Elevating the Standard in Performance Reporting for Alternative Investments

Your clients want an easy-to-understand explanation of the performance for their alternative investments. And you want an easy way to give it to them. Now you both get what you need.

Solving Industry Reporting Problems

The unique characteristics of alternative products, their opaque nature, and the metrics by which they are judged are not easily consumable by existing performance reporting platforms. This requires asset managers and advisors to spend an inordinate amount of time trying to cobble together a concise explanation for their clients. That requires them to source a diverse set of data from a disparate set of service providers. The result is often latent reporting that doesn’t rise to the level of sophistication their clients rightly demand.

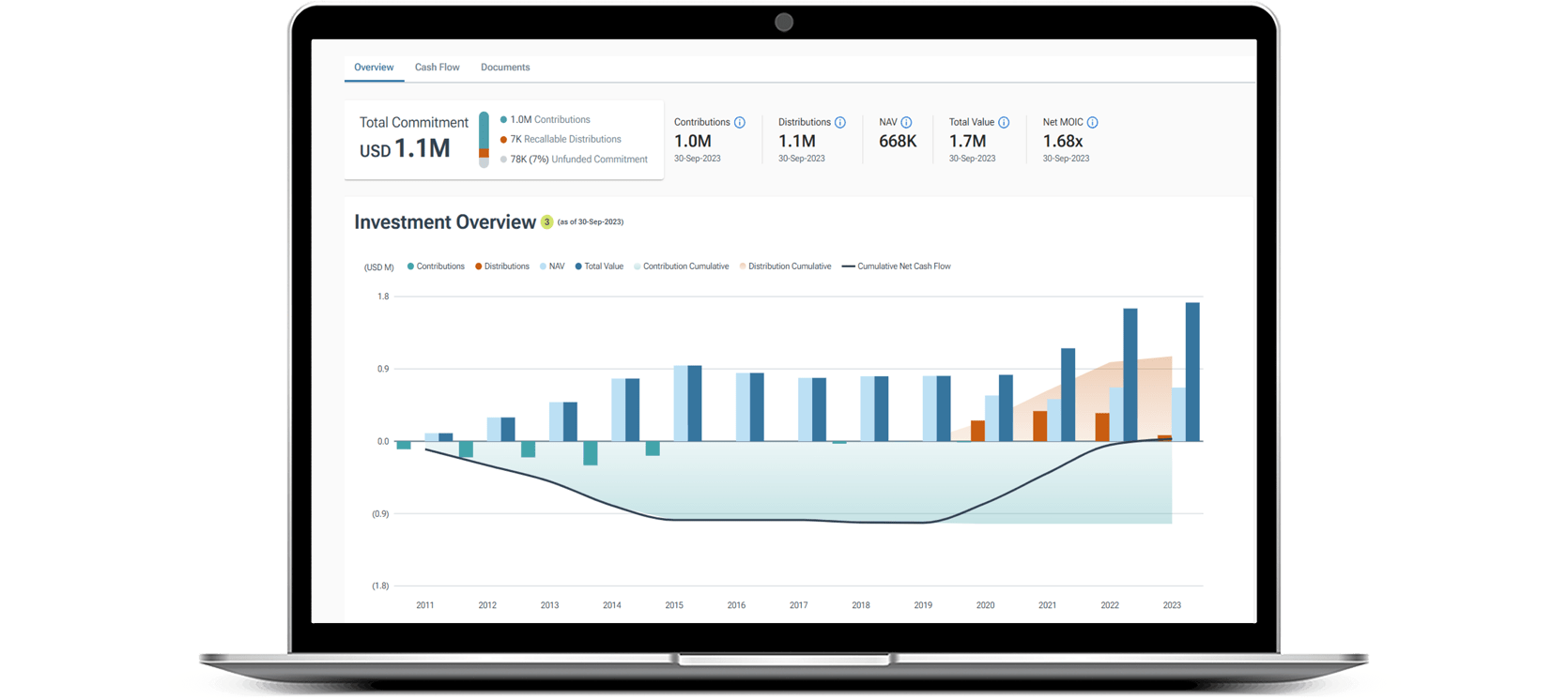

For illustrative purposes only.

Key Features & Benefits

Centralized Data Repository Across GP’s and Administrators

- Eliminates manual collection of disparate data.

- Allows for data to be summarized and categorized in multiple ways.

Modern Graphical Illustrations of Valuations and Cashflow over Customizable Time Periods

- Simplifies the explanation of performance so that investors can understand this critical part of their overall portfolio

Publishes Performance Metrics at the Fund, Account and Household Levels

- Allows for different levels of analysis and decision making

Featured Articles

IMPORTANT INFORMATION

iCapital and its affiliates provide various services through a number of affiliated entities – please refer to Certain iCapital Entities for a full list of entities. iCapital entities are collectively referred to as “iCapital”, and they all are affiliated with iCapital, Inc. and Institutional Capital Network, Inc. Among these affiliates, iCapital Markets LLC (“iCapital Markets”), an SEC-registered broker-dealer, member FINRA and SIPC, offers securities products and services. The registrations and memberships listed in Certain iCapital Entities in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services provided by iCapital. Additional information is available upon request.

This website is for informational purposes only. This website is the property of iCapital and may not be shared, reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This website and any information included on it are not intended, and may not be relied on in any manner, as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. Financial products, including investment funds and structured investments, are complex and may be speculative and are not suitable for all investors. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This website and the information contained on it is not intended to, and does not, address the financial objectives, situation or specific needs of any specific investor.

iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc.