KEY TAKEAWAYS

• For the decade from 2010 to 2019, large buyout funds outperformed all other fund size cohorts across a variety of metrics, including pooled and median returns.

• The marked improvement in large buyout fund performance in recent years may reflect structural trends driven by private equity market maturity, rather than transient business and economic dynamics. In fact, as the private equity market has matured over the last decade there appears to be a growing advantage to operating at scale.

• Leveraging greater scale, including the ability to write bigger checks and increasing operational advantages, large funds have been able to support and take advantage of the elongation of the private company life cycle.

• As the private equity industry has matured and dollars have chased outperformance, stronger managers have transitioned into the large fund cohort, boosting the overall returns within this sector.

There exists a curious narrative regarding large buyout funds.*

On the one hand, they are highly sought after. Large funds operated by established private equity firms continue to raise significant sums of capital and have of late been oversubscribed.1 Large funds accounted for 41% of fundraising across all buyout funds in 2021.2 On the other hand, a section of investors look upon large funds as staid operators in a more competitive section of the market, with less potential upside than smaller, more nimble firms.

Both of these things could be true—large buyout funds could be popular in part because they are relatively unexciting, with investors looking to add what could be perceived as more dependable returns to their portfolio. And for large funds launched in the first decade of the millennium, the perception of solid but unspectacular returns was indeed accurate, particularly for the vintages that invested into the Global Financial Crisis (GFC).3 Smaller funds posted the best returns during this decade.4 However, the story in the decade that followed has been very different. Globally, large buyout funds have outperformed all other fund size cohorts across a variety of metrics, including pooled and median returns, and all with a higher floor.5

While there is no guarantee that this outperformance will continue, there are good reasons to think that the improvements in large fund performance may be as much structural as they are a result of business and economic cycles. In short, as the private equity market has matured over the last decade, there appears to be a growing advantage to operating at scale.

In this paper, we will explain the changes that have underpinned recent improvements in large fund performance, which broadly fall into three main categories, all of which to some extent reflect the increasing maturity of the private equity market. These are:

• The rise of well-run, high-performing funds into the large fund cohort

• Shifting dynamics in the broader private investment space

• Operational improvements derived from greater scale and experience

Before we break down each of these trends, however, it is important to examine the performance data highlighting the resurgence of large funds over the last few years.

THE DATA

A tale of two decades

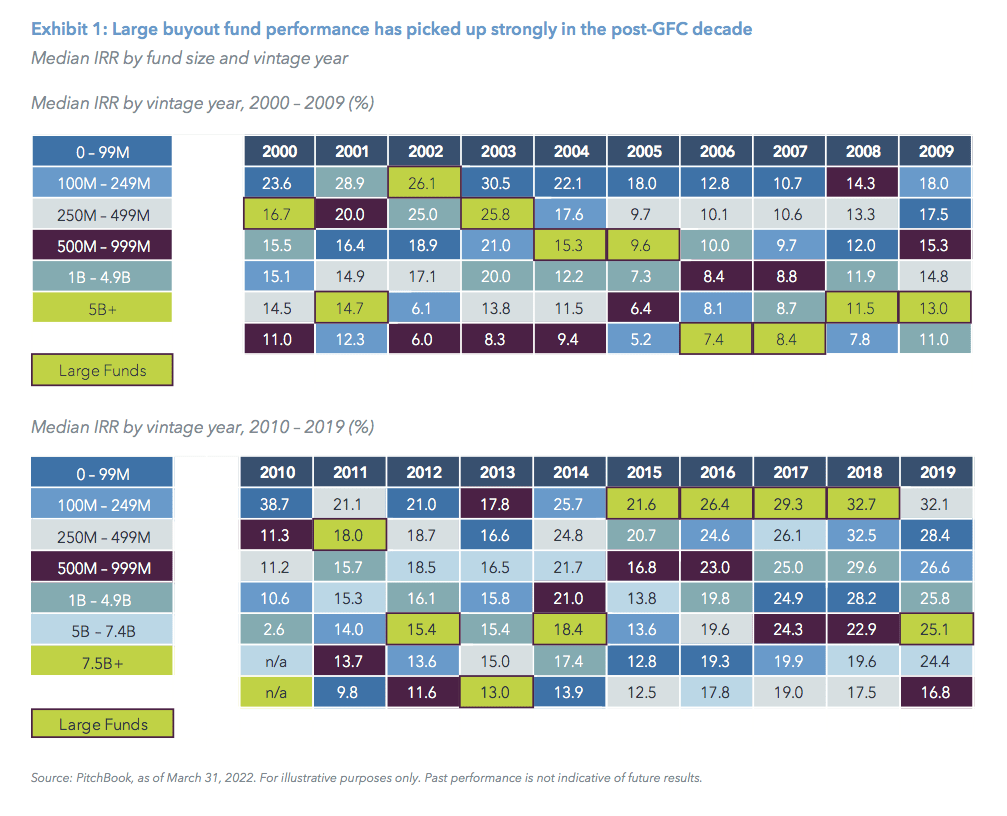

Aside from highlighting the truism that it is very difficult to time investments in private equity across any dimension (vintage, fund size, strategy, geography, etc.), the median internal rate of return (IRR) data paint a clear picture of two distinct decades. Large funds performed moderately, relative to other fund size cohorts, in the years up to and including the GFC, but produced strong relative (and absolute) performance as we moved through the last decade (See Exhibit 1).

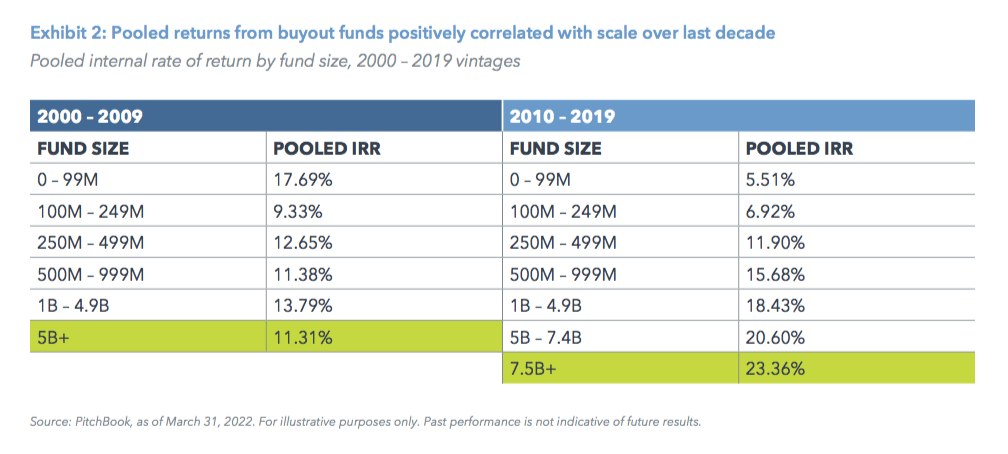

Evaluating the data through the lens of a pooled IRR—which can provide a more holistic view of returns by considering and aggregating cash flows during an investment period— paints an even starker picture (See Exhibit 2). Although small buyout funds collectively outperformed their larger peers in the decade from 2000 to 2009, for the 2010 to 2019 vintages, large funds returned a pooled IRR of more than 23%, with an almost linear positive relationship between returns and fund scale.6

Large funds a consistently safe bet

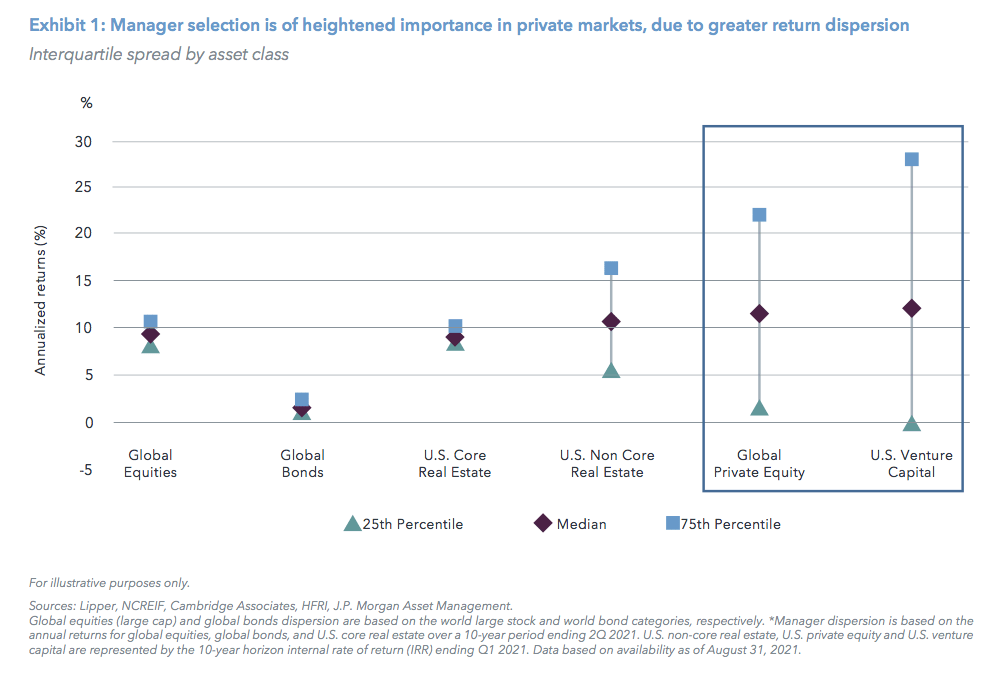

Median and pooled returns are certainly representative, but they also do not present the full picture—an investor is not going to select the median fund in each vintage nor invest in all of them. Fund selection is of heightened importance in private equity relative to public market funds, as the performance dispersion is much wider.7

This means that analyzing the distribution of returns is even more important in private equity than in other asset classes, as this provides a much clearer picture of the true upside and risk of a particular fund category or cohort.

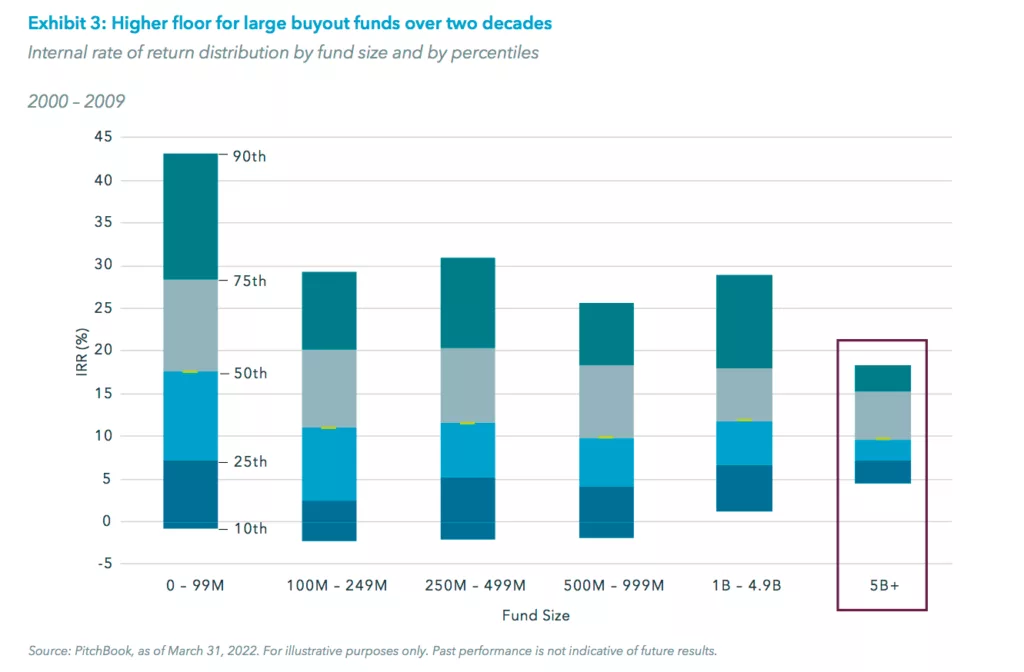

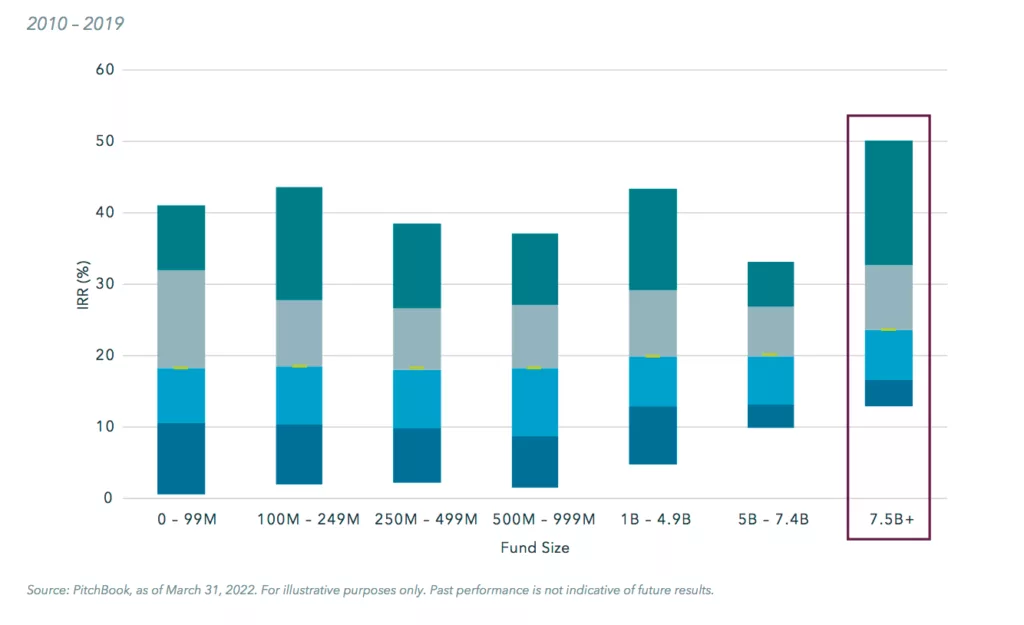

Looking at the percentile data (showing performance of funds at the 10th, 25th, 50th, 75th, and 90th percentile levels) for each decade in our analysis reinforces the evidence of a notable shift in large buyout fund performance (See Exhibit 3).

The performance of larger funds from 2000 to 2009 may explain why some investors came to perceive them as relatively uninspiring. However, 2010 to 2019 data tell a very different story. This tale of two decades echoes the data presented in earlier exhibits, but the percentile data importantly highlight one constant: the higher floor on returns from large funds.8

Even though returns for a top-decile large fund in the first decade were a relatively disappointing 18.3%, the bottom-decile fund still produced positive annualized returns (4.4%).9 This was the strongest bottom-decile performance across all fund size cohorts, and large funds maintained the highest floor across the next decade.10 At the same time, large funds in the 2010 to 2019 vintages were able to pair this higher floor with greater upside. The upper-decile fund produced an IRR of just over 50%.11

WHAT CHANGED?

So, having established a clear pattern of improved performance, the multibillion-dollar question is, what changed?

We posit that it reflects a combination of trends that, to some extent, each signal the increasing maturity of the private equity market. The trends we identify are: the movement of outperforming managers into the large fund space as investors committed more capital to them; changing market dynamics in the private equity space; and operational advantages and improvements among managers of large funds.

The rise of outperformers

The first trend that we believe has helped support stronger performance among large buyout funds is the graduation of higher-performing managers into this cohort.12

Many of the firms at the larger end of the private equity market got big for a good reason, which is that investors rewarded high performance by increasing allocations to future funds. Numerous firms have moved from the lower middle market into the middle market, and eventually into the large fund cohort.13

This trend illustrates the importance of increasing industry maturity as a key driver of improved returns by larger funds. Performance drove investment in skilled managers, and as they continued to outperform, the virtuous circle continued.

This is more than anecdotal. Our analysis of performance data indicates that those firms that outperformed with smaller funds have remained relative outperformers after raising much larger amounts of capital, making an outsized contribution to improved performance of this cohort since 2015.14

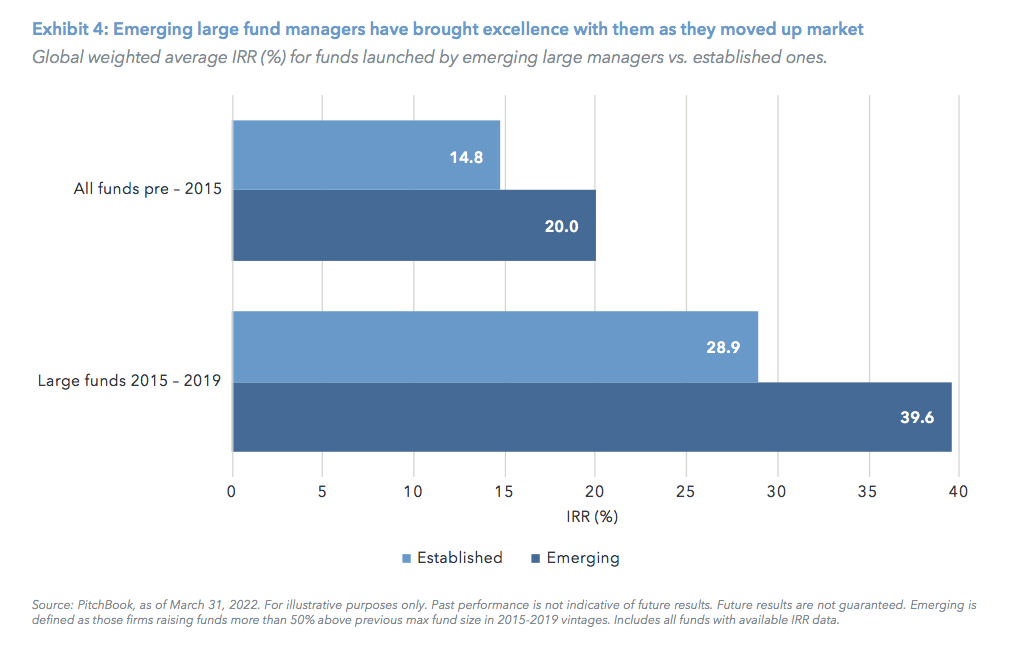

Our global emerging large-manager cohort featured firms that raised a $7.5 billion-plus buyout fund in the 2015 to 2019 period that was at least 50% larger than their prior high-water mark for a fundraise (performance metrics for funds launched after 2019 are not yet statistically meaningful). A total of nine fund managers fell into this category. Fourteen managers that had raised large funds in that period did not meet this same expansion criterion— these comprised our established manager cohort.

By calculating an aggregate weighted average IRR for all the buyout funds raised by these managers for the periods before and after 2015, we were able to make a direct comparison of their performance. We found that the emerging managers had outperformed the established players before 2015 (prior to becoming large fund managers) and had continued to do so via their large funds from 2015 onwards (See Exhibit 4).

The emerging managers’ large funds had an aggregate weighted average IRR more than 10 percentage points higher than that of the established manager cohort, with their earlier funds having outperformed the established managers by more than five percentage points.15 This emerging manager group accounted for 40% of capital raised by large buyout funds from 2015 to 2019,16 so it seems fair to conclude that their outperformance has meaningfully boosted the overall return figures presented in Exhibit 1 during that period.

A closer look at our data suggests that the strongest performing large buyout funds over the last few years are those that have remained relatively focused in terms of the asset classes or geographies in which they invest.17 Rather than deviating into a variety of asset classes, like real estate and real assets, these firms have typically focused on an area in which they specialize. Where they have expanded, they have been selective and have tended to extend the same investment team, or ensure strong connectivity with a new team to maintain the same culture and rigor.

Managers that remain focused are likely to have an advantage in terms of identifying the best deals. More than that, they are more likely to access deals earlier than other firms as a preferred partner within that sector, potentially sidestepping a public auction and allowing them to execute a deal on more favorable terms.18 A focused approach can also help keep the most skilled investment professionals working on managing investments, rather than drifting into broader management positions within these firms. Attracting and retaining talent and then keeping them in the right roles is vital to optimal deal selection. The best people will be able to identify good deals quickly and execute them efficiently and at the best possible price.

Market dynamics benefiting larger funds

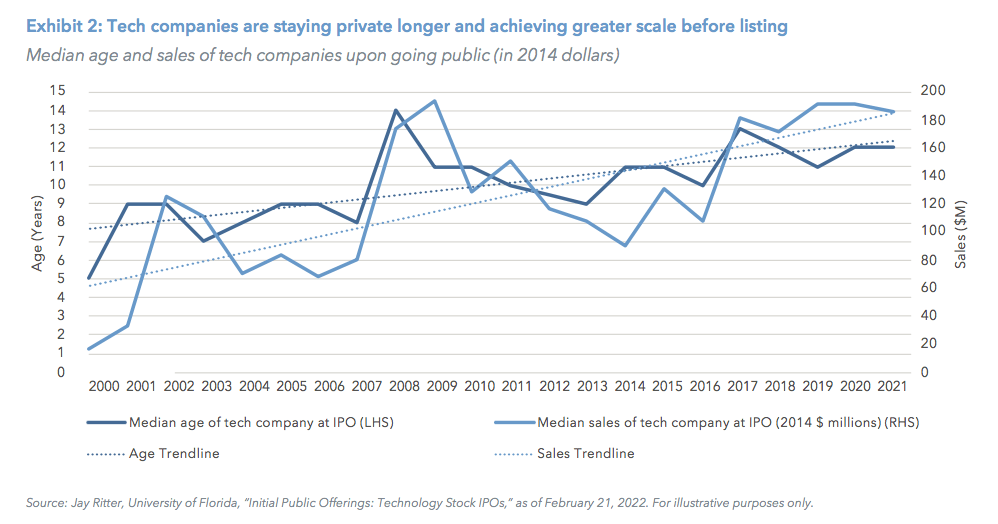

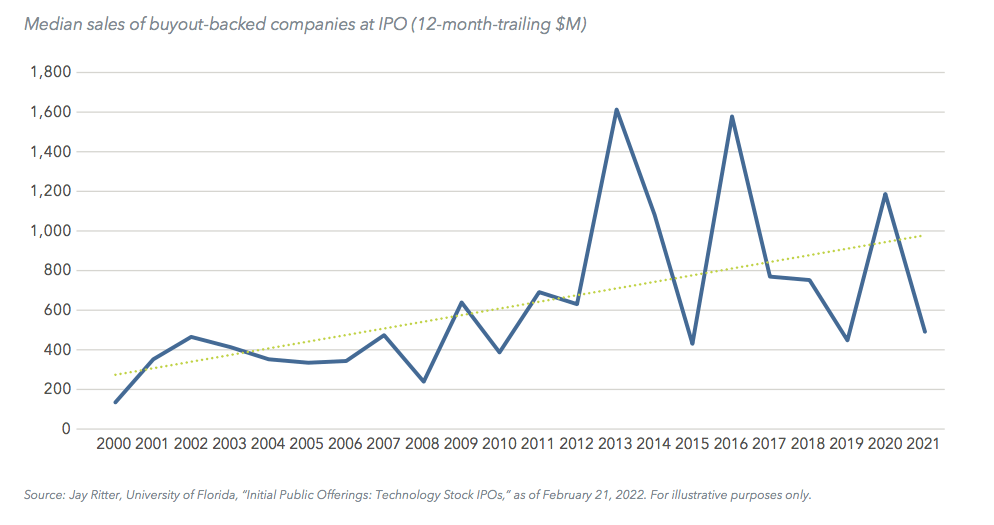

More broadly, larger funds have benefited from the elongation of the private company life cycle and the increased scale of companies in private markets over the last couple of decades, allowing private equity to capture more of a company’s growth phase.

The median age and scale of companies that choose to list in the United States has been on an upward trend over the last two decades, with the size of buyout-backed companies going public increasing in lockstep.19 More importantly, there has been rapid growth in the number of companies reaching scale and remaining private: There were 1.9 million private companies in the United States with over 50 employees in 2020,20 and 22,316 private equity-backed companies across North America and North and Western Europe in 2021 (up from 6,273 only 10 years ago), versus just 13,599 listed on public markets.21 Meanwhile, the enormous opportunities for buyout firms with tech exposure are highlighted by the rise in the number of companies classified as unicorns (private, tech-focused companies valued at over $1 billion), which now exceeds 1,100 globally, up from just 269 in 2017.22

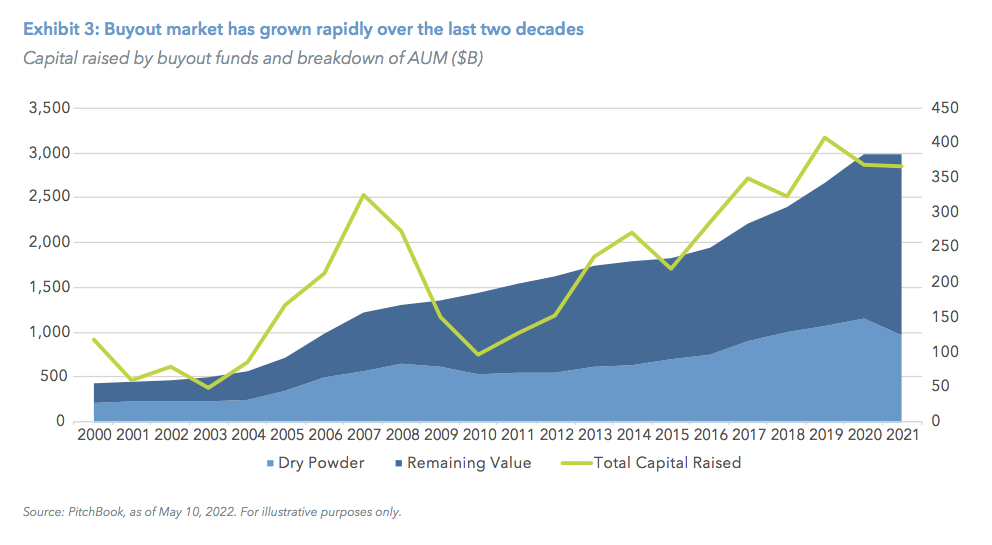

Growing market scale has also helped drive the elongation of the private company lifespan. Global buyout fund assets under management grew from $433 billion in 2000 to just under $3 trillion at the end of 2021.23 These funds raised $1.82 trillion in just the last five calendar years, and by the end of 2021 had $971 billion in dry powder ready to deploy.24 Large buyout funds can write checks big enough to facilitate strategic sales to keep large-scale, high-growth firms private, whereas previously these companies would have needed to go public to fund their continued growth. Increased private lifespan has, in turn, created new opportunities for even larger funds, and so on, in a virtuous circle of expansion.

For their part, by staying private the entrepreneurs and executives running these businesses can continue to focus on their long-term strategic goals without the distraction of quarterly earnings calls and the requirement to disclose financial information and key performance indicators to competitors.

This large scale additionally positions these funds to become merger and acquisition “machines,” initiating consolidation plays to turn their portfolio companies into dominant players across a variety of industries and driving top-line growth.

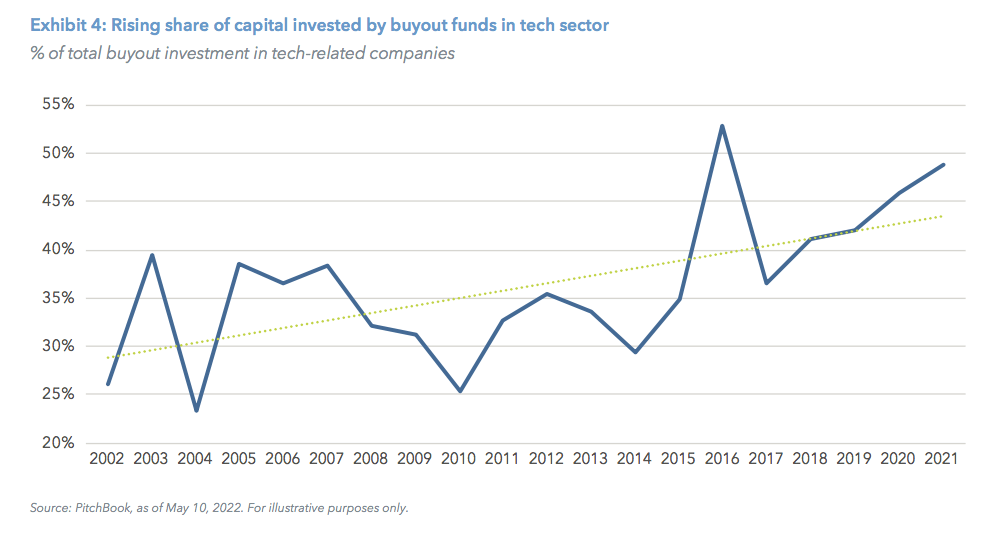

Buyout fund performance has also benefited from increased exposure to tech. Over half of the firms identified as top-10 performers by the 2021 HEC Paris-Dow Jones Large Buyout Private Equity Performance Ranking had a strong focus on software or tech.25 Many buyout funds proactively geared their firms to exploit the growth of tech, but they also benefited from an increased supply of high-quality tech businesses of scale nurtured by a proliferation of venture funds.

That said, while it is certainly true that investing in an outperforming sector like technology is likely to create a lower probability of failure, the data show that the distribution of returns within sectors is considerably greater than between sectors.26 Put another way, above-market returns are possible in any sector. Several high-performing and rapidly growing managers have broad sector exposure, including, for example, Hellman & Friedman, Clayton Dubilier & Rice, and Advent International.27

Large buyout funds also benefit from relatively privileged access to deals at the top end of the market. While funds raising north of $7.5 billion may have accounted for 41% of capital committed to buyouts in the 2021 vintage globally, this cohort comprised just eight funds, out of a total of 553 raised that year.28 Scale, therefore, provides an access advantage, with competition for the largest available deals relatively limited. Their size additionally allows larger funds to negotiate better terms for credit lines, including longer repayment durations.29 This may also provide a boost to return figures early in a fund’s life, but not enough to significantly distort performance or shift our view of the overall performance trend.

Finally, the impression that many people have that large buyout deals are more expensive does not seem to be reflected in the data.30 While purchase price multiples may have at one time been higher for larger deals, the data suggest that, at least on a median basis, the difference has narrowed or even evaporated completely in recent years.31

Operational advantages from experience and scale

The final trend driving better large fund performance is improvement at the firm level. Due, in part, to their subpar performance around the GFC, operators of larger funds faced pressure to become more professionalized, implement greater deal discipline, improve their risk control mechanisms, and expand their resources and capabilities.

Many are now able to marry experience and skill with the sometimes underappreciated operational benefits of scale, which may include better infrastructure, broader networks, and advantages in terms of human capital.

Infrastructure

Scale can provide significant benefits in allowing greater firmwide investment in infrastructure, from a data, technology, and physical perspective. This can include the inevitable accretion over time of broader and deeper historical data sets derived from deal flow data. This may allow for more comprehensive and nuanced views of the market and individual companies, and in conjunction with technology, can speed up the due diligence process and allow the manager to move on a deal more rapidly and with greater certainty.

On a purely physical basis, large managers are often better placed to expand their geographical footprint, which can again provide a speed advantage given physical proximity to companies, expanded local networks, and potentially better established financial frameworks for operating internationally. Local offices may also make it easier to hire market specialists, who can provide an edge in sourcing and diligence.

Networks

As private equity firms have scaled up over the last decade, they increasingly get to tap into larger networks. This is a function of both longer industry experience—over time connections inevitably expand—and increased headcount. Broader and deeper networks can improve the quality and breadth of the deal funnel, making sure that good investment opportunities do not slip through the net. Accessing the best opportunities is vital to alpha generation in private equity.

Human capital

Large, well-resourced managers, due to both prestige and pay structure, may be able to better attract and retain leading investment professionals. As mentioned above, in private capital, having the right people in place is fundamental to appropriate deal selection and execution. Further, in an industry that invests with much longer time horizons, better retention and team continuity may be a key factor in sustaining success.

Greater recruiting firepower can develop broader expertise across sectors and deal types, and greater depth via larger, sector-focused teams. Broader expertise can—in the right culture—create a more diverse “marketplace of ideas” within a firm.

In combination, these three advantages mean that many large firms have been able to build the flexibility to execute up and down the market at their discretion, identifying value wherever it may be found, rather than just focusing on mega-deals.

The above factors also contribute to increasingly sophisticated risk management capabilities. The advantages from amassing deep data sets as private markets mature arguably accrue disproportionately to larger firms with the ability to collect, analyze, and apply large volumes of data. This is particularly true in areas such as risk management, where data are central to appropriately determining not just investment and business risk, but also funding, liquidity, market, and capital risks, among others.

The edge that larger firms have in managing both investment and business risk may increase as markets get increasingly choppy and regulatory issues need handling across multiple global jurisdictions.

CONCLUSION

This analysis is not, of course, intended to suggest that investors should only allocate to larger buyout funds. History is not circular, circumstances can change, and we are entering particularly uncertain times. However, we are saying that large buyout funds have played a highly constructive role in investor portfolios over the last few years, with strong median performance and reduced downside at the lower quartile and decile level, and that there are reasons to believe this is structural, rather than just a transient product of broader market dynamics.

Smaller funds certainly have a place in a well-balanced portfolio. They can provide differentiated exposure in terms of sector, company profile, and geography, and allow investors to express a view on future market trends.

Regardless of an investor’s perspective on the market’s likely trajectory, Exhibit 1 clearly shows that it is very difficult to time investments in private equity funds through the lens of fund size. Vintage-by-vintage fluctuations are unpredictable and inevitable. Consistent investment and carefully managed diversification across high-quality managers in different size cohorts over time remains a sensible approach to mitigating this unpredictability and reducing downside risk.

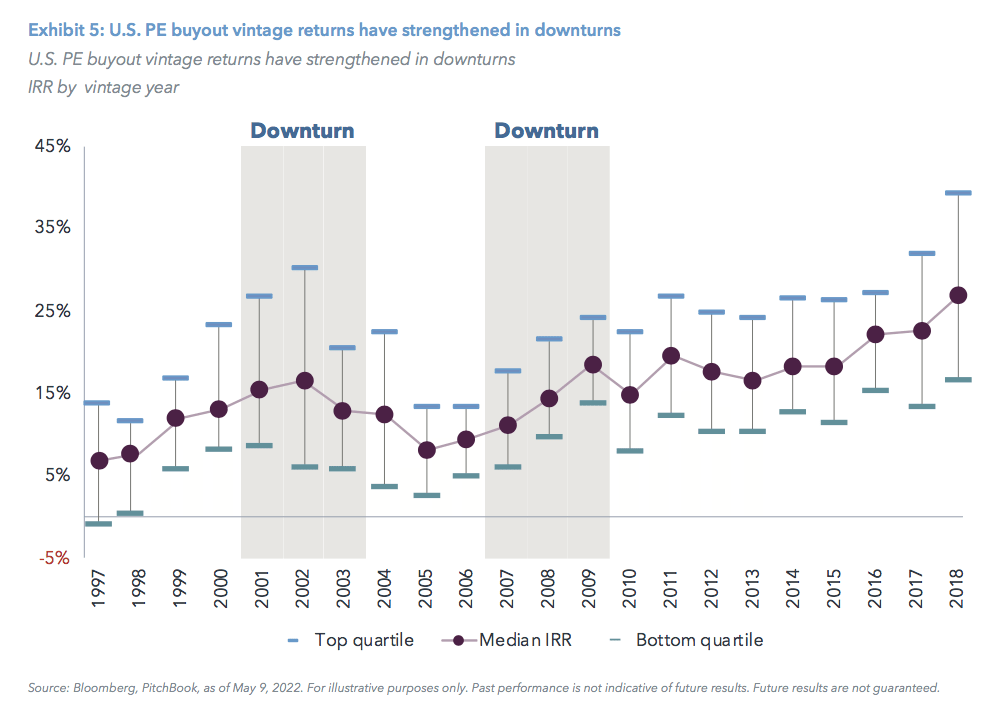

For individual investors, accessing larger funds and creating a diversified private equity portfolio have historically been expensive and challenging, discouraging many from allocating to the asset class. However, this is changing. Rising competition for individual investor capital and structural and legal innovations have opened up individual access to larger and higher-caliber managers and driven a reduction in investment minimums and fees.32 With the data suggesting that returns from buyout fund vintages improve during a downturn,33 it may be an opportune time to allocate to private equity.

APPENDIX

*Defined in this paper as those raising more than $5 billion in vintages 2000 to 2009, and those raising more than $7.5 billion in vintages 2010 to 2019, reflecting the expansion of the overall private equity market.

ENDNOTES

1. Source: Private Equity International, “Oversubscribed funds raised almost $30bn above their targets last year,” April 13, 2022.

2. Source: PitchBook, as of April 11, 2022.

3. See Exhibit 1 later in this paper. Source: PitchBook, as of March 31, 2022.

4. See Exhibit 1 later in this paper. Source: PitchBook, as of March 31, 2022.

5. See Exhibits 1, 2, and 3 in this paper. Source: PitchBook, as of March 31, 2022.

6. Source: PitchBook, as of March 31, 2022.

7. See Appendix, Exhibit 1. Sources: Lipper, NCREIF, Cambridge Associates, HFRI, J.P. Morgan Asset Management.

8. Source: PitchBook, as of March 31, 2022.

9. Source: PitchBook, as of March 31, 2022.

10. Source: PitchBook, as of March 31, 2022.

11. Source: PitchBook, as of March 31, 2022.

12. Source: PitchBook, as of March 31, 2022.

13. Source: PitchBook, as of March 31, 2022.

14. Source: PitchBook, as of March 31, 2022.

15. Source: PitchBook, as of March 31, 2022.

16. Source: PitchBook, as of March 31, 2022.

17. Source: PitchBook, iCapital, as of March 31, 2022.

18. Source: Bain & Company, “Raising Sector Strategy to the Next Level,” March 7, 2022

19. See Appendix, Exhibit 2. Source: Jay Ritter, University of Florida, as of May 5, 2022.

20. Source: Agency for Healthcare Research and Quality, Center for Financing, Access and Cost Trends. Medical Expenditure Panel Survey-Insurance Component, 2020.

21. Source: PitchBook, World Federation of Exchanges.

22. Source: CBInsights, as of July, 2022.

23. See Appendix, Exhibit 3. Source: PitchBook, as of May 10, 2022.

24. See Appendix, Exhibit 3. Source: PitchBook, as of May 10, 2022.

25. Source: 2021 HEC Paris-Dow JonesLarge Buyout Private Equity Performance

Rankings, January 24, 2022.

26. Source: Bain & Company, “Raising Sector Strategy to the Next Level,” March 7, 2022.

27. Source: PitchBook, as of May 2, 2022.

28. Source: PitchBook, as of May 9, 2022.

29. Source: MJ Hudson, “Line dance: The rise of subscription credit lines in private funds,” February 2019.

30. Source: PitchBook, as of May 2, 2022. S&P LCD, as of May 11, 2022.

31. Source: PitchBook, as of May 2, 2022. S&P LCD, as of May 11, 2022.

32. Source: AI Insight.

33. See Appendix, Exhibit 5. Source: Bloomberg, PitchBook, as of May 9, 2022.

IMPORTANT INFORMATION

The material herein has been provided to you for informational purposes only by Institutional Capital Network, Inc. (“iCapital Network”) or one of its affiliates (iCapital Network together with its affiliates, “iCapital”). This material is the property of iCapital and may not be shared without the written permission of iCapital. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This material is provided for informational purposes only and is not intended as, and may not be relied on in any manner as, legal, tax or investment advice, a recommendation, or as an offer or solicitation to buy or sell any security, financial product or instrument, or otherwise to participate in any particular trading strategy. This material does not intend to address the financial objectives, situation, or specific needs of any individual investor. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation.

ALTERNATIVE INVESTMENTS ARE CONSIDERED COMPLEX PRODUCTS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prospective investors should be aware that an investment in an alternative investment is speculative and involves a high degree of risk. Alternative Investments often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; may not be required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. There is no guarantee that an alternative investment will implement its investment strategy and/or achieve its objectives, generate profits, or avoid loss. An investment should only be considered by sophisticated investors who can afford to lose all or a substantial amount of their investment.

iCapital Markets LLC operates a platform that makes available financial products to financial professionals. In operating this platform, iCapital Markets LLC generally earns revenue based on the volume of transactions that take place in these products and would benefit by an increase in sales for these products.

The information contained herein is an opinion only, as of the date indicated, and should not be relied upon as the only important information available. Any prediction, projection or forecast on the economy, stock market, bond market or the economic trends of the markets is not necessarily indicative of the future or likely performance. The information contained herein is subject to change, incomplete, and may include information and/or data obtained from third party sources that iCapital believes, but does not guarantee, to be accurate. iCapital considers this third-party data reliable, but does not represent that it is accurate, complete and/or up to date, and it should not be relied on as such. iCapital makes no representation as to the accuracy or completeness of this material and accepts no liability for losses arising from the use of the material presented. No representation or warranty is made by iCapital as to the reasonableness or completeness of such forward-looking statements or to any other financial information contained herein.

Securities products and services are offered by iCapital Markets, an SEC-registered broker-dealer, member FINRA and SIPC, and an affiliate of iCapital, Inc. and Institutional Capital Network, Inc. These registrations and memberships in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services discussed herein. Annuities and insurance services are provided by iCapital Annuities and Insurance Services LLC, an affiliate of iCapital, Inc. “iCapital” and “iCapital Network” are registered trademarks of Institutional Capital Network, Inc. Additional information is available upon request.

©2024 Institutional Capital Network, Inc. All Rights Reserved. | 2024.01