With the implementation of the tariffs on Mexico and Canada, as well as additional tariffs on China, the S&P 500 is down roughly -6% from recent highs and approaching oversold levels.1 With crowded positioning getting unwound and bearish sentiment standing at multi-year highs at 60.10%, we are starting to focus on how this episode could end and the ideas investors could look towards in the meantime.2

Given the contrarian bearish and oversold levels described above, we see the potential for a near-term bounce back and think the bar for positive market surprises has been reset lower.

Looking past that, however, we believe there are four factors that could provide a sustainable floor to equity markets but could still take some time.

1. The full impact from tariffs gets priced in. While the tariffs are certainly now more priced into markets than we saw in February, markets have still not fully discounted the downside from tariffs that extend beyond this round. Indeed, additional tariffs are coming in April, which will focus on Europe, as well as sector tariffs on cars, pharmaceuticals, semiconductors, not to mention the highly touted reciprocal tariff. And now with the 25% Mexico and Canada tariffs going into effect, we think markets need to take the risk of these tariffs being implemented seriously.

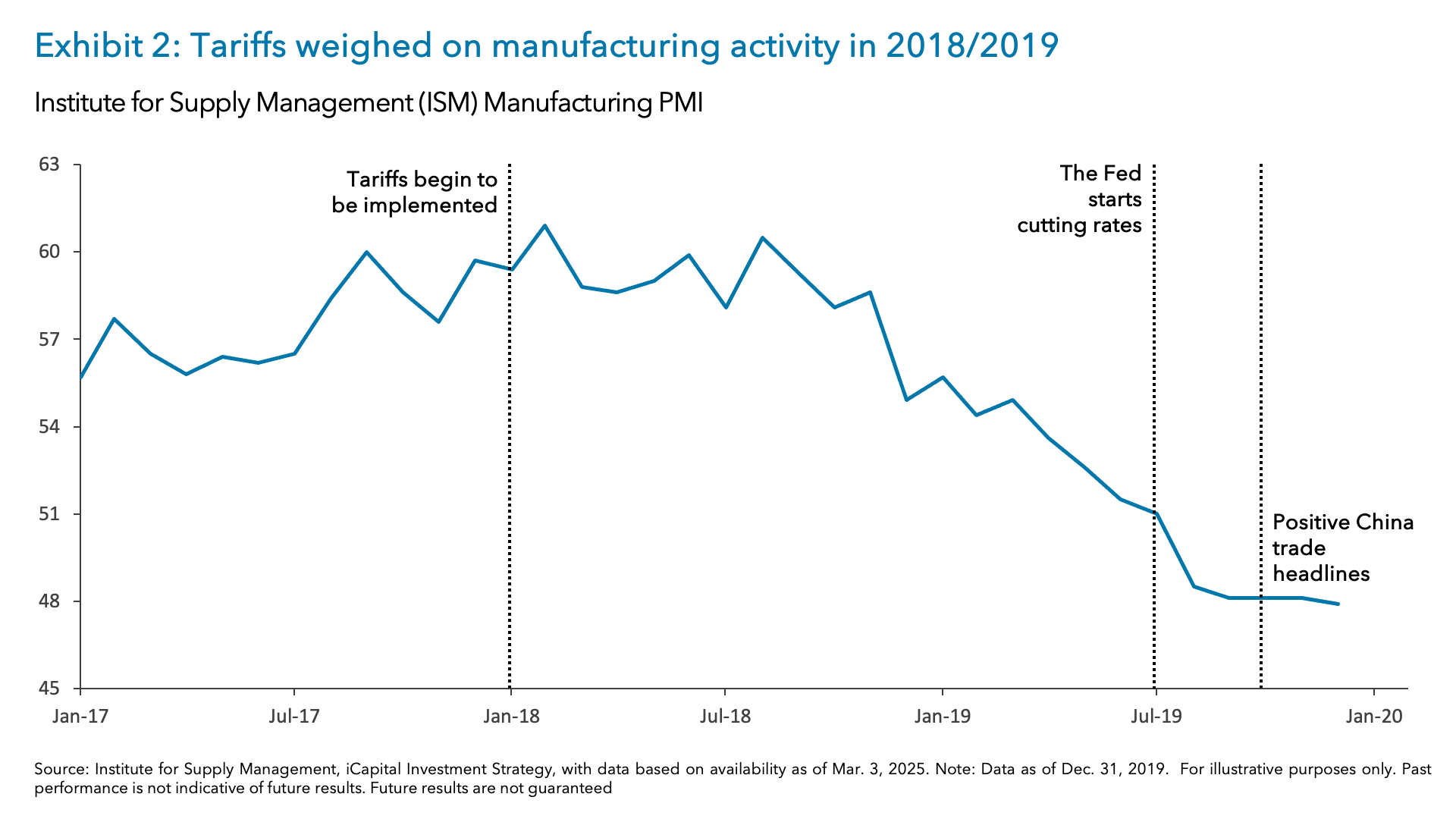

2. Manufacturing slump stops. It still feels like we are not there yet, as the ISM manufacturing Purchasing Managers Index (PMI) just returned to an expansion last month.3 As seen in 2018, when President Trump implemented the safeguard tariffs on January 22nd, this coincided with the peak in the ISM manufacturing PMI.4 During the first trade war, we saw the manufacturing PMI weaken throughout 2018 and 2019 weighing on the performance of cyclical sectors. With tariff headlines and announcements leading to higher uncertainty, this could weigh on the animal spirits that supported corporate America and ultimately lead to negative earnings revisions going forward – we have seen this already in the latest reporting season.5

3. Fed starts to cut rates again. One of the reasons why markets started to recover in 2018/2019 is because the Fed pivoted and ultimately cut rates in July 2019 – markets started discounting rate cuts after the March FOMC meeting in 2019.6 While the Fed has stated that they are on an extended pause, markets have started to price in more rate cuts – three cuts are now priced in.7 All eyes will be on Fed Chair Powell this Friday as he speaks at 12:30pm and again at the March FOMC press conference on the 19th, which will also include updated economic and inflation forecasts.8

4. Trade agreements are reached. In addition to the Fed cutting rates in 2019, trade headlines turned more positive and ultimately resulted in the Phase One trade agreement between the U.S. and China, which was supportive of risk assets. However, today’s situation is unique as we are fighting a multi-front trade war, and it does not seem like we are close to reaching any trade agreements.

How to position for this uncertain environment

As we highlighted in our 2025 Market Outlook (here), we believed this was going to be a year where investors would have to deal with a number of wildcards. With heightened uncertainty and volatility, there are a few ways investors can think about their current portfolio allocations.

First, we would favor alternatives and income-generating asset classes. Indeed, these asset classes historically deliver lower volatility and better risk-adjusted returns and may be insulated from any large spikes in public markets volatility.

Second, we would rotate from cyclicals into domestic, defensive stocks, as we suggested in our Market Outlook. When we look back to the first trade war, cyclical sectors underperformed domestic, defensive sectors. With the potential for manufacturing activity to continue to weaken from current levels, this will likely weigh on the earnings revisions and performance of cyclicals, including semiconductors. In addition, we think defensives should benefit from having valuations that remain well below their 10-year averages.9

If investors are looking to take advantage of the unwind of sentiment and positioning, we would look towards oversold parts of the markets that have already discounted a number of risks. Specifically, we would favor U.S. software companies with AI exposure, which have already experienced large drawdowns and are now oversold.

Finally, given the rise that we have seen in volatility with the VIX index now standing at 25.3310, we think investors should look to take advantage of this spike, as the terms on various structured investments could be potentially more attractive, depending on the options tenor.

1. S&P Capital IQ, as of Mar. 4, 2025.

2. American Association of Individual Investors, as of Feb. 27, 2025.

3. Institute for Supply Management, as of Mar. 4, 2025.

4. Institute for Supply Management, Peterson Institute, as of Mar. 4, 2025.

5. FactSet, as of Feb. 28, 2025.

6. Bloomberg, as of Mar. 4, 2025.

7. Bloomberg, as of Mar. 4, 2025.

8. Federal Reserve, as of Mar. 4, 2025.

9. S&P Capital IQ, as of Mar. 4, 2025.

10. Cboe, as of Mar. 4, 2025.

INDEX DEFINITIONS

CBOE Volatility Index (VIX Index): The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500 Index (SPX) call and put options.

S&P 500 Index: The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities. The index includes 500 of the top companies in leading industries of the U.S. economy and covers approximately 80% of available market capitalization.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.