Investment Outlook

Private infrastructure includes long-duration investments that aim to provide a mix of cash income and capital appreciation and can play a role in complementing a fixed income allocation. Infrastructure projects are large-scale and tend to have project-specific return elements with revenue tied to usage volume and little sensitivity to price. Given performance is often tied to individual projects, these assets have a longer investment horizon.

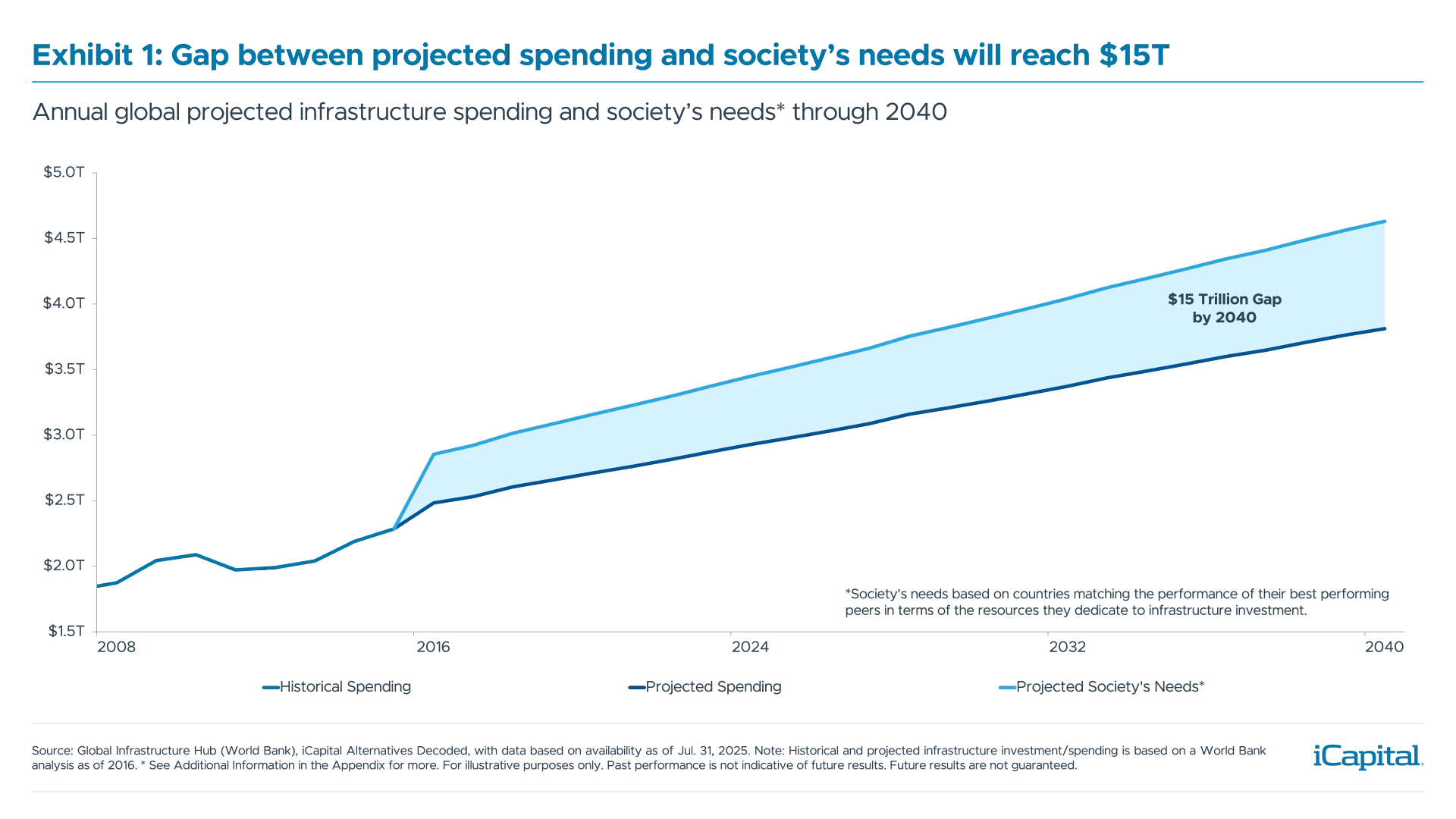

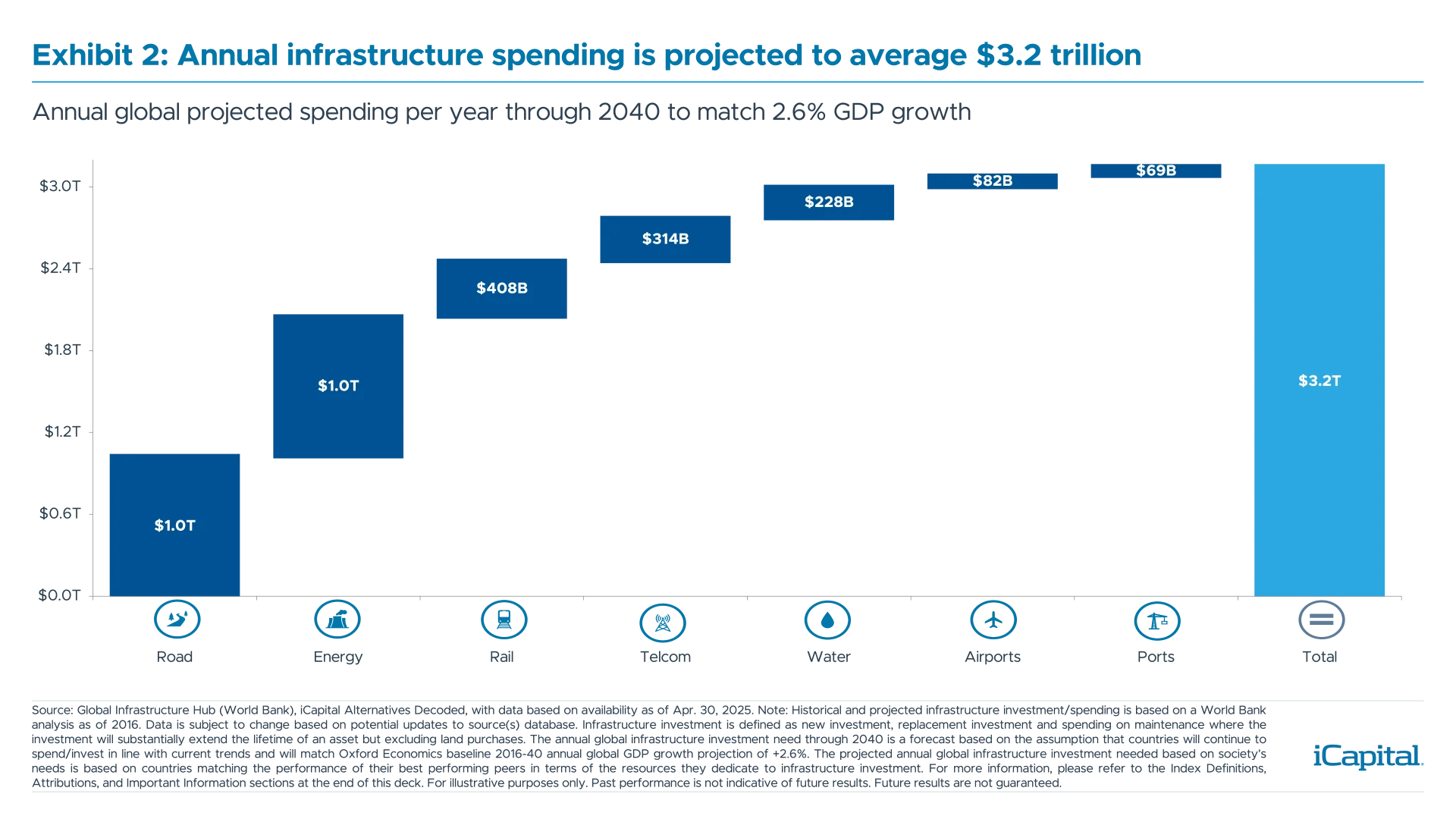

An attractive supply and demand environment, in part to a large funding gap, has been drawing interest to the infrastructure opportunity. According to The Work Bank, the projected infrastructure spending to meet societal needs will reach $15 trillion by 2040. Projects tend to be large and expensive with 10-plus year time periods, which is ideal for private market investments. Further, growing public deficits are shifting more financing opportunities to the private sector.

The opportunity is characterized by a push towards renewable energy projects and supportive policies such as the 2022 U.S. Inflation Reduction Act (IRA). Importantly, this is a global trend also affecting Europe and Asia. For example, the NextGenerationEU’s Recovery and Resilience Facility (RRF) is a financing facility geared towards climate transition and digital transition projects for EU Member States.

Infrastructure is not without risks, including financial and operational risks.1 Because projects have high costs and long payback periods, duration risk exists. Economic growth can also affect GDP-sensitive sectors such as transportation while regulatory hurdles and shifting policy landscapes can be difficult to predict. For example, rather than a single provision, the recently enacted One Big Beautiful Bill Act (OBBBA) includes a series of changes that, on net, scales back parts of the IRA’s energy transition agenda. Most notably, it accelerates the phase-out of clean energy investment (ITC) and production (PTC) tax credits for wind and solar. The earlier phase-out of wind and solar credits may drive a near-term flurry of deal activity through mid-2026.

Infrastructure is not without risks, including financial and operational risks.1 Because projects have high costs and long payback periods, duration risk exists. Economic growth can also affect GDP-sensitive sectors such as transportation while regulatory hurdles and shifting policy landscapes can be difficult to predict. For example, rather than a single provision, the recently enacted One Big Beautiful Bill Act (OBBBA) includes a series of changes that, on net, scales back parts of the IRA’s energy transition agenda. Most notably, it accelerates the phase-out of clean energy investment (ITC) and production (PTC) tax credits for wind and solar. The earlier phase-out of wind and solar credits may drive a near-term flurry of deal activity through mid-2026.

Recent Market Trends

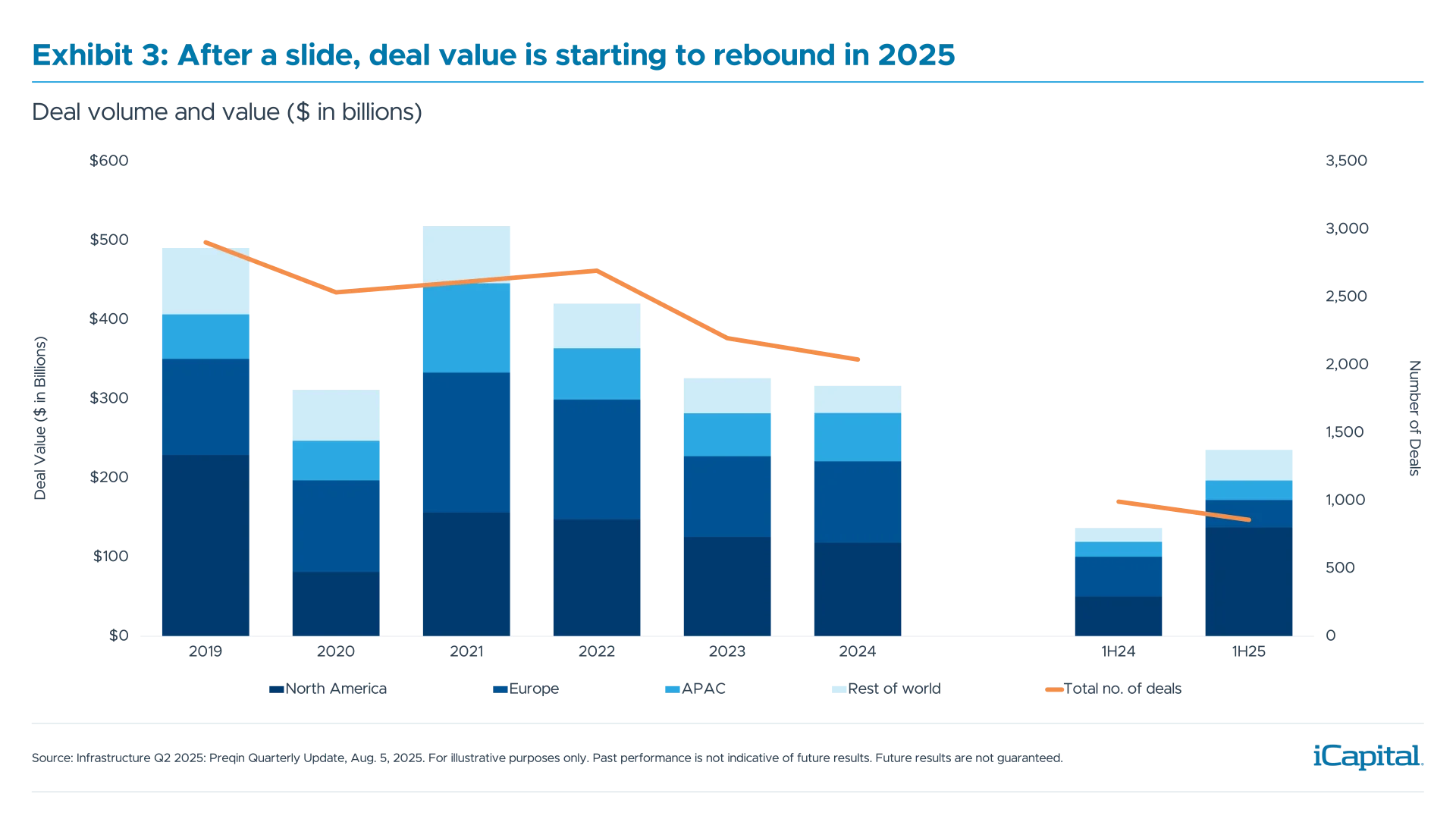

The interest in infrastructure is backed by strong demand, especially around digital infrastructure and energy transition opportunities. Infrastructure funds raised over $115 billion in the first half of 2025, compared to $102 billion for all of 2024, and are on pace to exceed annual fundraising highs from 2022.2 Transaction activity has been lower over the last several years. However, deal activity is improving in 2025 and is on pace to show annual growth from 2024 due in part from larger deals (Exhibit 3).

Globally, we estimate that significant funding gaps exist that will require annual investments of $3.2 trillion in infrastructure assets through 2040 in order to keep pace with global GDP growth.3 This is nowhere more evident than the increase in the electricity and data center demand associated with the rapid development of artificial intelligence (AI). Amazon, Google, Meta, and Microsoft invested roughly $180 billion into data center expansion in 2024, with large portions of these investments earmarked for deals with private market firms to develop energy infrastructure.4

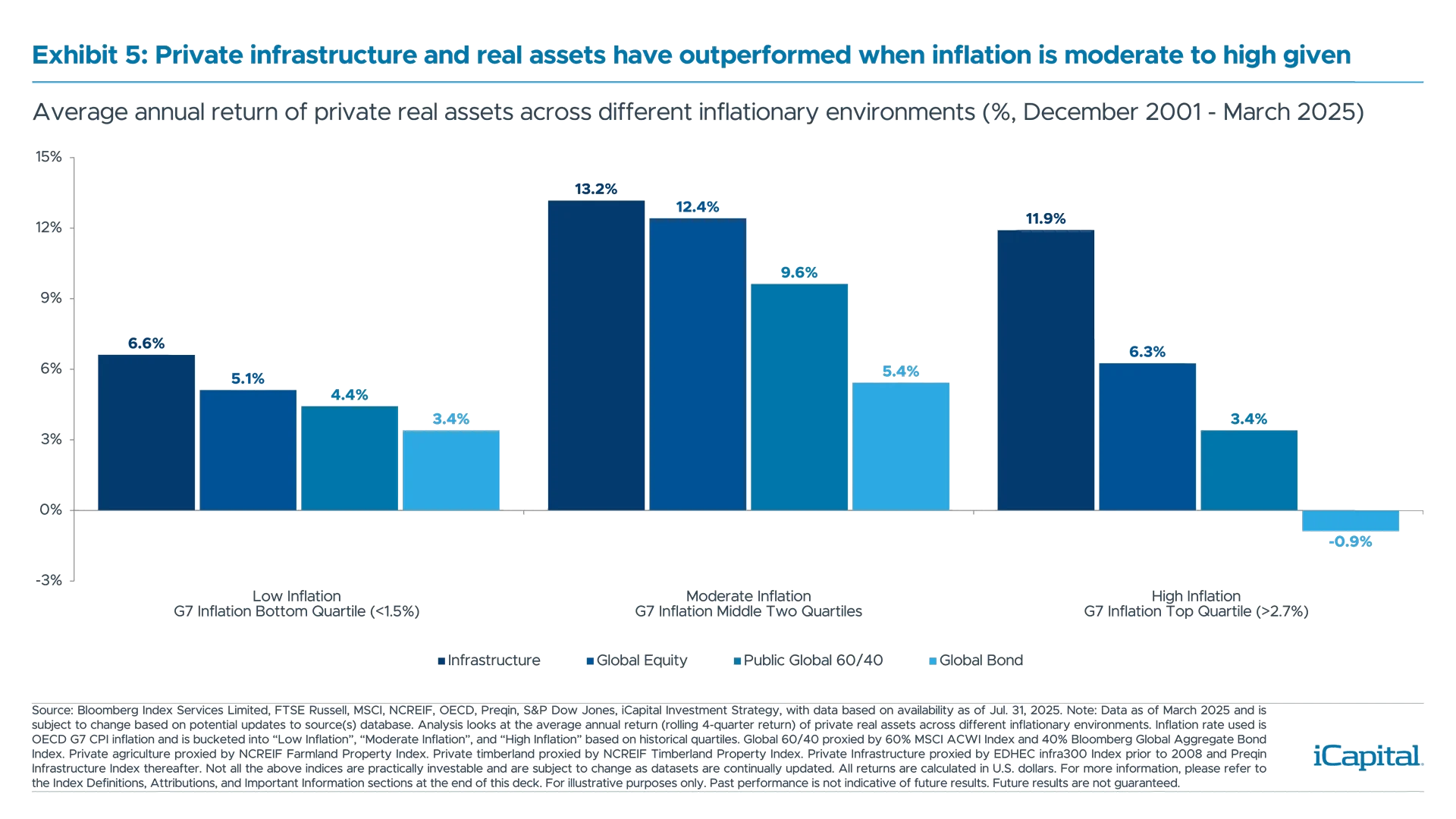

Governments are also increasingly using a variety of public-private partnerships to bridge infrastructure funding gaps. In the U.S. alone, there is an estimated $2.9 trillion of cumulative investment need for the period 2020 to 2029, much of which is unfunded.5 With so much focus on growing public deficits, many of these projects will likely be funded through the private markets, which currently sit on $350 billion in dry powder.6 There are also tactical tailwinds that could support infrastructure. For example, should inflation remain elevated from tariffs enacted by the U.S. administration, fund flows could see support as infrastructure typically outperforms in moderate and high inflation environments.

Governments are also increasingly using a variety of public-private partnerships to bridge infrastructure funding gaps. In the U.S. alone, there is an estimated $2.9 trillion of cumulative investment need for the period 2020 to 2029, much of which is unfunded.5 With so much focus on growing public deficits, many of these projects will likely be funded through the private markets, which currently sit on $350 billion in dry powder.6 There are also tactical tailwinds that could support infrastructure. For example, should inflation remain elevated from tariffs enacted by the U.S. administration, fund flows could see support as infrastructure typically outperforms in moderate and high inflation environments.

Industry Focus – Electricity

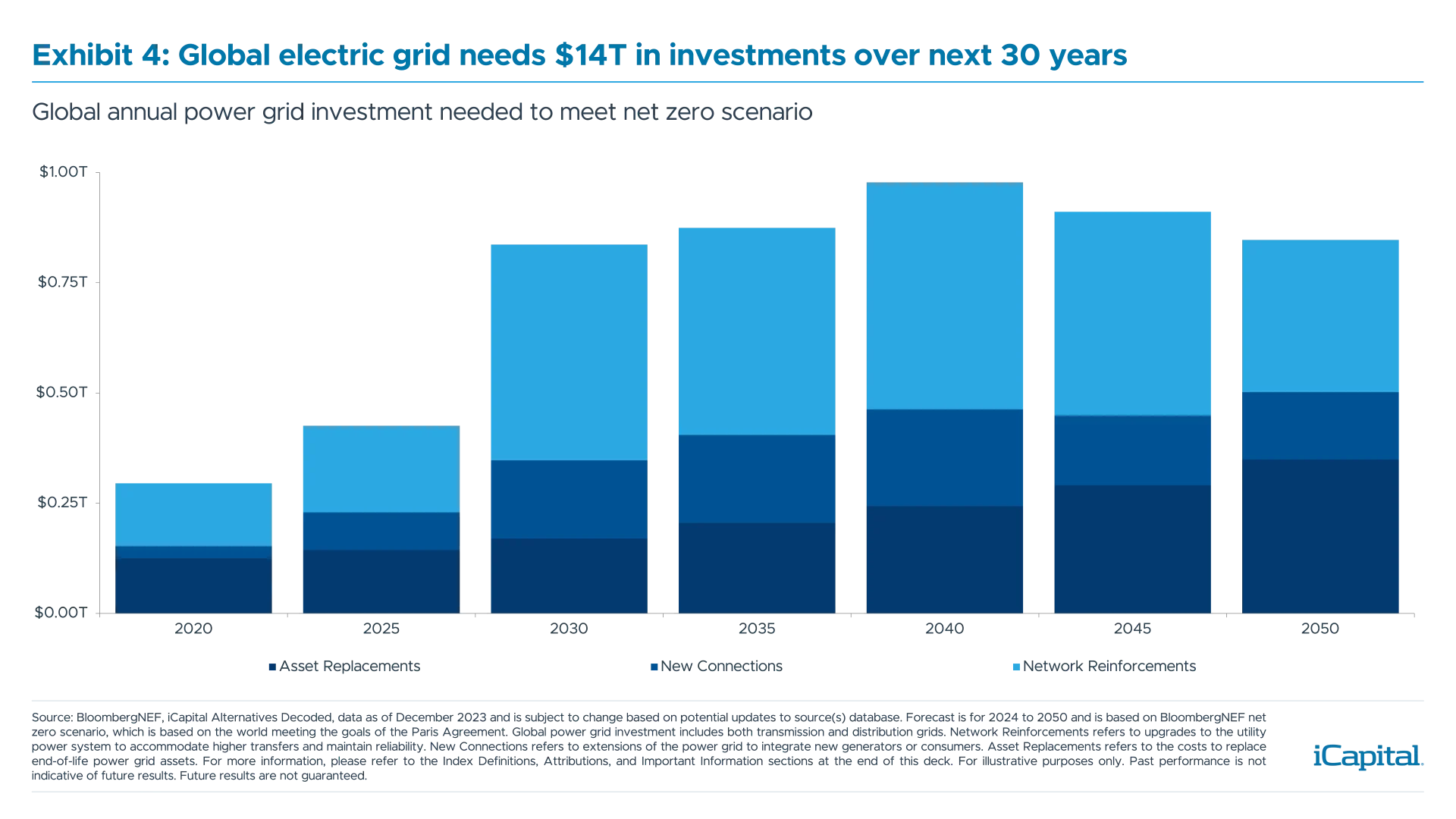

The increasing appetite for data centers isn’t just affecting traditional and renewable energy demand, but also the need for investment in power and utilities. This includes both the need for more power generation projects as well as grid connection capacity to meet the upcoming demand. Some sources forecast that data centers could account for up to 12% of total U.S. electricity consumption by 2028, from about 4.4% in 2023.7 Starting in 2017, the growth of graphic processing unit (GPU)-accelerated servers for AI became such a significant portion of data center usage that it had a material uplift on data center electricity demand.

Upgrading electricity infrastructure is also critical in meeting growing global demand for energy. The World Bank estimates that over 700 million people lack access to electricity, primarily in Sub-Saharan Africa and South Asia.8 Elsewhere, outdated grids do not always have the flexibility or capability to successfully integrate high levels of solar power. Smart grids can balance supply and demand, optimize energy flow, and accommodate intermittent sources of energy such as wind and solar. The global push for renewable energy sources requires significant upgrades to successfully integrate these energy sources.

Upgrading electricity infrastructure is also critical in meeting growing global demand for energy. The World Bank estimates that over 700 million people lack access to electricity, primarily in Sub-Saharan Africa and South Asia.8 Elsewhere, outdated grids do not always have the flexibility or capability to successfully integrate high levels of solar power. Smart grids can balance supply and demand, optimize energy flow, and accommodate intermittent sources of energy such as wind and solar. The global push for renewable energy sources requires significant upgrades to successfully integrate these energy sources.

In the interim, developed nations will be reliant on low cost and available power through existing sources. The U.S. is expected to see incremental demand of 3.3 billion cubic feet per day of new natural gas demand by 2030.9 New midstream pipeline capacity will be needed to supply further consumption domestically. Separately, European nations maintain the oldest power gids in the world with the majority of supply sourced from hydro, wind, and solar. To create more capacity, modernization of transmission and distribution requires $861 billion of capital investment over the next decade. Furthermore, an added $900+ billion of investment in solar and wind energy projects will be needed to support expected growth to consumption into the 2030s.10

Performance Snapshot

ENDNOTES

- Different types of private infrastructure investments have different risk and return characteristics. See Infrastructure: More Than Just an Inflation Hedge for more.

- Infrastructure Q2 2025: Preqin Quarterly Update, Aug. 5, 2025.

- iCapital Alternatives Decoded, World Bank’s G20 Global Infrastructure Hub, Oxford Economics

- Dell’Oro Group, company reports.

- iCapital Alternatives Decoded Q2 2025 based on data from American Society of Civil Engineers.

- Preqin, as of Jan. 31, 2025.

- Source: Berkeley National Laboratory, 2024 United States Data Center Energy Usage Report.

- 2024 Tracking SDG 7: The Energy Progress Report, Press release tracking SDG7 2024 World Bank

- Source: Goldman Sachs: AI is poised to drive 160% increase in data center power demand

- Ibid

ADDITIONAL INFORMATION:

For Exhibit 1, infrastructure investment is defined as new investment, replacement investment and spending on maintenance where the investment will substantially extend the lifetime of an asset but excluding land purchases. The annual global infrastructure investment need through 2040 is a forecast based on the assumption that countries will continue to spend/invest in line with current trends and will match Oxford Economics baseline 2016-40 annual global GDP growth projection of +2.6%. The projected annual global infrastructure investment needed based on society’s needs is based on countries matching the performance of their best performing peers in terms of the resources they dedicate to infrastructure investment. For more information, please refer to the Index Definitions, Attributions, and Important Information sections at the end of this deck.

INDEX DEFINITIONS

Bloomberg Global Aggregate Bond Index: A flagship measure of global investment grade debt from a multitude of local currency markets. This multi-currency benchmark includes treasury, government-related, corporate, and securitized fixed-rate bonds from both developed and emerging markets issuers

EDHEC infra300 Index: The index is a global index that represents the monthly total return of 300 unlisted infrastructure companies and is designed to provide an accurate reflection of the performance of the unlisted infrastructure sector

MSCI ACWI Index: MSCI’s flagship global equity index is designed to represent performance of the full opportunity set of large- and mid-cap companies from developed and emerging markets around the world.

NCREIF Farmland Property Index: The NCREIF Farmland Index is a quarterly time series composite return measure of investment performance of a large pool of individual farmland properties acquired in the private market for investment purposes only.

NCREIF Timberland Property Index: The NCREIF Timberland Index is a quarterly time series composite return measure of investment performance of a large pool of individual U.S. timber properties acquired in the private market for investment purposes only.

Preqin Infrastructure Index: The index covers over 14,000 closed-end funds captured in the broader Private Capital index including funds/strategies listed as Infrastructure core, infrastructure core-plus, infrastructure debt, infrastructure fund of funds, infrastructure opportunistic, infrastructure secondaries, infrastructure value added, as defined by Preqin.

IMPORTANT INFORMAITON

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax, and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit from an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection, or forecast on the economy, stock market, bond market, or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third-party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete, and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2025 Institutional Capital Network, Inc. All Rights Reserved.