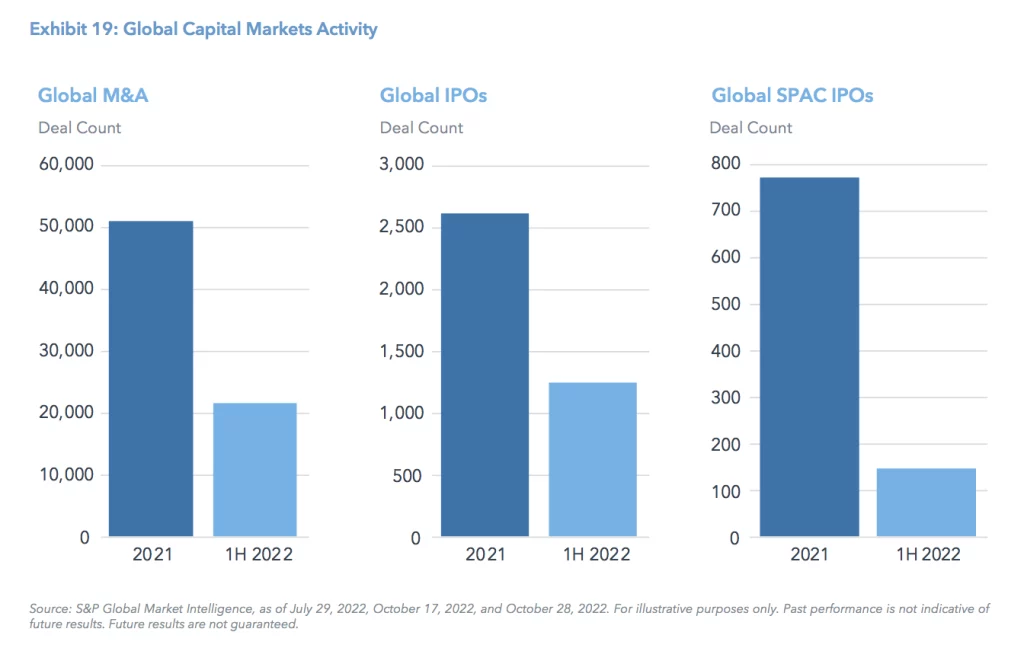

The exit environment for middle market deals has been significantly worse compared to the record year in 2021. Although middle market companies continued to be sold to financial sponsors and strategic acquirers in 1H 2022, the 336 deals worth $77.7 billion in value represents an approximately 30% decrease by both metrics.6 With no public listing of middle market companies in Q2, initial public offerings (IPOs) are not a viable exit option in the current environment.

Although the macro outlook for middle market buyout could face headwinds, there are more opportunities to generate returns by improving operations and growing revenues by adding product lines, expanding geographically, and executing accretive merger and acquisitions (M&A). Middle market companies often operate domestically, limiting the potential impact from geopolitical instability and a stronger dollar. These companies also benefit from a larger buyer universe and are particularly valuable to strategic buyers, given their high levels of growth.

Risks: Impact of higher borrowing costs and slower growth leading to contraction in multiple valuations; supply chain issues; increased energy costs; and labor shortages impacting portfolio company performance.

SECTOR-FOCUSED BUYOUT

Current Outlook – Positive

Trend versus Q2 2022 – Same

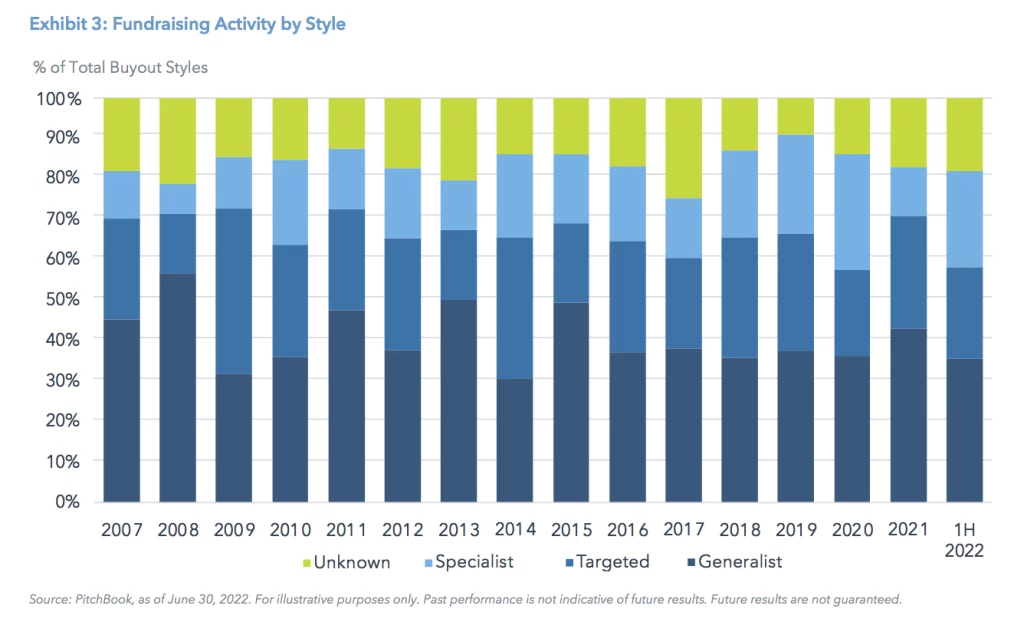

Capital raised for sector-focused funds has grown significantly in recent years, according to PitchBook data.7 Specialized sponsors often have advantages over their generalist peers when it comes to sourcing, market intelligence, ability to navigate sector-specific complexities, and implementing value creation initiatives at portfolio companies. Against a challenging macro backdrop, not all sector specialists are positioned equally. Those focusing on defensive sectors with tailwinds across market cycles, e.g., technology and health care, are likely best placed.

According to PitchBook, technology M&A through Q3 2022 trended lower compared with 2021’s record levels. However, both deal count and value were on track to outpace all prior years between 2017 and 2020. Technology continues to represent over 20% of total estimated global deal value through Q3 2022, a fifth consecutive yearly increase in share.

Health care remains attractive, due to the increased demographic drivers, adoption of digital health/health care information technology (IT), and heightened awareness emerging from the pandemic. Many subsectors within health care are largely insulated from changes in consumer spending and are perceived as more resilient across cycles. According to PitchBook data, health care M&A represented 11% of total estimated global deal value through Q3 2022.

The current dislocation in the public equity markets, particularly in the technology sector, will continue to impact private market valuations in the coming quarters. Given the timing and information lag inherent in private markets, this dynamic has not yet been fully realized at the deal level, but further contraction in multiples is expected. While this may lead to multiple compression in existing portfolios, a valuation reset may create an attractive buying environment for sector specialists, particularly those in high-growth sectors like health care and technology.

In this environment, sectors that may face headwinds include: (i) discretionary consumer products and services, based on the impact of inflation and potential recession; and (ii) commodity-driven business models, which are more cyclical in nature.

Risks: Impact of higher borrowing cost; slower growth; likely contraction in valuation multiples at exit; supply chain issues; increased energy costs; and labor shortages impacting portfolio company performance.

GROWTH EQUITY

Current Outlook – Neutral

Trend versus Q2 2022 – Downgrade

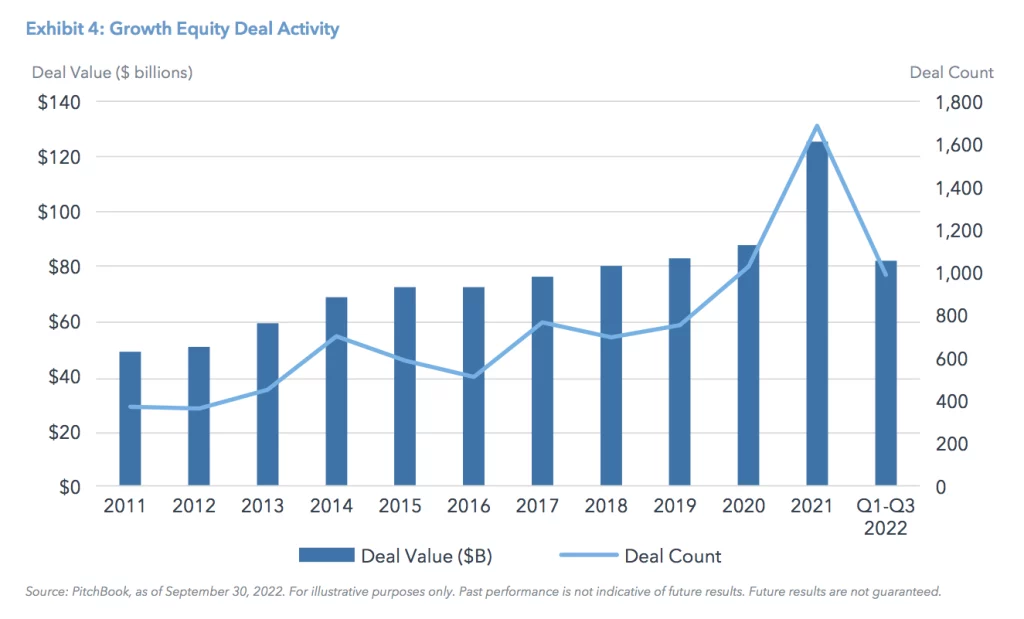

Growth equity targets companies that are at or near profitability; in need of capital to scale operations; and typically focuses on opportunities in health care, technology, and financial services. According to PitchBook data, U.S. growth equity deal activity has increased significantly in recent years. Although 2022 full-year deal activity is likely to fall below the level of 2021, both deal count and deal value are still on track to exceed 2020 and prior years, indicating that public equity market corrections have not yet had a meaningful impact on private counterparts.

Given the significant correction of high-growth, publicly traded technology stocks, privately held growth companies will be unable to avoid the aftershocks. This dynamic may be most apparent in late-stage venture, which will be addressed later in these ratings. However, growth equity represents a distinct segment in which managers can invest in either majority control or minority positions, with the ability to drive operational value-add and downside protection through deal structuring (e.g., seniority in the capital stack, milestone-driven investing, minority protection rights, etc.). Furthermore, unlike buyout-oriented strategies, growth equity managers typically utilize little to no leverage.

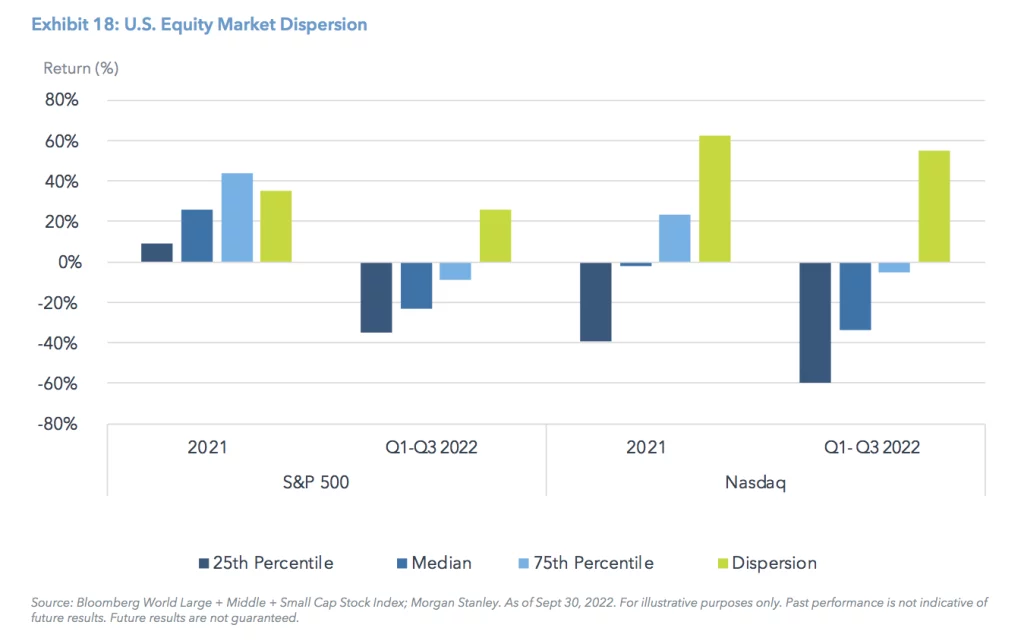

The funds that are most at risk include those with sizable active portfolios and limited realizations that have deployed capital in the high-valuation environment of the past few years. These funds will face a more challenging macro environment that could have an adverse impact on company operations, ability to raise capital, and holding periods. In addition, these funds will see further effects from the pullback in publicly held high-growth technology companies as private valuations catch up over the next few quarters. This dynamic will also affect underlying portfolio companies, which will likely face slower growth prospects in a more uncertain environment. This, in turn, should drive significant dispersion within the category as certain companies will be better positioned than others, depending on financial or operational discipline, resilience of business models, and target end markets (among other factors).

Risks: Potential competition from larger investor universe; less control over execution due to minority ownership; likely valuation multiple contraction at exit; and slowdown in exit activity.

LATE-STAGE VENTURE CAPITAL

Current Outlook – Negative

Trend versus Q2 2022 – Downgrade

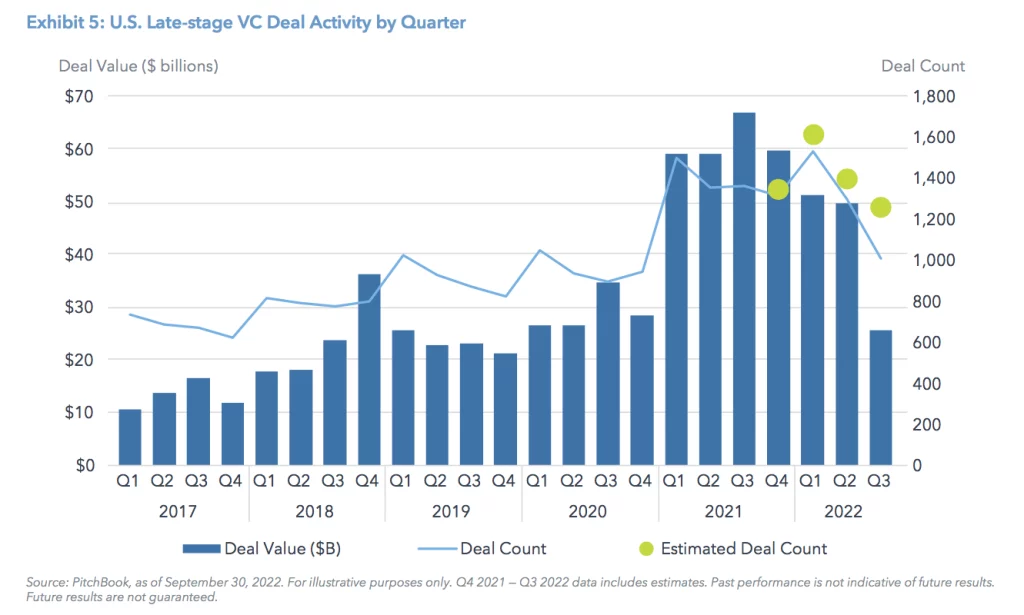

The current market environment is expected to impact the broader venture capital (VC) asset class. Higher interest rates, inflationary pressures, and lower appetite for riskier assets are leading to valuation degradation, greater financing challenges, and slower fundraising. Between 2022’s second and third quarters, deal activity within late-stage VC fell 48% from $48.1 billion to $24.9 billion – a level not seen since the end of 2019.8

Late-stage median deal size trended downward in 2022, and investors are taking a more selective approach in the current market environment, potentially leading to repricing of late-stage VC deals. Instacart was a prime example. The valuation of the grocery delivery and pick-up service company experienced three consecutive declines and has dropped almost 40% since March 2022. Instacart’s repricing is even more significant when compared to its 2021 valuation of $39 billion, representing a decline of nearly 67%. Against this backdrop, investors may likely favor more resilient sectors, such as cybersecurity and health care.

Similarly, there was a decline in late-stage VC mega-rounds (at least $100 million) completed in Q3 2022. Mega-rounds generally drive a large portion of deal activity within late-stage VC, however, deal value was impacted by the lack of liquidity in the public markets (the S&P 500 and NASDAQ Composite were down 20% and 30%, respectively).

Late-stage pre-money valuations fell below 2021’s level, due to softened pre-money valuations related to the uncertain exit environment. Moreover, exits for late-stage investments via the IPO route were limited. There were only 90 U.S. IPOs in the first half of 2022, compared with 968 in 2021. We expect the decline to continue in the current market environment.9

Risks: Slower growth; public market volatility and uncertainty; limited exit options.

EARLY-STAGE VENTURE CAPITAL

Current Outlook – Neutral

Trend versus Q2 2022 – Downgrade

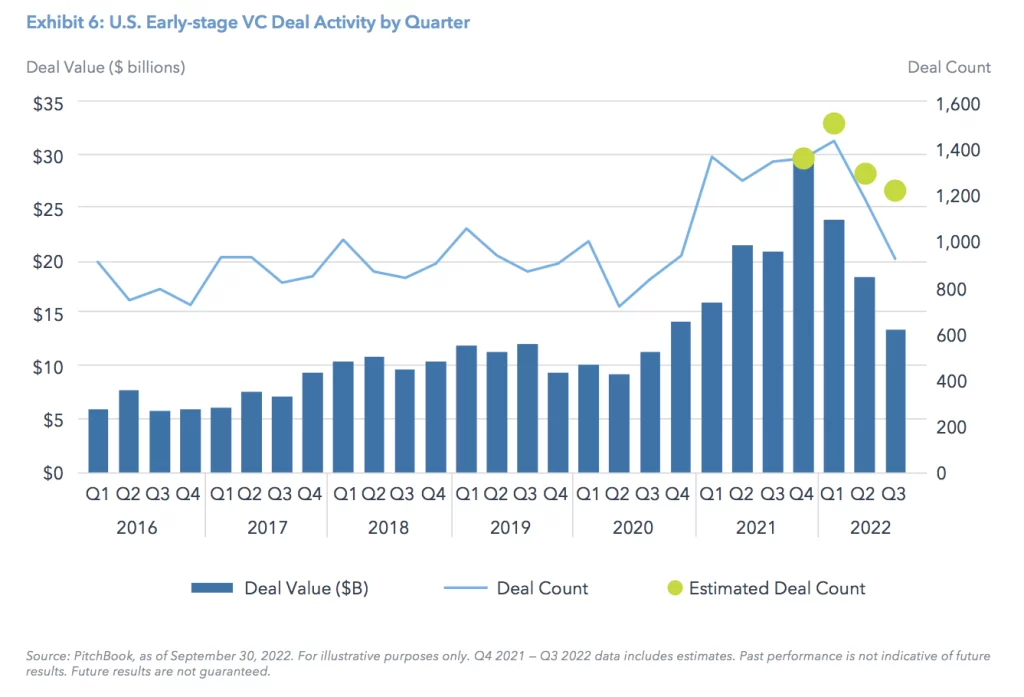

Early-stage VC deal value declined quarter over quarter in 2022 after peaking in Q4 2021, according to PitchBook and Venture Monitor data. It is worth noting, however, that year-end Q3 2022 VC investment activity reached $55.8 billion, surpassing 2020’s total amount of $45 billion. Capital deployment into early-stage deals weakened, with the median deal size totaling $8.9 million in Q3 2022, down from $11 million in the previous quarter, a 19.1% decline.10

Early-stage valuations started to retrench in Q3 2022, with the median pre-money valuation decreasing about 16% from Q2 2022.11 The slowdown in early-stage activity is due, in part, to the fact that early-stage investors can no longer make investments under the sole assumption of growth, which they have benefitted from in recent years, particularly in 2021. Investors will need to shift focus to investment fundamentals and talented entrepreneurs, rather than relying on another VC firm to invest at an even higher valuation. With that said, entrepreneurs who are embedded in more mature companies are less likely to embark on new endeavors until a liquidity event occurs at their current employer.

Risks: Higher loss rates, higher interest rates, and longer hold periods.

SECONDARIES

Current Outlook – Positive

Trend versus Q2 2022 – Upgrade

Following a strong rebound in secondary market activity in 2021, transaction volume remained robust in the first half of 2022, totaling $55 billion and exceeding the previous record of $48 billion in the first half of 2021.12 The increase in deal volume is attributable to the market normalizing in 2021 and a significant amount of dry powder raised in 2020 and 2021, totaling over $127 billion.13

Recent public market volatility has left many institutions overweight PE, which could lead to substantial supply coming to market as investors rebalance their portfolios and seek liquidity to continue investing in new PE funds, similar to the industry experience during the GFC. This creates a situation where sellers may be less focused on price, which improves the discounts at which buyers of secondaries can purchase portfolios. According to Goldman Sachs, the average secondary purchase price discount to net asset value (NAV) in the first half of 2022 increased to 14%, from 8% in 2021.14

Adding secondaries to a portfolio can be a valuable risk-mitigating tool. They typically moderate the J-curve effect; often generate faster distribution and return of capital; and reduce blind pool risk at the asset level. In an environment where investors are receiving fewer PE distributions, secondaries could provide an efficient risk-adjusted method for building PE exposure.15

Risks: Heightened competition following several years of record fundraising; less potential for alpha due to narrower dispersion of returns; and heightened overall PE market risks due to increasing interest rates, the potential for slower growth, and geopolitical uncertainty.

PRIVATE DEBT

PRIVATE CREDIT

Current Outlook – Neutral

Trend versus Q2 2022 – Downgrade

Private credit performed strongly through 1H 2022, however, there are increased headwinds in the near-to-medium term. We continue to favor large and established managers who have strong relationships with repeat borrowers and a disciplined approach to underwriting.

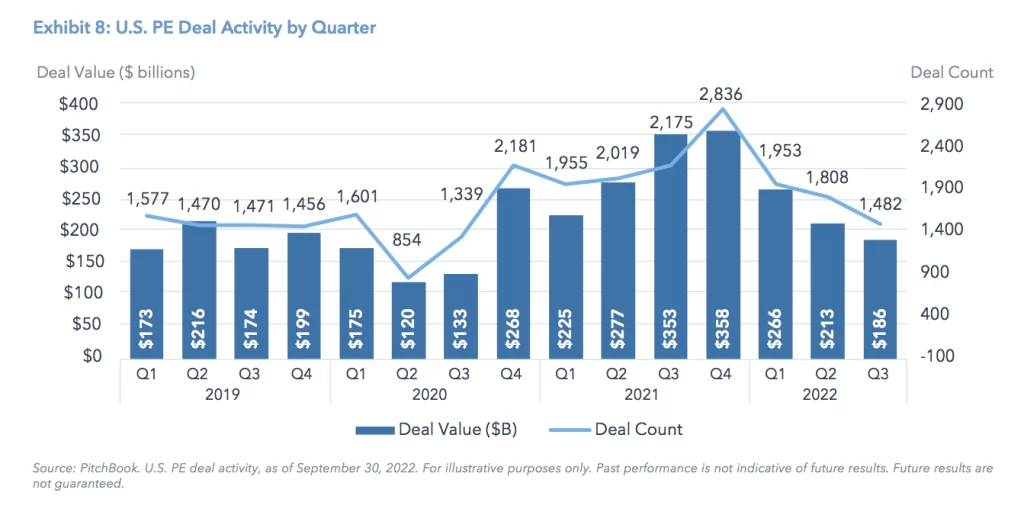

Opportunities for direct lending strategies – for both sponsor and non-sponsor transactions – were robust in 2022, amid high levels of PE investment activity. At 3Q 2022, U.S. PE deal value totaled over $650 billion, which was a retreat from the record levels of 2021 but remains on pace to surpass all prior years.16 However, this is predominantly due to robust deal activity in 1H 2022, and as the year progressed, momentum slowed in every sequential quarter. As PE managers grapple with a turbulent market environment, dealmaking is likely to continue to weaken, which in turns leads to a smaller opportunity set for private credit managers to deploy their $400+ billion of dry powder.17

Amid a potentially more challenging deployment environment, there are also increased risks to private credit from rapidly rising interest rates. The federal funds target rate has gone from 1.50% – 1.75% in June 2022 to 3.75% – 4.0% in November. Furthermore, the median terminal/ peak fed funds rate is expected to reach 5.0% in 2023, up from 3.8% earlier this year (following the June Federal Open Market Committee meeting).18 While private credit lenders are mostly insulated from duration risk, due to the floating rate structure of most loan packages, they can, in most cases, pass on only a certain increase in yield without over burdening their portfolio companies. U.S. buyout deals in 2021 had an average Debt/EBITDA ratio of 6.1x, compared to 4.7x in 2012, signifying an already highly leveraged environment before potential degradation of EBITDA.19 Additionally, private credit funds themselves are levered, and thus, their returns will also be impacted by the rising cost of debt.

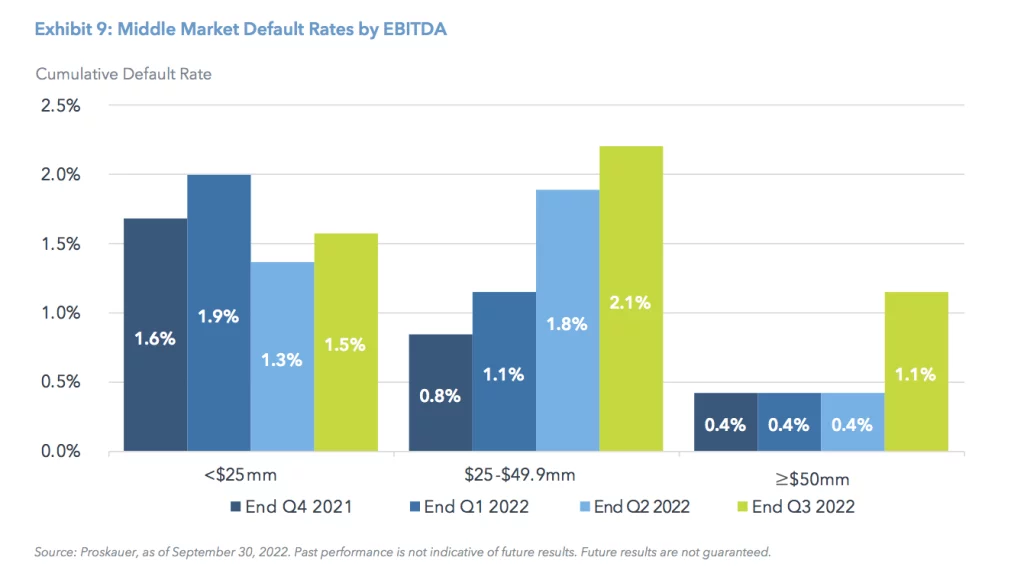

Compounding the complexity of higher interest rates is the elevated risk of a recession on the horizon. As macro conditions tighten, borrowers will have to navigate higher interest rates, along with slowing and contracting EBITDA growth. That will likely lead to higher defaults.

Despite a more difficult outlook, we believe private credit can still play an important role in client portfolios, providing attractive absolute return and yield, albeit less attractive relative to prior periods where interest rates were materially lower. The buy-and-hold nature of private credit should help shelter investors from the volatility felt by public fixed income investors during periods of market dislocations.

Risks: Rising interest rates and recession risk; greater direct lending competition; looser covenant packages and lack of structure discipline in recent years; and risk of higher defaults.

DISTRESSED DEBT/SPECIAL SITUATIONS

Current Outlook – Positive

Trend versus Q2 2022 – Upgrade

The heightened potential for macro shocks and stress in the financial system, driven by sustained inflationary pressures and rising rates should create opportunities for countercyclical strategies. The Fed raised rates six times in 2022, bringing the fed funds target rate range to 3.75% – 4.0%, the highest level since January 2008. It is the most aggressive pace of monetary policy tightening since the early 1980s, and Fed Chairman Jerome Powell is stressing the need for further monetary tightening to reach a level that is “sufficiently restrictive” to lower inflation.

The magnitude and pace of the interest rate hikes are expected to put economic growth under pressure and potentially weaken credit quality, the impact of which is exacerbated by the growth of lower-rated corporate debt and more relaxed underwriting standards in recent years. As previously noted, buyout deals in 2021 had an average debt/ EBITDA ratio of 6.1x, compared to 4.7x in 2012.20 That could set the stage for rising downgrades and defaults in the year ahead. Moody’s expects the 12-month trailing default rate for non-financial companies to jump to 4.8% by September 2023, from 1.5% at the end of September 2022.21

Against this backdrop, the opportunity set for distressed credit and special situations could be substantial. Signs of stress are already present, with the amount of U.S. high yield bonds and leveraged loans trading at distressed levels reaching $125 billion in August, up from $33 billion at the end of 2021. There was also an estimated $70 billion of hung bridge loans on bank balance sheets related to M&A transactions in the United States and Europe at the end of August.22 The Proskauer Credit Default Index, covering middle market companies, showed a default rate of 1.56% for Q3 2022, up from 1.04% in Q4 2021, with a significant uptick in stress among consumer goods, service sectors, and health care.23

In 2020, distressed opportunities were largely short-lived due to unprecedented monetary and fiscal stimulus. Similar stimulus interventions today are much less likely given soaring inflation, higher rates, and elevated debt/ GDP ratio. That said, the schedule of maturating debt could postpone anticipated defaults, and somewhat ironically, the prevalence of covenant-lite loans may actually provide companies more flexibility in a downturn. In that case, however, if and when defaults do happen, it could cause recovery values to be lower than in the past, where earlier triggers helped limit borrower losses.

Risks: Uncertain timing and scale of the go-forward opportunity set.

REAL ASSETS

REAL ESTATE

Current Outlook – Neutral

Trend versus Q2 2022 – Downgrade

Inflation remains elevated at multi-decade highs with the Consumer Price Index (CPI) rising 7.7% in October 2022.24 While headline inflation modestly retraced through October, personal consumption expenditures (PCE), which excludes energy and food, climbed higher to 6.3% from one year ago.25 Real estate has traditionally served as an inflation hedge, particularly in sectors that can pass through rent increases more frequently (i.e., multifamily and industrial), and geographies exhibiting strong growth dynamics (i.e., the Sunbelt states) where increased rents can mitigate the impact of inflation.

At the same time, increasingly hawkish policy by the Fed heightens the risk of an economic slowdown. Softer economic growth can impact affordability and net operating income, while rising interest rates could push up cap rates (after a lag), resulting in lower commercial real estate (CRE) valuations on investors’ existing portfolios. The NCREIF National Property Index (NPI)26 posted a 0.49% decline in net operating income during the 2022’s third quarter, while cap rates remained relatively flat.

Against this backdrop, we see a widening of the opportunity set between core and value-add/opportunistic CRE strategies. Rising rates may affect the relative attractiveness of core and core-plus real estate as an income yield investment in the short-term, with cap rate spreads to 10-yr Treasury notes retracing to 2.7% as of June 30, 2022, which is below its long-term average of 3.6%.27 Core real estate emphasizes income yield as a key driver of its attractiveness, so an environment that reduces the relative value of income yield to fixed income alternatives could be negative for this strategy. We believe the more attractive risk-reward proposition may be further up the risk spectrum in value-add and opportunistic real estate, which can offer better total return profiles given their additional paths to return on investment, including light renovations, lease-up strategies, and potentially better pricing.

The outlook for real estate sectors is divergent in our opinion, with residential and industrial sectors poised to weather the current environment better than office and retail. Over the past 12 months, core returns for those sectors were 18.2%, 34.6%, 3.2%, and 6.6%, respectively.28 Residential investments continue to be supported by limited housing supply, rising mortgage rates, and tight homeowner lending standards. The industrial sector continues to benefit from the secular tailwinds of e-commerce adoption and the move to just-in-time delivery. Office and retail, already facing structural headwinds from the shift to a more flexible work environment and e-commerce penetration, respectively, could be further challenged by an economic slowdown. Additionally, both sectors tend to enter into longer leases with their tenants, limiting the inflation hedging success for those investments.

Risks: Rising inflation and interest rates weighing on economic growth and affordability of lessees; valuation contraction.

INFRASTRUCTURE

Current Outlook – Neutral

Trend versus Q2 2022 – Downgrade

Historically, infrastructure has been resilient during periods of above-average inflation, due to the sector’s ability to either directly or indirectly pass on rising costs to the end customer. During 1H 2022, rapid inflation resulted in listed infrastructure equities outperforming global stocks by almost 12%.29 However, rising rates may affect the relative attractiveness of core infrastructure as an income investment in the short term, as single-digit yields look less compelling with 10-yr U.S. Treasury rates climbing above 4.0%.30

Yet, the global need for infrastructure spending remains substantial, with the G20’s Global Infrastructure Hub estimating an investment shortfall of $15 trillion against the $94 trillion of need over the next 20 years.31 The recently passed $1.2 trillion-dollar bipartisan Infrastructure Investment and Jobs Act is one example of fiscal efforts to address the shortfall. However, it remains to be seen how big a role private infrastructure will play. While the number of private infrastructure projects has increased since 2016, the dollar amount of investment has remained relatively stagnant.

A sector that we believe will be an investment priority in the immediate future is digital infrastructure, (data centers and fiber optics), which leverages the secular tailwinds in data consumption, bandwidth demand, and 5G roll out.32 Renewables will also continue to remain in demand as short-term impacts of rising energy costs and secular environmental, social, and governance (ESG) trends create an increasing opportunity set. The G20 estimates an additional $3.5 trillion of funding is needed over the next 10 years to meet the UN Sustainable Development Goals (SDGs), representing a robust potential pipeline. Areas of infrastructure that may struggle in a recessionary environment would be those that are GDP sensitive: toll roads, airports, and ports.

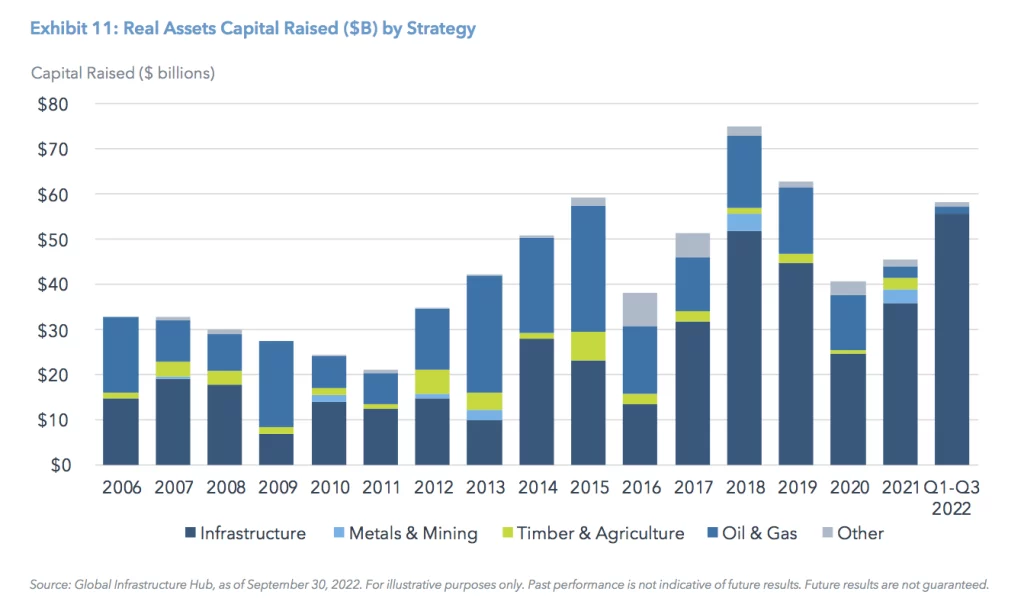

Despite the current macro and market conditions, infrastructure fundraising activity has remained resilient throughout 2022. According to PitchBook, infrastructure funds raised almost $43 billion in the first quarter, putting it on pace to be the largest fundraising year ever. Even so, fewer funds have come to market in 2022, indicating that more assets are concentrating in mega-funds.

Risks: Economic slowdown weighing on the value of incremental projects; heightened valuations of existing assets limiting returns for core funds making acquisitions.

ENERGY

Current Outlook – Neutral

Trend versus Q2 2022 – Same

Energy, supported by elevated oil prices, was the only positive sector in the S&P 500 in 2022, gaining 65.7% versus -18.1% for the broader index.33 While Brent Crude Oil spot prices have come down significantly from the $127 per/barrel (bbl) reached in March, they have hovered in the mid-$90s for the past several months, well above the five-year average of $68/bbl.34 Furthermore, energy prices are sensitive to rising rates and a stronger dollar and may likely remain volatile.

Geopolitics loom large over global energy markets, and the Russian-Ukraine conflict accentuated supply constraints resulting from years of declining energy capex, poor returns, and a lack of long-term investment in the oil sector, due to ESG concerns.35 While renewables are a growing source of electricity generation, the International Energy Agency noted in its 2021 Energy report that “global electricity demand is growing faster than renewables,” driving greater demand for fossil fuels.36

The lack of past capex and market volatility should continue to support industry consolidation as firms seek economies of scale to manage costs in the United States and Europe. Energy M&A have followed gains in oil prices, with deal activity remaining strong after the COVID-19 lows. Through Q3 2022, 732 deals worth $273 billion have been completed, compared to $301 billion for all of 2021.37 At the same time, medium- to long-term price uncertainty and environmental concerns may hold back sustained growth in the sector.

Risks: Global central banks raising interest rates to fight inflation could slow economic growth, bringing supply and demand back into balance; unpredictable supply side issues concerning OPEC’s approach and the status of Iran’s nuclear deal are further variables.

INTERNATIONAL

EUROPE

Current Outlook – Neutral

Trend versus Q2 2022 – Downgrade

Europe continues to face significant economic and geopolitical challenges. In September, inflation in Europe reached a multi-decade high of 9.9% in the euro area and 10.1% in the United Kingdom.38 In an attempt to control inflation, central banks continue to aggressively increase interest rates.

Political chaos in the United Kingdom (three prime ministers in less than two months) triggered market turmoil, sending the British pound to an all-time low against the U.S. dollar and UK gilts to a 20-year high. Prospects for de-escalation of the Russia-Ukraine conflict appear remote, and in retaliation against economic sanctions, Russia has largely cut off gas supplies to Europe.

For disciplined investors who prudently use leverage, market dislocation may offer buying opportunities to target resilient business models. However, macro uncertainty on the continent remains high.

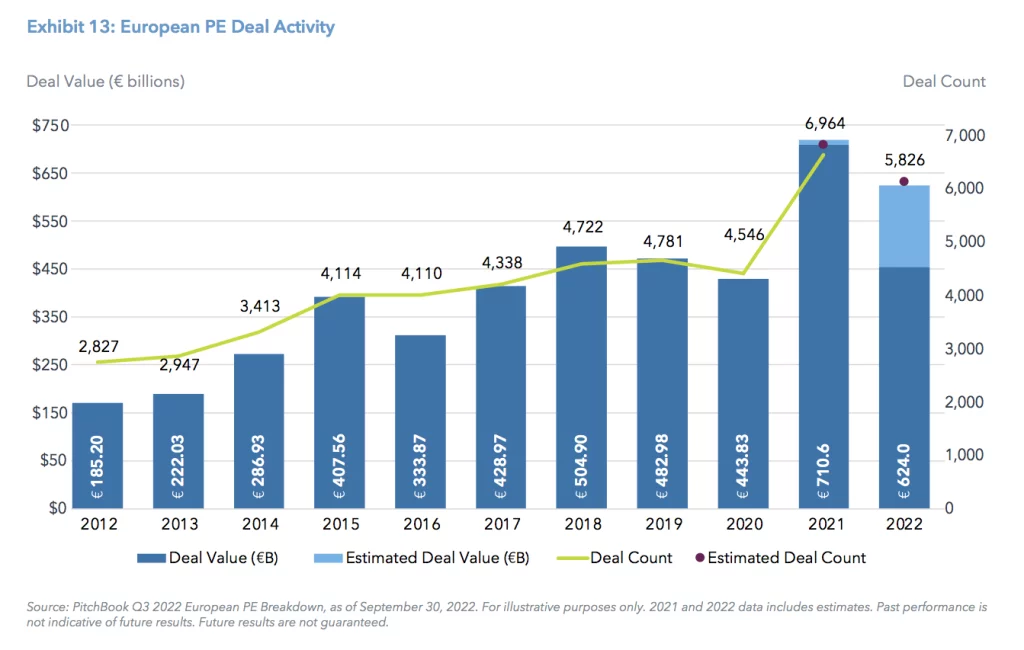

Despite the challenging environment, deal activity in Europe was down only moderately. Through Q3 2022, €466 billion of deals were completed, compared to €515 billion over the same period in 2021. The business products and services sector has been leading the charge in 2022, accounting for 37.8% of all European deals through the end of the third quarter. On the basis of depressed public market valuations, GPs continue to look into take-private deals, executing €21 billion of transactions in the first three quarters. Consistent with other regions, fundraising in Europe has slowed significantly on the back of the unfavorable market environment, leading to denominator effect and lower distributions. As of Q3 2022, European PE raised €37 billion, down from €92 billion for full 2021.

Risks: Inflationary environment; rising rates; mortgage crisis; political volatility; escalating conflict in Ukraine; volatile fossil fuel markets leading to supply disruption and energy rationing.

ASIA

Current Outlook – Neutral

Trend versus Q2 2022 – Same

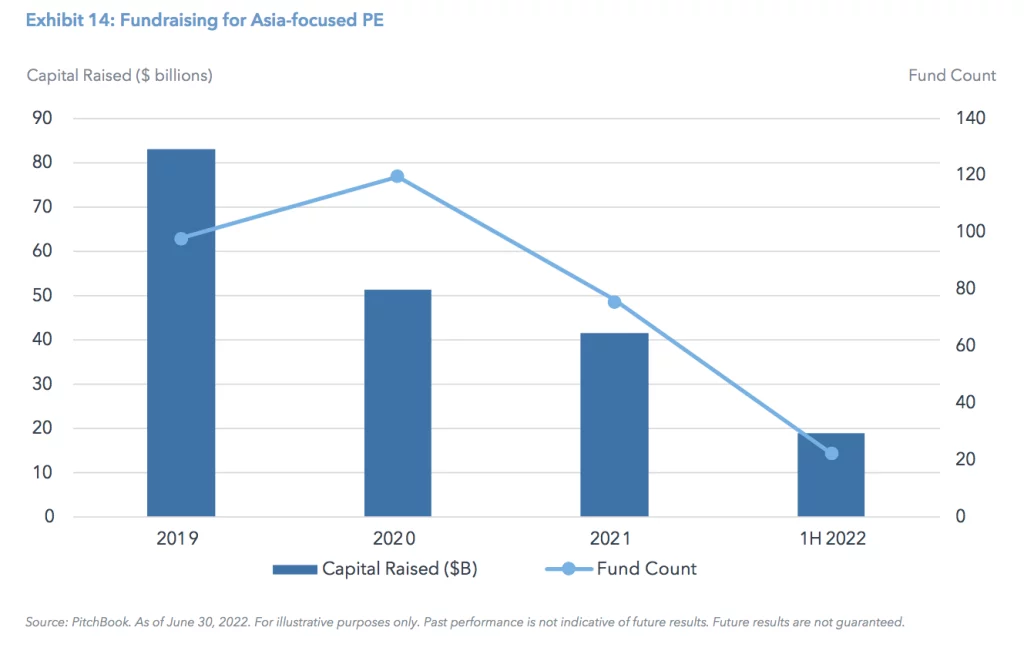

On a full-year basis, 2022 fundraising for Asia-focused PE funds was on track to decline for a third consecutive year on the back of record levels of dry powder.39 The number of deals trended down for the past four quarters, partly impacted by China’s zero-COVID policy, which has restrained economic growth and impacted dealmaking.

COVID and the Russia-Ukraine conflict exposed the risks of supply chain dependencies and disruptions. The Chinese government’s tightening grip on the country is prompting businesses to diversify supply chains and end markets. Consequently, some investors are reassessing exposures in the region, although some others view the exodus as an entry opportunity. India, the world’s sixth largest40 and the fastest growing economy, is a possible beneficiary of the potential shift from China.

The technology and internet sectors were less popular, but other industries, such as electric vehicles and artificial intelligence, are gaining traction. By contrast, deals in India grew year-on-year both in terms of value and volume, thanks to the maturing ecosystem and favorable regulatory environment.41

Risks: The region continues to provide investment opportunities, but cross-border complexities and tightening regulation will make investors cautious.

HEDGE FUNDS

MULTI-STRATEGY

Current Outlook – Positive

Trend versus Q2 2022 – Same

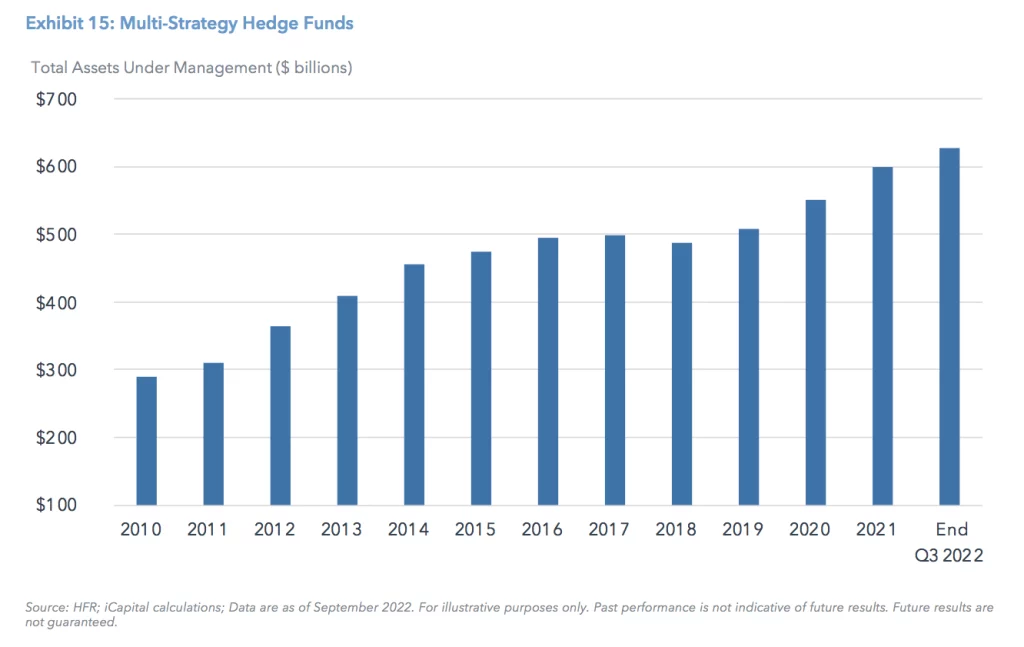

Multi-strategy funds provided downside protection – and in some cases, solid gains – amid the sell-off in traditional assets. Against this backdrop, the HFRI RV: Multi-Strategy Index was down 1.0% at the end of Q3, 2022.42

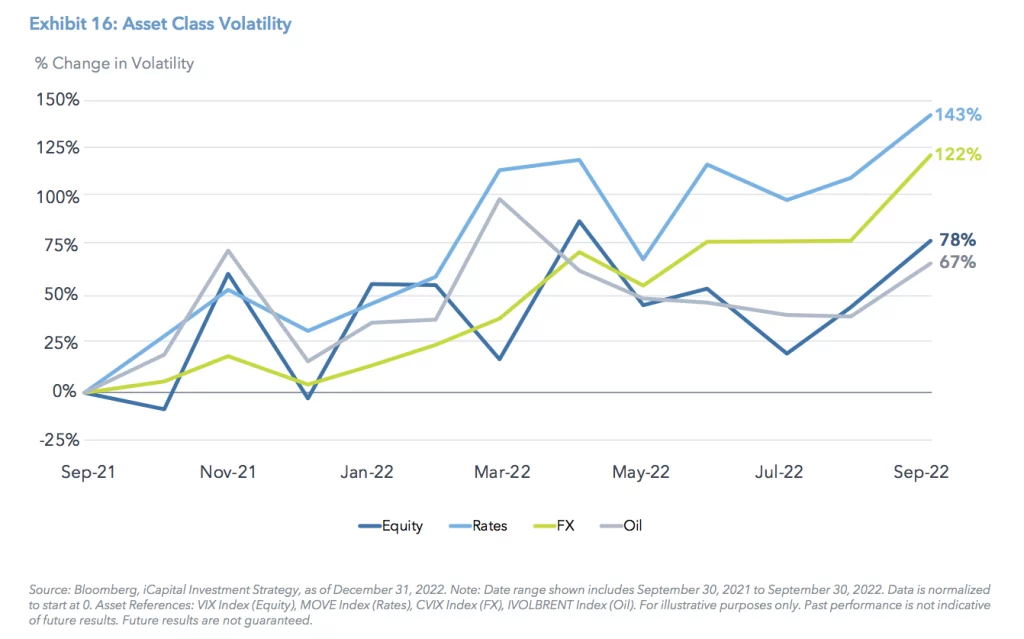

Persistent inflation, rising interest rates, and slowing economic activity resulted in higher volatility across global asset classes. This backdrop should continue to drive relative value trading opportunities and increased dispersion among individual issuers. Broadly diversified practitioners investing across asset classes and employing global trading teams (both fundamental and quantitative) remain well positioned to rotate capital amid an evolving market environment. Successful multi-manager platforms continue to differentiate themselves through their capital allocations, extended liquidity terms, flexible compensation structures, access to data, robust research, and support resources.

Client demand for multi-strategy funds has continued unabated. Managers’ willingness to build capacity in advance of growth — matching their asset base with their investment resources — will continue to be a critical input to success.

Risks: Dampened volatility across asset classes; lower dispersion/higher correlation among individual issuers; unbalanced or excessive risk factor exposures; growing competition for investment talent; unconstrained AUM growth.

MACRO

Current Outlook – Positive

Trend versus Q2 2022 – Same

Global macro strategies – both discretionary and systematic – posted strong returns, with the HFRI Macro Index rising 10.5% for the year ended Q3 2022.43 Managers took advantage of a range of investment themes globally, and sharp moves in rates, currencies, and commodities have been particularly pro table.

Heightened inflation, rising interest rates, and geopolitical instability contributed to higher volatility across asset classes. These factors, along with an expected slowdown in the global economy, are likely to continue to influence the pricing of risk assets in the coming quarters. Heterogeneous fiscal and monetary responses across geographies are adding further complexity to the macro backdrop. The impact of these varying policies will continue to ripple across markets, creating an attractive opportunity set for macro managers to identify and structure trades.

Commodity-oriented strategies have taken advantage of ongoing supply/demand imbalances. While COVID-related supply chain issues have begun to moderate, the Russian/ Ukraine war has caused new disruptions, particularly in the energy and agricultural markets. Managers who can weigh these supply-side issues against a backdrop of lower economic activity/slowing demand are likely to benefit from continued volatility in the space.

Risks: Dampened volatility across assets; sharp reversals in key investment themes; converging fiscal and monetary policies globally; return to easy money by global central banks; uncertain impact of anti-globalization/ protectionist policies.

CREDIT

Current Outlook – Neutral

Trend versus Q2 2022 – Same

After a strong 2021, characterized by spread compression and a benign rate environment that supported fixed income arbitrage and credit strategies, 2022 marked a stark reversal with the HFRI ED: Credit Arbitrage Index declining 5.6% for the year ended Q3 2022.44 Sharply rising rates, spread widening, and a drop in new issuance contributed to losses across the strategy group.

While higher rates and wider dispersion will ultimately create opportunities for carry strategies and funds with stronger credit risk underwriting capabilities, the velocity of rate increases may pressure borrower ability to service debt loads, resulting in a potential increase in default rates moving forward. As the distressed cycle unfolds in the coming quarters, managers are likely to find more opportunities for debt restructurings and reorganization. Municipal credit markets have been hampered by rising rates and technical selling pressure, due to outflows from the space, despite strong fundamentals and solid balance sheets of most issuers. With the broad municipal bond market down 12% through September, and the high yield muni segment down 16%, tax equivalent yields are approaching high-single digits, potentially creating an attractive entry point for long-term investors.

The backdrop for securitized credit is mixed. Asset-backed credits with exposure to consumers (e.g., credit cards, airlines, etc.) are facing headwinds from a slowdown in spending, even though consumer balance sheets are in a stronger position than in previous cycles. Mortgage-backed securities have been pressured by the pullback in housing activity and weakness in certain commercial segments (e.g., retail). Managers who can source primary deals and negotiate transaction terms are likely to benefit.

Risks: Economic slowdown/recession; sharp rise in unemployment; continued widening of spreads and a steeper default cycle; low dispersion and dampened volatility across fixed income; abrupt changes in liquidity in certain segments.

EQUITY HEDGE

Current Outlook – Neutral

Trend versus Q2 2022 – Same

Long/short equity funds struggled amid the sharp sell-off in global equity markets, and the HFRI Equity Hedge Index was down 13.8% for the year ended Q3 2022.45 Net long positioning and notable weakness in certain growth-oriented market segments (e.g., technology, consumer discretionary, communication services) exacerbated losses for certain managers.

Macro influences — particularly high inflation and rising interest rates — have dominated markets, causing both a broad rerating in market multiples and difficulties for fundamental practitioners. To the extent these headwinds begin to abate, bottom-up stock pickers are likely to find a more fertile backdrop as company fundamentals revert and drive share prices.

Quantitative equity strategies have generally outperformed by taking advantage of market dispersion while limiting factor and style biases within portfolios. The outlook for these strategies remains promising as higher dispersion is likely to persist amid a slowdown in the global economy. Equity market performance across geographic regions is likely to remain varied as governments respond to high inflation and slowing growth with a range of fiscal and monetary programs. This could give an edge to managers who can source opportunities on a global basis.

Risks: Continued beta headwinds in equity markets; economic slowdown/recession in the United States and abroad; macro factors dominating company fundamentals; falling dispersion among individual issuers; sharp style and factor imbalances (e.g., growth vs. value).

EVENT DRIVEN

Current Outlook – Neutral

Trend versus Q2 2022 – Downgrade

Event driven funds posted modest losses and the HFRI Event Driven Index was down 7.7% for the year ended Q3 2022.46 Long-leaning strategies have been challenged by the sell-off in risk assets and a broad-based slowdown in capital markets activity. Tighter financial conditions impacted M&A activity. Year over year, deal volumes and transaction values are on pace to fall by more than 15% and 23%, respectively. Corporate spin-offs are running at a similar pace to last year, but the forward calendar of announced activity also indicates a slowdown is looming.

Cross-border transactions are likely to come under greater scrutiny by regulators as governments emphasize the reshoring of manufacturing and supply chains, particularly in strategically important industries (e.g., energy, technology, and health care). The number of both global and special purpose acquisition company (SPAC) IPOs in 2022 fell sharply from 2021 levels; to 861 from 1,627 for global IPOs and to 146 from 432 for SPACs, translating into declines of 47% and 66%, respectively. The decline in SPAC offerings, along with the pending expiry of deal windows for many existing ones, is likely to further dampen transaction activity.

Managers who have the skill set to invest across the corporate capital structure may be well positioned to take advantage of special situations in both the equity and credit markets. Additionally, managers who can create their own catalysts and drive investment outcomes through active engagement and primary deal sourcing are likely to benefit, if capital markets remain constrained.

Risks: Tighter financial conditions constrain capital markets activity; beta overshadows alpha as events/ catalysts are offset by market volatility; more restrictive regulatory backdrop dampens dealmaking, particularly cross-border transactions.

END NOTES

1. PitchBook. (2022). Mega-Funds in U.S. PE. PE horizon IRRs by fund size.

2. PitchBook. (2022). Q2 2022 Global Private Markets Fundraising Report.

3. PitchBook. (2022). Q3 2022 U.S. PE Breakdown.

4. PitchBook. (2022). Q3 2022 U.S. PE Breakdown.

5. PitchBook 2022 Q2 U.S. PE Middle Market Report.

6. Ibid.

7. PitchBook Q3 2022 U.S. PE Breakdown.

8. PitchBook Q3 2022 Venture Monitor.

9. Preqin, 2022: Alternatives in North America.

10. PitchBook Q3 2022 Venture Monitor.

11. PitchBook Q3 2022 Venture Monitor.

12. Goldman Sachs.

13. PitchBook Q2 2022 Private Fund Strategies Report.

14. Goldman Sachs, secondaries intermediaries reporting, as of June 2022.

15. Bloomberg, “Billions in Capital Calls Threaten to Wreak Havoc on Global Stocks, Bonds,” So a Horta e Costa and Richard Henderson, Nov. 6, 2022.

16. PitchBook. As of Sept. 30, 2022.

17. PitchBook. As of June 30, 2022, includes debt, direct lending, bridge financing, distressed debt, mezzanine, credit special situations, infrastructure debt, venture debt and real estate debt.

18. Source: St. Louis Fed (fred.stlouisfed.org).

19. PitchBook, as of Sept. 30, 2022, U.S. PE Buyout Median Multiples.

20. Ibid.

21. Moody’s, Default rate likely to triple by Sept. 2023, J. Tyson, Oct. 31, 2022.

22. Oaktree, “The Roundup: Top Takeaways From Oaktree’s Quarterly Letters – 3Q2022.”

23. Proskauer Rose LLP, Insights, Oct. 26, 2022.

24. Bureau of Labor Statistics (bls.gov).

25. Ibid.

26. The NPI reflects investment performance for over 10,000 commercial properties held predominantly by core real estate managers.

27. Bloomberg: RECFICAE Index and USGG10YR Index.

28. NCREIF, NPI Flash 3rd Quarter 2022 (ncreif.org).

29. S&P Global Infrastructure Index and S&P 500 Total Return as of October 31, 2022 (spglobal.com)

30. As of October 31, 2022.

31. Global Infrastructure Hub. (2021). Forecasting infrastructure investment needs and gaps. Retrieved from https://outlook.gihub.org.

32. Infrastructure Strategy 2022, March 2022, EDHEC Infra.

33. eVestment.

34. NASDAQ and iCapital. As of Nov. 11, 2022.

35. Goldman Sachs Commodities Research, From Recovery to Scarcity, Sept. 13, 2021.

36. IEA, Global Energy Review 2021 – Analysis. IEA.

37. PitchBook, Q3 Global M&A Report, Oct. 24, 2022.

38. Eurostat for euro area inflation; Office for National Statistics for UK inflation.

39. PitchBook. PE fundraising for Asia cools in H1 2022, Aug. 3, 2022.

40. The World Bank, by GDP in current US$, as of 2021.

41. Preqin, India continues to charge ahead of China as Asia’s top fintech hub, Oct. 19, 2022.

42. HFR via eVestment, as of September 30, 2022.

43. HFR via eVestment, as of September 30, 2022.

44. HFR via eVestment, as of September 30, 2022.

45. HFR via eVestment, as of September 30, 2022.

46. HFR via eVestment, as of September 30, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01