Investment Outlook

Late-stage venture capital includes investments that occur once a company has developed a viable product or service, demonstrated market fit and are in a scaling and execution phase. Considering that late-stage venture companies tend to be larger and more mature compared to early-stage, investments in these strategies tend to be more concentrated and returns can be more tightly tied to exit activity.

Venture capital strategies have faced recent headwinds, including a sluggish exit environment. In addition, late-stage strategies have been increasingly linked to mega-deals, due to record investments in artificial intelligence (AI).

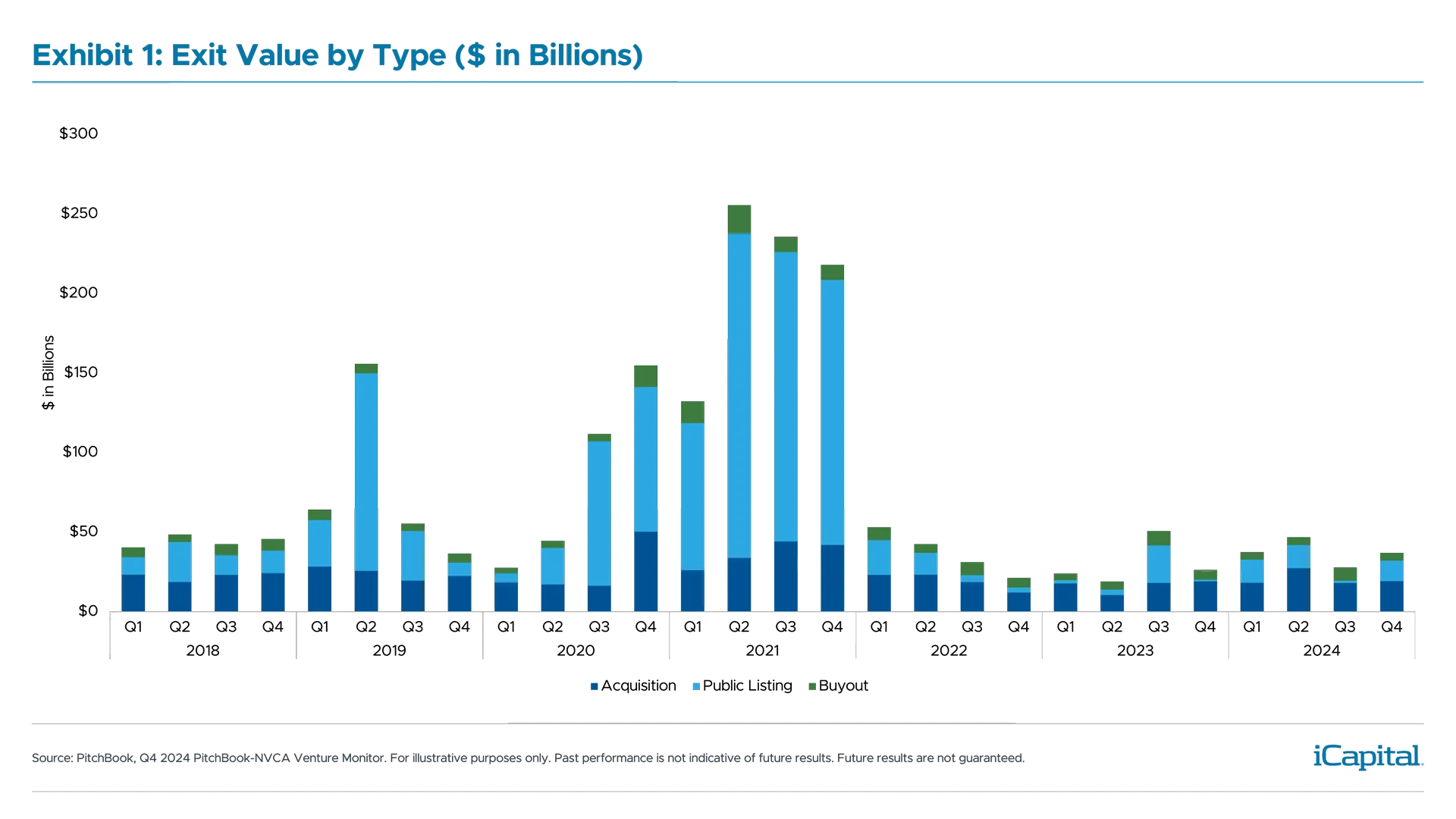

The absence of a sustainable increase in exits has kept a lid on value realization with total exit value still below 2018 and 2019 levels, as seen in Exhibit 1. A growing inventory of larger investments is locking up capital, particularly for late-stage strategies. According to Pitchbook, venture portfolios hold a total of $4.0 trillion in start-up value, more than double 2020’s market value of $1.7 trillion.

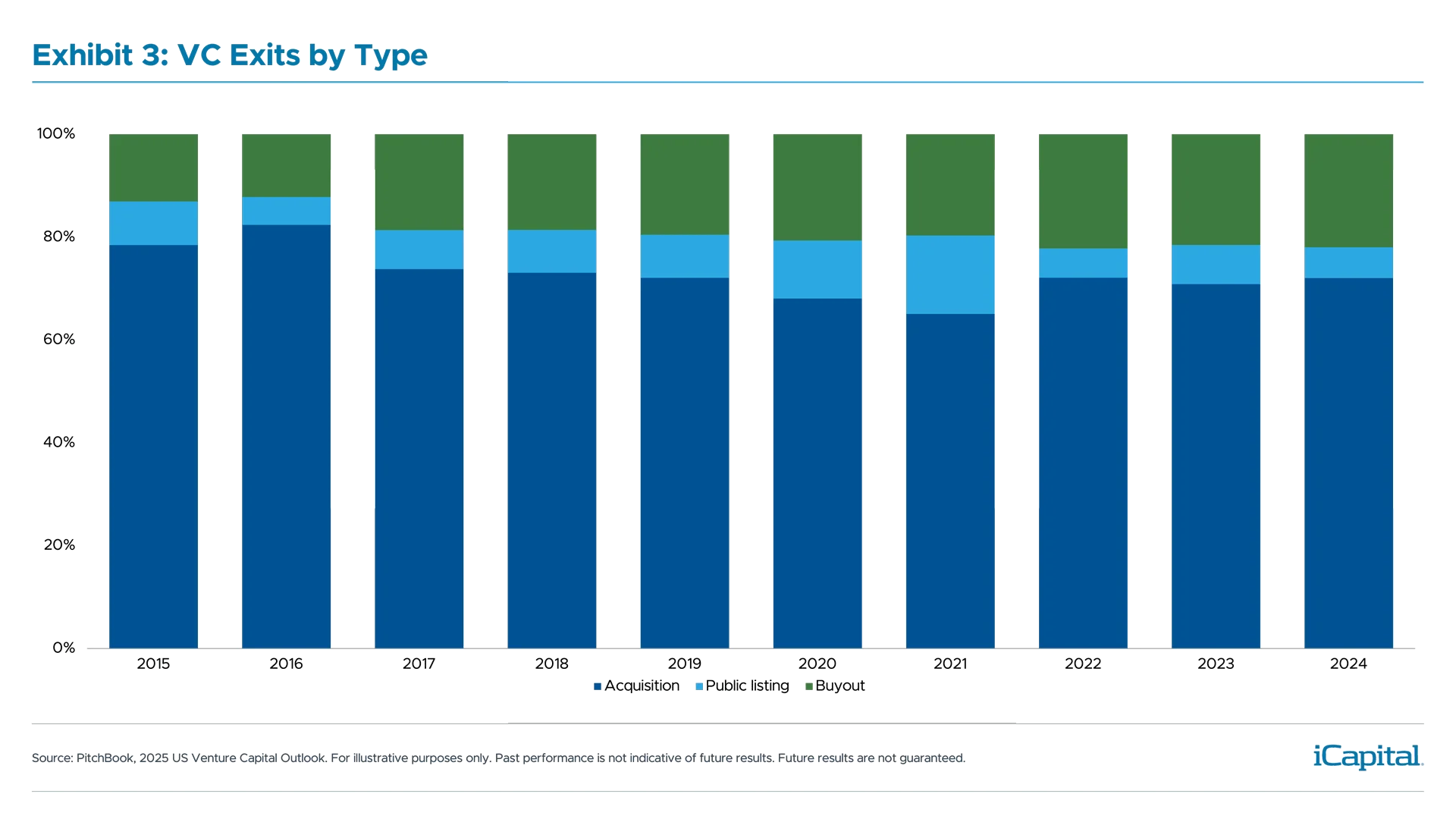

In absence of IPOs, M&A is playing a larger role with exits. However, a growing majority of acquisitions are occurring in early-stage deals. In 2023 and 2024, 89% of acquisitions occurred prior to Series C round, compared to an average of 78% from 2014 to 2019.1 To see late-stage strategies return to a healthier cycle of fundraising, distributions and new investment, an increase in exits to release trapped value is a key catalyst.

Please see Additional Information at the bottom of this report for definition of early and late-stage venture capital.

Recent Market Trends

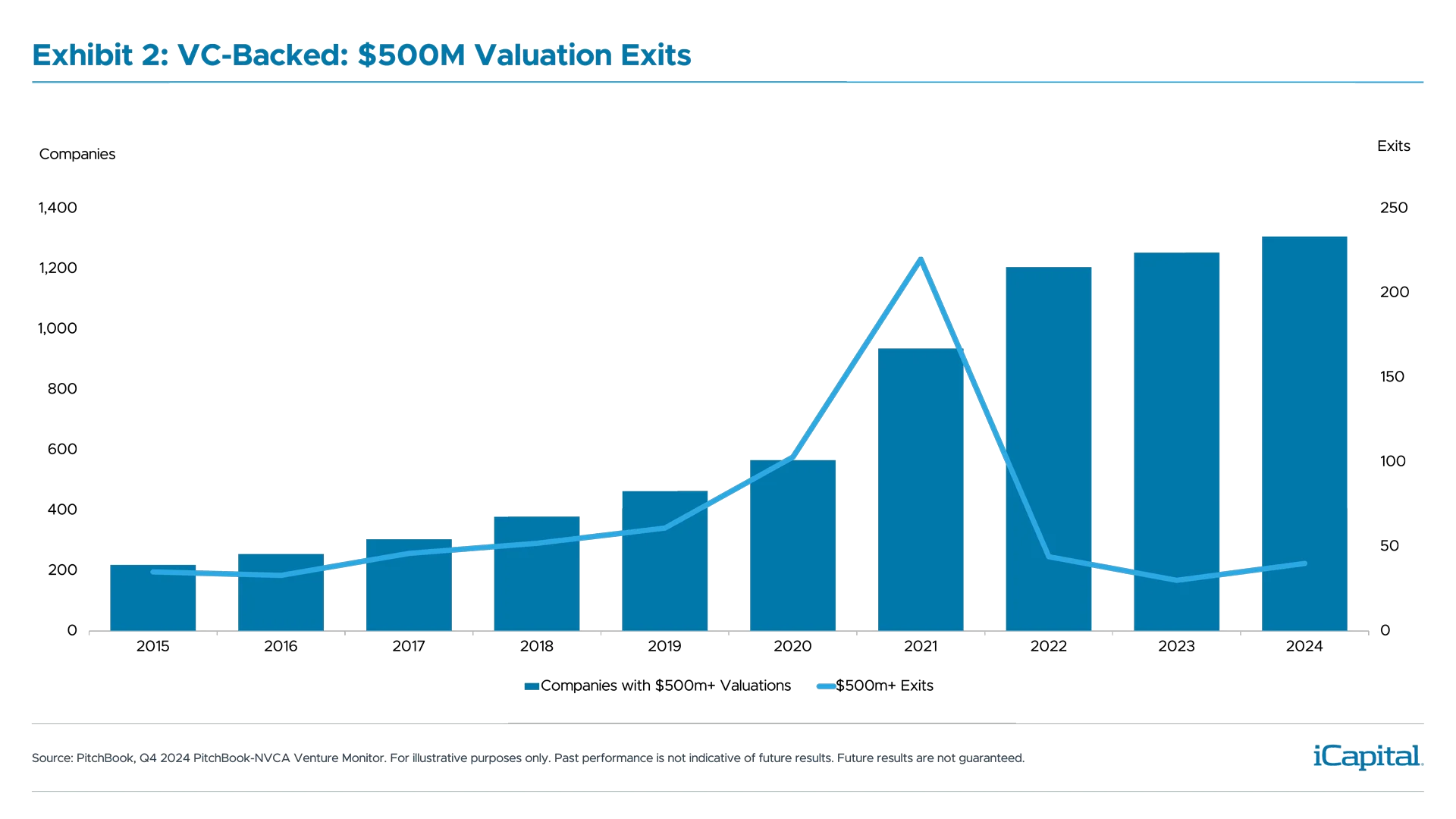

Slow deal and exit activity have been a challenge for all stages of the venture capital industry over the last few years. This can be a bigger issue for late-stage venture as exits in these strategies are tied to larger transactions which are difficult in a slower deal environment. According to the PitchBook NCVA Venture Monitor report, exits of $500 million or more accounted for 4% of all exits but accounted for 79% of total exit value in 2024. Further, there are more venture-backed companies valued at $500 million or more than ever, highlighting the trapped value that is sitting in larger, harder to exit VC-backed companies.

Slow deal and exit activity have been a challenge for all stages of the venture capital industry over the last few years. This can be a bigger issue for late-stage venture as exits in these strategies are tied to larger transactions which are difficult in a slower deal environment. According to the PitchBook NCVA Venture Monitor report, exits of $500 million or more accounted for 4% of all exits but accounted for 79% of total exit value in 2024. Further, there are more venture-backed companies valued at $500 million or more than ever, highlighting the trapped value that is sitting in larger, harder to exit VC-backed companies.

Late-stage venture strategies have been increasingly tied to outsized deals, which have been influenced by the opportunities in AI. But the concentration of these investment opportunities in select funds suggests that not all investors will benefit until the market sees broader deal and exit activity and/or or the number of large exits increases. A barometer for large exit activity is the health of the IPO market. While IPOs represent the smallest volume of exits, averaging 8% of all venture exits over the last decade, they are typically the largest exit for venture firms.2

Industry Focus: Artificial Intelligence

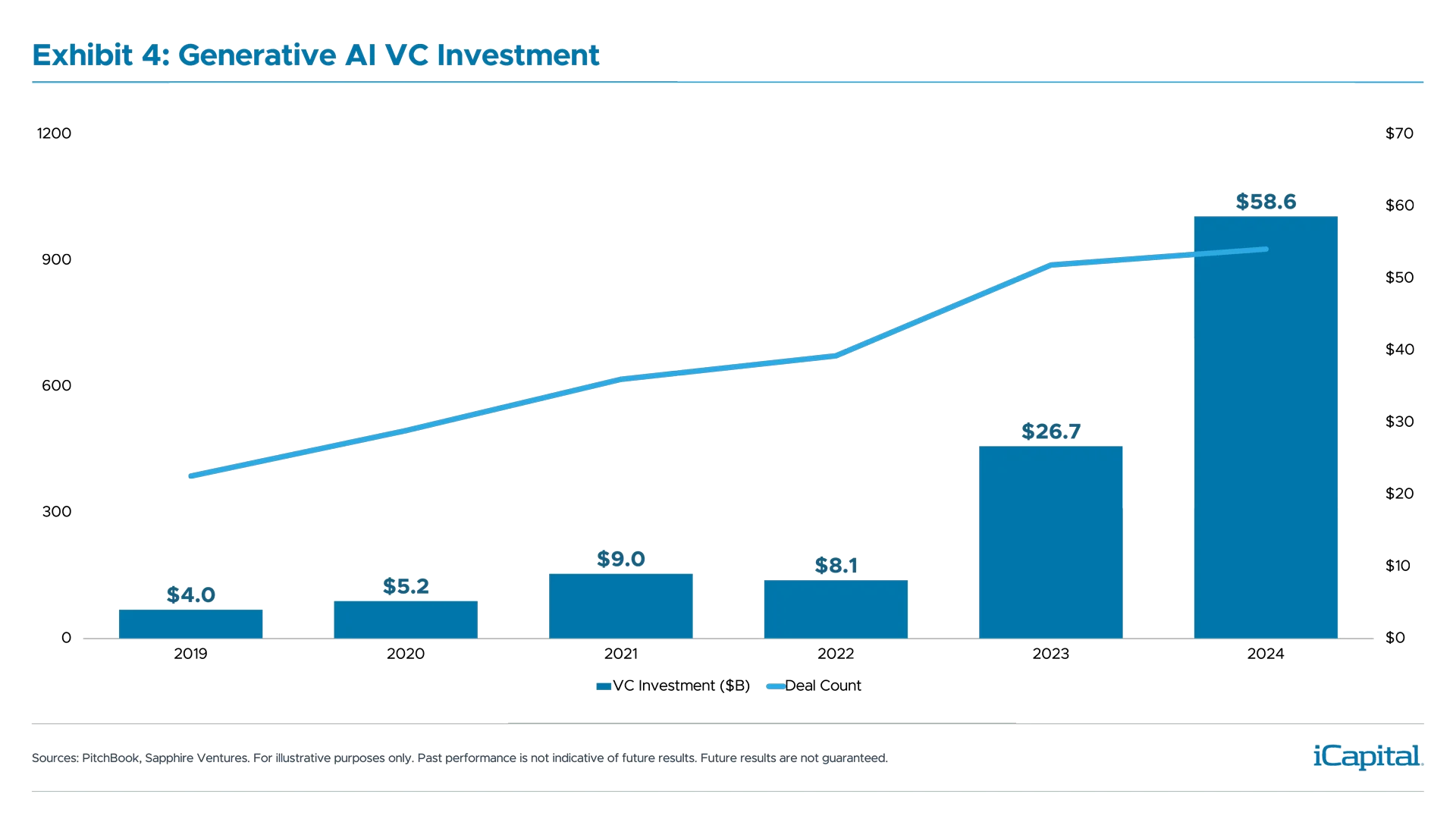

Venture investment in AI companies has increased seven-fold in two years to $59 billion (Exhibit 4). This compares to overall venture capital investment that has been flat-to-down over the same period. Across AI, outsized deals have been the main driver of total investment and valuation, arguably providing an inflated sense of health for late-stage strategies.

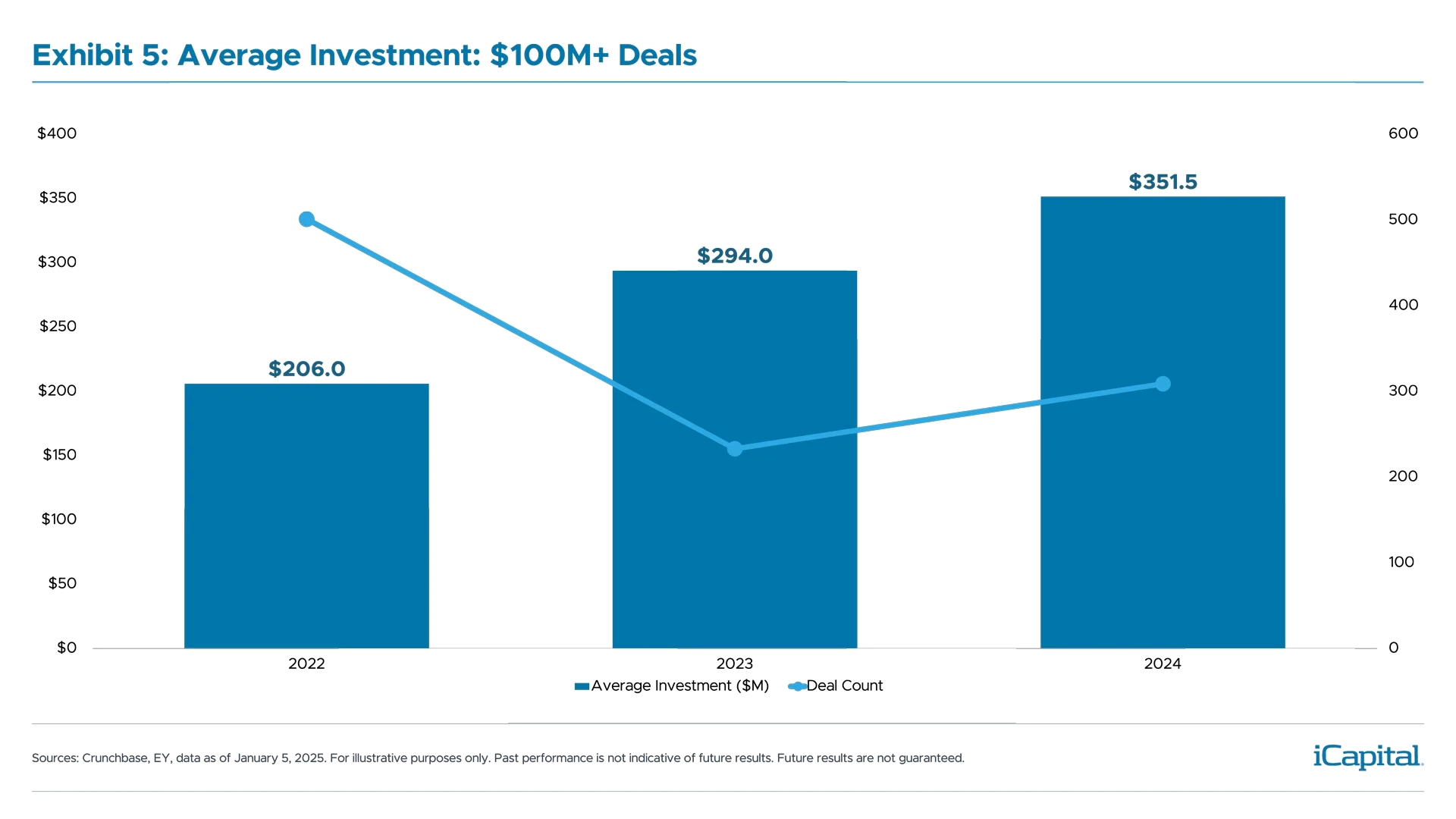

In looking at just large financing rounds ($100 million-plus) that occur in later-stage venture, average deal size increased in both 2023 and 2024 to $351 million in 2024 (Exhibit 5). This increase was significantly influenced by AI which, according to Crunchbase and EY, accounted for 44% of all VC investment and six of the top 10 deals in 2024.

Given the early stage of the AI revolution – and wide scope spanning computing infrastructure to software – many expect AI to continue to influence the venture market for years to come.

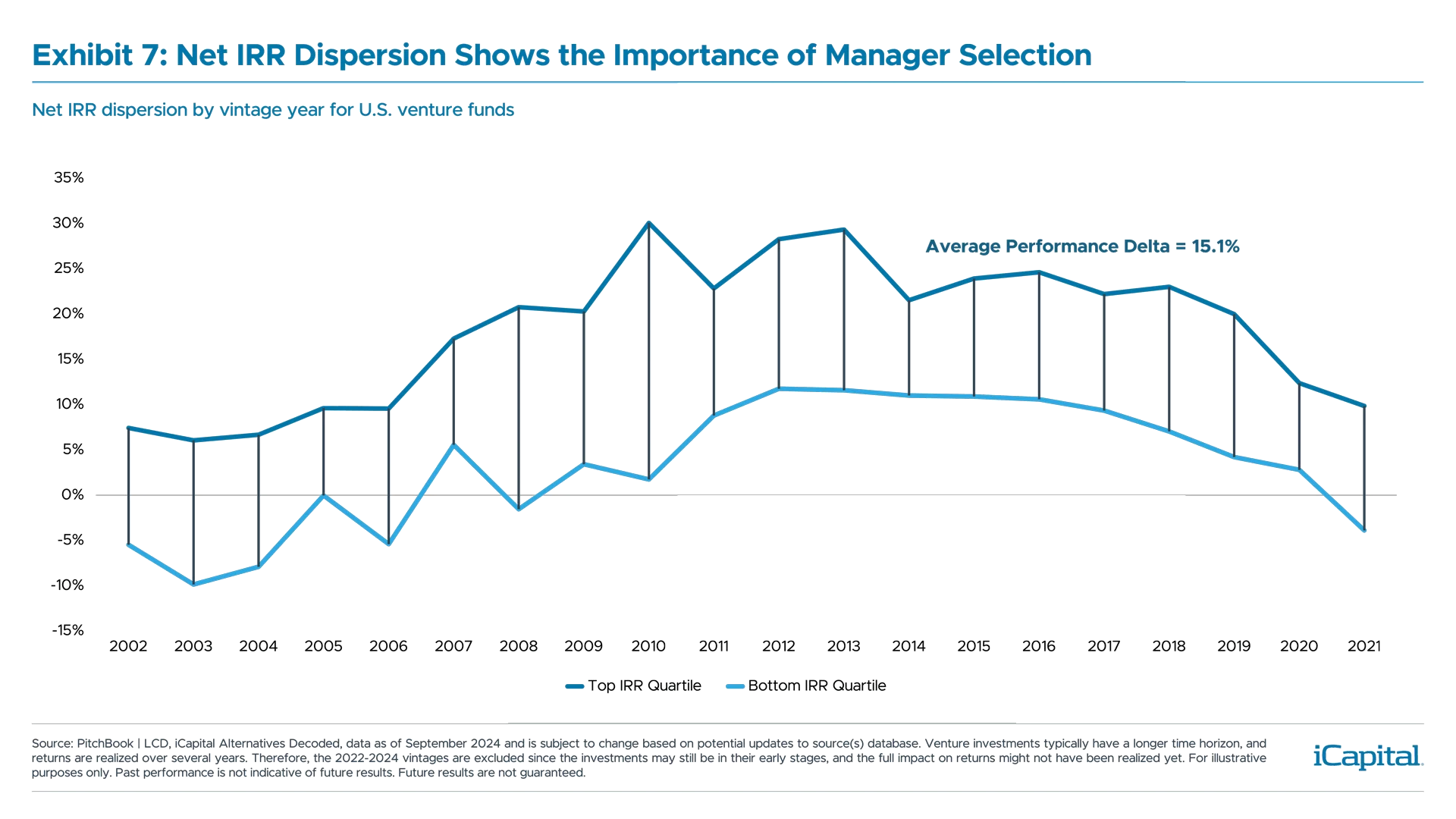

Large deals drive the most exit value and rely on a cooperative IPO market. However, the race for AI technology and talent has also led to large acquisition exits and other non-traditional deals where established technology companies aim for a partnership approach. AI exits will be a key for late-stage strategies given that companies can stay private for longer without compromising valuation. From an investor standpoint, manager selection remains critical due to the concentration of top-tier venture firms, and the reward that comes with this.

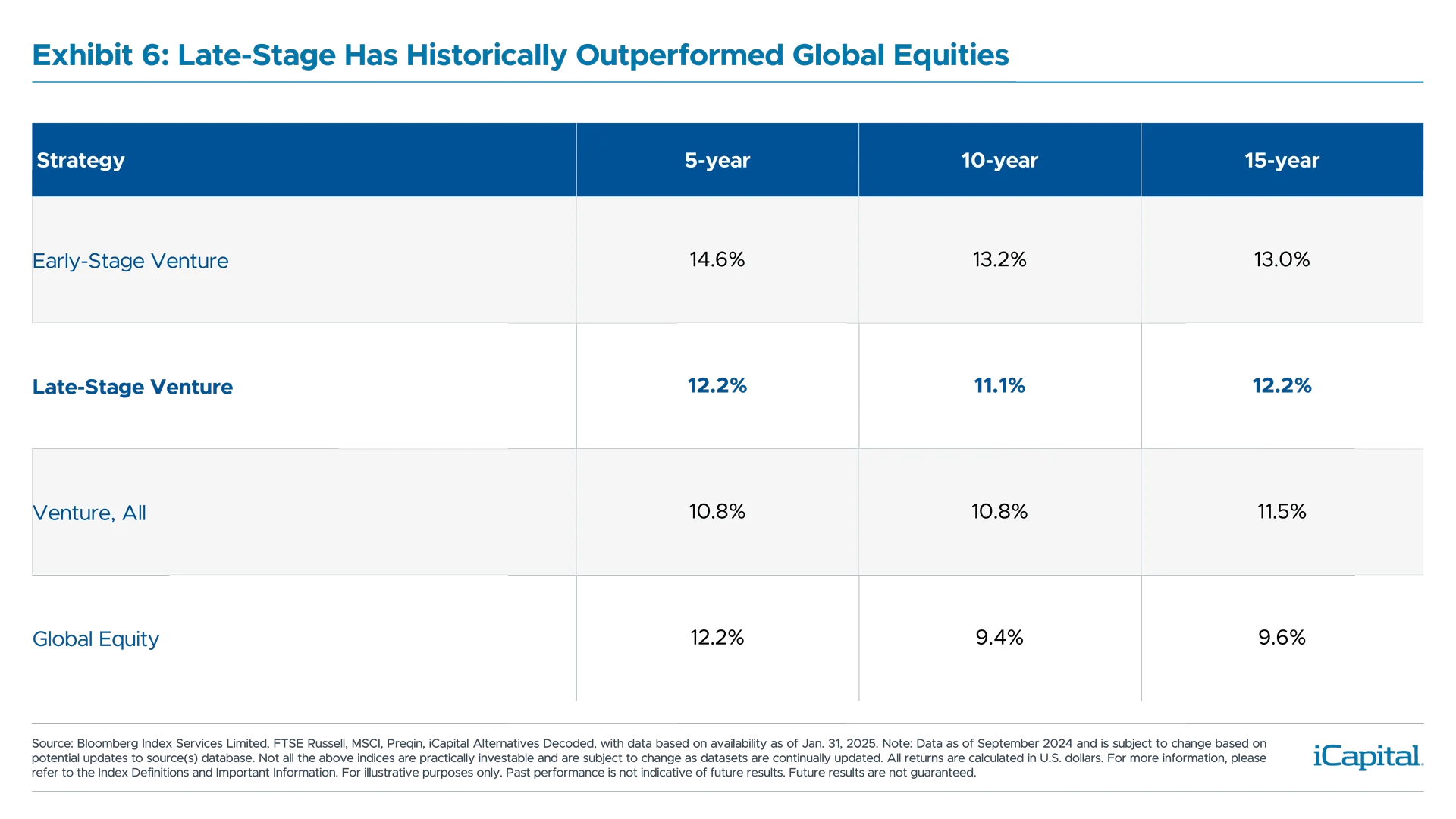

Performance Snapshot

Endnotes

- PitchBook, “Q4 2024 PitchBook-NVCA Venture Monitor”, January 13, 2025.

- PitchBook, “2025 US Venture Capital Outlook”, December 16, 2024.

Additional Information:

We define Early-Stage Venture as companies in Series A or B of financing; and Late-Stage as Series C or D.

Performance Snapshot, Exhibit 6: Venture - All proxied by Preqin Venture Capital Index. Late-Stage Venture proxied by Preqin Venture Capital Late-Stage Index. Early-Stage Venture proxied by Preqin Venture Capital Early-Stage Index. Global Equity proxied by MSCI ACWI Total Return Index.

Index Definitions:

Preqin Venture Capital Index: The index covers over 14,000 closed-end funds captured in the broader Private Capital index including funds/strategies listed as Early Stage, Early Stage: Seed, Early Stage: Start-up, Expansion/Late Stage, Venture (general), as defined by Preqin

Preqin Venture Capital Early-Stage Index: The index covers closed-end funds captured in the broader Private Capital index including funds/strategies that invests only in the early stage of a company’s life defined either as Seed or Start-up, as defined by Preqin.

Preqin Venture Capital Late-Stage Index: The index covers closed-end funds captured in the broader Private Capital index including funds/strategies that invests in companies towards the end of the venture stage cycle, as defined by Preqin.

MSCI ACWI Index: MSCI’s flagship global equity index is designed to represent performance of the full opportunity set of large- and mid-cap companies from developed and emerging markets around the world.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection, or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.