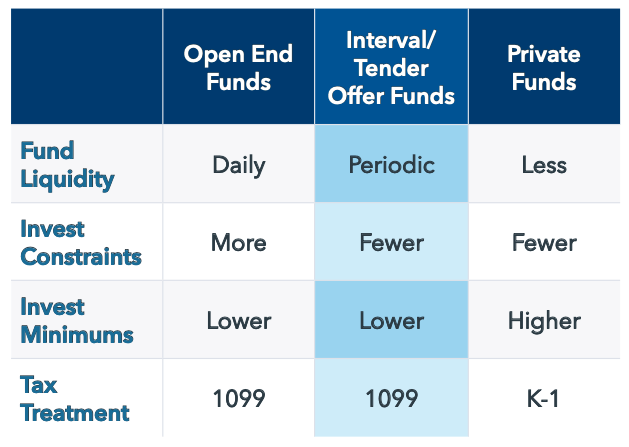

As the alternative investment industry continues to grow and evolve, registered closed-end funds — such as tender offer and interval funds — represent an increasingly important segment of the market. These funds, which are not listed on an exchange and do not trade, are registered with the U.S. Securities and Exchange Commission (“SEC”). They combine regulatory and investment features, which straddle those of private funds and open-end funds, enabling a broader number of investors to access “true” alternative strategies. Private equity and private credit fund managers have been at the forefront of this trend, but hedge fund managers are increasingly tapping into the benefits of these structures.

Before wading into the details of these types of closed- end funds, some historical perspective on the evolution of the hedge fund industry is probably warranted.

Private Funds – The Originals

The earliest hedge funds, such as those first championed by industry pioneer AW Jones in the 1950s, were private funds typically structured as limited partnerships or exempted companies. These unregistered vehicles allowed fund sponsors maximum flexibility to implement their investment strategies, decide fees and liquidity terms, and provide an efficient tax structure to their underlying investors. Decades later, and largely because of their flexibility, these structures are still the most widely used in the $4+ trillion hedge fund industry.1

For both fund managers and investors, however, one of the drawbacks of these private fund structures is that they are only available to a narrow pool of high-net-worth investors. These funds rely on a registration exemption which limits their investors to Qualified Purchasers (“QPs”) — that is, investors with at least $5 million in assets — which dramatically shrinks the audience of eligible buyers. As a result, fund managers wishing to broaden their prospective investor base began to explore the use of other fund structures.

Open-End Funds – Liquid Alternatives

The late 1990s and early 2000s saw the advent of alternative investment strategies offered through open- end fund structures. These “liquid alts” funds, as they are often called, enable investment managers to bring to market non-traditional trading strategies through daily-valued mutual funds and ETFs. Because these funds are available to retail investors, they are required to register with the SEC under the Investment Company Act of 1940, bringing with them greater regulatory oversight and more investor-friendly features. These include daily liquidity, lower investment minimums, greater transparency and ease of tax reporting. These features, along with the appeal of “hedge fund-like” strategies helped liquid alts funds gain in popularity among retail investors. Today, these open-end alternative mutual funds and ETFs represent over $400 billion in assets.

While registered open-end funds have additional safeguards for investors, some of these protections also place restrictions on the investment strategy itself. These include limits on portfolio concentration, the use of leverage and illiquid investments, among others. Certain hedge fund strategies, such as long/short equity and managed futures, have been able to operate reasonably well within these guidelines, although their performance record relative to unregistered funds with similar objectives has been mixed. Other hedge fund approaches, such as diversified multistrategy funds, are largely absent from the mutual fund space as their investment approaches do not translate effectively into this structure. Also, because incentive fees are not allowed due to legal prohibitions, some managers may not be inclined to make their best strategies available, especially if they are capacity constrained. So, while open-end funds are available to the widest audience of investors and are generally available to investors at a lower cost than private hedge funds, they have not always proven to be the most effective means for hedge fund managers to deliver their “true” strategies to market.

Registered Closed-End Funds – Best of Both Worlds?

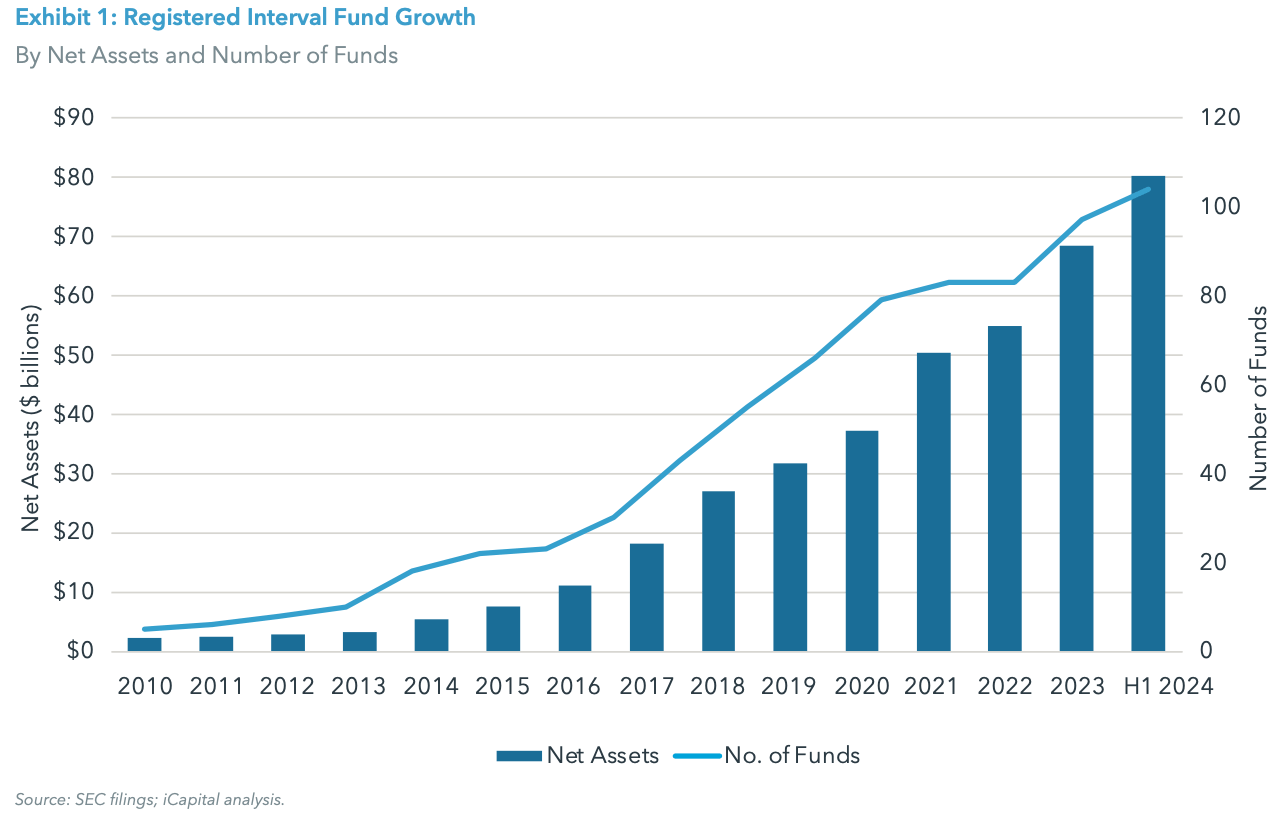

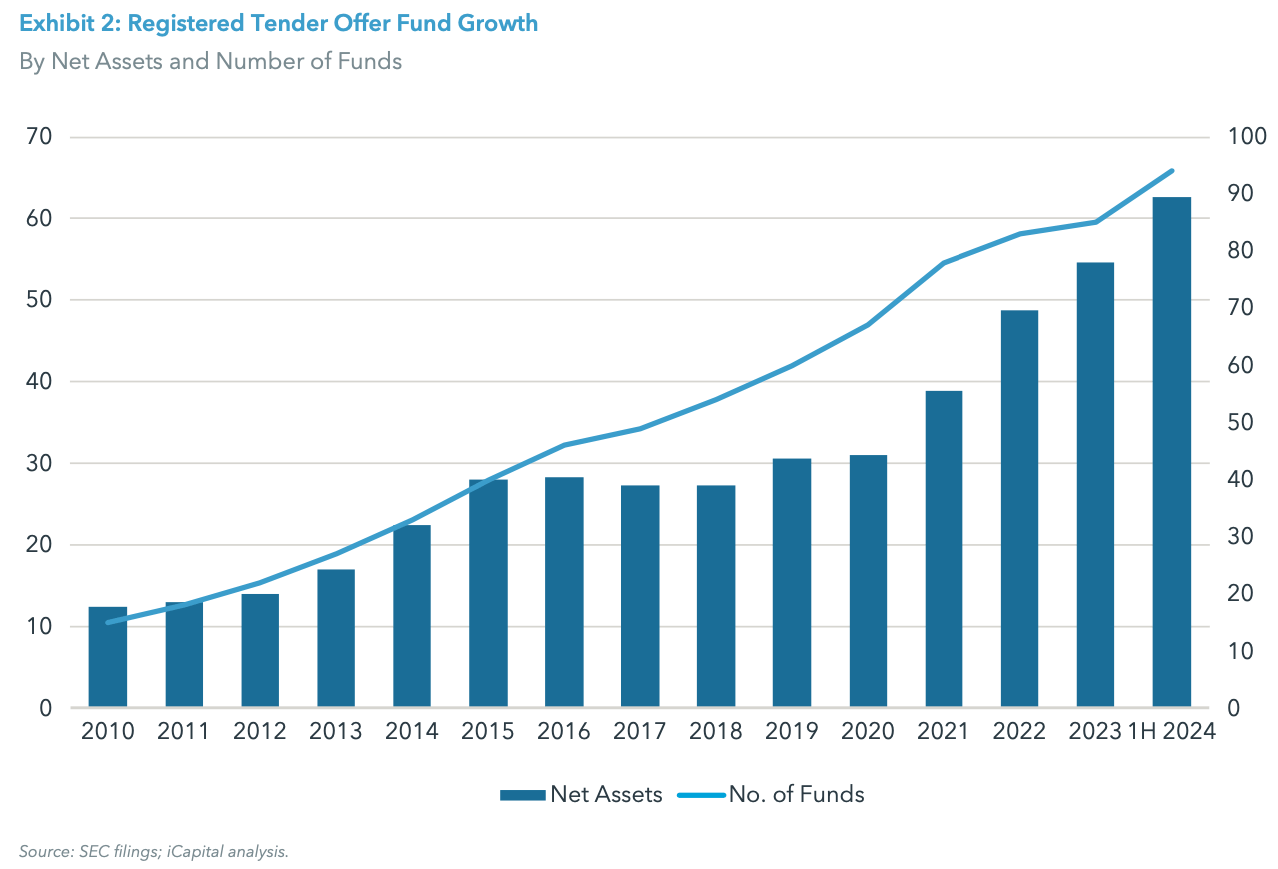

Given the limitations of both private funds and open-end funds, fund managers and investors have increasingly looked at registered closed-end fund structures as providing an ideal middle ground. These include tender offer funds and interval funds — semi-liquid vehicles which allow more investment flexibility than open-end funds, but with more friendly investor eligibility requirements than private funds. These funds offer periodic liquidity through share repurchases which enables them to hold more illiquid investments than open-end mutual funds and ETFs. At the same time, as registered vehicles, they are available to a broader audience of investors than private funds — most tender offer and interval funds are open to Accredited Investors (“AI”) who satisfy more modest income (e.g., >$200k) and net worth (e.g., >$1 million) requirements. This widens the pool of potential investors to the more than 18% of US households who are Accredited Investors.2

Tender offer and interval funds share similar features, but there are also a few key differences between the two structures that are worth highlighting:

- Interval funds are required to adopt a fundamental policy which defines their repurchase offers, setting both the amount (e.g., typically between 5% and 25%) and frequency (e.g., usually every 3, 6 or 12 months) of the offers. Interval funds must also specify the pricing date on which the fund determines the applicable NAV and must pay shareholders for any shares repurchased within 7 days following the pricing date.

- Tender offer funds have wide latitude in determining their share repurchase practices. There is no prescribed amount or frequency of repurchases which tender offer funds must follow. Instead, the specifics of the repurchase program are at the discretion of the fund’s board of directors. Despite this flexibility, however, most tender offer funds do adopt the practice of conducting regular share repurchases with certain minimum amounts, giving them a similar liquidity profile to that of interval funds.

As registered vehicles, tender offer and interval funds still face certain investment limitations, including caps on portfolio concentration and the use of leverage. They are also prohibited from charging an incentive fee, except in those cases where the fund is specifically designated for investors who meet the definition of a Qualified Client — an individual with at least $2.2 million in assets or $1.1 million with the advisor. Still, their ability to hold more illiquid investments, combined with their other investment and regulatory features, makes them an appealing option to both investment managers and investors. This has helped boost the adoption of these fund structures in recent years, including within the hedge fund community where most registered hedge funds utilize the tender offer structure.

Through both tender offer and interval funds, investors now have more options to access a growing array of hedge fund offerings. And similar to the world of private funds, investors are able to choose between single- manager and multi-manager vehicles. Single-manager funds can have their virtues — greater specialization and potentially lower costs among them. But as noted earlier, certain hedge fund strategies are still hamstrung by the investment limitations of the registered fund structure.

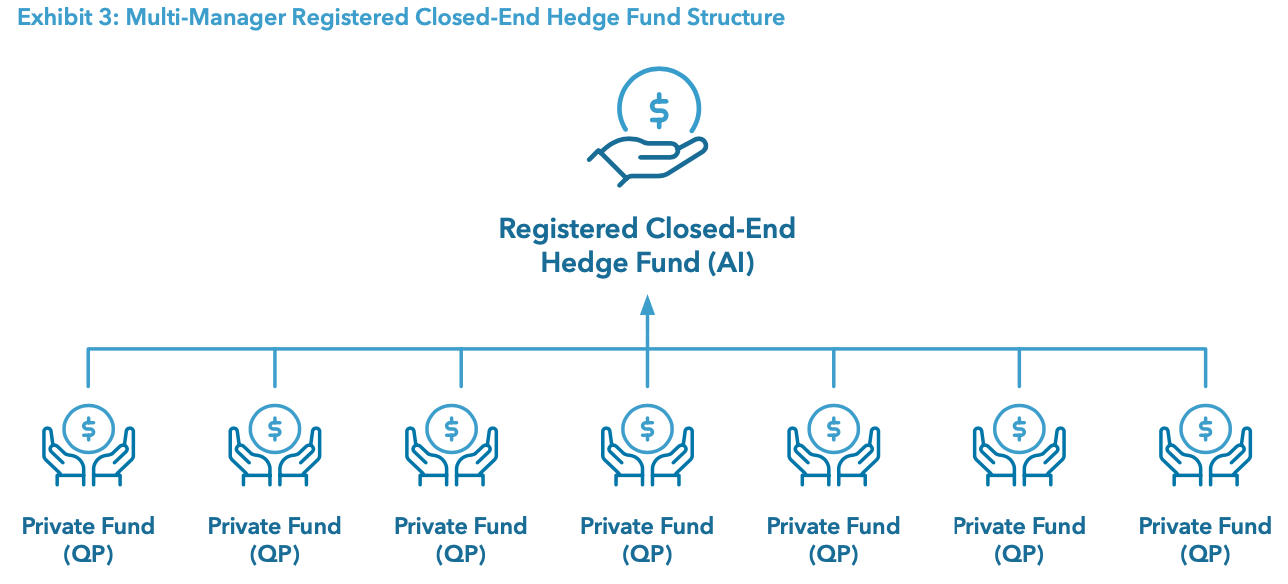

Increasingly, the solution to fitting unconstrained hedge fund strategies into the registered fund framework has been the use of multi-manager funds. The “magic” of this approach comes from the fact that, under SEC regulations, registered funds are able to invest in a diversified pool of private funds — up to 25% in each — enabling Accredited Investors to gain exposure to hedge funds that otherwise would have only been available to Qualified Purchasers. The multi-manager registered fund structure looks broadly similar to the chart on the next page:

Besides simply enabling investments into underlying QP hedge funds, the multi-manager approach offers several benefits to investors:

- Manager Access – investors can gain exposure to best-in-class hedge fund managers who may be difficult to access due to their limited capacity, periodic openings, or because their strategies would not otherwise “fit” into a registered fund structure on a standalone basis.

- Diversification – through investments into several underlying hedge funds, the multi-manager approach can provide broad exposure across various trading strategies, asset classes and geographies, rather than relying on a single manager or investment approach.

- Monitoring – the fund’s manager conducts ongoing diligence and monitoring of the underlying hedge funds and can implement changes to the manager lineup and portfolio allocations as needed.

- Efficiency – as a “single ticket solution”, the fund can provide economies of scale and cost efficiencies relative to a collection of standalone hedge fund investments.

Multi-manager funds can have their potential shortcomings — holding too many underlying funds can dilute returns, for example. But most of these concerns can be addressed by working with a skilled investment manager who is focused on generating attractive risk-adjusted returns while maintaining a keen eye on expenses. An investment manager should have an experienced team with professionals able to demonstrate their ability to access and invest in best-in-class managers. Additionally, a track record of successfully conducting initial due diligence and on- going monitoring is essential. Finally, to achieve the desired economies of scale, investors should remember registered closed-end funds require an array of operational, administrative and distribution expertise. Given the overall benefits of the multi-manager approach, these types of registered closed-end funds — both tender offer and interval — should continue to gain traction in the marketplace and help further the adoption of hedge fund strategies by the high-net- worth investor community.

Endnotes

1. HFR; HFR Global Hedge Fund Report; Q3 2024

2. Review of the “Accredited Investor” Definition under the Dodd-Frank Act

Important Information

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.