DATA MANAGEMENT

The Challenges of Managing

Alternative Investment Data

for Financial Professionals

12

Average number of different systems used to manage the investment lifecycle

7 Hrs

On average spent on NAV and tax prep per week

60%

Say they have too many disconnected systems

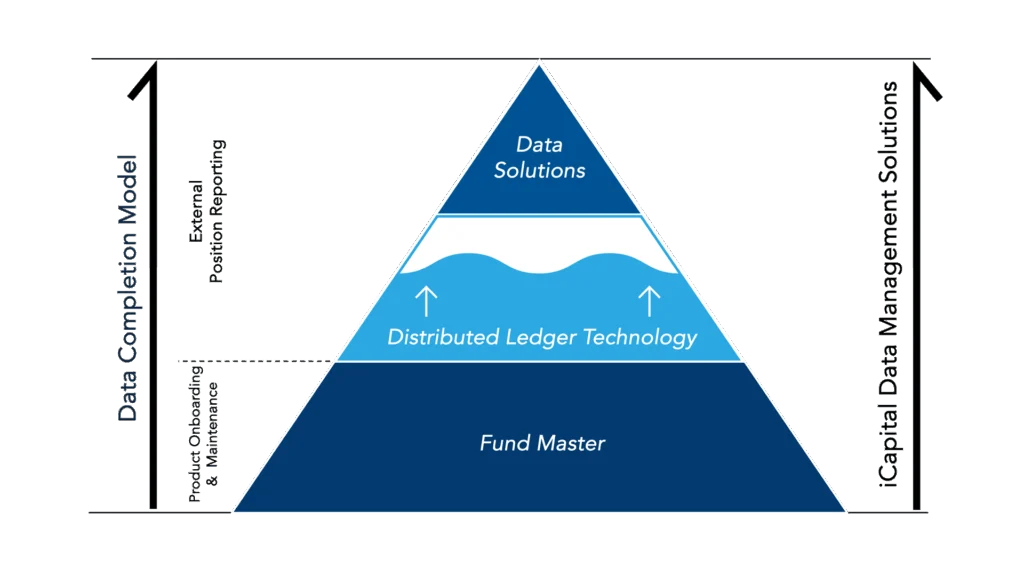

Three solutions. One seamless journey to scale.

For illustrative purposes only

1

DATA MANAGEMENT & REPORTING SERVICES

Aggregate and Automate Investment Data

Extract, clean, and centralize data from disparate systems to reduce manual work and improve transparency.

2

DISTRIBUTED LEDGER TECHNOLOGY

Connect Disconnected Systems Across Stakeholders

A shared source of truth with built-in transparency, automation, and secure API connectivity.

3

FUND MASTER

Take Control of Your Internal Investment Data

A security master to govern, permission, and integrate your data—so you can scale operations without sacrificing control.

Downloadable Resources

FEATURED

Forrester Research Paper: Unlocking Growth in Alternative Investments

What’s driving the next wave of growth in alternatives? This Forrester study, commissioned by iCapital, explores how wealth managers are scaling their alternative investment offerings—and the key capabilities they need to succeed. A must-read for firms looking to stay competitive in a rapidly evolving market.

The Hidden Opportunity in Private Markets: Data

Unlock efficiency and reduce risk with a smarter approach to private markets data.

Optimizing Alternative Investment Lifecycle Workflows Using DLT

See how distributed ledger tech is streamlining the alternative investment lifecycle.

DLT and the Challenge of Offline Alternative Data Management

Address the challenges of disparate and siloed data with automatic data extraction, aggregation, and consolidation.

Take the Next Step to Improve Your Data Management

Request an introductory call below

IMPORTANT INFORMATION

iCapital and its affiliates provide various services through a number of affiliated entities – please refer to Certain iCapital Entities for a full list of entities. iCapital entities are collectively referred to as “iCapital”, and they all are affiliated with iCapital, Inc. and Institutional Capital Network, Inc. Among these affiliates, iCapital Markets LLC (“iCapital Markets”), an SEC-registered broker-dealer, member FINRA and SIPC, offers securities products and services. The registrations and memberships listed in Certain iCapital Entities in no way imply that the SEC, FINRA, or SIPC have endorsed any of the entities, products, or services provided by iCapital. Additional information is available upon request.

This website is for informational purposes only. This website is the property of iCapital and may not be shared, reproduced in any form, or referred to in any other publication, without express written permission of iCapital.

This website and any information included on it are not intended, and may not be relied on in any manner, as legal, tax or investment advice, a recommendation, or as an offer to sell, a solicitation of an offer to purchase or a recommendation of any interest in any fund or security. Financial products, including investment funds and structured investments, are complex and may be speculative and are not suitable for all investors. You should consult your personal accounting, tax and legal advisors to understand the implications of any investment specific to your personal financial situation. This website and the information contained on it is not intended to, and does not, address the financial objectives, situation or specific needs of any specific investor.

iCapital and iCapital Network are registered trademarks of Institutional Capital Network, Inc.